Global Ready-Mix Concrete Market By Type (Transit Mixed Concrete, Shrink Mixed Concrete, Central Mixed Concrete), By Production (On-site, Off-site), By Mixer Type (Volumetric, Barrel Truck/In-transit mixer), By Application (Commercial Building, Residential Building, Infrastructure, Industrial Utilities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: February 2025

- Report ID: 135341

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

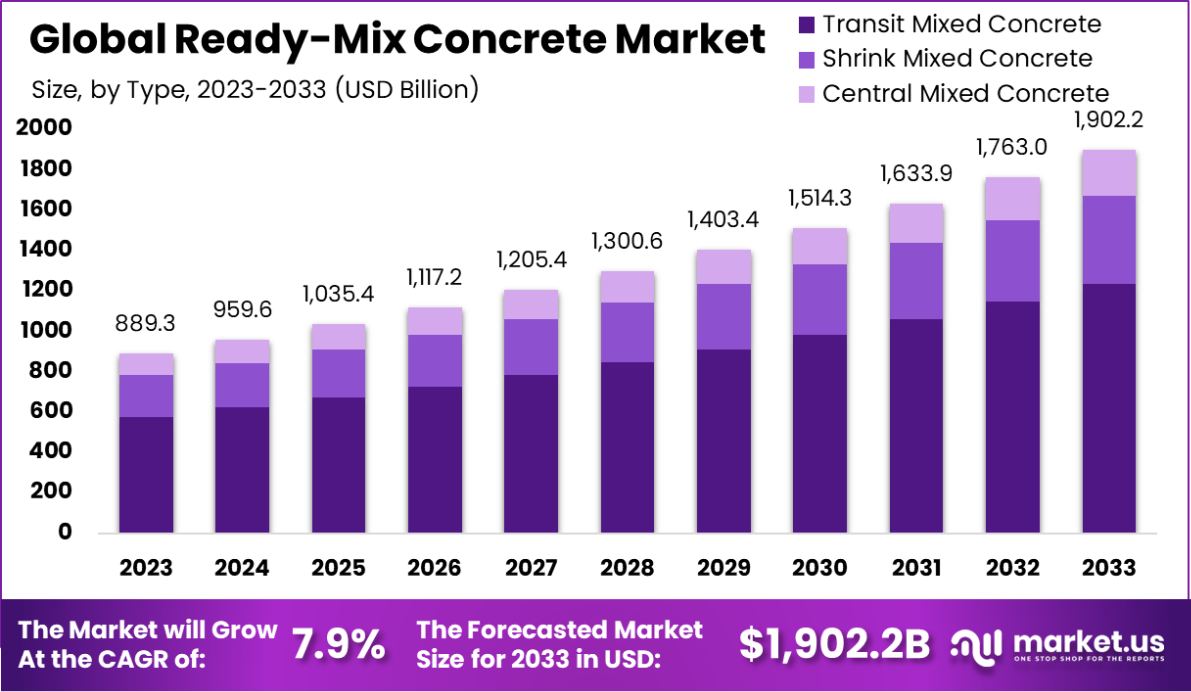

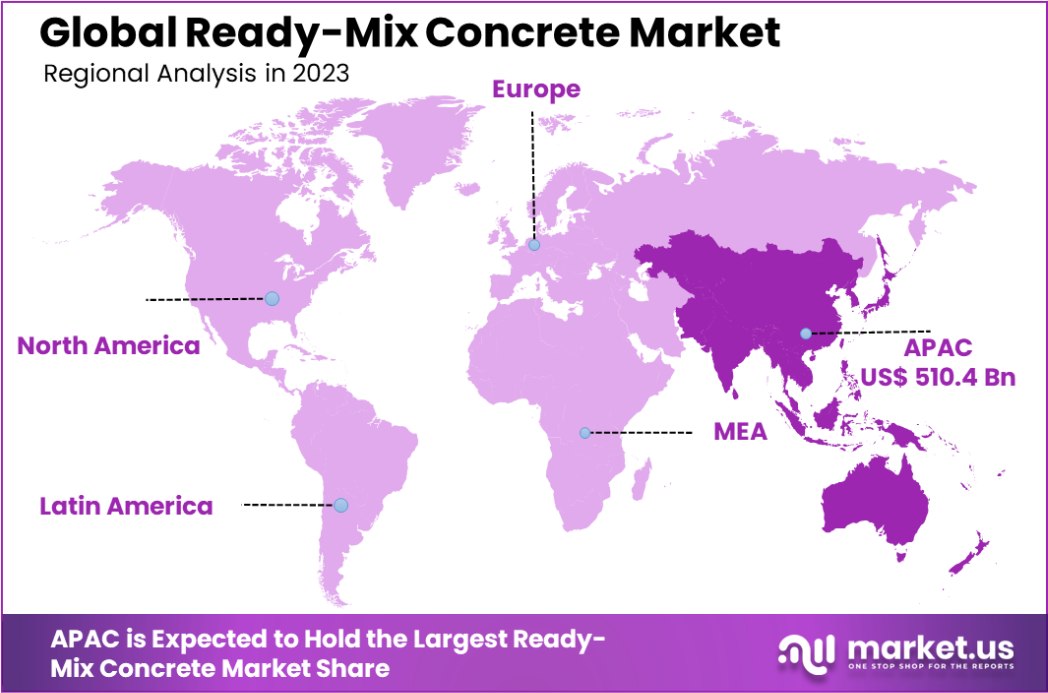

The Global Ready-Mix Concrete Market is expected to be worth around USD 1,902.2 Billion by 2033, up from USD 889.3 Billion in 2023, and grow at a CAGR of 7.9% from 2024 to 2033. The Asia-Pacific Ready-Mix Concrete Market holds a 57% share, valued at USD 510.4 billion.

Ready-Mix Concrete (RMC) is a precise blend of cement, aggregates, water, and admixtures mixed in a factory or batching plant according to specific formulations and then transported to construction sites in mixer trucks.

This method ensures high-quality and versatile concrete for a variety of construction applications, offering a more efficient and time-saving alternative to site-mixed concrete.

The Ready-Mix Concrete Market refers to the industry involved in the production and distribution of RMC. This market has seen growth due to rapid urbanization, rising population, and increased investment in infrastructure projects.

Factors driving its expansion include the consistent quality control RMC provides, reduced construction time, and labor savings. Opportunities in the RMC market are expanding with technological innovations in eco-friendly concrete and the rising popularity of smart cities that demand durable and sustainable building materials.

The Ready-Mix Concrete Market is currently navigating a complex landscape marked by regulatory challenges, tax implications, and significant opportunities stemming from infrastructure investment.

As of mid-2022, regulatory pressures are evident, with firms like Associated Ready Mixed Concrete, Inc. facing substantial fines, in this case, $150,500, for non-compliance with air quality regulations. This underscores a broader trend where environmental compliance is increasingly influencing operational costs and company practices.

Taxation also plays a critical role in the economic framework of this industry. In Texas, the ready-mix concrete sector is subject to a state sales tax of 6.25%, with the possibility of an additional local tax of up to 2%.

Moreover, the Texas Emissions Reduction Plan (TERP) has increased its surcharge from 1% to 2% on certain heavy-duty diesel equipment, although specific exemptions apply. These fiscal measures affect the cost structure and profitability margins of companies operating within the state.

Conversely, the sector is poised to benefit from a robust influx of federal funds aimed at revitalizing the U.S. infrastructure. The Bipartisan Infrastructure Law (BIL) has allocated over $2.3 billion to Ohio for roads, bridges, and other projects.

Furthermore, the RAISE program has committed $1.5 billion in 2023 for surface transportation projects nationwide. Such funding is expected to drive demand for ready-mix concrete significantly.

Additionally, industry-specific support, such as the $6.5 million in grants administered by the National Ready Mixed Concrete Association (NRMCA) for the creation of Environmental Product Declarations (EPDs), highlights a shift toward sustainability and transparency.

This is indicative of a strategic pivot where ready-mix concrete producers are increasingly leveraging environmental credentials as a competitive advantage.

Key Takeaways

- The Global Ready-Mix Concrete Market is expected to be worth around USD 1,902.2 Billion by 2033, up from USD 889.3 Billion in 2023, and grow at a CAGR of 7.9% from 2024 to 2033.

- The Ready-Mix Concrete Market is dominated by Transit Mixed Concrete with a 65.4% share.

- Off-site production leads in the Ready-Mix Concrete Market, capturing a significant 73.2% market portion.

- Barrel trucks or in-transit mixers are the preferred equipment, holding a 77.2% stake in the market.

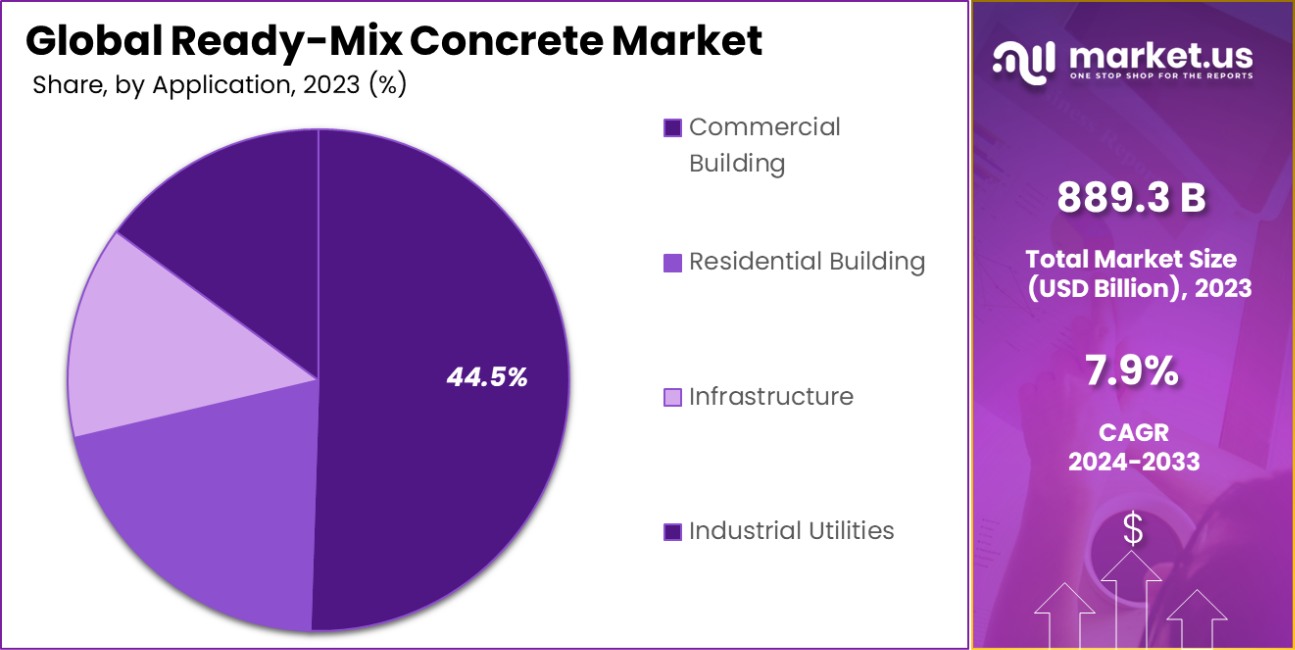

- Commercial buildings are a major application in the Ready-Mix Concrete Market, accounting for 44.5%.

- The Asia-Pacific Ready-Mix Concrete Market dominates with 57%, valued at USD 510.4 billion.

By Type Analysis

The Ready-Mix Concrete Market is dominated by transit-mixed concrete, accounting for 65.4% of the market share.

In 2023, Transit Mixed Concrete held a dominant market position in the “By Type” segment of the Ready-Mix Concrete Market, with a 65.4% share. This segment outperformed other types such as Shrink Mixed Concrete and Central Mixed Concrete, highlighting its widespread adoption and versatility in various construction projects.

Transit Mixed Concrete’s leading position can be attributed to its efficiency and reliability in delivering high-quality concrete that meets the stringent standards required by modern construction practices.

Shrink Mixed Concrete followed, capturing a significant portion of the market. Although smaller in comparison, this type of concrete offers unique benefits, such as improved workability and reduced water content, making it suitable for specific applications that demand higher precision and durability.

Central Mixed Concrete, while having the smallest share, is critical for projects requiring high-volume batches of concrete with consistent quality. Its controlled environment allows for precise mixing and customization, catering to complex and large-scale construction needs.

Overall, the diversity in concrete types reflects the evolving demands of the construction industry, where each type serves distinct purposes and contributes uniquely to the market dynamics. The dominance of Transit Mixed Concrete underscores its foundational role in construction, supported by the specialized applications of Shrink and Central Mixed Concrete.

By Production Analysis

Off-site production leads in the Ready-Mix Concrete Market, comprising 73.2% of the industry’s output.

In 2023, Off-site held a dominant market position in the “By Production” segment of the Ready-Mix Concrete Market, with a 73.2% share. This method surpassed On-site production, emphasizing its critical role in streamlining construction processes.

Off-site production of ready-mix concrete allows for greater control over the mixing environment, resulting in consistent product quality and reduced material waste. This method also benefits from economies of scale, reducing costs and environmental impact by minimizing on-site pollution and disturbances.

On-site production, while holding a smaller market share, remains essential for projects that require immediate concrete mixing or where logistical constraints hinder the use of pre-mixed concrete. This method provides flexibility and adaptability, allowing construction projects to tailor concrete properties specifically to the immediate needs and conditions of the site.

The significant preference for Off-site production illustrates its efficiency and the construction industry’s shift towards more sustainable and cost-effective building practices. However, the continued relevance of On-site production highlights the diverse needs and scenarios encountered in construction projects, ensuring that both methods retain vital roles in the market.

The segmentation between Off-site and On-site production underscores the dynamic nature of the Ready-Mix Concrete Market, catering to a wide array of construction demands.

By Mixer Type Analysis

Barrel trucks or in-transit mixers are the most common equipment, used in 77.2% of Ready-Mix Concrete operations.

In 2023, Barrel Truck/In-transit Mixer held a dominant market position in the “By Mixer Type” segment of the Ready-Mix Concrete Market, with a 77.2% share. This type of mixer leads the market over Volumetric Mixers, underscoring its indispensable role in modern construction.

Barrel Trucks, also known as In-transit Mixers, are favored for their efficiency in delivering large volumes of concrete that are mixed en route to construction sites, ensuring freshness and workability upon arrival. This method is particularly beneficial for large-scale projects requiring precise timing and consistent quality of concrete.

On the other hand, Volumetric Mixers, which allow for the mixing of concrete at the job site, offer a distinct advantage in flexibility and control over the mixture. Although they hold a smaller portion of the market, these mixers are invaluable for projects with unpredictable demands or for adjustments in the mix based on immediate site conditions.

The overwhelming preference for Barrel Truck/In-transit Mixers reflects their capability to support rapid construction timelines and reduce downtime. This efficiency drives their popularity in large infrastructure and building projects, demonstrating the construction industry’s reliance on effective and reliable concrete delivery systems.

The differentiation in mixer types highlights the varied requirements of construction projects and the technological adaptations developed to meet these needs.

By Application Analysis

Commercial building applications represent a significant portion of the market, making up 44.5% of Ready-Mix Concrete usage.

In 2023, Commercial Building held a dominant market position in the “By Application” segment of the Ready-Mix Concrete Market, with a 44.5% share. This segment leads over Residential Building, Infrastructure, and Industrial Utilities, showcasing its pivotal role in the burgeoning urban landscape.

Commercial buildings, encompassing offices, retail spaces, and other business facilities, increasingly demand high-quality, durable concrete for both structural integrity and aesthetic purposes. The high share reflects the ongoing global expansion in commercial real estate development fueled by economic growth and urbanization.

Residential Building, while significant, follows behind, driven by housing developments and multi-family units that require vast quantities of ready-mix concrete for foundations, walls, and other structural components. Infrastructure projects also command a considerable market share, utilizing ready-mix concrete for transportation networks, utilities, and public services, which are critical for supporting both commercial and residential growth. Lastly, Industrial Utilities, though smaller in comparison, rely on specialized concrete solutions for heavy-duty environments that withstand harsh conditions and heavy loads.

The leadership of Commercial Building in the market underscores the critical role of commercial construction in driving demand for ready-mix concrete, reflecting broader economic trends and the importance of sustainable and robust construction practices in commercial development.

Key Market Segments

By Type

- Transit Mixed Concrete

- Shrink Mixed Concrete

- Central Mixed Concrete

By Production

- On-site

- Off-site

By Mixer Type

- Volumetric

- Barrel Truck/In-transit mixer

By Application

- Commercial Building

- Residential Building

- Infrastructure

- Industrial Utilities

Driving Factors

Urbanization and Infrastructure Development Drive Demand

As global urbanization continues at an unprecedented pace, the need for new infrastructures such as roads, bridges, and buildings is expanding. Ready-mix concrete is crucial in meeting this demand due to its reliability and strength, making it ideal for urban infrastructure projects.

The growth of smart cities worldwide directly correlates with increased consumption of ready-mix concrete, as it is essential for both the development and the renovation of urban spaces. This factor ensures a steady market for ready-mix concrete as more governments and private sectors invest heavily in infrastructure.

Technological Advancements Enhance Efficiency

Advancements in technology have significantly impacted the ready-mix concrete market by improving the mixing and delivery processes. Modern mixing technologies allow for more precise formulations, enhancing the quality and sustainability of the concrete. GPS and IoT integration in delivery systems enable more efficient logistics and real-time tracking, reducing delays and ensuring timely delivery of materials to construction sites.

These innovations lead to cost savings, better resource management, and higher customer satisfaction, thus driving the market forward.

Increased Focus on Sustainability and Regulation Compliance

Environmental concerns and regulatory standards are increasingly shaping industries, and the ready-mix concrete market is no exception. There is a growing demand for green construction materials and practices, prompting ready-mix concrete providers to innovate eco-friendly mixes that reduce carbon footprints, such as using recycled materials and low-emission cement.

Compliance with stricter building codes and sustainability standards not only mitigates environmental impact but also opens new markets and opportunities for compliant companies, thereby becoming a significant driving factor in the market.

Restraining Factors

High Initial Investment Limits Market Entry

The ready-mix concrete industry requires substantial initial capital investment for equipment, facilities, and vehicles like concrete mixers and batching plants. This high upfront cost acts as a significant barrier to entry, particularly for new or smaller players in the market.

The financial outlay for maintaining operations with high standards of quality and compliance further strains resources, discouraging new entrants and limiting competition. This restraint can affect market diversity and innovation, as it consolidates market power among established companies with the capital to invest and sustain operations.

Volatility in Raw Material Prices Affects Stability

Fluctuations in the prices of raw materials such as cement, aggregates, and water directly impact the cost of producing ready-mix concrete. This volatility can be driven by changes in global commodity markets, trade policies, and environmental factors affecting resource availability.

Such unpredictability makes it difficult for manufacturers to maintain consistent pricing and profit margins, often leading to project delays and increased costs passed on to consumers. This factor can restrain growth by making budgeting and financial planning more challenging for businesses in the industry.

Stringent Environmental Regulations Stifle Expansion

Environmental regulations are becoming stricter, imposing limits on mining operations for aggregates and emissions from cement production, crucial components of ready-mix concrete. Compliance with these regulations often requires significant investment in cleaner technologies and practices, which can be costly and time-consuming.

While these regulations aim to reduce the environmental impact of construction activities, they also add layers of complexity and cost to ready-mix concrete production. This can restrain market growth, especially in regions with the most stringent environmental standards.

Growth Opportunity

Emerging Markets Offer New Revenue Streams

Emerging economies are rapidly developing their infrastructure, presenting significant growth opportunities for the ready-mix concrete market. As these countries invest in building roads, housing, and commercial spaces to support their growing populations and economies, the demand for construction materials like ready-mix concrete increases.

Entering these markets early can give companies a competitive edge, allowing them to establish brand recognition and loyalty before the market becomes saturated. Furthermore, aligning with local development projects can provide steady demand and long-term contracts, boosting profitability and market share.

Green Building Initiatives Create Demand

The global shift towards sustainable building practices offers a substantial growth opportunity for the ready-mix concrete market. Developing and promoting concrete mixes that incorporate recycled materials or that reduce greenhouse gas emissions can attract new customers, especially in regions with strict environmental regulations or green building standards.

Companies that innovate in eco-friendly products and processes can differentiate themselves from competitors and tap into new segments of the market. This approach not only aligns with global sustainability trends but also meets the increasing demand from consumers and governments for environmentally responsible construction solutions.

Technological Integration in Concrete Mixing and Delivery

Advancements in technology present growth opportunities in the ready-mix concrete market by optimizing production and delivery processes. Implementing AI and IoT technologies can enhance the efficiency of concrete batching, mixing, and delivery operations, leading to faster and more reliable service.

Moreover, adopting digital tools for real-time data analysis and customer management can improve service customization, enhancing customer satisfaction and retention. Companies that leverage these technologies can increase their operational efficiency, reduce waste, and offer competitive pricing, positioning themselves as leaders in a technologically evolving market.

Latest Trends

Adoption of Green Concrete for Sustainable Construction

The trend towards sustainable construction is strongly influencing the ready-mix concrete market. Green concrete, made with recycled materials and by-products like fly ash, slag, and silica fume, reduces the environmental footprint of construction projects.

This type of concrete not only minimizes the use of virgin raw materials but also offers improved durability and life cycle benefits. As more companies and governments prioritize sustainability, the demand for green concrete is expected to rise, shaping the development of new formulations and techniques within the industry.

Increased Use of Automation in Concrete Production

Automation is transforming the ready-mix concrete industry by enhancing the precision and efficiency of production processes. Automated batching plants ensure consistent quality and composition of concrete while minimizing human error and labor costs.

These systems often integrate advanced smart sensors and control technologies that adjust the mixing process in real time, based on feedback and environmental conditions. As automation technology advances, its adoption is expected to increase, enabling faster and more cost-effective concrete production suited to the fast pace of modern construction projects.

Expanding Application in Architectural Projects

There is a growing trend of using ready-mix concrete in architectural applications due to its versatility and aesthetic potential. Architects and designers are increasingly experimenting with concrete’s texture, color, and form to create distinctive visual effects in building facades and interior elements.

This trend is driven by technological advancements that allow for greater creativity in concrete use, such as 3D printing and custom molds. As the architectural applications of ready-mix concrete expand, it continues to open new markets and opportunities for innovation within the sector.

Regional Analysis

The Asia-Pacific Ready-Mix Concrete Market holds a 57% share, valued at USD 510.4 billion.

The Ready-Mix Concrete Market exhibits diverse dynamics across different regions, influenced by local economic activities, construction rates, and infrastructural developments. As of the latest data, Asia-Pacific dominates the market, holding a staggering 57% share, valued at USD 510.4 billion.

This region’s growth is primarily driven by rapid urbanization, substantial infrastructure investments, and robust construction activities in emerging economies such as China and India.

In contrast, North America and Europe show mature market characteristics with steady growth, supported by the renovation of aging infrastructure and increasing adoption of green building practices. These regions focus on sustainable and high-quality concrete products to comply with stringent environmental regulations.

Meanwhile, the Middle East & Africa region, though smaller in comparison, is experiencing significant growth due to infrastructure development in Gulf Cooperation Council (GCC) countries, driven by economic diversification efforts away from oil dependency. Latin America, on the other hand, faces slower growth due to economic volatility but holds potential due to urban development projects.

Overall, while Asia-Pacific leads with its massive share and high growth trajectory, other regions present varied growth environments shaped by regional economic conditions and construction requirements.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Ready-Mix Concrete market for 2023, key players have displayed strategic diversity and adaptation to both regional market demands and evolving industry trends. Among these companies, significant ones like CEMEX, S.A.B. de C.V., Heidelberg Materials AG, and UltraTech Cement Ltd. continue to expand their market presence by enhancing production capacity and incorporating sustainable practices, which are increasingly critical given environmental regulations.

CEMEX, with its broad international footprint, has been focusing on digital transformation and customer-centric solutions, offering custom concrete mixes and logistical efficiencies that reduce environmental impact and enhance on-site productivity. This approach not only strengthens their market position but also aligns with the global shift towards sustainable construction materials.

Heidelberg Materials AG, formerly known as HeidelbergCement, has been another key contender. Its investment in carbon capture technologies and the development of eco-friendly concrete solutions highlight the company’s commitment to innovation and sustainability. This strategic focus not only addresses regulatory pressures but also caters to a growing segment of environmentally conscious consumers.

UltraTech Cement Ltd., dominant in the Asia-Pacific region, which is the most significant market for ready-mix concrete, capitalizes on regional growth dynamics. The company’s expansion strategies in emerging markets and its enhancements in product quality and service delivery position it well within the competitive landscape.

Smaller regional players like Barney & Dickenson, Inc. and Livingston’s Concrete Service, Inc. continue to thrive by focusing on localized markets, offering tailored products and services that meet specific regional demands. This strategy enables them to maintain competitive edges in their respective areas despite the dominance of larger global players.

Overall, the ready-mix concrete market in 2023 shows a robust competitive landscape where innovation, sustainability, and regional market penetration are key to gaining and sustaining market share.

Top Key Players in the Market

- ACC Limited

- Barney & Dickenson, Inc.

- Buzzi Unicem SpA

- CEMEX, S.A.B. de C.V.

- China National Building Material Group Corporation

- Dillon Bros Ready Mix Concrete

- Hanson Cement Ltd.

- Heidelberg Materials AG

- HEIDELBERGCEMENT AG

- HOLCIM

- Italcementi Group

- LafargeHolcim

- Livingston’s Concrete Service, Inc.

- M. I. Cement Factory Limited.

- R. W. Sidley, Inc.

- U.S. Concrete, Inc.

- UltraTech Cement Ltd.

- Vicat S.A.

Recent Developments

- In 2024, Dillon Bros Ready Mix Concrete emphasized its commitment to excellence by upgrading its facilities, ensuring the best concrete delivery services in New Orleans with a state-of-the-art batch plant producing over 120 cubic yards per hour.

- In 2023, Hanson Cement Ltd. focused on sustainability by integrating evoZero carbon captured cement and Regen GGBS into their product line, aligning with global eco-friendly construction trends and enhancing their market position.

Report Scope

Report Features Description Market Value (2023) USD 889.3 Billion Forecast Revenue (2033) USD 1,902.2 Billion CAGR (2024-2033) 7.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Transit Mixed Concrete, Shrink Mixed Concrete, Central Mixed Concrete), By Production (On-site, Off-site), By Mixer Type (Volumetric, Barrel Truck/In-transit mixer), By Application (Commercial Building, Residential Building, Infrastructure, Industrial Utilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ACC Limited, Barney & Dickenson, Inc., Buzzi Unicem SpA , CEMEX, S.A.B. de C.V., China National Building Material Group Corporation, Dillon Bros Ready Mix Concrete, Hanson Cement Ltd. , Heidelberg Materials AG, HEIDELBERGCEMENT AG, HOLCIM, Italcementi Group, LafargeHolcim, Livingston’s Concrete Service, Inc., M. I. Cement Factory Limited., R. W. Sidley, Inc., U.S. Concrete, Inc., UltraTech Cement Ltd., Vicat S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ready-Mix Concrete MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Ready-Mix Concrete MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ACC Limited

- Barney & Dickenson, Inc.

- Buzzi Unicem SpA

- CEMEX, S.A.B. de C.V.

- China National Building Material Group Corporation

- Dillon Bros Ready Mix Concrete

- Hanson Cement Ltd.

- Heidelberg Materials AG

- HEIDELBERGCEMENT AG

- HOLCIM

- Italcementi Group

- LafargeHolcim

- Livingston's Concrete Service, Inc.

- M. I. Cement Factory Limited.

- R. W. Sidley, Inc.

- U.S. Concrete, Inc.

- UltraTech Cement Ltd.

- Vicat S.A.