Global Biodiesel Market By Feedstock (Vegetable Oils and Animal Fats), By Application (Fuel, Marine, Automotive, Power Generation, Agriculture, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 18999

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

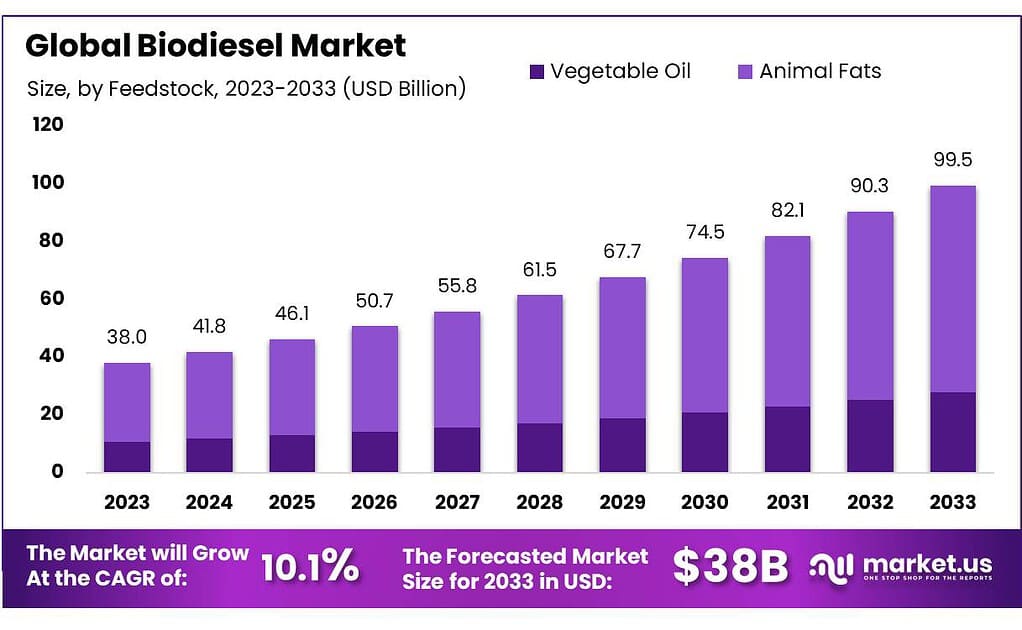

The global biodiesel market size is expected to be worth around USD 101.6 billion by 2033, from USD 38.8 billion in 2023, growing at a CAGR of 10.1% during the forecast period from 2023 to 2033.

Biodiesel substitute fuels are renewable and clean-burning alternatives that can be easily integrated into existing diesel engines without modifications. Biodiesel alternatives come from various sources including vegetable oils, animal fats, and agricultural feedstock – making the transition an economical one!

Biodiesel market growth will likely be driven by its increasing use as an alternative fuel in power generation and automotive applications, coupled with numerous dealers and suppliers in its marketplace, rendering its development highly fragmented.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Size: It is expected that by 2033 the global biodiesel market will experience rapid expansion to reach USD 101.6 billion – representing an incredible leap forward from USD 38.8 billion recorded as of 2023. Compound annual growth from 2023-2033 should average 10.1% CAGR.

- Biodiesel Is A Sustainable Fuel: Biodiesel provides an eco-friendly and cost-efficient fuel alternative that can easily fit into existing diesel engines without modifications.

Biodiesel production relies on various feedstocks such as vegetable oils, animal fats and agricultural sources for its creation. - Feedstock Analysis: In 2023, vegetable oil dominated the market, constituting over 72% of the share. Palm oil, especially from Indonesia and Thailand, is expected to be a major feedstock, with these countries contributing over 80% to its production.

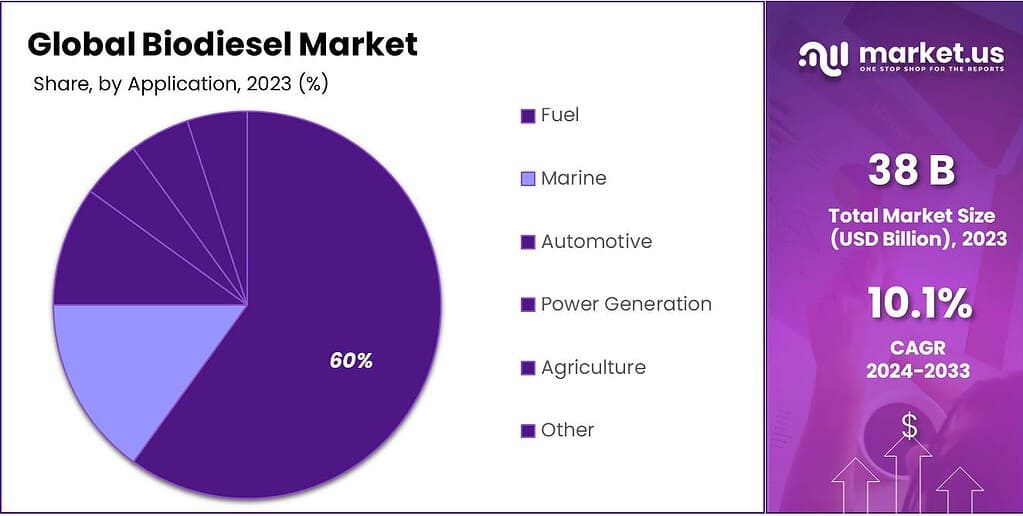

- Application Trends: Fuel applications commanded a significant share in 2023, capturing more than 60% of the market. Biodiesel’s role in the marine sector is projected to grow substantially, driven by its eco-friendly nature and lower emissions of Volatile Organic Compounds (VOCs).

- Drivers of Market Growth: The potential to reduce emissions is a major driver, as biodiesel emits fewer greenhouse gases compared to traditional fossil fuels, contributing to global efforts to combat climate change Government initiatives worldwide to adopt renewable power sources and the eco-friendly nature of biodiesel are significant growth drivers.

- Opportunities and Government Support: OEM support for biodiesel is increasing, with major automotive companies extending warranties for vehicles using biodiesel blends. Government initiatives in countries like Germany and France mandate specific biodiesel blends for vehicles, propelling the expansion of biodiesel in automotive applications.

- Challenges Faced: Performance concerns include issues like water separation, fuel foaming, and potential damage to engines, particularly in modern direct injection engines. The availability of raw materials in emerging regions has led to overcapacity, resulting in a surplus of biodiesel production and triggering a price war in local markets.

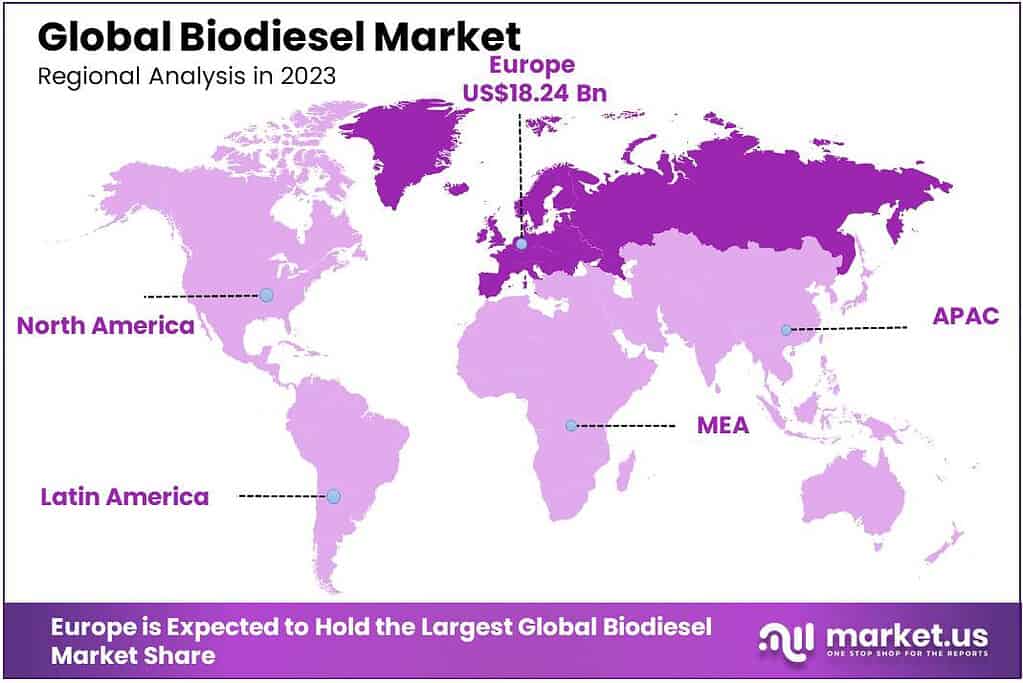

- Regional Dynamics: Europe, historically the largest market, represented 48% of the global market share in 2023. Asia Pacific is expected to experience substantial growth, with Thailand emerging as one of the fastest-growing countries due to a rising demand for diesel-powered vehicles.

- Key Players and Industry Competitiveness: The industry boasts a competitive landscape with the presence of large manufacturers such as Ag Processing, Inc., Archer Daniels Midland Company (ADM), and Cargill, Inc.

Feedstock Analysis

In 2023, vegetable oil took the lead in the feedstock analysis, grabbing over 72% of the market share. This means it was the most used ingredient in making things.

Vegetable oil was the largest contributor to revenue share in 2023, though feedstock availability and costs may differ according to location. Palm oil has proven popular as a biodiesel production material in countries like Indonesia and Thailand.

Indonesia and Thailand dominated palm oil production, accounting for more than 80 percent of total production and producing most of what European nations used as feedstock imports from Asian nations for biofuel production.

Application Analysis

Fuel application held a significant revenue share in 2023. As it emits less volatile organic compounds (VOCs) than diesel, this fuel will bring many advantages to the industry.

Fuel applications led the analysis, accounting for more than 60% of the market share. This meant that when people used these things most of the time it was related to fuel.

This product will be utilized by marine industry applications and grow at an impressive compound annual growth rate over its forecast period. Furthermore, increased agricultural mechanization will drive an uptick in demand for this product throughout this time frame.

Governments worldwide are taking measures to decrease GHG emissions by adopting renewable power sources like solar. Demand is expected to surge at an exponential compound annual growth rate from 2023-2032.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

By Feedstock

- Vegetable Oil

- Soybean Oil

- Canola Oil

- Corn Oil

- Palm Oil

- Other Vegetable Oils

- Animal Fats

- Poultry

- White Grease

- Tallow

- Other Animal Fats

By Application

- Fuel

- Marine

- Automotive

- Power Generation

- Agriculture

- Other Applications

Drivers

Potential to reduce emissions

Biodiesel is easy to use, breaks down naturally, and is not harmful, plus it’s free of aromatic and sulfur compounds. It’s eco-friendly, emitting fewer greenhouse gases and pollutants while cutting down toxic carbon-based emissions. The rising worry about greenhouse gas emissions from fossil fuels is pushing the biodiesel market forward. Compared to regular diesel, biodiesel slashes greenhouse gas emissions by up to 50% and contains fewer toxic and cancer-causing carbon elements.

In 2015, the U.S. used about 2 billion gallons of biodiesel, lowering carbon emissions by at least 18.2 million metric tons, says the latest data from the U.S. EPA. Many countries making biodiesel at home are relying less on foreign oil, and it’s easy to use in diesel engines with minimal or no adjustments. With the cost of petroleum-based products going up and down, biodiesel is becoming a more wallet-friendly choice.

Restraints

Performance concerns

Switching from regular fuels to biodiesel blends is seen as crucial for both social and environmental reasons, but there are potential issues when using them in vehicles. One problem is the higher chances of water separation and fuel foaming compared to using just regular fuels. Additionally, blending with less stable biodiesel might cause more injector deposits and corrosion due to the creation of low-molecular-weight acids.

There have been complaints from original equipment manufacturers (OEMs) and fuel injection equipment makers about this kind of damage happening in real-world use. Moreover, using poor-quality biodiesel blends has led to a noticeable loss of power in modern direct injection engines. To tackle these issues, a helpful diesel fuel additive, commonly known as flow improvers, can be used to prevent such problems.

Opportunities

OEM support for biodiesel continues to grow

German automotive giants DaimlerChrysler, Volkswagen, and Mercedes Benz are backing biodiesel by extending warranties for vehicles using this fuel. DaimlerChrysler, for instance, plans to boost engine warranty coverage for vehicles using a 20% biodiesel blend. This move is giving a significant push to the growth of biodiesel in automotive applications.

Moreover, the U.S. Department of Defense, the largest oil consumer globally, is shifting most of its on-road fleets to biodiesel blends. Several state governments, including those in Carolina and North Dakota, are following this lead. In certain European countries like Germany and France, government regulations mandate vehicles to run on specific biodiesel blends (ranging from 5% to 10%). These government initiatives are further propelling the expansion of biodiesel in automotive applications.

Challenges

Easy availability of raw materials in emerging regions leading to overcapacity

The primary ingredients used to produce biodiesel are palm oil, animal tallow, soy oil, palm kernel oil, and coconut oil. These raw materials are abundantly produced in the emerging regions of the Asia-Pacific. Unlike the mature markets in North America and Europe, the biodiesel market in the Asia-Pacific is in a growing phase, prompting manufacturers to shift their focus to this region. The easy availability of raw materials is a key factor driving the growth of the Asia-Pacific market, leading major global players to concentrate on relocating biodiesel production to these emerging areas.

The ample availability of raw materials in developing regions has reduced entry barriers for manufacturers. Consequently, many small, medium, and large manufacturers have entered both the biodiesel and its feedstock markets, resulting in an oversupply. To balance the excess production and demand, surplus biodiesel is being exported, triggering a price war in local markets. This represents a significant challenge faced by the biodiesel market.

Regional Analysis

Europe represented 48% of the global market share in 2023. Because of its acceptance of the product early in the region and the government’s emphasis on replacing carbon-emitting sources with bio-based, it has historically been the largest market.

Biodiesel is made from the most popular feedstock in Europe. Germany accounts for the largest share of European countries’ feedstock production. This is why the region has a high product demand.

The expected rise in regional consumption is expected to fuel the overall market growth during the forecast period. Asia Pacific is expected to see a substantial CAGR from 2023 through 2032. Thailand is expected to be one of the fastest-growing countries, with a growing demand for diesel-powered vehicles in the region.

Production is expected to increase which will in turn propel market growth for the forecast period. But, palm oil is also used by the food industry which will limit the market growth. Market growth will be driven by government initiatives to promote green fuels and less dependence on crude oil.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The strong presence of large manufacturers makes the industry highly competitive. Ports are near the production sites of these companies, which makes it possible to deliver fuel efficiently.

This has resulted in lower transportation costs, which should increase profit margins for participants over the period. In order to sustain their market presence, existing producers are expected to finance the expansion of their production capabilities and geographic reach.

Key Market Players

- Ag Processing, Inc.

- Archer Daniels Midland Company (ADM)

- Bunge Ltd.

- Cargill, Inc.

- Ecodiesel Colombia S.A.

- FutureFuel Corp.

- Manuelita S.A.

- Renewable Biofuels, Inc.

- TerraVia Holdings, Inc.

- Wilmar International Ltd.

Recent Development

- In December 2021, LRE Petroleum received a letter of intent (LOI) from Indian Oil to set up a biodiesel manufacturing plant in India. The plant is in Karnataka and can produce 4 million L of biodiesel (B-100) annually.

- In November 2022, Neste announced plans to invest €1.4 billion to build a new biodiesel refinery in Rotterdam, Netherlands. The refinery will have a production capacity of 1.1 million tonnes of biodiesel per year and is expected to be operational in 2025.

- In October 2022, the US Environmental Protection Agency (EPA) proposed to increase the biodiesel blending requirement under the RFS from 5% to 6% in 2024. This would increase the demand for biodiesel in the US by an estimated 1.2 billion gallons per year.

Report Scope

Report Features Description Market Value (2022) USD 38.8 Bn Forecast Revenue (2032) USD 101.6 Bn CAGR (2023-2032) 10.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Company Profiles, Recent Developments Segments Covered By Feedstock (Vegetable Oils and Animal Fats), By Application (Fuel, Marine, Automotive, Power Generation, Agriculture, and Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Ag Processing, Inc., Archer Daniels Midland Company (ADM), Bunge Ltd., Cargill, Inc., Eco diesel Colombia S.A., FutureFuel Corp., Manuelita S.A., Renewable Biofuels, Inc., TerraVia Holdings, Inc., Wilmar International Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). Frequently Asked Questions (FAQ)

What is the Size of biodiesel market?biodiesel market size is expected to be worth around USD 101.6 billion by 2033, from USD 38.8 billion in 2023.

What is the CAGR of Biodiesel Market?The global Biodiesel Market is growing at a CAGR of 10.1% during the forecast period 2022 to 2033.Who are the major players operating in the Biodiesel Market?Ag Processing, Inc., Archer Daniels Midland Company (ADM), Bunge Ltd., Cargill, Inc., Ecodiesel Colombia S.A., FutureFuel Corp., Manuelita S.A., Renewable Biofuels, Inc., TerraVia Holdings, Inc., Wilmar International Ltd.

-

-

Ag Processing, Inc. Archer Daniels Midland Company (ADM) Bunge Ltd. Cargill, Inc. Ecodiesel Colombia S.A. FutureFuel Corp. Manuelita S.A. Renewable Biofuels, Inc. TerraVia Holdings, Inc. Wilmar International Ltd.