Global Ammonium Carbonate Market By Product Grade (Food Grade, Pharmaceutical Grade, Chemical Grade), By Product Type (Powder, Lumps), By Application (Pharmaceutical Ingredients, Food and Beverages Ingredients, Foaming Agent, Others), By End-use Industry (Pharmaceutical, Cosmetics and Personal Care, Food and Beverage, Textile, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133868

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

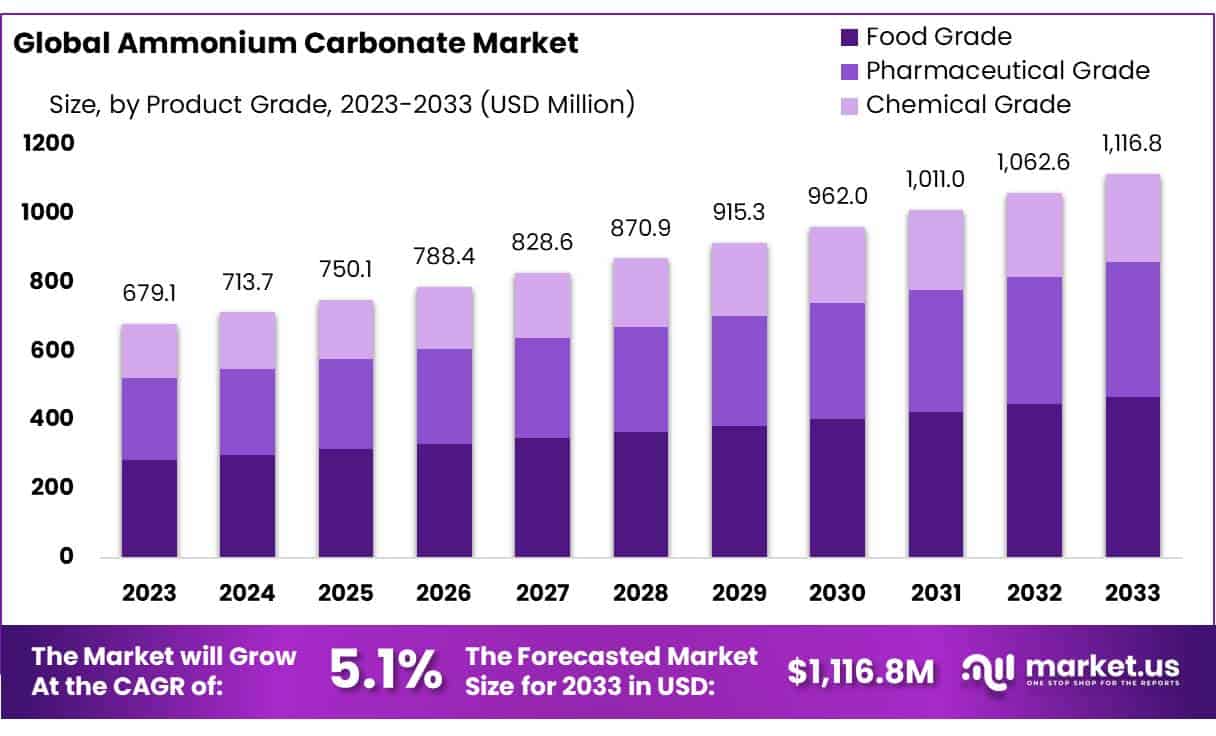

The Global Ammonium Carbonate Market size is expected to be worth around USD 1116.8 Mn by 2033, from USD 679.1 Mn in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

The ammonium carbonate market involves the production, distribution, and use of ammonium carbonate, an inorganic compound used in various industries. It is commonly employed as a leavening agent in baking, a cleaning agent in personal care products, and a neutralizing agent in pharmaceuticals. The compound’s versatility extends to agricultural practices and wine production, with notable growth observed in regions like Chile.

In pharmaceuticals, ammonium carbonate plays a crucial role, particularly in food and pharma-grade applications, where it contributes about 75.8% of the market share. The compound is often used as an excipient in drug formulations, which enhances its demand within the industry.

The food industry’s increasing demand for processed foods further drives the market, with a rising preference for ammonium carbonate as an alternative to traditional baking powders.

On the global trade front, ammonium carbonate imports saw a notable shift. In 2023, Ukraine led imports with 6,118 shipments, followed by India (1,000 shipments) and Vietnam (804 shipments). However, a sharp decline in imports was observed in February 2024, where global shipments fell by 79% compared to February 2023 and by 70% from January 2024. This decline points to potential seasonal or market-related fluctuations in demand.

Government regulations also play a significant role in shaping the market. In India, the Food Safety and Standards Authority of India (FSSAI) monitors the use of ammonium carbonate as a food additive to ensure its safety.

Additionally, China recently updated its National Food Safety Standard for ammonium carbonate, which outlines specific technical requirements and testing methods. These regulatory developments indicate a growing focus on ensuring product safety and quality in the global market.

Key Takeaways

- Ammonium Carbonate Market size is expected to be worth around USD 1116.8 Mn by 2033, from USD 679.1 Mn in 2023, growing at a CAGR of 5.1%.

- Food Grade held a dominant market position, capturing more than a 42.2% share.

- Powder held a dominant market position, capturing more than a 72.2% share of the global ammonium carbonate market.

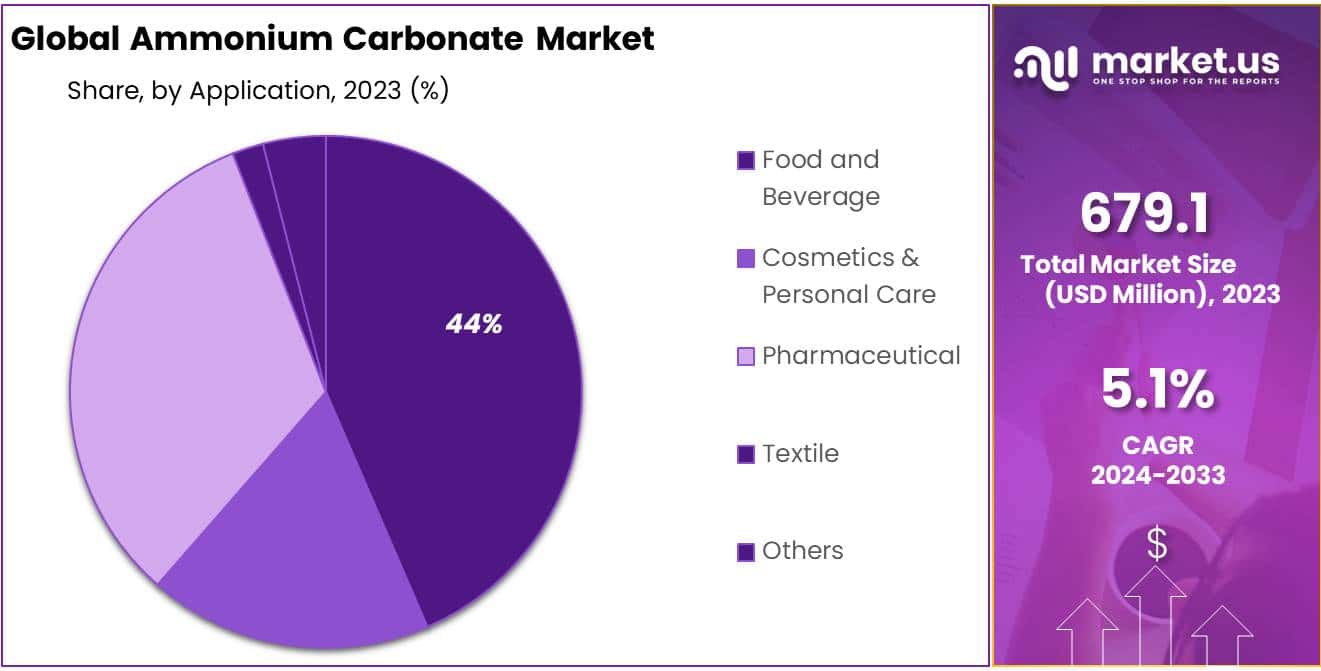

- Food and Beverage Ingredients held a dominant market position, capturing more than a 43.3% share.

- Food and Beverage held a dominant market position, capturing more than a 44.6% share.

- North America held a dominant market share in the ammonium carbonate market, capturing more than 42.4% of the total market.

By Product Grade

In 2023, Food Grade held a dominant market position, capturing more than a 42.2% share of the overall ammonium carbonate market. This segment’s growth can be attributed to the increasing demand for food additives and leavening agents in the baking industry.

Food grade ammonium carbonate is commonly used in the production of cookies, crackers, and other baked goods due to its ability to release ammonia gas, which helps in leavening. Consumer preferences for natural and clean-label products are expected to further drive demand for food-grade ammonium carbonate, making it a key segment in the market.

Pharmaceutical Grade ammonium carbonate holds a smaller but growing share of the market. It is primarily used in the formulation of medicinal products, including cough syrups and expectorants.

This grade is manufactured to meet stringent quality standards, ensuring its safety and efficacy in healthcare applications. The rise in respiratory diseases and the increasing demand for over-the-counter medications are expected to contribute to steady growth in this segment.

Chemical Grade ammonium carbonate is primarily used in industrial applications, including the production of fertilizers, cleaning agents, and water treatment chemicals.

This segment is the second largest in the market and is projected to grow steadily due to the widespread use of ammonium carbonate in various chemical processes. The increasing demand for fertilizers, particularly in regions with large agricultural industries, is expected to support the expansion of this segment.

By Product Type

In 2023, Powder held a dominant market position, capturing more than a 72.2% share of the global ammonium carbonate market. This segment is favored for its ease of use and versatility across a range of industries.

Powdered ammonium carbonate is commonly used in food processing, pharmaceuticals, and chemicals due to its quick dissolution properties and precise application. Its widespread availability and ability to be easily handled in bulk have made it the preferred form for industrial and commercial applications.

Lumps of ammonium carbonate, while accounting for a smaller market share, are still an important product type, particularly in large-scale industrial applications. The lump form is typically used in situations where slower dissolution is required or where handling in bulk is more efficient.

Lumps are often utilized in the production of fertilizers and some chemical processes where the gradual release of ammonia is beneficial. However, this form faces competition from powdered ammonium carbonate due to the latter’s greater convenience in most applications.

By Application

In 2023, Food and Beverage Ingredients held a dominant market position, capturing more than a 43.3% share of the global ammonium carbonate market. This segment’s growth is primarily driven by its use as a leavening agent in baking.

Ammonium carbonate is commonly used in the production of cookies, crackers, and other baked goods, where it helps create a light and airy texture. As the demand for processed and convenience foods continues to rise, the food and beverage industry is expected to remain the largest consumer of ammonium carbonate.

Pharmaceutical Ingredients is another key application, though it holds a smaller share compared to food and beverage uses. Ammonium carbonate is used in the formulation of various medicinal products, particularly in cough syrups and expectorants.

It helps to thin mucus and ease coughing, making it an important ingredient in respiratory treatments. With the rising demand for over-the-counter and prescription medications, this segment is expected to see steady growth in the coming years.

Ammonium carbonate is also utilized as a foaming agent in various industrial and chemical applications. This segment is relatively small but is growing due to its use in the production of cleaning products, fire extinguishers, and certain industrial processes.

The ability of ammonium carbonate to produce stable foam makes it useful in products where controlled foam generation is required. As demand for specialized industrial products rises, the foaming agent application is expected to expand.

By End-use Industry

In 2023, Food and Beverage held a dominant market position, capturing more than a 44.6% share of the global ammonium carbonate market. The food and beverage industry is the largest consumer of ammonium carbonate, primarily due to its role as a leavening agent in baking.

It is widely used in the production of baked goods such as cookies, crackers, and pastries. As consumer demand for processed and convenience foods continues to grow, the food and beverage sector is expected to remain the leading driver of ammonium carbonate consumption.

The Pharmaceutical industry is a significant end-use sector for ammonium carbonate, although it holds a smaller share compared to food and beverage applications. Ammonium carbonate is used in the formulation of various medicinal products, particularly as an ingredient in cough syrups and expectorants.

It helps in thinning mucus and easing coughing, making it an important component in respiratory treatments. As the global demand for over-the-counter and prescription medications increases, the pharmaceutical sector is projected to see steady growth in its use of ammonium carbonate.

Ammonium carbonate also finds applications in the Cosmetics & Personal Care industry, where it is used as a pH regulator and emulsifier in the formulation of creams, lotions, and other beauty products. Although this segment is relatively smaller in terms of market share, it is growing as the demand for personal care products rises. As consumers increasingly prefer products with natural ingredients and eco-friendly formulations, ammonium carbonate is expected to see increased adoption in this sector.

In the Textile industry, ammonium carbonate is used in the dyeing and finishing processes. It acts as a catalyst in certain textile treatments, helping to improve color retention and fabric texture. While this segment remains a niche market for ammonium carbonate, the growing demand for textile products, especially in emerging economies, is expected to support steady growth in this application.

Key Market Segments

By Product Grade

- Food Grade

- Pharmaceutical Grade

- Chemical Grade

By Product Type

- Powder

- Lumps

By Application

- Pharmaceutical Ingredients

- Food and Beverages Ingredients

- Foaming Agent

- Others

By End-use Industry

- Pharmaceutical

- Cosmetics & Personal Care

- Food and Beverage

- Textile

- Others

Drivers

Rising Demand in the Food and Beverage Industry

The global food and beverage industry is one of the largest consumers of ammonium carbonate. As of 2023, the global food and beverage market is projected to surpass $7 trillion, with the sector’s growth largely driven by an increased demand for processed, ready-to-eat, and convenience foods. Ammonium carbonate is an essential leavening agent used in the production of a variety of baked goods, such as cookies, crackers, and other snacks.

In 2022, it was reported that the global snack food market alone was valued at over $500 billion, growing at a compound annual growth rate (CAGR) of approximately 5.2% between 2022 and 2030. This rising demand for snacks and processed foods, which often require leavening agents like ammonium carbonate, is contributing significantly to market growth.

The global trend toward healthier eating and cleaner labels, coupled with ammonium carbonate’s status as a natural food ingredient, further strengthens the compound’s position in the market. This increase in demand from food manufacturers, combined with ongoing innovations in food production, is expected to sustain and expand the market for ammonium carbonate in the food industry.

Growth in Pharmaceutical Applications

The pharmaceutical industry is another key driver of ammonium carbonate demand. As a vital ingredient in the formulation of certain respiratory drugs, particularly cough syrups and expectorants, ammonium carbonate plays an essential role in managing respiratory conditions.

According to the World Health Organization (WHO), chronic respiratory diseases are a major cause of global morbidity and mortality, affecting over 500 million people worldwide. The growing prevalence of respiratory conditions, such as chronic obstructive pulmonary disease (COPD) and asthma, has led to an increase in demand for pharmaceutical products designed to treat these illnesses.

Ammonium carbonate, known for its ability to aid in the thinning of mucus, is a key component in many cough medicines. The global pharmaceutical market, valued at over $1.5 trillion in 2023, continues to expand due to rising healthcare needs and aging populations. As healthcare systems focus more on affordable, over-the-counter medicines for respiratory issues, ammonium carbonate’s role in the pharmaceutical industry is expected to remain crucial, further contributing to the compound’s market growth.

Supportive Government Initiatives in Agriculture and Chemical Sectors

Ammonium carbonate is also used as a nitrogen source in fertilizers, playing a critical role in the agricultural sector. The growing global demand for food production, driven by an increasing global population, has led to a rise in fertilizer consumption. In 2023, the global fertilizer market was valued at over $230 billion and is expected to grow at a CAGR of 4.5% from 2023 to 2030.

Governments worldwide are also encouraging the use of sustainable agricultural practices, and ammonium carbonate fits into this trend as a nitrogen-based compound that can improve crop yield and soil quality. The United States Department of Agriculture (USDA) and other international regulatory bodies are continuously promoting sustainable farming practices, which include the use of ammonium carbonate-based fertilizers to boost agricultural productivity.

In countries like India and China, where agriculture plays a central role in the economy, the government’s focus on improving crop yield through enhanced fertilizer use has led to increased demand for ammonium carbonate. With increasing investment in agricultural technology and support for farmers, ammonium carbonate’s role in the fertilizer industry is likely to expand, further driving market growth.

Industrial Demand and Chemical Manufacturing

The chemical manufacturing sector is another key driver of ammonium carbonate demand. Ammonium carbonate is used in the production of various chemicals, including ammonium bicarbonate and as a catalyst in industrial applications.

According to the International Fertilizer Association (IFA), the global chemical sector’s demand for ammonium carbonate has been steadily rising, fueled by the continued growth in industrial applications and the chemical processing of natural resources. For instance, ammonium carbonate plays a role in water treatment, as it is used to remove excess ammonia from wastewater.

The increasing demand for water treatment chemicals is expected to grow with rising industrialization, urbanization, and the need for clean water supplies in rapidly developing economies. Additionally, the global chemicals market, valued at approximately $5 trillion in 2023, is projected to grow steadily, providing continued support for ammonium carbonate demand across various industrial processes.

This rise in industrial and chemical manufacturing, particularly in emerging markets, contributes to the expanding use of ammonium carbonate in the chemical sector.

Restraints

Environmental and Safety Concerns in Production

Ammonium carbonate is produced through chemical reactions that can result in the emission of harmful gases, such as ammonia and carbon dioxide. The production process can lead to environmental contamination if proper safety measures are not followed. According to the U.S. Environmental Protection Agency (EPA), industries involved in ammonia and ammonium-based production are subject to stringent environmental regulations to minimize emissions of hazardous pollutants.

In 2022, ammonia-related emissions from manufacturing facilities in the U.S. were estimated to exceed 3.5 million metric tons per year. Such environmental impacts, combined with the need for costly compliance with environmental standards, could limit the ability of ammonium carbonate producers to scale operations or expand into new regions without investing heavily in mitigation technologies.

Governments are continuously pushing for cleaner, greener industrial processes. This has created pressure on chemical manufacturers to reduce their carbon footprints, which may lead to increased production costs or the development of alternative, more sustainable ingredients. As a result, the environmental impact of ammonium carbonate production represents a significant restraint, especially in markets with strict environmental regulations.

Health and Safety Risks in Handling

Another significant restraint for the ammonium carbonate market is the health and safety risks associated with its handling and use. Ammonium carbonate, like many chemical compounds, can be hazardous when not handled properly. Inhalation of ammonium carbonate dust or fumes can cause respiratory irritation, and prolonged exposure may lead to more severe health problems.

According to the Occupational Safety and Health Administration (OSHA), exposure limits for ammonia-based compounds such as ammonium carbonate are set to ensure worker safety in industrial environments. In the U.S., OSHA has set permissible exposure limits (PELs) for ammonia in the workplace at 25 ppm (parts per million) for an 8-hour workday.

With these strict regulations, manufacturers must invest in adequate safety equipment, training, and ventilation systems to ensure safe handling, which can increase production costs. Additionally, in the food industry, there are ongoing concerns over the potential health effects of using ammonium carbonate as a food additive.

Although considered safe in small quantities, concerns about its long-term consumption, particularly in large-scale food production, could limit its use or shift consumer preferences toward other, safer alternatives. As such, the health and safety risks associated with ammonium carbonate could dampen its widespread adoption in certain industries.

Competition from Safer and More Sustainable Alternatives

As industries continue to prioritize sustainability and safety, ammonium carbonate faces increasing competition from safer and more environmentally friendly alternatives. In the food and beverage industry, for example, there is a rising demand for natural and clean-label ingredients, driven by consumer preferences for products with fewer artificial additives and preservatives.

The global clean-label food market was valued at approximately $42.5 billion in 2022 and is projected to grow at a CAGR of 6.1% from 2023 to 2030. This trend is pushing manufacturers to seek alternatives to ammonium carbonate, such as more natural leavening agents like baking soda or other non-chemical-based solutions.

Similarly, in the pharmaceutical and chemical industries, companies are increasingly looking for greener, safer alternatives to traditional chemicals like ammonium carbonate, which may have adverse environmental impacts. As stricter regulations are enacted by governments around the world to encourage more sustainable chemical production processes, ammonium carbonate could face growing competition from plant-based or bio-derived substitutes that are less harmful to the environment and human health.

Volatile Raw Material Prices

The price of raw materials used to produce ammonium carbonate, such as ammonia and carbon dioxide, can be volatile, which poses a challenge to the stability of the ammonium carbonate market. The production of ammonium carbonate requires a stable supply of these raw materials, but global supply chain disruptions, geopolitical tensions, and fluctuating energy prices can cause significant price volatility.

For instance, in 2021, the global ammonia market saw price increases of up to 50% due to disruptions in the supply chain, particularly in regions like Europe and Asia. Higher production costs for raw materials translate to higher prices for ammonium carbonate, which can negatively impact its competitiveness in the market.

This price volatility is particularly concerning in price-sensitive sectors, such as food production and pharmaceuticals, where any increase in input costs can affect profit margins. As global energy prices remain unpredictable and supply chain challenges continue, ammonium carbonate producers may face difficulties in maintaining price stability, which could act as a significant restraint to market growth.

Opportunity

Expansion in the Agricultural and Fertilizer Sector

One of the most prominent growth opportunities for ammonium carbonate is in the agricultural sector, particularly in the production of fertilizers. Ammonium carbonate serves as an important source of nitrogen for crops, which is essential for healthy plant growth.

Governments worldwide are also supporting the use of fertilizers to boost agricultural productivity and ensure food security, which further increases the demand for nitrogen-based fertilizers like ammonium carbonate.

Additionally, as nations strive to meet their sustainability goals, ammonium carbonate’s relatively lower environmental impact compared to other chemical fertilizers gives it an edge in certain markets. This sector’s growing demand for fertilizers, along with ongoing agricultural innovations, presents a significant opportunity for ammonium carbonate manufacturers.

Increasing Focus on Sustainable Agricultural Practices

As global agricultural practices shift towards sustainability, ammonium carbonate is well-positioned to benefit from the growing focus on eco-friendly farming. Governments and regulatory bodies around the world are implementing stricter sustainability policies aimed at reducing the environmental impact of farming.

For instance, the European Union’s “Farm to Fork” strategy, part of its Green Deal, aims to make food systems fair, healthy, and environmentally-friendly by promoting sustainable agricultural practices. This includes reducing the use of chemical fertilizers, but it also encourages the use of more sustainable alternatives, like ammonium carbonate, which has a relatively lower environmental footprint compared to traditional fertilizers.

According to the Food and Agriculture Organization (FAO), sustainable practices like precision farming, crop rotation, and better fertilizer management are expected to be widely adopted across developing regions, particularly in Asia and Africa. With these initiatives, ammonium carbonate’s role in environmentally conscious farming practices is likely to increase, especially in regions where the demand for higher crop yields is growing. The shift towards sustainable agriculture presents an important growth opportunity for ammonium carbonate as it becomes an integral component of eco-friendly fertilizer formulations.

Expanding Demand for Ammonium Carbonate in Water Treatment

Ammonium carbonate also presents significant growth potential in the water treatment industry, an often-overlooked sector for this chemical. Ammonium carbonate is used in wastewater treatment to remove excess ammonia, a common pollutant in industrial wastewater. With rapid urbanization and industrialization, the global demand for water treatment chemicals is increasing.

The rising need for clean water, especially in developing countries, combined with increasing industrial discharges and pollution, is driving the need for effective wastewater treatment solutions. Ammonium carbonate’s ability to neutralize ammonia in wastewater makes it a key player in this market.

Moreover, the chemical is being increasingly used in the treatment of drinking water, especially in regions with high levels of industrialization. With growing government initiatives aimed at improving water quality and expanding clean water access—such as the UN’s Sustainable Development Goal 6 (Clean Water and Sanitation)—ammonium carbonate is expected to see increased demand as part of the solution to global water challenges.

Technological Advancements and New Applications

The continuous advancement of chemical technologies offers additional opportunities for ammonium carbonate’s application in new industries. One of the most promising developments is in the emerging field of bio-based chemicals and sustainable industrial processes. Ammonium carbonate is being explored as a potential substitute in various industrial processes, including polymer production, which traditionally uses more harmful chemicals.

The growing trend toward green chemistry, which focuses on minimizing environmental impact and utilizing sustainable resources, aligns with ammonium carbonate’s profile as a safer, more eco-friendly alternative. Additionally, ammonium carbonate is increasingly being considered for use in cleaner energy technologies.

Research has shown potential applications in the production of biofuels and as part of sustainable energy storage solutions, as part of the growing need for alternative energy sources. With advancements in chemical engineering, ammonium carbonate’s utility in new and emerging applications will likely expand. This shift towards greener, more sustainable chemical processes presents another significant growth opportunity, especially as industries increasingly prioritize environmental responsibility.

Trends

Shift Towards Sustainable and Eco-friendly Products

One of the most significant trends in the ammonium carbonate market is the growing demand for sustainable and environmentally friendly chemicals. As governments and industries focus on reducing their environmental footprints, there is a rising preference for products that are considered safer for both human health and the environment.

In particular, ammonium carbonate is increasingly being viewed as a more eco-friendly alternative to other chemical fertilizers, which can contribute to environmental degradation through runoff and soil acidification. According to the European Commission, the EU’s Green Deal aims to reduce the use of harmful chemical fertilizers by 50% by 2030, a policy that aligns with the growing interest in alternatives like ammonium carbonate.

The global fertilizer market itself is expected to grow at a CAGR of 4.5% from 2023 to 2030, reaching $230 billion by the end of the decade. Amid these growth projections, demand for nitrogen-based fertilizers is anticipated to increase, with ammonium carbonate being one of the preferred choices due to its relatively lower environmental impact compared to ammonium nitrate or urea-based fertilizers.

This trend toward more sustainable, eco-friendly alternatives is being further supported by government incentives and environmental regulations, encouraging producers to adopt cleaner, greener production practices. As sustainability continues to be a key focus across various industries, ammonium carbonate’s role in promoting more responsible agricultural practices positions it well for growth.

Rising Demand in Clean Label Foods and Natural Ingredients

Another major trend in the ammonium carbonate market is the increasing use of the chemical in the food and beverage industry, particularly in clean label foods. Clean label refers to products that have simple, recognizable, and natural ingredients, with consumers increasingly seeking out foods that are free from artificial additives and preservatives.

In this market, ammonium carbonate serves as a vital ingredient in the production of baked goods like cookies, crackers, and pastries. Its status as a natural leavening agent is particularly appealing in a market increasingly focused on food transparency and health-conscious choices.

Moreover, with the rising global population and changing dietary preferences, the demand for convenience foods, including those with clean labels, is also expected to grow. The increasing consumer demand for clean-label products presents a significant opportunity for ammonium carbonate producers to tap into the expanding market of natural, minimally processed ingredients.

Technological Advancements in Ammonium Carbonate Production

Technological advancements in chemical manufacturing are also influencing the ammonium carbonate market. Innovations in production methods, such as more energy-efficient and environmentally friendly processes, are making the production of ammonium carbonate both cost-effective and sustainable.

In recent years, researchers have focused on improving the efficiency of ammonium carbonate production by developing methods that use less energy and produce fewer emissions. For example, the adoption of new catalysts and reaction technologies has enabled more efficient ammonia production, which is a key component in the synthesis of ammonium carbonate.

According to the International Energy Agency (IEA), the chemical industry accounts for over 10% of global energy consumption and 7% of global CO2 emissions, making energy efficiency a critical area for improvement. Advances in green chemistry and renewable energy integration are allowing ammonium carbonate producers to reduce their carbon footprints and make their production processes more sustainable.

Additionally, some ammonium carbonate manufacturers are exploring the use of carbon capture and storage (CCS) technologies to further reduce emissions during the production process. As industries and governments around the world push for more sustainable manufacturing practices, these technological improvements are expected to drive the growth of ammonium carbonate in the coming years.

Government Regulations and Support for Sustainable Agriculture

Governments around the world are implementing stricter regulations on the use of chemical fertilizers and promoting more sustainable agricultural practices, which is benefiting the demand for ammonium carbonate.

The United Nations’ Sustainable Development Goal 2 aims to end hunger, achieve food security, improve nutrition, and promote sustainable agriculture by 2030. This has prompted governments to adopt policies that encourage the use of more sustainable fertilizers to reduce the negative environmental impact of traditional farming methods.

Regional Analysis

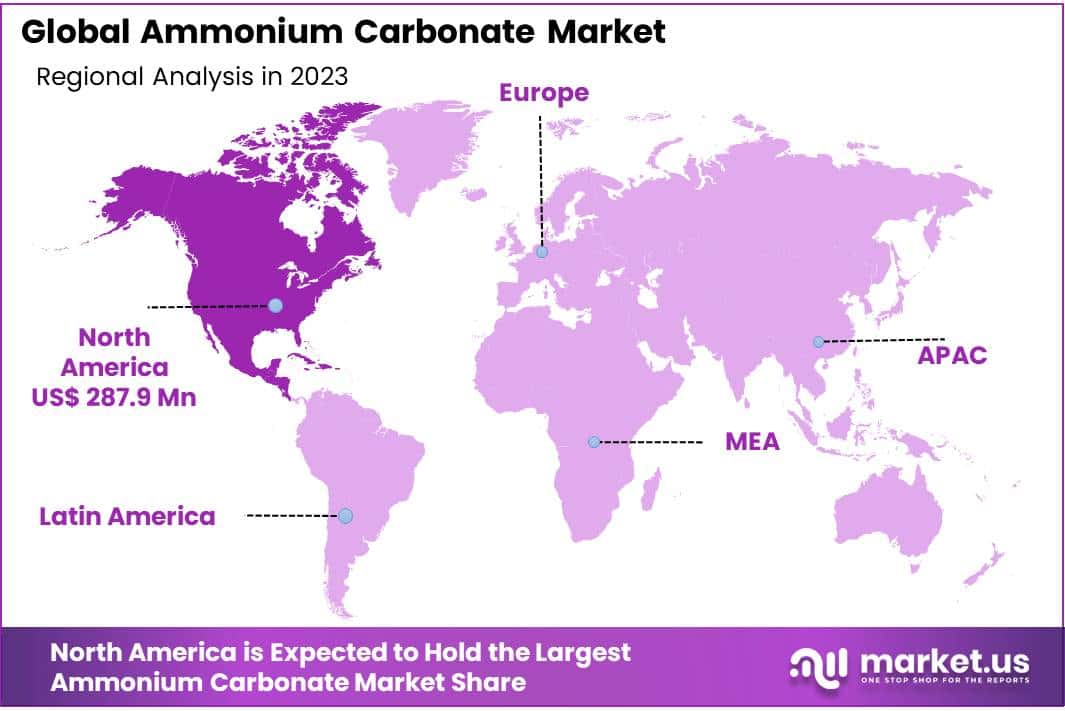

In 2023, North America held a dominant market share in the ammonium carbonate market, capturing more than 42.4% of the total market, valued at approximately USD 287.9 million. The region’s leadership can be attributed to the strong demand for ammonium carbonate across industries such as food and beverage, pharmaceuticals, and agriculture.

In particular, the U.S. remains a key contributor, driven by its large-scale agricultural sector and increasing adoption of clean-label food products. Additionally, stringent environmental regulations and the ongoing shift toward sustainable chemical processes further support market growth in North America.

Europe follows closely behind, accounting for a significant portion of the market, driven by the EU’s policies on reducing chemical fertilizers’ environmental impact. The EU’s Green Deal and Farm to Fork strategy are pushing for more eco-friendly agricultural practices, which are expected to boost demand for alternative fertilizers like ammonium carbonate. The European ammonium carbonate market is projected to grow steadily, with Germany, France, and the UK being the key consumers of this compound in agriculture and food industries.

In the Asia Pacific region, the market is experiencing robust growth, driven by the increasing population, rising demand for food production, and expanding agricultural activities in countries such as China, India, and Japan. Asia Pacific’s market share is expected to rise significantly, with a CAGR of 5.3% from 2023 to 2030.

Latin America and the Middle East & Africa represent smaller shares of the market but are growing steadily, particularly in the agriculture sector, where ammonium carbonate is being increasingly adopted for fertilizer use.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The ammonium carbonate market is characterized by the presence of several prominent global and regional players that contribute to its growth and innovation. Leading companies such as Thermo Fisher Scientific Inc., Merck Group, and BASF SE dominate the market, leveraging their extensive product portfolios, strong R&D capabilities, and wide distribution networks.

Thermo Fisher Scientific and Merck Group are recognized for their extensive offerings in high-purity chemicals and laboratory-grade ammonium carbonate, catering to sectors like pharmaceuticals, life sciences, and research. BASF, a key player in the chemical industry, also offers ammonium carbonate products, with a focus on sustainability and environmentally-friendly manufacturing processes.

Other notable players in the market include Avantor, Honeywell International Inc., and Carolina Biological Supply, which have strengthened their positions through strategic partnerships, acquisitions, and a focus on expanding their global reach.

Companies like Kanto Chemical Co., Inc., Molekula Group, and ProChem Inc. focus on providing high-quality chemicals for specialized applications, including food and beverage, agriculture, and industrial manufacturing. Additionally, Noah Chemicals, Loba Chemie, and Henan Tianfu Chemical Co., Ltd. cater to both regional markets and emerging economies, with a strong presence in Asia-Pacific and Latin America.

Smaller regional players like Canton Laboratories Pvt Ltd., Vinipul Inorganics Pvt Ltd., and MP Biomedicals focus on the growing demand in emerging markets, offering ammonium carbonate in various grades for agricultural and industrial uses. With an increasing emphasis on sustainability, these companies are also investing in cleaner production technologies and seeking to expand their product offerings to meet the diverse needs of end-use industries globally.

Top Key Players in the Market

- Thermo Fisher Scientific Inc.

- Merck Group

- Kanto Chemical Co., Inc.

- BASF SE

- Avantor

- Carolina Biological Supply

- Noah Chemicals

- Honeywell International Inc.

- Loba Chemie

- Molekula Group

- ProChem Inc.

- Canton Laboratories Pvt Ltd.

- Henan Tianfu Chemical Co., Ltd.

- Alpha Chemika

- Nacalai Tesque

- Plater Group

- Spectrum Chemical Mfg. Corp

- MP Biomedicals

- Vinipul Inorganics Pvt Ltd.

Recent Developments

In 2023, Thermo Fisher’s chemical division reported revenues of approximately USD 40.4 billion, with a notable share of that revenue derived from chemicals used in laboratory and industrial applications.

In 2023, Merck’s Life Science division reported revenues of approximately €11.2 billion, contributing significantly to the company’s overall performance.

Report Scope

Report Features Description Market Value (2023) USD 679.1 Mn Forecast Revenue (2033) USD 1116.8 Mn CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Grade (Food Grade, Pharmaceutical Grade, Chemical Grade), By Product Type (Powder, Lumps), By Application (Pharmaceutical Ingredients, Food and Beverages Ingredients, Foaming Agent, Others), By End-use Industry (Pharmaceutical, Cosmetics and Personal Care, Food and Beverage, Textile, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Merck Group, Kanto Chemical Co., Inc., BASF SE, Avantor, Carolina Biological Supply, Noah Chemicals, Honeywell International Inc., Loba Chemie, Molekula Group, ProChem Inc., Canton Laboratories Pvt Ltd., Henan Tianfu Chemical Co., Ltd., Alpha Chemika, Nacalai Tesque, Plater Group, Spectrum Chemical Mfg. Corp, MP Biomedicals, Vinipul Inorganics Pvt Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific Inc.

- Merck Group

- Kanto Chemical Co., Inc.

- BASF SE

- Avantor

- Carolina Biological Supply

- Noah Chemicals

- Honeywell International Inc.

- Loba Chemie

- Molekula Group

- ProChem Inc.

- Canton Laboratories Pvt Ltd.

- Henan Tianfu Chemical Co., Ltd.

- Alpha Chemika

- Nacalai Tesque

- Plater Group

- Spectrum Chemical Mfg. Corp

- MP Biomedicals

- Vinipul Inorganics Pvt Ltd.