Global Crotonaldehyde Market By Grade(Technical Grade, Chemical Grade), By Formulation Type (Liquid Crotonaldehyde, Solid Crotonaldehyde), By Production Method (Catalytic Dehydrogenation of Butyraldehyde, Oxidation of Butadiene, Dehydration of Butanol), By Product Type (Resins, Adhesives, Coatings), By Functionality (Preservative, Solvent, Intermediate), By Application (Warning Agent, Alcohol Denaturant, Surfactant, Insecticide, Rubber Accelerator, Chemical Intermediate), By End Use (Textile, Agrochemicals, Chemical Industry, Food Industry, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 133879

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Grade Analysis

- By Formulation Type Analysis

- By Production Method Analysis

- By Product Type Analysis

- By Functionality Analysis

- By Application Analysis

- By End-Use Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Trending Factors

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

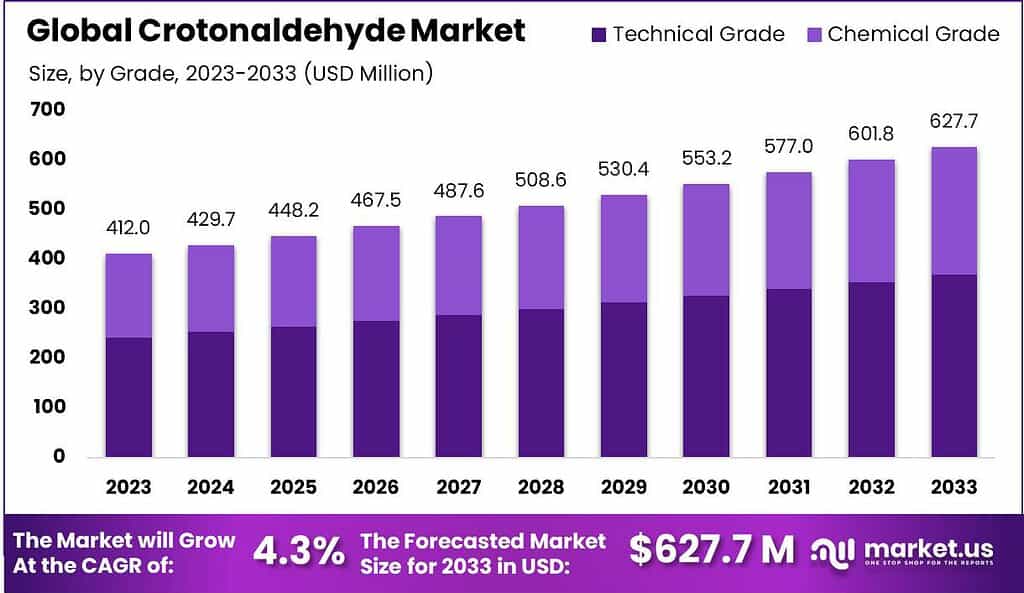

The Global Crotonaldehyde Market size is expected to be worth around USD 627.7 Million by 2033, from USD 412.02 Million in 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

Crotonaldehyde, a chemical compound with the formula C4H6O, is a colorless, flammable liquid with a strong odor. It is widely used as an intermediate in the production of chemicals like rubber additives plasticizers, and chemical accelerators, as well as in the manufacture of agrochemicals such as pesticides and herbicides.

It also finds applications in the pharmaceutical industry for drug production. Its role as a key building block for a variety of chemicals drives its demand across different sectors, including rubber, plastics, and chemicals.

However, the growth of the crotonaldehyde market is influenced by various government regulations and environmental concerns due to the chemical’s toxicity and flammability. In the United States, crotonaldehyde is classified as a hazardous air pollutant under the Clean Air Act, which imposes strict emission control standards on its production and use.

Similarly, in the European Union crotonaldehyde is regulated under REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals), requiring manufacturers to meet strict safety standards. In India, it is categorized as a toxic substance under the Manufacture, Storage, and Import of Hazardous Chemicals Rules (MSIHC), which mandates safety protocols for its handling and transportation.

The global trade of crotonaldehyde is heavily influenced by production capacity in key chemical manufacturing hubs such as North America Europe, and Asia-Pacific. In 2022, the U.S. alone saw an import-export value of USD 65 million in crotonaldehyde. Germany China, and India are major importers, while South Korea, Brazil, and the U.S. are key exporters.

Notably, the Asia-Pacific region accounts for over 45% of the global trade in crotonaldehyde, with China being a significant player, importing 35,000 metric tons and exporting 25,000 metric tons in 2023.

Governments in industrialized countries have been focusing on sustainable chemical production, which is influencing the crotonaldehyde market. For instance, the U.S. Department of Energy announced a USD 100 million investment in 2023 to support cleaner chemical production processes, including the reduction of emissions from crotonaldehyde.

Similarly, the European Chemical Industry Council (CEFIC) allocated EUR 40 million in 2023 to promote greener chemicals, which includes efforts to reduce the environmental footprint of crotonaldehyde production.

In terms of industry developments, several companies are investing in expanding their portfolios through acquisitions and partnerships. In 2022, Lanxess acquired Chemtura, a producer of specialty chemicals, including crotonaldehyde derivatives, for USD 1.5 billion Additionally, BASF and Clariant entered a partnership in 2023 valued at around USD 400 million to develop more sustainable chemical solutions, including crotonaldehyde-based products.

Research is also focused on improving the efficiency of crotonaldehyde production. For example, a new catalytic process developed by Johnson Matthey in 2022 promises to reduce energy consumption by 15% and improve yields by 25%.

In summary, the crotonaldehyde market is set for moderate growth, driven by demand in key industries like chemicals, rubber, and agrochemicals, while also facing regulatory challenges and pressure to adopt sustainable production practices.

Key Takeaways

- The Global Crotonaldehyde Market size is expected to be worth around USD 627.7 Million by 2033, from USD 412.02 Million in 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

- Technical Grade is dominated By the Grade segment of the Crotonaldehyde market, holding 58.5% of the share.

- Liquid Crotonaldehyde is dominated By the Formulation Type segment of the market with a 73.3% share.

- Catalytic Dehydrogenation of Butyraldehyde dominated the production Method segment of the market with a 54.4% share.

- Resins led the Crotonaldehyde market with a 44.5% share By Product Type segment.

- Preservative functionality dominated the Crotonaldehyde market with a 36.2% share by functionality segment.

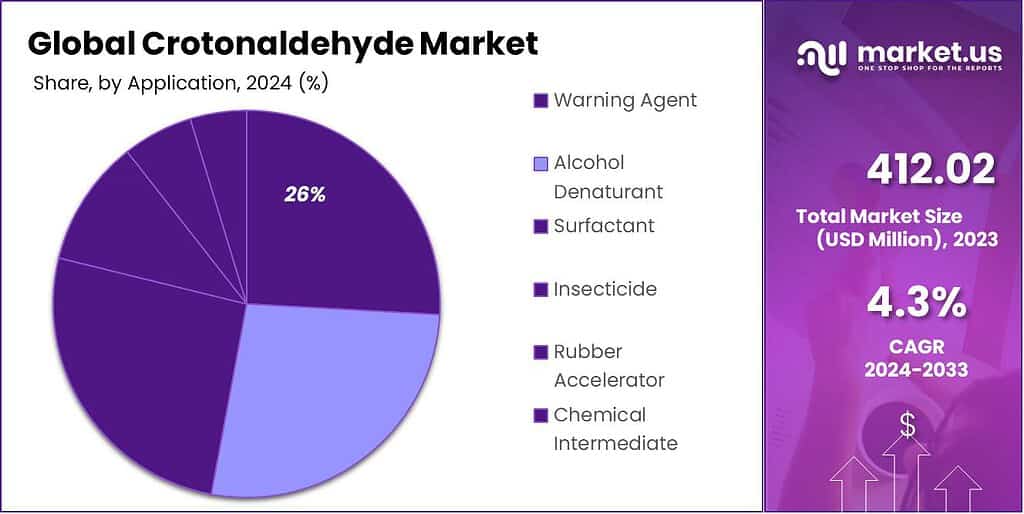

- Warning Agent dominated the “By Application” segment of the Crotonaldehyde market with a 24.5% share.

- Textile dominated the Crotonaldehyde market with a 24.5% share “by End Use” segment.

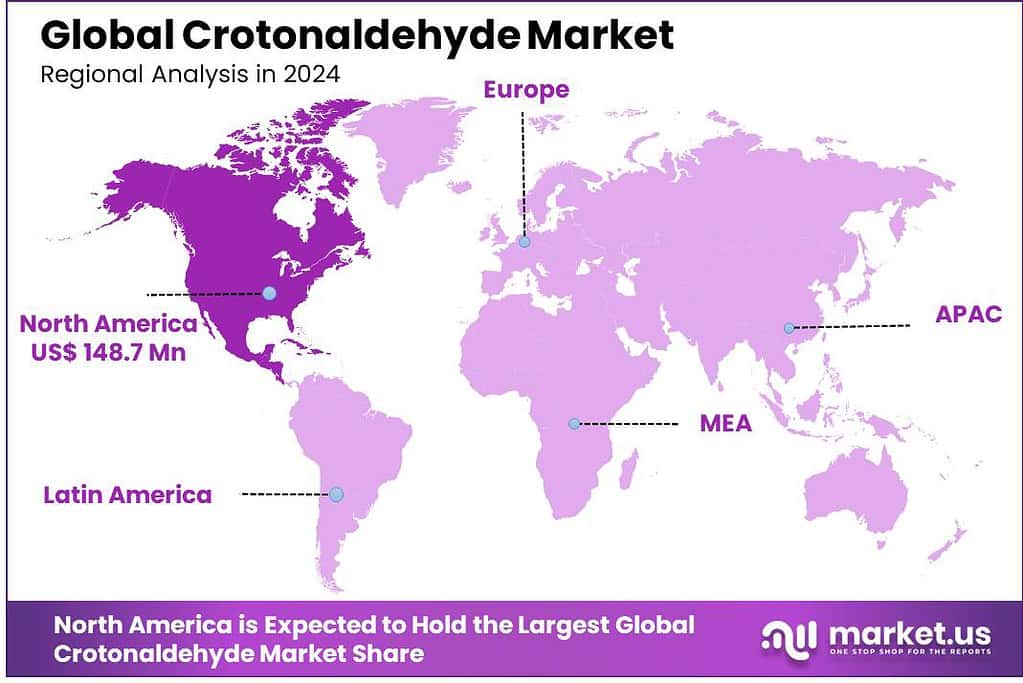

- North America dominates the Crotonaldehyde market with a 36% share, valued at $148.7 million.

By Grade Analysis

Technical Grade is dominated By the Grade segment of the Crotonaldehyde market, holding 58.5% of the share.

In 2023, Technical Grade held a dominant market position in the By Grade segment of the Crotonaldehyde market, capturing more than 58.5% share. This dominance is primarily driven by the widespread application of technical-grade Crotonaldehyde in industrial processes, including the production of agricultural chemicals, polymers, and coatings. Its high purity and suitability for manufacturing intermediates make it the preferred choice for various sectors. The robust demand for technical-grade Crotonaldehyde in the production of herbicides, fungicides, and other agrochemicals further supports its market leadership.

Chemical-grade crotonaldehyde, while crucial in specialized applications, holds a relatively smaller share. Chemical-grade Crotonaldehyde is primarily used in the synthesis of specialty chemicals, and fragrances, and as a stabilizing agent in certain formulations. Although its market presence is growing, particularly in the pharmaceutical and personal care sectors, it lags behind technical-grade in terms of overall demand.

By Formulation Type Analysis

Liquid Crotonaldehyde dominated the By Formulation Type segment of the market with a 73.3% share.

In 2023, Liquid Crotonaldehyde held a dominant market position in the By Formulation Type segment of the Crotonaldehyde market, capturing more than 73.3% share. The higher share of liquid Crotonaldehyde can be attributed to its widespread use in various industrial applications, including the production of agrochemicals, plastics, and coatings. Liquid Crotonaldehyde offers better handling, storage, and transportation advantages, making it the preferred form for large-scale production processes. It is also more versatile in formulations, which has led to its dominance in applications ranging from agricultural chemicals to the synthesis of specialty chemicals.

Solid Crotonaldehyde, while still utilized in specific niche applications, accounts for a significantly smaller market share. Solid forms are typically used in specialized industries, including certain pharmaceuticals and laboratory applications, where their stability and specific properties are required. However, the limited handling and processing flexibility of solid Crotonaldehyde has restricted its broader adoption in comparison to the liquid form.

By Production Method Analysis

Catalytic Dehydrogenation of Butyraldehyde dominated the production Method segment of the market with a 54.4% share.

In 2023, Catalytic Dehydrogenation of Butyraldehyde held a dominant market position in the By Production Method segment of the Crotonaldehyde market, capturing more than 54.4% share. This production method is widely favored due to its cost-effectiveness, high yield, and relatively straightforward processing. Catalytic dehydrogenation is a well-established technique that allows for the efficient conversion of butyraldehyde into Crotonaldehyde, making it the preferred method for large-scale production. The method’s ability to produce high-purity Crotonaldehyde with fewer by-products further contributes to its dominance in the market.

In contrast, Oxidation of Butadiene accounts for a smaller share but is still a significant production route, especially for large-volume industrial applications. This method, which involves the oxidation of butadiene to produce Crotonaldehyde, is particularly prevalent in regions with abundant butadiene supplies.

Finally, the Dehydration of Butanol method, while less common, remains an alternative for producing Crotonaldehyde, particularly in niche applications. However, it faces challenges related to higher energy requirements and lower yields compared to catalytic dehydrogenation. As the demand for Crotonaldehyde grows, the catalytic dehydrogenation process is expected to maintain its leading role due to its efficiency and scalability.

By Product Type Analysis

Resins led the Crotonaldehyde market with a 44.5% share By Product Type segment.

In 2023, Resins held a dominant market position in the By Product Type segment of the Crotonaldehyde market, capturing more than 44.5% share. This dominance is driven by the widespread use of Crotonaldehyde as an intermediate in the production of various resins, particularly in the manufacturing of unsaturated polyester resins (UPRs), which are used in the automotive, construction, and marine industries. The high demand for durable, high-performance materials in these sectors has bolstered the use of Crotonaldehyde in resin production.

Adhesives, while also a significant application for Crotonaldehyde, account for a smaller share. Crotonaldehyde is used in the synthesis of certain types of adhesive formulations, particularly in industries where strong bonding agents are required, such as in automotive and electronics. However, the adhesive segment is still developing compared to resins.

Coatings is another key application for Crotonaldehyde, where it is used in the production of specialty coatings, including automotive finishes and industrial coatings. While coatings are a high-value segment, they account for a smaller portion of the market compared to resins due to their more specific applications. Overall, resins continue to dominate the market due to their broad applicability in multiple industries.

By Functionality Analysis

Preservative functionality dominated the Crotonaldehyde market with a 36.2% share by functionality segment.

In 2023, Preservatives held a dominant market position in the By Functionality segment of the Crotonaldehyde market, capturing more than 36.2% share. Crotonaldehyde is widely used as a preservative due to its antimicrobial properties, particularly in the preservation of food, cosmetics, and pharmaceuticals. The ability of Crotonaldehyde to inhibit the growth of bacteria and fungi makes it a valuable ingredient in formulations that require extended shelf life. This functionality is especially critical in the food and personal care industries, where maintaining product integrity is paramount.

Solvent, while an important application of Crotonaldehyde, holds a smaller share compared to preservatives. As a solvent, Crotonaldehyde is used in industrial applications, including coatings and adhesives, to dissolve other substances, aiding in the production of various materials. However, its use as a solvent is less widespread than its role as a preservative, particularly in high-demand sectors.

Intermediate is another key functionality of Crotonaldehyde, where it serves as a building block in the synthesis of other chemicals, such as agrochemicals and resins. While the intermediate functionality supports a range of industrial applications, its share in the market remains lower than that of preservatives due to more specialized use cases.

By Application Analysis

Warning Agent dominated the “By Application” segment of the Crotonaldehyde market with a 24.5% share.

In 2023, Warning Agent held a dominant market position in the By Application segment of the Crotonaldehyde market, capturing more than 24.5% share. Crotonaldehyde is commonly used as a warning agent in products such as industrial solvents and fuels, where it imparts a distinct odor to prevent accidental ingestion or misuse. This functionality is crucial in sectors where safety is paramount, particularly in the chemical and automotive industries, helping to reduce the risk of hazardous exposure.

Alcohol Denaturant is another significant application of Crotonaldehyde, although it holds a smaller market share than warning agents. In this role, Crotonaldehyde is added to alcohol to make it undrinkable, thus preventing abuse and ensuring compliance with regulatory standards. The use of Crotonaldehyde as an alcohol denaturant is particularly prevalent in the production of industrial alcohol and certain household products.

Surfactant applications, where Crotonaldehyde is used to modify surface properties in detergents and emulsions, also contribute to its market share, though the segment is less dominant compared to warning agents and denaturants.

Insecticide formulations utilize Crotonaldehyde for its toxic properties, particularly in pest control products, although its share is smaller due to the rise of alternative, more effective insecticides.

Rubber Accelerator applications are another niche segment, where Crotonaldehyde is used in the manufacturing of synthetic rubber. Finally, Chemical Intermediate functions account for a significant portion of the market, with Crotonaldehyde used in the synthesis of agrochemicals, resins, and other chemicals. Overall, the diverse applications of Crotonaldehyde support its significant presence in the market.

By End-Use Analysis

Textile dominated the Crotonaldehyde market with a 24.5% share.

In 2023, Textile held a dominant market position in the By End Use segment of the Crotonaldehyde market, capturing more than 24.5% share. Crotonaldehyde is widely used in the textile industry for its ability to act as a key intermediate in the production of dyes, resins, and finishing agents. The demand for Crotonaldehyde in textiles is driven by its role in improving fabric properties, such as durability, water resistance, and color fastness. Additionally, the growing focus on sustainable and eco-friendly production processes in the textile sector has further bolstered its use in specialized textile treatments.

Agrochemicals is another major end-use segment for Crotonaldehyde, particularly as an intermediate in the synthesis of herbicides, insecticides, and fungicides. As the agricultural industry continues to grow, the demand for Crotonaldehyde in crop protection chemicals is expected to rise.

The Chemical Industry, where Crotonaldehyde is used as a building block in the synthesis of various chemicals, and the Food Industry uses Crotonaldehyde as a preservative in certain products, although its share is relatively smaller compared to other applications.

Key Market Segments

By Grade

- Technical Grade

- Chemical Grade

By Formulation Type

- Liquid Crotonaldehyde

- Solid Crotonaldehyde

By Production Method

- Catalytic Dehydrogenation of Butyraldehyde

- Oxidation of Butadiene

- Dehydration of Butanol

By Product Type

- Resins

- Adhesives

- Coatings

By Functionality

- Preservative

- Solvent

- Intermediate

By Application

- Warning Agent

- Alcohol Denaturant

- Surfactant

- Insecticide

- Rubber Accelerator

- Chemical Intermediate

By End Use

- Textile

- Agrochemicals

- Chemical Industry

- Food Industry

- Others

Driving factors

Increasing Demand from the Chemical Industry

The chemical industry has emerged as a primary driver of growth for the crotonaldehyde market, with crotonaldehyde being a key intermediate in the production of various chemical compounds, such as plasticizers, resins, and synthetic rubber. As industrial applications expand, the demand for crotonaldehyde to produce such chemicals has been consistently increasing.

The versatility of crotonaldehyde as a chemical intermediate has made it indispensable across various sub-sectors within the chemical industry, further boosting its market growth. With global chemical production increasing at a steady pace, particularly in emerging economies, crotonaldehyde’s role as a critical building block ensures sustained demand.

Growth of Pharmaceutical and Agrochemical Sectors

The pharmaceutical and agrochemical sectors have contributed significantly to the expansion of the crotonaldehyde market. In pharmaceuticals, crotonaldehyde is used in the synthesis of active pharmaceutical ingredients (APIs) and drug intermediates, playing a crucial role in the development of treatments for various diseases. Likewise, the agrochemical industry uses crotonaldehyde in the formulation of pesticides and herbicides.

As the global population grows and the demand for healthcare and crop protection products intensifies, both sectors are poised for continued growth, indirectly driving the need for crotonaldehyde. Market research indicates that the global pharmaceutical market is projected to grow at a compound annual growth rate (CAGR) of over 4% from 2023 to 2028, which will support increased demand for crotonaldehyde-based compounds.

Increased Investment in Renewable Energy

Increased investment in renewable energy has also contributed to the growth of the crotonaldehyde market, albeit indirectly. Renewable energy projects often require advanced materials and chemicals, in which crotonaldehyde plays a role, particularly in the production of bio-based plastics, resins, and other sustainable materials.

As nations and corporations invest more in green energy technologies and seek sustainable alternatives, the demand for crotonaldehyde in renewable energy applications is expected to rise. This trend aligns with the growing global shift towards eco-friendly and sustainable solutions, further supporting the broader market dynamics.

Restraining Factors

Health and Safety Concerns

Health and safety concerns are significant restraining factors in the growth of the crotonaldehyde market. Crotonaldehyde is a highly reactive and toxic compound, with exposure potentially leading to serious health issues, including respiratory and skin irritation, and long-term exposure can cause more severe effects like organ damage or carcinogenic risks.

As regulations around chemical safety and environmental impact tighten globally, manufacturers face increasing pressure to comply with stringent health and safety standards. This not only increases operational costs but also limits the scope of applications for crotonaldehyde, particularly in industries where worker safety is a major concern, such as pharmaceuticals and agrochemicals. Stringent regulatory frameworks, such as REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) in the European Union, impose additional hurdles for crotonaldehyde manufacturers, inhibiting growth in certain markets.

Fluctuating Raw Material Prices

Fluctuating raw material prices also pose a challenge to the stability of the crotonaldehyde market. Crotonaldehyde is derived from petrochemical feedstocks, including propylene, and its production is sensitive to shifts in crude oil and natural gas prices. Periodic volatility in the prices of these raw materials, often due to geopolitical tensions, market imbalances, or natural disasters, leads to unpredictable cost structures for manufacturers.

This price instability can significantly impact the profitability of crotonaldehyde production and, consequently, its pricing in the market. As raw material costs rise, manufacturers may pass on these increases to end users, potentially limiting demand in price-sensitive applications or prompting customers to explore cheaper alternatives.

Competition from Alternative Chemicals

The crotonaldehyde market also faces competition from alternative chemicals, which offer similar functionalities with lower toxicity or greater availability. For instance, alternative aldehydes and bio-based intermediates have been developed as substitutes in key applications, such as resins, plastics, and agrochemicals. These alternatives are often viewed as safer or more environmentally friendly, particularly in light of growing consumer and regulatory demand for sustainable solutions.

As industries move towards greener and more sustainable chemicals, the demand for crotonaldehyde could be stifled by the increasing availability of these alternatives. Furthermore, the development of bio-based or renewable feedstocks for these chemicals adds further pressure on traditional crotonaldehyde production methods.

Growth Opportunity

Bio-Based Crotonaldehyde Production

A key opportunity in 2024 lies in the growing focus on bio-based Crotonaldehyde production. As sustainability becomes a central theme in the chemical industry, the demand for renewable raw materials is escalating. Bio-based Crotonaldehyde, produced from renewable resources such as plant biomass, offers a more eco-friendly alternative to traditional petroleum-based production.

Companies are increasingly investing in sustainable production methods, which could lead to reduced environmental impact and enhanced market appeal. This shift aligns with the broader trend toward green chemistry and circular economy principles, which is expected to boost demand for bio-based Crotonaldehyde in diverse industries.

Increased Use in Agricultural Chemicals

The use of Crotonaldehyde as an intermediate in the production of agricultural chemicals is expanding. It serves as a precursor for the synthesis of herbicides and fungicides, which are critical in modern agriculture. With the growing demand for effective crop protection solutions, driven by the need to ensure food security and improve agricultural productivity, the agricultural sector is increasingly adopting chemicals that enhance crop yields and reduce losses.

This trend is expected to fuel the demand for Crotonaldehyde, particularly in emerging markets with expanding agricultural industries.

Rising Demand for Cosmetics and Personal Care Products

Another promising growth driver is the rising demand for cosmetics and personal care products. Crotonaldehyde is used in the production of fragrances and as a stabilizing agent in various formulations. As the global beauty industry continues to expand, particularly in developing economies, the demand for high-quality cosmetic products will likely increase. This is anticipated to create a steady demand for Crotonaldehyde, further diversifying its applications.

Trending Factors

Integration of Digital Technologies in Production

The integration of digital technologies into the production processes of Crotonaldehyde is an emerging trend that could enhance operational efficiency and reduce production costs. Advancements in process automation, data analytics, and artificial intelligence (AI) allow manufacturers to optimize chemical reactions, improve yield, and minimize waste.

As digital technologies become more prevalent, manufacturers are expected to adopt smart systems that enable real-time monitoring and predictive maintenance, ensuring a more efficient and reliable production process. This shift towards digitalization is poised to reduce operational inefficiencies, contributing to the profitability and scalability of Crotonaldehyde production.

Sustainability and Green Chemistry Innovations

Sustainability continues to be a defining trend in the Crotonaldehyde market. The industry is increasingly focused on green chemistry innovations that reduce the environmental footprint of chemical production. The demand for more sustainable processes such as bio-based Crotonaldehyde production and the use of renewable feedstocks is growing.

These innovations not only cater to increasing environmental regulations but also appeal to consumers and industries seeking eco-friendly alternatives. Companies investing in green chemistry are likely to gain a competitive advantage, as sustainability becomes a key driver of corporate strategy.

Increasing Application in Polymers and Coatings

Another key trend is the rising application of Crotonaldehyde in polymers and coatings. Crotonaldehyde is used as an intermediate in the production of specialty resins and coatings, which are crucial in industries such as automotive, construction, and electronics.

With the expanding demand for high-performance materials, driven by technological advancements and infrastructure development, the use of Crotonaldehyde in these sectors is expected to increase. The trend towards more durable, high-quality coatings in various applications will likely drive demand for Crotonaldehyde-based resins.

Regional Analysis

North America dominates the Crotonaldehyde market with a 36% share, valued at $148.7 million.

The global Crotonaldehyde market is experiencing varied growth dynamics across different regions, driven by local industrial demands, sustainability initiatives, and regulatory environments.

North America dominates the global Crotonaldehyde market, accounting for 36% of the total market share, valued at approximately $148.7 million in 2023. This is primarily due to the well-established chemical manufacturing sector, robust demand for industrial chemicals, and significant investments in bio-based production technologies. The presence of key market players and the focus on sustainability in the U.S. further contribute to this dominance. North America is expected to continue leading the market, driven by advancements in green chemistry and increasing demand in the agricultural and automotive sectors.

In Europe, the market for Crotonaldehyde is projected to grow steadily, supported by stringent environmental regulations and the push for sustainable chemical production. The region’s demand is largely driven by the use of Crotonaldehyde in agricultural chemicals, particularly herbicides, and fungicides. Countries like Germany and France are significant contributors, with the European market focusing on eco-friendly, bio-based chemical production.

Asia Pacific is anticipated to witness the highest growth rate in the coming years, driven by rapid industrialization, the expansion of the chemical and agricultural sectors, and increasing production capacities in countries like China and India. The rising demand for consumer goods, including cosmetics and coatings, is also fueling the demand for Crotonaldehyde in the region.

Latin America and the Middle East & Africa represent emerging markets for Crotonaldehyde, with growing infrastructure development and expanding agricultural industries contributing to moderate growth. However, these regions face challenges in terms of regulatory frameworks and local production capabilities.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Crotonaldehyde market in 2024 is driven by the activities of several key players, each contributing to the market’s growth through innovation, production capabilities, and strategic investments. Prominent companies in this space include Alfa Aesar, Celanese Corporation, Godavari Biorefineries Ltd, and Haihang Industry Co., Ltd, among others.

Alfa Aesar, a leading global supplier of research chemicals, plays a critical role in the Crotonaldehyde market by offering a wide range of chemical intermediates, including Crotonaldehyde. The company’s emphasis on high-quality chemicals and its robust distribution network enables it to cater to diverse industries, including pharmaceuticals, agriculture, and materials science. Alfa Aesar’s global presence and commitment to expanding its chemical product portfolio position it as a major player in the market.

Celanese, a major global producer of engineered materials and chemicals, is a key contributor to the Crotonaldehyde market. The company’s advanced manufacturing capabilities and focus on sustainability in chemical production, including bio-based alternatives, are central to its strategic growth. Celanese’s broad portfolio of chemicals, including Crotonaldehyde, is utilized in diverse applications, from automotive coatings to industrial chemicals, supporting its position in the market.

Godavari Biorefineries, based in India, is a significant player in the Crotonaldehyde market, particularly in the bio-based segment. The company has made notable strides in producing Crotonaldehyde from renewable resources, aligning with the growing demand for eco-friendly, sustainable chemicals. This focus on sustainability, alongside its expanding production capacity, makes Godavari Biorefineries a strong contender in the global market.

Haihang Industry Co., Ltd is a prominent Chinese chemical manufacturer known for its production of Crotonaldehyde and other fine chemicals. The company’s well-established supply chain and extensive product range serve various industries, including agriculture, pharmaceuticals, and chemicals. Haihang’s focus on quality control and competitive pricing allows it to maintain a strong market presence, particularly in Asia-Pacific.

These companies, with their diverse strengths in innovation, production, and sustainability, are poised to drive the Crotonaldehyde market forward in 2024. Their strategic investments in sustainable technologies and expanding production capacities are crucial in meeting the growing demand across key applications, such as agriculture, automotive, and personal care.

Market Key Players

- Alfa Aesar

- Amadis Chemicals

- Ambinter

- Celanese Corporation

- Central Drug House

- Chemhere

- China Overseas Pioneer Chemicals

- Finetech Industry Limited

- Godavari Biorefineries Ltd

- Haihang Industry Co., Ltd

- MolCore

- Nantong Acetic Acid Chemical Co., Ltd

- Shandong Kunda Biotechnology

- Tokyo Chemical Industry

- Tokyo Chemical Industry Co., Ltd

- Vitas-M Laboratory

Recent Development

- In June 2024, Haihang Industry Co., Ltd, a key player based in China, expanded its export operations for Crotonaldehyde to new markets in Europe and North America. The company has been focusing on meeting the rising demand for Crotonaldehyde in the agricultural and coatings sectors, which is expected to drive market growth. This strategic move is designed to position Haihang as a leading supplier in the global chemical supply chain, leveraging its manufacturing capabilities and cost-effective production methods.

- In April 2024, Godavari Biorefineries Ltd, an Indian leader in bio-based chemicals, launched a new production line dedicated to manufacturing bio-based Crotonaldehyde from renewable agricultural feedstocks. The initiative, which is expected to reduce the environmental impact of Crotonaldehyde production, is in line with the company’s commitment to sustainable practices. This move is aimed at meeting the increasing demand for eco-friendly chemicals, particularly in the agricultural and personal care sectors.

- In February 2024, Alfa Aesar, a prominent supplier of research chemicals, entered into a strategic partnership with a leading agricultural chemical firm to supply Crotonaldehyde for use in the production of herbicides and fungicides. This partnership underscores the growing importance of Crotonaldehyde in the agriculture industry, where it is used as an intermediate in crop protection chemicals. The collaboration is expected to strengthen Alfa Aesar’s market position, particularly in the growing demand for sustainable agricultural solutions.

Report Scope

Report Features Description Market Value (2023) USD 412.02 Million Forecast Revenue (2033) USD 627.7 Million CAGR (2024-2032) 4.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Grade(Technical Grade, Chemical Grade), By Formulation Type (Liquid Crotonaldehyde, Solid Crotonaldehyde), By Production Method (Catalytic Dehydrogenation of Butyraldehyde, Oxidation of Butadiene, Dehydration of Butanol), By Product Type (Resins, Adhesives, Coatings), By Functionality (Preservative, Solvent, Intermediate), By Application (Warning Agent, Alcohol Denaturant, Surfactant, Insecticide, Rubber Accelerator, Chemical Intermediate), By End Use (Textile, Agrochemicals, Chemical Industry, Food Industry, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Alfa Aesar, Amadis Chemicals, Ambinter, Celanese Corporation, Central Drug House, Chemhere, China Overseas Pioneer Chemicals, Finetech Industry Limited, Godavari Biorefineries Ltd, Haihang Industry Co., Ltd, MolCore, Nantong Acetic Acid Chemical Co., Ltd, Shandong Kunda Biotechnology, Tokyo Chemical Industry, Tokyo Chemical Industry Co., Ltd, Vitas-M Laboratory Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alfa Aesar

- Amadis Chemicals

- Ambinter

- Celanese Corporation

- Central Drug House

- Chemhere

- China Overseas Pioneer Chemicals

- Finetech Industry Limited

- Godavari Biorefineries Ltd

- Haihang Industry Co., Ltd

- MolCore

- Nantong Acetic Acid Chemical Co., Ltd

- Shandong Kunda Biotechnology

- Tokyo Chemical Industry

- Tokyo Chemical Industry Co., Ltd

- Vitas-M Laboratory