Global Fire Resistant Fabrics Market By Type (Treated, Inherent), By Application (Apparel, Non-Apparel), By End-Use (Industrial, Defense and public safety Services, Transportation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 135326

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

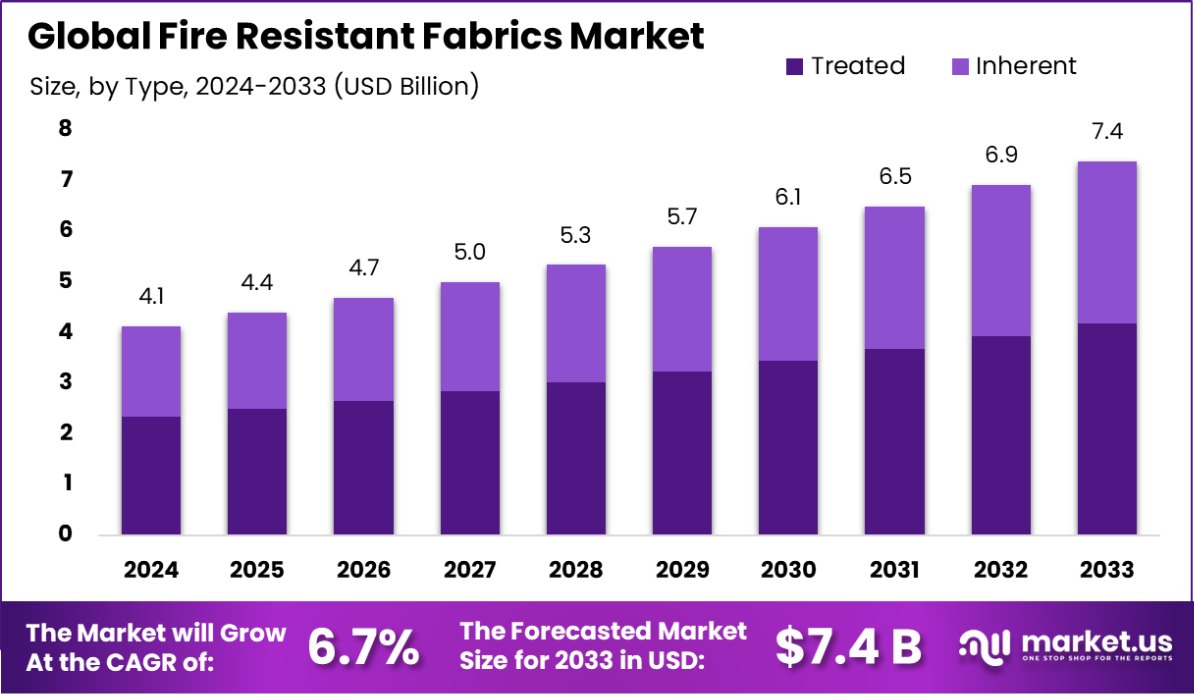

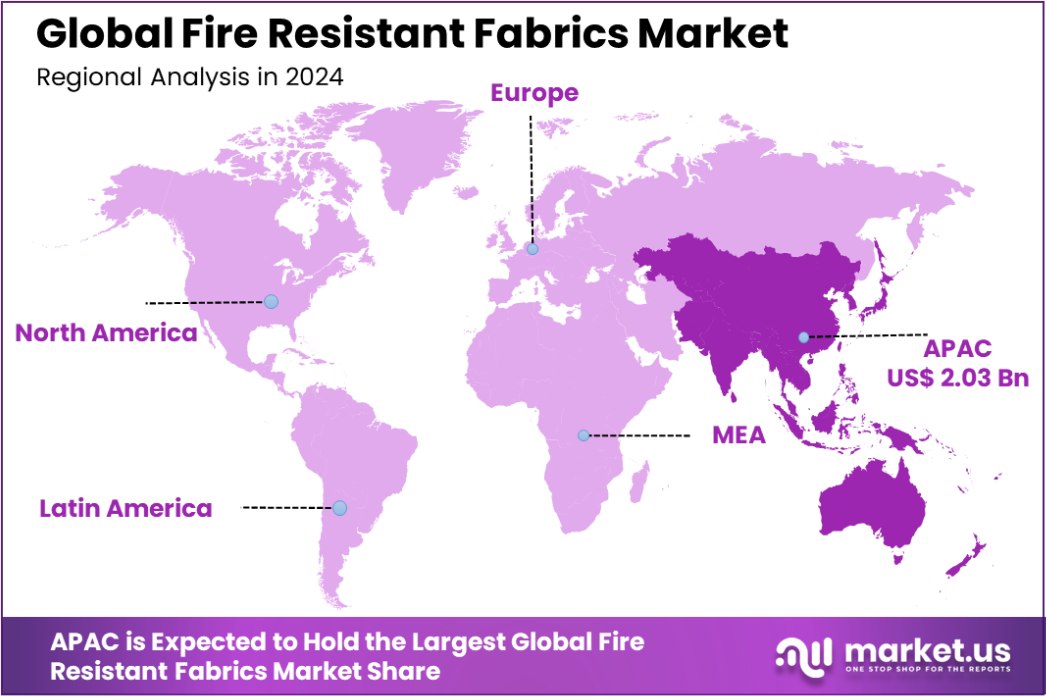

The Global Fire Resistant Fabrics Market is expected to be worth around USD 7.4 Billion by 2033, up from USD 4.1 Billion in 2023, and grow at a CAGR of 6.7% from 2024 to 2033. Asia-Pacific holds 49.4% of the Fire Resistant Fabrics Market at USD 2.03 billion.

Fire-resistant fabrics are materials that are more resistant to fire than others through chemical treatment or manufactured fireproof fibers. These fabrics are designed to resist ignition, prevent flame spread, and protect against heat exposure.

They are commonly used in protective clothing for firefighters, industrial workers, and military personnel, as well as in various applications like curtains, upholstery, and other furnishings in both residential and commercial settings.

The fire-resistant fabrics market is growing due to factors such as stringent safety regulations and increasing awareness of workplace safety across industries. This market benefits from the rising demand in sectors like oil and gas, construction, and aerospace, where safety requirements are stringent.

Opportunities in the market are expanding with advancements in technology that improve the comfort, durability, and protective qualities of fire-resistant fabrics, making them suitable for a wider range of applications.

The Fire Resistant Fabrics Market is increasingly critical in a safety-driven global environment, where stringent regulations and growing awareness of hazards contribute significantly to market expansion.

The demand for fire-resistant fabrics is underpinned by robust industrial safety standards and a surge in sectors like construction, oil and gas, and firefighting, which require specialized protective apparel to ensure worker safety against fire hazards.

Recent data underscores the importance of fire safety investments and technological enhancements in protective materials. For instance, the U.S. Department of Environmental Conservation is bolstering fire safety through its Volunteer Fire Assistance grant program, with a notable increase in funding to $976,622.

This initiative not only strengthens rural fire departments by providing them with 50/50 matching funds—up to $2,500 per department—but also emphasizes the broader commitment to public safety and the preservation of natural resources.

Such funding is vital as it equips departments with resources to handle fires more effectively, many of which involve residential settings where soft furnishings can ignite, leading to severe incidents.

The risks associated with soft furnishings are significant, as they are the first items ignited in approximately 5% of all U.S. residential fires annually. In the context of market demands, fire-resistant fabrics become essential in manufacturing products like mattresses, which must comply with stringent federal safety standards.

According to Federal Regulation 16 CFR 1633, the peak heat release rate for a mattress must not exceed 200 kW during a 30-minute test, with total heat release capped at 15 MJ in the first 10 minutes.

Given the market’s regulatory landscape and the associated consumer and industrial needs, the fire-resistant fabrics industry is poised for substantial growth. This growth is further propelled by technological advancements in fabric materials and treatments that enhance fire resistance while maintaining comfort and durability.

As market analysts, we project a positive trajectory for this sector, fueled by regulatory compliance, enhanced safety awareness, and technological innovations that meet stringent safety standards.

Key Takeaways

- The Global Fire Resistant Fabrics Market is expected to be worth around USD 7.4 Billion by 2033, up from USD 4.1 Billion in 2023, and grow at a CAGR of 6.7% from 2024 to 2033.

- The Fire Resistant Fabrics Market sees 56.7% of its products undergoing specialized treatment processes.

- Apparel applications dominate the market, with 58.4% of fire-resistant fabrics used in clothing manufacturing.

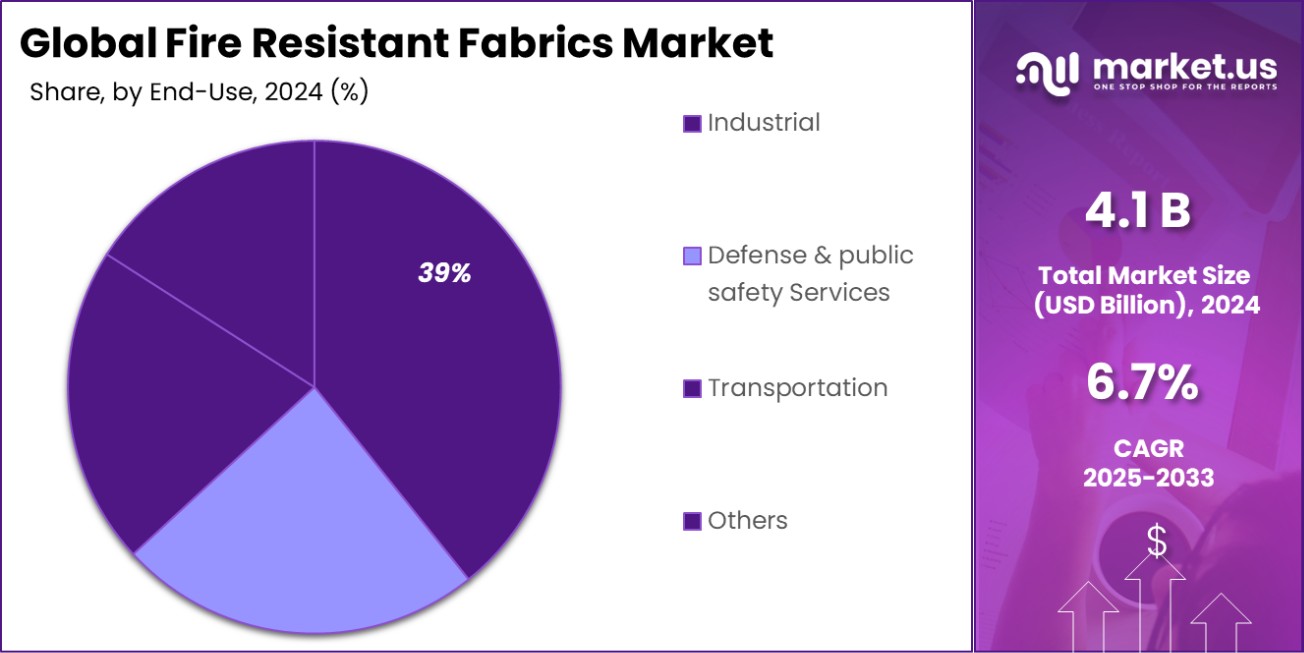

- Industrial applications account for 39.4% of the market, emphasizing safety in challenging work environments.

- In 2023, Asia-Pacific dominated the Fire Resistant Fabrics Market with 49.4%, USD 2.03 billion.

By Type Analysis

The Fire Resistant Fabrics Market sees 56.7% of its products treated to enhance their fire-retardant properties significantly.

In 2023, Treated held a dominant market position in the “By Type” segment of the Fire Resistant Fabrics Market, with a 56.7% share. This segment includes both Treated and Inherent types of fire-resistant fabrics, with Treated types leveraging chemical treatments to confer flame resistance to various materials.

The market dynamics for Treated fabrics have been influenced significantly by advancements in treatment technologies that have improved the durability and effectiveness of these fabrics in extreme conditions. Industries such as oil and gas, firefighting, and military sectors, where safety standards are stringent, have heavily relied on these innovations.

On the other hand, the Inherent segment, which constituted the remaining market share, involves fabrics that are naturally flame-resistant without the need for additional chemical treatments. These fabrics are gaining traction due to their long-term reliability and lower environmental impact compared to Treated fabrics. The shift towards sustainable practices in industries like automotive and aerospace is expected to boost the demand for Inherent fire-resistant fabrics.

Overall, the market is seeing a trend where both segments are growing, but at different rates due to their distinct properties and applications. Strategic investments in research and development, particularly in enhancing the performance characteristics of Inherent fabrics, could redefine market dynamics and competitive standings in the coming years.

By Application Analysis

In the Fire Resistant Fabrics Market, apparel applications dominate, accounting for 58.4% of the market’s demand.

In 2023, Apparel held a dominant market position in the “By Application” segment of the Fire Resistant Fabrics Market, with a 58.4% share. This segment is bifurcated into Apparel and Non-Apparel categories, with the former leading due to extensive applications in industries that require personal protective equipment (PPE).

Apparel for fire-resistant purposes includes clothing for firefighters, military personnel, and workers in industries like oil & gas, which face high risks of fire hazards. The demand in this segment is driven by stringent regulatory standards for worker safety across various sectors, compelling companies to invest in reliable and effective fire-resistant apparel.

Meanwhile, the Non-Apparel segment, which includes applications such as draperies, tents, and coverings used in both commercial and residential settings, accounts for the rest of the market share. Although smaller in comparison, this segment benefits from the growing awareness of fire safety in public spaces and homes, leading to an increased demand for fire-resistant fabrics in non-apparel applications.

The overall market is influenced by technological advancements in fabric materials and treatments, which improve the performance and durability of fire-resistant fabrics. As industries continue to prioritize safety, the market for both apparel and non-apparel fire-resistant fabrics is expected to expand, with innovations and regulatory compliance playing key roles in shaping the future landscape.

By End-Use Analysis

Industrial end-users hold a substantial share in the Fire Resistant Fabrics Market, representing 39.4% of total usage.

In 2023, Industrial held a dominant market position in the “By End-Use” segment of the Fire Resistant Fabrics Market, with a 39.4% share. This segment is categorized into Industrial, Defense and Public Safety Services, Transportation, and Others.

The Industrial category includes sectors such as oil & gas, chemical, and manufacturing, where the risk of fires and explosions is high, necessitating robust fire-resistant solutions for worker safety. The substantial market share of this segment underscores the critical importance of fire-resistant fabrics in maintaining safety standards and regulatory compliance in industrial settings.

Defense and Public Safety Services also represent a significant portion of the market, driven by the need for fire-resistant uniforms and gear to protect military and emergency service personnel. The smart transportation sector, encompassing automotive, aerospace, and rail, requires fire-resistant fabrics for upholstery and safety gear, influenced by stringent fire safety regulations.

The “Others” category includes applications in sectors like construction and energy, where fire-resistant materials are used for protective barriers and other safety measures. Overall, the market dynamics reflect an increasing demand for fire-resistant fabrics across all end-use categories, supported by technological advancements and a heightened focus on safety and regulatory standards.

Key Market Segments

By Type

- Treated

- Inherent

By Application

- Apparel

- Non-Apparel

By End-Use

- Industrial

- Defense & Public Safety Services

- Transportation

- Others

Driving Factors

Enhanced Safety Regulations Across Industries

Stringent safety regulations across various industries such as oil and gas, construction, and manufacturing have been pivotal in driving the demand for fire-resistant fabrics. Governments and regulatory bodies worldwide are enforcing stricter safety standards to minimize the risk of injuries and fatalities caused by fire-related accidents.

This regulatory pressure compels companies to adopt fire-resistant materials in their operational and safety gear, ensuring worker protection and compliance with safety norms.

Growth in High-Risk Industries

The expansion of high-risk industries such as oil and gas exploration, energy production, and chemical manufacturing directly influences the demand for fire-resistant fabrics. As these industries face inherent fire hazards due to the materials and processes they involve, the need for advanced protective apparel becomes crucial.

This industrial growth not only drives the need for safety equipment but also spurs innovation in developing more effective and comfortable fire-resistant materials.

Technological Advancements in Fabric Manufacturing

Recent technological advancements in textile manufacturing have significantly improved the quality and effectiveness of fire-resistant fabrics. Innovations such as nanotechnology, hybrid materials, and enhanced chemical treatments have resulted in fabrics that offer better protection against fire while maintaining comfort and durability.

These advancements attract a broader range of industries, from aerospace to public safety, looking to enhance the protective gear of their workforce with the latest in fire-resistant technology.

Restraining Factors

High Cost of Fire-Resistant Fabric Production

The production of fire-resistant fabrics involves sophisticated technology and costly raw materials, which significantly increase the final product’s price. This high cost can be a major barrier for small and medium enterprises (SMEs) and developing economies, where budget constraints limit the adoption of advanced safety materials.

As a result, industries in these sectors may opt for less expensive, albeit less effective, alternatives, restraining the broader market growth of high-quality fire-resistant fabrics.

Environmental and Health Concerns Over Chemical Treatments

Chemical treatments used to enhance the fire resistance of fabrics can raise serious environmental and health concerns. The chemicals involved may be toxic, posing risks during manufacturing and disposal, and potentially harming workers and ecosystems.

This has led to regulatory scrutiny and calls for safer, more sustainable alternatives. The pressure to develop eco-friendly fire-resistant fabrics without compromising performance is a significant challenge that can inhibit market growth.

Limited Awareness and Adoption in Emerging Markets

In many emerging markets, there is limited awareness about the benefits of fire-resistant fabrics, coupled with less stringent enforcement of safety regulations. This lack of awareness and regulatory pressure results in lower adoption rates of advanced safety materials, including fire-resistant fabrics.

Efforts to educate industries and improve regulation enforcement are needed to increase the market penetration of these crucial safety products in developing regions.

Growth Opportunity

Expansion into Emerging Markets with Rising Safety Standards

Emerging markets present significant growth opportunities for the fire-resistant fabrics market as safety standards become more stringent in these regions. As developing countries industrialize, there is an increasing demand for improved workplace safety measures, particularly in industries like manufacturing and construction where fire hazards are prevalent.

Companies that tailor their offerings to meet the unique needs and regulatory environments of these growing markets can capture new revenue streams and expand their global footprint.

Innovation in Eco-Friendly Fire-Resistant Materials

The push towards sustainability is driving innovation in eco-friendly fire-resistant materials. There is a growing demand for fabrics that offer fire resistance without harmful environmental impacts, spurred by both regulatory changes and consumer preferences for sustainable products.

Companies that invest in research and development to create non-toxic, recyclable, or biodegradable fire-resistant fabrics will tap into new customer segments and differentiate themselves in a competitive market.

Strategic Collaborations with Industries and Governments

Forming strategic collaborations with various industries and government bodies can open up numerous growth opportunities in the fire-resistant fabrics market. Partnerships with sectors like aerospace, defense, and public safety can drive custom solutions and product innovations tailored to specific needs.

Additionally, collaborating with governments for the development of safety standards and training programs can establish a brand as a leader in safety innovation, fostering trust and increasing market share.

Latest Trends

Integration of Smart Technology into Fire Resistant Fabrics

A leading trend in the fire-resistant fabrics market is the integration of smart technologies. Fabrics are now being embedded with smart sensors and IoT (Internet of Things) capabilities to enhance safety features. These smart fabrics can monitor environmental conditions and the health status of the wearer, providing real-time data and alerts in hazardous situations.

This technology not only improves safety but also adds value by enabling predictive maintenance and personalized safety measures, making protective clothing more interactive and responsive.

Increasing Use of Nanotechnology in Fabric Treatment

The application of nanotechnology in fire-resistant fabrics is a burgeoning trend that offers enhanced protection without sacrificing comfort or flexibility. Nanotechnology allows for the manipulation of fabric at the molecular level, providing superior fire resistance while maintaining or even improving the breathability and softness of the material.

This advancement is particularly appealing in industries where comfort and wearability are critical, such as firefighting and industrial workspaces.

Rise of Hybrid Material Solutions

There is a growing trend towards the development of hybrid materials in fire-resistant fabrics. These materials combine the benefits of inherent and treated fire-resistant fabrics, offering both built-in fire resistance and enhanced protective properties through chemical treatments.

The use of hybrid solutions enables manufacturers to cater to a wider range of applications and meet diverse market needs. This approach not only improves performance but also extends the durability and applicability of fire-resistant fabrics across different environments and conditions.

Regional Analysis

In 2023, the Asia-Pacific Fire Resistant Fabrics Market held a 49.4% share, valued at USD 2.03 billion.

The Fire Resistant Fabrics Market demonstrates significant regional diversity, with Asia-Pacific leading the pack, holding a dominant 49.4% market share valued at USD 2.03 billion. This region’s growth is propelled by rapid industrialization, especially in emerging economies like China and India, coupled with stringent safety regulations across numerous industries.

In North America, the market is driven by advanced technological integration and strict adherence to occupational safety standards, particularly in the oil and gas, chemical, and defense sectors. Europe follows closely, with its market expansion fueled by a strong regulatory framework from the European Union focusing on industrial safety and environmental sustainability.

The Middle East & Africa region shows promising growth potential, driven by the development of oil and gas infrastructure and an increasing focus on workplace safety. Meanwhile, Latin America is gradually catching up, with Brazil and Mexico leading the way as industries there start to adopt more stringent fire safety standards to align with global norms.

Collectively, these regions underscore a global commitment to enhancing fire safety measures, each contributing uniquely to the global market dynamics based on regional industrial activities and regulatory environments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Fire Resistant Fabrics Market has seen significant contributions from key players, each bringing unique strengths and strategies to the forefront. DuPont de Nemours, Inc. remains a leader due to its innovative approach to developing advanced materials like Nomex® and Kevlar®, which are benchmarks in the industry for fire-resistant properties.

The company’s extensive R&D capabilities and global reach allow it to maintain a strong position in various sectors, from industrial safety to defense.

Asahi Kasei Advance Corporation is another prominent player, capitalizing on its expertise in synthetic fibers to produce high-quality fire-resistant fabrics. The company’s focus on integrating sustainability with safety by developing eco-friendly materials has helped it to differentiate itself in a competitive market.

Huntsman Corporation leverages its chemical expertise to enhance the fire resistance of textiles through specialized chemical treatments. Its commitment to innovation is evident in its continuously evolving product lines that meet stringent safety standards across diverse industries.

Arvind Limited and Kaneka Corporation have focused on expanding their product portfolio and geographical footprint. Arvind Limited, with its deep market penetration in Asia, focuses on cost-effective yet reliable solutions, whereas Kaneka emphasizes the enhancement of material properties through high-performance polymer technologies.

Glen Raven, Inc., known for its technical textiles, continues to innovate with materials that offer durability and fire resistance, catering especially to outdoor and protective markets.

Smaller regional players like Henan Fireman Textile Co., Ltd. and Gunei Chemical Industry Co., Ltd. focus on niche markets, providing specialized solutions that cater to local needs and regulations, which is crucial for maintaining relevance in regional segments of the market.

Overall, the landscape in 2023 is highly competitive, with companies constantly striving to balance cost, performance, and environmental impact, while aligning with global safety standards to drive growth in the Fire Resistant Fabrics Market.

Top Key Players in the Market

- Arvind Limited

- Asahi Kasei Advance Corporation

- Auburn Manufacturing, Inc.

- DuPont de Nemours, Inc.

- Glen Raven, Inc.

- Gun El Chemical Industry Co., Ltd.

- Gunei Chemical Industry Co., Ltd.

- Henan Fireman Textile Co., Ltd.

- Huntsman Corporation

- Kaneka Corporation

- KERMEL

- Koninklijke Ten Cate bv

- L. Gore Associates Inc.

- Lenzing Ag

- LENZING AG

- Marina Textiles Inc.

- Mount Vernon Mills

- Newtex Industries, Inc.

- Norfab Corporation

- PBI Performance Products Inc.

- Royal TenCate N.V.

- Solvay S.A.

- Taiwan K.K. Corp

- Teijin Ltd.

- Tex Tech Industries

- W. L. Gore & Associates, Inc.

- Westex By Milliken

Recent Developments

- In 2023, Arvind Limited continued to lead in the Fire Resistant Fabrics sector through its Advanced Materials Division, which focuses on producing specialty fabrics including fire-retardant materials. The company’s dedication to innovation is evident in its technological advancements and partnerships, such as the exclusive license to manufacture NOMEX-branded fabrics in India.

- In 2023, Auburn Manufacturing, Inc. (AMI) continues to be a leader in the production of high-performance textiles for extreme temperature applications. The company is recognized for its capabilities to engineer and produce a wide array of standard and specialized textiles that withstand temperatures ranging from 225°F to 3000°F.

Report Scope

Report Features Description Market Value (2023) USD 4.1 Billion Forecast Revenue (2033) USD 7.4 Billion CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Treated, Inherent), By Application (Apparel, Non-Apparel), By End-Use (Industrial, Defense and public safety Services, Transportation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Arvind Limited, Asahi Kasei Advance Corporation, Auburn Manufacturing, Inc., DuPont de Nemours, Inc., Glen Raven, Inc., Gun El Chemical Industry Co., Ltd., Gunei Chemical Industry Co., Ltd., Henan Fireman Textile Co., Ltd., Huntsman Corporation, Kaneka Corporation, KERMEL, Koninklijke Ten Cate bv, L. Gore Associates Inc., Lenzing Ag, LENZING AG, Marina Textiles Inc., Mount Vernon Mills, Newtex Industries, Inc., Norfab Corporation, PBI Performance Products Inc., Royal TenCate N.V., Solvay S.A., Taiwan K.K. Corp, Teijin Ltd., Tex Tech Industries, W. L. Gore & Associates, Inc., Westex By Milliken Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fire Resistant Fabrics MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Fire Resistant Fabrics MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Arvind Limited

- Asahi Kasei Advance Corporation

- Auburn Manufacturing, Inc.

- DuPont de Nemours, Inc.

- Glen Raven, Inc.

- Gun El Chemical Industry Co., Ltd.

- Gunei Chemical Industry Co., Ltd.

- Henan Fireman Textile Co., Ltd.

- Huntsman Corporation

- Kaneka Corporation

- KERMEL

- Koninklijke Ten Cate bv

- L. Gore Associates Inc.

- Lenzing Ag

- LENZING AG

- Marina Textiles Inc.

- Mount Vernon Mills

- Newtex Industries, Inc.

- Norfab Corporation

- PBI Performance Products Inc.

- Royal TenCate N.V.

- Solvay S.A.

- Taiwan K.K. Corp

- Teijin Ltd.

- Tex Tech Industries

- W. L. Gore & Associates, Inc.

- Westex By Milliken