Global Sulphur Bentonite Market By Type (Sulphur-90%, Sulphur-85%, Others), By Form (Solid, Liquid), By Application (Oilseeds, Cereals and Crops, Fruits and Vegetables, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 135092

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

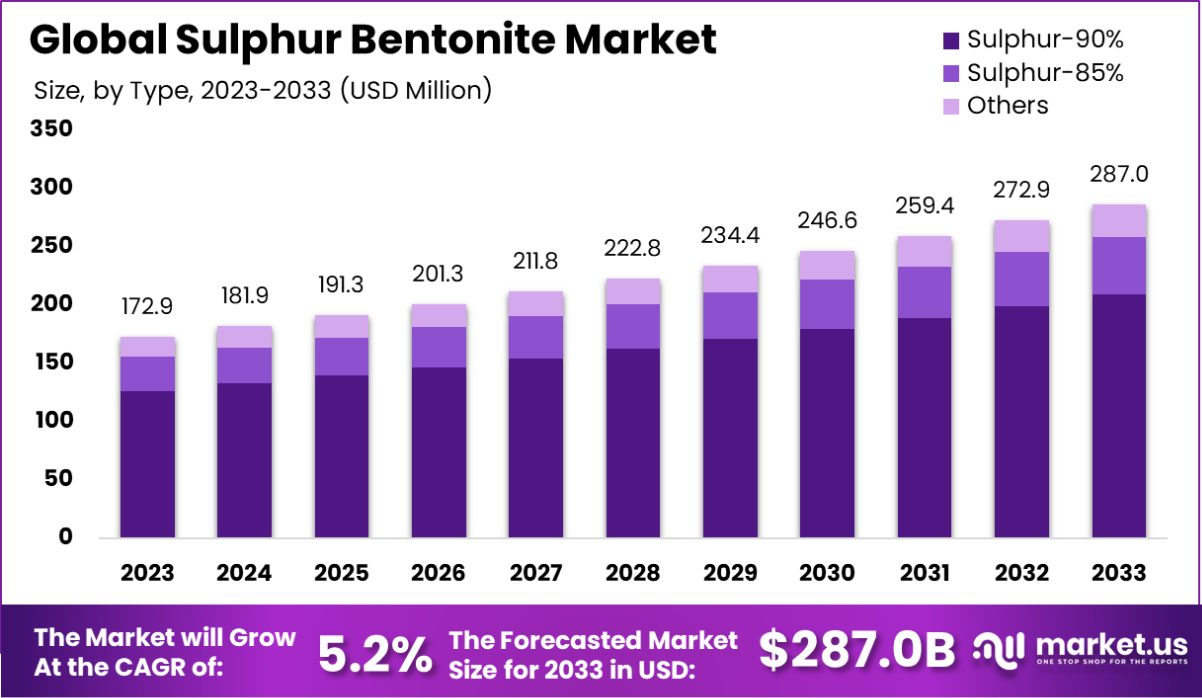

The Global Sulphur Bentonite Market is expected to be worth around USD 287.0 Million by 2033, up from USD 172.9 Million in 2023, and grow at a CAGR of 5.2% from 2024 to 2033. Asia-Pacific Sulphur Bentonite market holds 34.3%, valued at USD 59.3 million.

Sulphur bentonite is a micronutrient used primarily in the agricultural sector to enhance soil fertility and crop yields by providing plants with essential sulphur. It is a unique form of granular fertilizer that combines sulphur with bentonite, a type of clay, which helps in the gradual release of sulphur when applied to the soil.

The sulphur bentonite market is experiencing growth due to its increasing application in agriculture to meet the rising demand for higher crop yields. This market is driven by the recognition of sulphur deficiencies in soils across various regions and the subsequent need for replenishment to support healthy crop production.

The growth of the sulphur bentonite market can be attributed to the global rise in agricultural productivity needs and the adoption of sustainable farming practices that rely on nutrient-rich inputs to improve soil health.

Increased awareness among farmers regarding the benefits of nutrient-specific fertilizers and government initiatives promoting balanced fertilization practices are driving demand for sulphur bentonite.

Emerging markets offer significant opportunities for the expansion of the sulphur bentonite market due to the intensification of agriculture and the need for enhanced soil amendments to support diverse crop requirements.

The Sulphur Bentonite market is poised for significant growth, driven by the increasing necessity for enhanced agricultural yields and the recognition of sulphur’s critical role in crop nutrition.

In India, one of the largest global markets for sulphur bentonite, the agricultural sector is increasingly adopting this product to combat widespread sulphur deficiencies in soils, which range from 30% to 50%. This deficiency affects crop vitality and reduces agricultural productivity, making sulphur supplementation crucial for improving soil health and crop yields.

India’s substantial bentonite reserves, estimated at 583 million tonnes according to the Indian Minerals Yearbook, underscore the country’s potential as a pivotal player in the sulphur bentonite market. The majority of these reserves are located in Rajasthan and Gujarat, which hold 428 million tonnes and 144 million tonnes, respectively.

This abundant availability facilitates the production of S-bentonite fertilizers, which integrate granular elemental sulphur with swelling clay like bentonite—generally 10% by weight—to enhance the efficacy of the fertilizer.

The development of high-sulphur content fertilizers such as Fada-90, which contains 90% pure sulphur, marks a significant advancement in the market. These fertilizers are designed for easy application and to ensure long-lasting effects, enhancing their appeal to the agricultural sector.

This scenario presents a lucrative opportunity for market players to capitalize on the expanding demand for effective agricultural inputs in India and globally. As the market evolves, stakeholders in the supply chain—from mineral extraction to agri-business—stand to benefit from the integration of these resources into valuable agricultural solutions.

Key Takeaways

- The Global Sulphur Bentonite Market is expected to be worth around USD 287.0 Million by 2033, up from USD 172.9 Million in 2023, and grow at a CAGR of 5.2% from 2024 to 2033.

- Sulphur Bentonite Market primarily includes Sulphur-90% type, dominating with a 73% market share.

- Solid forms of Sulphur Bentonite lead the market, accounting for 78.2% of sales.

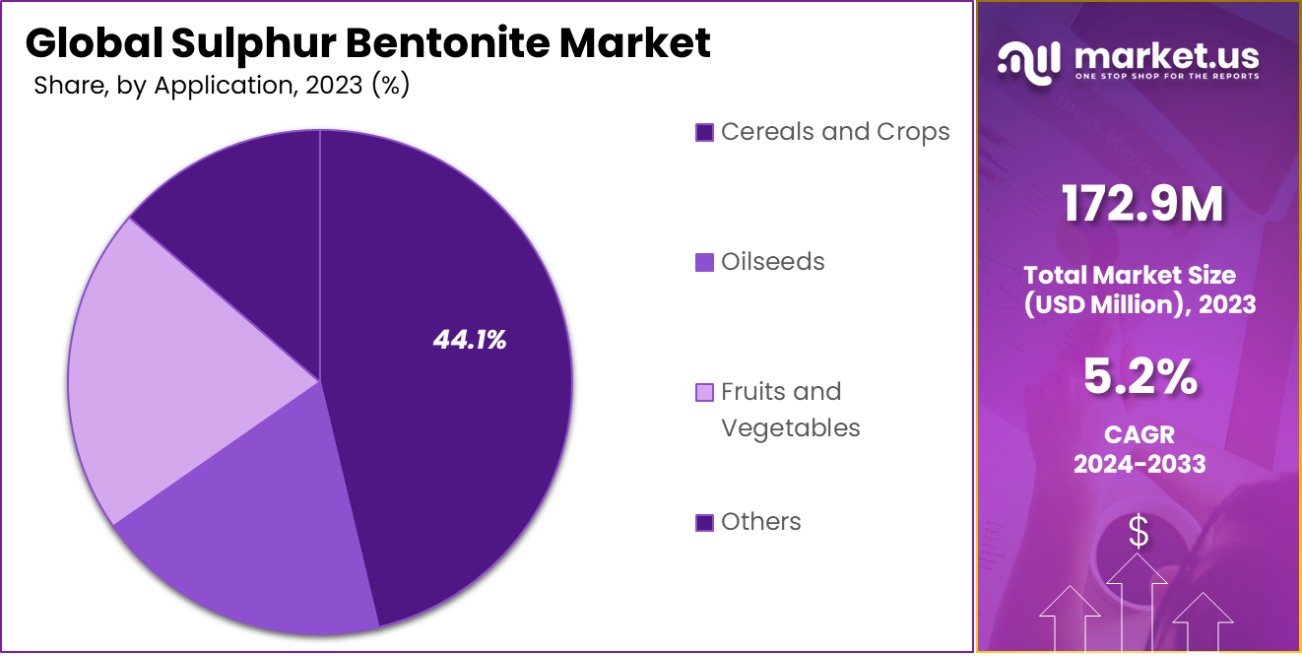

- The primary application of Sulphur Bentonite is in cereals and crops, covering 44.1%.

- The Asia-Pacific Sulphur Bentonite market holds a 34.3% share, valued at USD 59.3 million.

By Type Analysis

The Sulphur Bentonite market predominantly features a 90% Sulphur content, capturing a significant 73% market share.

In 2023, Sulphur held a dominant market position in the “By Type” segment of the Sulphur Bentonite market, commanding a significant 73% share. The breakdown of this dominance reveals concentrations in two main subcategories: Sulphur-90% and Sulphur-85%, which collectively underpin the robust demand within this sector.

The Sulphur-90% variant, known for its high purity and efficacy, has been especially popular among agricultural applications, optimizing nutrient uptake and improving crop yield. On the other hand, Sulphur-85% has catered to a slightly different market niche, offering a cost-effective solution while still maintaining sufficient quality to meet the less stringent requirements of certain agricultural and industrial applications.

This segmental leadership by Sulphur can be attributed to its critical role in agriculture as a vital nutrient that aids in chlorophyll production and the synthesis of proteins, promoting healthier and more bountiful crops. The strategic positioning of these products, supported by ongoing research and development efforts, has ensured that they meet the evolving demands of both local and international markets.

Moreover, the growing awareness among farmers about the benefits of nutrient-rich soil and the increasing popularity of precision farming has further fueled the demand for high-quality Sulphur Bentonite, solidifying Sulphur’s lead in the market.

By Form Analysis

Solid forms of Sulphur Bentonite lead the market, with a substantial 78.2% preference among consumers and industries.

In 2023, Solid held a dominant market position in the “By Form” segment of the Sulphur Bentonite Market, with a commanding 78.2% share. The market’s preference for solid forms, such as pellets or granules, is largely due to their ease of application and effectiveness in delivering nutrients directly to the soil.

Solid Sulphur Bentonite is highly valued for its controlled release, which ensures a steady supply of sulphur to crops over extended periods, optimizing nutrient absorption and enhancing soil quality.

The alternative liquid form, while useful in specific applications requiring rapid soil integration and nutrient delivery, has not seen the same level of adoption. This is attributed to the logistical challenges associated with its transportation and storage, as well as the precision required in its application to prevent nutrient runoff and environmental impact.

The significant market share held by solid forms is indicative of robust demand from the agricultural sector, where precision, effectiveness, and ease of handling are key considerations.

As farmers globally continue to focus on sustainable and efficient farming practices, the demand for solid Sulphur Bentonite is expected to grow, further cementing its status as a market leader in this segment.

By Application Analysis

Within the application segment, Cereals and Crops utilize 44.1% of Sulphur Bentonite, underscoring its agricultural importance.

In 2023, Cereals and Crops held a dominant market position in the “By Application” segment of the Sulphur Bentonite Market, securing a 44.1% share. This substantial market share is reflective of the critical role Sulphur Bentonite plays in enhancing the yield and quality of cereal crops like wheat, rice, and corn, which are staples in global agriculture.

The nutrient helps in the formation of enzymes and vitamins, which are essential for crop growth, leading to increased productivity.

Despite stiff competition from other segments like Oilseeds and Fruits and Vegetables, Cereals and Crops have maintained their lead due to the sheer volume of global cereal production and the increasing need for agricultural efficiency to meet the food demands of a growing population.

Oilseeds and Fruits and Vegetables also benefit significantly from Sulphur Bentonite, particularly in areas with Sulphur-deficient soils, but their overall market penetration is lower compared to Cereals and Crops.

The continued dominance of Cereals and Crops in the Sulphur Bentonite market is supported by ongoing research and development activities aimed at improving crop resistance to diseases and environmental stress, further driving the demand for Sulphur Bentonite in this segment.

As agricultural practices evolve and focus more on sustainability and soil health, the role of Sulphur Bentonite in Cereals and Crops is expected to remain integral and expansive.

Key Market Segments

By Type

- Sulphur-90%

- Sulphur-85%

- Others

By Form

- Solid

- Liquid

By Application

- Oilseeds

- Cereals and Crops

- Fruits and Vegetables

- Others

Driving Factors

Increasing Demand for Higher Crop Yields

The global Sulphur Bentonite market is experiencing significant growth, primarily driven by the rising demand for enhanced agricultural productivity. As the global population continues to rise, the pressure on the agricultural sector to produce higher crop yields intensifies.

Sulphur Bentonite is essential for improving soil fertility and, consequently, crop yields, as it provides plants with vital nutrients like sulphur, which is crucial for chlorophyll production and protein synthesis. The application of Sulphur Bentonite is recognized as a cost-effective method to replenish deficient soil, making it an attractive option for farmers aiming to increase productivity sustainably.

Expansion of Sulphur-Deficient Regions

The expansion of sulphur-deficient areas across the globe serves as a pivotal driving factor for the Sulphur Bentonite market. Soil depletion, caused by intensive farming practices and inadequate soil management, has led to widespread sulphur deficiencies, adversely affecting crop health and yields. Sulphur Bentonite, being an effective soil amendment, is increasingly utilized to correct these deficiencies.

As awareness of soil health’s importance grows among agricultural practitioners, the demand for products like Sulphur Bentonite, which directly addresses nutrient depletion, is expected to continue rising, further propelling market growth.

Strategic Initiatives by Leading Market Players

Market dynamics are significantly influenced by strategic actions undertaken by key players in the Sulphur Bentonite industry. Companies are aggressively investing in research and development to enhance the efficiency and application methods of Sulphur Bentonite. Furthermore, partnerships and expansions in emerging markets are commonplace as firms aim to tap into new agricultural sectors.

These initiatives not only bolster the market presence of these companies but also enhance the accessibility and affordability of Sulphur Bentonite for farmers globally. Such strategic moves are crucial in driving the adoption and innovation within the market, ensuring steady growth.

Restraining Factors

High Costs and Availability of Alternatives

One of the primary challenges facing the Sulphur Bentonite market is the high cost associated with its production and distribution. These costs can be prohibitive for small-scale farmers, particularly in developing countries where agricultural budgets are limited.

Additionally, the availability of cheaper alternatives, such as other sulphur-containing fertilizers that offer similar benefits, poses a significant competitive threat. These alternatives are often preferred due to their lower price points and comparable effectiveness, which can restrain the growth of the Sulphur Bentonite market as users opt for more cost-effective solutions.

Logistical Challenges in Transportation and Storage

The transportation and storage of Sulphur Bentonite present logistical challenges that act as barriers to market growth. Sulphur Bentonite, due to its chemical properties, requires specialized storage facilities to prevent degradation and maintain its efficacy.

Moreover, the material is sensitive to moisture and temperature changes, necessitating controlled environments during transport. These requirements increase the logistical costs and complicate the supply chain, making it difficult for suppliers to maintain quality and deliver products timely. Such logistical issues can deter potential new entrants and limit the expansion of the market into new regions.

Limited Awareness and Adoption in Emerging Markets

Despite the proven benefits of Sulphur Bentonite in agriculture, a significant restraint is the limited awareness and slow adoption rates in emerging markets. Many farmers in these regions are either unaware of the advantages of Sulphur Bentonite or lack the technical knowledge required for its proper application.

Educational and outreach programs are often insufficient, and without proper guidance, farmers may hesitate to transition from traditional practices to using advanced soil amendments like Sulphur Bentonite. This limited awareness and adoption are critical factors that hinder market penetration and growth in potentially lucrative emerging markets.

Growth Opportunity

Expansion into Emerging Agricultural Markets

Significant growth opportunities exist for the Sulphur Bentonite market through expansion into emerging agricultural markets, particularly in Asia, Africa, and South America. These regions are experiencing rapid agricultural development and are increasingly adopting modern farming techniques.

By entering these markets, Sulphur Bentonite manufacturers can tap into a growing base of potential customers who are seeking effective soil amendments to boost crop productivity. Strategic partnerships and local production facilities could facilitate market entry, reduce logistical costs, and enhance market penetration, ultimately driving global market growth.

Development of Enhanced Product Formulations

The ongoing development of enhanced Sulphur Bentonite formulations represents a major growth opportunity within the market. By improving product efficiency and ease of use, manufacturers can meet the evolving needs of modern agriculture. Innovations might include faster nutrient release rates, better soil integration, or tailored products for specific crop types or climatic conditions.

Investing in research and development to create these advanced formulations can differentiate brands and capture the attention of progressive farmers, thereby expanding the market base and increasing sales volumes.

Leveraging Technology for Precision Agriculture

Integrating Sulphur Bentonite with precision agriculture technologies offers a promising growth avenue. As precision agriculture gains traction globally, utilizing advanced technologies like GPS, smart sensors, and data analytics to optimize the Sulphur Bentonite application can significantly enhance its effectiveness.

This integration enables farmers to apply the right amount of product precisely where it is needed, maximizing crop yields and minimizing waste. Market players that can provide comprehensive solutions combining Sulphur Bentonite with these technologies are likely to experience increased demand, positioning themselves as leaders in a technologically advancing market.

Latest Trends

Increasing Use of Integrated Soil Management Practices

A notable trend in the Sulphur Bentonite market is the increasing adoption of integrated soil management practices. As environmental concerns grow and the emphasis on sustainable farming intensifies, farmers are increasingly turning to comprehensive soil health management strategies that include the use of Sulphur Bentonite.

This product is being integrated with other soil amendments and organic matter to enhance soil structure, fertility, and productivity. This holistic approach not only improves crop yields but also contributes to the long-term sustainability of farming operations, driving continuous demand for Sulphur Bentonite as part of these integrated practices.

Rise in Organic Farming Initiatives

The global shift towards organic farming is significantly influencing the Sulphur Bentonite market. As consumers increasingly demand organic produce, farmers are seeking natural fertilizers and soil conditioners that comply with organic farming standards. Sulphur Bentonite, being a natural product, fits well within these parameters.

Its ability to naturally enhance soil properties without the use of synthetic chemicals makes it highly desirable in organic agriculture. This trend is likely to persist as consumer preferences continue to lean towards environmentally friendly and health-conscious food options, propelling the market forward.

Technological Advancements in Fertilizer Application Equipment

Technological advancements in fertilizer application equipment are shaping the Sulphur Bentonite market. New technologies are enabling more precise and efficient application of fertilizers, including Sulphur Bentonite. These innovations include GPS-guided spreaders and variable rate technology, which allow for site-specific application, optimizing the effectiveness of Sulphur Bentonite and reducing waste.

As these technologies become more accessible and affordable, their adoption is expected to increase, enhancing the overall growth and efficiency of the Sulphur Bentonite market. This trend supports sustainable agriculture by ensuring optimal nutrient use and minimizing environmental impact.

Regional Analysis

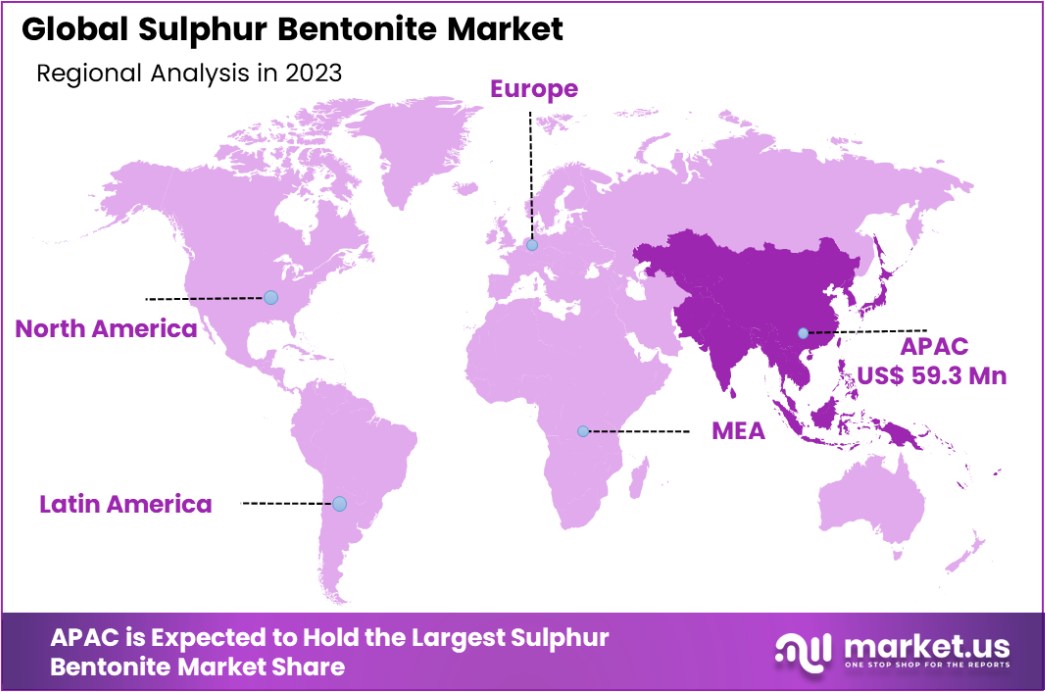

The Asia-Pacific Sulphur Bentonite market holds a 34.3% share, valued at USD 59.3 million.

The Sulphur Bentonite market demonstrates varied growth dynamics across different regions due to differences in agricultural practices, economic conditions, and technological advancements.

In North America, the market is driven by advanced agricultural technologies and a strong focus on crop yield maximization. The region benefits from high adoption rates of specialized agricultural inputs, including Sulphur Bentonite, supported by a robust agricultural infrastructure.

Europe presents a market characterized by stringent environmental regulations, which promote the use of environmentally sustainable agricultural inputs. Sulphur Bentonite is increasingly used to improve soil health and productivity, particularly in countries with high agricultural output.

Asia-Pacific is the dominant region in the Sulphur Bentonite market, holding a 34.3% share with a market value of USD 59.3 million. The region’s substantial agricultural sector, coupled with growing awareness about the benefits of soil enhancement products, drives significant demand. Countries like China and India are major contributors to market growth due to their large agricultural bases and increasing need for yield improvement.

The Middle East & Africa region shows growth potential, driven by the need to enhance arid agricultural lands. Sulphur Bentonite is crucial for improving the soil quality in these water-scarce regions, thus supporting agricultural productivity.

Latin America, with its diverse agricultural environments, is increasingly adopting Sulphur Bentonite to address soil deficiencies and boost crop production, particularly in major agricultural countries like Brazil and Argentina.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Sulphur Bentonite market is significantly shaped by the activities and strategies of key players, each contributing uniquely to the industry’s landscape.

Abu Dhabi Fertilizer Industries and Coromandel International Limited are notable for their expansive production capacities and strategic market positioning, which allow them to meet the growing demand for Sulphur Bentonite in high-demand regions such as Asia-Pacific and the Middle East. Their focus on quality and distribution efficiency helps in maintaining their competitive edge.

Aries (Amarak Chemicals) and Deepak Fertilizers and Petrochemicals leverage advanced technological processes to enhance the effectiveness of their Sulphur Bentonite products. Their commitment to R&D is evident in their product offerings, which are tailored to meet the specific needs of different agricultural environments, thus enhancing crop yields and soil health.

Coogee Chemicals, DFPCL, and Gujarat State Fertilizers & Chemicals Limited emphasize sustainability and environmental compliance, which resonate well with the global shift towards sustainable agricultural practices. These companies are exploring eco-friendly ways to produce and distribute Sulphur Bentonite, thereby appealing to a market that is increasingly sensitive to environmental issues.

Indian Farmers Fertiliser Cooperative Limited (IFFCO) and National Fertilizer Limited (NFL) have a strong foothold in the Indian market, one of the largest in the Asia-Pacific region. Their extensive distribution networks and government support play crucial roles in their dominance.

Tiger-sul (Tiger Industries Ltd) stands out for its innovative approach to market penetration and customer engagement, utilizing both traditional and digital marketing strategies to reach a broader audience.

Lastly, companies like NEAIS (Said Ali Ghodran Group) and Zafaran Industrial Group are focusing on expanding their geographical reach by establishing operations in underserved regions, thus tapping into new customer bases and driving regional market dynamics.

Top Key Players in the Market

- Abu Dhabi Fertilizer Industries

- Aries (Amarak Chemicals)

- Chung Kwang

- NTCS Group

- Coogee Chemicals

- Coromandel International Limited

- Deepak Fertilizers and Petrochemicals

- Devco Australia

- DFPCL

- Galaxy Sulfur

- Gujarat State Fertilizers & Chemicals Limited

- H Sulphur Corp

- Indian Farmers Fertiliser Cooperative Limited (IFFCO)

- Montana Sulphur & Chemical Co

- National Fertilizer Limited (NFL)

- National Sulfur Fertilizer

- NEAIS (Said Ali Ghodran Group)

- NTCS Group

- Sohar Sulphur Fertilizers (SSF)

- Tiger-sul (Tiger Industries Ltd)

- Zafaran Industrial Group

Recent Developments

- In 2023, Coogee Chemicals expanded its Sulphur Bentonite production capacity to meet the rising demand for sulfur-based fertilizers, supporting sustainable agriculture with a projected market growth rate of 4-6%.

- In 2023, National Sulfur Fertilizer has maintained its standing as a significant producer within the global sulphur bentonite market. The company produces 30,000 tons annually of high-quality sulphur bentonite from its facility in the Messaied Industrial area, leveraging this product to enhance nitrogen and phosphorus absorption by plants, thereby improving the effectiveness of NPK fertilizers and the overall quality of crops.

Report Scope

Report Features Description Market Value (2023) USD 172.9 Billion Forecast Revenue (2033) USD 287.0 Billion CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Sulphur-90%, Sulphur-85%, Others), By Form (Solid, Liquid), By Application (Oilseeds, Cereals and Crops, Fruits and Vegetables, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abu Dhabi Fertilizer Industries, Aries (Amarak Chemicals), Chung Kwang, NTCS Group, Coogee Chemicals, Coromandel International Limited, Deepak Fertilizers and Petrochemicals, Devco Australia, DFPCL, Galaxy Sulfur, Gujarat State Fertilizers & Chemicals Limited, H Sulphur Corp, Indian Farmers Fertiliser Cooperative Limited (IFFCO), Montana Sulphur & Chemical Co, National Fertilizer Limited (NFL), National Sulfur Fertilizer, NEAIS (Said Ali Ghodran Group), NTCS Group, Sohar Sulphur Fertilizers (SSF), Tiger-sul (Tiger Industries Ltd), Zafaran Industrial Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sulphur Bentonite MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Sulphur Bentonite MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Abu Dhabi Fertilizer Industries

- Aries (Amarak Chemicals)

- Chung Kwang

- NTCS Group

- Coogee Chemicals

- Coromandel International Limited

- Deepak Fertilizers and Petrochemicals

- Devco Australia

- DFPCL

- Galaxy Sulfur

- Gujarat State Fertilizers & Chemicals Limited

- H Sulphur Corp

- Indian Farmers Fertiliser Cooperative Limited (IFFCO)

- Montana Sulphur & Chemical Co

- National Fertilizer Limited (NFL)

- National Sulfur Fertilizer

- NEAIS (Said Ali Ghodran Group)

- NTCS Group

- Sohar Sulphur Fertilizers (SSF)

- Tiger-sul (Tiger Industries Ltd)

- Zafaran Industrial Group