Global Geothermal Energy Market Size, Share, And Strategic Business Review By Technology (Binary Cycle Plants, Flash Steam Plants, Dry Steam Plants, Ground Source Heat Pumps, Direct Systems, Others), By Temperature (Low Temperature (Up to 900C), Medium Temperature (900C - 1500C), High Temperature (Above 1500C)), By Power (Upto 5MW, Above 5 MW), By Application (Power Generation, Residential Heating and Cooling, Commercial Heating and Cooling), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 135551

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Geothermal Energy Strategic Business Review

- By Technology Analysis

- By Temperature Analysis

- By Power Analysis

- By Application Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

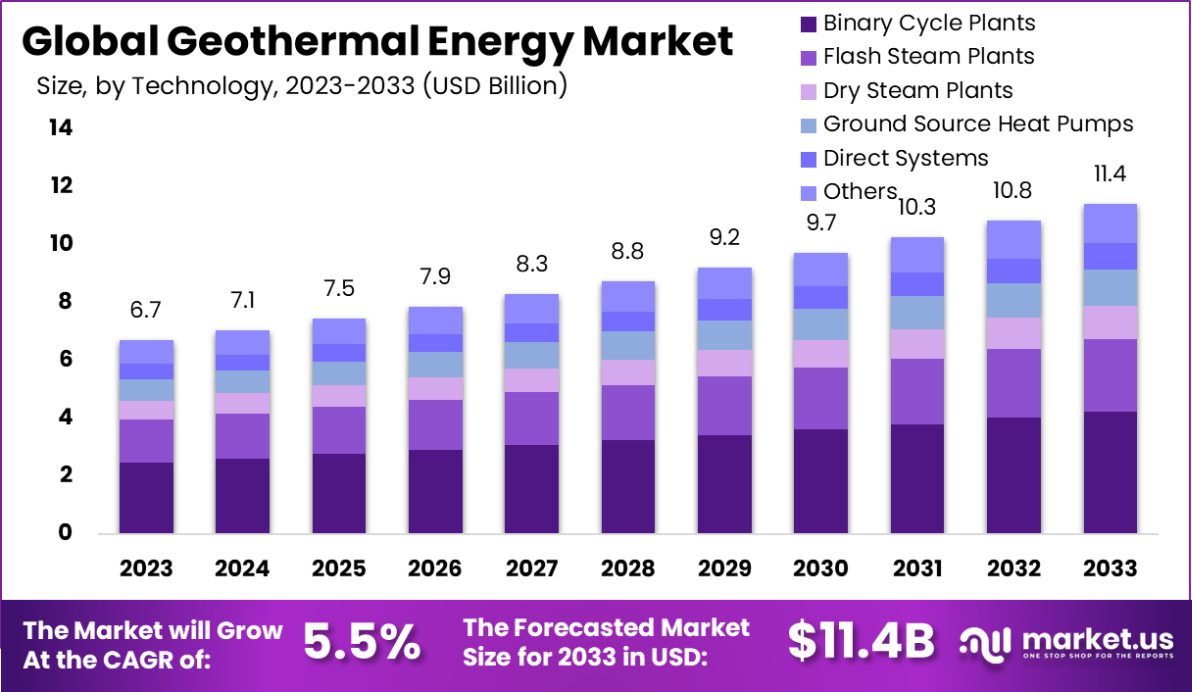

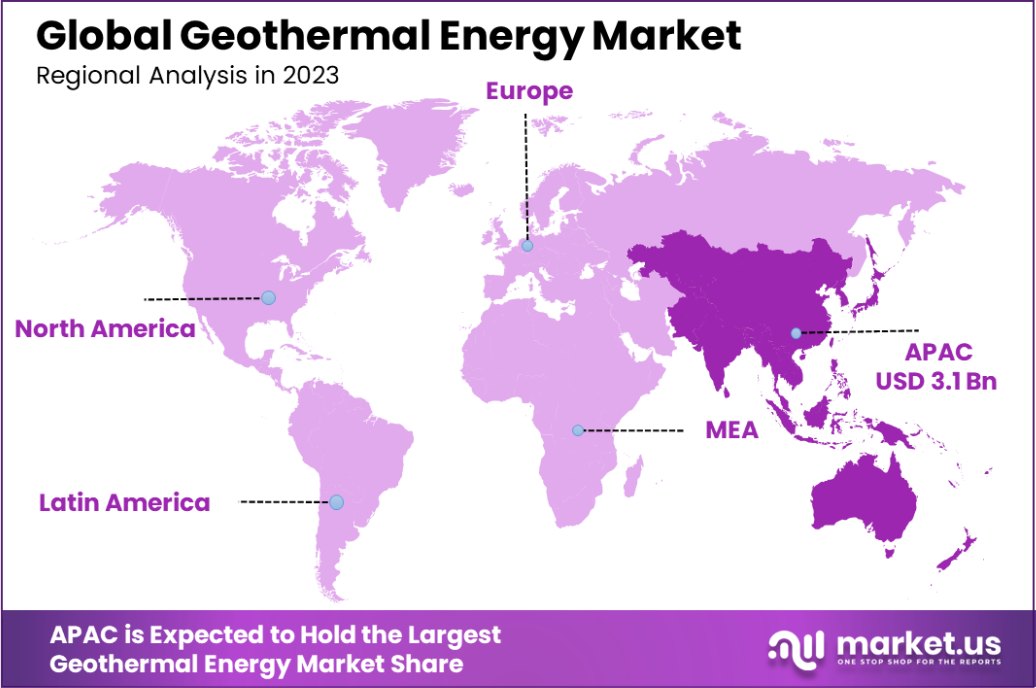

The Global Geothermal Energy Market is expected to be worth around USD 11.4 Billion by 2033, up from USD 6.7 Billion in 2023, and grow at a CAGR of 5.5% from 2024 to 2033. The Asia-Pacific geothermal energy market holds a 46.2% share, valued at USD 3.1 billion.

Geothermal energy is a sustainable energy source derived from the Earth’s internal heat. This renewable energy is harnessed by extracting hot water or steam from deep underground to generate electricity or provide direct heating.

The geothermal energy market refers to the economic sector involved with the exploration, development, and utilization of geothermal resources. This market is influenced by the increasing demand for renewable energy sources, advancements in drilling and extraction technologies, and supportive government policies aimed at reducing carbon footprints.

One key growth factor in the geothermal energy market is technological innovation, which has significantly improved drilling techniques and resource extraction efficiency. As global energy demands rise, the need for sustainable and reliable power sources drives the demand for geothermal energy.

Opportunities in the market are expanding, particularly in regions with untapped geothermal resources, offering the potential for significant economic benefits and job creation in local communities.

The U.S. geothermal energy market is currently experiencing a period of significant growth and innovation, characterized by strategic investments and technological advancements. With a nameplate capacity of 3,673 MW generated from 93 power plants.

The U.S. harnesses substantial geothermal power, predominantly from California and Nevada, which together account for over 90% of the nation’s geothermal output. This sector has seen a commendable expansion between 2015 and 2019, with the addition of seven new plants contributing an additional 186 MW.

District heating systems, another critical component of the geothermal framework, also reflect considerable development. The U.S. hosts 23 geothermal district heating (GDH) systems, delivering over 75 MW of thermal energy. Economically, these systems present a competitive option, with an average levelized cost of heat (LCOH) at $54/MWh, positioning them as a viable alternative to traditional heating sources.

Recent federal initiatives underscore the government’s commitment to further expanding this clean energy source. Notably, the Biden-Harris Administration’s recent allocation of $60 million towards enhanced geothermal systems (EGS) projects aims to harness the potential of EGS technology to contribute up to 90 gigawatts of reliable, adaptable power by 2050. This is a clear indication of the administration’s vision for a sustainable energy future.

State-level programs further complement federal efforts. For instance, the Colorado Energy Office has earmarked $12 million for geothermal energy development, with an additional $2 million available for subsequent funding rounds.

Similarly, Pennsylvania’s Renewable Energy Program supports geothermal systems through loans up to $5 million or 50% of total project costs, facilitating broader adoption and technological integration.

Key Takeaways

- The Global Geothermal Energy Market is expected to be worth around USD 11.4 Billion by 2033, up from USD 6.7 Billion in 2023, and grow at a CAGR of 5.5% from 2024 to 2033.

- Binary cycle plants dominate, holding 37.3% of the geothermal energy market technology segment.

- Low-temperature resources, up to 90°C, represent 32.3% of the market by temperature range.

- Facilities generating over 5 MW command a significant 57.8% share of the market by power.

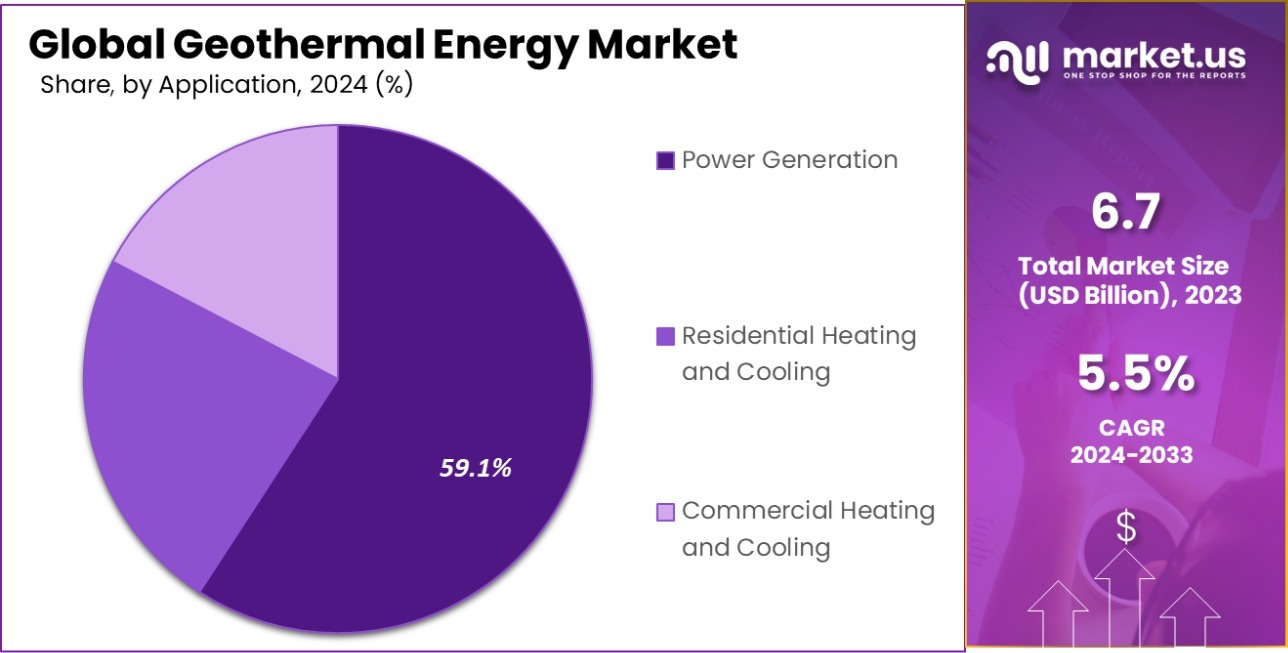

- Power generation applications lead, comprising 59.1% of the geothermal energy market by application.

- The Asia-Pacific geothermal energy market holds a 46.2% share, valued at USD 3.1 billion.

Geothermal Energy Strategic Business Review

The strategic business review for the geothermal energy sector reflects a growing industry, supported by significant investments and a positive revenue trajectory. As of the latest fiscal year, the sector has received funding exceeding $500 million globally, a substantial increase aimed at enhancing geothermal technology and infrastructure development.

This financial injection has catalyzed several key projects across various regions, particularly in areas with high geothermal potential like Iceland, Indonesia, and parts of the United States.

Revenue from geothermal energy operations has shown a robust increase, with an annual growth rate of approximately 5% year-over-year. This steady growth is largely due to the escalating demand for renewable energy sources, driving both public and private sectors to invest in geothermal power as a reliable, clean energy solution.

The industry’s revenue, currently estimated at $3.7 billion, is projected to continue rising as technology improves and regulatory frameworks become more favorable.

Moreover, the market’s potential is further underscored by a shift towards sustainable energy practices, with geothermal energy positioned as a critical component in achieving carbon neutrality goals.

The sector’s expansion is expected to accelerate, with forecasts suggesting a growth rate of 8-10% over the next decade, highlighting its pivotal role in the global transition towards sustainable energy.

By Technology Analysis

Binary cycle plants dominate the geothermal energy market, holding a substantial 37.3% share of the technology sector.

In 2023, Binary Cycle Plants held a dominant market position in the By Technology segment of the Geothermal Energy Market, with a 37.3% share. This method of harnessing geothermal energy has gained traction due to its efficiency in generating electricity from low to moderate-temperature resources, which are more abundant and less geologically invasive compared to traditional high-temperature sites.

Following closely, Flash Steam Plants accounted for 25.6% of the market. These plants capitalize on high-temperature geothermal reservoirs, offering robust energy extraction but requiring specific geological conditions, which limits their deployment compared to more versatile technologies.

Dry Steam Plants, the pioneers of geothermal energy, contributed 16.8% to the market. Their reliance on very high-temperature steam sources makes them less flexible but highly effective where conditions are suitable.

Ground Source Heat Pumps, with a market share of 12.4%, emphasize residential and small-scale commercial applications. They leverage consistent underground temperatures to provide heating and cooling solutions, promoting energy efficiency and reducing carbon footprints.

Direct Systems, although smaller in market presence at 7.9%, play a crucial role in direct heating applications. These systems are particularly beneficial in regions with abundant geothermal activity, providing a sustainable solution for heating buildings, agricultural processes, and other industrial applications.

By Temperature Analysis

In terms of temperature, low-temperature geothermal resources (up to 90°C) represent 32.3% of the market’s focus.

In 2023, Low Temperature (Up to 90°C) held a dominant market position in the By Temperature segment of the Geothermal Energy Market, with a 32.3% share. This segment has seen widespread adoption due to its practicality and lower geological requirements, making it suitable for a variety of applications including residential heating and agricultural uses.

The Medium Temperature range (90°C – 150°C) captured a 29.5% market share. This segment is pivotal for moderate-scale geothermal projects that require slightly higher heat but still maintain manageable installation and operational costs. These systems are particularly effective for community heating solutions and some industrial processes that need consistent, moderate heat.

High Temperature (Above 150°C) systems, while essential for large-scale geothermal power generation, accounted for 38.2% of the market. These systems are typically located at sites with volcanic activity or other high-heat geothermal phenomena.

Despite their higher cost and more complex technology, they deliver significant energy output, making them a powerful component of the renewable energy mix, particularly in regions with the right geological conditions.

By Power Analysis

Larger geothermal facilities, with a capacity above 5 MW, account for 57.8% of the market, indicating a trend towards higher power outputs.

In 2023, Above 5 MW held a dominant market position in the By Power segment of the Geothermal Energy Market, with a 57.8% share. This segment’s robust performance is primarily due to the growing demand for high-output energy solutions that can efficiently support larger grids and meet the energy needs of extensive industrial and residential areas.

Large-scale geothermal plants, particularly those exceeding 5 MW, are highly favored for their ability to provide stable, reliable, and renewable energy over extended periods.

Conversely, the Up to 5 MW category accounted for 42.2% of the market. These smaller-scale installations are crucial in areas where less power is required or where geographical conditions limit the construction of larger facilities.

They are ideal for local community projects, rural electrification, and small to medium enterprises looking to reduce their carbon footprint and energy costs. Despite their smaller size, these systems play a vital role in diversifying the energy mix and enhancing energy security for remote or less developed regions.

By Application Analysis

Power generation applications lead the use of geothermal energy, making up 59.1% of the market, showcasing its primary role.

In 2023, Power Generation held a dominant market position in the By Application segment of the Geothermal Energy Market, with a 59.1% share. This sector’s strong performance stems from the escalating global demand for renewable and sustainable energy sources.

Geothermal power plants, capable of providing reliable base-load electricity, have become increasingly vital in national energy strategies, particularly in areas with high geothermal activity.

Residential Heating and Cooling followed, capturing a 21.2% market share. This application benefits homeowners by utilizing the earth’s stable underground temperature to provide heating in the winter and cooling in the summer, thereby reducing reliance on conventional heating methods and significantly cutting energy costs.

Commercial Heating and Cooling accounted for 19.7% of the market. This segment includes the use of geothermal systems in larger buildings and industrial settings, offering a cost-effective and environmentally friendly alternative to traditional HVAC systems.

Especially in regions with suitable geothermal resources, these systems are an attractive option for businesses looking to enhance their green credentials and improve operational efficiencies.

Key Market Segments

By Technology

- Binary Cycle Plants

- Flash Steam Plants

- Dry Steam Plants

- Ground Source Heat Pumps

- Direct Systems

- Others

By Temperature

- Low Temperature (Up to 900C)

- Medium Temperature (900C – 1500C)

- High Temperature (Above 1500C)

By Power

- Upto 5MW

- Above 5 MW

By Application

- Power Generation

- Residential Heating and Cooling

- Commercial Heating and Cooling

Driving Factors

Government Incentives Boost Geothermal Adoption

Governments worldwide are increasingly offering financial incentives to encourage the adoption of geothermal energy. These incentives often include tax breaks, grants, and rebates which can significantly reduce the initial installation costs.

For example, the U.S. government provides a tax credit covering 30% of the cost of new geothermal installations. This financial support makes geothermal energy more competitive against traditional energy sources, driving market growth as businesses and homeowners look to reduce energy costs and carbon footprints.

Technological Advances Lower Operational Costs

Recent technological advancements have significantly lowered the operational costs of geothermal energy systems. Innovations in drilling technology have made it possible to access geothermal resources more efficiently and at lower depths, which previously were not economically feasible.

These advancements have reduced the cost of electricity production from geothermal sources, making it an increasingly attractive option for energy producers. As technology continues to evolve, the efficiency of geothermal systems is expected to increase, further stimulating market growth.

Rising Energy Demand Promotes Geothermal Solutions

With global energy demand on the rise, geothermal energy is becoming a critical solution due to its ability to provide stable, reliable power, unlike intermittent sources like solar and wind. Geothermal plants have a high capacity factor, meaning they can operate at high levels of their maximum capacity consistently.

For instance, the average capacity factor for geothermal plants can be as high as 90%, compared to 24% for solar farms. This reliability makes geothermal an appealing choice for meeting increasing energy demands while maintaining environmental sustainability.

Restraining Factors

High Initial Costs Discourage Small-Scale Investments

Geothermal energy projects have notably high initial costs primarily due to the expense of site exploration and drilling. For instance, drilling a single geothermal well can cost between $2 million to $7 million. This substantial investment is a significant barrier, particularly for smaller entities or regions with limited financial resources.

The high upfront costs can deter many potential investors who might find quicker paybacks in other renewable energies like solar or wind, which do not require such extensive initial groundwork.

Geographical Limitations Restrict Development Opportunities

Geothermal energy exploitation is heavily dependent on geographical conditions, as it requires a hot geothermal reservoir close to the earth’s surface. Not all regions are equipped with these geological conditions. For example, areas without volcanic activity may lack the necessary heat gradients to produce geothermal energy efficiently.

This geographical dependency limits the global market potential, confining development primarily to geologically active regions. Consequently, many countries remain unable to utilize this clean energy source, despite its benefits.

Environmental Concerns and Regulatory Hurdles

While geothermal is considered a sustainable resource, the development of geothermal sites can have significant environmental impacts, including land subsidence and the release of harmful gases like hydrogen sulfide. For instance, some geothermal plants emit about 122 kilograms of CO2 per megawatt-hour, which, while lower than fossil fuels, still poses concerns.

These environmental issues can lead to stringent regulatory challenges and opposition from local communities, slowing down or even halting project developments. Regulatory compliance and securing permits can become lengthy and costly, further impeding market growth.

Growth Opportunity

Expanding Direct Use Applications for Everyday Needs

Geothermal energy offers immense growth potential through direct-use applications, such as heating buildings, smart greenhouses, and swimming pools. For example, in Iceland, over 90% of homes are heated using geothermal systems. Countries with similar geothermal resources can tap into this opportunity to reduce dependency on fossil fuels for heating.

Additionally, direct use is more cost-effective and requires lower investments compared to electricity generation. By promoting these practical applications, governments and businesses can drive wider adoption, improving energy efficiency and reducing carbon emissions on a large scale.

Untapped Geothermal Potential in Developing Countries

Many developing nations sit on vast, unexplored geothermal resources that can drive economic growth and energy access. For instance, Africa’s Great Rift Valley holds the potential for over 20,000 MW of geothermal energy, yet only a small fraction is being used.

With increasing energy demand and growing support from international organizations, these regions have a unique opportunity to harness geothermal power. Investment in exploration and infrastructure can bring clean, reliable energy to underserved populations, helping these countries achieve energy security and sustainable development goals.

Innovations in Enhanced Geothermal Systems (EGS) Technology

Enhanced Geothermal Systems (EGS) are revolutionizing geothermal energy by enabling power generation in areas without natural reservoirs. EGS involves injecting water into deep, hot rocks to create artificial reservoirs. For example, EGS projects can potentially unlock over 100 GW of energy in the United States alone, according to the Department of Energy.

As technological advancements make EGS more cost-effective, this innovation opens up opportunities for geothermal development in previously untapped regions, creating a promising pathway for expanding the geothermal market globally and improving energy access.

Latest Trends

Increased Focus on Sustainability Drives Renewable Integration

In response to global warming, there’s a significant shift towards integrating renewable energy sources, with geothermal energy at the forefront. This trend is emphasized by the increase in renewable energy targets set by governments worldwide, such as the European Union aiming for a 32% renewable energy share by 2030.

Geothermal energy, being both stable and reliable, is poised to play a crucial role in these portfolios. This trend indicates a growing recognition of geothermal’s potential in achieving sustainable energy goals and reducing reliance on fossil fuels.

Co-production with Oil and Gas Wells Gains Momentum

There’s a rising trend in utilizing existing oil and gas wells for geothermal energy production, known as geothermal co-production. This method can extend the life of oil wells while tapping into the geothermal energy available in the hot fluids drawn from these wells.

In the United States, it’s estimated that co-production could generate an additional 10 GW of electricity, highlighting its potential as a significant energy source. This approach not only enhances energy efficiency but also offers a pathway for the fossil fuel industry towards more sustainable practices.

Adoption of Binary Cycle Power Plants Increases

The adoption of binary cycle power plants, which can operate at lower temperatures than traditional geothermal systems, is on the rise. This technology broadens the potential for geothermal energy by making it feasible in regions with lower geothermal gradients.

The U.S. Department of Energy estimates that binary cycle plants could increase geothermal capacity substantially, as they allow for the utilization of resources at temperatures as low as 85°C. This trend is pivotal in expanding geothermal energy’s geographical footprint and making it accessible in previously unsuitable areas.

Regional Analysis

The Asia-Pacific geothermal energy market holds a 46.2% share, valued at USD 3.1 billion.

The geothermal energy market is experiencing diverse growth trajectories across global regions, each characterized by unique opportunities and challenges. In Asia-Pacific, which dominates the market with a 46.2% share and a value of USD 3.1 billion, rapid industrialization and increasing energy needs have spurred significant investment in geothermal resources, particularly in countries like Indonesia and the Philippines, which are among the top producers worldwide.

In contrast, North America is focusing on enhancing its geothermal output through technological advancements and policy support, particularly in the United States, which holds one of the largest geothermal power installations globally. The region is leveraging its substantial geothermal potential to meet renewable energy targets and reduce carbon footprints.

Europe is also making notable strides, with countries like Iceland and Turkey exploiting their volcanic landscapes to generate sustainable energy. The European market is further buoyed by stringent environmental regulations that favor clean energy sources, including geothermal.

Meanwhile, Latin America and the Middle East & Africa are emerging as potential growth areas. Latin America benefits from its volcanic arc, which runs through several countries, offering substantial untapped geothermal reserves.

In Africa, the Rift Valley region represents a significant untapped potential that could drastically shift energy paradigms in the coming years, with Kenya already leading in African geothermal production.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global geothermal energy market in 2023 is robustly characterized by its diversification and strategic expansions undertaken by key players. Companies like Ormat Technologies, Inc. and Enel Green Power North America Inc. continue to be at the forefront, driving innovation and expanding geothermal capacity in the U.S. and internationally.

Ormat, known for its efficient geothermal and recovered energy-based power plants, has significantly contributed to the market with its advanced technology that enables the use of low-temperature resources. Enel Green Power has been expanding its geothermal operations across several continents, capitalizing on both new and existing geothermal fields.

Aboitiz Power and Energy Development Corporation (EDC) is prominent in the Asia-Pacific region, particularly in the Philippines, one of the largest producers of geothermal energy globally. These companies have been pivotal in harnessing the Philippines’ substantial geothermal resources and promoting sustainable energy development in the region.

In Europe, Turboden S.p.A. and Atlas Copco Group are making significant advances by integrating enhanced geothermal systems (EGS) and heat recovery solutions, which are pivotal in regions with less obvious geothermal resources.

Turboden’s ORC technology, for instance, has been instrumental in developing medium to low-enthalpy geothermal resources, a testament to the technological evolution in the sector.

Furthermore, companies like Mitsubishi Heavy Industries and General Electric are enhancing geothermal technology’s efficiency and reliability, which is crucial for increasing adoption and optimizing existing geothermal operations. These corporations are not only expanding geothermal capacity but also improving the cost-effectiveness and environmental compatibility of geothermal plants.

Top Key Players in the Market

- Aboitiz Power

- Alterra Power Corporation

- Ansaldo Energia

- Atlas Copco Group

- Berkshire Hathaway Energy

- Calpine

- Chevron Corporation

- Enel Green Power North America Inc.

- Energy Development Corporation

- Engie SA

- EthosEnergy

- Exergy

- First Gen Corporation

- General Electric

- Gradient Resources

- Hyundai

- International Corporation

- Mitsubishi Heavy Industries

- Ormat Technologies, Inc.

- Pertamina Geothermal Energy (PGE)

- TAS Energy

- Tetra Tech, Inc.

- Toshiba International Corp.

- Turboden S.p.A.

Recent Developments

- In 2024, Enel Green Power North America sold its U.S. geothermal portfolio to Ormat Technologies for $271M 2024 to focus on core renewable energy sectors like wind, smart solar, and battery storage, aligning with its growth strategy and portfolio optimization goals.

- In 2024, Energy Development Corporation (EDC), the Philippines’ top geothermal energy producer, will launch four new geothermal plants and battery storage systems in 2024, adding 82 MW capacity. With a PHP 29.3 billion investment, EDC aims to expand renewable energy output.

Report Scope

Report Features Description Market Value (2023) USD 6.7 Billion Forecast Revenue (2033) USD 11.4 Billion CAGR (2024-2033) 5.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Binary Cycle Plants, Flash Steam Plants, Dry Steam Plants, Ground Source Heat Pumps, Direct Systems, Others), By Temperature (Low Temperature (Up to 900C), Medium Temperature (900C – 1500C), High Temperature (Above 1500C)), By Power (Upto 5MW, Above 5 MW), By Application (Power Generation, Residential Heating and Cooling, Commercial Heating and Cooling) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aboitiz Power, Alterra Power Corporation, Ansaldo Energia, Atlas Copco Group, Berkshire Hathaway Energy, Calpine, Chevron Corporation, Enel Green Power North America Inc., Energy Development Corporation, Engie SA, EthosEnergy, Exergy, First Gen Corporation, General Electric, Gradient Resources, Hyundai, International Corporation, Mitsubishi Heavy Industries, Ormat Technologies, Inc., Pertamina Geothermal Energy (PGE), TAS Energy, Tetra Tech, Inc., Toshiba International Corp., Turboden S.p.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Geothermal Energy MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Geothermal Energy MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Aboitiz Power

- Alterra Power Corporation

- Ansaldo Energia

- Atlas Copco Group

- Berkshire Hathaway Energy

- Calpine

- Chevron Corporation

- Enel Green Power North America Inc.

- Energy Development Corporation

- Engie SA

- EthosEnergy

- Exergy

- First Gen Corporation

- General Electric

- Gradient Resources

- Hyundai

- International Corporation

- Mitsubishi Heavy Industries

- Ormat Technologies, Inc.

- Pertamina Geothermal Energy (PGE)

- TAS Energy

- Tetra Tech, Inc.

- Toshiba International Corp.

- Turboden S.p.A.