Global Azodicarbonamide Market By Type (Industrial Quality, Food Quality), By Formulation Type (Granular, Powder, Liquid), By Functionality (Blowing Agent, Processing Aid, Stabilizer), By Grade (Low Grade, Medium Grade, High Grade), By Application (Blowing Agent, Plastic Additive, Food Additive, Flour Bleaching Agent, Improving Agent), By End User (Plastic and Rubber, Food and Beverage, Leather and Textile, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133656

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

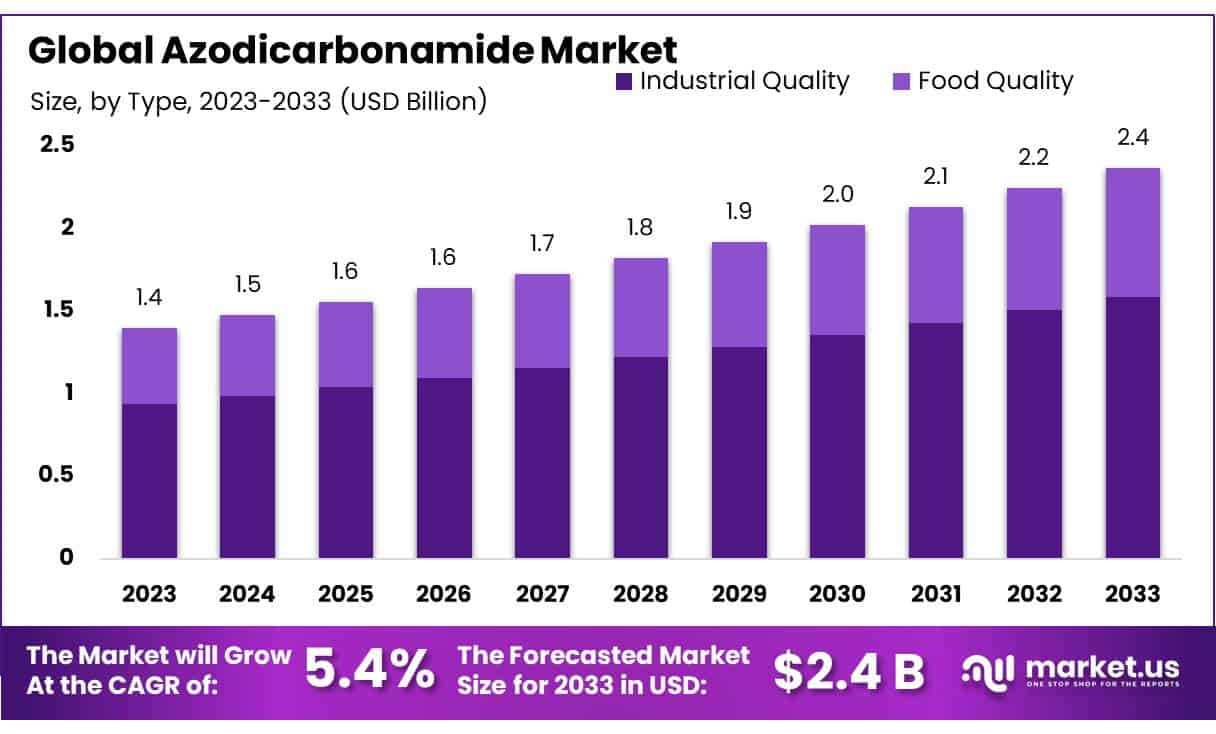

The Global Azodicarbonamide Market size is expected to be worth around USD 2.4 Bn by 2033, from USD 1.4 Bn in 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

Azodicarbonamide (ADA) is a chemical compound widely used in both the food and industrial sectors. In the food industry, it primarily functions as a dough conditioner and flour bleaching agent, enhancing the texture and elasticity of dough in baked goods. It is commonly added to bread and other baked products to improve volume and create a light, airy texture by releasing gases when exposed to heat.

In addition to its use in food processing, azodicarbonamide is also utilized in the production of foamed plastics, including materials for yoga mats, synthetic leather, and shoe soles. The global production of azodicarbonamide is estimated to range between 30,000 to 40,000 metric tons annually, with the food industry being the largest consumer, accounting for about 60% to 70% of global demand.

The compound’s usage is heavily regulated across different regions. In the United States, the FDA permits azodicarbonamide as a dough conditioner in bread at concentrations up to 45 parts per million (ppm). However, concerns over the breakdown product semicarbazide, which has been linked to potential carcinogenic effects, have led to a decline in its use.

In contrast, the European Union banned its use in food products in 2005 due to health concerns, and Australia has also prohibited its use. While these regulatory measures have restricted its food applications, azodicarbonamide continues to be widely used in the plastics industry, particularly in the production of foamed plastics, a market projected to reach 7.5 million metric tons globally by 2025.

The global trade of azodicarbonamide is significant, with China being the largest producer and exporter, accounting for over 50% of global production. In 2022, China’s exports of azodicarbonamide were valued at USD 200 million, primarily targeting North America, Europe, and Southeast Asia.

Conversely, European imports amounted to USD 40 million in the same year. The compound’s widespread use in both the food and plastics sectors continues to drive its market, despite regulatory challenges in certain regions.

Key Takeaways

- Azodicarbonamide Market size is expected to be worth around USD 2.4 Bn by 2033, from USD 1.4 Bn in 2023, growing at a CAGR of 5.4%.

- Industrial Quality held a dominant market position, capturing more than a 67.1% share.

- Granular held a dominant market position, capturing more than a 41.1% share.

- Blowing Agent held a dominant market position, capturing more than a 54.3% share.

- Medium Grade held a dominant market position, capturing more than a 53.2% share.

- Blowing Agent held a dominant market position, capturing more than a 47.2% share.

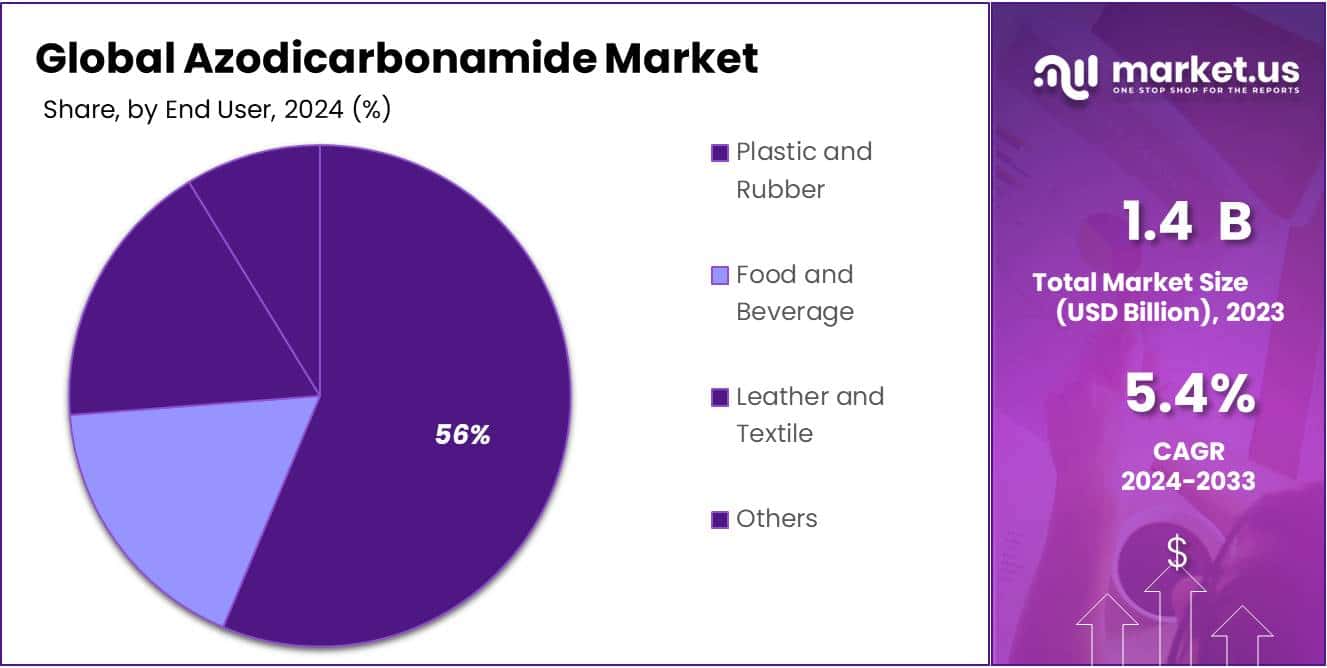

- Plastic and Rubber held a dominant market position, capturing more than a 58.4% share.

By Type

In 2023, Industrial Quality held a dominant market position, capturing more than a 67.1% share of the global azodicarbonamide market. This segment’s dominance is primarily driven by the widespread use of industrial-grade azodicarbonamide in the production of foamed plastics, rubber, and synthetic materials. The compound is used as a blowing agent in the manufacturing of products such as yoga mats, shoe soles, and other plastic components.

Industrial quality azodicarbonamide is favored for its cost-effectiveness and ability to create lightweight, durable products with consistent texture and structure. The significant demand for foamed plastics across industries such as automotive, construction, and consumer goods continues to support the strong position of this segment.

The Food Quality segment, while smaller, is growing steadily as more consumers seek cleaner, safer ingredients in food products. Azodicarbonamide used in food applications is primarily employed as a dough conditioner and flour bleaching agent in the baking industry. It is used to improve the texture and consistency of bread and other baked goods.

However, its use is increasingly being questioned due to health concerns, leading to regulatory scrutiny in various regions. Despite these concerns, food quality azodicarbonamide remains popular due to its effectiveness and relatively low cost, but demand is being tempered by the growing trend toward clean-label and natural food ingredients.

By Formulation Type

In 2023, Granular held a dominant market position, capturing more than a 41.1% share of the global azodicarbonamide market. The granular form is widely used in industrial applications due to its ease of handling and storage. It is commonly employed in the production of foamed plastics, rubber, and other synthetic materials.

Granular azodicarbonamide is preferred in these sectors for its ability to release gases efficiently when exposed to heat, making it ideal for creating lightweight and durable products. Its stable and easy-to-mix nature further supports its dominance in industrial uses, especially in large-scale manufacturing processes.

The Powder segment, while smaller than granular, continues to be a popular choice in both food processing and industrial applications. Powdered azodicarbonamide is commonly used as a dough conditioner in the food industry, where it is added to flour to improve dough elasticity and texture.

It is also used in smaller-scale industrial applications where precise, easy dispersion of the chemical is required. The demand for powder-form azodicarbonamide is influenced by its versatility and ease of integration into various formulations.

The Liquid segment, though accounting for a smaller share, is gaining attention due to its convenience in specific applications. Liquid azodicarbonamide is typically used in industries where precise liquid measurements are necessary, such as in certain food processing or chemical manufacturing settings. The segment is expected to grow as manufacturers look for more efficient and versatile forms of the compound for specialized applications.

By Functionality

By Grade

In 2023, Medium Grade held a dominant market position, capturing more than a 53.2% share of the global azodicarbonamide market. This grade is widely used across both industrial and food applications due to its balanced properties and cost-effectiveness. Medium-grade azodicarbonamide is commonly used in the production of foamed plastics, rubber, and certain food products like baked goods. Its versatility and reliability in different formulations make it the preferred choice for many manufacturers.

Low Grade azodicarbonamide accounts for a smaller share of the market, primarily used in industrial applications where stringent performance standards are less critical. This grade is typically employed in lower-cost products, such as general-purpose plastics and non-food applications, where the chemical’s primary role is to serve as a blowing agent or processing aid. Its lower purity and performance level make it a more affordable option for specific sectors.

High Grade azodicarbonamide, though accounting for a smaller percentage of the market, is used in more specialized applications that require higher purity and consistency. This grade is often found in premium food products, where its quality and safety standards must meet stricter regulatory requirements. It is also used in high-performance industrial products where precise control over the material’s properties is essential, such as in advanced rubber compounds and specialty foamed plastics.

By Application

In 2023, Blowing Agent held a dominant market position, capturing more than a 47.2% share of the global azodicarbonamide market. This segment’s strong performance is driven by the widespread use of azodicarbonamide in the production of foamed plastics and rubber.

As a blowing agent, azodicarbonamide helps create lightweight, durable materials by releasing gas when heated, which forms bubbles or foam. This functionality is essential in the manufacturing of products such as yoga mats, shoe soles, and automotive parts, where lightweight and flexible properties are required.

The Plastic Additive segment also holds a significant share of the market. Azodicarbonamide is used in the plastic industry to modify the properties of plastics, including improving their texture, flexibility, and strength. It is particularly effective in the production of foamed plastics, which are used in various consumer goods and industrial applications. The growing demand for lightweight and sustainable plastic products is expected to drive continued growth in this segment.

The Food Additive segment, although smaller, remains an important application for azodicarbonamide. It is used as a dough conditioner and processing aid in the food industry, particularly in bread and bakery products. Azodicarbonamide improves dough texture, volume, and elasticity, making it a key ingredient in large-scale food production. However, its use in food has become more controversial due to health concerns, leading some manufacturers to seek alternative ingredients.

The Flour Bleaching Agent segment is closely related to the food additive application, where azodicarbonamide is used to bleach flour and improve its quality for baking. This application is more common in certain regions, particularly in industrial baking operations. However, increasing consumer demand for natural, clean-label products is pushing some companies to reduce or eliminate its use in favor of more natural bleaching alternatives.

The Improving Agent segment is also relevant, as azodicarbonamide is used to enhance the properties of dough and baked goods. It helps improve the texture, volume, and shelf life of bread and pastries. Although this application is less prominent than other uses, it still represents a key function of azodicarbonamide in food processing.

By End User

In 2023, Plastic and Rubber held a dominant market position, capturing more than a 58.4% share of the global azodicarbonamide market. This segment is the largest consumer of azodicarbonamide, primarily due to its role as a blowing agent in the production of foamed plastics and rubber products.

Azodicarbonamide is used to create lightweight, durable materials that are essential in a wide range of industries, including automotive, construction, and consumer goods. The demand for high-quality, flexible, and cost-effective foamed products continues to drive the dominance of this segment, with applications in products such as yoga mats, shoe soles, and synthetic leather.

The Food and Beverage segment is also significant, accounting for a smaller but growing share of the market. In this sector, azodicarbonamide is used primarily as a dough conditioner and flour bleaching agent in the production of bread and other baked goods. It helps improve the texture, volume, and consistency of dough.

However, its use in food products has become increasingly controversial due to health concerns, leading to stricter regulations and growing consumer preference for clean-label alternatives. Despite these challenges, the demand for azodicarbonamide in large-scale food manufacturing remains steady, especially in regions where it is still legally permitted.

The Leather and Textile segment represents a niche application of azodicarbonamide, where it is used as a foaming agent in the production of synthetic leather and textile products. This segment has seen limited growth compared to plastics and food, but the increasing demand for eco-friendly and cost-effective alternatives to natural leather is helping to support its development.

Azodicarbonamide is used in the production of synthetic leather, which is more affordable and often considered more sustainable than animal-derived leather.

Key Market Segments

By Type

- Industrial Quality

- Food Quality

By Formulation Type

- Granular

- Powder

- Liquid

By Functionality

- Blowing Agent

- Processing Aid

- Stabilizer

By Grade

- Low Grade

- Medium Grade

- High Grade

By Application

- Blowing Agent

- Plastic Additive

- Food Additive

- Flour Bleaching Agent

- Improving Agent

By End User

- Plastic and Rubber

- Food and Beverage

- Leather and Textile

- Others

Drivers

Growing Demand for Lightweight and Durable Materials in the Plastics and Rubber Industry

Azodicarbonamide plays a pivotal role in the production of foamed plastics and rubber, which are widely used in various consumer goods and industrial applications. The demand for lightweight, durable, and cost-effective materials is a major driving factor for the azodicarbonamide market, especially in the plastic and rubber industries.

Azodicarbonamide acts as a blowing agent, creating foam in plastics and rubber, thereby reducing weight while maintaining strength and durability.

The global demand for foamed plastics is expected to reach approximately 7.5 million metric tons by 2025, growing at a compound annual growth rate (CAGR) of about 4.5%. The use of azodicarbonamide in foamed plastic products, such as yoga mats, shoe soles, automotive parts, and synthetic leather, continues to grow as industries seek to reduce material costs while maintaining high performance.

According to the PlasticsEurope Market Data Report, Europe alone produced about 55 million metric tons of plastics in 2021, with a significant portion attributed to foamed plastics, where azodicarbonamide is used.

Advancements in the Food Industry Driving the Need for Azodicarbonamide

Azodicarbonamide is widely used in the food industry, particularly in the production of baked goods. Its primary function in food processing is as a dough conditioner and flour bleaching agent, where it helps improve dough texture, volume, and elasticity, resulting in high-quality bread and pastries. The increasing global demand for processed and ready-to-eat foods is a major factor driving the growth of azodicarbonamide usage in the food sector.

According to the Food and Agriculture Organization (FAO), the global market for processed foods was valued at approximately USD 7.3 trillion in 2020, and it is expected to grow at a rate of 4.5% CAGR through 2026.

The demand for convenient and long-shelf-life food products such as packaged bread and baked goods is increasing, particularly in emerging markets like India, China, and Latin America. This surge in processed food consumption is driving the need for ingredients that enhance product quality and shelf life, where azodicarbonamide plays an essential role.

Government Regulations and Initiatives Promoting Sustainable Manufacturing Practices

Government initiatives aimed at reducing environmental impact and promoting sustainable manufacturing practices are also fueling the demand for azodicarbonamide, particularly in the plastics industry. Azodicarbonamide is used in the production of foamed plastics, which are more lightweight and energy-efficient than traditional plastic materials. Governments worldwide are tightening regulations on manufacturing processes, encouraging companies to adopt more sustainable practices.

In the European Union, regulations like the EU Circular Economy Action Plan encourage the use of recycled materials and reduced environmental impact in plastic manufacturing. The plan, which includes a target to increase recycling rates to 55% by 2025, indirectly supports the growth of foamed plastics, where azodicarbonamide is a key component. In addition, the EU Plastics Strategy aims to reduce plastic waste by making plastic products more sustainable and recyclable, further boosting demand for lightweight materials like foamed plastics.

Restraints

Health and Safety Concerns Over Azodicarbonamide in Food Products

A major restraining factor for the azodicarbonamide market is the growing health and safety concerns related to its use, particularly in the food industry. Azodicarbonamide is primarily used as a dough conditioner and flour bleaching agent in the production of baked goods. However, its potential health risks have raised alarms among consumers, food safety experts, and regulatory authorities.

The Food and Drug Administration (FDA) in the United States allows azodicarbonamide to be used in food products at levels up to 45 ppm (parts per million). Despite this, concerns persist over its potential to release harmful byproducts, including semicarbazide, which has been linked to cancer in animal studies.

The controversy surrounding azodicarbonamide’s safety is a significant challenge for its use in food processing. Public pressure and increased demand for clean-label and natural ingredients are pushing manufacturers to reduce or eliminate the use of synthetic chemicals in food production.

For example, the Clean Label Project, an initiative focused on promoting transparency in food labeling, has highlighted the potential health risks of food additives like azodicarbonamide. This growing consumer awareness is contributing to a shift toward healthier alternatives, such as enzymes and natural dough conditioners. As a result, azodicarbonamide faces significant regulatory scrutiny, and some companies have voluntarily removed it from their products.

Shift Toward Natural and Clean-Label Alternatives

The increasing consumer preference for clean-label products is another significant restraint for the azodicarbonamide market. Clean-label refers to products that contain fewer synthetic additives, preservatives, and chemicals, with a focus on transparency and natural ingredients. As part of this trend, many consumers are seeking alternatives to ingredients like azodicarbonamide, which is perceived as a synthetic and potentially harmful chemical.

The global clean-label market was valued at approximately USD 64.9 billion in 2021, and is projected to reach USD 79 billion by 2025, growing at a compound annual growth rate (CAGR) of 7.4%. This shift is driven by consumer awareness of food quality, sustainability, and health risks associated with artificial ingredients.

A 2018 study by The International Food Information Council (IFIC) found that 66% of consumers look for food products with simple, understandable ingredients. As a result, food manufacturers are increasingly seeking natural alternatives to azodicarbonamide, such as plant-based enzymes, which can fulfill similar functions in dough conditioning and flour bleaching.

Regulatory Pressure and Bans in Key Markets

Government regulations and the increasing scrutiny over the safety of azodicarbonamide in food products are major restraining factors. Several governments and regulatory bodies have imposed restrictions on the use of azodicarbonamide in food, driven by consumer concerns about its potential health risks.

For instance, in the European Union, the use of azodicarbonamide in food products is subject to strict regulations. Some EU countries have gone further, placing complete bans on its use, particularly in bakery products. The European Food Safety Authority (EFSA) has raised concerns about the safety of azodicarbonamide, especially regarding the byproducts it may release when used in food.

In the United States, while azodicarbonamide is still approved by the FDA for use in food, the agency has placed restrictions on its use, requiring food manufacturers to disclose its presence on ingredient labels.

The FDA also closely monitors the levels of azodicarbonamide in food products to ensure they do not exceed approved concentrations. This growing regulatory pressure, coupled with rising consumer concerns, is pushing manufacturers to explore alternative ingredients that can meet safety standards without compromising on product quality.

Opportunity

Expanding Applications in the Plastics and Rubber Industry

One of the most significant growth opportunities for the azodicarbonamide market lies in its expanding applications within the plastics and rubber industry. As a key blowing agent, azodicarbonamide is used to produce lightweight, durable foamed plastics and rubber products.

These materials are essential in industries such as automotive, construction, and consumer goods. The demand for lightweight materials continues to rise, driven by the global push for fuel efficiency and reduced carbon footprints in automotive manufacturing.

For example, automobile manufacturers are increasingly relying on lightweight foamed plastics made with azodicarbonamide to reduce vehicle weight and improve fuel efficiency. According to the International Organization of Motor Vehicle Manufacturers (OICA), global car production reached approximately 80 million units in 2021, with a significant portion of these vehicles incorporating lightweight materials.

The global plastics market is expected to grow to USD 1 trillion by 2026, with foamed plastics contributing significantly to this expansion. In particular, the use of foamed plastics in automotive interiors, construction insulation, and consumer electronics packaging is expected to drive increased demand for azodicarbonamide.

Government Regulations Promoting Sustainable Manufacturing Practices

Government initiatives aimed at promoting sustainable manufacturing and carbon footprint reduction are creating significant growth opportunities for the azodicarbonamide market. The increasing emphasis on eco-friendly products is pushing industries to adopt lightweight materials, where azodicarbonamide plays a crucial role. Governments worldwide are setting ambitious carbon reduction targets that support the adoption of materials that reduce the overall weight of products, leading to lower energy consumption and emissions.

In the European Union, for example, the Green Deal aims for net-zero carbon emissions by 2050, with a focus on circular economy practices. The EU Plastics Strategy outlines specific actions for sustainable plastics production, which includes enhancing recycling rates and promoting the use of lightweight materials.

Azodicarbonamide, being a key ingredient in the production of foamed plastics, directly benefits from these regulations, as the material helps reduce the weight of plastic products, thus supporting the EU’s carbon-neutral objectives. According to the European Commission, the EU produced approximately 55 million metric tons of plastics in 2021, and a significant portion of this demand is for sustainable, lightweight products that utilize foaming agents like azodicarbonamide.

Trends

Increasing Demand for Clean-Label and Natural Alternatives

A prominent trend in the azodicarbonamide market is the growing consumer preference for clean-label and natural ingredients. Clean-label refers to products that contain simple, recognizable ingredients and avoid synthetic additives like azodicarbonamide.

This shift is particularly strong in the food industry, where consumers are increasingly seeking products that are free from artificial chemicals and additives. According to a 2018 study by the International Food Information Council (IFIC), 66% of U.S. consumers say they pay attention to food labels and prefer products with ingredients they can easily identify.

Rising Demand for Sustainable and Eco-Friendly Alternatives in Plastics and Rubber

Another key trend for azodicarbonamide is its application in plastics and rubber, particularly as a blowing agent for producing foamed plastics. The rising focus on sustainability and carbon footprint reduction in manufacturing processes has led to increased demand for lightweight and energy-efficient materials.

According to a 2021 report by the European Commission, the global plastics market is valued at over USD 1 trillion and is expected to grow steadily, with foamed plastics playing a major role in automotive, construction, and consumer goods industries.

Azodicarbonamide is commonly used in the automotive sector to produce lightweight materials that reduce vehicle weight and improve fuel efficiency. As automobile manufacturers face increasing pressure to meet carbon emission reduction targets, they are turning to lightweight foamed plastics made using azodicarbonamide.

For instance, Germany’s automotive industry, one of the largest in the world, produced around 5.6 million vehicles in 2021, with a significant portion of these vehicles incorporating foamed plastics to reduce weight. This growing trend in the automotive industry presents a clear growth opportunity for azodicarbonamide in applications where lightweight, durable, and energy-efficient materials are required.

Regional Analysis

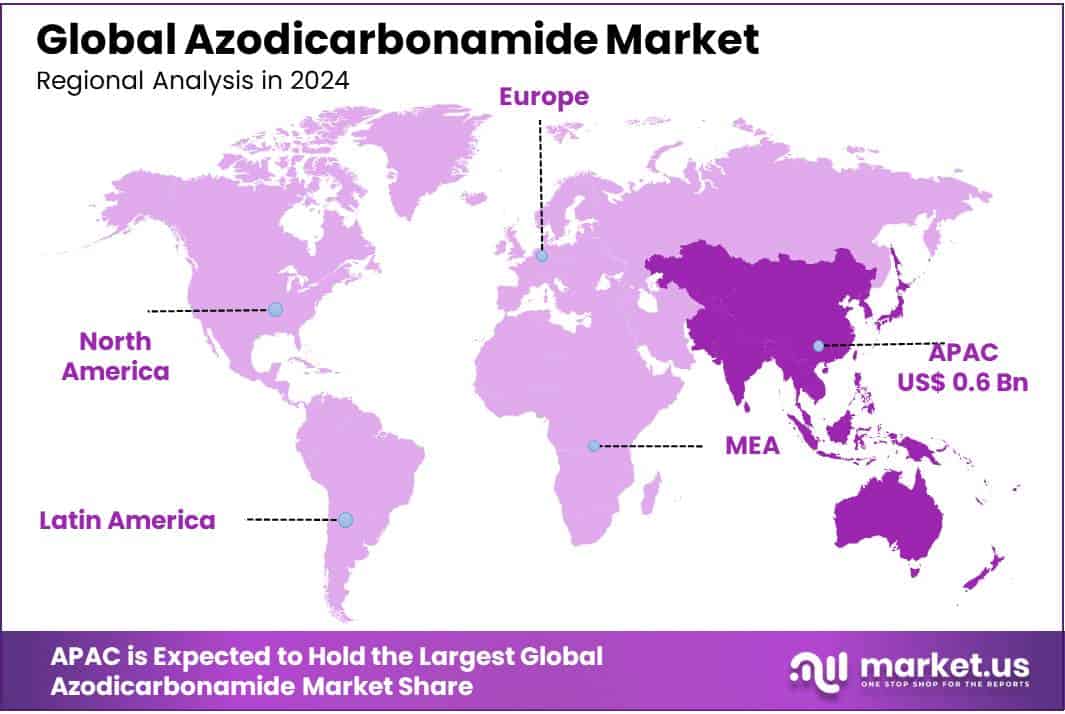

In 2023, the Asia Pacific (APAC) region dominated the global azodicarbonamide market, capturing a share of 38.4% and generating revenues of approximately USD 0.6 billion. This growth can be attributed to the region’s expanding manufacturing base, particularly in industries such as plastics, rubber, and food processing, where azodicarbonamide is extensively used.

The rising demand for lightweight and energy-efficient materials in the automotive and construction sectors, alongside the booming processed food industry, has fueled market expansion in APAC.

Furthermore, significant production capabilities in countries like China, India, and Japan have contributed to the region’s substantial market share. According to the Asian Development Bank (ADB), the region’s manufacturing sector continues to grow at a robust pace, boosting demand for industrial chemicals like azodicarbonamide.

North America follows as a significant player, holding a share of 27.6% in the global market. The region’s strict regulatory frameworks and increasing consumer preference for clean-label products have somewhat constrained the use of azodicarbonamide in the food industry. However, its applications in the plastics and rubber industries continue to support steady market growth.

The U.S. Food and Drug Administration (FDA) and the European Union (EU) have implemented regulations that impact the use of azodicarbonamide in food applications, which has led manufacturers to seek alternatives in North America and Europe.

Europe holds a market share of 18.9%, with stringent regulatory standards driving innovations in azodicarbonamide’s applications. In contrast, regions like Latin America and the Middle East & Africa (MEA) account for smaller shares but are witnessing gradual adoption, driven by expanding industrial activities and food processing sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The azodicarbonamide market features a competitive landscape with several prominent players engaged in manufacturing, distribution, and innovation of azodicarbonamide products. LANXESS, a leading global chemicals company, is one of the key players in the market, with a strong presence across multiple industries, including plastics and rubber.

The company’s expertise in polymer chemistry and additive solutions has allowed it to maintain a significant share in the azodicarbonamide segment. Another major player, Haihang Industry Co. Ltd., is recognized for its extensive portfolio in industrial chemicals, including azodicarbonamide, with applications across various sectors such as plastics, rubber, and food processing.

Ajanta Group, which has been active in the chemical manufacturing space for several years, continues to expand its reach, particularly in the Asia-Pacific market, contributing to the rising demand for azodicarbonamide.

Other significant players include Guangzhou Jiangyan Chemical Co. Ltd., Jiangxi Selon Industrial Co. Ltd., and SPL Group, which cater primarily to the Asia-Pacific and Middle East & Africa regions. These companies have been key to meeting the growing industrial demand, driven by the rapid development of sectors such as automotive, construction, and food processing.

Nikunj Chemical Limited and Kum Yang Co. Ltd. also hold a considerable market position, supplying azodicarbonamide to industries seeking cost-effective solutions for plastic foaming and rubber production. Otsuka Chemical Co. Ltd. and Weifang Yaxing Chemical Co. Ltd. focus on innovating the chemical production process, ensuring compliance with stringent environmental regulations while maintaining product efficiency.

Top Key Players in the Market

- Abtonsmart Chemicals (Group) Co. Ltd

- Ajanta Group

- Ajanta Group of Industries

- Guangzhou Jiangyan Chemical Co. Ltd

- Haihang Industry Co. Ltd

- Jiangxi Selon Industrial Co. Ltd

- Jing Jiang Hangsun Plastic Additives Co. Ltd

- Khadgawats Group

- Kum Yang Co. Ltd

- LANXESS

- Lanxess AG

- Nikunj Chemical Limited

- Otsuka Chemical Co. Ltd

- SPL Group

- Sri Dwarikadheesh Polymers Pvt. Ltd

- Sundow Polymers Co. Ltd

- Weifang Yaxing Chemical Co. Ltd.

Recent Developments

In 2023, Abtonsmart Chemicals expanded its production capacity by 12%, increasing its output to meet the rising demand for lightweight materials used in sectors such as automotive and construction.

In 2023, Ajanta Group reported a 6% increase in its chemical sales, with azodicarbonamide contributing significantly to its growth in the Asia-Pacific and Middle East markets.

Report Scope

Report Features Description Market Value (2023) USD 1.4 Bn Forecast Revenue (2033) USD 2.4 Bn CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Industrial Quality, Food Quality), By Formulation Type (Granular, Powder, Liquid), By Functionality (Blowing Agent, Processing Aid, Stabilizer), By Grade (Low Grade, Medium Grade, High Grade), By Application (Blowing Agent, Plastic Additive, Food Additive, Flour Bleaching Agent, Improving Agent), By End User (Plastic and Rubber, Food and Beverage, Leather and Textile, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abtonsmart Chemicals (Group) Co. Ltd, Ajanta Group, Ajanta Group of Industries, Guangzhou Jiangyan Chemical Co. Ltd, Haihang Industry Co. Ltd, Jiangxi Selon Industrial Co. Ltd, Jing Jiang Hangsun Plastic Additives Co. Ltd, Khadgawats Group, Kum Yang Co. Ltd, LANXESS, Lanxess AG, Nikunj Chemical Limited, Otsuka Chemical Co. Ltd, SPL Group, Sri Dwarikadheesh Polymers Pvt. Ltd, Sundow Polymers Co. Ltd, Weifang Yaxing Chemical Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abtonsmart Chemicals (Group) Co. Ltd

- Ajanta Group

- Ajanta Group of Industries

- Guangzhou Jiangyan Chemical Co. Ltd

- Haihang Industry Co. Ltd

- Jiangxi Selon Industrial Co. Ltd

- Jing Jiang Hangsun Plastic Additives Co. Ltd

- Khadgawats Group

- Kum Yang Co. Ltd

- LANXESS

- Lanxess AG

- Nikunj Chemical Limited

- Otsuka Chemical Co. Ltd

- SPL Group

- Sri Dwarikadheesh Polymers Pvt. Ltd

- Sundow Polymers Co. Ltd

- Weifang Yaxing Chemical Co. Ltd.