Global Copper Mining Market By Process (Open-pit Mining, Underground Mining), By Grade (Below 0.5%, 0.5%-1.0%, 1.0%-1.5%, Above 1.5%), By Product Type (Primary, Secondary, By Application (Metal Processing Industry, Chemical Industry, Others), By End-Users (Building and Construction Industry, Equipment Manufacturers, Transportation, Infrastructure Industry) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 131093

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

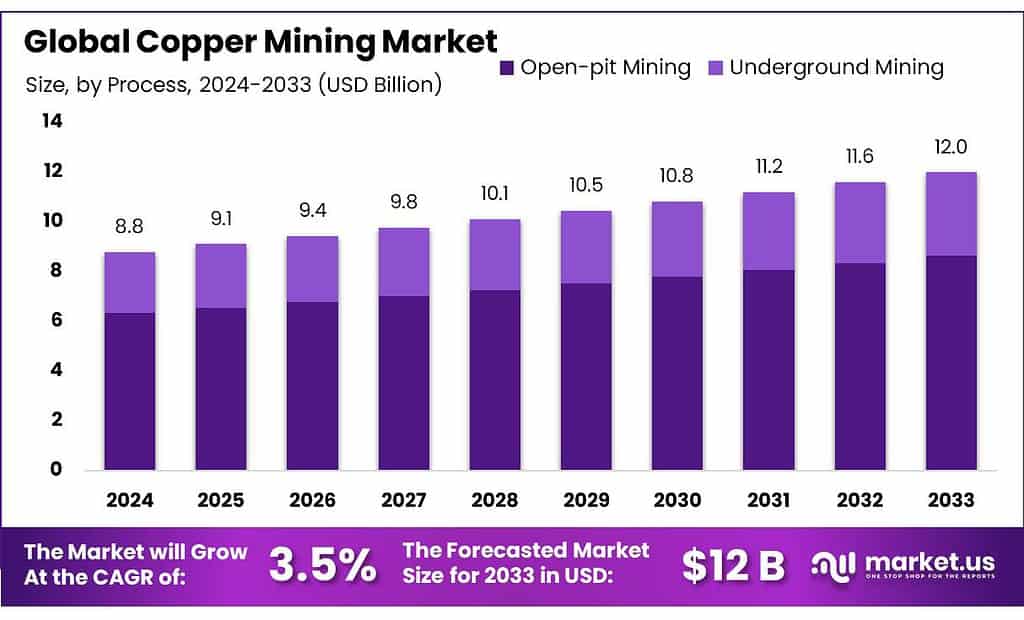

The Global Copper Mining Market size is expected to be worth around USD 12 Bn by 2033, from USD 8.8 Bn in 2023, growing at a CAGR of 3.5% during the forecast period from 2024 to 2033.

Copper mining refers to the process of extracting copper from the earth. Copper is a valuable metal found in natural deposits as copper ore. These ores contain copper in a bonded form with other elements such as oxygen (as an oxide) or sulfur (as a sulfide). To extract the copper, these ores are mined from large open pits or underground mines.

According to the PwC’s 2023 Mining report, the total revenue for the top 40 mining companies remained stable at approximately US$711 billion in 2022. The report also highlights that despite economic pressures, EBITDA margins for these companies narrowed from 32% to 29% due to rising costs and economic uncertainty.

Codelco’s Production Decline Industry reports indicate that Codelco, the world’s largest copper producer, experienced a 10% decline in production year-on-year due to operational challenges at their primary sites in Chile.

Government Role in Copper Mining The PwC’s 2023 Mining report further discusses the increasing role of governments worldwide in regulating and supporting the copper mining industry. This includes enacting policies that promote sustainable practices and direct investments to secure national supplies of crucial minerals like copper.

Copper Demand Data Data on copper production and consumption, which underscores the robust demand for copper in electrical applications, construction, and renewable energy sectors, is provided by the U.S. Geological Survey. This reflects copper’s critical role in supporting high-growth industries.

Key Takeaways

- Copper Mining Market size is expected to be worth around USD 12 Bn by 2033, from USD 8.8 Bn in 2023, growing at a CAGR of 3.5%.

- Open-pit Mining held a dominant market position, capturing more than a 72.4% share.

- 1.0% – 1.5% copper grade segment held a dominant market position, capturing more than a 38.4% share.

- Primary copper held a dominant market position, capturing more than an 84.3% share.

- Metal Processing Industry held a dominant market position in the copper mining sector, capturing more than a 56.3% share.

- Building & Construction Industry held a dominant market position in the copper mining market, capturing more than a 44.2% share.

- Asia Pacific (APAC) dominates the copper mining market with a 41% share, translating to a market size of USD 3.6 billion.

By Process

In 2023, Open-pit Mining held a dominant market position, capturing more than a 72.4% share. This method is favored due to its cost-effectiveness and efficiency in extracting minerals from large, near-surface deposits.

Open-pit mining involves removing large quantities of soil and rock to access the ore, making it suitable for areas where the mineral layer is thick and spread out. Its high market share reflects its widespread adoption in regions abundant in easily accessible mineral deposits.

Underground Mining, while less dominant, plays a critical role in extracting minerals located deep below the earth’s surface. This process is more complex and expensive than open-pit mining but is essential for accessing ore that cannot be reached through surface mining techniques.

Underground mining requires more advanced technology and skilled labor, factors that contribute to its smaller market share. However, it is indispensable for extracting high-value minerals that are less accessible, ensuring the continued demand and technological innovation in this segment.

By Grade

In 2023, the 1.0% – 1.5% copper grade segment held a dominant market position, capturing more than a 38.4% share. This grade range is particularly significant because it strikes a balance between ore quality and the economic viability of extraction, making it preferred for many mining operations. The popularity of this grade is due to its sufficient purity to ensure cost-effective processing and refining, while still being widely available in major copper deposits around the world.

Below 0.5% grade copper, while abundant, is less favored due to the higher costs associated with processing such low-grade ore. It requires more ore to be processed to extract the same amount of copper, driving up production costs and environmental impacts.

The 0.5%-1.0% grade segment represents a middle ground, offering a reasonable compromise between ore quality and extraction cost. This range is suitable for many modern technological applications and supports steady demand from manufacturers and builders.

Above 1.5% grade copper is less common but highly sought after due to its high purity, which simplifies the smelting and refinement process, reducing costs and increasing efficiency. However, its rarity means it commands a smaller market share, as fewer deposits meet this high-grade criterion. This segment is critical for high-end applications where superior quality copper is required.

By Product Type

In 2023, Primary copper held a dominant market position, capturing more than an 84.3% share. This segment includes copper produced directly from ores through various mining and refining processes.

The high demand for primary copper is driven by its essential role in numerous industrial applications, from electrical wiring to construction and electronics. The purity of primary copper makes it highly effective and desirable for these critical uses, which require high conductivity and durability.

Secondary copper, while making up a smaller portion of the market, is also vital. This type involves recycling used copper and reintroducing it into the supply chain. Despite its smaller market share, the importance of secondary copper is increasing due to growing environmental concerns and the push towards sustainable practices.

Recycling copper uses significantly less energy compared to extracting and refining new copper, making it an attractive option in light of global energy conservation efforts and cost considerations.

By Application

In 2023, the Metal Processing Industry held a dominant market position in the copper mining sector, capturing more than a 56.3% share. This industry primarily uses copper for manufacturing various metal products and components that are essential in construction, electrical systems, and machinery. The high conductivity of copper makes it indispensable for producing electrical motors, wiring, and other critical components that require efficient electricity transmission.

The Chemical Industry also significantly utilizes copper, particularly as a catalyst in chemical reactions and in the production of chemical compounds where copper properties are beneficial. Although this segment holds a smaller share of the copper market, its role is crucial for the production of fertilizers, pesticides, and other chemical products.

By End-Users

In 2023, the Building & Construction Industry held a dominant market position in the copper mining market, capturing more than a 44.2% share. This industry relies heavily on copper for its superior electrical and thermal properties, which are crucial in modern building practices. Copper is widely used in electrical wiring, plumbing, heating, and cooling systems, as well as in architectural elements and roofing materials. Its durability and resistance to corrosion make it a preferred material for building infrastructure that lasts.

Equipment Manufacturers form another significant segment of the copper market. These manufacturers use copper extensively in the production of industrial machinery and consumer goods, including household appliances and electronic devices. The metal’s excellent heat conductivity makes it ideal for use in motors, wiring, and radiators.

The Transportation and Infrastructure Industry also utilizes a substantial amount of copper, particularly in transportation equipment like automobiles, trains, and airplanes. In these applications, copper is vital for electrical systems, batteries, and various mechanical components. As global focus shifts towards electric vehicles, demand from this sector is expected to grow, reflecting copper’s critical role in energy-efficient transport solutions.

Key Market Segments

By Process

- Open-pit Mining

- Underground Mining

By Grade

- Below 0.5%

- 0.5%-1.0%

- 1.0%-1.5%

- Above 1.5%

By Product Type

- Primary

- Secondary

By Application

- Metal Processing Industry

- Chemical Industry

- Others

By End-Users

- Building & Construction Industry

- Equipment Manufacturers

- Transportation

- Infrastructure Industry

Driving Factors

Accelerated Demand Due to the Energy Transition

The paramount driving factor for the copper mining industry is the accelerated global demand spurred by the energy transition towards renewable energy and electrification. Copper is crucial for the development of green technologies, including electric vehicles (EVs) and renewable energy infrastructure such as wind turbines and solar panels.

According to the International Energy Agency (IEA), the rapid adoption of EVs and the expansion of renewable energy capacities are significantly increasing the demand for copper. For instance, a typical electric car uses up to six times the mineral inputs of a conventional car, and an onshore wind power plant requires nine times more mineral resources than a gas-fired power plant. This substantial increase in mineral usage directly correlates with a heightened demand for copper, essential for its conductive properties.

The IEA’s 2023 report forecasts that under the Net Zero Emissions by 2050 scenario, copper demand is expected to increase by 50% by 2040 from 2023 levels, highlighting the metal’s critical role in achieving global climate goals. Similarly, S&P Global reports anticipate a 20% rise in global copper demand by 2035, reaching up to 30 million metric tons per year

Government policies and initiatives are also amplifying this trend. For example, the Inflation Reduction Act in the United States and similar legislation in Europe, Australia, and Canada include provisions to boost domestic production and processing of critical minerals like copper, aiming to reduce dependency on imports, particularly from China. These policies not only support the mining industry but also ensure a stable supply chain essential for the energy transition.

The increased demand for copper driven by the energy transition presents both challenges and opportunities. While it necessitates the expansion and efficiency improvement of copper mining and recycling operations, it also opens up new avenues for growth and innovation within the industry. The commitment to a sustainable mining process, as emphasized by the International Copper Association, underscores the need for an environmentally and socially responsible approach to meet this burgeoning demand.

Restraining Factors

Stringent Environmental Regulations

A significant restraining factor for the copper mining industry is the increasingly stringent environmental regulations that govern the sector. These regulations aim to minimize the environmental impact of mining activities but can pose considerable challenges to operational efficiency and cost-effectiveness.

Environmental regulations impact several facets of the copper mining process, from exploration and extraction to waste management and mine closure.

For instance, the Metal Mining Effluent Regulations (MMER) under the Fisheries Act in Canada set strict limits on the quality and quantity of effluent that mines can release, requiring mines to maintain effluent concentrations of certain deleterious substances within specified limits. Mines must also develop comprehensive closure plans that detail the measures for reclaiming and monitoring the mine site post-closure to ensure environmental safety and compliance.

The environmental assessment processes required under regulations such as the Impact Assessment Act (IAA) add layers of complexity and time to project timelines. These assessments are designed to ensure that projects are environmentally viable and socially equitable, involving extensive consultations and reviews that can extend project timelines significantly.

For example, in Québec, the legal framework and extended permitting guidelines represent significant barriers to investment, with mine development projects often facing delays due to the time required to navigate these regulatory landscapes.

Moreover, the focus on reducing water pollution and preserving water quality further complicates mining operations. The Canadian government has introduced water usage and effluent quality standards that mining companies must meet, which necessitates advanced water treatment solutions and can lead to increased operational costs

These regulatory frameworks, while essential for protecting the environment and ensuring sustainable mining practices, require mining companies to invest heavily in compliance measures. This not only increases the upfront and operational costs but also affects the overall feasibility and attractiveness of mining projects. The need for environmental compliance, coupled with the high costs and extended timelines for obtaining necessary permits, acts as a significant restraint on the growth and expansion of the copper mining industry.

Growth Opportunity

Rising Demand from the Energy Transition

A significant growth opportunity in the copper mining industry stems from the soaring demand for copper due to the global shift towards renewable energy and electrification. This trend is particularly driven by the increased deployment of technologies such as electric vehicles (EVs), wind turbines, solar panels, and the expansion of electrical grids.

The International Energy Agency (IEA) highlights that the clean energy sector’s rapid development is propelling immense demand for critical minerals like copper. With the energy sector’s expansion, especially with record deployments of clean energy technologies, the demand for minerals critical to these technologies, including copper, has surged dramatically. From 2017 to 2022, there was a notable increase in overall demand for these minerals, underscoring the critical role they play in clean energy transitions.

Investment trends also reflect this growth opportunity, with a substantial rise in capital directed towards developing mineral supplies essential for supporting the energy transition. For instance, investment in critical mineral development saw a significant increase in recent years, which supports the speed and affordability of clean energy transitions by ensuring a stable supply of necessary minerals.

Visual Capitalist reports a projected increase in demand for copper in the transport sector, emphasizing that by 2050, the demand for copper just in transport could increase eleven-fold from 2022 levels due to the expansion of EVs which require extensive copper wiring. Moreover, the need for copper to expand global electricity grids is expected to grow nearly five times by 2050 from 2022, highlighting the crucial role copper plays in modern infrastructure.

The market for copper and other critical minerals is expected to continue its rapid growth trajectory, making it an increasingly central focus for the global mining industry. As nations and industries strive to meet their energy and climate goals, the copper mining sector stands to gain significantly from these developments. The ongoing and future expansions in copper mining are not only pivotal in meeting the immediate demands of the energy transition but also represent a lucrative long-term investment as global efforts to achieve a sustainable and electrified economy intensify.

Latest Trends

Increasing Demand for Copper in Clean Energy Applications

A major trend in the copper mining industry is the soaring demand driven by the transition to renewable energy and the widespread adoption of electric vehicles (EVs). As these sectors expand, they require significant amounts of copper due to its excellent electrical conductivity and resistance properties.

The International Energy Agency (IEA) underscores that the deployment of clean energy technologies like solar panels, wind turbines, and EVs is propelling this demand, with expectations that the global copper demand will grow substantially by 2050

Rise of Recycling and Secondary Copper Use There’s a growing emphasis on recycling and the use of secondary copper to meet the expanding market demand. Companies are increasingly leveraging scrap copper as a significant source of supply. This trend is driven by both environmental considerations and the need to secure supply chains against the backdrop of rising primary copper demand. The availability of ‘old scrap’, such as from end-of-life products, and ‘new scrap’, from manufacturing waste, is seen as a crucial element to sustainably meeting future copper needs

Technological advancements are playing a crucial role in shaping the future of copper mining. Innovations in mining processes and efficiency improvements are helping to reduce environmental impact and operational costs. For instance, many mining companies are integrating renewable energy sources into their operations, which not only reduces greenhouse gas emissions but also enhances the sustainability of mining activities

Consolidation in the Copper Mining Sector The copper mining industry is experiencing consolidation, with larger companies acquiring smaller ones or forming strategic partnerships. This trend is expected to continue, leading to a more concentrated industry. Such consolidations are often aimed at achieving scale, reducing costs, and enhancing access to resources

Challenges and Opportunities from Political and Regulatory Changes Copper mining companies must navigate various political and regulatory challenges that can affect their operations. Changes in government policies, regulatory adjustments, and geopolitical tensions can significantly impact the mining landscape. Companies are continuously adapting to these changes to mitigate risks and capitalize on new opportunities

Strategic Focus on Environmental, Social, and Governance (ESG) Factors There is a strategic pivot towards enhancing ESG credentials within the copper mining industry. Companies are increasingly focusing on natural capital and engaging in circular economy practices to meet the booming demand for copper responsibly. This shift is not only about compliance but also about improving the social and environmental impact of mining operations

Regional Analysis

Asia Pacific (APAC) dominates the copper mining market with a 41% share, translating to a market size of USD 3.6 billion. This region benefits from extensive copper deposits and high demand from rapidly growing industrial sectors, particularly in China and India. The region’s leadership in manufacturing and electronics, coupled with significant investments in renewable energy, continues to drive robust demand for copper.

North America follows, with advanced mining technologies and substantial reserves in the United States and Canada. The region is characterized by stringent environmental regulations and a strong focus on sustainable mining practices, which have spurred innovations in mining and recycling processes.

Europe maintains a steady demand for copper, primarily driven by the automotive and electrical industries. The region’s focus on reducing carbon emissions and increasing renewable energy installations contributes to the consistent need for copper, especially in green technologies and infrastructure projects.

Latin America is notable for its vast natural resources with major copper mines in Chile and Peru. These countries are crucial to the global copper supply chain, though they face challenges such as political instability and operational risks that can affect output levels.

Middle East & Africa (MEA), while smaller in market share, shows potential for growth due to untapped reserves and increasing investments in mining infrastructure. The development of mining sectors in countries like Zambia and the Democratic Republic of Congo is gradually enhancing their contributions to the global copper market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The copper mining market features a diverse range of key players, each contributing uniquely to global copper production and technological advancements in the industry. These players include giants like Codelco, BHP Billiton Ltd., Rio Tinto, and Freeport-McMoRan Inc., alongside other significant companies such as Anglo American, First Quantum, and Glencore International AG.

Codelco, the state-owned Chilean firm, remains the largest copper producer globally, spearheading efforts in efficient and sustainable mining practices. Similarly, BHP Billiton and Rio Tinto, with operations spanning multiple continents, are instrumental in pushing the boundaries of mining technology and environmental conservation. These companies have been pivotal in implementing autonomous and remote-controlled machinery, which not only enhances safety but also boosts production efficiency.

On the other hand, Freeport-McMoRan Inc. and First Quantum are known for their significant contributions in areas with rich copper deposits, such as the Grasberg mine in Indonesia and the Cobre Panama mine in Central America, respectively. Glencore stands out for its extensive commodity trading and mining operations, playing a critical role in the copper supply chain by managing both extraction and global distribution.

Emerging players like Zijin and Southern Copper Corp are also notable for their rapid growth and strategic expansions into new mining territories, which reflect the dynamic nature of the copper mining industry. These companies are expanding their influence in the industry by venturing into new regions and scaling up their operations to meet the growing demand for copper, particularly from the renewable energy and electric vehicle sectors.

Top Key Players in the Market

- Advance SCT Limited

- African Copper Plc.

- Amerigo Resources Ltd.

- Anglo American

- BHP Billiton Ltd.

- Caribou King Resources Limited

- Codelco

- Dot Resources Ltd.

- First Quantum

- Freeport-McMoRan Inc.

- Glencore International AG

- Global Hunter Corp.

- KGHM

- McMorRan Inc.

- Rio Tinto

- Southern Copper Corp

- Bougainville Copper Limited

- Zijin

Recent Developments

In 2023, Amerigo faced challenges that impacted its production capabilities, leading to a production output of 57.6 million pounds of copper, which was a decline from the previous year. Despite these challenges, the company managed a cash cost of $2.17 per pound for the year.

In 2023 Anglo American alone significantly boosted Anglo American’s output, contributing to a 24% rise in annual copper production to 826,000 metric tons.

Report Scope

Report Features Description Market Value (2023) USD 8.8 Bn Forecast Revenue (2033) USD 12.0 CAGR (2024-2033) 3.5% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Process (Open-pit Mining, Underground Mining), By Grade (Below 0.5%, 0.5%-1.0%, 1.0%-1.5%, Above 1.5%), By Product Type (Primary, Secondary, By Application (Metal Processing Industry, Chemical Industry, Others), By End-Users (Building and Construction Industry, Equipment Manufacturers, Transportation, Infrastructure Industry) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Advance SCT Limited, African Copper Plc., Amerigo Resources Ltd., Anglo American, BHP Billiton Ltd., Caribou King Resources Limited, Codelco, Dot Resources Ltd., First Quantum, Freeport-McMoRan Inc., Glencore International AG, Global Hunter Corp., KGHM, McMorRan Inc., Rio Tinto, Southern Copper Corp, Bougainville Copper Limited, Zijin Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Advance SCT Limited

- African Copper Plc.

- Amerigo Resources Ltd.

- Anglo American

- BHP Billiton Ltd.

- Caribou King Resources Limited

- Codelco

- Dot Resources Ltd.

- First Quantum

- Freeport-McMoRan Inc.

- Glencore International AG

- Global Hunter Corp.

- KGHM

- McMorRan Inc.

- Rio Tinto

- Southern Copper Corp

- Bougainville Copper Limited Zijin