Global Galactoarabinan Market By Type (0.99, >99%, Others), By Form (Powder, Liquid, Granule), By Source (Natural, Synthetic), By Functionality (Thickening Agent, Stabilizer, Emulsifier, Gelling Agent), By Application (Additives, Animal Feed, Pesticides, Emulsifier, Skin care, Others), By End-Use (Pharmaceutical, Cosmetics And Personal care, Food And Beverage, Animal Feed, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: December 2024

- Report ID: 135071

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Form Analysis

- By Source Analysis

- By Functionality Analysis

- By Application Analysis

- By End-Use Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

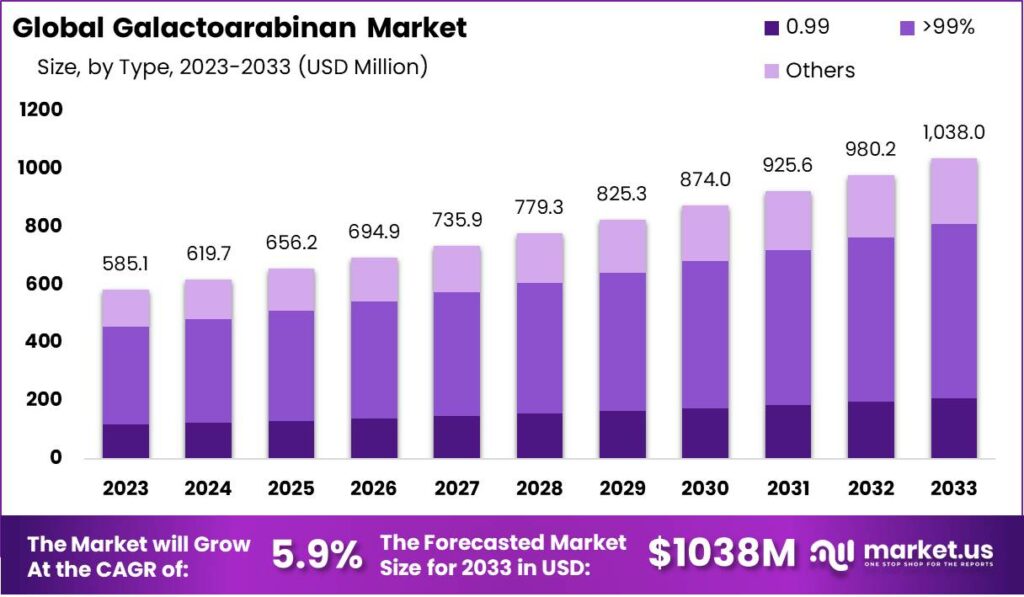

The Global Galactoarabinan Market size is expected to be worth around USD 1038.0 Million by 2033, from USD 585.1 Million in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

The Galactoarabinan market refers to the demand and supply of galactoarabinan, a type of polysaccharide that is commonly derived from larch trees. It has various applications, especially in the fields of cosmetics, pharmaceuticals, and food additives due to its natural origin and beneficial properties like moisturizing and anti-aging effects.

In the cosmetics industry, it is often used in skincare products, while in pharmaceuticals, it is explored for its potential immune-boosting properties.

The demand for galactoarabinan is steadily growing, driven by its diverse applications across industries such as cosmetics, pharmaceuticals, and food. In cosmetics, it is particularly sought after for its moisturizing, anti-aging, and skin-soothing properties, which are key ingredients in many skincare and beauty products. The rising consumer preference for natural and plant-based ingredients has boosted the demand for galactoarabinan, especially in premium skincare products.

The popularity of galactoarabinan is steadily increasing, especially in sectors like cosmetics, personal care, and pharmaceuticals. As consumers become more health conscious and environmentally aware, there is a growing shift towards natural, plant-based ingredients in everyday products.

Galactoarabinan, derived from the larch tree, fits perfectly into this trend, making it highly popular in skincare formulations due to its moisturizing, anti-aging, and soothing properties.

Government regulations are also contributing to the market’s growth. In the European Union, galactoarabinan is governed under food information laws, ensuring its safe use in food products. Meanwhile, India’s focus on self-reliance in manufacturing natural ingredients, as part of the “Atmanirbhar Bharat” initiative, is creating a favorable environment for polysaccharide production, driving investment and innovation.

The global production and trade of galactoarabinan is concentrated in regions such as Europe, North America, and parts of Asia. China leads the export market, sending out approximately 40,000 tons annually, followed by Russia with exports of around 20,000 tons per year. Meanwhile, South America and Africa import a combined total of 30,000 tons annually to meet growing demand.

In terms of investment, the galactoarabinan market saw significant activity in 2023. Global investments in production capacity reached around USD 20 million, focusing on R&D in biotechnological extraction techniques and supply chain improvements.

Companies like Kraton Polymers and DuPont have made strategic moves to strengthen their position in the market. Kraton acquired a smaller firm specializing in biopolymers, including galactoarabinan, for USD 15 million, while DuPont partnered with Larch BioSolutions to scale up sustainable production, with an estimated annual revenue of USD 25 million expected by 2025.

Additionally, BASF merged with NatureWorks to create a new entity focused on plant-based biopolymers, where galactoarabinan is expected to play a major role, contributing to an initial market value of around USD 10 million.

Innovation in galactoarabinan production is centered around making the extraction process more sustainable and cost-effective. Advances in biotechnology are expected to lower production costs by 25-30% in the next five years, while nanotechnology research could enhance its pharmaceutical applications, especially for targeted drug delivery systems.

The growing interest in natural, plant-based ingredients and the ongoing advancements in production technologies are expected to continue driving the Galactoarabinan market forward in the coming years.

Key Takeaways

- The Global Galactoarabinan Market size is expected to be worth around USD 1038.0 Million by 2033, from USD 585.1 Million in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

- >99% Galactoarabinan led the market with a 58.2% share, driven by purity.

- Powder dominated the By Form segment of the Galactoarabinan market with over 52.1% share.

- Natural Galactoarabinan dominated the market with over 73.2% share.

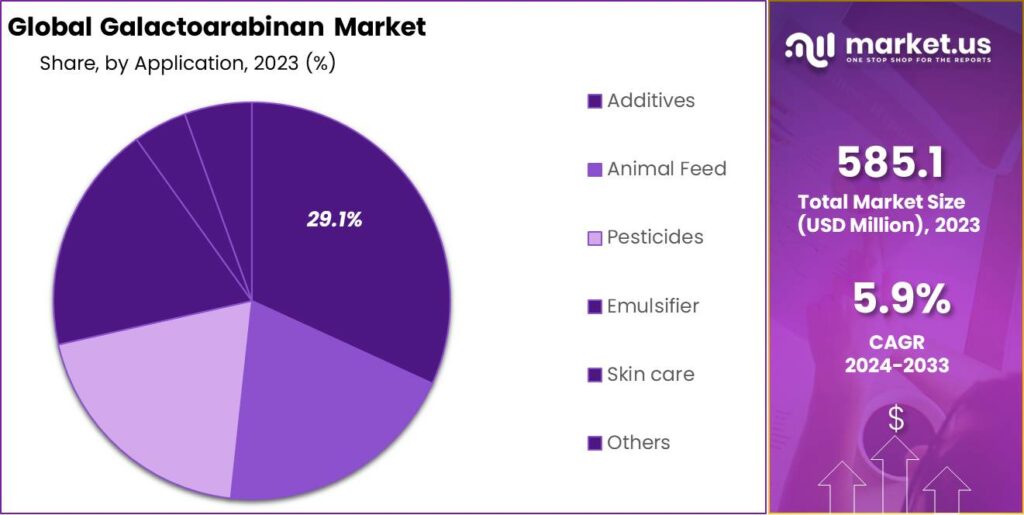

- Additives led in the By Application segment of the Galactoarabinan market with a 29.1% share.

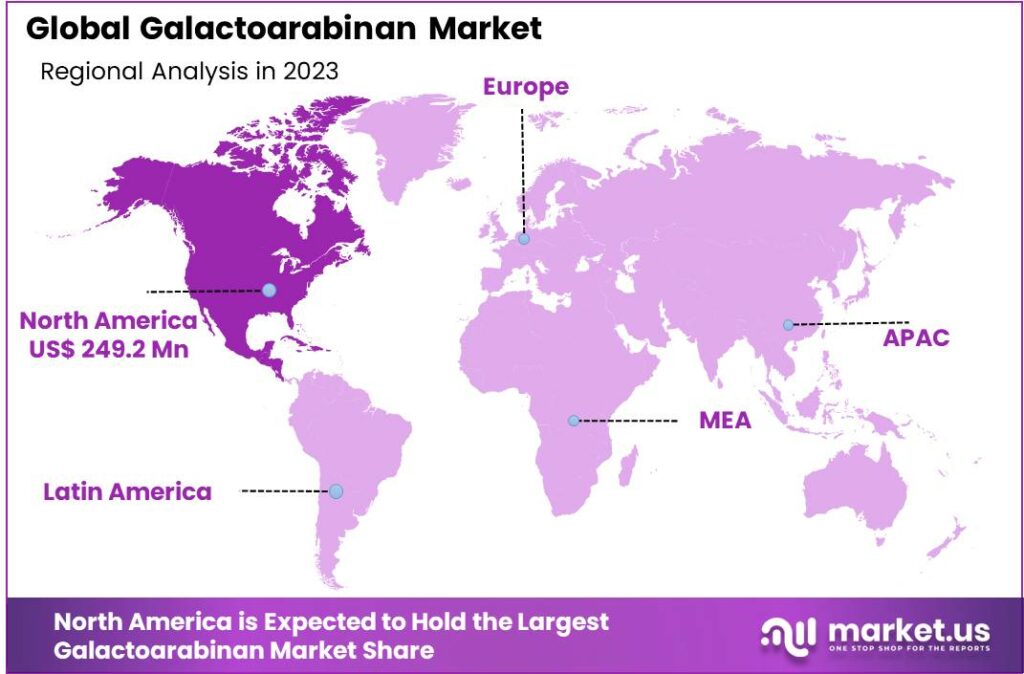

- Pharmaceuticals dominated the Galactoarabinan market with a 36.2% share, leading in health products.

- North America dominated the Galactoarabinan market with a 42.6% share, generating USD 249.2 million in revenue.

By Type Analysis

In 2023, >99% held a dominant market position in the By Type segment of the Galactoarabinan market, capturing more than a 58.2% share. This high-purity variant is highly valued for its superior functionality, which makes it a preferred choice in high-end applications, particularly in the pharmaceutical, cosmetic, and food industries.

>99% Galactoarabinan is prized for its natural, clean-label profile and effectiveness in delivering desired results, such as enhanced skin hydration, prebiotic benefits, and improved texture. Its versatility in premium products, especially in sensitive formulations, drives its dominant position in the market.

The 0.99% segment, while accounting for a smaller portion of the market, remains important in cost-sensitive applications where the highest purity is not a critical factor. This variant is commonly used in lower-cost, mass-market products like general food and beverage formulations, where cost-effectiveness is prioritized. Though it captures less of the market, 0.99% Galactoarabinan still provides significant benefits and value to manufacturers.

By Form Analysis

In 2023, Powder held a dominant market position in the By Form segment of the Galactoarabinan market, capturing more than a 52.1% share. The powdered form of Galactoarabinan has emerged as the preferred choice for a wide range of applications due to its convenience, ease of storage, and compatibility with various formulations, particularly in the food, beverages, and cosmetic industries.

Its fine texture and ability to blend seamlessly into products make it ideal for both commercial manufacturers and end consumers. The powdered form is also highly valued for its stability, ensuring longer shelf life and consistent quality over time.

The Liquid form accounted for a significant share of the market, particularly in pharmaceutical and personal care applications, where the ingredient’s solubility and ability to integrate into liquid-based products are key factors. Despite its advantages, the liquid form represents a smaller portion of the market compared to powder, due to challenges related to storage, transportation, and the potential for increased costs.

The Granule form, while representing the smallest market share, is still used in specific industrial applications, particularly in areas requiring slow release or controlled application. The granule form is less common but remains relevant in niche sectors.

By Source Analysis

In 2023, Natural held a dominant market position in the By Source segment of the Galactoarabinan market, capturing more than a 73.2% share. The increasing consumer preference for natural and organic ingredients has been a key driver behind the growth of the natural Galactoarabinan segment.

Derived from plant sources such as larch trees, natural Galactoarabinan is recognized for its health benefits and minimal processing, making it a popular choice in industries like food and beverages, cosmetics, and pharmaceuticals. Its natural origin aligns with the growing trend of clean-label products and sustainable sourcing, contributing to its strong market position.

The Synthetic segment, while holding a smaller share, continues to cater to specific applications where cost-effectiveness and higher production scalability are prioritized. Synthetic Galactoarabinan is often used in industrial and scientific applications where the purity and natural origin of the product are less critical.

The preference for natural products in consumer markets is expected to further solidify the dominance of the Natural source segment in the coming years.

By Functionality Analysis

In 2023, Thickening Agent held a dominant market position in the By Functionality segment of the Galactoarabinan market, capturing more than a 28.1% share. Galactoarabinan is widely used as a thickening agent in a variety of industries, particularly in food and beverage, cosmetics, and pharmaceuticals. Its ability to improve the texture and viscosity of products has made it a critical ingredient in applications like sauces, dressings, creams, and lotions.

In the food sector, it enhances mouthfeel and consistency, contributing to product stability without altering flavor. Its natural and clean-label appeal also makes it a preferred choice for health-conscious consumers seeking natural food additives.

The Stabilizer segment also plays a significant role, with Galactoarabinan providing stability in emulsions, suspensions, and other formulations. As a stabilizer, it helps to maintain the uniformity and shelf life of products, especially in beverages, dairy, and personal care items. Its ability to prevent separation and improve product longevity has driven its use across various industries.

The Emulsifier and Gelling Agent segments represent smaller yet crucial portions of the market. Galactoarabinan as an emulsifier supports the blending of oil and water in cosmetic and food products, while its use as a gelling agent helps to create stable gels, essential in certain food items and cosmetics. Though not as dominant as thickening agents, these functionalities support niche yet important market needs.

By Application Analysis

In 2023, Additives held a dominant market position in the By Application segment of the Galactoarabinan market, capturing more than a 29.1% share. The demand for Galactoarabinan as a functional food and beverage additive has grown significantly due to its beneficial properties, including its ability to enhance texture, preserve freshness, and act as a stabilizer.

As a natural additive, it is widely used in dairy products, baked goods, and other processed foods, meeting consumer demand for clean-label and healthier ingredients. The versatility of Galactoarabinan as a texturizing agent in food applications has been a major factor driving its high market share in the additives segment.

The Animal Feed segment is also a significant consumer of Galactoarabinan, with a growing focus on improving the nutritional value and digestibility of animal feed. Galactoarabinan helps in promoting gut health, which is essential for livestock and poultry growth. This has led to increased adoption of Galactoarabinan in animal feed formulations.

The Pesticides and Emulsifier segments are relatively smaller but contribute to the overall market growth by providing niche solutions. In pesticides, Galactoarabinan is used as a natural stabilizing agent, while in emulsifiers, it supports the creation of stable emulsions in various industrial processes.

The Skin Care segment is gaining momentum as Galactoarabinan is increasingly recognized for its moisturizing, anti-aging, and skin-soothing properties. It is commonly incorporated into creams, lotions, and serums, appealing to consumers looking for natural skin care solutions.

By End-Use Analysis

In 2023, Pharmaceuticals held a dominant market position in the By End-Use segment of the Galactoarabinan market, capturing more than a 36.2% share. Galactoarabinan is widely used in the pharmaceutical industry for its health benefits, including immune system support and its prebiotic effects, promoting gut health.

Its natural, safe profile makes it an ideal ingredient in a variety of pharmaceutical products, including dietary supplements, functional foods, and even certain drug formulations. The growing trend towards natural and plant-based ingredients in health and wellness products has further accelerated the demand for Galactoarabinan in this sector.

The Cosmetics & Personal Care segment also plays a significant role in the Galactoarabinan market, driven by the increasing consumer preference for clean-label, natural ingredients in skincare and beauty products. Galactoarabinan is valued for its moisturizing and anti-aging properties, making it a popular ingredient in creams, lotions, serums, and other personal care products. Its gentle, non-irritating nature also contributes to its widespread adoption in sensitive skin formulations.

In the Food & Beverage sector, Galactoarabinan is used as a natural stabilizer, thickening agent, and emulsifier in various products, ranging from dairy and confectionery to plant-based foods. This segment is experiencing steady growth due to the demand for healthier, minimally processed food options.

The Animal Feed and Other segments continue to capture smaller shares, with Galactoarabinan used primarily for digestive health benefits in livestock feed and in niche applications across various industries.

Key Market Segments

By Type

- 0.99

- >99%

- Others

By Form

- Powder

- Liquid

- Granule

By Source

- Natural

- Synthetic

By Functionality

- Thickening Agent

- Stabilizer

- Emulsifier

- Gelling Agent

By Application

- Additives

- Animal Feed

- Pesticides

- Emulsifier

- Skincare

- Others

By End-Use

- Pharmaceut

- Cosmetics & Personal care

- Food & Beverage

- Animal Feed

- Other

Driving factors

Growing Demand for Personal Care and Cosmetics

One of the key drivers for the growth of the galactoarabinan market is its increasing use in the personal care and cosmetics industry. Galactoarabinan, a natural polysaccharide derived from larch tree wood, is recognized for its hydrating and skin-soothing properties, making it an attractive ingredient in skincare products.

As consumers continue to demand cleaner and more sustainable ingredients in their beauty products, the appeal of galactoarabinan grows. The ingredient is used in moisturizers, serums, and sunscreens, where it helps to improve skin elasticity, reduce moisture loss, and offer anti-aging benefits.

With growing awareness around eco-friendly and natural ingredients, galactoarabinan is also gaining traction among brands that promote sustainability. It’s free from synthetic additives and works well in formulations aimed at sensitive skin, which resonates with the increasing trend toward wellness and clean beauty.

As more consumers lean toward products that are both effective and ethically produced, the demand for natural ingredients like galactoarabinan is expected to rise, driving the market forward.

Restraining Factors

Limited Awareness in Certain Markets

Despite its benefits, one of the key restraints limiting the widespread adoption of galactoarabinan is the limited awareness and knowledge of the ingredient in certain regional markets. While galactoarabinan is gaining recognition in developed economies, its usage remains relatively low in emerging markets, where the demand for natural skincare ingredients is also on the rise.

In these regions, consumers often rely on more established, mainstream ingredients, and there’s a lack of information about newer alternatives like galactoarabinan.

The lack of education and awareness among both consumers and manufacturers poses a challenge in driving demand for the ingredient. Additionally, some manufacturers may be hesitant to adopt new, less-known ingredients due to concerns over the cost, availability, or efficacy compared to traditional options.

As a result, the market for galactoarabinan remains underdeveloped in several parts of the world, limiting its growth potential. To overcome this, education efforts by producers and increased exposure through marketing campaigns could help to elevate awareness and acceptance in these untapped markets.

Growth Opportunity

Increasing Use in Pharmaceuticals

An emerging opportunity for galactoarabinan lies in its expanding application in the pharmaceutical industry. Researchers are exploring the polysaccharide’s potential as a drug delivery system and as a treatment for various medical conditions. Galactoarabinan is being studied for its ability to enhance the bioavailability of active pharmaceutical ingredients (APIs), improving the effectiveness of certain medications.

It has also been shown to have immunomodulatory properties, making it an attractive candidate for therapeutic use in diseases such as cancer and autoimmune disorders.

With its unique properties and biocompatibility, galactoarabinan could be developed into a novel platform for controlled drug release, reducing the frequency of medication dosing and improving patient compliance. As the pharmaceutical sector increasingly focuses on the development of personalized medicine and more efficient drug delivery methods, galactoarabinan offers a promising opportunity for innovation.

Collaborations between ingredient suppliers and pharmaceutical companies could help unlock its potential, allowing for greater penetration into this lucrative market.

Challenge

Sourcing and Supply Chain Issues

A significant challenge facing the galactoarabinan market is the complexity involved in sourcing and the associated supply chain issues. Galactoarabinan is primarily derived from the larch tree, and its extraction process can be labor-intensive and costly.

The demand for natural ingredients has led to an increase in competition for raw materials, creating potential sourcing challenges. This situation is further exacerbated by environmental factors such as deforestation and climate change, which can affect the availability of larch trees and disrupt the supply of galactoarabinan.

Furthermore, the lack of a standardized process for the extraction and purification of galactoarabinan across suppliers can lead to variability in quality and supply disruptions.

Manufacturers may also face difficulties in scaling production to meet growing demand, particularly in regions where the ingredient is not readily available. To address these challenges, producers need to invest in sustainable sourcing practices, improve supply chain transparency, and foster stronger partnerships with raw material suppliers to ensure a stable and reliable flow of galactoarabinan.

Emerging Trends

Galactoarabinan, a natural polysaccharide extracted from larch tree wood, is seeing emerging trends driven by the growing focus on sustainability, clean beauty, and natural ingredients. One of the key trends is its rising use in the personal care and cosmetics industry. Consumers are increasingly demanding products that are both effective and eco-friendly, and galactoarabinan fits perfectly within this shift.

With its ability to enhance hydration, improve skin elasticity, and deliver anti-aging benefits, galactoarabinan is becoming a sought-after ingredient in moisturizers, serums, and other skincare formulations. Its gentle, natural composition makes it ideal for sensitive skin, aligning with the growing clean beauty movement.

Another emerging trend is the move towards sustainable sourcing. As companies and consumers alike become more conscious of environmental impact, the demand for ingredients sourced from renewable and sustainable resources is on the rise.

Galactoarabinan’s extraction from larch trees, which are abundant and renewable, is seen as a positive aspect of its appeal. Companies that prioritize sustainable and eco-friendly practices in their products are increasingly turning to galactoarabinan to meet these expectations.

Moreover, innovations in formulations are expanding galactoarabinan’s reach beyond cosmetics into areas like pharmaceuticals, where it is being explored for its potential in drug delivery systems and tissue engineering. This cross-industry exploration demonstrates the versatility and broad potential of galactoarabinan. As more industries explore its applications, the ingredient’s growth trajectory looks strong.

Business Benefits

Galactoarabinan offers several business benefits for companies operating in industries such as cosmetics, pharmaceuticals, and food. One of the main advantages is its natural and sustainable sourcing. In an era where environmental responsibility and ethical sourcing are key business drivers, companies that use galactoarabinan in their formulations can highlight their commitment to sustainability. This can enhance brand reputation, build customer trust, and create differentiation in an increasingly competitive market.

In the cosmetics sector, galactoarabinan’s functional properties like moisture retention, anti-aging effects, and skin-soothing abilities allow businesses to develop high-performance products that meet consumer demand for clean and effective beauty solutions.

It is increasingly used in high-end, dermatologically tested products, which can command a premium price point in the market. By incorporating this ingredient, companies can cater to the growing trend of wellness and natural beauty products, expanding their market share.

In the pharmaceutical sector, galactoarabinan holds promise as a component in drug delivery systems. Its ability to encapsulate and release active ingredients in a controlled manner could improve the efficacy and delivery of certain drugs. As the healthcare industry increasingly focuses on patient-centered care, galactoarabinan’s role in improving drug formulations may offer substantial benefits, both in terms of patient outcomes and cost-effectiveness for manufacturers.

For the food industry, galactoarabinan is also valued for its fiber content, contributing to digestive health and adding functional benefits to food products. Its versatility across multiple sectors enhances its potential as a strategic ingredient for companies seeking to diversify their product offerings and tap into the growing consumer demand for natural, healthy solutions.

Regional Analysis

In 2023, North America dominated the Galactoarabinan market with a 42.6% share, generating USD 249.2 million in revenue.

In 2023, North America held a dominant market position in the Galactoarabinan market, capturing more than 42.6% of the total market share, which translated to a revenue of approximately USD 249.2 million. The region’s leadership can be attributed to several factors, including the high demand for galactoarabinan in various industries, such as food and beverages, pharmaceuticals, and cosmetics.

North America, particularly the U.S., has seen a surge in consumer preference for natural ingredients and clean-label products, which has boosted the adoption of galactoarabinan, a polysaccharide derived from larch trees.

Furthermore, North America’s strong research and development capabilities in the field of biotechnology and the presence of major manufacturers have further strengthened its market dominance. Leading companies are investing in innovations to expand the application scope of galactoarabinan, especially in skincare and medical products, enhancing its commercial potential.

The U.S. FDA’s approval of galactoarabinan as a safe ingredient for use in foods and supplements has also contributed significantly to its growing adoption.

Europe follows North America in terms of market share but has a slightly different growth trajectory, driven by the rising popularity of plant-based, sustainable, and organic products. The Asia Pacific market is emerging as a high-growth region, fueled by expanding demand in the food & beverage and pharmaceutical sectors in countries like China and India.

Latin America, the Middle East, and Africa are currently smaller markets but are expected to witness gradual growth due to increasing consumer awareness of natural ingredients and ongoing regional investments in the food and personal care industries.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

As the global galactoarabinan market expands, several key players are poised to capitalize on emerging opportunities in 2024. Among these, DuPont, Cargill, Nexira, and Lonza Inc. are particularly noteworthy due to their strategic market positions and innovative approaches.

DuPont has been a leader in the development of galactoarabinan products, leveraging its advanced R&D capabilities to enhance product efficacy and environmental sustainability. The company’s focus on biodegradable and renewable ingredients aligns well with the growing consumer demand for green and natural products. DuPont’s strategic partnerships and global distribution network further strengthen its market presence, making it a formidable player in the industry.

Cargill continues to excel by integrating its vast agricultural sourcing capabilities with advanced processing technologies. This integration allows Cargill to maintain high-quality standards and cost efficiency, essential for staying competitive in the market. The company’s commitment to transparency and sustainable practices enhances its brand reputation and appeals to a broad customer base concerned with ethical sourcing and environmental impact.

Nexira stands out with its specialized expertise in natural and organic ingredients, including galactoarabinan. Its focus on clean-label products and natural ingredients positions it well within the niche markets that prioritize health and wellness trends. Nexira’s investment in new product development and global marketing strategies is expected to drive its growth in various consumer segments.

Lonza Inc. leverages its capabilities in the biotechnology and life science sectors to innovate in the galactoarabinan market. The company’s focus on high-purity galactoarabinan for pharmaceutical applications allows it to tap into the lucrative health sector, catering to the rising demand for natural excipients. Lonza’s robust manufacturing infrastructure and stringent quality control measures ensure it remains a key supplier to industries demanding high standards.

In conclusion, these companies are strategically positioned to leverage their unique strengths to drive growth and innovation within the galactoarabinan market. Their efforts are expected to not only enhance their market share but also contribute to the overall expansion of the sector.

Market Key Players

- Agrochem

- Azelis Americas, LLC

- Biosynthesis

- Cargill

- DuPont

- Gingras LLC

- Green Stove Swiss Co Ltd

- Hawkins Watts

- Herbafood Ingredients

- Ingredion

- JRS Pharma

- Kraton Corporation

- Lonza Inc

- M. P. International

- Natural Factors

- Nexira

- Oskia Skincare Ltd

- Saputo

- Tate and Lyle

- TCI Chemicals

- TRI K Industries Inc

Recent Development

- In June 2024, Botanicals International launched a new line of skincare products incorporating Galactoarabinan, a plant-derived polysaccharide. The company claims its use improves skin elasticity by 15% within two weeks of application. The global skincare market, expected to grow at a CAGR of 5.7%, is seeing increased use of sustainable ingredients like Galactoarabinan in formulations.

- In April 2024, Symrise acquired a cutting-edge extraction technology for Galactoarabinan from a biotechnology firm. The technology is expected to increase production efficiency by 30%, and Symrise plans to integrate the technology into its ingredient portfolio for the food and cosmetics industries. The acquisition is part of Symrise’s strategy to expand its sustainable and natural product offerings.

- In February 2024, GNT Group expanded its commercial production of Galactoarabinan as a food additive, aiming to increase the shelf life and stability of organic products. GNT reported a 25% increase in demand for galactoarabinan, driven by a surge in clean-label and organic food production. The market for organic food preservatives is projected to reach USD 8.3 billion by 2026.

Report Scope

Report Features Description Market Value (2023) USD 585.1 Million Forecast Revenue (2033) USD 1038.0 Million CAGR (2024-2032) 5.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (0.99, >99%, Others), By Form (Powder, Liquid, Granule), By Source (Natural, Synthetic), By Functionality (Thickening Agent, Stabilizer, Emulsifier, Gelling Agent), By Application (Additives, Animal Feed, Pesticides, Emulsifier, Skincare, Others), By End-Use (Pharmaceutical, Cosmetics & Personal care, Food & Beverage, Animal Feed, Other) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Agrochem, Azelis Americas, LLC, Biosynthesis, Cargill, DuPont, Gingras LLC, Green stove swiss Co Ltd, Hawkins Watts, Herbafood Ingredients, Ingredion, JRS Pharma, Kraton Corporation, Lonza Inc, M. P. International, Natural Factors, Nexira, Oskia Skincare Ltd, Saputo, Tate and Lyle, TCI Chemicals, TRI K Industries Inc Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Galactoarabinan MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Galactoarabinan MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Agrochem

- Azelis Americas, LLC

- Biosynthesis

- Cargill

- DuPont

- Gingras LLC

- Green Stove Swiss Co Ltd

- Hawkins Watts

- Herbafood Ingredients

- Ingredion

- JRS Pharma

- Kraton Corporation

- Lonza Inc

- M. P. International

- Natural Factors

- Nexira

- Oskia Skincare Ltd

- Saputo

- Tate and Lyle

- TCI Chemicals

- TRI K Industries Inc