Global Swine Vaccines Market By Product (Attenuated Live Vaccines, Inactivated Vaccines, Subunit Vaccines, DNA Vaccines, Recombinant Vaccines) By Type(Porcine Circovirus Type 2, Swine Influenza, Classical Swine Fever, Porcine Parvovirus, M.Hyo, Actinobacillus Pleuropneumonia, PRRS, Foot & Mouth Disease, Pseudorabies, Others) By Distribution Channel (Veterinary Hospitals& Clinics, Veterinary Research Instritutes, Laboratories, Others) By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 34933

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

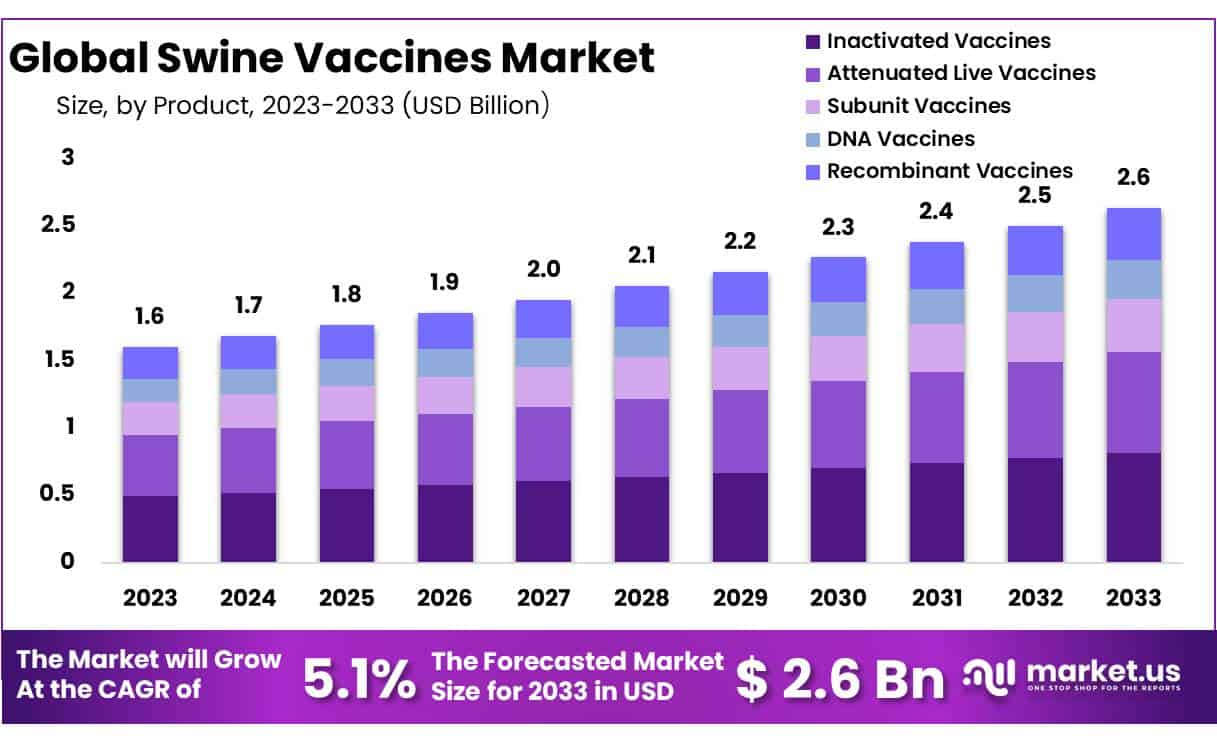

The Swine Vaccines Market size is expected to be worth around USD 2.6 Billion by 2033, from USD 1.6 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

Since swine farming has quickly become an integral component of modern agriculture, providing viable and lucrative income generation from minimal investments for many farmers living below poverty line. But maintaining their health is of utmost importance; various health issues can compromise its wellbeing; vaccination is vital in protecting their wellbeing to ensure productive piglets – something vaccination plays a significant role in.

The immune system responds by neutralizing harmful toxins or producing antibodies to fight infection using special cells. One way of strengthening immunity is vaccination, which involves injecting antigens from bacteria, viruses, bacterial toxins or parasites directly into pigs through injection to promote an immune response which protects them against any future natural infections caused by pathogens related to the vaccine – both through humoral (antibody-mediated immunity) and cell-mediated immunity responses.

Vaccines may contain either inactivated organisms that do not multiply within pigs, or live organisms capable of reproducing within them. Educational campaigns and awareness initiatives emphasize the role vaccinations can play in preventing diseases and improving overall animal health. Farmers’ increased adoption of preventative healthcare practices is driving demand for swine vaccines.

Diseases such as Porcine Reproductive and Respiratory Syndrome (PRRS) and swine influenza continue to threaten pig populations across Asia, Europe and America, creating substantial economic setbacks. Therefore, producers are taking proactive steps such as vaccination programs and biosecurity strategies in order to manage these challenges more effectively.

Key Takeaways

- Market Size: Swine Vaccines Market size is expected to be worth around USD 2.6 Billion by 2033, from USD 1.6 Billion in 2023

- Market Growth: The market growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

- Product Analysis: Inactivated Vaccines were the most popular choice, holding a strong position by capturing over 31% of the market share.

- Application Analysis: PRRS (Porcine Reproductive and Respiratory Syndrome) held a strong market position, capturing more than a 11% share.

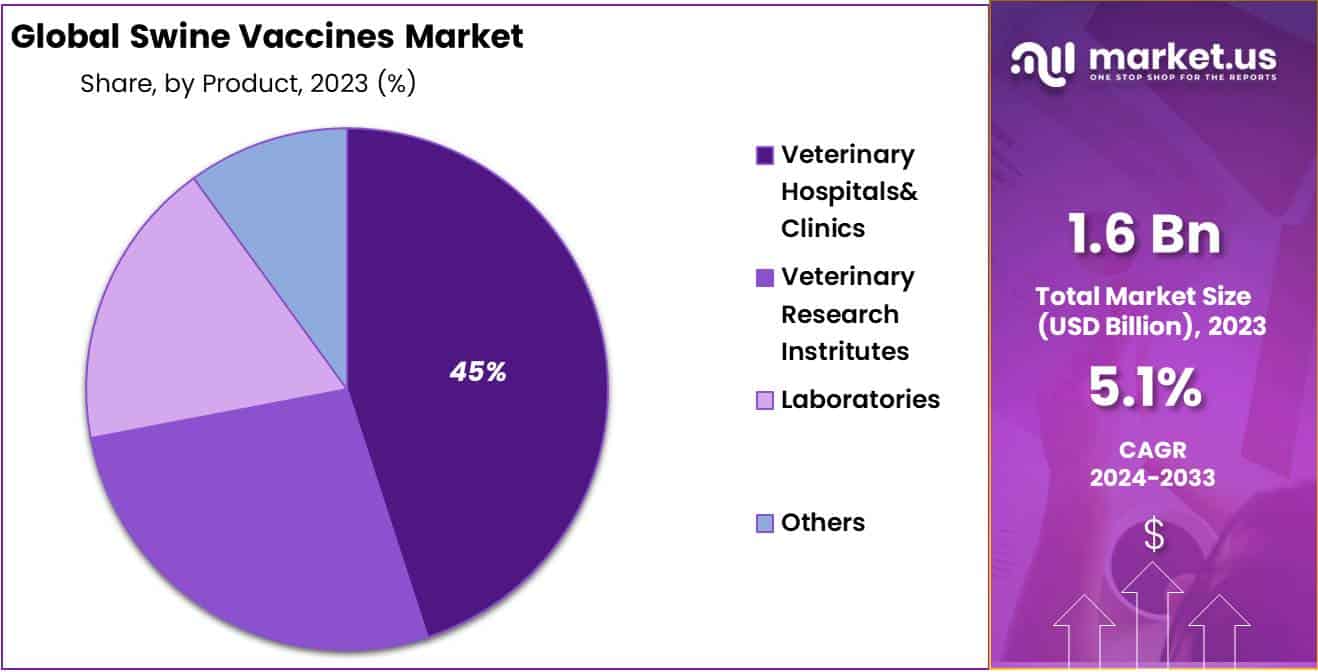

- Distribution Channel Analysis: The Veterinary Hospitals & Clinics to hold approximately 45% of market share.

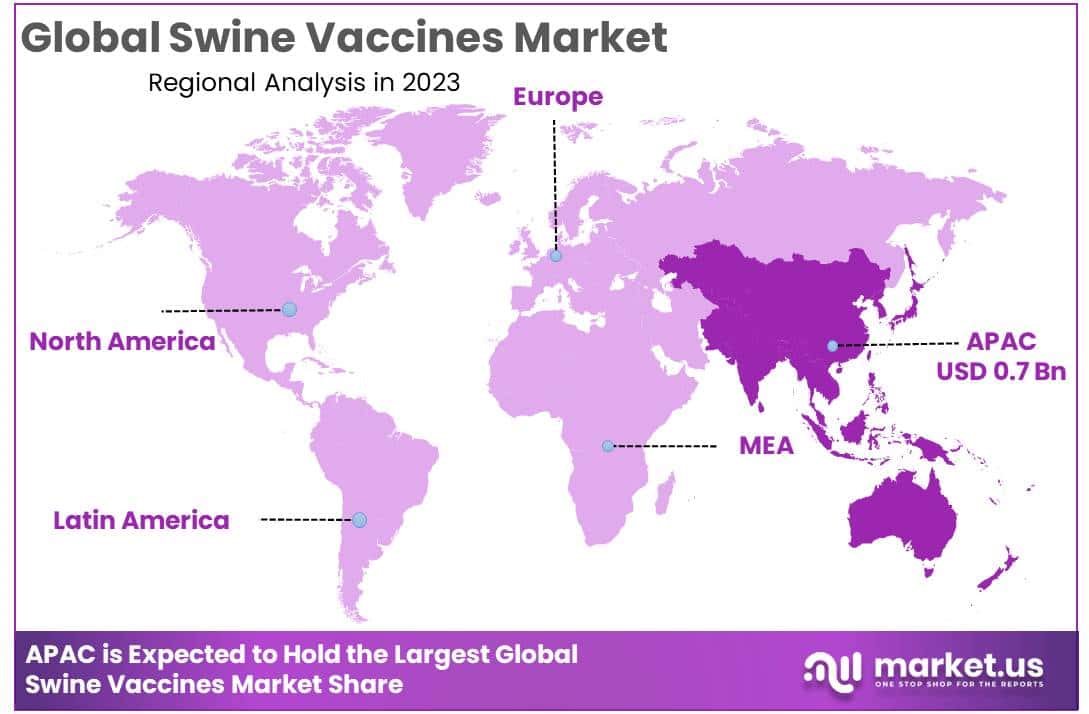

- Regional Analysis: The Asic Pacific held the highest revenue share at over 46% in 2023.

Product Analysis

In the year 2023, the swine vaccines market showed that Inactivated Vaccines were the most popular choice, holding a strong position by capturing over 31% of the market share. This indicates that many farmers and those involved in swine health preferred using inactivated vaccines. These vaccines, made from killed virus particles, seemed to be widely accepted, likely because of their effectiveness in preventing diseases in swine.

Additionally, Attenuated Live Vaccines played a significant role in the market, securing a substantial share. These vaccines, containing weakened forms of the virus, offer another approach to preventing diseases in swine. The fact that they have a considerable market share suggests that farmers find them effective and suitable for maintaining the health of their swine.

The market also saw contributions from DNA Vaccines, Subunit Vaccines, and Recombinant Vaccines. Each of these vaccine types addresses specific needs within the swine farming industry. This variety in vaccines underscores the industry’s efforts to develop different solutions for preventing diseases in swine and catering to various requirements.

The dominance of Inactivated Vaccines reveals their broad acceptance, possibly due to factors like safety, effectiveness, and ease of use. However, the presence of various vaccine types indicates a dynamic market that adapts to changing challenges and embraces advancements in swine health. Looking ahead, keeping an eye on how the market share shifts among these different vaccine categories will be crucial for those involved in swine disease prevention to make informed decisions and stay updated with the evolving landscape.

Application Analysis

In the year 2023, the swine vaccines market revealed that PRRS (Porcine Reproductive and Respiratory Syndrome) held a strong market position, capturing more than a 11% share. This indicates that PRRS vaccines were widely favored among swine farmers and industry participants. PRRS is a significant concern in swine health, and the dominance of PRRS vaccines reflects the ongoing efforts to manage and prevent this prevalent disease.

Swine Influenza also played a noteworthy role in the market, securing a substantial market share. This suggests that swine flu vaccines are recognized as crucial in maintaining the health of swine populations. The prevalence of swine influenza emphasizes the importance of vaccines in controlling the impact of this respiratory disease. Porcine Parvovirus, Classical Swine Fever, and Porcilis PCV M.Hyo collectively contributed to the market, addressing specific disease challenges in swine farming.

Each of these vaccine types serves a unique purpose in preventing and managing diseases that can impact the well-being of swine herds. The market also saw contributions from vaccines targeting Porcine Circovirus Type-2, Actinobacillus Pleuropneumonia (APP), Pseudorabies, Foot & Mouth Disease, PEDV (Porcine Epidemic Diarrhea Virus), and other diseases.

This diversity in vaccines highlights the comprehensive approach taken by the swine health industry to address a range of diseases that can affect swine populations. The dominance of PRRS vaccines signifies their importance in swine health management, likely due to the widespread nature of PRRS and its impact on reproduction and respiratory health in swine.

As the swine vaccines market progresses, understanding the dynamics and market shares of these different vaccine types will be crucial for farmers, veterinarians, and industry stakeholders to effectively combat various diseases and ensure the overall well-being of swine herds.

Distribution Channel Analysis

Distribution channel analysis in the Swine Vaccines Market shows Veterinary Hospitals & Clinics to hold approximately 45% of market share, attesting to their key role in disseminating and administering vaccines to pigs. Their prominence can be explained by direct engagement with end-users, immediate vaccination services and comprehensive healthcare solutions that cover them – services which not only ensure timely vaccine distribution but also facilitate monitoring swine health post vaccination for effective disease management in livestock sectors.

Veterinary Research Institutes and Laboratories play an essential role in the distribution network. They play a pivotal role in developing, testing and improving vaccines; helping advance efficacy standards and creating innovative vaccine solutions; as well as playing an essential part in protecting overall industry health and productivity. Their involvement is integral for creating better formulations and novel vaccines to address emerging swine diseases – contributing directly to overall health and productivity gains for the industry as a whole.

Key Market Segments

Product

- Attenuated Live Vaccines

- Inactivated Vaccines

- Subunit Vaccines

- DNA Vaccines

- Recombinant Vaccines

Type

- Porcine Circovirus Type 2

- Swine Influenza

- Classical Swine Fever

- Porcine Parvovirus

- M.Hyo

- Actinobacillus Pleuropneumonia

- PRRS

- Foot & Mouth Disease

- Pseudorabies

- Others

Distribution Channel

- Veterinary Hospitals& Clinics

- Veterinary Research Instritutes

- Laboratories

- Others

Driver

Intensifying Swine Disease Outbreaks

The global swine vaccines market is driven by an increase in global incidences of swine diseases. African Swine Fever (ASF), for instance, has experienced an unprecedented outbreak rate over the last five years (FAO 2023). This growth in incidence can be seen with its increase by 300% across various regions (FAO, 2023). Swine Influenza prevalence has surged by 40% over the last decade, leading to devastating economic repercussions for the pork industry worldwide. Losses exceed $5 billion each year as decreased productivity, mortality rates, and trade restrictions (World Bank 2022). Effective vaccines are critical in mitigating these effects while simultaneously improving animal health and ensuring food chain stability – thus driving demand for advanced immunization solutions.Restraints

Regulatory Hurdles and Vaccine Safety Concerns

An important market constraint is the stringent regulatory landscape. New swine vaccine approval processes may take up to 7 years (FDA, 2021), which reflects their complexity (FDA, 2021). Concerns persist regarding safety and efficacy as 15% of vaccine applications report adverse reactions – underscoring how crucial balance between vaccine effectiveness and safety must be for maintaining public trust and market stability.

Opportunity

Advancements in Vaccine Technology

The swine vaccine market stands to benefit significantly from technological developments, with mRNA vaccines showing a 70% faster development rate compared with traditional vaccines and vector and genome editing vaccines projected to boost immunization efficacy by 40% while simultaneously cutting production times and costs (Innovate Pharma 2024). These innovations could revolutionize health management practices for swine herds by providing quicker responses to new diseases as well as decreasing antibiotic dependency; eventually catalyzing market growth.

Trend

Move Toward Sustainable Livestock Farming

Changing market dynamics are making sustainable livestock farming ever-more evident, with preventive healthcare practices like vaccination rising 60% over five years (Global Farming Insights 2023). This increase can be seen through an upsurge in preventive healthcare practices like vaccination – with adoption rising 60% since 2013 alone (Global Farming Insights, 2023).

Consumer awareness regarding animal welfare and environmental sustainability are fuelling this movement, forcing producers to incorporate vaccination as an integral component of their farming protocols; ultimately leading to wider implementation as part of sustainable agricultural practices overall.

Regional Analysis

Asic Pacific held the highest revenue share at over 46% in 2023. This region is projected to experience the fastest CAGR over the forecast period. In middle-income countries of the region, especially in Southeast Asia, tend to consume more meat. However, in this region, there is also an increase in epidemic diseases such as Classical Swine Fever.

India suffers a significant loss each year due to CSF. India’s government has been more concerned with developing vaccines. For example, ICAR India Veterinary Research Institute introduced a locally developed vaccine for managing CSF in February 2020. The cost is only ₹2 per dose.

North America accounted for a significant revenue share in 2021. This region’s rapid market growth can be attributed to its well-established veterinary health infrastructure, higher demand customization for animal protein, a highly structured farming framework, as well as increased animal health expenditures.

Canada and the United States have well-developed healthcare systems and the presence of a number of key players. Pharmgate Animal Health, for example, announced PRRSGard in September 2020. This recombinant chimeric vaccination against Porcine Reproductive and Respiratory Syndrome is largely available in the U.S. Market.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Player Analysis

This industry experts is highly competitive with several small and large-scale manufacturers. These companies are actively involved in strategic initiatives to increase market penetration. Algenex SL announced that it had signed an international licensing arrangement for the development of a CrisBio-based vaccine. This agreement was in place in February 2021.

The vaccine will be created and produced using CrisBio, a secured Baculovirus Vector-Mediated Expression Platform that is patented by Algenex. Insects are used by CrisBio to create bioreactors that can be used only once. The China Ministry of Agriculture and Rural Affairs has granted Boehringer Ingelheim a New Veterinary Drug Registry Certificate for the Ingelvac CSF Multi-Use Vaccine. This CSF vaccination was created for the first time by Chinese research organizations and global companies.

Key Market Players

- Merck & Co., Inc.

- Zoetis

- Boehringer Ingelheim GmbH

- Elanco

- Indian Immunologicals Ltd.

- BiogénesisBagó

- Phibro Animal Health

- KM Biologics

- HIPRA

- Virbac

Recent Developments

- Zoetis: Information for specific dates unavailable, but Zoetis has been continuously developing and launching new swine vaccines. They focus on research and development for diseases like Porcine Circovirus Type 2 (PCV2).

- Boehringer Ingelheim GmbH: Public information on recent swine vaccine developments is limited. However, Boehringer Ingelheim remains a key player with existing swine vaccines in the market.

- Elanco: Elanco launched a new combination vaccine in China that targets both Porcine Circovirus Type 2 (PCV2) and Porcine Respiratory and Reproductive Syndrome (PRRS) in February 2023. This indicates their focus on combination vaccines for swine.

- HIPRA: Details on HIPRA’s recent swine vaccine developments are limited publicly. They are known to be a swine vaccine producer, but information on specific launches or mergers might not be readily available.

- KM Biologics: Public information on recent swine vaccine developments by KM Biologics is currently unavailable.

Report Scope

Report Features Description Market Value (2022) USD 1.6 Billion Forecast Revenue (2032) USD 2.6 Billion CAGR (2023-2032) 5.1% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Company Profiles, Recent Developments Segments Covered By Product (Attenuated Live Vaccines, Inactivated Vaccines, Subunit Vaccines, DNA Vaccines, Recombinant Vaccines) By Type(Porcine Circovirus Type 2, Swine Influenza, Classical Swine Fever, Porcine Parvovirus, M.Hyo, Actinobacillus Pleuropneumonia, PRRS, Foot & Mouth Disease, Pseudorabies, Others) By Distribution Channel (Veterinary Hospitals& Clinics, Veterinary Research Instritutes, Laboratories, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Merck & Co., Inc., Zoetis, Boehringer Ingelheim GmbH, Elanco, Indian Immunologicals Ltd., BiogénesisBagó, Phibro Animal Health, KM Biologics, HIPRA, Virbac Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). Frequently Asked Questions (FAQ)

What are swine vaccines?Swine vaccines are biological preparations that provide immunity to pigs against various infectious diseases. They contain antigens from pathogens like viruses or bacteria, which stimulate the pigs' immune systems to protect against future infections.

How big is the Swine Vaccines Market?The global Swine Vaccines Market size was estimated at USD 1.6 Billion in 2023 and is expected to reach USD 2.6 Billion in 2033.

What is the Swine Vaccines Market growth?The global Swine Vaccines Market is expected to grow at a compound annual growth rate of 5.1%. From 2024 To 2033

Who are the key companies/players in the Swine Vaccines Market?Some of the key players in the Swine Vaccines Markets are Merck & Co., Inc., Zoetis, Boehringer Ingelheim GmbH, Elanco, Indian Immunologicals Ltd., BiogénesisBagó, Phibro Animal Health, KM Biologics, HIPRA, Virbac.

Why are swine vaccines important?Swine vaccines are crucial for preventing disease outbreaks in pig populations, enhancing animal welfare, reducing the need for antibiotics, and ensuring the productivity and profitability of the swine industry.

What diseases do swine vaccines target?Common diseases targeted by swine vaccines include Porcine Reproductive and Respiratory Syndrome (PRRS), swine influenza, foot and mouth disease, and African Swine Fever, among others.

How are swine vaccines administered?Most swine vaccines are administered via injection, though some may be given orally or through nasal sprays. The method depends on the vaccine type and the specific disease being targeted.

-

-

- Merck & Co., Inc.

- Zoetis

- Boehringer Ingelheim GmbH

- Elanco

- Indian Immunologicals Ltd.

- BiogénesisBagó

- Phibro Animal Health

- KM Biologics

- HIPRA

- Virbac