Global Hydrogen Chloride Market Size, Share, And Business Benefits By Type (Liquid, Solid), By Grade (Technical Grade, Electronic Grade), By Application (Chemical Manufacturing, Steel and Metallurgy, Water Treatment, Food Processing, Oil and Gas Industry, Textile Industry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: January 2025

- Report ID: 137632

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

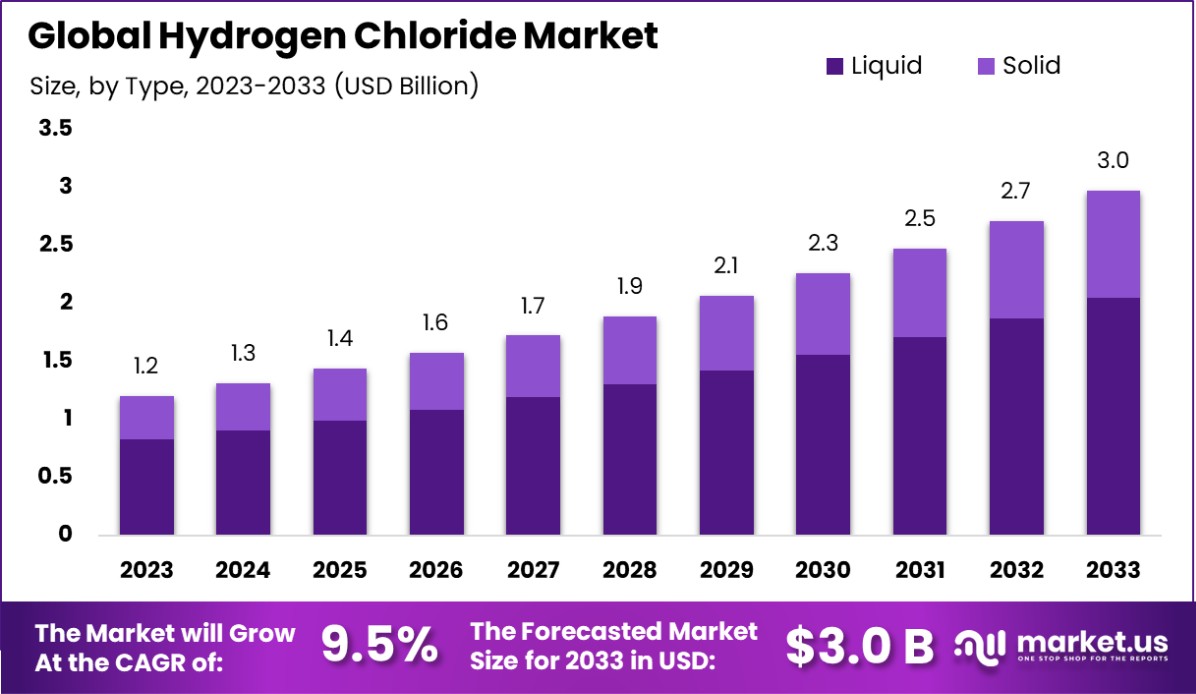

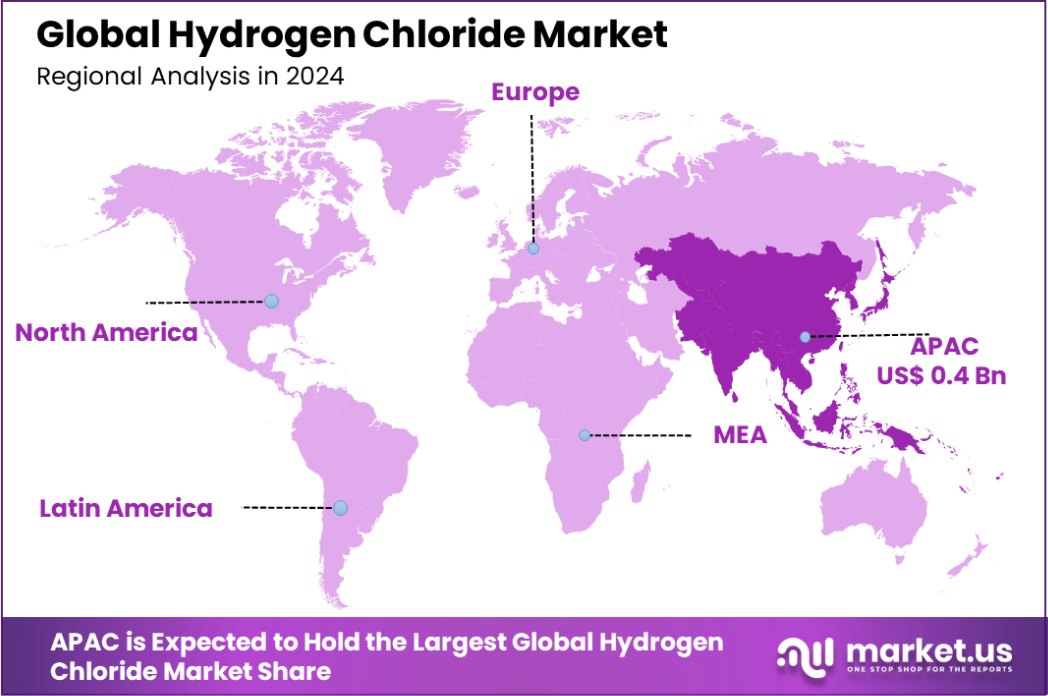

The Global Hydrogen Chloride Market is expected to be worth around USD 3.0 Billion by 2033, up from USD 1.2 Billion in 2023, and grow at a CAGR of 9.5% from 2024 to 2033. Asia-Pacific Hydrogen Chloride Market: 35.6%, valued at USD 0.4 billion.

Hydrogen chloride (HCl), commonly known as hydrochloric acid in its aqueous form, is integral to various industrial processes, including steel pickling, oil well acidification, and chemical production.

The U.S. Environmental Protection Agency (EPA) notes that over 90% of HCl is produced as a byproduct during the manufacture of chlorinated organic chemicals, with the remainder generated through the direct reaction of hydrogen and chlorine.

The industrial landscape for HCl has experienced notable fluctuations in recent years. In 2020, the COVID-19 pandemic led to a significant decline in demand from sectors such as oil and gas and steel manufacturing, resulting in supply disruptions.

The EPA’s 2022 report highlights that hydrochloric acid production is directly dependent on chlorine and is primarily produced as a co- or byproduct in the manufacturing of chlorinated derivative chemicals.

Key factors influencing the HCl market include its critical role in pH adjustment and the production of water treatment chemicals. The EPA’s 2022 assessment underscores the high criticality of HCl, noting its essentiality for pH adjustment and production of water treatment chemicals, with a moderate-low risk rating for supply disruption.

Recent trends indicate a gradual recovery in industrial activities, leading to a stabilization of HCl demand. The EPA’s 2022 report suggests that the distributed domestic manufacturing and supply of HCl contribute to low vulnerability in its supply chain.

Looking ahead, the HCl market is poised for growth, driven by its indispensable applications across various industries. The EPA’s 2022 report emphasizes the essential role of HCl in pH adjustment and the production of water treatment chemicals, indicating sustained demand in these sectors.

The Hydrogen Chloride market is navigating through a dynamic phase influenced by various factors across the global landscape. Industry stakeholders are particularly attentive to the shifts in export behaviors and government investments that signal the evolving demand and technological integration.

In 2023, India emerged as a notable player in the market, with its exports of hydrogen chloride (hydrochloric acid) reaching a substantial value of $16,974,760. This underscores the country’s growing influence and strategic positioning in the global chemical sector.

Additionally, in the United States, the Department of Energy’s Office of Fossil Energy allocated approximately $30 million to solid oxide activities for hydrogen-related projects. This investment is part of a broader initiative to enhance the energy sector’s infrastructure and efficiency, particularly in cleaner and more sustainable technologies.

Key Takeaways

- The Global Hydrogen Chloride Market is expected to be worth around USD 3.0 Billion by 2033, up from USD 1.2 Billion in 2023, and grow at a CAGR of 9.5% from 2024 to 2033.

- In the Hydrogen Chloride Market, 68.3% of products are offered in liquid form for diverse applications.

- Technical Grade hydrogen chloride dominates the market, accounting for 73.2% of all available grades.

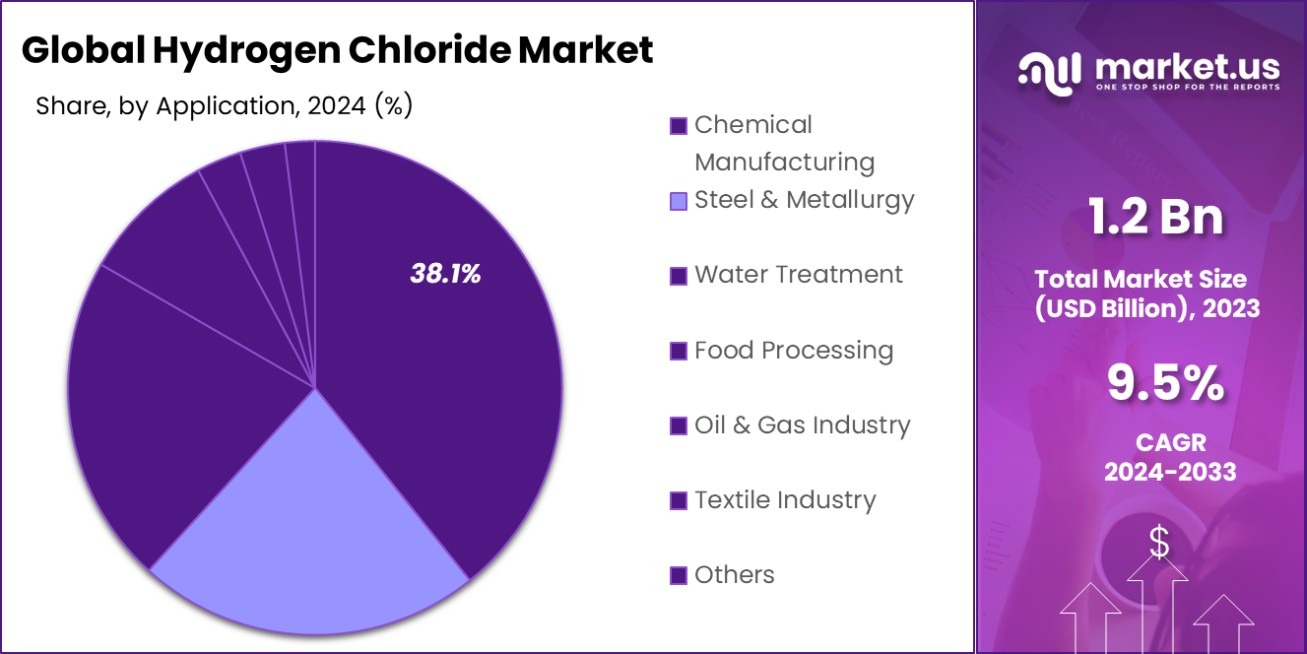

- The chemical manufacturing sector utilizes 38.1% of the hydrogen chloride supplied in the market.

- In Asia-Pacific, the Hydrogen Chloride Market is valued at USD 0.4 billion, 35.6% share.

Business Benefits of the Hydrogen Chloride Market

Hydrogen chloride (HCl) plays a crucial role in various industrial applications, including the synthesis of chlorides, fertilizers, and dyes, as well as in metal refining and electroplating processes.

Recognizing its importance, government reports highlight its contributions to sectors like pharmaceuticals and agriculture, underscoring its utility in producing essential compounds such as hydrochloric acid.

The market’s expansion is driven by the stringent environmental regulations that promote the use of cleaner and more efficient chemical processes. For instance, HCl’s role in the semiconductor industry is critical for cleaning silicon wafers, an application that benefits from advancements in technology and increased regulatory support for reducing environmental impact.

This is corroborated by environmental protection agencies that emphasize improved standards and practices in chemical manufacturing, which indirectly supports the HCl market by ensuring compliance and enhancing production efficiencies.

The stability of the HCl market is also supported by government initiatives and investments in research and development, which aim to innovate and optimize its use in safer and more sustainable chemical processes.

As governments focus on reducing harmful emissions and promoting safe industrial practices, industries reliant on HCl benefit from a regulatory environment that fosters growth and sustainability.

By Type Analysis

Hydrogen Chloride Market sees liquid form dominating at 68.3% share.

In 2023, Liquid held a dominant market position in the By Type segment of the Hydrogen Chloride Market, capturing a 68.3% share. Liquid hydrogen chloride is preferred for its ease of handling and extensive application in industries like pharmaceuticals and smart agriculture. This form’s utility drives its predominance in market consumption patterns.

Solid hydrogen chloride accounted for 31.7% of the market share in 2023. It is primarily used where storage and transportation conditions favor solid states, such as in certain chemical synthesis applications that require precise control of reactivity. The niche applications of solid hydrogen chloride ensure its steady demand within the market.

By Grade Analysis

Technical grade leads the Hydrogen Chloride Market with 73.2% market segment.

In 2023, Technical Grade held a dominant market position in the By Grade segment of the Hydrogen Chloride Market, with a 73.2% share. This grade is extensively utilized across various industrial applications, including metal refining and organic synthesis, highlighting its essential role in manufacturing processes.

Electronic Grade accounted for 26.8% of the market segment in 2023. This purity level is critical for the electronics industry, particularly in the cleaning and etching of semiconductor materials. Its specialized use in high-tech manufacturing underpins its significant, albeit smaller, market presence compared to technical grade.

By Application Analysis

Chemical manufacturing utilizes 38.1% of Hydrogen Chloride Market applications.

In 2023, Chemical Manufacturing held a dominant market position in the By Application segment of the Hydrogen Chloride Market, with a 38.1% share. Its use in synthesizing chlorides and organic compounds underlines its pivotal role in this sector.

Steel and Metallurgy followed with a 22.4% share, leveraging hydrogen chloride in processes like pickling and cleaning of metals, crucial for enhancing product quality.

Water Treatment captured 14.6% of the market, utilizing hydrogen chloride for pH control and impurity precipitation, essential for maintaining safe and clean water standards.

Food Processing held an 11.2% share, where hydrogen chloride is used to produce various food additives and as a processing aid, ensuring the safety and quality of food products.

The Oil and Gas Industry accounted for 8.5% of the market, using hydrogen chloride primarily in oil well acidizing to improve production efficiency.

Lastly, the Textile Industry had a 5.2% share, employing hydrogen chloride in the processing and finishing of textiles, crucial for achieving desired fabric properties.

Key Market Segments

By Type

- Liquid

- Solid

By Grade

- Technical Grade

- Electronic Grade

By Application

- Chemical Manufacturing

- Steel and Metallurgy

- Water Treatment

- Food Processing

- Oil and Gas Industry

- Textile Industry

- Others

Driving Factors

Increased Use in Pharmaceuticals Boosts Hydrogen Chloride Demand

The pharmaceutical sector is witnessing a growing utilization of hydrogen chloride, primarily due to its critical role in producing various medicinal products. This chemical is essential for synthesizing an array of active pharmaceutical ingredients (APIs) and intermediates, contributing to the development of treatments for diverse health conditions.

As global health awareness rises and pharmaceutical R&D activities expand, the need for high-purity hydrogen chloride is expected to surge, supporting steady market growth.

Technological Advancements in Hydrogen Chloride Production

Recent technological innovations in chemical processing have enhanced the efficiency and environmental sustainability of hydrogen chloride production. These advancements include improved methods for capturing and recycling hydrogen chloride from industrial waste gases, reducing both costs and environmental impact.

This progress has made hydrogen chloride more accessible and cost-effective for various industries, including semiconductors and metallurgy, fostering broader adoption and stimulating market expansion.

Rising Demand in Semiconductor Manufacturing

The semiconductor industry’s rapid growth is a primary driver for the hydrogen chloride market. This chemical is used extensively in the etching and cleaning processes during semiconductor manufacturing.

As the electronics market continues to expand with new technologies such as smartphones, tablets, and IoT devices, the need for hydrogen chloride to produce high-quality semiconductors becomes increasingly crucial. This trend is expected to continue as advancements in technology require more complex and precise semiconductor components.

Restraining Factors

Stringent Environmental Regulations Limit Market Expansion

The hydrogen chloride market faces challenges from strict environmental regulations globally. Hydrogen chloride, when released into the atmosphere, can contribute to air pollution and pose health risks, prompting governments to enforce tighter controls on its production and usage.

These regulations require companies to invest in pollution control technologies and adhere to complex compliance protocols, increasing operational costs and potentially slowing down market growth. This regulatory landscape is a significant hurdle for new entrants and could restrain the market’s development.

Volatility in Raw Material Prices Affects Production Costs

Fluctuations in the prices of raw materials necessary for hydrogen chloride production, such as chlorides and hydrocarbons, directly impact the market. These materials costs can vary widely based on global economic conditions, supply chain disruptions, or geopolitical tensions, leading to unpredictable production expenses.

This volatility makes it challenging for hydrogen chloride producers to maintain consistent pricing and profitability, potentially deterring investment in capacity expansions or new technology, thereby hindering market growth.

Development of Alternative Technologies and Substitutes

The advancement of alternative technologies and the availability of substitute chemicals pose considerable challenges to the hydrogen chloride market. As industries seek to reduce their reliance on hazardous chemicals, they are increasingly turning to safer or more environmentally friendly alternatives.

This shift is particularly noticeable in industries like pharmaceuticals and semiconductors, where companies prioritize reducing hazardous emissions and improving workplace safety. The development of these alternatives could lead to a decreased reliance on hydrogen chloride, impacting its long-term market demand.

Growth Opportunity

Expansion into Emerging Markets Offers New Revenue Streams

Hydrogen chloride producers have significant opportunities to expand into emerging markets where the industrial and pharmaceutical sectors are growing rapidly. Countries in regions such as Asia-Pacific and Latin America are experiencing an increase in manufacturing and healthcare investments, driving demand for chemicals like hydrogen chloride.

By establishing a presence in these markets, producers can tap into new customer bases and diversify their revenue streams. This strategy could mitigate risks associated with market saturation or economic downturns in more developed regions.

Partnerships with Local Industries to Drive Market Penetration

Forming strategic partnerships with local industries in various regions can provide hydrogen chloride manufacturers with direct access to burgeoning markets. These collaborations can include joint ventures or supply agreements with local pharmaceutical and manufacturing companies that require a steady supply of hydrogen chloride.

Such partnerships not only secure a reliable demand for the product but also enable manufacturers to navigate local regulatory landscapes more effectively, enhancing their market presence and penetration.

Innovation in Recycling and Sustainability Practices

As sustainability becomes a critical focus for industries worldwide, hydrogen chloride producers have the opportunity to innovate in recycling and environmentally friendly practices. Developing technologies that allow for the efficient recycling of hydrogen chloride from industrial processes can reduce environmental impact and lower production costs.

This approach not only appeals to environmentally conscious consumers and regulators but also positions companies as leaders in sustainable chemical production, potentially opening up further markets and improving brand loyalty.

Latest Trends

Increasing Adoption of Green Chemistry Practices

The hydrogen chloride market is experiencing a shift towards green chemistry practices, aimed at reducing chemical waste and improving safety standards. This trend involves developing methods that require less energy and produce fewer byproducts, making the production of hydrogen chloride more environmentally sustainable.

As industries and regulatory bodies emphasize sustainability, companies that adopt these practices are likely to gain competitive advantages. This shift not only helps in complying with environmental regulations but also meets the growing consumer demand for eco-friendly products.

Integration of IoT Technology in Production Facilities

The integration of Internet of Things (IoT) technology into hydrogen chloride production facilities is a growing trend. IoT devices enable real-time monitoring and control of production processes, leading to increased efficiency and safety.

These technologies allow for precise control over the conditions under which hydrogen chloride is produced, minimizing the risk of accidents and ensuring consistent product quality. As more companies invest in IoT to optimize their operations, this trend is set to reshape production standards and efficiencies in the hydrogen chloride market.

Rise of Customized Hydrogen Chloride Solutions

There is a growing trend towards the provision of customized hydrogen chloride solutions tailored to specific industry needs. Producers are now offering specialized formulations that cater to the unique requirements of various sectors such as pharmaceuticals, electronics, and food processing.

This customization allows users to achieve more precise results in their applications, enhancing product performance and operational efficiency. As customer needs become more sophisticated, the ability to provide these tailored solutions is becoming a key differentiator in the hydrogen chloride market.

Regional Analysis

In 2023, the Asia-Pacific Hydrogen Chloride Market held a 35.6% share, valued at USD 0.4 billion.

In 2023, the Hydrogen Chloride Market displayed varied dynamics across global regions. Asia-Pacific emerged as the dominating region, holding a 35.6% market share, valued at USD 0.4 billion, driven by robust manufacturing sectors in countries like China and India.

North America followed, contributing a substantial share, attributed to advancements in chemical manufacturing and stringent environmental regulations boosting demand for high-purity grades.

Europe maintained a strong position, supported by its well-established industrial base and increasing investments in pharmaceuticals and food processing industries, where hydrogen chloride plays a critical role.

The Middle East & Africa region, although smaller in comparison, showed potential for growth, particularly through developments in oil and gas industries that utilize hydrogen chloride for various applications including oil well acidizing.

Latin America, with its emerging economies, saw a moderate but growing demand, tied closely to the expansion of industrial and water treatment facilities. These regional markets collectively underscore the diverse applications and essential nature of hydrogen chloride globally, with Asia-Pacific leading in both share and revenue.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Hydrogen Chloride market, the landscape in 2023 is shaped by a diverse set of key players, ranging from specialty chemical companies to major industrial gas providers. Companies like Air Liquide, BASF SE, and Linde Industrial Gas, with their broad capabilities in gas production and management, are critical in supplying high-purity hydrogen chloride essential for various demanding applications, including pharmaceuticals and electronics manufacturing.

Firms such as Covestro AG and Solvay are not only consumers of hydrogen chloride in their production processes but also innovators in chemical manufacturing techniques that could potentially set new industry standards for efficiency and environmental sustainability. Their focus on integrating green chemistry practices and advanced recycling technologies highlights a shift towards sustainability within the sector.

Smaller specialized companies like Detrex Corporation and Coogee Chemicals play a vital role in the market by catering to niche markets and providing tailored solutions that meet specific customer needs in local and regional markets. These companies often drive innovation by developing new applications and improving product performance, which is crucial for maintaining competitive advantage.

On the other hand, players such as Occidental Petroleum Corporation and Olin Corporation, with their integrated operations in chemicals and materials, are well-positioned to leverage their extensive infrastructure and technological expertise to meet the global demand for hydrogen chloride, especially in large-scale industrial applications.

Top Key Players in the Market

- AGC Chemicals

- Air Liquide

- B Vynova Group

- BASF

- BASF SE

- Chinalco

- Coogee Chemicals

- Covestro AG

- Detrex Corporation

- Dongyue Group

- ERCO Worldwide

- Ercros SA

- Inovyn

- Juhua Group

- Linde Industrial Gas

- Merck KGaA

- Nouryon Industrial Chemicals

- Occidental Petroleum Corporation

- Olin Corporation

- PCC Group

- Praxair

- Shandong Xinlong Group

- Shin-Etsu Chemical Co. Ltd

- Solvay

- Tessenderlo Group

- Toagosei Co. Ltd

- Versum Materials

- Wandali Special Gas

- Westlake Chemical Corporation

Recent Developments

- In 2023, AGC Chemicals focused on advancing digital technologies in their chemical sector, notably through the development and operational launch of a Process Digital Twin technology. This innovation began full-scale operations at the vinyl chloride monomer manufacturing plant in Indonesia. The technology offers real-time, high-speed calculations of plant conditions, which enhances decision-making and operational stability.

- In 2023, B Vynova Group, a major player in the European chemical industry and part of the International Chemical Investors Group, continued its involvement in the hydrogen chloride sector by enhancing its sustainable practices and expanding its product offerings. They provide high-purity synthetic hydrochloric acid suitable for various applications, including food and pharmaceuticals.

Report Scope

Report Features Description Market Value (2023) USD 1.2 Billion Forecast Revenue (2033) USD 3.0 Billion CAGR (2024-2033) 9.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Liquid, Solid), By Grade (Technical Grade, Electronic Grade), By Application (Chemical Manufacturing, Steel and Metallurgy, Water Treatment, Food Processing, Oil and Gas Industry, Textile Industry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AGC Chemicals, Air Liquide, B Vynova Group, BASF, BASF SE, Chinalco, Coogee Chemicals, Covestro AG, Detrex Corporation, Dongyue Group, ERCO Worldwide, Ercros SA, Inovyn, Juhua Group, Linde Industrial Gas, Merck KGaA, Nouryon Industrial Chemicals, Occidental Petroleum Corporation, Olin Corporation, PCC Group, Praxair, Shandong Xinlong Group, Shin-Etsu Chemical Co. Ltd, Solvay, Tessenderlo Group, Toagosei Co. Ltd, Versum Materials , Wandali Special Gas, Westlake Chemical Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hydrogen Chloride MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Hydrogen Chloride MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AGC Chemicals

- Air Liquide

- B Vynova Group

- BASF

- BASF SE

- Chinalco

- Coogee Chemicals

- Covestro AG

- Detrex Corporation

- Dongyue Group

- ERCO Worldwide

- Ercros SA

- Inovyn

- Juhua Group

- Linde Industrial Gas

- Merck KGaA

- Nouryon Industrial Chemicals

- Occidental Petroleum Corporation

- Olin Corporation

- PCC Group

- Praxair

- Shandong Xinlong Group

- Shin-Etsu Chemical Co. Ltd

- Solvay

- Tessenderlo Group

- Toagosei Co. Ltd

- Versum Materials

- Wandali Special Gas

- Westlake Chemical Corporation