Global Resistant Starch Market By Source (Fruits and Nuts, Grains, Vegetables, Cereal Food, Beans and Legumes, Others), By Functionality (Dietary Fiber, Prebiotic, Fat Replacement), By Product (RS1, RS2, RS3, RS4), By Application (Bakery Products, Confectionery, Beverages, Breakfast Cereals, Pasta and Noodles, Dairy Products, Nutrition Bars, Meat and Processed Food, Meat Substitutes, Soups, Dressings, and Condiments, Others), By Distribution Channel (Online, Offline), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 134355

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Source Analysis

- By Functionality Analysis

- By Product Analysis

- By Application Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

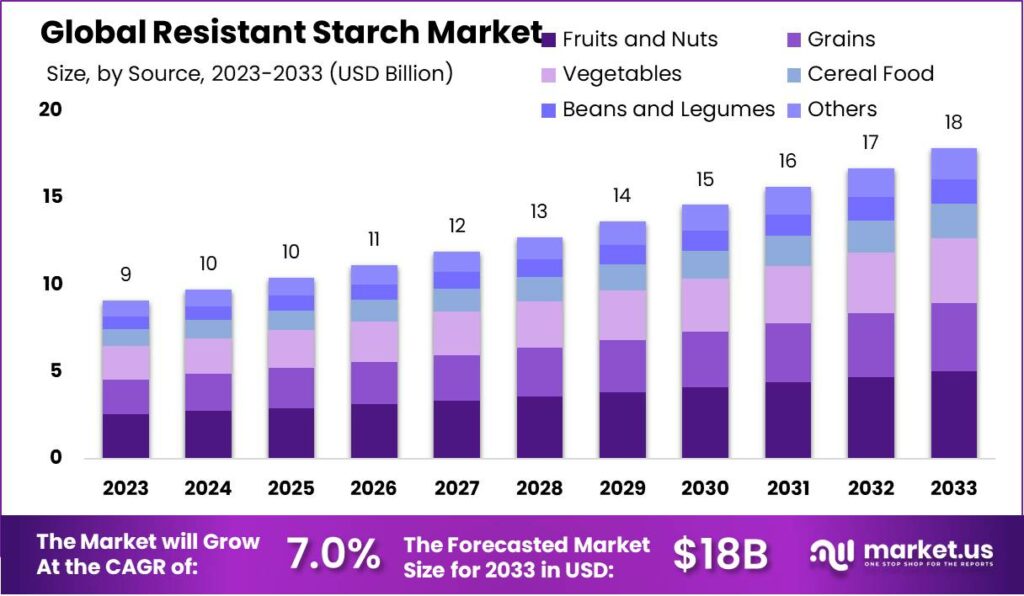

The Global Resistant Starch Market size is expected to be worth around USD 18.0 Billion by 2033, from USD 9.1 Billion in 2023, growing at a CAGR of 7.0% during the forecast period from 2024 to 2033.

The Resistant Starch Market has seen significant growth, driven by increased consumer awareness of its health benefits, such as improving gut health, regulating blood sugar levels, and aiding in weight management.

Resistant starch, a type of fiber that resists digestion in the small intestine, is becoming a popular ingredient in functional foods, including snacks, bakery products, and dietary supplements. As more consumers opt for healthier, high-fiber, and low-carb diets, demand for resistant starch-based products is steadily rising, particularly in regions like North America and Europe.

This growth is fueled by the shift toward natural, plant-based ingredients in food products. Resistant starch is being incorporated into various food items, including gluten-free and diabetic-friendly options, in response to rising consumer interest in digestive health and gut microbiota.

As a prebiotic fiber, it supports the growth of beneficial gut bacteria, contributing to its popularity in weight management and fitness programs, especially among individuals with type 2 diabetes.

The market also benefits from increased government recognition of the health benefits of resistant starch. In the U.S., the FDA has classified resistant starch as a dietary fiber under the Food Labeling Modernization Act, encouraging its inclusion in food products.

Similarly, the European Union has established favorable regulations, allowing prebiotic claims on packaging, which boosts consumer demand. International trade of resistant starch has flourished, with key markets like the U.S., Germany, and China being the largest importers. The global trade of functional food ingredients, including resistant starch, grew by 8% annually between 2020 and 2023.

Innovation is a key driver in this market, with companies exploring new production methods and expanding their production capacities. In 2023, Ingredion Incorporated acquired a resistant starch facility in Brazil, investing $50 million to meet growing demand in Latin America.

Meanwhile, Tate & Lyle partnered with a biotech startup to develop a more cost-effective production process, promising a 10% reduction in production costs. These developments, combined with government support, such as the USDA’s $7 million funding for high-fiber foods, are expected to further accelerate market growth.

Key Takeaways

- The Global Resistant Starch Market size is expected to be worth around USD 18.0 Billion by 2033, from USD 9.1 Billion in 2023, growing at a CAGR of 7.0% during the forecast period from 2024 to 2033.

- Fruits and Nuts led the By Source segment of the Resistant Starch Market, capturing a 28.3% share.

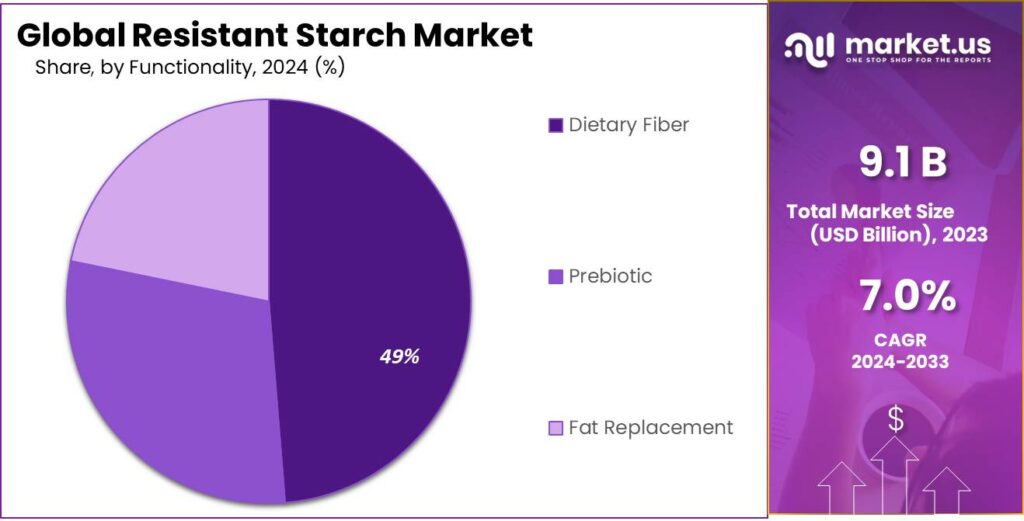

- Dietary Fiber dominated the By Functionality segment, capturing a 48.2% share.

- In 2023, RS3 dominated the By Product segment, capturing a 35.3% share.

- In 2023, Bakery Products dominated the By Application segment, capturing a 29.3% share.

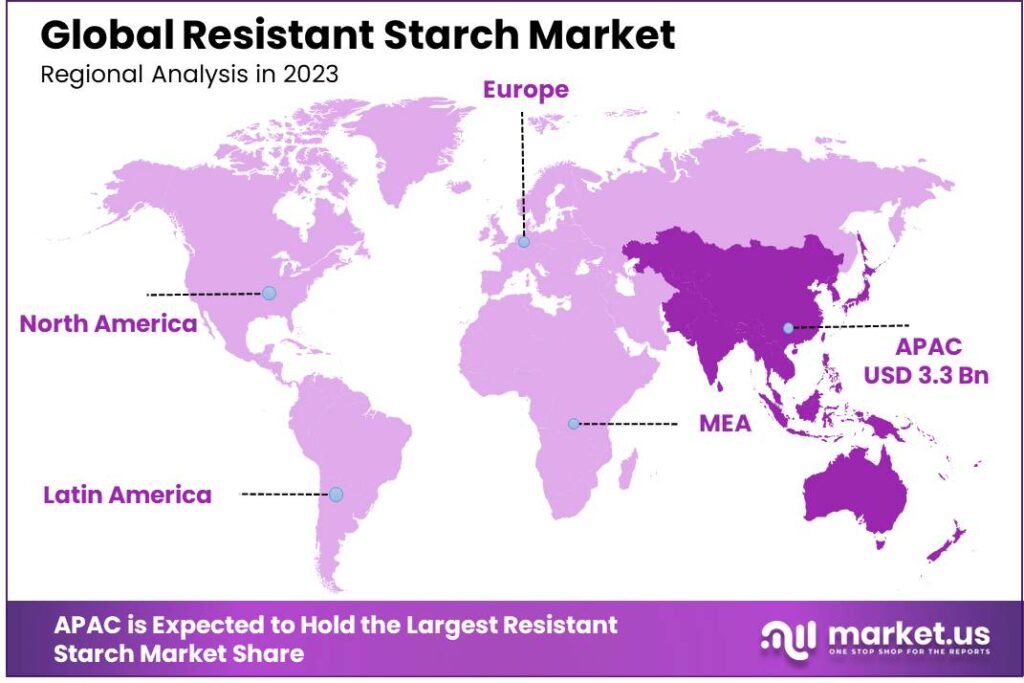

- APAC dominated the Resistant Starch Market with a 45.4% share, earning USD 154.5 million.

By Source Analysis

In 2023, Fruits and Nuts held a dominant market position in the By Source segment of the Resistant Starch Market, capturing more than a 28.3% share. This substantial market share can be attributed to the widespread use of fruits and nuts as natural sources of dietary fiber, which have gained popularity due to their health benefits, including improved digestion and blood sugar regulation. Fruits such as bananas, particularly unripe varieties, are well-known for their highly resistant starch content, further strengthening their position in the market.

Following closely, Grains accounted for a significant portion of the market, driven by the increasing demand for whole grains like oats, barley, and rice, which are known to contain high levels of resistant starch. Consumers’ rising interest in gluten-free and plant-based diets has further propelled the demand for resistant starch in grain-based products.

Vegetables, especially root vegetables like sweet potatoes and carrots, have also contributed to the growth of the segment, owing to their natural ability to provide resistant starch. The health-conscious trend and increasing consumption of plant-based foods have expanded vegetable consumption, directly influencing market dynamics.

Cereal Food has carved out a niche, with manufacturers incorporating resistant starch into products like breakfast cereals and snacks, appealing to consumers looking for functional foods. Beans and Legumes are another important source of resistant starch, with their high fiber content and role in weight management contributing to their growing use in food formulations.

By Functionality Analysis

In 2023, Dietary Fiber held a dominant market position in the By Functionality segment of the Resistant Starch Market, capturing more than a 48.2% share. This strong market presence can be attributed to the growing consumer demand for fiber-rich foods, which are known to support digestive health, regulate blood sugar levels, and improve overall wellness. Resistant starch, a type of dietary fiber, plays a pivotal role in promoting gut health, which has contributed to its increasing use in functional food products.

Prebiotic functionality followed closely, driven by the rising awareness of gut microbiome health. Resistant starch acts as a prebiotic, fostering the growth of beneficial gut bacteria, which has become a key factor in many consumers’ dietary choices. The growing trend of personalized nutrition and the focus on gut health has further fueled the demand for prebiotic-rich products containing resistant starch.

The Fat Replacement functionality segment has also gained momentum, particularly in low-calorie and reduced-fat food products. Resistant starch’s ability to mimic the texture and mouthfeel of fat, while contributing fewer calories, has made it an attractive ingredient for manufacturers targeting health-conscious consumers looking for healthier alternatives in food formulation.

By Product Analysis

In 2023, RS3 held a dominant market position in the By Product segment of the Resistant Starch Market, capturing more than a 35.3% share. This dominance is largely due to the widespread use of RS3, which is primarily found in high-amylose foods such as potatoes, rice, and corn when they are cooked and cooled. RS3, also known as retrograded starch, offers various health benefits, such as improving gut health and regulating blood sugar levels, which has contributed to its popularity in functional food products.

RS1 followed as a significant contributor to the market, comprising foods like whole grains, legumes, and seeds. RS1 is typically present in its natural form and is less digestible than other starches, making it a valuable component for consumers seeking high-fiber diets. While not as prevalent as RS3, RS1’s demand is growing as more consumers embrace plant-based and whole-food diets.

RS2 comes from raw starches such as unripe bananas and some legumes. Although it is less digestible than RS1 and RS3, its role in promoting digestive health and offering benefits like weight management has made it increasingly popular in the functional foods market.

Finally, RS4, which is chemically modified starch, represents a smaller but growing segment. RS4 is valued for its versatility in food processing, where it is often used to improve texture and stability, particularly in processed foods. This segment continues to evolve as manufacturers seek innovative ways to incorporate resistant starch into a wide variety of food products.

By Application Analysis

In 2023, Bakery Products held a dominant market position in the By Application segment of the Resistant Starch Market, capturing more than a 29.3% share. This dominance can be attributed to the increasing demand for healthier bakery options, as consumers seek functional foods with added nutritional benefits.

Resistant starch, which is used to enhance the fiber content in products like bread, muffins, and cakes, has gained popularity due to its ability to improve digestive health and regulate blood sugar levels. As the demand for low-calorie, high-fiber bakery products grows, bakery manufacturers are increasingly incorporating resistant starch into their formulations.

Confectionery products followed as a significant application segment, with the use of resistant starch helping to reduce the sugar content in candies and chocolates while maintaining their texture. As consumers become more health-conscious, the demand for reduced-sugar confectionery options has propelled the growth of this segment.

Beverages, particularly functional drinks and smoothies, have also embraced resistant starch due to its ability to provide a feeling of fullness and support gut health. Manufacturers are incorporating it into ready-to-drink beverages as part of the growing trend toward functional beverages.

Breakfast Cereals are another significant application for resistant starch, with manufacturers adding it to cereals and granolas to boost fiber content and offer health benefits such as improved gut health and reduced glycemic response.

The Pasta and Noodles segment is growing due to increasing interest in gluten-free and low-carb options. Resistant starch’s role in these products supports better digestive health, making it a popular ingredient in healthier pasta and noodle alternatives.

In Dairy Products, Nutrition Bars, and Meat Substitutes, resistant starch is used to enhance texture and nutritional value. As the focus on plant-based and functional foods continues to rise, these segments are expected to grow significantly. The Soups, Dressings, and Condiments sector is also integrating resistant starch to increase fiber content and improve product consistency, catering to the rising demand for health-conscious food options.

By Distribution Channel Analysis

In 2023, Online held a dominant market position in the By Distribution Channel segment of the Resistant Starch Market, capturing more than a 57.4% share. The growing trend of e-commerce and direct-to-consumer models has significantly contributed to this dominance, as consumers increasingly prefer the convenience of purchasing health-related products online.

Online platforms provide easy access to a wide range of resistant starch products, such as dietary supplements and functional foods, making them readily available to a global audience. Additionally, the rise in health consciousness and the increasing demand for functional foods have further boosted online sales.

The Offline segment, which includes traditional retail outlets such as supermarkets, health food stores, and pharmacies, accounted for the remaining share. While the offline market remains important, it is gradually being overshadowed by the growing popularity of online shopping, especially among younger, tech-savvy consumers who prefer to research and purchase health products online. However, offline retail continues to play a key role in providing immediate access to resistant starch products, especially in regions where e-commerce penetration is lower.

Key Market Segments

By Source

- Fruits and Nuts

- Grains

- Vegetables

- Cereal Food

- Beans and Legumes

- Others

By Functionality

- Dietary Fiber

- Prebiotic

- Fat Replacement

By Product

- RS1

- RS2

- RS3

- RS4

By Application

- Bakery Products

- Confectionery

- Beverages

- Breakfast Cereals

- Pasta and Noodles

- Dairy Products

- Nutrition Bars

- Meat and Processed Food

- Meat Substitutes

- Soups, Dressings, and Condiments

- Others

By Distribution Channel

- Online

- Offline

Driving factors

Growing Health Awareness and Demand for Gut Health Products

The increasing awareness about the importance of gut health is one of the major drivers for the growth of the resistant starch market. Resistant starch is known to have prebiotic effects, meaning it supports the growth of beneficial gut bacteria. As consumers become more conscious of their digestive health, they are increasingly seeking foods that promote a healthy gut microbiome.

Additionally, resistant starch is linked to various health benefits, such as improved blood sugar control, weight management, and enhanced satiety. This growing consumer interest in functional foods has fueled the demand for resistant starch in various food products, including snacks, bakery items, and dietary supplements. Manufacturers are also investing in research to develop more innovative ways to incorporate resistant starch into everyday food products, thereby meeting consumer needs for both convenience and health benefits.

As a result, the market for resistant starch is experiencing a positive shift, with consumers opting for ingredients that offer long-term health advantages. The dietary trends, such as low-carb and low-glycemic diets, further boost the demand for resistant starch, as it helps manage blood sugar levels while providing a feeling of fullness.

Restraining Factors

Limited Consumer Awareness

Despite its health benefits, one of the key restraints in the resistant starch market is limited consumer awareness. While health-conscious individuals may be familiar with the benefits of resistant starch, the broader population still lacks an understanding of how this ingredient can contribute to digestive and overall health. This limited awareness may hinder the widespread adoption of products containing resistant starch.

Moreover, many consumers are unaware of its presence in common food sources like unripe bananas, legumes, and whole grains, which can lead to a lack of interest in seeking out products that include this ingredient. The lack of education on how resistant starch functions in the body and its role in maintaining gut health may prevent consumers from making informed decisions about its inclusion in their diets.

Overcoming this barrier requires targeted consumer education, as well as marketing strategies that highlight the specific benefits of resistant starch. Until these efforts are made, market growth could be stunted, especially in regions where health trends are slower to develop.

Growth Opportunity

Innovation in Processed Foods

One of the key opportunities for the resistant starch market lies in innovation within the processed food industry. As food manufacturers seek to meet the growing demand for healthier, functional foods, incorporating resistant starch into processed products presents a unique opportunity. Resistant starch can be added to a wide range of products, including bakery items, snacks, beverages, and meal replacements, to enhance their health benefits.

This innovation not only addresses the consumer demand for health-focused foods but also provides a competitive edge for brands looking to differentiate themselves in the crowded food industry. The rise of plant-based and gluten-free products further accelerates the potential for resistant starch, as many plant-based foods are naturally rich in resistant starch, making it an ideal ingredient for this category.

In addition, the growth of the online retail sector presents an opportunity for brands to educate consumers directly, promoting the benefits of resistant starch-based products. As manufacturers continue to experiment with new formulations and products that cater to specific health concerns like diabetes, gut health, and weight management, the market for resistant starch is poised for expansion.

Challenge

Variability in Resistance to Digestive Enzymes

A significant challenge in the production and use of resistant starch is the variability in its resistance to digestive enzymes. While resistant starch is known for its ability to pass through the small intestine without being digested, its effectiveness can vary based on factors like the type of starch, its source, and the processing method.

For example, not all starches are resistant in the same way, and even cooking methods can alter the starch’s resistance. This variability presents challenges for manufacturers who aim to deliver consistent health benefits in their products. In addition, the digestive resistance of resistant starch can be influenced by factors such as the consumer’s gut microbiome and individual digestion rates, making it harder to predict the precise benefits on a per-person basis.

This inconsistency may lead to challenges in marketing, as consumers may not experience the same health benefits in every product. Furthermore, producing resistant starch with a high degree of digestibility for commercial use requires advanced processing technologies, which could add to the production cost. Addressing this challenge requires further research into standardizing production methods and developing technologies that ensure consistency in resistant starch’s efficacy across various products.

Emerging Trends

The demand for resistant starch is increasing as more consumers become aware of its potential health benefits. One key emerging trend is the growth of “gut-friendly” foods that highlight prebiotics like resistant starch. With the rising focus on digestive health, brands are increasingly incorporating resistant starch into everyday products such as snacks, smoothies, and even beverages.

This trend is fueled by consumers seeking solutions to improve gut health and manage conditions such as irritable bowel syndrome (IBS) and diabetes. In fact, research indicates that resistant starch promotes the growth of beneficial gut bacteria, which is driving its popularity in functional foods.

Another trend gaining momentum is the rise of low-glycemic index diets. Resistant starch has a low glycemic index, making it a suitable option for consumers looking to manage blood sugar levels. The popularity of low-carb and ketogenic diets has paved the way for foods containing resistant starch as they provide a healthier way to maintain energy levels without spiking blood sugar.

This has particularly resonated with health-conscious consumers who are also looking for weight management benefits, as resistant starch increases feelings of fullness, which can aid in reducing calorie intake.

Additionally, plant-based and gluten-free foods are also benefiting from the inclusion of resistant starch. Many plant-based and gluten-free foods, such as beans, lentils, and certain grains, naturally contain high levels of resistant starch, making it easier for manufacturers to develop functional foods catering to these growing dietary preferences.

The expanding range of products available, including ready-to-eat meals, has accelerated the integration of resistant starch into mainstream diets. As a result, the market for resistant starch is expanding rapidly, especially as food innovation continues to push boundaries in creating health-focused alternatives.

Business Benefits

Incorporating resistant starch into food products offers significant business benefits, particularly as consumers become more health-conscious. For food manufacturers, using resistant starch can help differentiate their products in a crowded market. As awareness about gut health and the need for functional foods grows, offering products with resistant starch can appeal to consumers seeking digestive support, weight management, and overall wellness.

For example, companies in the snack and beverage sectors are increasingly adding resistant starch to their offerings to tap into the growing demand for products that deliver health benefits without compromising on taste or convenience.

Additionally, resistant starch can play a role in helping food manufacturers align with current dietary trends, such as low-carb, gluten-free, and plant-based diets. By incorporating resistant starch into their products, companies can cater to a broader customer base that follows these health-conscious trends.

This is particularly relevant as consumers move away from highly processed and sugar-laden foods, opting instead for options that promote gut health and provide sustained energy. As such, businesses can tap into an emerging consumer need and expand their market reach.

Furthermore, resistant starch has the potential to improve the nutritional profile of products, which can be a selling point for health-focused brands. With its ability to improve satiety and help manage blood sugar levels, incorporating resistant starch into product formulations can lead to better positioning in a competitive market.

Companies that prioritize ingredient transparency and health benefits are likely to gain consumer trust, which is increasingly important in today’s market. The adoption of resistant starch can therefore improve product innovation, drive consumer loyalty, and support a positive brand image as a leader in functional foods.

Regional Analysis

APAC dominated the Resistant Starch Market with 45.4% share, earning USD 154.5 million.

In 2023, APAC held a dominant market position in the Resistant Starch Market, capturing more than 37.1% of the global share, equating to a revenue of approximately USD 3.3 billion. This leadership can be attributed to several factors, including the region’s large population base, rapid urbanization, and increasing consumer awareness of health and wellness. Countries like China, India, and Japan have seen a notable rise in the demand for functional foods and dietary supplements, driving the adoption of resistant starch as an ingredient for its digestive health benefits and role in weight management. Moreover, APAC’s growing middle class and higher disposable incomes have led to increased spending on healthy food alternatives, further fueling the market’s growth.

The expansion of the food and beverage industry in APAC is another key driver. With a burgeoning demand for processed and convenience foods, resistant starch, due to its health benefits such as improving gut health, blood sugar management, and satiety, has found its way into a wide array of products such as snacks, bakery items, and beverages. In countries like Japan and South Korea, where health-conscious eating is culturally ingrained, the incorporation of functional ingredients like resistant starch into mainstream food products has been particularly pronounced.

Furthermore, the presence of key manufacturers and suppliers in APAC plays a significant role in this regional dominance. Many global companies have established production and distribution networks in the region, capitalizing on the lower production costs and robust export infrastructure. The ongoing innovation in food technology, particularly in clean-label and gluten-free products, has also contributed to the steady growth of the resistant starch market in APAC.

Looking forward, APAC is expected to maintain its leadership in the resistant starch market, driven by continued advancements in food science and nutrition, as well as an increasing focus on sustainable and plant-based ingredients. As consumer preferences evolve toward healthier, more sustainable food options, the market for resistant starch in the region is projected to grow at a compound annual growth rate (CAGR) of approximately 6.7% over the next five years.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global Resistant Starch Market is characterized by a dynamic competitive landscape, with several prominent players driving innovation, market expansion, and product development. Among the key companies shaping the market, ADM, Ingredion Incorporated, Tate & Lyle, and Roquette Frères stand out due to their strategic initiatives and market influence.

ADM has positioned itself as a leader through its vast global presence and strong portfolio of plant-based ingredients, including resistant starch derived from corn and other grains. The company’s investments in sustainable sourcing and innovation in functional ingredients have enabled it to tap into the growing demand for healthier food options.

Ingredion Incorporated is another critical player, leveraging its expertise in starch production to provide a wide range of resistant starch products. Ingredion’s focus on the development of clean-label and plant-based solutions has resonated well with health-conscious consumers. The company’s innovations in resistant starch have contributed significantly to its strong position in the market.

Tate & Lyle, with its well-established research capabilities and expertise in food science, continues to expand its reach in the resistant starch market. Its portfolio includes highly functional ingredients that promote digestive health, weight management, and blood sugar regulation, aligning with current consumer health trends.

Roquette Frères has also made significant strides, particularly in the growing demand for plant-based nutrition. The company’s focus on sustainable ingredient sourcing, coupled with a strong emphasis on product innovation, has positioned it as a formidable competitor in the resistant starch sector.

Market Key Players

- ADM

- Arcadia Biosciences

- Cargill, Inc.

- Emsland Group

- Gut Garden

- Ingredion Incorporated

- Lodaat Pharmaceuticals

- MGP Ingredients Inc.

- MSP Starch Products

- MSPrebiotics

- Natural Stacks

- Penford Corporation

- Roquette Frères

- Sheekharr Starch Private Limited

- SunOpta

- Tate & Lyle Pic

- Xian Kono Chem

Recent Development

- In May 2024, Tate & Lyle announced a significant investment to expand its production of resistant starch in Asia, particularly in its facilities in China and India. The investment, valued at $50 million, will increase capacity by 25%, enabling Tate & Lyle to better serve the growing demand for functional ingredients in the region’s rapidly expanding food and beverage markets.

- In March 2024, Ingredion Incorporated launched a new line of clean-label resistant starch products under its VITESSENCE brand. These ingredients are designed to meet the increasing consumer preference for simple, natural ingredients. The company reported a 15% year-over-year increase in demand for clean-label products, with resistant starch playing a central role in this growth. Ingredion’s global investment in R&D for health-oriented ingredients has exceeded $100 million this year.

- In February 2024, ADM expanded its plant-based protein and ingredient portfolio with the acquisition of Sojaprotein, a leading European supplier of soy-based ingredients. This acquisition strengthens ADM’s capabilities in offering resistant starch products derived from soy, aligning with the rising demand for plant-based and health-focused food ingredients. The acquisition is valued at approximately $700 million and is expected to enhance ADM’s position in the growing functional foods market.

Report Scope

Report Features Description Market Value (2023) USD 9.0 Billion Forecast Revenue (2033) USD 18.0 Billion CAGR (2024-2032) 7.0% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source (Fruits and Nuts, Grains, Vegetables, Cereal Food, Beans and Legumes, Others), By Functionality (Dietary Fiber, Prebiotic, Fat Replacement), By Product (RS1, RS2, RS3, RS4), By Application (Bakery Products, Confectionery, Beverages, Breakfast Cereals, Pasta and Noodles, Dairy Products, Nutrition Bars, Meat and Processed Food, Meat Substitutes, Soups, Dressings, and Condiments, Others), By Distribution Channel (Online, Offline) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape ADM, Arcadia Biosciences, Cargill, Inc., Emsland Group, Gut Garden, Ingredion Incorporated, Lodaat Pharmaceuticals, MGP Ingredients Inc., MSP Starch Products, MSPrebiotics, Natural Stacks, Penford Corporation, Roquette Frères, Sheekharr Starch Private Limited, SunOpta, Tate & Lyle Pic, Xian Kono Chem Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Resistant Starch MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Resistant Starch MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ADM

- Arcadia Biosciences

- Cargill, Inc.

- Emsland Group

- Gut Garden

- Ingredion Incorporated

- Lodaat Pharmaceuticals

- MGP Ingredients Inc.

- MSP Starch Products

- MSPrebiotics

- Natural Stacks

- Penford Corporation

- Roquette Frères

- Sheekharr Starch Private Limited

- SunOpta

- Tate & Lyle Pic

- Xian Kono Chem