Global Krypton Gas Market Size, Share, And Business Benefits By Grade (Research Grade, Commercial Grade, Medical Grade), By Purity Level (99% Purity, 99.9% Purity, 99.99% Purity), By Packaging (Compressed Gas Cylinders, Specialty Gas Cylinders, Cryogenic Storage Tanks), By Type (High purity krypton, Common purity krypton), By Application (Lighting, Lasers, Medical Imaging, Semiconductors, Aerospace, Military, Others), By End-Use (Automotive, Electronics, Healthcare, Manufacturing, Transportation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 141022

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Grade Analysis

- By Purity Level Analysis

- By Packaging Analysis

- By Type Analysis

- By Application Analysis

- By End-Use Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

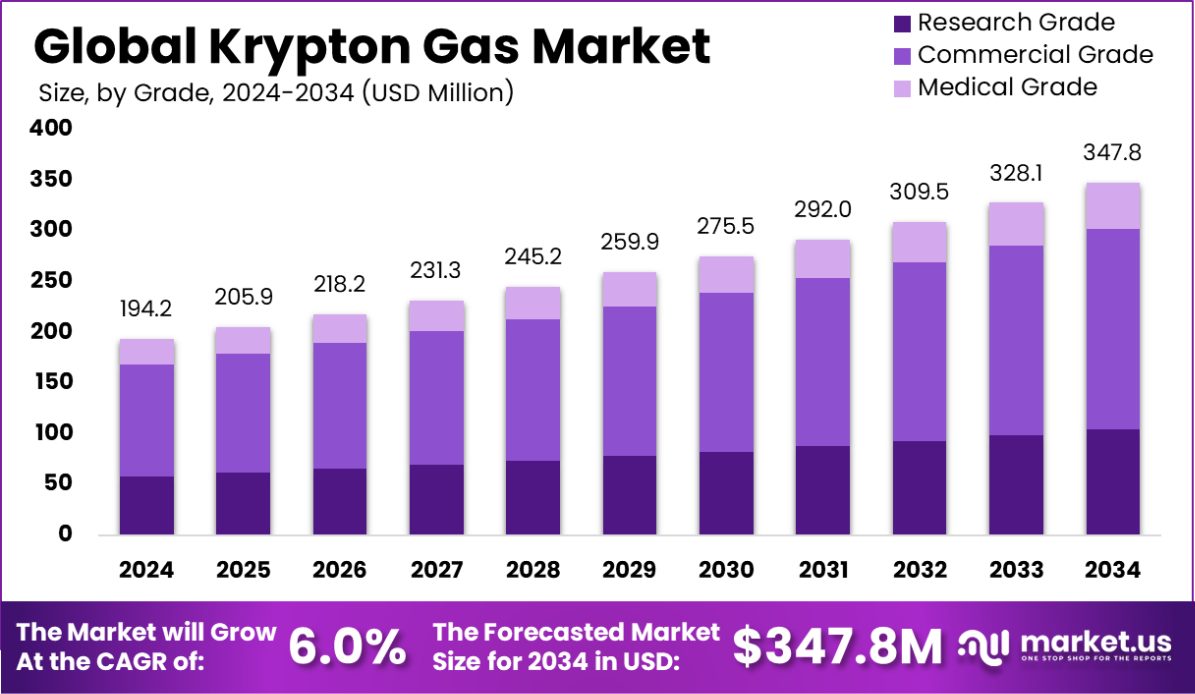

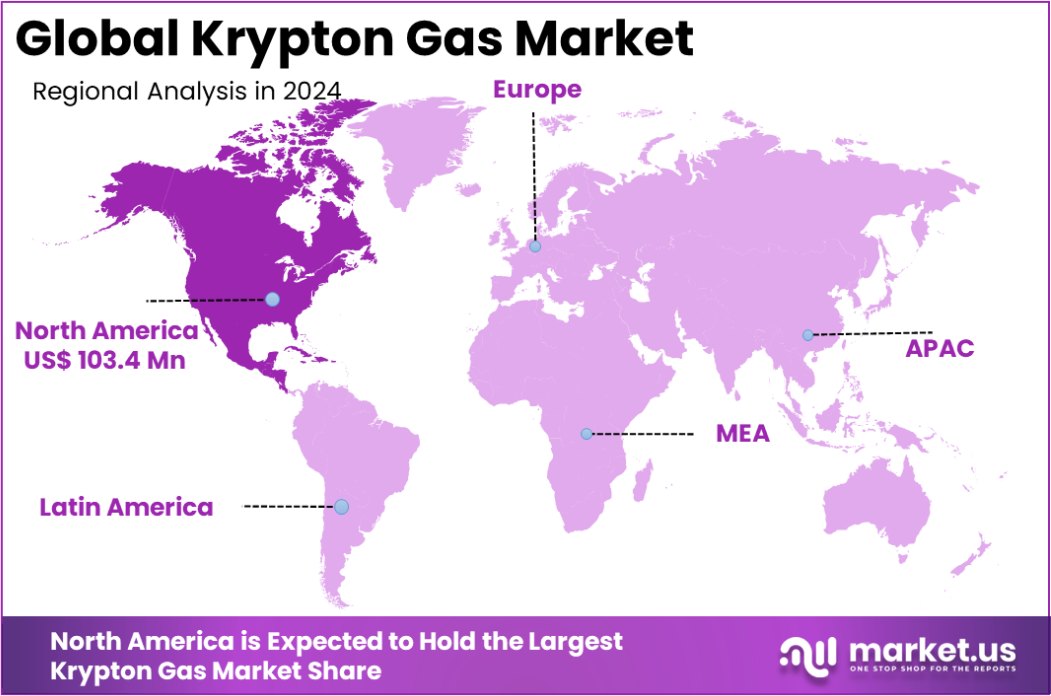

The Global Krypton Gas Market is expected to be worth around USD 347.8 million by 2034, up from USD 194.2 million in 2024, and grow at a CAGR of 6.0% from 2025 to 2034. North America’s Krypton Gas Market reached USD 103.4 million in 2024, representing 38.8% of the market.

Krypton gas is a colorless, odorless, and tasteless noble gas found in trace amounts in the Earth’s atmosphere. It is chemically inert and typically used in specialized applications like lighting, insulation, and scientific research. Krypton is often utilized in energy-efficient light bulbs, high-performance windows, and as a component in producing certain types of lasers. Due to its inert nature, it does not react with other substances, making it safe for use in many environments.

The krypton gas market is driven by its unique properties, which make it a valuable resource in niche sectors such as the production of energy-efficient lighting and high-performance windows. The market is expected to grow as industries continue to seek sustainable and energy-saving solutions, especially in the construction and lighting sectors. The demand for krypton is influenced by technological advancements, the rise of energy-efficient construction practices, and the growing emphasis on reducing energy consumption globally.

Growth factors in the krypton gas market include the ongoing development of advanced lighting technologies and the increased demand for energy-efficient building materials. As the need for sustainable and eco-friendly solutions rises, krypton’s role in creating energy-efficient windows and lighting systems positions it for growth.

Demand for krypton gas has surged due to its use in manufacturing energy-saving products. The global shift toward eco-friendly infrastructure, including low-emission lighting and insulation materials, has heightened the need for krypton.

The opportunities in the krypton gas market lie in the continued innovation of energy-efficient technologies. As industries focus on reducing carbon footprints and energy use, krypton will likely see a rise in demand for its applications in green building initiatives and lighting solutions.

Krypton-85, a metastable isotope of krypton, is used in medical applications for respiratory organ ventilation/perfusion scans, where it is inhaled and imaged with a gamma camera, according to Vedantu. The cost of krypton capture and storage through cryogenic distillation is estimated to range from $830.15/L to $1,522.52/L, as reported by INL Digital Library.

In comparison, the cost of xenon capture and storage is notably lower, ranging from $71.50/L to $131.13/L. Additionally, an aqueous reprocessing plant with a throughput of 300 MTHM/yr incurs plant capital expenditures of approximately $8.26 billion using the CURIE tool for calculations.

Key Takeaways

- The Global Krypton Gas Market is expected to be worth around USD 347.8 million by 2034, up from USD 194.2 million in 2024, and grow at a CAGR of 6.0% from 2025 to 2034.

- The krypton gas market is largely driven by commercial grade products, comprising 57.6% of the market share.

- Krypton gas with 99.9% purity holds a significant portion of the market, representing 48.4% share.

- Compressed gas cylinders are the primary packaging method, accounting for 48.3% of the krypton market.

- Common purity krypton dominates the market with a share of 68.4%, meeting broader industrial needs.

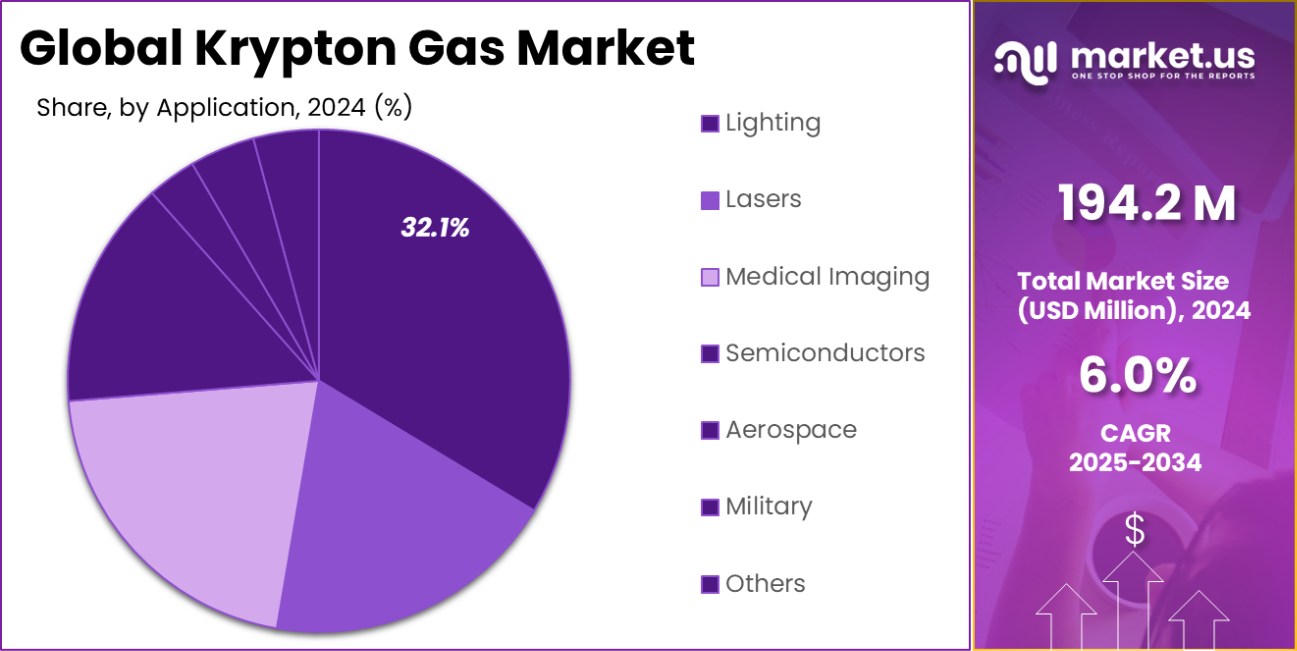

- The lighting sector leads krypton gas applications, consuming 32.1% of the total gas market share.

- Electronics is a key end-use industry for krypton gas, contributing to 39.3% of market consumption.

- With a market share of 38.8%, North America contributed USD 103.4 million to the Krypton Gas Market.

By Grade Analysis

Commercial grade krypton holds a 57.6% share in the global market segment.

In 2024, Commercial Grade held a dominant market position in the By Grade segment of the Krypton Gas Market, with a 57.6% share. This is primarily due to its widespread use across various industries, including lighting, insulation, and aerospace applications. Commercial-grade krypton is considered cost-effective and meets the required purity standards for the production of energy-efficient light bulbs and specialized windows, making it the preferred choice for mass production.

The high demand for energy-efficient lighting systems, particularly in residential and commercial buildings, has significantly contributed to the growth of commercial-grade krypton. Additionally, the expansion of the construction industry in emerging markets, where energy-efficient solutions are increasingly prioritized, has bolstered the segment’s dominance. As global focus shifts toward reducing energy consumption, commercial-grade krypton remains a key component in sustainable building practices.

In contrast, the High Purity Grade segment is anticipated to witness a steady growth trajectory, driven by its applications in scientific research, lasers, and specialized manufacturing processes. While the demand for high-purity krypton remains limited to niche sectors, its applications in advanced technology and high-precision equipment are expected to fuel its market expansion.

By Purity Level Analysis

Krypton with 99.9% purity accounts for 48.4% of total market demand.

In 2024, 99.9% Purity held a dominant market position in the By Purity Level segment of the Krypton Gas Market, with a 48.4% share. This high-purity grade of krypton is extensively utilized in applications requiring precise gas compositions and minimal contaminants, such as in the production of specialized lighting, medical equipment, and scientific research. The demand for 99.9% purity krypton continues to rise due to its critical role in industries where gas purity directly impacts performance and safety.

The segment’s dominance can be attributed to the increasing use of krypton in energy-efficient lighting solutions, particularly in halogen and xenon lamps, where high purity is crucial for optimal efficiency and longevity. Additionally, the growth of research applications, including gas discharge lasers and certain semiconductor manufacturing processes, further boosts the demand for this high-purity grade.

While 99.9% purity remains the leading grade, the market for krypton with lower purity levels is expected to grow gradually. Lower purity grades, often used in less critical applications such as insulation and lower-end lighting, are cost-effective alternatives that cater to broader industrial uses.

The demand for 99.9% purity krypton is expected to remain strong due to its pivotal role in both technological advancements and the growing global emphasis on energy-efficient and high-performance products. As the need for precision and high-quality manufacturing continues, this segment is set for sustained growth.

By Packaging Analysis

Compressed gas cylinders are responsible for 48.3% of krypton gas packaging use.

In 2024, Compressed Gas Cylinders held a dominant market position in the Packaging segment of the Krypton Gas Market, with a 48.3% share. This packaging type is widely preferred due to its ease of handling, storage, and transportation, particularly for industrial and commercial applications. Compressed gas cylinders are commonly used in sectors such as lighting, insulation, and scientific research, where krypton gas is needed in controlled, high-pressure environments.

The popularity of compressed gas cylinders is driven by their ability to store large quantities of krypton in a compact and easily transportable form. This makes them an ideal solution for industries requiring bulk supplies of krypton, such as those involved in the production of energy-efficient lighting systems and gas-filled windows. Furthermore, cylinders are essential for maintaining the purity and integrity of the gas, preventing contamination during storage and transportation.

While other packaging types, such as cryogenic tanks and bulk containers, are used for larger-scale applications, compressed gas cylinders remain the preferred choice for most commercial users due to their versatility and cost-effectiveness. The continued growth of industries that require on-site delivery and easy storage, particularly in the construction and automotive sectors, is expected to sustain the dominance of compressed gas cylinders.

As the demand for krypton gas increases, driven by energy efficiency and technological advancements, the role of compressed gas cylinders in the market is expected to remain critical, ensuring a steady supply for industries worldwide.

By Type Analysis

Common purity krypton dominates with 68.4% of the total market share.

In 2024, Common Purity Krypton held a dominant market position in the By Type segment of the Krypton Gas Market, with a 68.4% share. This type of krypton, typically characterized by a purity level of around 99.0%, is primarily used in non-specialized applications where ultra-high purity is not essential. Common purity krypton is widely used in the manufacturing of energy-efficient lighting solutions, insulation, and various industrial processes, making it the preferred choice for mass-market products.

The widespread adoption of common purity krypton can be attributed to its cost-effectiveness and versatility. It provides a reliable and affordable solution for applications like double-glazed windows and some forms of discharge lamps, where high purity is not a critical requirement. This has contributed significantly to its market share, as many industries seek to balance performance with cost-efficiency.

Despite the dominance of common-purity krypton, higher-purity grades are gaining traction in niche markets, particularly those involving scientific research and precision manufacturing. However, common purity krypton is expected to continue leading the market due to its broader applicability and the ongoing demand from energy-efficient construction and lighting sectors.

As industries increasingly prioritize cost-effective solutions for sustainable technologies, the dominance of common purity krypton in the market is anticipated to remain strong, especially as its role in general lighting and insulation continues to grow.

By Application Analysis

The lighting industry uses 32.1% of global krypton gas production annually.

In 2024, Lighting held a dominant market position in the By Application segment of the Krypton Gas Market, with a 32.1% share. Krypton is widely used in specialized lighting applications, particularly in energy-efficient and high-performance lighting systems such as halogen lamps, fluorescent lamps, and certain types of LEDs. Its ability to provide higher luminosity and energy efficiency compared to traditional lighting technologies has driven its strong demand in the lighting industry.

The demand for krypton in lighting applications is largely influenced by the growing emphasis on energy conservation and sustainability in both commercial and residential sectors. As governments worldwide implement stricter regulations on energy use and carbon emissions, krypton’s role in creating more efficient lighting systems becomes increasingly crucial. Additionally, the long lifespan and superior brightness of krypton-enhanced lamps contribute to its continued dominance in this application.

While krypton is also used in other applications such as insulation and scientific research, the lighting sector remains the largest contributor to market growth. The ongoing transition to more energy-efficient lighting solutions, including the rise of smart lighting systems, is expected to keep the lighting segment at the forefront of krypton gas demand.

By End-Use Analysis

Electronics end-use applications contribute to 39.3% of total krypton gas consumption.

In 2024, Electronics held a dominant market position in the By End-Use segment of the Krypton Gas Market, with a 39.3% share. Krypton is increasingly used in the electronics industry for applications such as semiconductors, flat-panel displays, and certain types of lasers. Its inert properties and ability to form stable environments make it a critical component in the production of high-performance electronic devices.

The rise of advanced electronic products, such as smartphones, computers, and high-definition displays, has significantly contributed to the demand for krypton gas. In particular, krypton is used in the production of flat-panel displays, where its properties help improve image clarity and reduce energy consumption. The growth of the consumer electronics sector, especially in emerging markets, is expected to continue driving demand for krypton in this segment.

In addition, the increasing reliance on lasers for precision cutting, engraving, and scientific research further enhances the electronics industry’s demand for krypton. Its role in ensuring the stability and effectiveness of these processes makes it indispensable for high-tech manufacturing.

While other industries such as lighting and insulation also use krypton, the electronics sector is expected to maintain its dominant position in the market. As technology continues to evolve and demand for high-quality electronic devices grows, krypton’s applications in the electronics industry are set to expand, ensuring ongoing market growth.

Key Market Segments

By Grade

- Research Grade

- Commercial Grade

- Medical Grade

By Purity Level

- 99% Purity

- 99.9% Purity

- 99.99% Purity

By Packaging

- Compressed Gas Cylinders

- Specialty Gas Cylinders

- Cryogenic Storage Tanks

By Type

- High purity krypton

- Common purity krypton

By Application

- Lighting

- Lasers

- Medical Imaging

- Semiconductors

- Aerospace

- Military

- Others

By End-Use

- Automotive

- Electronics

- Healthcare

- Manufacturing

- Transportation

- Others

Driving Factors

Growing Demand for Energy-Efficient Lighting Solutions

One of the key driving factors for the Krypton Gas Market is the growing demand for energy-efficient lighting solutions. Krypton is widely used in energy-saving light bulbs, particularly in halogen lamps and fluorescent lighting, due to its ability to improve brightness while reducing energy consumption. As governments and industries worldwide continue to emphasize energy conservation and sustainability, krypton’s role in energy-efficient lighting becomes even more critical.

The global push for reducing carbon footprints and enhancing the performance of lighting systems in residential, commercial, and industrial applications has spurred significant demand for krypton gas. As a result, the krypton gas market is experiencing steady growth, driven by the adoption of eco-friendly lighting technologies across various sectors.

Restraining Factors

High Cost of Krypton Gas Production

A significant restraining factor for the Krypton Gas Market is the high cost of krypton gas production. Krypton is a rare gas, and its extraction requires complex processes, primarily from air separation units or during the production of liquid oxygen and nitrogen.

The costs associated with these methods, including energy consumption and equipment maintenance, make krypton a relatively expensive gas compared to other gases like argon or nitrogen.

This high production cost can limit its widespread adoption in some industries, especially for applications where more cost-effective alternatives exist. Additionally, fluctuations in supply and demand, along with the specialized nature of krypton, can lead to price volatility, further hindering its use in price-sensitive markets.

Growth Opportunity

Expansion of Sustainable Building and Construction

A key growth opportunity for the Krypton Gas Market lies in the expansion of sustainable building and construction practices. As the demand for energy-efficient buildings increases, krypton gas plays a crucial role in the production of high-performance, energy-efficient windows. Krypton is often used in insulating glass units (IGUs) due to its superior thermal insulation properties, helping buildings maintain temperature while reducing energy consumption.

With the growing trend toward green building certifications and eco-friendly construction practices, krypton gas is expected to see increased demand in both residential and commercial construction projects. Additionally, as governments enforce stricter energy efficiency standards, the use of krypton in sustainable architecture presents a significant opportunity for growth in the market.

Latest Trends

Rising Adoption of Smart and LED Lighting

A notable trend in the Krypton Gas Market is the rising adoption of smart and LED lighting systems. As consumers and businesses increasingly prioritize energy efficiency and long-term cost savings, the demand for LED lights has surged. Krypton, due to its role in enhancing the performance of certain lighting solutions, is seeing growing use in the development of high-quality LED bulbs and smart lighting systems.

These technologies not only offer energy savings but also align with the global shift toward sustainability and carbon reduction. As smart lighting continues to gain traction in residential, commercial, and industrial sectors, the need for krypton gas in advanced lighting applications is expected to rise, positioning it as a key player in the market’s future growth.

Regional Analysis

In 2024, North America dominated the Krypton Gas Market, holding a 38.8% share worth USD 103.4 million.

In 2024, North America held a dominant position in the Krypton Gas Market, accounting for 38.8% of the market share, valued at USD 103.4 million. The region’s leadership is primarily driven by the high demand for krypton in energy-efficient lighting and insulation applications.

With an increasing emphasis on sustainability and energy-saving solutions, the U.S. and Canada have witnessed significant adoption of krypton in energy-efficient building materials and advanced lighting systems. Additionally, North America’s established industrial base and technological advancements in semiconductor and electronics manufacturing further support the growing demand for krypton in niche applications.

Europe is another significant market for krypton gas, holding a substantial share due to the stringent energy regulations and a strong focus on green building standards. The European Union’s commitment to reducing carbon emissions and promoting energy-efficient solutions has propelled the demand for krypton, especially in the construction of energy-efficient windows and high-performance lighting. The region’s robust automotive, aerospace, and electronics sectors also contribute to the market’s growth.

Asia Pacific is expected to experience the fastest growth in the coming years, driven by rapid industrialization, urbanization, and an increasing demand for energy-efficient technologies. Countries like China, India, and Japan are seeing a rise in construction activities and the adoption of advanced lighting solutions, propelling the region’s krypton gas market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Krypton Gas Market continues to be shaped by several key players who are contributing to the market’s growth through innovation, strategic partnerships, and operational excellence. Among these, Air Liquide and Linde plc stand out as dominant players, leveraging their extensive global networks and technical expertise to provide krypton gas solutions across various industries, particularly in energy-efficient lighting and electronics manufacturing. Their robust presence in both developed and emerging markets positions them to capitalize on the growing demand for krypton in energy-saving applications.

Chart Industries, Inc. and Coregas Pty Ltd are also noteworthy contributors to the market, focusing on advanced technologies for gas storage and distribution. With increasing demand for krypton in high-purity applications, these companies are playing a crucial role in ensuring efficient supply chains and minimizing production costs.

Electronic Fluorocarbons, LLC and Fukuda Sangyo Co., Ltd. are focusing on niche segments of the market, such as the electronics and semiconductor industries, where krypton plays a vital role in precision manufacturing. Their expertise in high-purity gas production is critical in meeting the exacting standards required for these sectors.

Smaller but significant players like Iceblick Ltd., Ingas LLC, Kaimeite Gases Co., Ltd., and Kobe Steel, Ltd. are expanding their footprints in regional markets. They are focusing on regional supply, cost-effective solutions, and enhancing product quality to compete with the larger multinational players. These companies are expected to play a pivotal role in meeting localized demands as the market continues to grow.

Top Key Players in the Market

- Air Liquide Linde plc

- Chart Industries, Inc.

- Coregas Pty Ltd

- Electronic Fluorocarbons, LLC

- Fukuda Sangyo Co., Ltd.

- Iceblick Ltd

- Ingas LLC

- Kaimeite Gases Co., Ltd.

- Kobe Steel, Ltd.

- Linde plc

- Matheson Tri-Gas, Inc

- Messer Group GmbH

- Nippon Gases Co., Ltd.

- Praxair, Inc.

- Showa Denko K.K.

- SOL Group

- Sumitomo Seika Chemicals Co., Ltd.

- Taiyo Nippon Sanso Corporation

- watani Corporation

- Worthington Industries, Inc.

- Yingde Gases Group Company Limited

Recent Developments

- In February 2025, Chart Industries, Inc. Partnered with Bloom Energy to develop carbon capture technology using natural gas and fuel cells, which could potentially impact Krypton gas production.

- In January 2025, Nippon Sanso Acquired Coregas Group from Wesfarmers Limited for A$770 million ($480m), expanding its presence in the Australasian industrial gas market.

Report Scope

Report Features Description Market Value (2024) USD 194.2 Million Forecast Revenue (2034) USD 347.8 Million CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Research Grade, Commercial Grade, Medical Grade), By Purity Level (99% Purity, 99.9% Purity, 99.99% Purity), By Packaging (Compressed Gas Cylinders, Specialty Gas Cylinders, Cryogenic Storage Tanks), By Type (High purity krypton, Common purity krypton), By Application (Lighting, Lasers, Medical Imaging, Semiconductors, Aerospace, Military, Others), By End-Use (Automotive, Electronics, Healthcare, Manufacturing, Transportation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Air Liquide Linde plc, Chart Industries, Inc., Coregas Pty Ltd, Electronic Fluorocarbons, LLC, Fukuda Sangyo Co., Ltd., Iceblick Ltd, Ingas LLC, Kaimeite Gases Co., Ltd., Kobe Steel, Ltd., Linde plc, Matheson Tri-Gas, Inc, Messer Group GmbH, Nippon Gases Co., Ltd., Praxair, Inc., Showa Denko K.K., SOL Group, Sumitomo Seika Chemicals Co., Ltd., Taiyo Nippon Sanso Corporation, watani Corporation, Worthington Industries, Inc., Yingde Gases Group Company Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Air Liquide Linde plc

- Chart Industries, Inc.

- Coregas Pty Ltd

- Electronic Fluorocarbons, LLC

- Fukuda Sangyo Co., Ltd.

- Iceblick Ltd

- Ingas LLC

- Kaimeite Gases Co., Ltd.

- Kobe Steel, Ltd.

- Linde plc

- Matheson Tri-Gas, Inc

- Messer Group GmbH

- Nippon Gases Co., Ltd.

- Praxair, Inc.

- Showa Denko K.K.

- SOL Group

- Sumitomo Seika Chemicals Co., Ltd.

- Taiyo Nippon Sanso Corporation

- watani Corporation

- Worthington Industries, Inc.

- Yingde Gases Group Company Limited