Global Phycoerythrin Market By Source (Marine Algae, Freshwater Algae), By Process of Extraction (Buffer Extraction, Cell Wall Extraction, Hydrolysis Extraction), By Form (Freeze Dried, Liquid), By Product Type (R-PE, B-PE, C-PE), By End Use Application (Pharmaceutical, Food, Cosmetics, Diagnostic, Agricultural, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 134340

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Source Analysis

- By Process of Extraction Analysis

- By Form Analysis

- By Product Type Analysis

- By End Use Application Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

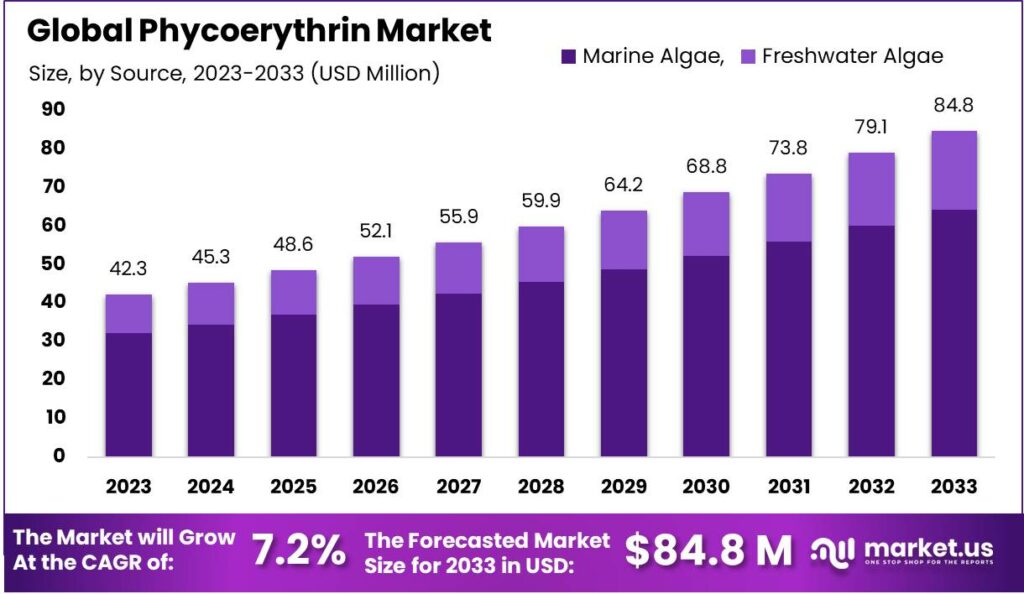

The Global Phycoerythrin Market size is expected to be worth around USD 84.8 million by 2033, from USD 42.3 Million in 2023, growing at a CAGR of 7.2% during the forecast period from 2024 to 2033.

The phycoerythrin market is experiencing consistent growth, driven by its diverse applications in biotechnology, pharmaceuticals, cosmetics, and food industries. Phycoerythrin, a pigment-protein complex derived from red algae, is highly valued for its fluorescent properties, which are essential in scientific research, diagnostics, and as a natural colorant.

This growing demand is further supported by the shift toward sustainable and eco-friendly ingredients, with consumers increasingly favoring natural alternatives. The market’s steady expansion can be attributed to its multiple functional uses, which make it a desirable option for companies seeking innovative and sustainable ingredients.

The demand for phycoerythrin is primarily driven by its versatility in biotechnology applications, especially in flow cytometry and fluorescence microscopy. As these technologies advance, the need for high-quality, non-toxic products like phycoerythrin is expected to grow. The biotechnology sector, valued at approximately $800 billion in 2023, is anticipated to expand at a CAGR of 9% from 2024 to 2030, further boosting the demand for fluorescent markers.

Additionally, the cosmetics industry is embracing natural colorants, with the global natural cosmetics market projected to reach over $30 billion by 2025, growing at a CAGR of 5.6%. This trend positions phycoerythrin as a popular choice due to its non-toxic and eco-friendly nature.

Phycoerythrin’s popularity in research and diagnostics is increasing, particularly in molecular biology and immunology, where it is trusted for its efficiency and precision. Its use in clean beauty formulations, driven by the growing trend for vegan and natural products, is also pushing the market forward. As phycoerythrin continues to gain traction, especially in clean-label cosmetics, it is poised to become a key ingredient in these industries.

Emerging markets, particularly in the Asia-Pacific region, offer significant opportunities for growth. These markets are rapidly adopting natural and sustainable products, which creates a favorable environment for phycoerythrin. Companies investing in R&D to expand their applications may capitalize on these opportunities.

Furthermore, the global trade of algae-based products is steadily increasing. In 2022, the import-export trade for algae products, including phycoerythrin, was valued at over $2.5 billion. The U.S. accounted for approximately 35% of global algae exports, amounting to $850 million. This trend is expected to continue as countries like China and India increase their investments in algae farming and bio-based products.

Governments are supporting the growth of algae-derived products like phycoerythrin through regulations and funding initiatives. The U.S. Department of Energy allocated $16 million in 2023 for algae biofuel research, indirectly benefiting the algae-based product market. Companies like Cyanotech Corporation and Algaecytes have raised substantial investments, such as the $10 million raised by Cyanotech in 2023 to expand its algae production facilities. In addition, NutraScience Labs partnered with a biotechnology firm to enhance phycoerythrin extraction methods, improving yield and product purity.

As demand for phycoerythrin grows, key players are expanding production capabilities. For instance, Algal Technologies plans to increase its production capacity by 30% in 2024, adding 5 tons of phycoerythrin to the market, worth an estimated $2 million. These expansions, along with ongoing innovations, are expected to shape the future of the phycoerythrin market.

Key Takeaways

- The Global Phycoerythrin Market size is expected to be worth around USD 84.8 million by 2033, from USD 42.3 Million in 2023, growing at a CAGR of 7.2% during the forecast period from 2024 to 2033.

- In 2023, Marine Algae dominated the phycoerythrin market By Source with 76.1%.

- Buffer Extraction dominated the phycoerythrin market By Process with 54.3%.

- Freeze-dried dominated the phycoerythrin market By Form with 68.1%.

- R-PE dominated the Fermented phycoerythrin market By Product Type with 59.1%.

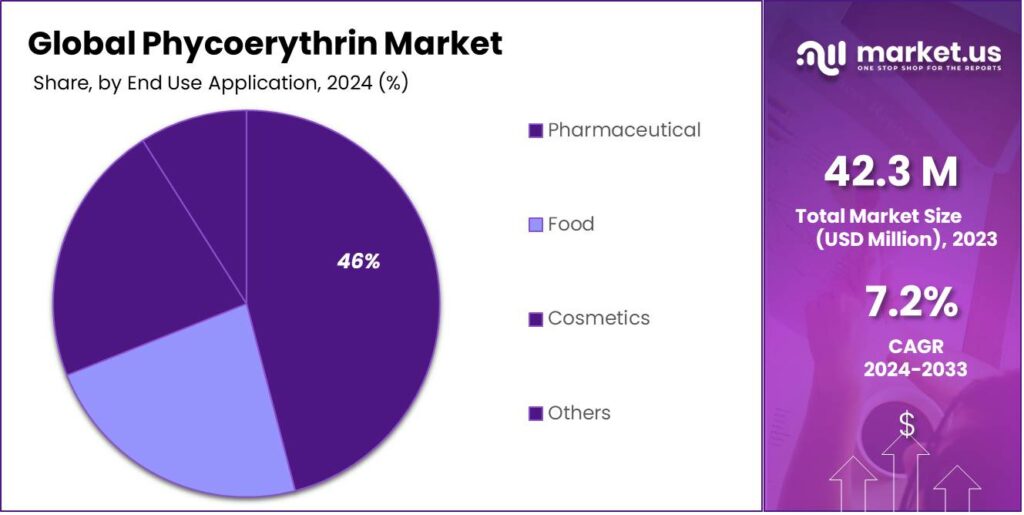

- Pharmaceuticals dominated the phycoerythrin market By End Use Application with 37.1%.

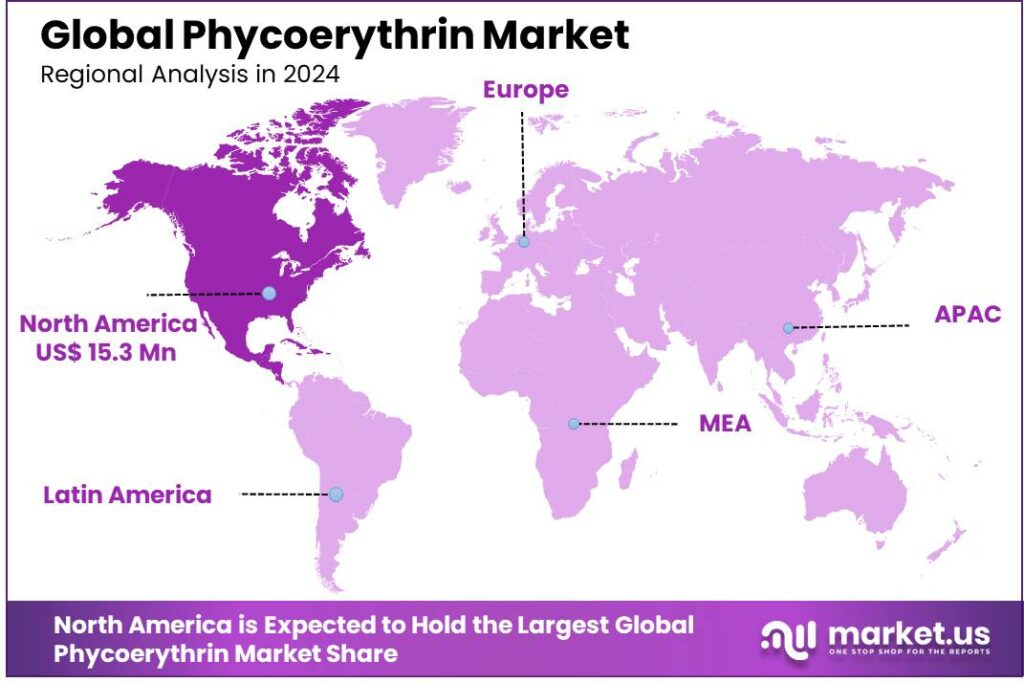

- North America dominated the phycoerythrin market with a 36.6% share, generating USD 15.3 million.

By Source Analysis

In 2023, Marine Algae held a dominant market position in the By Source segment of the Phycoerythrin Market, capturing more than a 76.1% share. This dominance can be attributed to the abundant availability of marine algae species, particularly from coastal ecosystems, which are rich in phycoerythrin.

Marine algae offer a higher concentration of phycoerythrin, making them the preferred source for large-scale commercial production. The natural environment of marine algae also contributes to their higher yield and the ability to produce more consistent extracts, which is crucial for industrial applications.

Freshwater Algae, while accounting for a smaller share of the market, continues to play a significant role, especially in specific niche applications where the sourcing of freshwater species is more accessible or preferred. Freshwater algae are often used in research and smaller-scale production due to their relatively lower cost and the ease of cultivating them in controlled environments.

However, their phycoerythrin content is generally lower than that of marine algae, which impacts their competitiveness in large-scale production. As demand for sustainable and efficient sourcing practices grows, both sources are expected to benefit from innovations in algae cultivation and extraction technologies.

By Process of Extraction Analysis

In 2023, Buffer Extraction held a dominant market position in the By Process of Extraction segment of the Phycoerythrin Market, capturing more than a 54.3% share. This method remains the preferred choice due to its efficiency and cost-effectiveness, as it allows for high yields with minimal processing time. The Buffer Extraction process is particularly popular in commercial applications, where consistency and scalability are essential for large-scale production.

Cell Wall Extraction followed as the second-largest method, accounting for a significant portion of the market. This technique is often employed when high purity and the preservation of the integrity of phycoerythrin are paramount. Though it is more labor-intensive and requires more advanced equipment, it is widely used in research and specialized industrial applications where the highest quality of extract is needed.

Hydrolysis Extraction, while holding a smaller market share, continues to gain traction due to its ability to break down complex compounds, making phycoerythrin more accessible for various biotechnological applications. As the demand for sustainable extraction methods grows, all three processes are expected to evolve with advancements in technology, improving efficiency and sustainability across the sector.

By Form Analysis

In 2023, Freeze-Dried held a dominant market position in the By Form segment of the Phycoerythrin Market, capturing more than a 68.1% share. Freeze-dried phycoerythrin is highly favored due to its long shelf life, ease of storage, and ability to retain most of the bioactive properties of the pigment. This form is particularly popular in industries where stability and portability are crucial, such as in pharmaceuticals, biotechnology, and food processing. The freeze-drying process ensures that phycoerythrin remains stable even at room temperature, which is a significant advantage for large-scale production and distribution.

Liquid phycoerythrin, while holding a smaller market share, continues to see demand, especially in applications where immediate use is required or where the convenience of a ready-to-use form outweighs the need for long-term stability. Liquid forms are commonly used in research and clinical settings where fresh extracts are preferred for immediate application.

However, their shorter shelf life and potential for degradation during storage limit their use in certain industrial applications. The trend towards more sustainable and efficient extraction and preservation methods is expected to drive innovations in both freeze-dried and liquid forms in the coming years.

By Product Type Analysis

In 2023, R-PE (R-Phycoerythrin) held a dominant market position in the By Product Type segment of the Phycoerythrin Market, capturing more than a 59.1% share. R-PE is widely recognized for its superior fluorescence properties, making it the preferred choice in various applications such as biotechnology, diagnostics, and food coloring. Its high performance in fluorescence and ease of use in analytical applications contribute to its widespread adoption, driving its leading market share. Furthermore, R-PE’s stability and availability from marine algae have reinforced its dominance in industrial and research sectors.

B-PE (B-Phycoerythrin) follows as the second-largest product type, accounting for a notable portion of the market. B-PE is often used in niche applications that require specific optical characteristics, including certain types of immunoassays and molecular biology research. While it is not as universally applicable as R-PE, its unique properties still provide significant value in select industries.

C-PE (C-Phycoerythrin), though holding the smallest share, continues to find its place in specialized markets where specific functional qualities are required, particularly in fluorescence-based techniques for medical and environmental applications. As the market evolves, each product type is expected to benefit from advancements in extraction and processing technologies, enhancing their performance and applications.

By End Use Application Analysis

In 2023, Pharmaceutical held a dominant market position in the By End Use Application segment of the Phycoerythrin Market, capturing more than a 37.1% share. This significant share can be attributed to the growing demand for phycoerythrin in drug formulation, particularly in targeted drug delivery and diagnostic applications. The ability of phycoerythrin to act as a fluorescent marker makes it ideal for use in medical imaging and biomarker research. Moreover, its potential in immunotherapy and other advanced therapeutic techniques further drives its widespread adoption within the pharmaceutical industry.

The Food industry followed, holding a substantial share of the market. Phycoerythrin is increasingly being utilized as a natural colorant due to its vibrant red hue and its status as a safe, plant-based alternative to synthetic dyes. With rising consumer demand for clean-label products, the use of phycoerythrin in food and beverages continues to expand, particularly in products such as dairy, confectionery, and beverages.

The Cosmetics sector accounted for a moderate share, where phycoerythrin is gaining popularity in formulations for skincare products due to its antioxidant properties. It is used in formulations targeting anti-aging and skin protection, tapping into the growing market for natural ingredients in cosmetics.

Diagnostic applications also play a significant role, particularly in research and clinical diagnostics where phycoerythrin is utilized in fluorescence-based detection systems, immunoassays, and flow cytometry. The Agricultural sector, though smaller, is emerging with applications in bio-fertilizers and plant growth regulators.

Key Market Segments

By Source

- Marine Algae

- Freshwater Algae

By Process of Extraction

- Buffer Extraction

- Cell Wall Extraction

- Hydrolysis Extraction

By Form

- Freeze Dried

- Liquid

By Product Type

- R-PE

- B-PE

- C-PE

By End Use Application

- Pharmaceutical

- Food

- Cosmetics

- Diagnostic

- Agricultural

- Others

Driving factors

Increasing Demand for Natural Ingredients in the Cosmetics Industry

The rising demand for natural and sustainable ingredients in the cosmetics industry is a key driver for the phycoerythrin market. Phycoerythrin, a red pigment found in algae, is increasingly used in various cosmetic and skincare products due to its natural, antioxidant, and anti-inflammatory properties. As consumers become more conscious of the environmental and health impacts of synthetic chemicals, there is a clear trend toward plant-based and algae-derived ingredients.

This shift is particularly noticeable in the beauty and personal care sector, where phycoerythrin is valued for its skin-enhancing benefits, including soothing irritated skin and providing a natural glow. According to industry reports, the global demand for natural beauty products is growing at a steady pace, driven by the increasing awareness of harmful chemicals used in traditional cosmetics. The preference for green, eco-friendly, and vegan-certified products is likely to keep pushing the demand for phycoerythrin, as brands seek alternatives to chemical additives and dyes.

As a result, companies are looking to innovate and expand their product lines to include phycoerythrin, capitalizing on this consumer trend and the growing demand for transparency in ingredient sourcing.

Restraining Factors

High Production Costs

One of the primary restraints in the phycoerythrin market is the high production cost associated with its extraction. Phycoerythrin is extracted from red algae, which requires specific cultivation and harvesting conditions. The extraction process is labor-intensive, time-consuming, and requires specialized equipment. Additionally, the algae need to be grown in controlled environments, which adds to the overall production costs.

Due to the complex and resource-heavy nature of obtaining phycoerythrin, it is often more expensive than other synthetic colorants and additives used in similar applications. This can limit its widespread adoption, especially in price-sensitive markets or among smaller companies that may not have the budget to invest in such high-cost ingredients.

Furthermore, algae cultivation is dependent on environmental factors such as water quality and temperature, making large-scale production even more difficult and costly. While the demand for natural ingredients is increasing, the high cost of phycoerythrin remains a significant barrier to its broader use, particularly in industries where cost efficiency is critical.

Growth Opportunity

Expansion in Nutraceuticals and Functional Foods

An exciting opportunity for the phycoerythrin market lies in its potential use in the nutraceuticals and functional foods industries. Phycoerythrin has antioxidant and anti-inflammatory properties, which could make it a valuable ingredient in dietary supplements and functional foods. As consumers increasingly look for products that offer both nutritional benefits and disease prevention, phycoerythrin could serve as a natural and health-promoting alternative to synthetic additives.

With its potential to enhance cellular health and provide anti-aging benefits, phycoerythrin could find its place in various functional food categories, such as energy bars, smoothies, and fortified beverages. Furthermore, as the global nutraceuticals market continues to grow, the demand for natural ingredients in supplements is also on the rise.

Companies in the nutraceuticals sector are investing in algae-derived products to meet the consumer demand for clean, plant-based alternatives. Given its unique properties and growing consumer interest in holistic health, phycoerythrin is poised to tap into the nutraceuticals market, offering substantial growth opportunities for producers and manufacturers.

Challenge

Limited Commercial Availability and Supply Chain Issues

A significant challenge faced by the phycoerythrin market is the limited commercial availability of the algae from which it is derived, coupled with supply chain challenges. Phycoerythrin is predominantly extracted from specific species of red algae, which are not as widely cultivated as other types of algae. This results in supply constraints and can lead to inconsistent availability.

Additionally, the cultivation of these algae requires specific geographic and environmental conditions, which makes large-scale farming challenging. The lack of commercial-scale production facilities and the complexities in sourcing raw materials further exacerbate the issue. Consequently, companies may face difficulties in securing a stable, cost-effective supply of phycoerythrin. The high demand for algae-based ingredients across various industries, including food, cosmetics, and pharmaceuticals, is also putting pressure on supply chains, further contributing to this challenge.

Moreover, the reliance on a limited number of suppliers can lead to supply chain vulnerabilities, especially during periods of environmental disruption or market fluctuations. Addressing these supply chain issues will be crucial for ensuring a stable and sustainable supply of phycoerythrin in the future.

Emerging Trends

The phycoerythrin market is witnessing a surge in demand, driven by several emerging trends, particularly in the beauty, wellness, and food industries. One of the most notable trends is the increasing consumer shift toward natural and organic products. Consumers are becoming more conscious of the ingredients in their cosmetics, skincare, and food products, leading to a preference for plant-based, algae-derived ingredients.

Phycoerythrin, a red pigment from algae, fits perfectly into this movement, thanks to its natural antioxidant and anti-inflammatory properties, which are in high demand for personal care products. As health and environmental awareness grow, companies are increasingly turning to phycoerythrin as an alternative to synthetic colors and additives.

Another emerging trend is the use of phycoerythrin in the nutraceutical industry. Given its health benefits, including its ability to combat oxidative stress and support immune function, phycoerythrin is being explored for use in dietary supplements and functional foods. With the growing interest in health-focused foods, phycoerythrin offers an opportunity for companies to differentiate their products in a crowded market by promoting the natural, sustainable, and health-enhancing qualities of algae-derived ingredients.

The growing trend of plant-based eating and the demand for vegan, cruelty-free, and eco-conscious products is further accelerating the adoption of phycoerythrin in various industries. Companies are recognizing the need to innovate and diversify their product offerings, and phycoerythrin’s incorporation into functional food, cosmetic, and wellness products reflects this change in consumer behavior. This aligns with the broader trend of sustainable and ethical consumerism, where ingredient transparency and sustainability are highly valued.

Business Benefits

The inclusion of phycoerythrin in business offerings can bring several strategic benefits to companies, especially in industries such as cosmetics, nutraceuticals, and functional foods. For cosmetics brands, the use of phycoerythrin as a natural coloring agent provides a way to meet the rising demand for eco-friendly, vegan, and cruelty-free products. Consumers are increasingly looking for transparency in ingredients, and phycoerythrin’s natural, algae-derived origins offer a strong selling point in terms of sustainability and ethical production.

Additionally, with its antioxidant and anti-inflammatory properties, phycoerythrin enhances the functionality of cosmetic formulations by providing skin benefits such as reducing redness and irritation, which can be a significant market differentiator.

In the nutraceutical sector, phycoerythrin offers businesses an opportunity to expand into the growing market for functional foods and dietary supplements. The antioxidant and health-boosting properties of phycoerythrin make it an attractive ingredient for products designed to enhance immunity, improve skin health, and support cellular function.

As consumers demand more from their food and supplements in terms of both nutrition and health benefits, businesses incorporating phycoerythrin could appeal to this market segment, which is highly focused on natural, plant-based solutions. This trend is expected to continue to grow as the focus on holistic health deepens globally.

Furthermore, phycoerythrin’s potential for broad market applications, from cosmetics to food and pharmaceuticals, provides businesses with an opportunity for diversification. By incorporating this ingredient into a range of products, companies can tap into various consumer segments, enhance their product portfolio, and achieve competitive differentiation. The sustainable, eco-friendly nature of phycoerythrin further strengthens a brand’s commitment to green practices, improving consumer loyalty and brand image.

Regional Analysis

North America dominated the phycoerythrin market with a 36.6% share, generating USD 15.3 million.

In 2023, North America held a dominant market position in the phycoerythrin market, capturing more than 36.6% of the total market share, with a revenue of approximately USD 15.3 million. The region’s leadership can be attributed to its advanced biotechnology sector, strong research and development activities, and increasing demand for natural colorants in industries such as food & beverages, cosmetics, and pharmaceuticals. Additionally, the growing trend towards plant-based and organic products has further fueled the demand for phycoerythrin as a natural pigment, especially in North American markets.

The U.S. represents the largest contributor to the market within North America, due to its robust healthcare and pharmaceutical industries, which utilize phycoerythrin for diagnostic applications. The rise in nutraceuticals and functional foods, with an emphasis on natural ingredients, has also been a driving force for market growth. Furthermore, the presence of key players involved in the production and distribution of phycoerythrin, along with an extensive regulatory framework supporting natural product innovations, has cemented the region’s market dominance.

Europe follows North America, with a notable market share driven by strong demand in the cosmetics and personal care sectors. The European market is characterized by an increasing preference for eco-friendly and organic alternatives, making phycoerythrin an attractive choice. Additionally, stringent regulations related to artificial food colorants and the shift towards clean-label products are contributing to the market’s growth in the region.

The Asia-Pacific (APAC) region is expected to witness the highest growth rate during the forecast period, owing to the expanding applications of phycoerythrin in emerging markets like China and India. These countries are experiencing rapid industrialization, with increasing investments in the food & beverage sector and growing awareness of health-conscious products.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global phycoerythrin market continues to be shaped by several key players, each contributing uniquely to its growth across various industries, including biotechnology, healthcare, and food & beverages. Among these, Agilent Technologies, DIC Corporation, Thermo Fisher Scientific Inc., and Sigma-Aldrich stand out due to their extensive market reach, innovation, and expertise in production.

Agilent Technologies plays a significant role by offering high-quality phycoerythrin products used extensively in diagnostics and research. Their robust portfolio, combined with strong research and development capabilities, has enabled the company to maintain a leading position in the biotechnology space. Agilent’s commitment to advancing molecular biology and diagnostics ensures a continuous demand for phycoerythrin, especially in academic and industrial research applications.

DIC Corporation has been a crucial player in the food and cosmetics industries, where natural colorants like phycoerythrin are in high demand. As a global supplier of colorants and specialty chemicals, DIC Corporation has leveraged its advanced manufacturing processes to deliver high-quality and consistent phycoerythrin products. This has solidified the company’s position as a key supplier of clean-label food products, which increasingly prioritize plant-based, natural ingredients.

Thermo Fisher Scientific Inc., a leader in laboratory supplies, has expanded its offerings to include phycoerythrin products, targeting the research, diagnostic, and pharmaceutical markets. Their global reach, paired with a focus on innovation and product quality, supports significant growth in the use of phycoerythrin for analytical and diagnostic applications.

Sigma-Aldrich, known for its comprehensive portfolio of chemical and biochemical reagents, has been instrumental in meeting the demand for phycoerythrin in the research and industrial sectors. With a strong distribution network and continuous product innovation, Sigma-Aldrich remains a preferred supplier of phycoerythrin for a variety of applications, ranging from academic research to commercial uses in food and cosmetics.

Market Key Players

- Abcepta

- Agilent Technologies

- Algapharma Biotech Corp. DIC Corporation

- Anaspec

- Assay Biotech Company Inc.

- Binmei Biotechnology

- Chemscene

- Columbia Bioscience

- Dainippon Ink and Chemicals

- Ecodiscovery

- Eurogentec

- Europa Biotechnology

- Fivephoton Biochemical

- Fujikura Kasei Co., Ltd.

- Headland Amenity

- Hoochoom Biotech

- Jackson Immuno Research

- Norland Products Inc.

- Procurement Limited

- R&D Systems Inc.

- SETA BioMedicals

- Sigma-Aldrich

- Thermo Fisher Scientific Inc.

- Vector Laboratories

- Zhejiang Binmei Biotechnology Co., Ltd.

Recent Development

- In April 2024, Thermo Fisher Scientific launched a new line of phycoerythrin-conjugated antibodies for use in diagnostic and research applications. The antibodies are designed to offer improved precision and efficiency in molecular analysis. The company projects a 5% increase in its overall market share in the diagnostic reagent sector, attributed to this launch, with expected sales of USD 3 million by Q3 2024.

- In March 2024, Agilent Technologies expanded its product portfolio by launching a new line of phycoerythrin-based reagents for research and diagnostic applications. The new reagents are designed to improve sensitivity and reduce detection times in flow cytometry and immunoassays. This move is expected to increase Agilent’s revenue from bioanalytical products by approximately 8-10%.

- In February 2024, DIC Corporation reported a 12% year-over-year growth in the demand for natural colorants, including phycoerythrin, for the food and beverage industry. This growth was driven by increasing consumer preference for plant-based products and clean-label ingredients. The company anticipates a market share increase of 2.5% in the global natural colorant market by the end of 2024.

Report Scope

Report Features Description Market Value (2023) USD 42.3 Million Forecast Revenue (2033) USD 84.8 Million CAGR (2024-2032) 7.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source (Marine Algae, Freshwater Algae), By Process of Extraction (Buffer Extraction, Cell Wall Extraction, Hydrolysis Extraction), By Form (Freeze Dried, Liquid), By Product Type (R-PE, B-PE, C-PE), By End Use Application (Pharmaceutical, Food, Cosmetics, Diagnostic, Agricultural, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Abcepta, Agilent Technologies, Algapharma Biotech Corp. DIC Corporation, Anaspec, Assay Biotech Company Inc., Binmei Biotechnology, Chemscene, Columbia Bioscience, Dainippon Ink and Chemicals, Ecodiscovery, Eurogentec, Europa Biotechnology, Fivephoton Biochemical, Fujikura Kasei Co., Ltd., Headland Amenity, Hoochoom Biotech, Jackson Immuno Research, Norland Products Inc., Procurement Limited, R&D Systems Inc., SETA BioMedicals, Sigma-Aldrich, Thermo Fisher Scientific Inc., Vector Laboratories, Zhejiang Binmei Biotechnology Co., Ltd. Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abcepta

- Agilent Technologies

- Algapharma Biotech Corp. DIC Corporation

- Anaspec

- Assay Biotech Company Inc.

- Binmei Biotechnology

- Chemscene

- Columbia Bioscience

- Dainippon Ink and Chemicals

- Ecodiscovery

- Eurogentec

- Europa Biotechnology

- Fivephoton Biochemical

- Fujikura Kasei Co., Ltd.

- Headland Amenity

- Hoochoom Biotech

- Jackson Immuno Research

- Norland Products Inc.

- Procurement Limited

- R&D Systems Inc.

- SETA BioMedicals

- Sigma-Aldrich

- Thermo Fisher Scientific Inc.

- Vector Laboratories

- Zhejiang Binmei Biotechnology Co., Ltd.