The US Municipal Water And Wastewater Plant Pipe Market By Material Type (Metal, Plastic, Concrete, and Clay), By Diameter (Up to 12 Inch, 12 to 24 Inch, 24 to 36 Inch, and Above 36 Inch), By Installation Type (New Installation, and Replacement and Rehabilitation) By Application (Water Supply and Distribution, and Wastewater Management), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133236

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

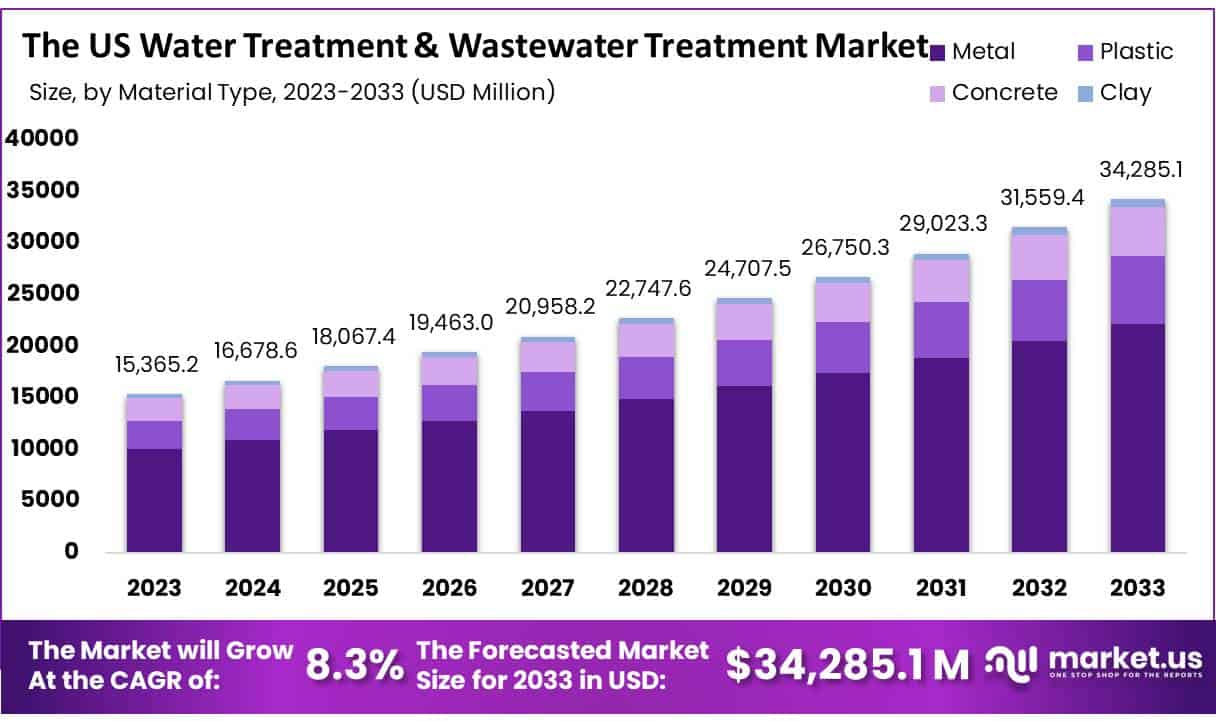

The Global The US Municipal Water And Wastewater Plant Pipe Market size is expected to be worth around USD 34285.1 Mn by 2033, from USD 15,365.2 Mn in 2023, growing at a CAGR of 8.3% during the forecast period from 2024 to 2033.

The U.S. municipal water and wastewater plant pipe market encompasses the infrastructure responsible for the distribution of potable water and the collection and treatment of wastewater in municipalities across the country. This market includes a wide range of pipe materials, such as PVC, HDPE, ductile iron, and concrete, each used based on factors such as durability, cost, and environmental conditions.

The market plays a critical role in supporting essential public health services, ensuring clean water supply, and effective sewage management for urban, suburban, and rural populations. As water and wastewater systems age across the U.S., there is a growing demand for pipe replacement and upgrades to modern, more efficient materials. The market is primarily driven by several factors, including population growth, urbanization, and the need to upgrade aging infrastructure.

Several cities and towns in the U.S. have water systems that are over 50 years old, resulting in frequent leaks, pipe bursts, and contamination risks. Furthermore, environmental regulations imposed by agencies such as the U.S. Environmental Protection Agency (EPA) require municipalities to maintain and improve their water and wastewater treatment infrastructure to meet modern safety and environmental standards. The demand for sustainable and resilient materials, particularly in regions prone to extreme weather events, also drives innovation and growth in the market.

In recent years, there has been significant investment in municipal water infrastructure from both federal and state governments. Initiatives such as the Bipartisan Infrastructure Law, which allocates billions to water and wastewater projects, are further expected to boost market growth. Overall, the U.S. municipal water and wastewater plant pipe market is a crucial component of the country’s infrastructure, providing essential services that support public health, environmental protection, and economic development.

Key Takeaways

- The US municipal water and wastewater plant pipe market is valued at US$ 15,365.2 Million in 2023 and is estimated to register a CAGR of 4.5%.

- The US municipal water and wastewater plant pipe market is projected to reach US$ 29,699.5 Million by 2033.

- Metal material type pipes accounted for the market share of 65.3%.

- Pipes with a diameter of up to 12 inches are majorly preferred by residential places and accounted for a significant share of 61.8%.

- New installations accounted for the largest market share, 68.7%.

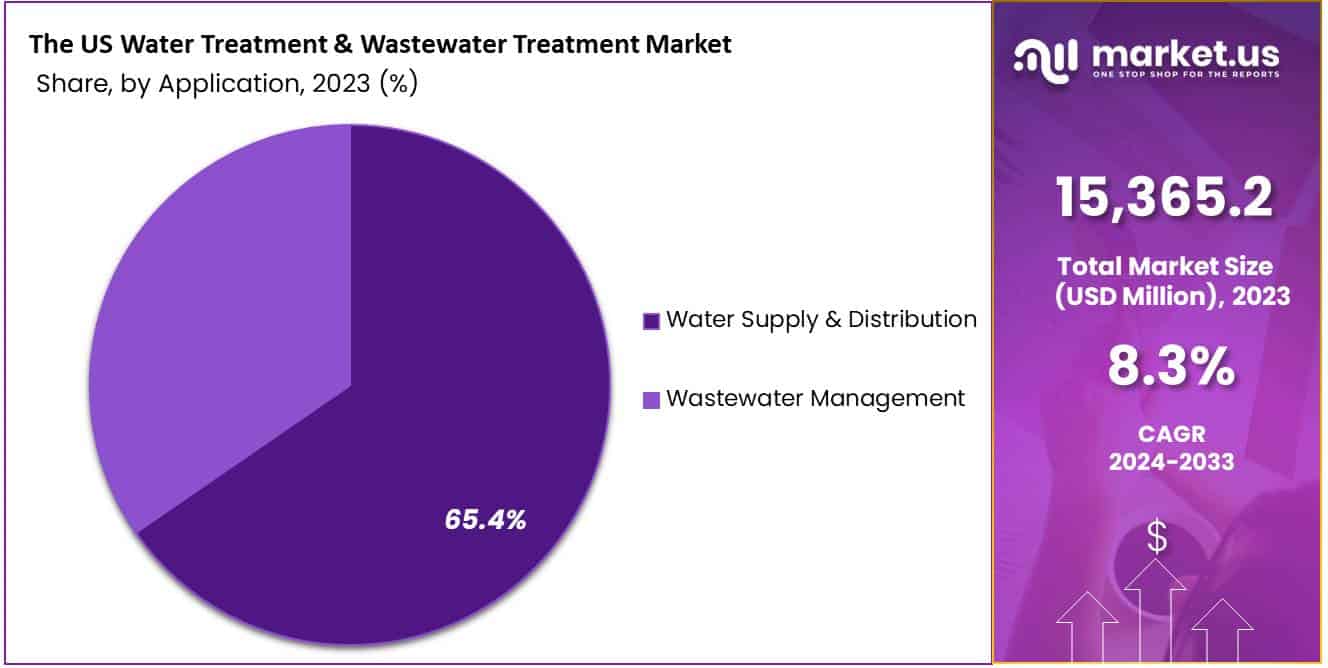

- Water supply & distribution accounted for the largest market share in 2023, with 65.4%.

- South Region held the largest market share among other Regions, with 3% in the US municipal water and wastewater plant pipe market in 2023.

Material Type Analysis

Metal Material Type Pipe Accounted for The Largest Share Due to its Durability and Strength.

The municipal water and wastewater plant pipe market is segmented based on material type into metal, plastic, concrete, and clay. Among these, metal held the majority of revenue share in 2023 of 65.3%, primarily due to its durability, strength, and reliability in long-term infrastructure projects.

Metal pipes, particularly ductile iron and steel, are widely favored for their ability to withstand high pressure and harsh environmental conditions, making them suitable for large-scale municipal water distribution and wastewater systems. Their high tensile strength allows for the transport of large volumes of water over long distances without the risk of significant deformation or failure, which is especially important in urban centers and industrial zones where water demand is high.

Another factor driving the dominance of metal pipes is their resistance to external loads, which is crucial in areas with heavy traffic, such as cities and industrial complexes, where pipes may be buried under roads and require the ability to support significant weight. Moreover, metal pipes have a long lifespan, often lasting 50-100 years, making them a cost-effective option despite their higher initial investment compared to materials such as plastic or concrete.

In addition, metal pipes are known for their resistance to fire and extreme temperatures, adding another layer of security in regions prone to wildfires, industrial accidents, or high-temperature fluctuations. These factors are particularly important in wastewater management, where metal pipes handle corrosive substances and variable temperatures more effectively than other materials. Furthermore, the existing infrastructure in several municipalities is built on metal pipe systems, and replacing or upgrading them with similar materials is often preferred for compatibility and ease of integration.

Diameter Analysis

Residential Water Distribution Majorly Use 12 Inches Diameter Pipes

Based on diameter, the market is segmented into Up to 12 Inch, 12 to 24 Inch, 24 to 36 Inch, and Above 36 Inch. Among these diameters, up to 12-inch municipal water and wastewater plant pipes accounted for the majority of the market share, with 61.8% due to its widespread application across various urban and suburban infrastructure projects.

Pipes with diameters of up to 12 inches are extensively used in residential water distribution and sewage systems, which are prevalent in both new construction and replacement projects in municipalities. These smaller-diameter pipes are commonly installed for localized water supply networks, including the delivery of potable water to homes, small commercial establishments, and local neighborhoods.

Additionally, the “Up to 12-inch” pipes are ideal for wastewater collection in smaller municipal systems, where large volumes of water are not typically required. Their versatility and cost-effectiveness make them the preferred choice for the vast majority of municipal projects focused on connecting residential areas to main water and wastewater lines. Since most municipalities prioritize maintaining and upgrading localized water supply systems for growing populations and housing developments, the demand for these smaller-diameter pipes is consistently high.

Furthermore, smaller-diameter pipes are easier to install, maintain, and replace compared to larger pipes, reducing labor and equipment costs for municipalities. They also tend to be more flexible in terms of material choices, such as PVC and HDPE, which are both durable and cost-efficient.

As a result, the frequent use of pipes “Up to 12 Inch” for a wide range of small-to-medium-scale infrastructure projects drives their dominance in the municipal water and wastewater plant pipe market, accounting for the largest share of the market in terms of both demand and application.

Installation Type Analysis

Based on installation type, the market is further divided into new installation and replacement & rehabilitation. Among these applications, new installation accounted for the largest market share in 2023, with 68.7%. In 2023, new installation accounted for the largest market share, 68.7%, in the U.S. municipal water and wastewater plant pipe market due to several key factors. One primary driver is the rapid expansion of urban and suburban areas, particularly in regions experiencing significant population growth.

This expansion creates a pressing need for new water supply and wastewater management systems to meet the increasing demand for clean water and sanitation services. As cities expand and new residential, commercial, and industrial developments emerge, municipalities are required to install new pipelines and infrastructure to support these growing communities, contributing to the high market share for new installations.

Additionally, federal and state governments have been investing heavily in infrastructure development, allocating significant funding for new water and wastewater projects. Programs such as the Bipartisan Infrastructure Law and various state-level initiatives have prioritized expanding and modernizing water systems, leading to the construction of new water treatment plants and pipeline networks across the country.

These investments are aimed not only at supporting population growth but also at addressing the need for more sustainable and efficient water management systems that can meet evolving environmental and regulatory standards.

Moreover, the growing emphasis on resilience in infrastructure due to climate change has prompted municipalities to install new water and wastewater systems that can withstand extreme weather events. In flood-prone or drought-affected areas, for example, the installation of more robust and efficient pipeline networks is critical to ensure reliable water supply and wastewater disposal.

Application Analysis

Based on applications, the market is further divided into water supply & distribution and wastewater management. Among these applications, water supply & distribution accounted for the largest market share in 2023, with 65.4%, due to several critical factors. One of the primary reasons is the increasing demand for clean and reliable water supply driven by population growth and urbanization.

As cities expand, the need for new water distribution networks becomes more urgent to provide households, industries, and businesses with a consistent and safe supply of potable water. Urban centers and suburbs, particularly in fast-growing regions such as the South and West, have been key drivers of this demand, prompting significant investments in water infrastructure.

Additionally, the aging water infrastructure across much of the U.S. has led to frequent leaks, pipe failures, and water loss, necessitating large-scale replacements and upgrades. Several municipalities face significant challenges with their aging water systems, some of which are more than 50 years old. The necessity to modernize these systems to prevent water wastage and meet regulatory standards has accelerated the demand for pipes in the water supply and distribution segment.

Another factor contributing to the dominance of water supply & distribution is the increased focus on ensuring water security and resilience against climate change impacts. Extreme weather events, including droughts and floods, have highlighted the need for robust water supply systems that can withstand environmental stresses and ensure uninterrupted service. As a result, municipalities are investing in more durable and efficient materials, such as HDPE and PVC pipes, to enhance their distribution networks.

Key Market Segments

By Material Type

- Metal

- Steel

- Ductile Iron

- 401 Lined

- Glass Lined

- Cement Lined

- Others

- Cast Iron

- Copper

- Plastic

- Polyvinyl Chloride

- High-Density Polyethylene

- Polypropylene

- Others

- Concrete

- Prestressed Concrete Cylinder Pipe (PCCP)

- Reinforced Concrete Pipe (RCP)

- Clay

By Diameter

- Up to 12 Inch

- 12 to 24 Inch

- 24 to 36 Inch

- Above 36 Inch

By Installation Type

- New Installation

- Replacement & Rehabilitation

By Application

- Water Supply & Distribution

- Wastewater Management

Drivers

Increasing Infrastructure Activities Is the Major Driving Factor for the Market

Increasing infrastructure activities are a major driving factor for the global municipal water and wastewater plant pipe market, as urbanization and population growth continue to surge worldwide. The rapid expansion of cities, coupled with the rising demand for clean water and efficient wastewater management, has created an urgent need for new water treatment plants, pipelines, and modernized sewage systems.

Governments and municipalities, particularly in developing regions, are making significant investments in upgrading and expanding their water infrastructure to meet these demands.

As more cities develop and rural areas become urbanized, the need for sustainable water supply and wastewater disposal solutions becomes critical, directly boosting the demand for advanced piping systems.

Infrastructure projects aimed at improving water distribution networks and wastewater treatment facilities often require a variety of pipes, including those made from materials such as PVC, HDPE, and steel, that can withstand high pressure, resist corrosion, and ensure long-term reliability. These pipes are crucial for ensuring that clean water reaches consumers efficiently and that wastewater is safely transported to treatment plants without contamination.

As aging water infrastructure in many countries faces increased strain, the need for pipe replacement and new installations has grown, driving the demand for more advanced, durable, and environmentally friendly piping solutions.

Moreover, government initiatives to enhance water management systems, especially in regions prone to water scarcity or pollution, further amplify the need for reliable municipal water and wastewater piping infrastructure. For instance, many developing nations are undertaking large-scale infrastructure projects to improve sanitation and water access, which in turn stimulates growth in the market for pipes used in these facilities.

Restraints

Rising Flood Risks May Hinder the Market’s Growth

Rising flood risks present a significant challenge to the growth of the global municipal water and wastewater plant pipe market, primarily due to the increased vulnerability of infrastructure in flood-prone areas. As climate change intensifies, extreme weather events, including heavy rainfall and flooding, are becoming more frequent and severe.

Floods can cause substantial damage to water and wastewater infrastructure, including pipelines, treatment plants, and pumping stations. Water pipes, especially those installed underground, are particularly susceptible to the effects of floods. Erosion, soil displacement, and excessive water pressure can weaken or rupture these pipes, leading to leaks, contamination, and disruption of services.

In flood-prone areas, the installation and maintenance of municipal water and wastewater systems become more complicated and costly. The need for flood-resistant materials and construction techniques, such as pipes with higher durability and flexibility, increases the overall cost of projects.

Furthermore, frequent flooding may necessitate more frequent repairs and replacements of damaged pipelines, adding to the operational costs for municipalities. This increases the financial burden on governments and utilities, which may slow down infrastructure investments and, consequently, the growth of the market.

Moreover, the potential contamination of water sources during floods poses a significant public health risk. Floodwaters can introduce harmful pollutants and pathogens into drinking water systems if pipelines are compromised.

This heightens the need for more resilient water and wastewater infrastructure that can withstand such events, further complicating design and construction requirements. As a result, decision-makers might prioritize other critical infrastructure needs or disaster mitigation efforts, diverting funds from the water and wastewater sector.

Opportunity

Rising Focus on Infrastructure Rehabilitation Is Anticipated to Create More Opportunities

The rising focus on infrastructure rehabilitation is anticipated to create significant opportunities in the global municipal water and wastewater plant pipe market, driven by the increasing need to upgrade aging and deteriorating systems. Across many regions, particularly in developed nations, much of the existing water and wastewater infrastructure has been in place for decades, and in some cases, for over a century.

These older systems are more prone to leaks, breakages, and inefficiencies, leading to substantial water losses and higher maintenance costs. Governments and municipalities are now placing greater emphasis on the rehabilitation and modernization of these infrastructures to ensure reliable and sustainable water management services.

Infrastructure rehabilitation presents a substantial growth opportunity as it involves replacing or repairing vast networks of outdated pipes and integrating modern materials that are more durable, efficient, and environmentally friendly.

New materials such as high-density polyethylene (HDPE) and polyvinyl chloride (PVC) are increasingly preferred for their corrosion resistance, flexibility, and longer life spans compared to traditional materials like iron and concrete. This shift opens up a new market for pipe manufacturers and suppliers, as rehabilitation projects typically involve large-scale replacements of old systems with these advanced materials.

Furthermore, the focus on rehabilitation aligns with the broader trend of improving sustainability and resilience in urban infrastructure. Aging water and wastewater systems often contribute to water loss and inefficiency, which is increasingly unacceptable in regions facing water scarcity or high demand due to population growth.

By investing in infrastructure rehabilitation, municipalities can improve water conservation, reduce costs, and enhance the overall resilience of their systems, particularly in the face of climate change and the increased risks of extreme weather events.

Trends

Adoption of Digital Technologies

The adoption of digital technologies is revolutionizing the global municipal water and wastewater plant pipe market by enhancing the efficiency, accuracy, and resilience of water management systems. Digital technologies such as Internet of Things (IoT) sensors, data analytics, artificial intelligence (AI), and Geographic Information Systems (GIS) are being increasingly integrated into the design, monitoring, and maintenance of municipal water infrastructure.

These innovations offer real-time insights into the condition of pipes and water networks, allowing operators to detect leaks, monitor flow rates, and assess the overall performance of water systems. This proactive approach to infrastructure management reduces operational costs by identifying potential issues before they escalate into major problems, such as pipe bursts or system failures.

One of the most significant benefits of adopting digital technologies is the improvement in predictive maintenance. With the use of smart sensors embedded within pipelines, utilities can continuously monitor key parameters such as pressure, temperature, and water quality.

These sensors transmit data in real time to centralized systems, where AI algorithms can analyze the information to predict when and where a pipe might fail. This predictive capability enables municipalities to prioritize maintenance, schedule repairs more efficiently, and avoid costly emergency interventions, thereby extending the life of the water and wastewater infrastructure.

Moreover, digital technologies enhance the planning and optimization of water distribution and wastewater collection networks. Using advanced GIS systems, municipalities can map out entire pipeline networks with precise geographical data, enabling better asset management and faster responses to operational challenges.

In combination with AI, these systems can also model future scenarios, such as the impact of population growth or climate change on water demand and infrastructure capacity, helping cities plan for long-term sustainability.

Geopolitical Impact Analysis

The Geopolitical Impact On the US Municipal Water and Wastewater Plant Pipe Market was Complicated and Subjective by Numerous Factors.

The current geopolitical impact on the global municipal water and wastewater plant pipe market is multifaceted, shaped by a complex interplay of international and regional factors. Geopolitical tensions, trade policies, and resource control significantly influence the supply chains, pricing, and investment flows within this market.

For instance, disruptions in raw material availability, particularly metals and polymers required for pipe manufacturing, can result from sanctions, tariffs, or conflicts in resource-rich regions. For instance, tensions between major suppliers such as Russia, a key player in global steel production, and Western countries can lead to shortages and price hikes in essential materials, directly affecting production costs and delivery timelines for water infrastructure projects.

Trade wars and protectionist policies also pose challenges to market growth, as restrictions on imports and exports of materials can slow down the development of water and wastewater infrastructure, especially in countries dependent on foreign supplies.

The imposition of tariffs, as seen between the U.S. and China in recent years, has disrupted the global supply of essential components for municipal piping systems, affecting cost structures and accessibility. This has forced manufacturers and contractors to seek alternative sources of materials, increasing procurement costs and sometimes leading to project delays.

Geopolitical instability also impacts foreign investment in water infrastructure projects. Regions experiencing political unrest or uncertain governance may see reduced foreign direct investment (FDI) in their water and wastewater sectors, limiting the resources available for much-needed infrastructure upgrades or new installations. Investors may view politically unstable regions as too risky, thereby slowing the pace of development.

Region Wise Analysis

South Region is Estimated to be The Most Lucrative Market in The US Municipal Water and Wastewater Plant Pipe Market

The South region is estimated to be the most lucrative market in the U.S. municipal water and wastewater plant pipe market due to several key factors. First, the South has experienced significant population growth and urbanization in recent years, particularly in states such as Texas, Florida, and Georgia.

This rapid development has placed increased pressure on existing water infrastructure, driving demand for new and upgraded municipal water and wastewater systems. With growing urban centers, municipalities are investing heavily in expanding and modernizing their water distribution networks and sewage systems to accommodate rising populations and industrial activities.

Additionally, the South is prone to extreme weather events such as hurricanes, flooding, and droughts, which frequently damage water infrastructure. As a result, there is a heightened need for resilient, durable pipes and systems that can withstand environmental stresses.

Municipalities in the region are increasingly focusing on replacing aging infrastructure with modern materials such as HDPE and PVC pipes that are better suited for these challenging conditions. This creates significant opportunities for manufacturers and suppliers in the pipe market.

Federal and state initiatives aimed at improving water management, such as investments in wastewater treatment facilities and clean water projects, have accelerated the demand for municipal water and wastewater infrastructure in the region. The combination of rapid urbanization, climate-related challenges, and strong government support makes the South a highly attractive and lucrative market for the municipal water and wastewater plant pipe industry in the U.S., with continued growth expected in the coming years.

Key Regions Covered

- West

- Midwest

- South

- Northeast

Key Players Analysis

Companies are Strongly Focusing On Product Portfolio Expansion Through Various Strategies To Maintain their Dominance as Industry Leaders

Companies are broadening their product lines to include a variety of pipe materials such as high-density polyethylene (HDPE), polyvinyl chloride (PVC), ductile iron, and concrete. This diversification enables them to cater to specific project requirements, environmental conditions, and longevity expectations.

By implementing these strategies, companies aim to address the complex challenges of the U.S. municipal water and wastewater infrastructure, thereby sustaining their leadership positions in the market.

Substantial R&D investments are directed toward developing innovative pipe materials and solutions that enhance performance, durability, and environmental sustainability. This includes the creation of pipes with improved resistance to corrosion, higher pressure ratings, and longer service life, thereby meeting the stringent demands of municipal water and wastewater systems.

Market Key Players

- INEOS

- Westlake

- McWane, Inc.

- AMERICAN (American Cast Iron Pipe Company)

- JM Eagle

- County Materials

- Northwest Pipe Company

- S Pipe

- Jensen Precast

- Diamond Plastics Corporation

- Foley Products Company

- AmeriTex Pipe & Products

- Hobas Pipe USA, Inc.

- Thompson Pipe Group

- Electrosteel USA

- Tricon Piping, Inc.

- Other Key Players

Recent Development

- In December 2023, Foley Products Company, LLC successfully finalized the acquisition of Coastal Precast of Florida, Inc., situated in Fort Myers, FL, a mere 15 miles from Foley’s current pipe plant. This strategic move enables Foley to expand its product portfolio and capabilities, allowing the company to provide a comprehensive range of pipe and precast products to customers in the Southwest Florida market.

- In April 2024, Hobas Pipe USA, Inc., the premier manufacturer of corrosion-resistant fiberglass pipe products in North America, is thrilled to unveil plans for expanding its production capabilities. This strategic expansion aims to enhance capacity, effectively addressing the growing needs of the water and wastewater infrastructure industries.

Report Scope

Report Features Description Market Value (2023) USD 15,365.2 Mn Market Volume (2023) XX Forecast Revenue (2033) USD 34,285.1 Mn CAGR (2024-2032) 8.3% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Metal, Plastic, Concrete, and Clay), By Diameter (Up to 12 Inch, 12 to 24 Inch, 24 to 36 Inch, and Above 36 Inch), By Installation Type (New Installation, and Replacement & Rehabilitation) By Application (Water Supply & Distribution, and Wastewater Management) Region Wise Analysis West, Midwest, South, and Northeast Competitive Landscape INEOS, Westlake, McWane, Inc., AMERICAN (American Cast Iron Pipe Company), JM Eagle, County Materials, Northwest Pipe Company, U.S Pipe, and Jensen Precast, Diamond Plastics Corporation, Foley Products Company, AmeriTex Pipe & Products, Hobas Pipe USA, Inc, Thompson Pipe Group, Electrosteel USA, Tricon Piping, Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  The US Municipal Water And Wastewater Plant Pipe MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

The US Municipal Water And Wastewater Plant Pipe MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- INEOS

- Westlake

- McWane, Inc.

- AMERICAN (American Cast Iron Pipe Company)

- JM Eagle

- County Materials

- Northwest Pipe Company

- S Pipe

- Jensen Precast

- Diamond Plastics Corporation

- Foley Products Company

- AmeriTex Pipe & Products

- Hobas Pipe USA, Inc.

- Thompson Pipe Group

- Electrosteel USA

- Tricon Piping, Inc.

- Other Key Players