Global Biopharmaceuticals Market By Type (Erythropoietin, Hormone, Growth & Coagulation Factor), By Application (Oncology, Neurological Disease, Metabolic Disease), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 21607

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

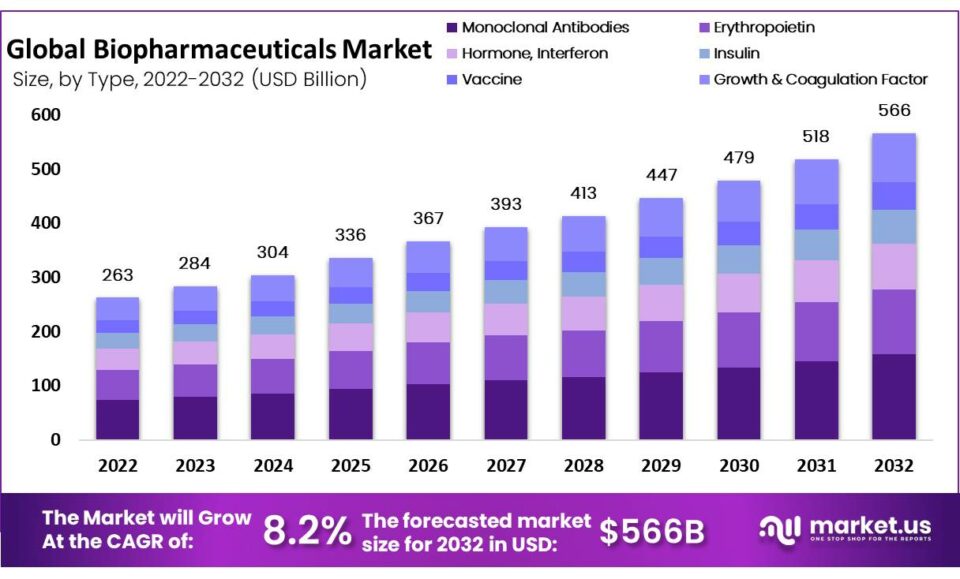

The global biopharmaceuticals market size is expected to be worth around USD 566 billion by 2032 from USD 263 billion in 2022, growing at a CAGR of 8.2% during the forecast period from 2022 to 2032.

Biopharmaceuticals are drugs with significant therapeutic efficacy that are made from living organisms like an animal and microbial cells. Biotech and biologics medications are other names for these huge, intricate molecules. A number of factors, including a geriatric population, and an increase in the frequency of chronic diseases like cancer and diabetes are driving the global market of biopharmaceuticals. Furthermore, another factor that is expected to support the expansion of the biopharmaceutical market is due to the emergence of strategic collaborations between biopharmaceutical firms.

Key Takeaways

- The global biopharmaceuticals market is expected to reach USD 566 billion in 2032.

- The market is projected to have a CAGR of 8.2% from 2023 to 2032.

- In 2022, the global biopharmaceuticals market was valued at USD 263 billion.

- Monoclonal antibodies are expected to dominate the market from 2023 to 2032.

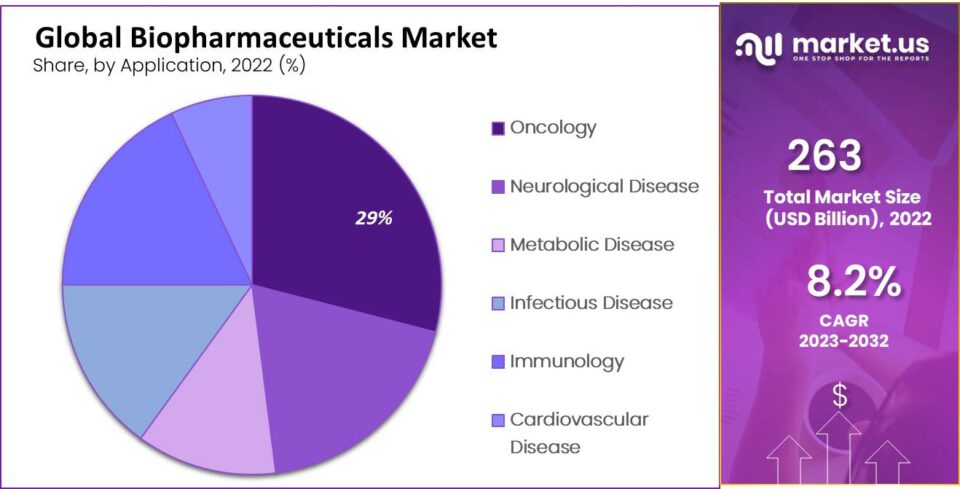

- The oncology segment held the largest market share in 2022.

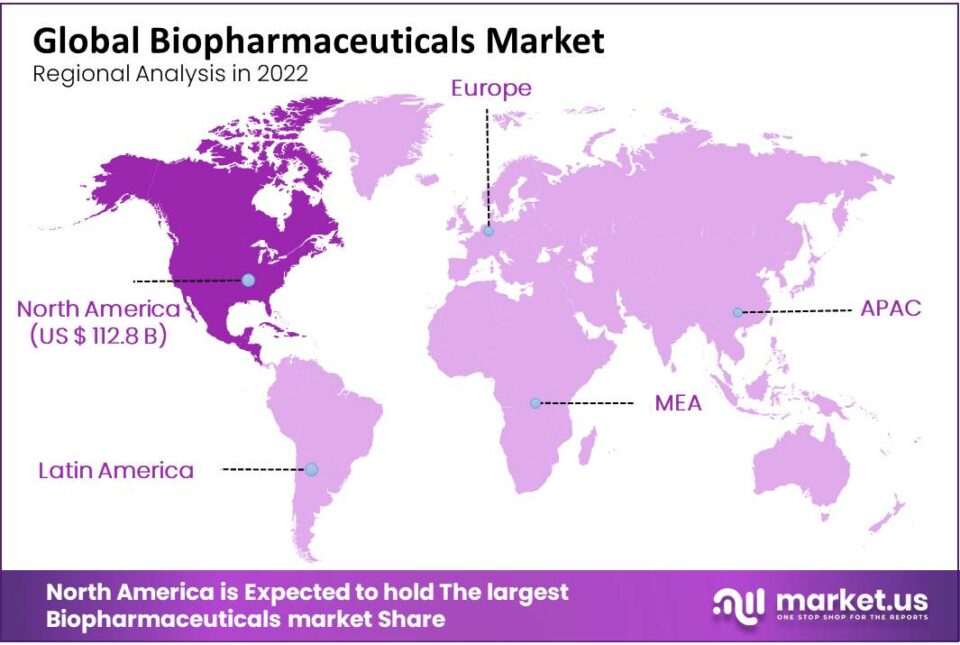

- Europe accounted for 23% of the market’s revenue share in 2022.

- North America dominated the market in 2022 with a 43% revenue share, due to government initiatives and healthcare investments.

- Asia Pacific is expected to grow significantly due to a large population and government initiatives in healthcare.

- Factors driving market growth include the increase in chronic diseases and strategic collaborations among biopharmaceutical firms.

- Other factors include the aging population, the impact of COVID-19, and growing investments in research.

- Monoclonal antibodies are laboratory-made proteins used to treat various diseases, including COVID-19.

- Major players in the market include Novo Nordisk, Johnson & Johnson, and Eli Lilly & Company.

Type Analysis

The Monoclonal Antibodies Segment Accounted for the Largest Market Share in the Biopharmaceuticals Market

Based on type analysis, the global biopharmaceuticals market is segmented into erythropoietin, growth & coagulation factors, hormones, interferon, insulin, vaccine, monoclonal antibodies, and other types. Among these types, the largest market share was occupied by monoclonal antibodies. Because the therapeutic use of monoclonal antibodies’ increased success rate. Cancer, Multiple sclerosis, cardiovascular disorders, rheumatoid arthritis, and other chronic diseases all can be effectively treated with monoclonal antibodies.

Additionally, because monoclonal antibodies only attack the cells of the targeted area and do not destroy healthy cells, also they are less toxic or have fewer side effects. Patients’ growing understanding of the advantages of monoclonal antibodies has accelerated their application in the treatment of numerous diseases all around the world.

Vaccines are the Most Lucrative Segment in the Forecast Period

In contrast, it is predicted that the vaccines category would become the most attractive over the course of the forecast period. This is due to the growing number of illnesses and increasing funding made by vaccine developers.

Application Analysis

The Oncology Segment Accounted for the Largest Market Share in Biopharmaceuticals Market

Based on application analysis, the global biopharmaceuticals market is segmented into oncology, neurological disease, metabolic disease, infectious disease, immunology, cardiovascular disease, a blood disorder, and others application. Among this therapeutic application, the largest market share was occupied by oncology. Because, biopharmaceuticals’ are highly used in the treatment of many diseases, including lung cancer, prostate cancer, breast cancer, and colorectal cancer. Hence, the number of cancer cases worldwide is increasing alarmingly.

Cardiovascular Disease is the Most Lucrative Segment during the Forecast Period

The most lucrative growth opportunities are anticipated in cardiovascular disease due to the increasing frequency of CVDs around the world and the increasing investment of biopharmaceutical market manufacturers in the development of novel medications for CVDs.

Key Market Segments

By Type

- Erythropoietin

- Growth & Coagulation Factor

- Hormone, Interferon

- Insulin

- Vaccine

- Monoclonal Antibodies

- Others Types

By Application

- Oncology

- Neurological Disease

- Metabolic Disease

- Infectious Disease

- Immunology

- Cardiovascular Disease

- Blood Disorder

- Others Applications

Drivers

Increasing acceptance, huge market demand for biopharmaceuticals, and the ability to treat previously untreatable diseases are driving the market’s growth.

The primary driver propelling the expansion of this market is the enormous demand for biopharmaceutical products brought on by the increase in chronic disorders and the geriatric population. Furthermore, it is anticipated that the capacity of biopharmaceuticals to treat untreatable conditions will speed up the market’s overall growth.

Increasing Awareness of the Efficacy and Accessibility of Biopharmaceuticals

Additionally, the population’s increasing awareness of the efficacy and accessibility of biopharmaceuticals as well as the rising healthcare sector are anticipated to temper market growth during the anticipated time frame. The market is expected to rise as a result of the increased efforts being made to improve the biopharmaceutical sector.

Restraints

High Industry Levels Investments and Stringent Regulatory Issues

Industry investment levels are relatively high, which is anticipated to impede market expansion. This biopharmaceuticals market review describes the latest developments, import-export analysis, trade regulations, production analysis, the effects of domestic & localized market players, value chain enhancement, and market share.

Moreover, it analyses opportunities in terms of new revenue pockets, regulatory changes, strategic analysis for market growth, category market growths, application niches & dominance, market size, product approvals, geographic expansions, product launches, and technological advancements in the market.

Opportunity

Growing Investments and Research of the Market Helping to Create New Opportunities

It is predicted that the market will benefit greatly from the increased research and associated investments. Hence, Numerous chances for market expansion will also be provided by the improved government funding for the development of the biopharmaceutical industry as well as the increased investments made by market participants in the r&d to develop pharmaceuticals and associated clinical trials.

Regional Analysis

North America Generated Highest Revenue Globally and dominated the Biopharmaceuticals Market

According to revenue, North America dominated the world market for biopharmaceuticals. The market growth is being augmented because of the market participants increased investments and government initiatives in a major market like the US. In reality, the bulk of recently developed innovative drugs is protected by US rights to intellectual property.

Additionally, rising healthcare costs, deeper awareness of biopharmaceuticals presence, and an increase in the frequency of different chronic disorders have led to North America’s dominance in the worldwide biopharmaceutical market.

Asia Pacific has Anticipated High Opportunity in the Forecast Period Due to the Large Population

However, during the projected period, Asia Pacific will be anticipated to become the market with the most opportunity because three-fifths of the world’s population resides in the Asia-Pacific region. The prevalence of numerous chronic diseases is likely to increase in the Asia Pacific region, along with healthcare spending and government initiatives in the construction of high-tech healthcare infrastructure.

These factors are predicted to support the expansion of the biopharmaceutical industry. A number of the leading CMOs are also concentrated in the region, which has a substantial positive impact on the market’s expansion.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Due to the presence of many local and regional players, the market for biopharmaceuticals market is fragmented. Market players are subject to intense competition from top key market players such as Amgen Inc., Eli Lilly, Company, and Johnson & Johnson, particularly those with strong brand recognition and high distribution networks. To stay on top of the market, companies have gained various expansion strategies like partnerships, investments, and product launches.

Market Key Players

- Novo Nordisk A/S

- AbbVie Inc.

- Eli Lilly and Company

- Amgen Inc.

- Abbott

- Bayer AG

- Biogen

- Bristol-Myers Squibb Company

- Hoffmann-La Roche, Ltd.

- Johnson & Johnson

- GlaxoSmithKline Plc

- Merck & Co., Inc.

- Pfizer Inc.

- Sanofi

Recent Development

- In Mar 2022, In order to promote the Company’s FixVac product BNT116, BioNTech SE announced expanding its strategic partnership with Regeneron.

- In Feb 2021, The Rockefeller University’s new monoclonal antibody duo therapies that negates the SARS-CoV-2 virus of COVID-19 will be developed, manufactured, and marketed under a conclusive agreement that was signed between Bristol Myers Squibb and The Rockefeller University.

- In Jul 2021, biopharmaceutical business HilleVax, Takeda Pharmaceutical partnered with Frazier Healthcare.

Report Scope

Report Features Description Market Value (2022) USD 263 Bn Forecast Revenue (2032) USD 566 Bn CAGR (2023-2032) 8.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Erythropoietin, Hormone, Growth & Coagulation Factor, Interferon, Insulin, Vaccine, Monoclonal Antibodies, and Others Type), By Application (Oncology, Neurological Disease, Metabolic Disease, Infectious Disease, Immunology, Cardiovascular Disease, Blood Disorder, and Others Application) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Novo Nordisk A/S, AbbVie Inc., Eli Lilly and Company, Amgen Inc., Abbott Laboratories, Bayer AG, Biogen Idec, Biogen Inc., Bristol-Myers Squibb Company, F. Hoffmann-La Roche, Ltd., Johnson & Johnson, GlaxoSmithKline Plc, Merck & Co., Inc., Pfizer Inc., Sanofi, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Who are the major players operating in the biopharmaceuticals market?The major players operating in the biopharmaceuticals market are Novo Nordisk A/S, AbbVie Inc., Eli Lilly and Company, Amgen Inc., Abbott, Bayer AG, Biogen, Bristol-Myers Squibb Company, Hoffmann-La Roche, Ltd., Johnson & Johnson, GlaxoSmithKline Plc, Merck & Co., Inc., Pfizer Inc., Sanofi.

What is the CAGR of biopharmaceuticals market?The global biopharmaceuticals market is growing at a CAGR of 8.2% from 2022 to 2032.

What segments are covered in the Biopharmaceuticals Market report?The Global Biopharmaceuticals Market is segmented based on Type, Application, and Geography.

What is the projected market size & growth rate of the Biopharmaceuticals Market?Biopharmaceuticals Market was valued at USD 262.5 Billion in 2022 and is projected to reach USD 566 Billion by 2030, growing at a CAGR of 8.2% from 2022 to 2032.

-

-

- Novo Nordisk A/S

- AbbVie Inc.

- Eli Lilly and Company

- Amgen Inc.

- Abbott

- Bayer AG

- Biogen

- Bristol-Myers Squibb Company

- Hoffmann-La Roche, Ltd.

- Johnson & Johnson

- GlaxoSmithKline Plc

- Merck & Co., Inc.

- Pfizer Inc.

- Sanofi