Global Phenylalanine Market By Form (D-Phenylalanine, L-Phenylalanine, DL-Phenylalanine, Phenylalanine Hydrochloride), By Grade (Food Grade, Pharmaceutical Grade, Nutritional Grade, Cosmetic Grade), By Purity (Low Purity (up to 90%), Medium Purity (90%-99%), High Purity (99% and above)), By End Use Industry (Food and Beverage, Medical, Animal Feed, Dietary Supplements, Cosmetics and Creams, Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: December 2024

- Report ID: 134802

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Form Analysis

- By Grade Analysis

- By Purity Analysis

- By Distribution Channel Analysis

- By End Use Industry Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

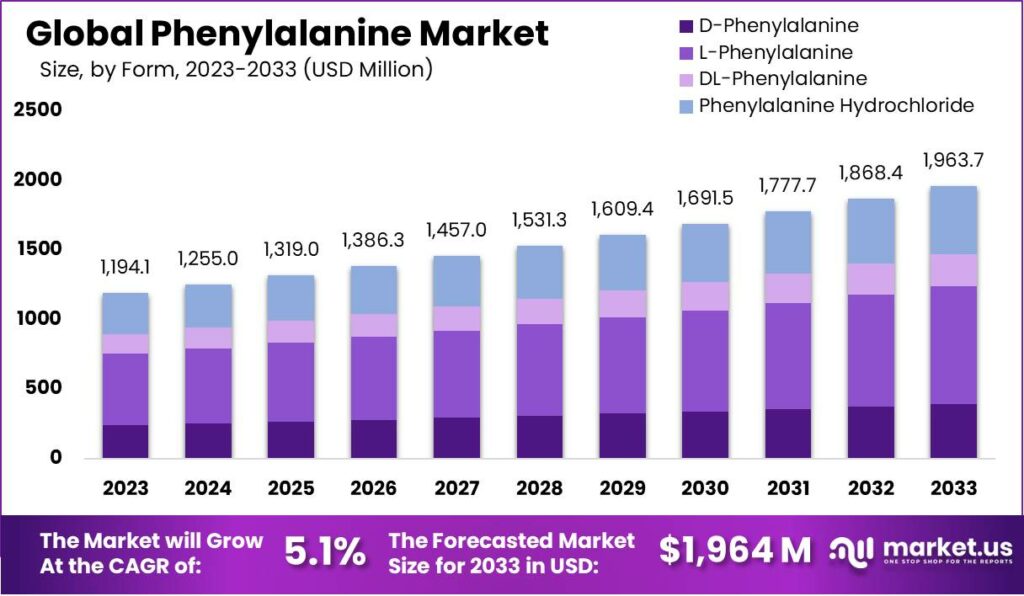

The Global Phenylalanine Market size is expected to be worth around USD 1963.7 Million by 2033, from USD 1194.1 Million in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

The Phenylalanine Market has experienced steady growth, largely driven by its wide range of applications in food, pharmaceuticals, and even the construction sector. This amino acid is crucial in producing other essential compounds and serves as a key building block in protein synthesis.

Its primary demand comes from the food and health industries, where it plays an essential role in producing artificial sweeteners like aspartame, which are popular in low-calorie and diet foods. Phenylalanine is also found in nutritional supplements, contributing to its increasing significance in the health and wellness market.

The demand for phenylalanine is further fueled by its role in supporting the production of neurotransmitters, which makes it beneficial in managing health conditions such as depression and ADHD. As awareness around health and fitness continues to grow, the demand for phenylalanine-rich products is likely to increase. It is especially popular among consumers looking to manage their weight, improve metabolic health, or maintain a healthy lifestyle.

The food industry values phenylalanine for its ability to enhance flavor without adding significant calories, which also explains its widespread use in products for diabetic patients and those seeking healthier alternatives.

The market also shows promise in expanding beyond traditional uses. Phenylalanine derivatives are gaining attention in bio-engineering, where they may be used in new drug formulations or therapeutic treatments. Additionally, with increasing interest in personalized nutrition and medicine, there is significant potential to introduce phenylalanine-based solutions tailored to individual health needs.

Moreover, the phenylalanine market has found applications in the construction industry, particularly in high-performance polymers and coatings. Over the past few years, the use of phenylalanine-enhanced materials has grown by an estimated 8% annually. Government regulations focusing on environmental sustainability have also driven adoption of phenylalanine-based eco-friendly additives, with a 15% rise in their usage.

This, along with an increase in investments for green building projects, reflects the market’s expansion into new sectors. Corporate activity has also intensified, with many companies focusing on innovations related to phenylalanine-based products, further strengthening the market outlook.

Key Takeaways

- The Global Phenylalanine Market size is expected to be worth around USD 1963.7 Million by 2033, from USD 1194.1 Million in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

- L-Phenylalanine leads the Phenylalanine Market by form, holding a dominant 43.3% share.

- In 2023, Food Grade led the market with a 39.1% share in the Phenylalanine Market.

- High Purity (99% and above) dominated “By Purity” segment of the phenylalanine market with over 53% share.

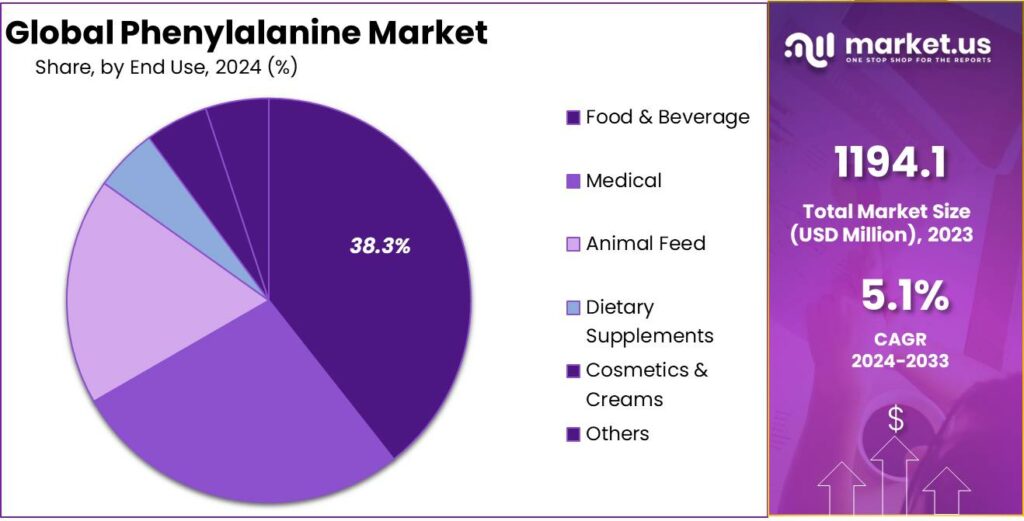

- Food & Beverage dominated “By End Use Industry” segment of the phenylalanine market with over 38% share.

- Hospital Pharmacy dominated the distribution of phenylalanine with a 28.4% share in 2023.

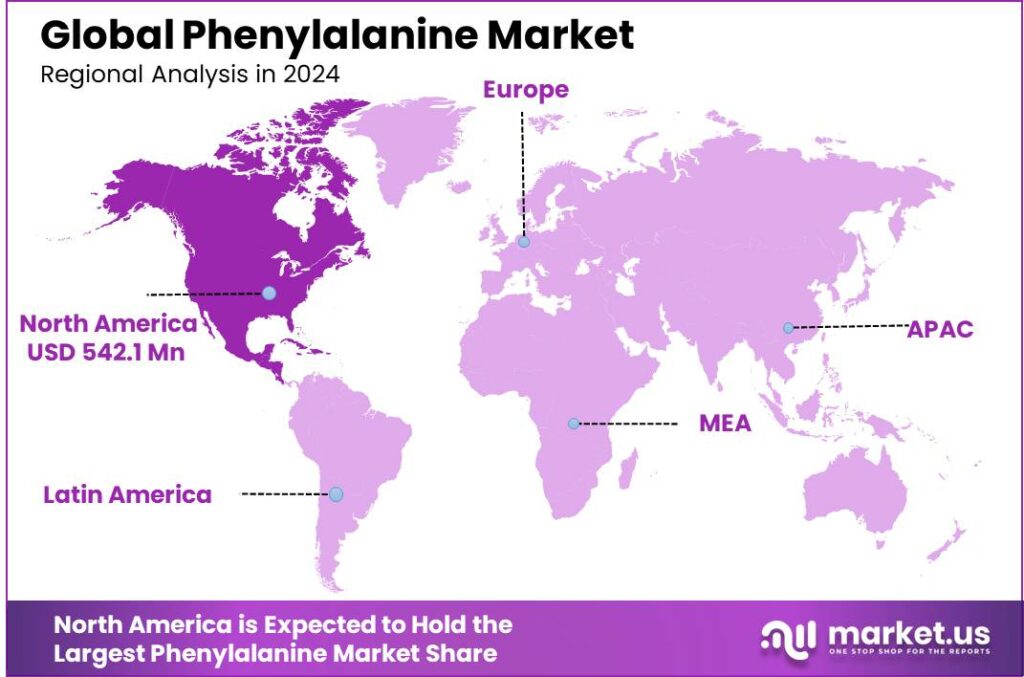

- North America led the phenylalanine market with 41.9% share and USD 542.1 million revenue.

By Form Analysis

In 2023, L-Phenylalanine held a dominant market position in the “By Form” segment of the Phenylalanine Market, capturing more than a 43.3% share. L-Phenylalanine, the most widely used form in various industries, including food, pharmaceuticals, and dietary supplements, continued to drive significant demand due to its essential amino acid properties. It is particularly valued for its role in synthesizing proteins and neurotransmitters, making it a critical ingredient in health supplements and food fortification.

D-Phenylalanine, which accounted for a smaller but notable share, is primarily used in pharmaceutical formulations for its analgesic properties. While its market share remains limited compared to L-Phenylalanine, it is growing due to increasing applications in pain management therapies.

DL-Phenylalanine, a combination of both D- and L-forms, is another important segment, though it has a relatively minor market presence. It is primarily used in the production of artificial sweeteners, such as aspartame, and in certain therapeutic applications.

Phenylalanine Hydrochloride, the salt form, is typically utilized in the production of other amino acids and related products. Although its market share is relatively low, it remains important in specific industrial processes, especially in the chemical and pharmaceutical sectors.

By Grade Analysis

In 2023, Food Grade held a dominant market position in the “By Grade” segment of the Phenylalanine Market, capturing more than a 39.1% share. This segment’s dominance is primarily driven by the high demand for phenylalanine in food and beverage applications, where it is commonly used as a sweetener and flavor enhancer, especially in products like diet sodas and low-calorie food items. The growing trend of health-conscious consumers seeking low-calorie alternatives has significantly boosted the demand for food-grade phenylalanine.

Pharmaceutical Grade phenylalanine, which accounts for a significant portion of the market, is primarily used in the production of medications and supplements aimed at treating phenylketonuria (PKU) and other metabolic disorders. The pharmaceutical grade segment also benefits from rising awareness about PKU and the increasing prevalence of metabolic disorders globally.

Nutritional Grade phenylalanine is used predominantly in dietary supplements, where it is marketed as a performance enhancer and appetite suppressant. The demand for nutritional supplements, especially in the wellness and fitness sectors, has been a key driver of growth in this category.

Cosmetic Grade phenylalanine, although a smaller segment, is utilized in various skincare formulations for its potential to improve skin elasticity and reduce signs of aging. This segment is expected to grow gradually, driven by the increasing adoption of ingredient transparency and natural products in cosmetics.

By Purity Analysis

In 2023, High Purity (99% and above) held a dominant market position in the “By Purity” segment of the Phenylalanine Market, capturing more than a 53.2% share. This category is primarily driven by the high demand for pharmaceutical-grade phenylalanine, where precise purity levels are critical for effective medical applications, such as in the treatment of phenylketonuria (PKU). The superior quality and consistency offered by high-purity phenylalanine make it a preferred choice in both pharmaceutical and nutritional supplement industries.

Medium Purity (90%-99%) phenylalanine accounted for a significant share, largely used in food and beverage applications, where high levels of purity are required but not necessarily at the extreme standards seen in pharmaceuticals. It is also used in the production of aspartame, a popular artificial sweetener.

Low Purity (up to 90%) phenylalanine holds the smallest share, mainly utilized in industrial applications where less stringent purity standards are acceptable. These include certain chemical synthesis processes where cost-efficiency is a higher priority than purity.

By Distribution Channel Analysis

In 2023, Hospital Pharmacy held a dominant market position in the “By Distribution Channel” segment of the Phenylalanine Market, capturing more than a 28.4% share. This dominance is primarily driven by the significant use of phenylalanine in medical treatments, particularly for phenylketonuria (PKU), where precise dosing and specialized products are required. Hospital pharmacies are often the primary point of contact for patients requiring these treatments, making them the leading distribution channel for pharmaceutical-grade phenylalanine.

Retail Pharmacy, the second-largest segment, caters to a broader range of customers, including those seeking phenylalanine in over-the-counter supplements or aspartame-containing products. While its market share is notable, it is somewhat constrained by the need for professional medical supervision when phenylalanine is used in higher doses for specific conditions like PKU.

Online Pharmacy, a rapidly growing channel, has gained popularity due to the increasing shift towards e-commerce in the healthcare industry. Consumers seeking dietary supplements or specialized treatments can conveniently access phenylalanine products from various online platforms. The convenience and accessibility of online pharmacies have contributed to their growth in the market.

By End Use Industry Analysis

In 2023, Food & Beverage held a dominant market position in the “By End Use Industry” segment of the Phenylalanine Market, capturing more than a 38.3% share. This segment’s leadership is primarily driven by the widespread use of phenylalanine as a key ingredient in low-calorie and sugar-free products, particularly in artificial sweeteners like aspartame. With the growing demand for healthier, low-calorie food options, food-grade phenylalanine continues to see strong growth across a variety of applications, from beverages to confectionery.

The Medical sector follows as a significant player in the market, where phenylalanine is used primarily in the treatment of phenylketonuria (PKU), a rare metabolic disorder. The increasing awareness of PKU and other genetic disorders has led to a steady rise in the use of phenylalanine in specialized medical treatments.

Animal Feed, a smaller but essential segment, benefits from the use of phenylalanine as an amino acid supplement to improve livestock growth and productivity. Its application in feed ensures optimal nutritional balance for animals, supporting the overall agricultural economy.

Dietary Supplements also contribute significantly, as phenylalanine is commonly included in supplements marketed for weight loss, mental health, and muscle recovery. The growing trend of fitness and wellness has made this segment one of the fastest-growing in the market.

Cosmetics & Creams account for a smaller but emerging segment, where phenylalanine is used for its potential anti-aging and skin benefits.

Key Market Segments

By Form

- D-Phenylalanine

- L-Phenylalanine

- DL-Phenylalanine

- Phenylalanine Hydrochloride

By Grade

- Food Grade

- Pharmaceutical Grade

- Nutritional Grade

- Cosmetic Grade

By Purity

- Low Purity (up to 90%)

- Medium Purity (90%-99%)

- High Purity (99% and above)

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

By End Use Industry

- Food & Beverage

- Medical

- Animal Feed

- Dietary Supplements

- Cosmetics & Creams

- Others

Driving factors

Growing Demand in Nutritional Supplements

Phenylalanine is increasingly being incorporated into various nutritional supplements, especially those targeting mental health and cognitive function. Phenylalanine is an essential amino acid that plays a key role in the synthesis of neurotransmitters such as dopamine, norepinephrine, and epinephrine, which are critical for mood regulation and mental clarity.

As awareness of mental health issues rises, more consumers are turning to supplements to help manage conditions like depression, anxiety, and ADHD. This growing demand for mood-boosting and cognitive-enhancing supplements is a major driver for the phenylalanine market.

Additionally, phenylalanine is used in weight loss supplements because of its ability to reduce appetite and increase satiety. As obesity rates rise globally, the market for weight management solutions is expanding, further boosting demand for phenylalanine in these products. This trend is supported by a broader shift toward natural, plant-based, and scientifically-backed supplements.

The increasing focus on holistic health and wellness is expected to fuel the growth of phenylalanine-based products in the coming years, making it a key driver of market expansion in the supplement industry.

Restraining Factors

Regulatory Concerns and Safety Issues

One of the primary restraints in the phenylalanine market is the regulatory scrutiny surrounding its use, particularly in food and beverage products. Phenylalanine is commonly used in artificial sweeteners like aspartame, but its consumption is closely monitored due to concerns about its potential health risks in certain individuals.

People with the genetic disorder phenylketonuria (PKU) must avoid phenylalanine because they cannot break it down properly, leading to harmful levels in the body. As a result, the use of phenylalanine in consumer products is highly regulated, with stringent labeling requirements to inform those with PKU.

Regulatory bodies, such as the FDA and European Food Safety Authority (EFSA), often impose restrictions on the concentration of phenylalanine in foods, further complicating its widespread use. Manufacturers must navigate these regulations carefully, balancing safety with consumer demand.

This regulatory burden can lead to increased costs, delays in product launches, and limited market access, especially in regions with strict food safety standards. These factors could hinder the growth of the phenylalanine market and limit its potential applications in certain sectors.

Growth Opportunity

Expansion in Functional Foods and Beverages

The phenylalanine market holds significant growth potential in the expanding functional foods and beverages sector. With consumers becoming more health-conscious, there is a rising interest in functional products that offer added health benefits beyond basic nutrition. Phenylalanine, due to its role in cognitive function, mood regulation, and weight management, fits well within the growing trend for functional foods.

Consumers are increasingly seeking products that not only provide basic sustenance but also contribute to overall well-being, which has led to a surge in demand for functional beverages, fortified snacks, and enriched meal replacements. Phenylalanine-based supplements are being added to energy drinks, protein bars, and even health-oriented beverages aimed at improving focus, memory, and mood.

As the global functional food market continues to expand, there is a clear opportunity for phenylalanine to play a larger role, particularly in markets like North America and Europe, where demand for personalized nutrition is high. By tapping into this growing segment, companies can unlock new revenue streams and cater to a more health-focused consumer base.

Challenge

Potential Consumer Misconceptions and Education

A significant challenge for the phenylalanine market is overcoming consumer misconceptions and educating the public about its benefits and safe usage. While phenylalanine is widely used in artificial sweeteners like aspartame, some consumers associate it with negative health effects, often due to misinformation or lack of understanding. This is especially true for those who have heard of phenylketonuria (PKU) and mistakenly believe that phenylalanine is harmful to everyone.

The negative stigma surrounding phenylalanine, often due to its presence in aspartame, presents a barrier to market acceptance, especially in regions with high awareness of health and wellness. As a result, there is a need for effective consumer education campaigns to address these concerns and highlight the actual benefits of phenylalanine in moderation, such as its role in mental health and metabolism.

Without such educational efforts, companies may struggle to effectively market phenylalanine-based products and expand their consumer base, limiting their growth prospects in the broader health and wellness market.

Emerging Trends

The Phenylalanine Market is growing due to trends in cognitive health, weight management, and plant-based sources.

The phenylalanine market has seen several emerging trends over recent years, driven by growing consumer interest in functional foods and supplements. One of the most notable trends is the increasing incorporation of phenylalanine in cognitive health supplements. As mental wellness continues to rise in priority for many, especially in response to the global increase in mental health issues, products containing phenylalanine are being marketed as mood enhancers and cognitive boosters.

This trend is particularly strong in regions like North America and Europe, where people are more open to using natural compounds to improve mental clarity and emotional well-being. Phenylalanine’s role in the synthesis of neurotransmitters such as dopamine and serotonin has attracted attention in products aimed at improving mood and combating conditions like depression and anxiety.

Another emerging trend is the use of phenylalanine in weight management supplements. As obesity and weight-related diseases become more widespread globally, phenylalanine is being promoted for its ability to suppress appetite and help with fat metabolism.

Consumers seeking to manage their weight naturally are turning to supplements containing phenylalanine as a part of their daily routine. This trend is especially evident in the Asia-Pacific region, where growing disposable incomes and a rising health-conscious middle class are driving demand for functional foods and supplements.

Lastly, there is a shift toward plant-based and clean-label phenylalanine sources. Consumers are increasingly demanding transparency regarding the ingredients in their food and supplements, with an emphasis on natural, sustainably sourced components. This has led to the development of plant-based phenylalanine alternatives, further expanding its presence in the market.

Business Benefits

Phenylalanine offers business benefits through its versatility, mood-enhancing properties, and market differentiation.

Phenylalanine presents several key business benefits for companies operating in the nutritional supplements, food, and health product sectors. One of the most significant advantages is its versatility in formulation. Due to its essential role in producing neurotransmitters like dopamine, phenylalanine is highly sought after for a wide range of products aimed at enhancing cognitive function and mood.

This includes supplements targeting mental health, focus, mood enhancement, and energy levels. As consumer interest in mental wellness continues to rise, businesses can leverage phenylalanine to create formulations that meet these growing demands.

Furthermore, phenylalanine has the potential to be a unique selling point for brands in the competitive health supplement market. Its ability to enhance mood and mental clarity gives it a distinct edge over other generic supplements. By incorporating phenylalanine, businesses can differentiate their products, making them stand out in the crowded market of vitamins and supplements.

This is particularly relevant in the wellness industry, where consumers are increasingly looking for products with proven, natural ingredients that support both physical and mental well-being.

From a market expansion perspective, companies producing phenylalanine-based products can capitalize on the growing popularity of plant-based and vegan supplements. By developing vegan-friendly phenylalanine options, businesses can tap into a rapidly expanding market. This trend is supported by the increasing number of consumers seeking plant-based alternatives for protein and amino acids, which adds a profitable avenue for expansion.

Additionally, research into the therapeutic benefits of phenylalanine offers pharmaceutical companies opportunities to explore new applications for the amino acid. For example, phenylalanine’s role in neurological health presents long-term opportunities for product development in the treatment of conditions such as depression and Parkinson’s disease.

Regional Analysis

In 2023, North America led the phenylalanine market with 41.9% share and USD 542.1 million revenue.

In 2023, North America held a dominant market position in the phenylalanine market, capturing more than a 41.9% share, with a revenue of USD 542.1 million. The region’s leadership can be attributed to several key factors, including the high demand for phenylalanine in food and beverage applications, as well as its critical role in the pharmaceutical industry.

North America’s advanced healthcare infrastructure and significant research and development (R&D) activities in biotechnology and food sciences further bolster its dominance. The region’s robust regulatory environment ensures the quality and safety of phenylalanine-based products, making it a preferred choice among consumers and manufacturers.

The presence of key players in the North American market, including large pharmaceutical and nutraceutical companies, also contributes to the region’s market strength. Additionally, increasing awareness about the health benefits of phenylalanine, particularly in managing conditions like phenylketonuria (PKU), supports growth in both the healthcare and dietary supplement sectors. The rising demand for protein supplements and functional foods, where phenylalanine is an essential amino acid, has created a significant opportunity for market expansion.

In Europe, the phenylalanine market is projected to grow steadily, driven by increasing healthcare expenditures and a growing focus on genetic disorders such as PKU. The European market also benefits from established pharmaceutical manufacturing and research capabilities. However, Europe’s market share is comparatively smaller than North America, largely due to a more fragmented regulatory landscape and varying consumer preferences across different countries.

Asia Pacific, on the other hand, is experiencing rapid growth in the phenylalanine market due to rising health awareness and the expanding food and beverage sector in countries like China and India. The region’s market share is expected to increase as more companies invest in production facilities and distribution channels to meet local demand.

Latin America, the Middle East, and Africa have smaller market shares but show promising growth trends, driven by expanding healthcare and dietary supplement markets.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global phenylalanine market is characterized by a competitive landscape with key players making significant contributions to the industry. Among the top companies, Ajinomoto, Archer Daniels Midland Company (ADM), Evonik Industries AG, and CJ CheilJedang Corporation are pivotal in shaping the market’s future trajectory.

Ajinomoto is one of the largest and most established players in the phenylalanine market, benefiting from its robust global distribution network and strong presence in both the food and pharmaceutical sectors. The company continues to lead innovations in amino acid production, with a focus on sustainability and high-quality manufacturing processes. Ajinomoto’s investments in research and development (R&D) help strengthen its market position.

Archer Daniels Midland Company (ADM) is a key player known for its vast agricultural and food ingredient offerings. Its advanced capabilities in fermentation technology and production of amino acids, including phenylalanine, have made it a strong contender in the global market. ADM’s focus on expanding its plant-based product lines and improving production efficiency aligns with rising consumer demand for plant-based and sustainable ingredients.

Evonik Industries AG stands out with its sophisticated technologies for amino acid production, leveraging cutting-edge biotechnological methods to produce phenylalanine efficiently. The company’s emphasis on sustainable practices and the health & nutrition segment strengthens its market presence and allows it to cater to the growing demand for amino acids in pharmaceutical applications.

CJ CheilJedang Corporation, a major South Korean conglomerate, has diversified its product portfolio and continues to invest in the phenylalanine segment. The company benefits from its integrated business model that spans production, research, and distribution, making it a strong competitor in both food and healthcare markets.

These companies are expected to lead the phenylalanine market in 2024, driving growth through innovation, strategic partnerships, and a focus on sustainability.

Market Key Players

- Ajinomoto

- Amino Gmbh

- Archer Daniels Midland Company

- Bafeng Pharmaceutical

- BASF SE

- CJ CheilJedang Corporation

- Daesang

- Dongchen Bio Engineering

- Evonik Industries AG

- Jinghai Amino acid

- JIRONG PHARM

- KYOWA

- Livzon Group

- Maidan Group

- Shandong Aowei Bioengineering Co., Ltd.

- Sichuan Kelong Pharmaceutical Co., Ltd.

- Sino Sweet

- Siwei Amino Acid

- Tianjin Jianfeng Chemical Co., Ltd.

- Tosoh Corporation

- Xiyue Pharmaceuticals

Recent Development

- In April 2024, BASF SE and Daesang Corporation entered into a joint venture to enhance the production and distribution of phenylalanine and other amino acids. The partnership, valued at $120 million, will result in the construction of a new production plant in South Korea, aiming to produce 8,000 metric tons of phenylalanine annually by 2025, catering to the growing demand in the Asia-Pacific region.

- In March 2024, Evonik Industries AG unveiled a novel enzyme-based technology for the production of phenylalanine. This technology is expected to reduce energy consumption by 30% compared to traditional fermentation processes. The company plans to deploy this method in its European production plants, increasing phenylalanine output by 15% annually.

- In January 2024, Ajinomoto Co., Inc. announced the expansion of its production facilities for phenylalanine in Japan. The expansion aims to increase annual production capacity by 25%, reaching an output of 10,000 metric tons annually. This strategic move is designed to meet growing global demand, particularly in the pharmaceutical and food sectors.

Report Scope

Report Features Description Market Value (2023) USD 1194.1 Million Forecast Revenue (2033) USD 1963.7 Million CAGR (2024-2032) 5.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Form (D-Phenylalanine, L-Phenylalanine, DL-Phenylalanine, Phenylalanine Hydrochloride), By Grade (Food Grade, Pharmaceutical Grade, Nutritional Grade, Cosmetic Grade), By Purity (Low Purity (up to 90%), Medium Purity (90%-99%), High Purity (99% and above)), By End Use Industry (Food & Beverage, Medical, Animal Feed, Dietary Supplements, Cosmetics & Creams, Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Ajinomoto, Amino Gmbh, Archer Daniels Midland Company, Bafeng Pharmaceutical, BASF SE, CJ CheilJedang Corporation, Daesang, Dongchen Bio Engineering, Evonik Industries AG, Jinghai Amino acid, JIRONG PHARM, KYOWA, Livzon Group, Maidan Group, Shandong Aowei Bioengineering Co., Ltd., Sichuan Kelong Pharmaceutical Co., Ltd., Sino Sweet, Siwei Amino Acid, Tianjin Jianfeng Chemical Co., Ltd., Tosoh Corporation, Xiyue Pharmaceuticals Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ajinomoto

- Amino Gmbh

- Archer Daniels Midland Company

- Bafeng Pharmaceutical

- BASF SE

- CJ CheilJedang Corporation

- Daesang

- Dongchen Bio Engineering

- Evonik Industries AG

- Jinghai Amino acid

- JIRONG PHARM

- KYOWA

- Livzon Group

- Maidan Group

- Shandong Aowei Bioengineering Co., Ltd.

- Sichuan Kelong Pharmaceutical Co., Ltd.

- Sino Sweet

- Siwei Amino Acid

- Tianjin Jianfeng Chemical Co., Ltd.

- Tosoh Corporation

- Xiyue Pharmaceuticals