Global Aviation Gas Turbine Market By Type (Turbojet, Turbofan, Turboprop, Ramjet, Scramjet, Others), By Technology (Conventional Gas Turbines, Advanced Gas Turbines, Hybrid Gas Turbines, Electric Gas Turbines, Power Augmentation Systems, Others), By Thrust Rating (Low-Thrust Engines, Medium-Thrust Engines, High-Thrust Engines), By Application (Commercial Aviation, Military Aviation, General Aviation, Helicopters, Unmanned Aerial Vehicles (UAVs), Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136119

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

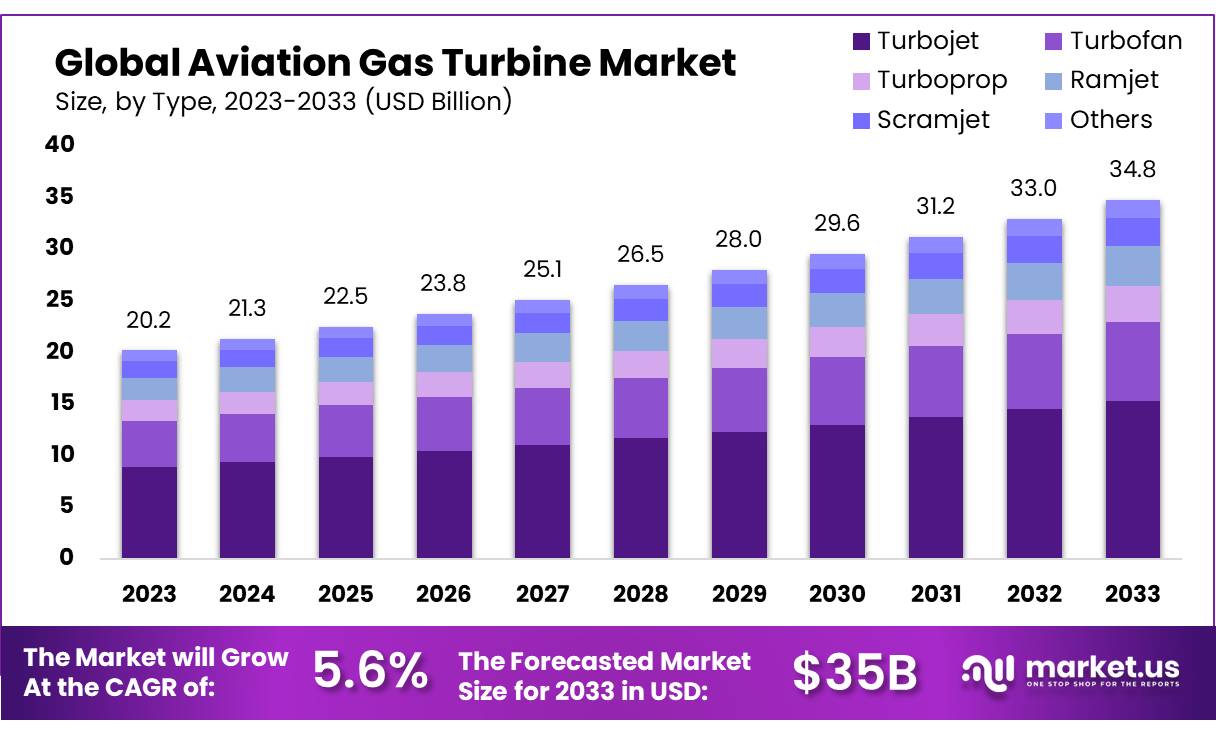

The Global Aviation Gas Turbine Market size is expected to be worth around USD 34.8 Bn by 2033, from USD 20.2 Bn in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

Aviation Gas Turbine refers to a type of engine used primarily in aircraft to generate thrust. These turbines are a key component of jet engines, which operate on the principle of converting chemical energy from aviation fuel into mechanical energy.

The energy produced by the turbine is used to power the aircraft’s propulsion system, allowing it to achieve lift and speed. Aviation gas turbines work by drawing in air, compressing it, mixing it with fuel, and igniting the mixture to produce high-speed exhaust gases that drive the turbine blades, which in turn power the engine.

According to the International Air Transport Association (IATA), the aviation industry is expected to reduce its net carbon emissions by 50% by 2050, aligning with global climate goals.

The market’s growth is supported by significant government initiatives. For instance, in 2023, the U.S. Department of Energy (DOE) allocated USD 25 million to research and develop fuel-efficient and low-emission aviation turbines. Additionally, the European Union’s Clean Aviation Initiative, part of its Horizon Europe program, is expected to invest up to EUR 1.7 billion by 2025 to develop new turbine technologies that will help reduce fuel consumption and emissions.

In terms of market dynamics, the Asia-Pacific region is seeing significant growth in the aviation sector, driven by rapid urbanization and rising disposable incomes. China and India are expected to see an annual increase in air traffic by 6% over the next decade, further boosting the demand for advanced gas turbines. In 2024, the import-export market for aviation gas turbines is projected to reach USD 3 billion, with the U.S. and Europe being major exporters to the Asia-Pacific region.

Moreover, there has been a surge in partnerships and acquisitions within the sector. In 2023, General Electric Aviation and Safran announced a USD 3.4 billion joint venture aimed at developing next-generation turbine engines for both commercial and military applications. This move is part of a broader strategy to combine resources and expertise in pursuit of more efficient and environmentally friendly propulsion systems.

Key Takeaways

- Aviation Gas Turbine Market size is expected to be worth around USD 34.8 Bn by 2033, from USD 20.2 Bn in 2023, growing at a CAGR of 5.6%.

- Turbofan engines held a dominant market position, capturing more than a 44.5% share of the aviation gas turbine market.

- Conventional Gas Turbines held a dominant market position, capturing more than a 48.4% share.

- High-Thrust Engines held a dominant market position, capturing more than a 46.5% share.

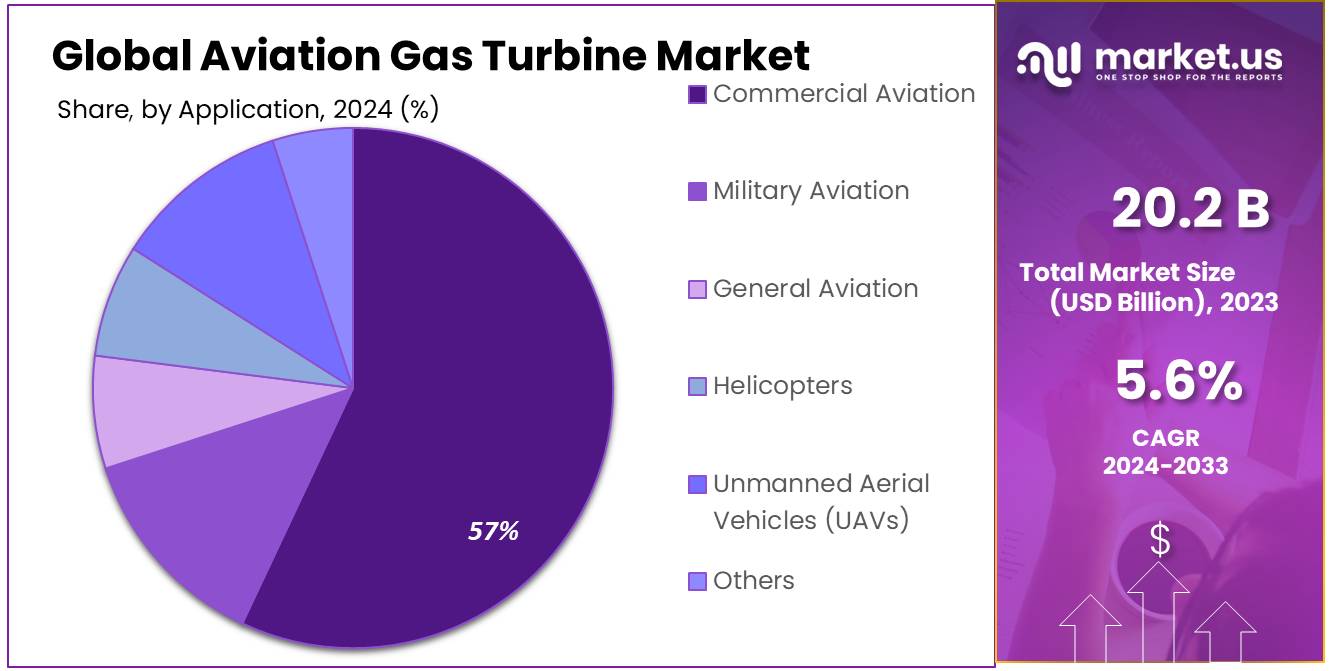

- Commercial Aviation held a dominant market position, capturing more than a 57.3% share of the aviation gas turbine market.

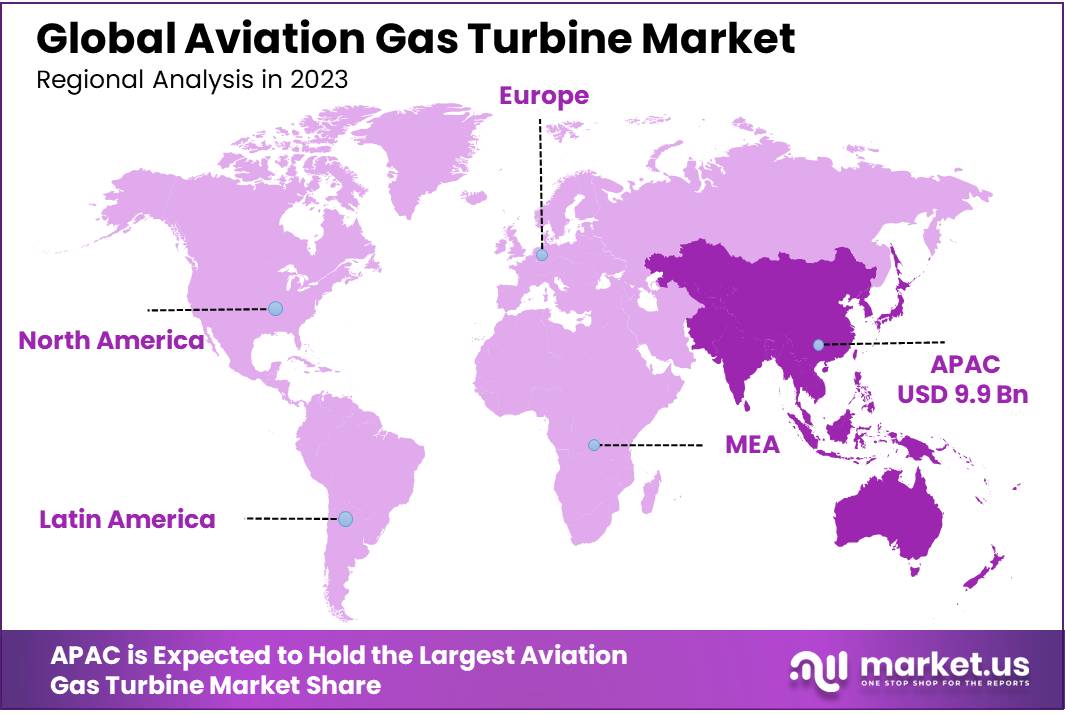

- Asia Pacific (APAC) dominates the aviation gas turbine market, accounting for 49.3% of the total market share, valued at approximately USD 9.9 billion in 2023.

By Type

In 2023, Turbofan engines held a dominant market position, capturing more than a 44.5% share of the aviation gas turbine market. Turbofan engines have long been favored in commercial aviation due to their efficiency and lower noise levels, making them the preferred choice for most modern passenger jets. This segment has seen steady growth, with an increase in demand from both the commercial aviation sector and the military. As more airlines look to modernize their fleets and meet stricter environmental regulations, turbofan technology continues to evolve, contributing to its continued dominance.

Following turbofan engines, the turbojet segment represented a significant share of the market. Turbojets, while less common in commercial aviation today, are still widely used in military applications, particularly for fighter jets and supersonic aircraft. The turbojet segment accounted for a substantial market share in 2023, driven by ongoing military investments and the need for high-speed, high-performance aircraft.

Turboprop engines, which are commonly used in smaller regional aircraft, maintained a steady market share in 2023. This segment is favored for its efficiency in short to medium-range flights, where low fuel consumption and versatility are crucial. Turboprops have seen a resurgence in certain regions, particularly in emerging markets where air travel demand is rising, but infrastructure for larger jets is limited.

The ramjet and scramjet segments, while still niche in the aviation gas turbine market, continue to garner interest in specific high-speed aerospace applications. Ramjets, typically used in supersonic aircraft and missiles, accounted for a smaller portion of the market, with a slight increase in investment from defense agencies and aerospace research organizations in 2023. Scramjets, which operate at hypersonic speeds, have been under development for future aerospace missions and space travel, but their commercial adoption remains limited as of 2023.

By Technology

In 2023, Conventional Gas Turbines held a dominant market position, capturing more than a 48.4% share of the aviation gas turbine market. Conventional gas turbines, which have been the standard for decades, are widely used due to their proven reliability and efficiency in commercial and military aircraft.

They continue to lead the market, benefiting from established technology and large-scale production that offers cost advantages. These turbines remain the preferred choice for both new aircraft and engine upgrades in existing fleets, providing robust performance for a wide range of aviation applications.

Advanced Gas Turbines, which are designed with improved materials and technologies for higher performance and fuel efficiency, followed as a key player in the market. In 2023, this segment saw a gradual rise in adoption, particularly in high-performance military and commercial jets.

The demand for advanced gas turbines is driven by the need for reduced emissions and better fuel efficiency, as well as the pursuit of next-generation aircraft. Over the years, significant investments have been made to improve turbine designs, enhancing their operational capabilities, making them more cost-effective in the long run.

Hybrid Gas Turbines, which combine traditional gas turbine technology with electric propulsion, gained a moderate share of the market in 2023. This segment is still in the early stages of development but is seeing increasing interest, particularly in the context of greener, more sustainable aviation. Hybrid systems promise to reduce fuel consumption and emissions, and while they are not yet widely deployed, ongoing research and development suggest potential for growth in the coming years.

Electric Gas Turbines remained a niche segment of the market in 2023, still in the early phases of commercialization. As the aviation industry seeks more environmentally friendly technologies, electric gas turbines are seen as a potential game-changer for reducing carbon emissions. However, challenges related to battery storage, weight, and energy efficiency mean that widespread adoption is still several years away. This segment is expected to see gradual growth, with a focus on smaller aircraft and urban air mobility solutions.

Power Augmentation Systems, which enhance the power output of conventional gas turbines, saw increased adoption in 2023, particularly in military applications and high-demand commercial operations. These systems allow for higher thrust and performance during specific phases of flight, such as takeoff or combat missions. The segment is projected to grow as more aircraft manufacturers look to maximize the efficiency of existing engines without the need for complete redesigns.

By Thrust Rating

In 2023, High-Thrust Engines held a dominant market position, capturing more than a 46.5% share of the aviation gas turbine market. High-thrust engines are primarily used in large commercial airliners and military fighter jets, where the demand for powerful and efficient propulsion is crucial.

These engines are designed to provide the necessary thrust for long-distance flights, large payloads, and supersonic speeds. The continued expansion of air travel and the growing demand for larger aircraft have supported the strong performance of high-thrust engines, making them the most significant segment in the market.

Medium-Thrust Engines represented the second-largest segment, with a steady market presence in 2023. These engines are commonly used in regional aircraft, business jets, and smaller military planes. Medium-thrust engines are valued for their balance between power output and fuel efficiency, making them ideal for short to medium-range flights. As the demand for regional and smaller commercial aircraft continues to grow, especially in emerging markets, the medium-thrust engine segment is expected to experience moderate growth in the coming years.

Low-Thrust Engines, while capturing a smaller share of the market, continue to serve an essential role in smaller aircraft and some military applications. In 2023, this segment accounted for a modest portion of the market, with applications primarily in light aircraft, training planes, and unmanned aerial vehicles (UAVs). The market for low-thrust engines remains relatively stable, driven by the need for efficient and cost-effective propulsion in smaller aircraft and the ongoing development of UAVs.

By Application

In 2023, Commercial Aviation held a dominant market position, capturing more than a 57.3% share of the aviation gas turbine market. The commercial aviation sector remains the largest driver of demand for aviation gas turbines, fueled by the continuous growth in global air travel.

Airlines are investing heavily in modernizing their fleets, with new aircraft requiring advanced and fuel-efficient turbines to meet both passenger demand and increasingly strict environmental regulations. The commercial aviation segment is expected to continue its dominance, bolstered by increasing passenger numbers, the rise of low-cost carriers, and expanding networks, particularly in emerging markets.

Military Aviation followed as the second-largest application segment in 2023. Military aviation remains a crucial segment due to the ongoing demand for advanced fighter jets, transport aircraft, and unmanned aerial systems.

The military aviation market is driven by the need for high-performance engines that can deliver superior thrust, efficiency, and reliability in various operational environments. Investments in defense and modernization programs across several countries have supported steady growth in this segment, with military forces seeking cutting-edge technologies and more powerful gas turbines for new-generation aircraft.

General Aviation, while smaller than commercial and military aviation, held a solid market share in 2023. This segment includes private jets, business aircraft, and light planes used for leisure, training, and small cargo transport. General aviation benefits from increasing demand for private air travel and regional connectivity, particularly in developed regions where high-net-worth individuals and businesses seek flexible, convenient travel options. The market for small turbine engines used in this sector is expected to grow gradually as technological advancements make them more affordable and efficient.

The Helicopters segment accounted for a modest portion of the market in 2023. Helicopters require specialized turbine engines that are optimized for vertical lift, reliability, and operational versatility. The demand for helicopter turbines is driven by both military applications, such as troop transport and surveillance, and civilian uses like medical evacuations, offshore oil and gas operations, and emergency response. While helicopter production numbers are smaller compared to fixed-wing aircraft, the segment remains vital due to the essential role helicopters play in specific industries.

Unmanned Aerial Vehicles (UAVs) saw significant growth in 2023, although still a smaller segment of the market. UAVs, or drones, have become increasingly popular in both military and civilian applications, such as surveillance, reconnaissance, and delivery services. While most UAVs currently use smaller, lighter engines or electric propulsion, the demand for gas turbines is expected to grow as military UAVs and larger drones require more power for extended range and heavier payloads. The growth of UAV technology, particularly for defense and commercial use, is expected to drive further market development in this segment.

Key Market Segments

By Type

- Turbojet

- Turbofan

- Turboprop

- Ramjet

- Scramjet

- Others

By Technology

- Conventional Gas Turbines

- Advanced Gas Turbines

- Hybrid Gas Turbines

- Electric Gas Turbines

- Power Augmentation Systems

- Others

By Thrust Rating

- Low-Thrust Engines

- Medium-Thrust Engines

- High-Thrust Engines

By Application

- Commercial Aviation

- Military Aviation

- General Aviation

- Helicopters

- Unmanned Aerial Vehicles (UAVs)

- Others

Drivers

Sustainable Aviation Fuel Initiatives

One of the key driving factors for the aviation gas turbine market is the push towards sustainable aviation fuels (SAF), supported by significant government initiatives aimed at reducing greenhouse gas emissions in the aviation sector. The White House announced the SAF Grand Challenge in 2021 with the ambitious goal to ramp up SAF production to 3 billion gallons per year by 2030 and further to 35 billion gallons by 2050, which is anticipated to meet 100% of the U.S. domestic commercial jet fuel demand by that year. This initiative underscores a significant commitment from the U.S. government towards greener aviation technologies.

Despite SAF currently representing a small fraction of the fuel used by major U.S. airlines, accounting for less than 0.1% of the total jet fuel consumption as of 2022, the federal commitment signals a strong market shift towards sustainable fuels. This is crucial for the growth of the aviation gas turbine market, as turbines adapted or designed to utilize SAF can expect heightened demand. Additionally, the Inflation Reduction Act of 2022 supports this trajectory by offering financial incentives, including tax credits and grants, aimed at boosting SAF production and adoption across commercial aviation.

In 2023, the aviation sector accounted for approximately 2-3% of global carbon dioxide emissions. As a result, governments around the world have set ambitious targets to reduce emissions from aviation, fueling the need for next-generation aviation gas turbines that offer better fuel efficiency and lower environmental impact.

The European Union, for example, has committed to reducing its carbon emissions by 55% by 2030, with a significant portion of this reduction expected to come from advancements in aviation technology, including turbine improvements. In addition, the U.S. government has pledged to achieve net-zero emissions in aviation by 2050, allocating over $1.5 billion in 2023 to support research into low-emission turbine technologies and sustainable aviation fuels.

These government-backed initiatives, coupled with the private sector’s investment in more fuel-efficient turbines, are contributing to the accelerated growth of the market. The development of hybrid-electric and hydrogen-powered turbines is expected to play a pivotal role in achieving these emission reduction goals. In fact, in 2023, global investments in sustainable aviation fuel (SAF) technologies reached $2.3 billion, indicating strong support for innovation in the sector.

Restraints

High Production and Development Costs

One of the significant restraining factors for the aviation gas turbine market is the high cost associated with the development and production of advanced turbines. This issue is particularly evident in the push towards sustainable aviation fuels (SAF) and the development of more fuel-efficient turbines.

As of 2022, the U.S. government has made notable strides in promoting SAF, with the goal of producing 3 billion gallons per year by 2030, aiming for 35 billion gallons per year by 2050. However, despite these efforts, SAF still makes up less than 0.1% of the total jet fuel used by major U.S. airlines. This highlights the challenges the industry faces in scaling up SAF production and integrating it into existing infrastructure, including gas turbines.

The primary financial challenge lies in the fact that SAF remains significantly more expensive than conventional jet fuel. The high production cost of SAF compared to traditional fuels discourages broader adoption and integration into the aviation sector. For example, while SAF production reached 15.8 million gallons in 2022, this is a tiny fraction of the 17.5 billion gallons of jet fuel consumed by major U.S. airlines.

The capital-intensive nature of developing new SAF production facilities further adds to the financial burden. The cost of building and maintaining these facilities is a significant barrier to scaling up production, making it harder for airlines to secure affordable, sustainable fuel.

In addition to fuel-related costs, the development of advanced turbines capable of efficiently using these fuels requires significant investment in research, technology, and infrastructure. Many airlines and manufacturers are still adjusting to the economic implications of these innovations, especially when the upfront costs are high and the returns are spread over a long period. These financial challenges slow down the industry’s transition to greener technologies, impeding the broader adoption of new, more efficient gas turbines.

The development of the aviation gas turbine market is heavily dependent on government subsidies, incentives, and long-term investments to make these technologies more cost-competitive. Until these financial hurdles are overcome, particularly regarding SAF integration and turbine innovation, the growth of the aviation gas turbine market could be restrained.

Opportunity

Increased Investment in Sustainable Aviation Fuels (SAF)

A major growth opportunity for the aviation gas turbine market is the increasing investment in Sustainable Aviation Fuels (SAF). SAF has been identified as a key technology for reducing carbon emissions from the aviation industry, which is a major contributor to global greenhouse gas emissions. In response to the growing need for cleaner energy solutions, the U.S. government has set ambitious goals to scale up SAF production.

By 2030, the federal government aims to produce 3 billion gallons of SAF annually, with a long-term target of meeting 100% of the country’s commercial jet fuel demand with SAF by 2050. This shift towards SAF presents a significant growth opportunity for the aviation gas turbine market as new turbines will be required to support the efficient use of these alternative fuels.

SAF production in the U.S. has been gradually increasing, with 15.8 million gallons produced in 2022. However, this still represents less than 0.1% of the total jet fuel consumed by major U.S. airlines. Despite this low percentage, the industry’s commitment to SAF is growing, with airlines signing long-term contracts for SAF delivery. For instance, major carriers like United Airlines and Delta have already committed to purchasing millions of gallons of SAF in the coming years, signaling strong future demand.

As the aviation industry works toward meeting these ambitious sustainability goals, demand for advanced gas turbines that can efficiently burn SAF will increase. These turbines will need to be optimized for high efficiency and low emissions, driving innovation and growth in turbine technology. The federal government’s financial support, such as grants and tax credits under the Inflation Reduction Act of 2022, is also expected to lower the barriers to SAF production and fuel turbine adoption. These incentives are crucial in offsetting the higher costs associated with SAF, which is currently more expensive than traditional jet fuel.

The increased demand for SAF will also stimulate advancements in the design of aviation gas turbines, including improvements in fuel efficiency, performance, and environmental impact. This creates a significant growth opportunity for turbine manufacturers who can innovate to meet the evolving needs of the aviation industry.

Trends

Shift Toward Hybrid and Electrification Technologies

A significant trend in the aviation gas turbine market is the increasing focus on hybrid and electrification technologies, aimed at improving fuel efficiency and reducing carbon emissions. This shift is primarily driven by the need for the aviation industry to meet stringent sustainability targets and reduce its carbon footprint.

As part of global efforts to decarbonize aviation, the U.S. government has set ambitious goals for reducing aviation emissions, with the White House aiming for net-zero emissions in aviation by 2050. This includes a heavy focus on incorporating hybrid and electric propulsion systems, in addition to sustainable aviation fuels (SAF), into the industry’s future roadmap.

One of the most notable trends is the integration of electric power systems alongside traditional gas turbines. In hybrid-electric propulsion systems, conventional engines are combined with electric motors to reduce fuel consumption and emissions.

The U.S. Department of Energy (DOE) has been actively supporting this transition through funding initiatives. For example, in 2022, the DOE allocated $20 million in research grants to advance hybrid-electric aircraft technologies, which are expected to improve fuel efficiency by up to 30% in the coming decades.

In addition to hybrid systems, fully electric aircraft are being explored, particularly for short-haul flights. Several startups and major aerospace companies, including Airbus and Boeing, are developing electric aircraft with smaller, more efficient turbines that consume less fuel and have lower operational costs. According to the International Air Transport Association (IATA), electric aircraft could account for up to 5% of the global aviation market by 2040.

Furthermore, the aviation industry is witnessing a trend towards lighter and more compact gas turbines. These turbines are being designed not only to improve fuel efficiency but also to accommodate hybrid-electric systems. Such innovations are expected to significantly reduce the weight of engines and improve overall aircraft performance. For instance, Rolls-Royce has been at the forefront of developing more fuel-efficient, compact turbine technologies capable of integrating with electric propulsion systems.

Regional Analysis

Asia Pacific (APAC) dominates the aviation gas turbine market, accounting for 49.3% of the total market share, valued at approximately USD 9.9 billion in 2023. The region’s dominance is driven by rapid economic growth, expanding aviation industries, and increasing passenger traffic, particularly in countries like China and India.

The strong investments in infrastructure and government initiatives to modernize air fleets further boost the demand for advanced gas turbines. APAC’s significant share is expected to continue as regional airlines and manufacturers focus on sustainable aviation fuels (SAF) and next-generation turbine technologies to meet future aviation demands.

North America holds a substantial share, particularly driven by the U.S. government’s ambitious sustainability targets, including achieving net-zero emissions in aviation by 2050. The adoption of hybrid-electric propulsion systems and government-backed initiatives such as SAF production support the regional market growth. North America remains a key player, supported by major aerospace companies like General Electric and Pratt & Whitney.

Europe is another key market, with countries like the UK, France, and Germany leading in turbine technology and innovation. The European Union’s Green Deal and aggressive emission reduction targets foster the development of more fuel-efficient and environmentally friendly turbines, further stimulating market growth.

Middle East & Africa (MEA) and Latin America represent smaller but steadily growing markets, fueled by increasing investments in aviation infrastructure and government policies encouraging sustainable aviation practices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Aviation Gas Turbine Market is highly competitive, with several leading players driving innovation and technological advancements. General Electric Aviation (GE) remains one of the top players, known for its CFM56 and LEAP engines, which are widely used in commercial aircraft.

GE has consistently focused on improving fuel efficiency and reducing emissions, with significant investments in research and development, such as the GE9X engine, designed for the Boeing 777X, which offers a 10% improvement in fuel efficiency over previous models. Similarly, Rolls-Royce is a major competitor with its Trent series engines, which power some of the world’s largest aircraft, including the Airbus A350 and Boeing 787. Rolls-Royce continues to innovate in sustainable aviation technologies, with a focus on hybrid-electric propulsion and sustainable aviation fuels (SAF).

Another key player, Pratt & Whitney, a division of Raytheon Technologies, is known for its PurePower PW1000G engines, which offer 15-20% better fuel efficiency compared to conventional engines. The company has made significant strides in advancing next-generation turbofan technologies that aim to reduce carbon emissions and improve engine performance. CFM International, a joint venture between GE Aviation and Safran Aircraft Engines, is another dominant player in the market, with its LEAP engines widely used across commercial aviation.

Aero Engine Corporation of China (AECC), Avio Aero, and Mitsubishi Heavy Industries are also important players, particularly in the APAC region. AECC’s CJ-1000A engine is part of China’s strategy to become more self-sufficient in aircraft engine production. Meanwhile, MTU Aero Engines and Honeywell

Aerospace focus on high-performance, reliable components, with innovations in advanced materials and turbine technologies. These companies continue to work on sustainable aviation solutions to meet increasing regulatory pressures and industry demand for greener technologies.

Top Key Players

- Aero Engine Corporation of China (AECC)

- Avio Aero

- CFM International

- Engine Alliance

- General Electric Aviation (GE)

- Honeywell Aerospace

- IHI Corporation

- International Aero Engines

- Mitsubishi Heavy Industries

- MTU Aero Engines

- NPO Saturn

- Pratt and Whitney Division

- Rolls-Royce

- Safran Aircraft Engines

Recent Developments

In 2023 Aero Engine Corporation of China has received government backing for its research, with the Chinese government investing over USD 2 billion in the development of aviation engine technologies in 2023.

In 2024 Avio Aero, the company is set to expand its production capacity, focusing on producing more than 3,000 turbine engines, including next-gen models that are optimized for sustainable aviation fuels

Report Scope

Report Features Description Market Value (2023) USD 20.2 Bn Forecast Revenue (2033) USD 34.8 Bn CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Turbojet, Turbofan, Turboprop, Ramjet, Scramjet, Others), By Technology (Conventional Gas Turbines, Advanced Gas Turbines, Hybrid Gas Turbines, Electric Gas Turbines, Power Augmentation Systems, Others), By Thrust Rating (Low-Thrust Engines, Medium-Thrust Engines, High-Thrust Engines), By Application (Commercial Aviation, Military Aviation, General Aviation, Helicopters, Unmanned Aerial Vehicles (UAVs), Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aero Engine Corporation of China (AECC), Avio Aero, CFM International, Engine Alliance, General Electric Aviation (GE), Honeywell Aerospace, IHI Corporation, International Aero Engines, Mitsubishi Heavy Industries, MTU Aero Engines, NPO Saturn, Pratt and Whitney Division, Rolls-Royce, Safran Aircraft Engines Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aviation Gas Turbine MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Aviation Gas Turbine MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Aero Engine Corporation of China (AECC)

- Avio Aero

- CFM International

- Engine Alliance

- General Electric Aviation (GE)

- Honeywell Aerospace

- IHI Corporation

- International Aero Engines

- Mitsubishi Heavy Industries

- MTU Aero Engines

- NPO Saturn

- Pratt and Whitney Division

- Rolls-Royce

- Safran Aircraft Engines