Global Influenza Vaccine Market By Type (Live Attenuated, Inactivated), By Valency (Quadrivalent, Trivalent), By Age Group (Pediatrics, Adults), By Route of Administration (Injection, Nasal Spray), By Distribution Channel (Hospital Pharmacy & Retail Pharmacy, Government Suppliers, Other Distribution Channels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 57384

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

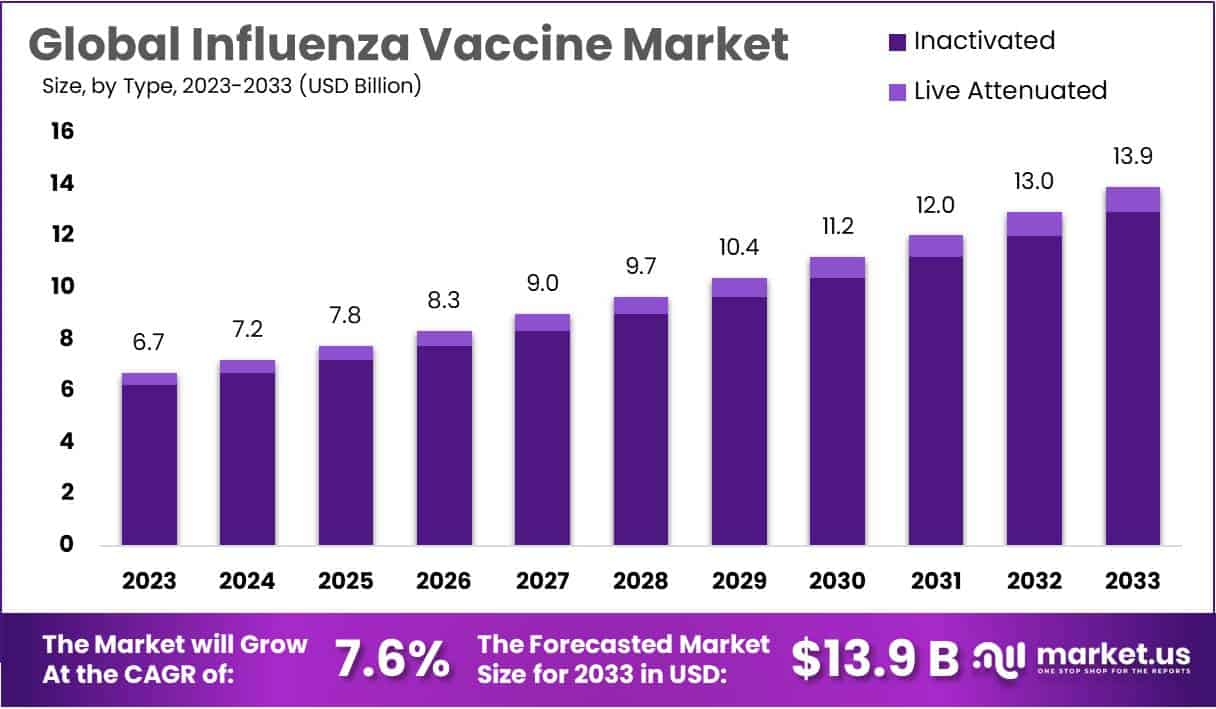

Global Influenza Vaccine Market size is expected to be worth around USD 13.9 Billion by 2033 from USD 6.7 Billion in 2023, growing at a CAGR of 7.6% during the forecast period from 2024 to 2033.

The U.S. government has launched the Vaccines National Strategic Plan for 2021–2025 to enhance the development and use of vaccines throughout all stages of life. This initiative aims to bolster vaccination infrastructure and tackle emerging health challenges, ensuring a robust defense against vaccine-preventable diseases and maintaining vaccine safety.

Recent data from the CDC showcases the effectiveness of influenza vaccines. While the effectiveness can vary, typically, flu vaccines reduce the risk of illness by about 40% to 60% when the strains in the vaccine match the circulating viruses. Despite this benefit, flu vaccination coverage in the U.S. saw a slight decline, with only 49.3% of the population vaccinated in the 2022–23 season, compared to previous years.

In terms of innovation, the flu vaccine market continues to evolve with a variety of options available to meet different needs. These include high-dose vaccines targeted at older adults and various formulations such as live attenuated, recombinant, and cell-based vaccines. These advancements are crucial in enhancing the efficacy and accessibility of flu vaccines.

The public health impact of these vaccines is significant. For instance, during the 2022-2023 flu season, it is estimated that vaccinations prevented around 6 million flu cases, 65,000 hospitalizations, and 3,700 deaths in the U.S. alone. These figures highlight the crucial role that flu vaccinations play in reducing the health burden of the flu.

Furthermore, the U.S. supports several global initiatives, such as the Partnership for International Vaccine Initiatives and collaborations with organizations like Gavi, the Vaccine Alliance. These efforts are essential for the development and distribution of flu vaccines, particularly in lower-income countries, and demonstrate a long-term commitment to global vaccine accessibility and sustainability.

key Takeaways

- The global influenza vaccine market is projected to reach USD 13.9 billion by 2033, up from USD 6.7 billion in 2023, with a 7.6% CAGR.

- Inactivated vaccines dominate the market with a 92.9% share. The live attenuated segment grows slower due to challenges and patient restrictions.

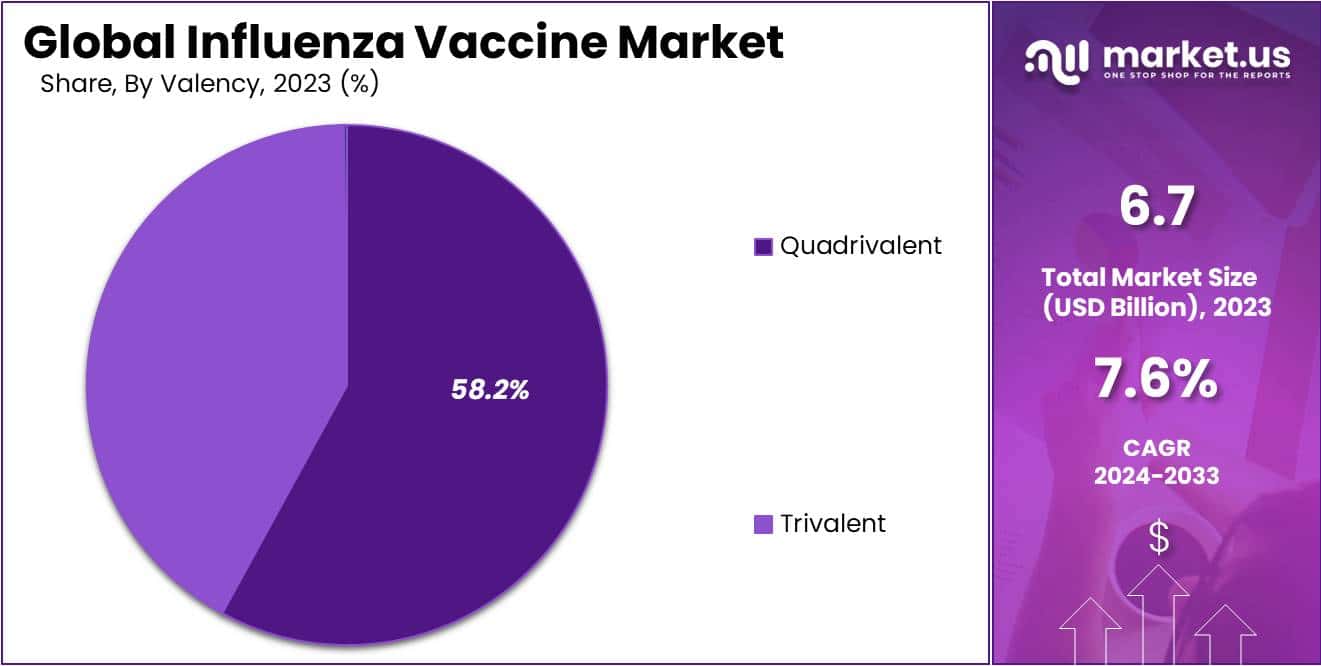

- Quadrivalent vaccines lead with a 58.2% revenue share due to their effectiveness, accessibility, and cost-effectiveness. Trivalent vaccines lag behind.

- Adults account for 78.4% of the market, driven by immunization efforts and a growing elderly population. The pediatric segment is expected to grow.

- Injection is the dominant administration method, holding a 60.7% share. Nasal spray vaccines are projected to grow due to ease of self-administration.

- Hospitals and retail pharmacies hold a 37.4% market share, driven by high vaccination initiatives and influenza hospitalizations. Government suppliers follow.

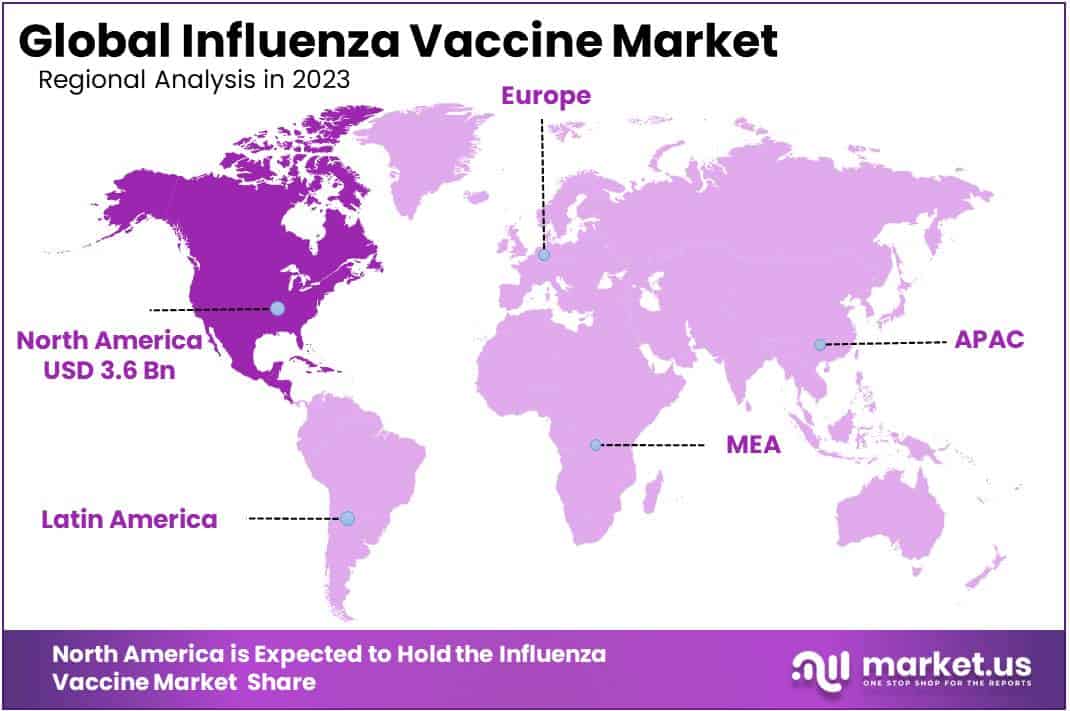

- North America leads the market with a 53.9% revenue share, followed by Europe.

- The Asia-Pacific region is anticipated to experience the fastest expansion due to strong government support and widespread awareness campaigns.

- Notable developments include vaccine approvals, partnerships, and acquisitions by major pharmaceutical companies.

- The report covers market value, forecasts, historical data, segments, regional analysis, competitive landscape, and recent developments. Customization options are available.

Type Analysis

The global influenza vaccine market is segmented into live attenuated and inactivated types. In 2023, the inactivated vaccine segment held the largest market share, accounting for 92.9%. This segment is expected to grow significantly during the forecast period. The demand for efficient vaccines and the high prevalence of diseases drive this growth. Additionally, a large number of manufacturers contribute to the segment’s expansion.

Inactivated vaccines administered to children aged 6-35 months have shown an effective antibody response. This increased demand, coupled with the high incidence of influenza, supports the segment’s high CAGR. Even after the primary vaccination, inactivated vaccines reduce the risk of influenza A and B infections over a long period.

Conversely, the live attenuated vaccine segment is anticipated to grow at a slower pace. This slower growth is due to various challenges in vaccine development and adoption. Additionally, live attenuated vaccines are not recommended for certain groups, such as individuals with asthma and pregnant women.

Valency Analysis

The inactivated segment of the global influenza vaccine market is expected to experience significant growth. This is largely due to the increasing efficiency of quadrivalent vaccines, which are showing the highest Compound Annual Growth Rate (CAGR). Based on valency, the market is divided into quadrivalent and trivalent vaccines.

The quadrivalent segment dominated the market in 2023, holding a 58.2% share. It also exhibited the fastest CAGR of 7.11% during the forecast period. The high efficiency of quadrivalent vaccines against viral infections is a major driver of this growth. These vaccines are readily available in hospitals and clinics and are cost-effective.

Medical specialists’ preference for quadrivalent vaccines further supports this segment’s growth. For instance, a survey conducted in June 2022 revealed that physicians and pharmacies recommend vaccines like Fluzone High-Dose Quadrivalent for individuals above 65 years.

Additionally, the increase in product approvals has propelled the uptake of this segment. The higher approval rates lead to more options for healthcare providers, which in turn boosts market growth.

Age Group Analysis

In 2023, the adult segment dominated the global influenza vaccine market, holding a significant revenue share of 78.4%. This growth is attributed to increased immunization efforts and substantial vaccine doses secured by organizations like PAHO, UNICEF, and GAVI. These efforts have also contributed to higher immunization coverage among the geriatric population, highlighting the importance of adult vaccinations in reducing influenza-related hospitalizations and deaths.

The pediatric segment is expected to grow at a notable rate. This growth is driven by the high number of vaccinations administered to newborns and infants to manage influenza. The World Health Organization (WHO) and other regulatory bodies have implemented policies to ensure vaccines are provided at a primary age. They aim to vaccinate every child worldwide, enhancing immunization coverage.

The rising awareness and efforts to promote immunization among adults and children are crucial in controlling influenza outbreaks. The significant revenue share of the adult segment underscores the effectiveness of targeted immunization strategies. As these efforts continue, both segments are expected to experience substantial growth, driven by ongoing initiatives and policies aimed at increasing vaccine coverage and reducing the impact of influenza globally.

Route of Administration Analysis

The global influenza vaccine market is divided into two segments based on the route of administration: injection and nasal spray. In 2023, the injection segment dominated, accounting for 60.7% of the market revenue share. This significant growth is attributed to the wide availability of intramuscular vaccine candidates. Additionally, the robust range of injectable products and recent product adoptions have further driven the segment’s development.

The nasal spray segment is expected to be the fastest-growing segment. This is due to the increasing acceptance of nasal spray vaccines, which offer ease of self-administration and suitability for home care settings. Nasal sprays are also capable of inducing systemic immunity. Researchers are continually exploring new possibilities for nasal spray vaccines, which is likely to contribute to the segment’s growth.

Distribution Channel Analysis

The Hospital and Retail Pharmacies segment has shown significant growth in the influenza vaccine market. In 2023, this segment held a dominant 37.4% market share. The primary factors driving this growth are the large number of hospitals and pharmacies offering influenza vaccinations. Smaller institutions also play a crucial role in extensive vaccination initiatives. High influenza cases, leading to increased hospital admissions, further boost the segment’s growth.

The government suppliers segment is also expected to hold a significant market share. Government administrations run extensive vaccination programs, benefiting immunized individuals globally. Additionally, hospitals contribute to the large supply of vaccines, creating growth opportunities for this segment.

Overall, the distribution channels in the global influenza vaccine market include hospitals and retail pharmacies, government suppliers, and others. The hospitals and retail pharmacies segment leads due to the widespread availability of influenza vaccines in these facilities.

Government programs also support the segment’s growth by ensuring vaccines reach a broad population. The high incidence of influenza and subsequent hospital admissions drive the demand for vaccines, making hospitals and retail pharmacies a crucial distribution channel. This trend is expected to continue, reinforcing the importance of these segments in the influenza vaccine market.

Key Market Segments

By Type

- Live Attenuated

- Inactivated

By Valency

- Quadrivalent

- Trivalent

By Age Group

- Pediatrics

- Adults

By Route of Administration

- Injection

- Nasal Spray

By Distribution Channel

- Hospital Pharmacy & Retail Pharmacy

- Government Suppliers

- Other Distribution Channels

Drivers

Enhanced Global Surveillance and Immunization Programs

The WHO and CDC are actively expanding influenza vaccination programs globally. Surveillance systems aid in customizing these programs, which have shown effectiveness in regions like Asia where extensive vaccination drives have contributed to a significant reduction in influenza and COVID-19 cases. In the 2023-2024 season, these measures helped manage the vaccine demand effectively, leveraging both national and international health resources.

Advancements and Strategic Recommendations in Vaccine Development

For the 2024-2025 flu season, updated trivalent vaccines have been recommended to protect against three major strains: H1N1, H3N2, and B/Victoria lineage. These vaccines are developed based on global surveillance data to enhance their effectiveness against the most likely virus strains to circulate each season.

Restraints

Challenges in Vaccine Development

Vaccine development is a critical but time-consuming process, typically requiring 10-15 years to ensure safety and efficacy. This extensive timeline reflects the necessary, meticulous stages of vaccine research and clinical trials. According UK Charity the typical vaccine development, from early research to final approval, can cost up to $500 million and often involves multiple phases over several years.

Clinical trials are particularly pivotal and protracted. Phase III trials alone, which assess vaccine safety and effectiveness among thousands of participants globally, are crucial for spotting rare side effects—some as infrequent as 1 in 10,000 which necessitates large and diverse participant pools.

Regulatory challenges further complicate the timeline. Diverse regulatory requirements across countries mean that manufacturers must navigate different approval processes and standards, which can introduce delays. For example, each country’s regulatory body, like the FDA in the U.S., must review and approve every stage of the vaccine manufacturing process, from the initial clinical data to the final product consistency checks.

The strict and variable regulatory environments across regions not only extend the timeline but also significantly impact the cost and complexity of vaccine development. These factors combined underscore the critical need for international collaboration to streamline processes and accelerate the availability of vaccines, especially during global health crises.

Opportunity

Government Initiatives Boost Influenza Vaccine Market Growth

Government support for influenza vaccination is significantly enhancing market growth. The World Health Organization advises countries to include influenza vaccines in national immunization programs, providing technical and financial backing.

In the U.S., the Centers for Disease Control and Prevention recommends annual flu vaccination for individuals over six months old, noting a rise in vaccine coverage with 2.5 million additional doses administered from 2019 to 2024.

The Australian government also offers free vaccines to high-risk groups through its National Immunisation Program, underscoring the need for yearly vaccination to prevent severe complications. These initiatives are driving market expansion by increasing vaccine accessibility and public awareness.

Trends

Strengthening Influenza Immunization Efforts

The global rise in influenza cases has prompted governments to incorporate influenza vaccines into national immunization programs. Increasing public awareness about infectious diseases has further supported the systematic inclusion of these vaccines, especially through organized immunization events aimed at combating the flu.

According to the World Health Organization, comprehensive vaccination coverage is crucial in preventing the severe impacts of the influenza virus. With enhanced policies and mandatory vaccination in emerging regions, countries are aiming to reduce health burdens during flu seasons and improve community health resilience. This proactive approach in public health highlights the crucial role of vaccines in managing and mitigating influenza outbreaks globally

Regional Analysis

North American region Accounted Significant Revenue Share of the Global Influenza Vaccine Market.

North America accounted for a significant influenza vaccine market revenue share of 53%. Owing to the rapid launch of effective products along with technically advanced vaccine production facilities around the region. Additionally, the rising dominance of influenza infection in Canada and the U.S. and the increasing sales of influenza vaccines in the region are also anticipated to propel the market growth.

Europe held the second prominent position in the global market. This is attributable to the extension of vaccination coverage for high-risk individuals prominent to greater immunization extents among the European population.

Asia-Pacific is anticipated to register at the fastest CAGR during the forecast period. The growing government advantages to offer vaccines and create awareness about influenza are estimated to drive market growth through the region. Latin America and, Middle East & Africa regions anticipated to account for significant growth throughout the forecast period due to rising government efforts to get everybody vaccinated, thereby propelling the market growth.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Key players are driving market growth through strong product portfolios. Companies like Sanofi are expanding their manufacturing facilities and geographical reach. Sanofi, a leading biopharmaceutical company, holds a significant share of the influenza vaccine market. Other notable players include GlaxoSmithKline plc, AstraZeneca, and Abbott. These companies have a global presence and their products are marketed worldwide.

Their strategic initiatives, such as launching novel products and expanding facilities, contribute to market dominance. According to recent studies by healthcare organizations, these efforts are expected to enhance market growth. The continued investment in research and development by these key players is a crucial factor in sustaining their competitive edge and driving the overall market expansion.

Market Key Players

- Sanofi S.A.

- AstraZeneca plc

- CSL Limited

- BIKEN Co, Ltd.

- GlaxoSmithKline plc

- Abbott

- Sinovac Biotech Ltd.

- Viatris Inc.

- Merck & Co, Inc.

- EMERGEX VACCINES

- Pfizer Inc.

- Novartis AG

- Merck & Co., Inc.

- Johnson & Johnson

- Novavax, Inc.

- Hoffmann –La Roche Ltd

- Baxter International Inc.

- Flugen Inc.

- Vaxart Inc.

- Altimmune Inc.

- Shijiazhuang Yiling Pharmaceutical Co, Ltd

- BiondVax Pharmaceuticals Ltd.

- Daiichi Sankyo Company

- Other Key Players

Recent Development

- In January 2024: Novavax initiated a Phase 3 clinical trial for its NVX-102 Universal Influenza Vaccine Candidate. Targeting a conserved region of the influenza virus, the vaccine aspires to confer protection against a wide array of influenza strains, including those currently not in circulation. The successful completion of this trial holds the potential to be a groundbreaking achievement in the field of influenza vaccine development, paving the way for a universal vaccine that transcends the limitations of strain-specific formulations.

- In December 2023: AstraZeneca and Seqirus unveiled a collaborative initiative focused on advancing next-generation influenza vaccines. Capitalizing on AstraZeneca’s proficiency in antibody discovery and Seqirus’ extensive knowledge of influenza vaccines, the collaboration aims to create vaccines with broad-spectrum protection against diverse influenza strains. This joint venture underscores a substantial commitment to innovation within the influenza vaccine landscape, positioning both companies at the forefront of future advancements in this critical healthcare segment.

- In October 2023: Sanofi Pasteur achieved regulatory approval in the European Union for its Quadrivalent FLUONE High-Dose Influenza Vaccine, specifically designed for individuals aged 65 and older. This innovative vaccine, characterized by an elevated antigen dose compared to standard formulations, addresses the heightened susceptibility of older adults to influenza-related complications. Sanofi’s strategic move into this market segment reflects a noteworthy development, signaling increased market presence and potential revenue growth in the influenza vaccine domain.

Report Scope

Report Features Description Market Value (2023) USD 6.7 Billion Forecast Revenue (2033) USD 13.9 Billion CAGR (2024-2033) 7.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type-Inactivated and Live Attenuated; By Valency-Quadrivalent and Trivalent; By Age Group- Adults and Pediatrics; By- Route of Administration- Injection and Nasal Spray; By Distribution Channel-Hospitals & Retail Pharmacy, Government Suppliers, and Other Distribution Channels Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Sanofi S.A., AstraZeneca plc, CSL Limited, BIKEN Co, Ltd. GlaxoSmithKline plc, Abbott, Sinovac Biotech Ltd. Viatris Inc. Merck & Co, Inc., EMERGEX VACCINES, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sanofi S.A.

- AstraZeneca plc

- CSL Limited

- BIKEN Co, Ltd.

- GlaxoSmithKline plc

- Abbott

- Sinovac Biotech Ltd.

- Viatris Inc.

- Merck & Co, Inc.

- EMERGEX VACCINES

- Pfizer Inc.

- Novartis AG

- Merck & Co., Inc.

- Johnson & Johnson

- Novavax, Inc.

- Hoffmann –La Roche Ltd

- Baxter International Inc.

- Flugen Inc.

- Vaxart Inc.

- Altimmune Inc.

- Shijiazhuang Yiling Pharmaceutical Co, Ltd

- BiondVax Pharmaceuticals Ltd.

- Daiichi Sankyo Company

- Other Key Players