Global Graphene Market By Type (Multilayer Graphene, Monolayer Graphene), By Product Type (Graphene Powder, Graphene Sheet, Graphene Ink, Graphene Nanoplatelets, Others), By End-Use (Automotive, Aerospace, Energy And Power, Construction, Healthcare, Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 28528

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

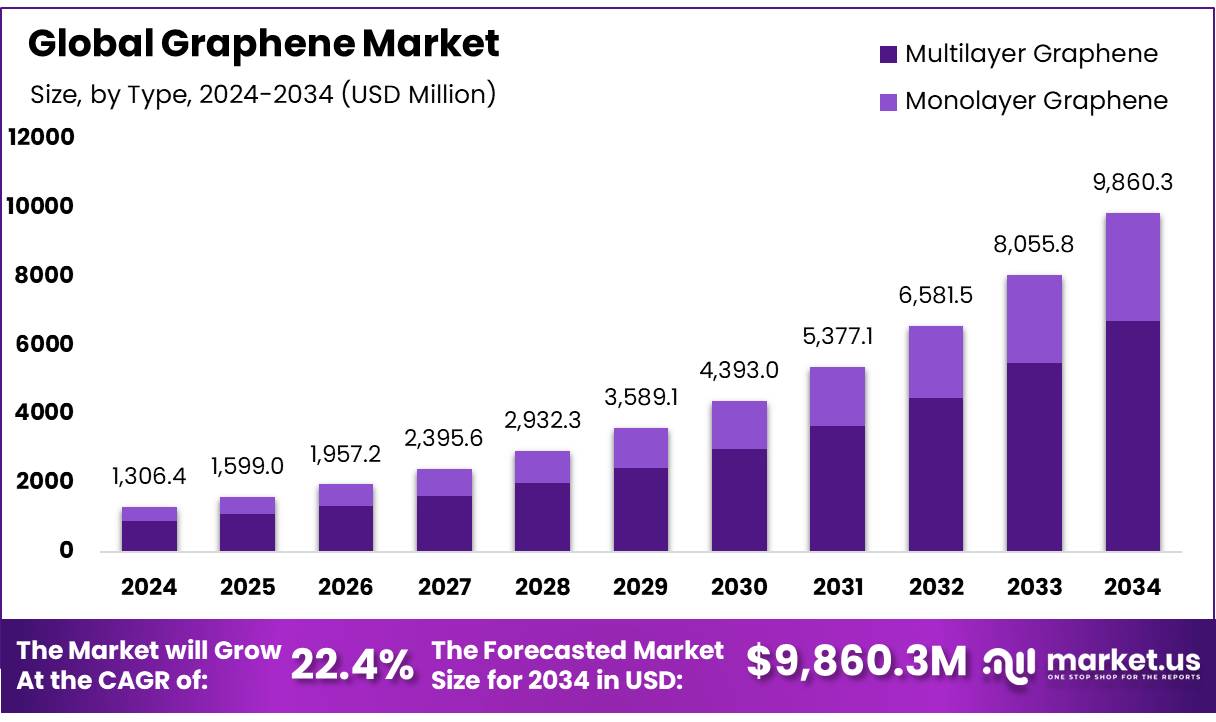

The Global Graphene Market size is expected to be worth around USD 9860.3 Million by 2034 from USD 1,306.40 Million in 2024, growing at a CAGR of 22.60% during the forecast period from 2025 to 2034.

The graphene market has witnessed substantial growth over the past few years, driven by its remarkable properties and versatility in a variety of industries, ranging from electronics to energy storage and manufacturing. Graphene, a single layer of carbon atoms arranged in a hexagonal lattice, is known for its outstanding strength, conductivity, and flexibility. These attributes have made it a highly sought-after material for applications in a range of sectors, including electronics, automotive, energy, and healthcare.

Several factors are driving the rapid expansion of the graphene market. One of the most prominent drivers is the demand for energy-efficient technologies. Graphene’s ability to enhance the performance of batteries and supercapacitors has made it a critical material in the electric vehicle (EV) and renewable energy sectors. The EV market, projected to reach USD 823 billion by 2030, relies on advanced battery technologies to meet performance and range demands, with graphene-based materials offering faster charging times, longer lifespans, and lighter weights than traditional lithium-ion batteries.

The future growth of the graphene market is expected to be propelled by continued technological advancements and increasing adoption across various industrial applications. One promising area is the development of graphene-based flexible electronics, including wearable devices and smart textiles, which have the potential to revolutionize the consumer electronics industry. With applications in sensors, displays, and conductive fabrics, graphene is poised to be a game-changer in the flexible electronics space.

Key Takeaways

- Graphene Market size is expected to be worth around USD 9860.3 Million by 2034 from USD 1,306.40 Million in 2024, growing at a CAGR of 22.60%.

- Multilayer Graphene held a dominant market position, capturing more than a 68.0% share.

- Graphene Powder held a dominant market position, capturing more than a 46.9% share of the overall graphene market.

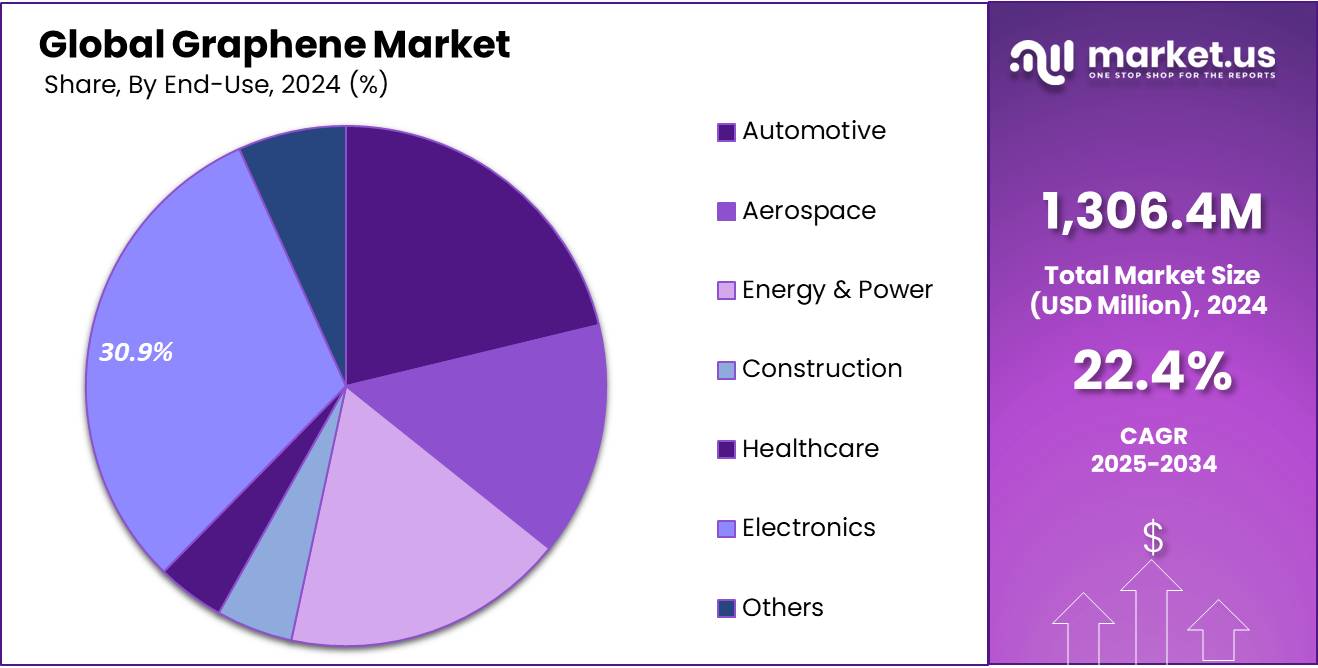

- Automotive held a dominant market position, capturing more than a 21.2% share of the graphene market.

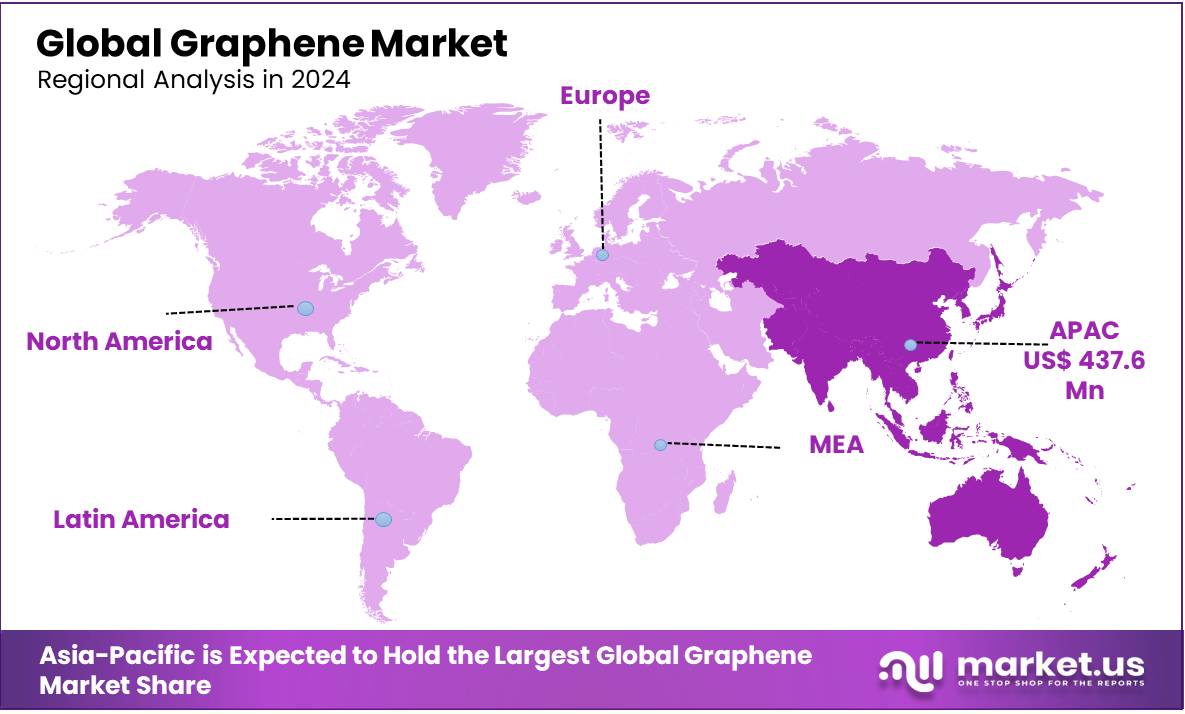

- Asia-Pacific (APAC) region emerged as the dominant player in the graphene market, capturing over 33.50% of the market share. Asia Pacific was valued at USD 437.64 Million in 2024.

By Type

In 2024, Multilayer Graphene held a dominant market position, capturing more than a 68.0% share of the overall graphene market. This type of graphene is widely used due to its superior electrical, thermal, and mechanical properties, which make it ideal for a range of applications, from electronics to energy storage. Multilayer graphene’s strong and stable structure allows it to withstand higher stresses, which is why it’s preferred in sectors like automotive, aerospace, and construction.

In contrast, Monolayer Graphene has shown steady growth in 2024. While it doesn’t have the same bulk strength as multilayer graphene, its unique properties such as high surface area and excellent conductivity make it highly attractive in fields like nanoelectronics and sensors. As research continues to push the boundaries of its applications, the market for monolayer graphene is expected to grow at a faster rate over the next few years, with predictions for further advancements in the material’s production techniques.

Product Type Analysis

In 2024, Graphene Powder held a dominant market position, capturing more than a 46.9% share of the overall graphene market. The primary appeal of graphene powder lies in its versatility and ease of use across various industries. It is widely employed in applications ranging from energy storage solutions, such as batteries and supercapacitors, to coatings and composites due to its high surface area and exceptional conductivity.

Graphene Sheets followed as the second most prominent product type in 2024, making up a considerable share of the market. Graphene sheets are particularly valued for their mechanical strength, flexibility, and conductivity, making them ideal for use in flexible electronics, sensors, and even transparent conductive films.

Graphene Ink has seen a steady increase in adoption, with growing demand in the fields of printed electronics and sensors. In 2024, graphene ink accounted for a smaller but significant portion of the market. This product type allows for the printing of conductive patterns on various substrates, making it highly useful in applications like printed circuits, displays, and energy-efficient devices.

Graphene Nanoplatelets also represented an important segment of the market in 2024, although its share was smaller compared to that of graphene powder. These materials are primarily used in the creation of high-strength composite materials and coatings.

End Use Analysis

In 2024, Electronics held a dominant market position, capturing more than a 30.9% share of the graphene market. Graphene’s remarkable electrical conductivity and flexibility make it an ideal material for next-generation electronic devices. It is increasingly used in flexible displays, touchscreens, transistors, and sensors, offering performance improvements over traditional materials.

The Automotive sector also plays a significant role in the graphene market, accounting for a substantial share in 2024. Graphene’s application in automotive materials helps reduce vehicle weight while improving strength and safety. It is also used to enhance battery performance, contributing to the growing electric vehicle market.

In 2024, the Aerospace industry also made significant strides in utilizing graphene, driven by the material’s strength-to-weight ratio and its potential to improve fel efficiency and reduce operational costs. Graphene is used in the production of lightweight composites, coatings, and advanced materials for aircraft and spacecraft.

The Energy & Power sector has increasingly adopted graphene for energy storage solutions in 2024. Graphene’s ability to enhance the performance of batteries and supercapacitors is a key factor in its rising popularity.

The Construction industry also saw growing adoption of graphene in 2024, particularly in the enhancement of building materials like concrete and coatings. Graphene is used to improve the strength, durability, and thermal conductivity of materials, making it highly suitable for construction applications.

In the Healthcare sector, while it represented a smaller portion of the market in 2024, graphene’s potential in medical applications is gaining attention. From drug delivery systems to biosensors and diagnostic tools, graphene’s biocompatibility and conductivity make it a promising material in the medical field.

Key Market Segments

By Type

- Multilayer Graphene

- Monolayer Graphene

By Product Type

- Graphene Powder

- Graphene Sheet

- Graphene Ink

- Graphene Nanoplatelets

- Others

By End-Use

- Automotive

- Aerospace

- Energy & Power

- Construction

- Healthcare

- Electronics

- Others

Driving Factors

- Innovative Applications: The versatility of graphene in a wide range of applications ranging including energy storage and electronics to coatings and composites is an important driving force. The extraordinary physical strength, electrical conductivity and thermal properties are what make it a desirable material for the development of innovative solutions.

- Government Investments in Research: Government initiatives and investments in research and development (R&D) play a pivotal role in driving the graphene market. Many countries are allocating substantial funds to support graphene-related projects, fostering technological advancements and market growth.

- Strong Demand in Electronics: The consumer electronics industry’s growing demand for lightweight, high-performance materials fuels the graphene market. Graphene’s use in flexible displays, batteries, and conductive inks contributes to its prominence in this sector.

- Environmental Sustainability: Graphene’s potential to enhance the energy efficiency of various technologies aligns with global sustainability goals. As industries seek eco-friendly solutions, graphene’s role in improving energy storage, water purification, and environmental remediation drives its adoption.

Restraining Factors

- Production Challenges: Scalable and cost-effective graphene production remains a challenge. The industry faces hurdles in achieving consistent quality, high yields, and low production costs, which can limit its widespread use.

- Regulatory Hurdles: Regulatory frameworks for graphene are still evolving. Uncertainty regarding safety standards and environmental impact assessments can hinder market growth and investments.

- Competitive Landscape: The graphene market is becoming increasingly competitive, with numerous companies entering the space. This competition can lead to pricing pressures and reduced profit margins for existing players.

- Material Integration: Integrating graphene into existing manufacturing processes can be complex. Compatibility issues and the need for process optimization can slow down adoption in some industries.

Growth Opportunities

- Energy Storage Advancements: Graphene’s use in supercapacitors and batteries presents a significant growth opportunity. As energy storage technologies advance, graphene’s role in improving battery capacity, charging speed, and lifespan will be crucial.

- Healthcare Innovations: The health sector has promising growth opportunities. The use of graphene-based materials is being investigated for delivery systems for drugs biosensors, biosensors, as well as tissue engineering, opening up new opportunities for medical applications.

- Emerging Markets: Countries like Asia-Pacific (APAC) along with Latin America are experiencing rapid urbanization and industrialization. These markets have significant growth opportunities, notably in the fields of construction, automobile and consumer electronics.

- Green Technologies: The potential of graphene to be used in environmentally friendly technologies including solar cells and water purification is an area that is rapidly growing. As environmental concerns push the use of green solutions, the role of graphene is set to grow.

Key Market Trends

- Graphene Nanocomposites: The use of graphene nanocomposites within materials like composites, plastics and coatings is an increasing trend. Nanocomposites can enhance the properties of material that provide increased durability, thermal conductivity and electrical efficiency.

- Graphene-Based Sensors: Graphene-based sensors are becoming popular in many industries. They offer high sensitivity and quick responses, making them useful for applications such as medical diagnostics, environmental monitoring, and health.

- Graphene in 3D Printing: 3D printing that incorporates graphene is a new trend. It enables the development of complex functional and functional structures that have enhanced mechanical properties that impact industries like healthcare and aerospace.

- Global Market Expansion: In 2023, APAC held a dominant market position, capturing more than a 34% share. The growth in this region is fueled by the growth of technological advancement, research investment, and the use graphene in the automotive and electronics. Europe as well as North America also remain key players in the graphene industry, with a particular focus on R&D and applications that are niche.

Geopolitical and Recession Impact Analysis

Geopolitical Impact:

- Trade Relations and Export Restrictions: Geopolitical tensions can lead to trade disruptions and export restrictions on critical materials used in graphene production. Export limitations on graphite, a primary source of graphene, or disruptions in supply chains due to political conflicts can affect the availability and pricing of graphene-based products.

- Intellectual Property and Regulation: Geopolitical developments can influence intellectual property protection and regulatory frameworks. Changes in patent laws and intellectual property disputes can impact innovation and competition in the graphene market, affecting market dynamics and investments.

- Global Collaboration: Geopolitical stability or instability can shape international research collaborations. Positive geopolitical relations may foster cross-border research and development efforts, leading to advancements in graphene technology. Conversely, geopolitical tensions may hinder such collaborations, slowing down innovation and growth.

- Market Access and Tariffs: Trade agreements and tariffs can impact the ease of market access for graphene products. Favorable trade agreements can facilitate market expansion, while trade disputes and tariffs may hinder market growth by increasing costs and reducing competitiveness.

Recession Impact:

- Research and Development Funding: Economic recessions can lead to reduced funding for research and development (R&D) in both the public and private sectors. This can slow down graphene innovation and the development of new applications, impacting the market’s growth potential.

- Consumer Spending: Economic downturns can reduce consumer spending on high-end products and technologies. Graphene, being an advanced and often premium material, may face decreased demand in certain consumer-facing industries, affecting market segments like electronics and automotive.

- Supply Chain Disruptions: Recessions can disrupt global supply chains, leading to material shortages and increased production costs. Graphene manufacturers may encounter challenges in sourcing raw materials or face delays in production, impacting product availability and pricing.

- Market Consolidation: Economic downturns can lead to market consolidation as smaller players struggle to compete. Larger companies with stronger financial positions may acquire or merge with competitors, reshaping the competitive landscape of the graphene market.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region emerged as the dominant player in the graphene market, capturing over 33.50% of the market share. The demand for graphene in Asia Pacific was valued at USD 437.64 Million in 2024 and is anticipated to grow significantly in the forecast period. APAC’s prominence is driven by its robust manufacturing capabilities, particularly in electronics and automotive industries, where graphene finds extensive use. Additionally, government initiatives and investments in research and development further stimulated market growth.

North America and Europe, while significant players, faced mature markets with steady growth rates. Latin America showcased potential growth opportunities in applications like composites, while the Middle East and Africa exhibited gradual adoption in various sectors. These regional dynamics underscore the importance of tailoring strategies to meet specific market conditions and opportunities in each region, allowing industry stakeholders to effectively navigate the global Graphene market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The market is extremely competitive and is constantly changing due to the existence of numerous small and medium-sized companies. Industry players are keen to spend money on research and development, as well as product innovations to increase their competitive edge over competitors. Some of the most notable players in the graphene industry include

- NanoXplore

- Repsol S.A.

- Graphenea SA

- Directa Plus

- Haydale Ltd.

- Global Graphene Group

- Ningbo Morsh Technology

- Moxi Group

- The Sixth Element (Changzhou) Materials Technology Co.,Ltd.

- Avanzare Innovación Tecnológica

- Xiamen Knano Graphene Technology

- Others

Recent Developement

In 2024 NanoXplore, the company’s revenue is projected to exceed CAD 40 million, reflecting strong demand for its graphene-enhanced products. NanoXplore is also expanding its footprint globally, with key partnerships and collaborations aimed at accelerating the adoption of graphene in commercial applications.

In 2024, Repsol aims to generate over €50 million in revenue from its graphene-related ventures, reflecting the increasing demand for advanced materials in these sectors.

Graphenea has a production capacity of over 20,000 square inches of graphene films annually and is focused on increasing its production capabilities to meet the growing demand for graphene in sectors like automotive and electronics.

Report Scope

Report Features Description Market Value (2024) US$ 1306.4 Mn Forecast Revenue (2034) US$ 9869.3 Mn CAGR (2025-2034) 22.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Multilayer Graphene, Monolayer Graphene), By Product Type (Graphene Powder, Graphene Sheet, Graphene Ink, Graphene Nanoplatelets, Others), By End-Use (Automotive, Aerospace, Energy And Power, Construction, Healthcare, Electronics, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape NanoXplore, Repsol S.A., Graphenea SA, Directa Plus, Haydale Ltd., Global Graphene Group, Ningbo Morsh Technology, Moxi Group, The Sixth Element (Changzhou) Materials Technology Co.,Ltd., Avanzare Innovación Tecnológica, Xiamen Knano Graphene Technology, Others Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- NanoXplore

- Repsol S.A.

- Graphenea SA

- Directa Plus

- Haydale Ltd.

- Global Graphene Group

- Ningbo Morsh Technology

- Moxi Group

- The Sixth Element (Changzhou) Materials Technology Co.,Ltd.

- Avanzare Innovación Tecnológica

- Xiamen Knano Graphene Technology

- Others