Global Small Gas Engine Market Size, Share, And Business Benefits By Engine Displacement (20 cc-100 cc, 101 cc-400 cc, 401 cc-650 cc), By Equipment (Chainsaws, Tillers, Hedge Trimmers, String Trimmers, Concrete Vibrators, Concrete Screeds, Lawn mowers, Leaf Blowers, Snow Blowers, Portable generators, Pressure Washer, Edgers, Others), By Fuel Type (Gasoline, Diesel), By Cooling System (Air-cooled, Liquid-cooled), By Fuel Delivery System (Carburetor, Fuel Injection), By Application (Domestic, Gardening/Landscaping, Construction, Industrial, Small Vehicles, Transportation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 135511

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Small Gas Engine Business Benefits

- By Engine Displacement Analysis

- By Equipment Analysis

- By Fuel Type Analysis

- By Cooling System Analysis

- By Fuel Delivery System Analysis

- By Application Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

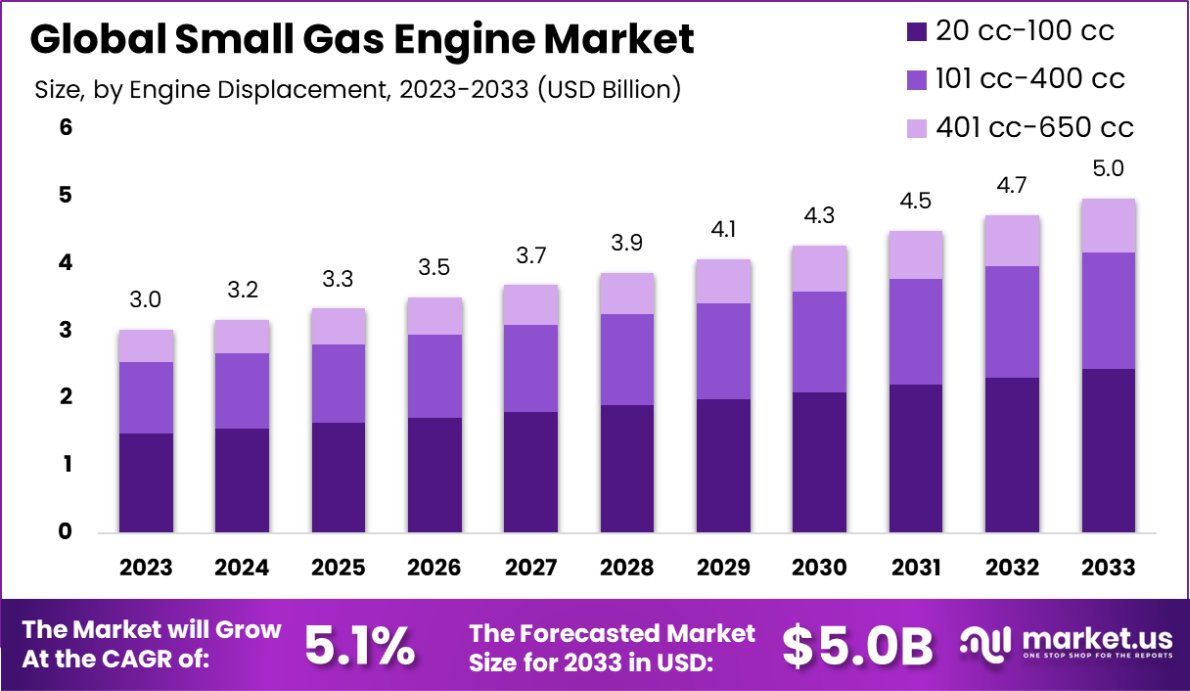

The Global Small Gas Engine Market is expected to be worth around USD 5.0 Billion by 2033, up from USD 3.0 Billion in 2023, and grow at a CAGR of 5.1% from 2024 to 2033. Asia-Pacific holds 48.4% of the Small Gas Engine Market, USD 1.4 Bn.

A small gas engine is a combustion engine that typically ranges in size from 0.5 to 20 horsepower. These engines are commonly used in a variety of power equipment such as lawn mowers, generators, and pressure washers. Their compact size and efficiency make them suitable for portable, outdoor, and residential applications where larger engines would be impractical.

The small gas engine market is experiencing growth due to several factors. Increased consumer spending on home improvement and landscaping projects has led to higher demand for outdoor power equipment. Moreover, advancements in technology have improved the fuel efficiency and performance of these engines, making them more appealing to environmentally conscious consumers.

Opportunities in the market are expanding with the rising popularity of battery-powered and hybrid models, which offer lower emissions and are gaining favor due to environmental regulations. This shift is driving innovation and creating new avenues for growth in the sector.

The Small Gas Engine (SGE) market is currently undergoing significant transformation, driven by regulatory pressures and technological advancements. As of 2018, the California Air Resources Board (CARB) reported approximately 15.4 million small off-road engines (SORE) in California, mirroring the state’s number of light-duty passenger cars.

This prevalence underscores the substantial role that SGEs play, particularly in sectors such as residential and commercial lawn and garden equipment, which account for 61% and 8% of SORE usage, respectively. Additionally, these engines are integral to construction and farming equipment (11%) and other equipment types (20%).

Regulatory initiatives have catalyzed notable improvements in emission standards, with CARB’s regulations making these engines 40-80% cleaner than they were before the program’s inception in 1990. This regulatory landscape is poised to evolve further, influenced by significant federal funding aimed at cleaner technology.

For instance, the U.S. Department of Energy has allocated $142 million for small business research and development grants in 2024, with $17.1 million earmarked specifically for hydrogen and fuel cell projects—a move that could pivot SGE applications towards more sustainable alternatives.

Additionally, an $18 million investment aims to enhance hydrogen detection systems, further bolstering the safety and efficacy of hydrogen-powered solutions in the SGE space.

Moreover, the shift towards cleaner fuels is already underway, evidenced by the 13.5% of Small SI engine families certified on CARB LEVI E10 fuel in 2018. This trend towards lower emissions and enhanced efficiency is not just a regulatory compliance measure but also a strategic imperative for manufacturers in the SGE market, aiming to align with both consumer preferences and global sustainability goals.

This holistic approach to innovation and environmental stewardship is expected to drive the SGE market’s growth and reshape its landscape in the coming years.

Key Takeaways

- The Global Small Gas Engine Market is expected to be worth around USD 5.0 Billion by 2033, up from USD 3.0 Billion in 2023, and grow at a CAGR of 5.1% from 2024 to 2033.

- The small gas engine market prominently features engines ranging from 101 cc to 400 cc, holding a 49.5% share.

- In terms of equipment utilization, chainsaws dominate, comprising 18.4% of the small gas engine market.

- Gasoline remains the preferred fuel type, overwhelmingly favored in the market at 79.5%.

- A majority of these engines are air-cooled, accounting for 78.4% of the market share.

- Carburetors are the primary fuel delivery system used, representing 67.4% of small gas engines.

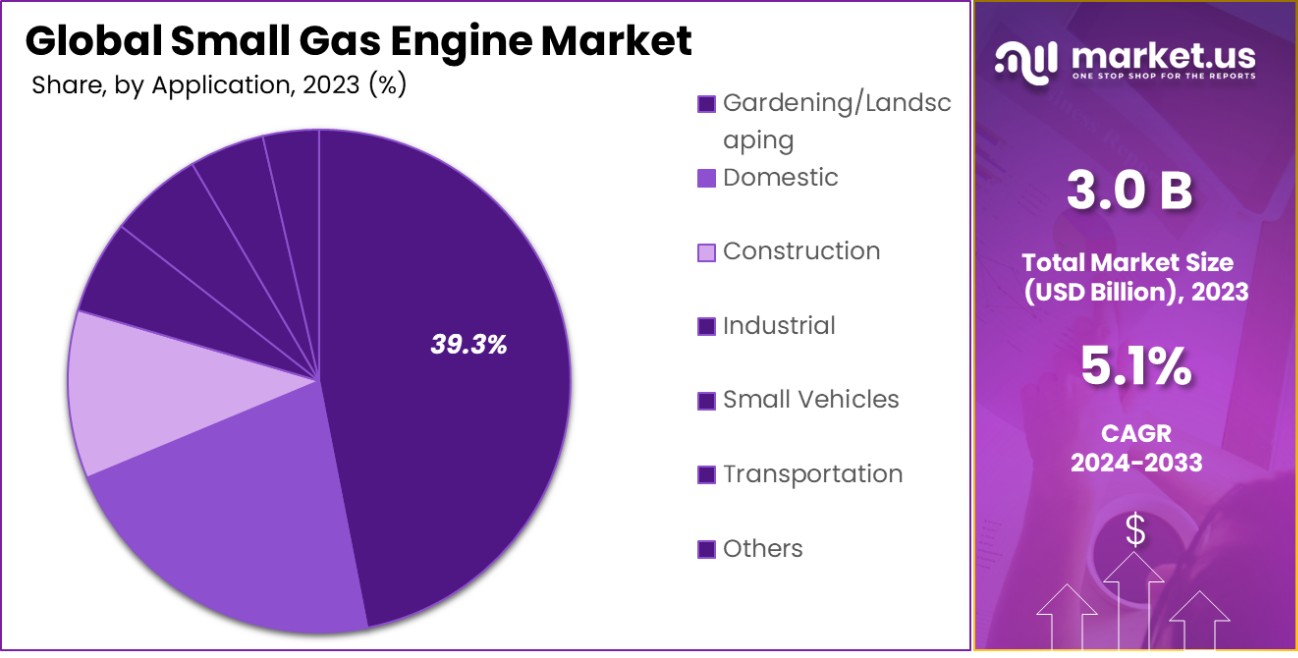

- Gardening and landscaping applications lead in usage, making up 39.3% of the small gas engine market.

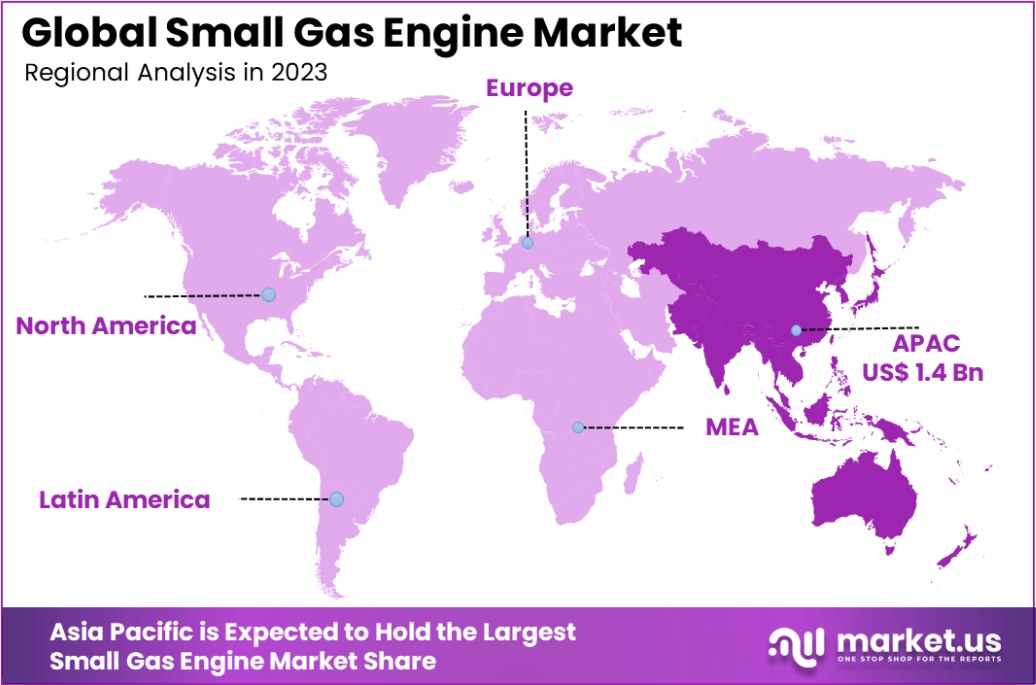

- The Asia-Pacific small gas engine market holds 48.4%, valued at USD 1.4 billion.

Small Gas Engine Business Benefits

Operating a small gas engine business can present numerous benefits, especially when aligned with supportive governmental data and initiatives. According to the U.S. Small Business Administration, small businesses can benefit from various government grants and tax incentives designed to encourage the growth of small-scale industries. For instance, specific tax credits may be available for businesses that employ sustainable practices or invest in research and development, which can include advancements in more efficient gas engine technologies.

The U.S. Department of Commerce reports that manufacturing businesses, including those in the small gas engine sector, have seen a steady growth in revenue, contributing significantly to the national economy. For example, a recent year showed a 5% increase in revenue for small manufacturing businesses, partially driven by the increased demand for more efficient and environmentally friendly gas engines.

Furthermore, governmental funding for technological innovation can be substantial. The Small Business Innovation Research (SBIR) program allocates funds to small businesses engaged in federal research and development with the potential for commercialization. In the past year, this program awarded approximately $2.5 billion across various sectors, including small-scale manufacturing sectors such as gas engines.

Such governmental support not only fuels revenue growth but also enhances the capabilities of small businesses in the gas engine industry to innovate and expand their market reach, creating a robust foundation for sustained economic contribution.

By Engine Displacement Analysis

In the small gas engine market, engines ranging from 101 cc to 400 cc dominate with a 49.5% share.

In 2023, the 101 cc-400 cc range held a dominant market position in the Small Gas Engine Market By Engine Displacement segment, capturing a 49.5% share. This segment’s leadership can be attributed to its versatile application in a broad array of equipment, from lawnmowers to small tractors, which are essential in both residential and commercial settings.

The engines within this displacement range offer a balance of power, efficiency, and affordability, making them highly appealing to a wide spectrum of users.

On the other hand, the 20 cc-100 cc segment, though smaller in capacity, also plays a crucial role in powering lightweight and portable devices. These engines are preferred for applications where compactness and ease of mobility are paramount. Meanwhile, the 401 cc-650 cc engines cater to a niche market that requires more robust power output for heavy-duty machinery and equipment.

Understanding these segments helps businesses tailor their products and marketing strategies to meet specific customer needs, ensuring they capture the right audience and optimize their market presence. As these segments continue to evolve, staying attuned to their dynamics will be key for stakeholders aiming to leverage growth opportunities within the Small Gas Engine Market.

By Equipment Analysis

Chainsaws, a vital tool for forestry and landscaping, represent 18.4% of the market by equipment type.

In 2023, Chainsaws held a dominant market position in the By Equipment segment of the Small Gas Engine Market, with an 18.4% share. This prominence is largely due to their indispensable role in forestry operations, residential landscaping, and emergency outdoor work. Chainsaws combine power with mobility, making them essential for both professionals and homeowners alike.

Tillers and lawnmowers also maintain substantial market shares due to their widespread use in gardening and landscape maintenance. These tools are favored for their efficiency in cultivating soil and maintaining lawns, crucial for both aesthetic and environmental management. Hedge trimmers, string trimmers, and edgers are similarly important for detailed trimming and edging, catering to precise landscaping needs.

Meanwhile, more specialized equipment like concrete vibrators, concrete screeds, and pressure washers address specific needs in construction and maintenance, ensuring quality and durability in building projects.

Snow blowers and leaf blowers, essential in seasonal maintenance, optimize labor efforts in adverse weather conditions. Lastly, portable generators stand out for providing essential power solutions in areas lacking electricity access or during power outages, highlighting their versatility and reliability.

This segmentation reveals the diverse applications of small gas engines and highlights the opportunities for targeted product development and marketing strategies within the industry.

By Fuel Type Analysis

A substantial 79.5% of small gas engines are powered by gasoline, highlighting its prevalence as a fuel choice.

In 2023, Gasoline held a dominant market position in the By Fuel Type segment of the Small Gas Engine Market, capturing an impressive 79.5% share. This significant preference for gasoline as a fuel source is primarily due to its widespread availability and cost-effectiveness compared to other fuel types.

Gasoline engines are highly favored in residential and commercial power equipment for their ease of use, efficiency, and reliable performance across a range of applications from lawn mowers to portable generators.

Diesel engines, although less prevalent in the small engine space, are valued for their durability and higher torque output, which are beneficial for heavy-duty equipment and applications that demand more sustained power. Despite their strengths, the higher cost, maintenance demands, and bulkier design of diesel engines make them less attractive for typical small engine applications.

The preference for gasoline engines highlights their adaptability and efficiency in meeting everyday needs in both urban and rural settings. For businesses operating within the Small Gas Engine Market, understanding this fuel type preference is crucial for aligning product development and marketing strategies with consumer and professional needs, ensuring they meet market demands effectively.

By Cooling System Analysis

Air-cooled systems are preferred for cooling in small gas engines, making up 78.4% of the market.

In 2023, Air-Cooled engines held a dominant market position in the By Cooling System segment of the Small Gas Engine Market, with a commanding 78.4% share. This widespread preference for air-cooled systems is primarily driven by their simplicity, cost-effectiveness, and lower maintenance requirements compared to liquid-cooled systems.

Air-cooled engines are particularly popular in smaller, portable equipment like chainsaws, lawn mowers, and leaf blowers, where direct cooling by ambient air provides sufficient temperature regulation without the added complexity and cost of a liquid system.

On the other hand, Liquid-cooled engines, while they represent a smaller portion of the market, are preferred in applications requiring engines that run cooler and at more consistent temperatures, such as in larger agricultural equipment and some high-power generators. These engines are appreciated for their ability to handle more intensive use without overheating, extending the engine’s lifespan and enhancing performance.

The dominance of air-cooled engines in the market highlights their suitability for a broad range of consumer and commercial applications, underscoring the importance for manufacturers to continue innovating within this technology to meet the evolving needs and preferences of the market.

By Fuel Delivery System Analysis

Carburetors are the most common fuel delivery system in small gas engines, with a 67.4% market share.

In 2023, Carburetor held a dominant market position in the Fuel Delivery System segment of the Small Gas Engine Market, with a 67.4% share, contributing significantly to the overall market dynamics. Carburetors have long been the preferred choice for small gas engines, offering a well-established and cost-effective solution for fuel mixing and delivery.

Their ease of use, lower initial cost, and simplicity in maintenance continue to make them the go-to option for a variety of small engine applications, such as lawnmowers, chainsaws, and generators. Despite the growing trend towards more advanced technologies, carburetors remain a key player, benefiting from their ability to deliver reliable performance at an affordable price point.

On the other hand, Fuel Injection systems, while accounting for the remaining share of the market, have been gradually gaining traction. In 2023, the Fuel Injection segment grew steadily, driven by increasing demand for improved fuel efficiency, lower emissions, and enhanced engine performance.

The shift towards fuel injection systems is expected to continue, as manufacturers invest in advanced engine technologies to meet stricter environmental standards and consumer preferences for higher fuel efficiency. Overall, while carburetors still dominate, the fuel injection segment is expected to experience significant growth as innovation in small engine technology progresses.

By Application Analysis

Gardening and landscaping applications account for 39.3% of the market, underscoring the importance of these sectors.

In 2023, Gardening/Landscaping held a dominant market position in the By Application segment of the Small Gas Engine Market, with a 39.3% share. This sector’s significant market share can be attributed to the widespread use of small gas engines in lawnmowers, trimmers, and other gardening tools.

As residential and commercial landscaping continues to grow, the demand for efficient, high-performance small gas engines remains strong. The trend of homeownership and urban gardening has also contributed to the expansion of this segment, with consumers seeking reliable equipment for their gardening and landscaping needs.

The Domestic application segment, while smaller, follows closely in importance, driven by the ongoing demand for small engines in household equipment. On the other hand, the Construction and Industrial sectors are seeing steady growth, fueled by the need for portable power tools and machinery in these industries.

Small engines are crucial for operating equipment such as portable generators, concrete mixers, and power washers, making them indispensable in construction and industrial applications.

In the Small Vehicles and Transportation segments, there is growing interest in compact, fuel-efficient engines for scooters, ATVs, and other small vehicles. While these segments are emerging, the growth in gardening and landscaping applications continues to lead, making it the dominant force in the small gas engine market.

Key Market Segments

By Engine Displacement

- 20 cc-100 cc

- 101 cc-400 cc

- 401 cc-650 cc

By Equipment

- Chainsaws

- Tillers

- Hedge Trimmers

- String Trimmers

- Concrete Vibrators

- Concrete Screeds

- Lawn mowers

- Leaf Blowers

- Snow Blowers

- Portable generators

- Pressure Washer

- Edgers

- Others

By Fuel Type

- Gasoline

- Diesel

By Cooling System

- Air-cooled

- Liquid-cooled

By Fuel Delivery System

- Carburetor

- Fuel Injection

By Application

- Domestic

- Gardening/Landscaping

- Construction

- Industrial

- Small Vehicles

- Transportation

Driving Factors

Increasing Demand for Outdoor Power Equipment

The rise in outdoor activities and gardening, especially in urban and suburban areas, has significantly driven the small gas engine market. People are spending more time maintaining their lawns and gardens, leading to a steady demand for equipment like lawnmowers, trimmers, and leaf blowers.

In addition, commercial landscaping services are expanding, increasing the need for reliable and efficient small gas engines. As outdoor power equipment becomes an essential part of daily life for both homeowners and businesses, the market for small gas engines is expected to grow further.

Growing Preference for Fuel Efficiency and Performance

As consumers become more environmentally conscious, there is an increasing preference for engines that offer better fuel efficiency and improved performance. Small gas engines have evolved to meet these demands by incorporating advanced technologies that reduce fuel consumption while maintaining high output.

This is particularly evident in industries like landscaping and construction, where equipment needs to operate efficiently for extended periods. The demand for more fuel-efficient, high-performing engines is driving innovation, encouraging manufacturers to develop products that cater to these needs, thus stimulating market growth.

Expanding Use of Small Gas Engines in Construction and Industrial Sectors

Small gas engines are becoming essential in construction and industrial applications, where portable equipment like generators, pressure washers, and compact machinery is in constant use. As these industries expand globally, the need for reliable, mobile power sources continues to increase.

Small gas engines offer flexibility and convenience for on-the-go power, making them the preferred choice for contractors and industrial operations that require durability and ease of transport. This growth in demand from the construction and industrial sectors is a key driver behind the expanding small gas engine market.

Restraining Factors

Growing Shift Towards Electric Alternatives

One of the biggest challenges facing the small gas engine market is the growing shift towards electric-powered alternatives. Consumers are increasingly opting for electric-powered tools and machinery due to their lower environmental impact, reduced noise, and ease of use.

Electric engines also eliminate the need for fuel and oil, offering lower maintenance costs. This trend is especially prominent in the gardening and landscaping sectors, where battery-powered lawnmowers and trimmers are becoming popular. As electric technology continues to improve, small gas engines face tough competition in several key markets.

Stringent Environmental Regulations and Emission Standards

With the increasing focus on environmental protection, stricter emission regulations and standards are posing significant challenges for the small gas engine market. Many countries are introducing tighter regulations to reduce emissions from small engines, especially in outdoor power equipment. These regulations often require manufacturers to invest in costly technologies to meet the new standards.

This not only increases production costs but also limits the flexibility of small gas engines in certain markets. As these regulations become more stringent, manufacturers may face difficulties maintaining compliance while keeping products affordable.

High Maintenance Costs and Fuel Dependency

While small gas engines offer reliable performance, they often require higher maintenance compared to their electric counterparts. Gas engines need regular oil changes, spark plug maintenance, and fuel management, which can be costly for users.

Additionally, the ongoing dependency on fuel, which can be expensive and subject to price fluctuations, creates a financial burden for consumers. As the cost of fuel rises, this may deter customers from investing in small gas engine products, especially when electric alternatives offer a lower overall cost of ownership with fewer maintenance requirements.

Growth Opportunity

Rising Demand for Outdoor Power Equipment in Urban Areas

As urbanization continues to grow, more people are investing in outdoor power equipment for both residential and commercial purposes. The demand for small gas engines in urban areas is increasing, driven by the need for lawnmowers, trimmers, and other gardening tools.

This trend presents a major growth opportunity for manufacturers of small gas engines, especially as more people seek efficient and reliable equipment for maintaining their green spaces. Companies that cater to these evolving needs can tap into a growing customer base.

Technological Advancements in Engine Efficiency and Emissions

Technological innovation presents a significant growth opportunity for the small gas engine market. Manufacturers are focusing on improving engine efficiency, reducing fuel consumption, and lowering emissions. Innovations such as cleaner burning technologies and hybrid solutions can help meet increasingly strict environmental regulations while improving engine performance.

Small gas engines that offer better fuel efficiency and lower emissions will be in high demand across various industries, especially construction, industrial, and gardening. Companies that invest in such technologies will have a competitive edge in the evolving market.

Expansion of Small Gas Engines in Emerging Markets

Emerging markets, especially in Asia-Pacific, Latin America, and parts of Africa, are experiencing rapid industrialization and urbanization. This growth is driving the demand for small gas engines in sectors like construction, agriculture, and smart transportation.

As these markets develop, the need for portable and efficient engines to power equipment such as generators, irrigation systems, and small vehicles will continue to rise. Manufacturers can capitalize on this opportunity by expanding their presence in these regions and offering cost-effective, high-performance solutions tailored to local needs.

Latest Trends

Shift Towards Cleaner and Greener Engine Technologies

One of the latest trends in the small gas engine market is the increasing focus on cleaner and greener engine technologies. As environmental concerns grow, manufacturers are incorporating innovative solutions to reduce emissions and fuel consumption.

Technologies such as catalytic converters, improved carburetors, and low-emission engines are gaining popularity. This trend is driven by stricter government regulations, consumer demand for sustainable products, and the need for businesses to reduce their environmental footprint. Engines that meet eco-friendly standards are expected to see continued growth in various industries.

Growing Popularity of Hybrid Gasoline-Electric Engines

Another emerging trend in the small gas engine market is the rising popularity of hybrid gasoline-electric engines. These engines combine the benefits of gas power with the efficiency of electric motors, offering the best of both worlds.

Hybrid systems are becoming more common in lawnmowers, trimmers, and small vehicles, as they provide increased fuel efficiency and lower emissions compared to traditional gas engines. This trend is driven by consumer preferences for more environmentally friendly options and the increasing availability of hybrid engine technologies at affordable prices.

Integration of Smart Technologies in Small Engines

The integration of smart technologies into small gas engines is another key trend shaping the market. Manufacturers are incorporating features such as GPS tracking devices, remote diagnostics, and automated maintenance alerts into their products.

These smart technologies not only enhance the user experience by providing greater control and efficiency but also improve engine performance and longevity. This trend is especially prominent in the landscaping and construction sectors, where equipment downtime can be costly. The growing demand for smart engines that offer more convenience and control is expected to drive further market expansion.

Regional Analysis

In 2023, the Asia-Pacific region dominated the small gas engine market with a 48.4% share, valued at USD 1.4 billion.

In the global Small Gas Engine Market, the Asia-Pacific region holds the dominant position, accounting for 48.4% of the market share, valued at approximately USD 1.4 billion in 2023. This region’s dominance is driven by rapid industrialization, urbanization, and a growing demand for outdoor power equipment in countries like China, India, and Japan. Additionally, the agricultural and construction sectors in these countries are major consumers of small gas engines.

North America is another significant market, contributing around 25.7% to the overall market, supported by strong demand for small engines in the lawn and garden, construction, and recreational vehicle segments. The United States, in particular, remains a key player, where advancements in engine technology and a preference for high-performance, fuel-efficient engines continue to drive growth.

Europe, holding 18.2% of the market share, sees steady demand for small gas engines in both domestic and industrial applications. The region’s focus on sustainability and eco-friendly products is pushing manufacturers toward cleaner engine technologies.

The Middle East & Africa and Latin America together account for the remaining share, with both regions gradually increasing their consumption due to growing industrial and infrastructure development needs. However, these regions still represent smaller markets compared to the dominant Asia-Pacific and North American sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global small gas engine market continues to be vibrant and competitive, with several key players shaping the industry landscape. Among these, Briggs & Stratton and Honda Motor Co., Ltd. stand out due to their long-standing reputation and broad market reach. Briggs & Stratton has been particularly adept at maintaining its market dominance through innovation in engine efficiency and durability, which are critical factors for consumers and industrial users alike.

Honda is renowned for its engineering excellence and has capitalized on its high-performance, reliable engines to penetrate diverse market segments. Both companies benefit from robust distribution networks and brand loyalty, which are essential in a market where reliability and performance are paramount.

Kohler Co. and Kawasaki Heavy Industries, Ltd. also play significant roles, each bringing their unique strengths to the table. Kohler has made significant inroads with its focus on power generation and versatility, making its engines ideal for a wide range of professional applications. Kawasaki, on the other hand, continues to leverage its expertise in precision engineering to enhance the performance standards of its engines.

Emerging players like Champion Power Equipment and Generac Power Systems, Inc. are also noteworthy, having successfully carved niches in residential and portable power applications, thus broadening the market’s scope. Their success can be attributed to strategic marketing and responsive manufacturing practices that meet specific consumer needs.

In summary, the competitive landscape in 2023 is defined by both innovation and strategic market segmentation, with leading companies like Briggs & Stratton and Honda maintaining their edge through continuous improvement and adaptation to market demands. Meanwhile, newer entrants are finding success by focusing on niche markets and specialized applications, adding a dynamic dimension to the industry.

Top Key Players in the Market

- Briggs & Stratton

- Honda Motor Co., Ltd.

- Kohler Co.

- Kawasaki Heavy Industries, Ltd.

- Yamaha Motor Corporation

- KUBOTA Corporation

- Liquid Combustion Technology, LLC

- KIPOR

- Champion Power Equipment

- Fuzhou Launtop M&E Co., Ltd.

- Loncin Holdings Co.

- MARUYAMA MFg., Co.Inc.

- Fujian Jinjiang Sanli Engine Co., Ltd.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- CHONGQING RATO HOLDING (GROUP) CO., LTD.

- Koki Holdings Co., Ltd.

- Generac Power Systems, Inc.

- Sinoquip Power

- Lifan Power

- Chongqing Winyou Power Co., Ltd.

- Lombardini Srl

Recent Developments

- In 2024, Briggs & Stratton enhanced their PowerProtect™ generators, introducing models from 13kW to 26kW with NGMax™ and Eco-Cise™ technologies. The 26kW model stands out with 68% more motor starting power and superior performance on natural gas, offering more power at a lower cost per kilowatt.

- In 2023, Kubota Corporation advanced in the small gas engine sector, focusing on eco-friendly engines like the D902-K and D1105-K. These models feature the TVCR system that enhances fuel efficiency and meets strict global emissions standards, supporting carbon neutrality efforts.

Report Scope

Report Features Description Market Value (2023) USD 3.0 Billion Forecast Revenue (2033) USD 5.0 Billion CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Engine Displacement (20 cc-100 cc, 101 cc-400 cc, 401 cc-650 cc), By Equipment (Chainsaws, Tillers, Hedge Trimmers, String Trimmers, Concrete Vibrators, Concrete Screeds, Lawn mowers, Leaf Blowers, Snow Blowers, Portable generators, Pressure Washer, Edgers, Others), By Fuel Type (Gasoline, Diesel), By Cooling System (Air-cooled, Liquid-cooled), By Fuel Delivery System (Carburetor, Fuel Injection), By Application (Domestic, Gardening/Landscaping, Construction, Industrial, Small Vehicles, Transportation) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Briggs & Stratton, Honda Motor Co., Ltd., Kohler Co., Kawasaki Heavy Industries, Ltd., Yamaha Motor Corporation , KUBOTA Corporation, Liquid Combustion Technology, LLC, KIPOR, Champion Power Equipment, Fuzhou Launtop M&E Co., Ltd., Loncin Holdings Co., MARUYAMA MFg., Co.Inc., Fujian Jinjiang Sanli Engine Co., Ltd., MITSUBISHI HEAVY INDUSTRIES, LTD., CHONGQING RATO HOLDING (GROUP) CO., LTD., Koki Holdings Co., Ltd., Generac Power Systems, Inc., Sinoquip Power, Lifan Power, Chongqing Winyou Power Co., Ltd., Lombardini Srl Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Small Gas Engine MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Small Gas Engine MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Briggs & Stratton

- Honda Motor Co., Ltd.

- Kohler Co.

- Kawasaki Heavy Industries, Ltd.

- Yamaha Motor Corporation

- KUBOTA Corporation

- Liquid Combustion Technology, LLC

- KIPOR

- Champion Power Equipment

- Fuzhou Launtop M&E Co., Ltd.

- Loncin Holdings Co.

- MARUYAMA MFg., Co.Inc.

- Fujian Jinjiang Sanli Engine Co., Ltd.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- CHONGQING RATO HOLDING (GROUP) CO., LTD.

- Koki Holdings Co., Ltd.

- Generac Power Systems, Inc.

- Sinoquip Power

- Lifan Power

- Chongqing Winyou Power Co., Ltd.

- Lombardini Srl