Global Hydrogen Fluoride Market By Source (Natural Fluorite, and Synthetic), By Product Form (Anhydrous, and Aqueous), By Application (Refrigerants, Pharmaceuticals, Herbicides, Aluminum, Electrical Components, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 112760

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

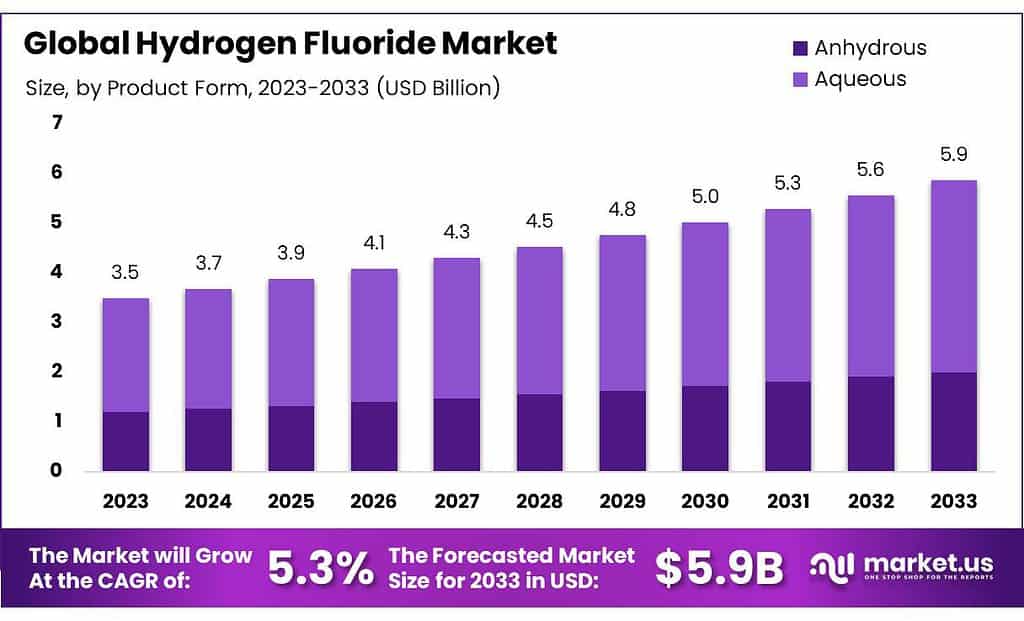

The global Hydrogen Fluoride Market size is expected to be worth around USD 5.9 billion by 2033, from USD 3.5 billion in 2023, growing at a CAGR of 5.3% during the forecast period from 2023 to 2033.

Hydrogen fluoride (HF) is a chemical compound consisting of hydrogen and fluorine. It is a colorless gas or liquid that is highly corrosive and toxic, commonly used in industrial applications. The growth of the market can be attributed to the expanding demand in several key industries, notably in the production of refrigerants and aluminum.

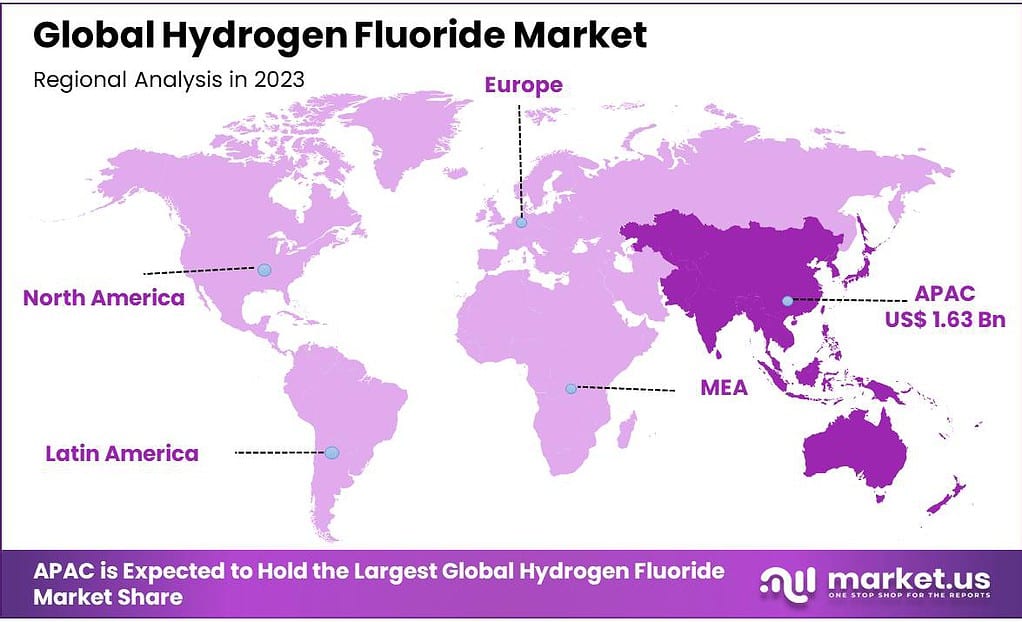

Regionally, Asia-Pacific holds a dominant position in the hydrogen fluoride market, attributed to the rapid industrialization and growth of the manufacturing sector in countries such as China and India. North America and Europe also represent significant markets, although their growth is moderated by stringent environmental regulations.

Furthermore, advancements in technology and the development of safer handling and transportation methods are likely to offer new opportunities for market expansion.

Key Takeaways

- In 2023, the global hydrogen fluoride market was valued at US$ 3.5 Billion and is expected to register a CAGR of 5.3% during the forecast period.

- By source, the synthetic held a major market share of 78.5% in 2023.

- By product form, the aqueous segment dominated the global market with a 65.8% market share in 2023.

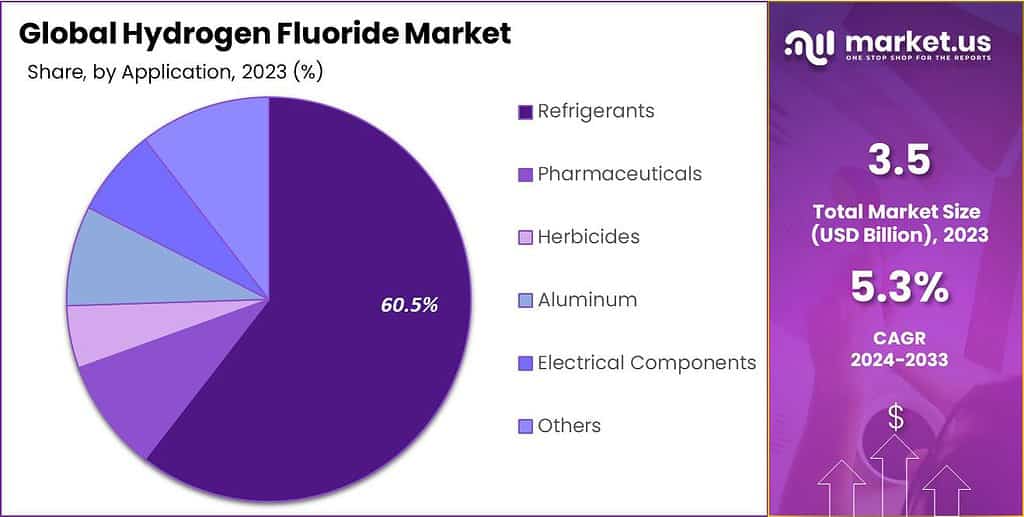

- By application, in 2023, refrigerants held a significant revenue share of 60.5%.

- In 2023, Asia Pacific dominated the market with the highest revenue share of 46.5%.

- China stands as the foremost global exporter of hydrogen fluoride, having exported more than 272 thousand metric tons of the chemical in 2021, equating to an estimated value of around 423 million U.S. dollars.

Actual Numbers Might Vary in the Final Report

By Source Analysis

The Synthetic Segment Held The Largest Market Share in 2023

Based on the source, the market for hydrogen fluoride is segmented into natural fluorite and synthetic. Among both, the synthetic segment was the most lucrative in the global hydrogen fluoride market, with a market share of 78.5% in 2023. Synthetic hydrogen fluoride is manufactured using controlled chemical processes, ensuring consistent quality and high purity levels.

This makes it highly desirable for industries requiring precise and consistent chemical properties in their products, such as electronics and semiconductors. Synthetic hydrogen fluoride typically has lower impurity levels compared to natural fluorite-derived HF.

Low impurity levels are crucial in industries such as semiconductor manufacturing, where even minor impurities can affect the performance of electronic components. Advances in chemical engineering and manufacturing technologies have improved the efficiency and cost-effectiveness of synthetic HF production.

This has made synthetic HF more competitive in terms of pricing while maintaining high-quality standards. The synthetic segment of the hydrogen fluoride market holds a dominant position due to its consistent quality, customization capabilities, low impurities, reliable supply, reduced environmental impact, advanced manufacturing technologies, diverse applications, and global availability.

By Product Form Analysis

Aqueous Hydrogen Fluoride Is Widely Used In Various Industries Due To Its Versatility

By product form, the global hydrogen fluoride can be further categorized into anhydrous and aqueous. The aqueous form dominated the market with a significant share of 65.8% in 2022. Aqueous hydrogen fluoride is widely used in various industries due to its versatility. It finds applications in etching and cleaning processes in the semiconductor industry, in the production of aluminum and its alloys, in glass etching for decorative purposes, and as an industrial cleaning agent.

Its broad range of applications contributes to its dominant market position. In some regions, regulatory requirements and safety standards favor the use of aqueous hydrogen fluoride, especially in applications where the risks associated with anhydrous HF are a concern. Compliance with these regulations can drive the preference for the aqueous form.

Aqueous hydrogen fluoride can often be more cost-effective than the anhydrous form. This cost advantage makes it an attractive choice for industries that require HF for various processes. Certain industrial processes require the use of aqueous HF due to its compatibility with specific materials or substrates. For instance, in the semiconductor industry, aqueous HF is often used for silicon wafer cleaning due to its effectiveness and safety.

By Application Analysis

Refrigerants Dominate The Hydrogen Fluoride Market Owing To Their Integral Role In Cooling And Air Conditioning Systems Across Various Industries

By application, the market is further segmented as, refrigerants, pharmaceuticals, herbicides, aluminum, electrical components, and others. The refrigerants dominated the hydrogen fluoride market with a noteworthy revenue share of 60.5%. Refrigerants, which are chemicals used in cooling and air conditioning systems, have extensive applications across various industries. These systems are essential for maintaining comfortable indoor temperatures in homes, commercial buildings, and vehicles. As a result, there is a consistent and high demand for refrigerants.

The HVAC (Heating, Ventilation, and Air Conditioning) and refrigeration industry has been experiencing significant growth, driven by factors such as increasing urbanization, rising temperatures, and the expansion of the retail and food industries. This growth directly correlates with the demand for refrigerants.

The automotive industry is a major consumer of refrigerants, particularly for air conditioning systems in vehicles. As the automotive industry continues to expand globally, the demand for refrigerants used in vehicle air conditioning systems also rises. The commercial refrigeration sector, including supermarkets, convenience stores, and cold storage facilities, relies heavily on refrigerants to maintain the freshness and safety of perishable goods.

As the food retail industry expands to meet the growing demand for convenience, the use of refrigerants remains essential. The increasing emphasis on energy efficiency, environmental regulations, and the growth of industries reliant on cooling systems contribute to the sustained demand for refrigerants in the market.

Actual Numbers Might Vary in the Final Report

Key Market Segmentation

Based on Source

- Natural Fluorite

- Synthetic

Based on the Product Form

- Anhydrous

- Aqueous

Based on Application

- Refrigerants

- Pharmaceuticals

- Herbicides

- Aluminum

- Electrical Components

- Others

- Others

Driving Factors

Rapid Growth In The Semiconductor Industry Is Propelling The Market Revenue Growth Of Hydrogen Fluoride

The burgeoning semiconductor industry is a significant driver for the global hydrogen fluoride market. Hydrogen fluoride is a critical etching and cleaning agent in the production of semiconductors and electronic components. In Asia-Pacific, countries such as South Korea, Taiwan, and China, are prominent hubs for semiconductor manufacturing. This regional market dynamic significantly contributes to the global demand for hydrogen fluoride.

Additionally, the United States and parts of Europe, with their advanced technological sectors, also contribute to the sustained demand. With the rapid growth in consumer electronics, telecommunications, and information technology sectors, the demand for semiconductors has escalated. This surge propels the demand for high-purity hydrogen fluoride, particularly in regions with a robust electronics manufacturing base.

The ongoing advancements in technology and the increasing demand for sophisticated electronic devices continue to stimulate market growth. Technological advancements in semiconductor manufacturing, such as the development of smaller and more efficient chips, necessitate the use of highly pure hydrogen fluoride. The trend towards miniaturization and the increasing complexity of semiconductor devices amplify the need for precise and efficient manufacturing processes, where the role of hydrogen fluoride becomes even more critical.

Restraining Factors

Environmental And Health Regulations Represent A Significant Restraint, Impacting Market Dynamics And Influencing Strategic Decisions Of Stakeholders.

Hydrogen fluoride (HF) is recognized for its high toxicity and corrosive nature, posing substantial environmental and health risks. Exposure to HF can lead to severe health issues, including respiratory problems, skin burns, and, in extreme cases, fatalities. Due to its hazardous properties, hydrogen fluoride is subject to stringent regulations globally, governing its production, handling, storage, transportation, and disposal.

The intensity and impact of these regulations vary geographically. Regions such as the European Union and North America have particularly strict regulations regarding the handling of hazardous chemicals, including HF. These regions demand rigorous compliance with environmental standards, which can act as a barrier to market entry or expansion for hydrogen fluoride producers.

Conversely, in some developing regions, where regulations might be less stringent, the risks associated with HF are still a concern, but the regulatory impact on the market might be comparatively lower.

The regulatory landscape for hydrogen fluoride is characterized by diverse and often stringent measures aimed at safeguarding public health and the environment. These regulations, while necessary for safety, impose additional operational costs on manufacturers and suppliers. Compliance with these regulations requires significant investment in safety equipment, training, transportation protocols, and disposal methods. Such investments can increase the cost of hydrogen fluoride, subsequently affecting its market price and demand.

Growth Opportunities

The Development Of Alternative Fluorine Sources Presents A Substantial Opportunity.

A significant opportunity in the hydrogen fluoride market lies in the development and commercialization of alternative fluorine sources. There is a growing interest in developing technologies that can produce fluorine or fluoride compounds through less hazardous and more environmentally friendly processes.

Innovations in this area could potentially reduce the reliance on traditional hydrogen fluoride, especially in applications where its use poses significant health or environmental risks. This shift not only aligns with global sustainability goals but also opens new market segments, catering to industries seeking greener alternatives. Companies investing in such technologies may find themselves at a competitive advantage in a market increasingly driven by environmental considerations.

The advent of alternative fluorine sources has the potential to transform the hydrogen fluoride market significantly. For industries reliant on fluorine, such as semiconductor manufacturing, pharmaceuticals, and refrigerants, these alternatives offer a way to mitigate the risks and regulatory challenges associated with HF. This can lead to a shift in market preferences, opening new segments and opportunities for companies that invest in these technologies.

Latest Trends

Increased Demand for Fluoropolymers and Refrigerants

A significant trend in the HF market is the growing demand for fluoropolymers and refrigerants. Fluoropolymers, known for their high-performance properties, are increasingly used in various industries, including automotive, aerospace, and electronics. This surge is directly impacting the demand for HF, as it is a key raw material in the production of fluoropolymers.

Similarly, the refrigerant industry, particularly for air conditioning and refrigeration, continues to demand HF for the production of hydrofluorocarbons and hydrochlorofluorocarbons. This trend is particularly pronounced in developing regions with rising urbanization and industrialization.

Technological Advancements in HF Production

Advancements in production technology represent a significant trend in the HF market. Companies are increasingly adopting innovative manufacturing processes to enhance efficiency, reduce environmental impact, and comply with stringent regulations.

These advancements include improved methods for anhydrous HF production, waste minimization techniques, and the development of more sustainable and safer production facilities. Such technological shifts are essential in maintaining competitiveness and aligning with global environmental and safety standards.

The focus on green chemistry and sustainable industrial practices is encouraging research and investment in alternative methods of fluorine production, potentially transforming the market landscape.

Shift Towards High-Purity HF in Electronics and Semiconductor Industries

The electronics and semiconductor industries are increasingly demanding high-purity HF, a trend driven by the need for precision and quality in manufacturing processes. High-purity HF is crucial in cleaning and etching processes in semiconductor fabrication, where even minor impurities can significantly impact product quality. This trend is influencing market players to focus on producing higher grades of HF, catering to the specific needs of these high-tech industries.

Geopolitics and Recession Impact Analysis

The global tension between countries has had a discernible impact on the global hydrogen fluoride (HF) market, affecting various facets of the industry. The conflict disrupted the chances of a global economic recovery from the COVID-19 pandemic, at least in the short term, and has led to economic sanctions on multiple countries, a surge in commodity prices, and supply chain disruptions.

These factors have influenced several markets across the globe, including the hydrofluoric acid market. Geopolitical developments often result in the imposition of trade policies and sanctions, which can directly impact the HF market. For instance, restrictions on trade with key HF-producing countries can lead to a supply shortfall, impacting global market prices and availability. Economic recessions typically result in reduced industrial activity.

As HF is predominantly used in industrial applications such as semiconductor manufacturing, fluoropolymer production, and aluminum smelting, a downturn in these industries due to a recession would lead to a decreased demand for HF. Specifically, the hydrofluoric acid market has experienced challenges due to these geopolitical tensions. The supply chain disruptions caused by the conflict have impacted the availability and cost of raw materials necessary for HF production.

Economic sanctions and increased commodity prices further exacerbate these challenges, potentially leading to increased production costs and pricing pressures in the HF market. Additionally, the overall uncertainty and instability caused by such a significant geopolitical event can lead to a cautious approach among investors and market players, possibly slowing down growth or expansion plans in the industry.

Despite these challenges, the hydrofluoric acid market is expected to continue growing, albeit at a modest pace. This growth is driven by the persistent demand for HF in its key application areas, such as in the production of refrigerants, herbicides, pharmaceuticals, high-octane gasoline, aluminum, plastics, electrical components, and fluorescent light bulbs. The market’s resilience can be attributed to the essential nature of these applications in various industries, underscoring the fundamental role HF plays in modern industrial processes.

Regional Analysis

Owing to the Rapid Growth Of Chemical Industries Across The Region, The Asia Pacific Dominates The Global Market.

In 2023, Asia Pacific held a significant position in the global hydrogen fluoride market, with around 46.5% owing to a constant growth of consumer goods and chemical industries across the region. The consumer goods industry, including the electronics and automotive sectors, is rapidly growing in the region.

This growth drives the demand for fluorine chemicals used in metal extraction, metallurgical applications, and the manufacturing of various consumer products. China, a key country in the Asia Pacific region, is the world’s largest producer of acid-grade fluorspar, the main raw material used for the production of anhydrous hydrogen fluoride.

This abundant availability of raw materials supports the region’s dominant position in the hydrogen fluoride market. There’s a surged demand for fluorine chemicals in the region, used in several industrial applications including refrigeration, air conditioning systems, and in the production of fluoropolymers and fluorogases.

China has become a major refrigerant manufacturer, largely due to inexpensive feedstocks derived from its extensive fluorspar mining operations. The rise in Chinese bulk refrigerant manufacturing has paralleled an increase in refrigeration and air-conditioning equipment production. These factors collectively contribute to Asia Pacific’s significant role in the global hydrogen fluoride market, driven by robust industrial growth, abundant raw material availability, and increasing demand across various industrial applications.

Actual Numbers Might Vary in the Final Report

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- India

- Japan

- South Korea

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Key Players Analysis

Key players in the global hydrogen fluoride market include Solvay, Honeywell International, Inc., Stella Chemifa Corp., Arkema Group, Lanxess AG, etc. Companies may invest in expanding their production facilities to increase output and meet growing demand. This often involves upgrading existing plants or constructing new ones, especially in regions with high demand.

Investing in research and development to improve production processes and develop new applications for hydrogen fluoride. This could include more efficient manufacturing techniques or innovations that reduce environmental impact. Leading companies are focusing on their research & development.

Investment in R&D is crucial for companies in the hydrogen fluoride market. This includes developing new and improved production methods, focusing on environmental sustainability, and creating high-purity grades of hydrogen fluoride for specialized applications.

Market Key Players

- Solvay

- Honeywell International, Inc.

- Stella Chemifa Corp

- Arkema Group

- Lanxess AG

- Navin Fluorine International Limited

- Foosung Co Ltd

- Fluorchemie Dohna GmbH

- Orbia

- Derivados Del Fluor

- Sinochem Lantian Co., Ltd.

- Fluorsid S.p.A.

- Other Key Players

Recent Developments

- In April 2021, EcoGraf announced its acquisition of a contract for the establishment of a battery anode materials facility designed for the production of spherical graphite. Importantly, this facility is located outside of China and incorporates an environmentally friendly alternative to traditional hydrofluoric acid purification processes.

- In April 2021, Renascor Resources explored green finance alternatives for its Savior Battery Anode Material Project in South Australia. This project aims to facilitate the production of materials intended for electric vehicle manufacturing facilities, employing vertical integration strategies as part of its approach.

- On June 3, 2020, Arkema announced an innovative collaboration with Nutrien Ltd. in the United States to provide anhydrous hydrogen fluoride, the primary essential component for fluoropolymers and fluorogases. Arkema invested US$ 150 million in a 40 kt/year AHF production plant which is located at Nutrien’s site.

Report Scope

Report Features Description Market Value (2023) US$ 3.5 Bn Forecast Revenue (2033) US$ 5.9 Bn CAGR (2024-2033) 5.3 % Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source (Natural Fluorite, and Synthetic), By Product Form (Anhydrous, and Aqueous), By Application (Refrigerants, Pharmaceuticals, Herbicides, Aluminum, Electrical Components, and Others) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape Solvay, Honeywell International Inc., Stella Chemifa Corp, Arkema Group, Lanxess AG, Navin Fluorine International Limited, Foosung Co Ltd, Fluorchemie Dohna GmbH, Orbia, Derivados Del Fluor, Sinochem Lantian Co., Ltd., and Fluorsid S.p.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Hydrogen Fluoride Market?Hydrogen Fluoride Market size is expected to be worth around USD 5.9 billion by 2033, from USD 3.5 billion in 2023

What CAGR is projected for the Hydrogen Fluoride Market?The Hydrogen Fluoride Market is expected to grow at 5.3% CAGR (2024-2033).Name the major industry players in the Hydrogen Fluoride Market?Solvay, Honeywell International, Inc., Stella Chemifa Corp, Arkema Group, Lanxess AG, Navin Fluorine International Limited, Foosung Co Ltd, Fluorchemie Dohna GmbH, Orbia, Derivados Del Fluor, Sinochem Lantian Co., Ltd., Fluorsid S.p.A., Other Key Players

-

-

- Solvay

- Honeywell International, Inc.

- Stella Chemifa Corp

- Arkema Group

- Lanxess AG

- Navin Fluorine International Limited

- Foosung Co Ltd

- Fluorchemie Dohna GmbH

- Orbia

- Derivados Del Fluor

- Sinochem Lantian Co., Ltd.

- Fluorsid S.p.A.

- Other Key Players