Global Natural Gas Refueling Stations Market Size, Share, Growth Analysis By Type (CNG Filling Stations, LNG Filling Stations), By Application (Vehicle, Ship, Others), By End User ( Automotive, Aerospace, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140806

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

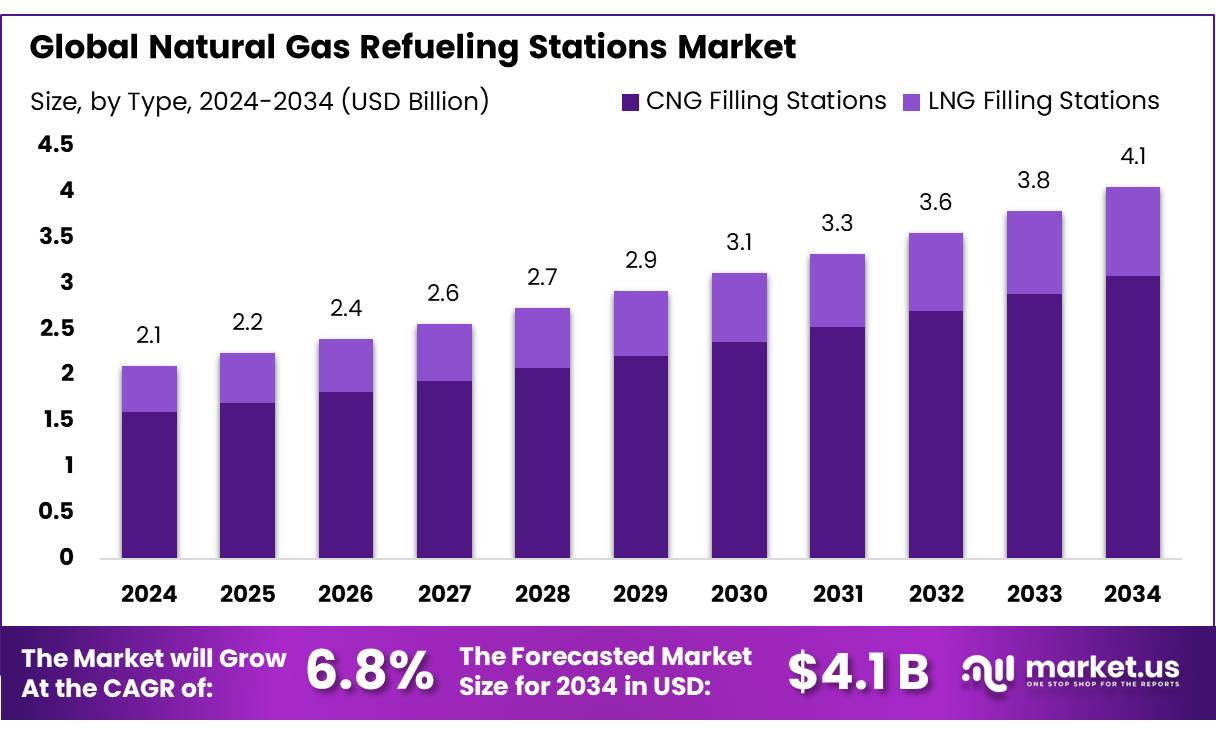

The Global Natural Gas Refueling Stations Market size is expected to be worth around USD 4.1 Bn by 2034, from USD 2.1 Bn in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

The natural gas refueling stations (NGRS) market is emerging as a result of the growing adoption of natural gas vehicles (NGVs), driven by environmental concerns, fuel cost efficiency, and government initiatives promoting cleaner energy sources.

Natural gas is increasingly being used in sectors like public transportation, logistics, and manufacturing, with heavy-duty trucks and buses being preferred for their lower emissions and operational cost-effectiveness. In 2022, the transportation sector accounted for approximately 14% of total natural gas consumption in the U.S., showcasing the potential for NGRS to cater to various industrial applications.

The market’s growth is further fueled by the global shift towards sustainability and reducing greenhouse gas emissions. Natural gas accounted for about 32% of total U.S. energy consumption in 2022, indicating strong and rising demand. As more investments are made in infrastructure, natural gas is becoming a key alternative fuel source in the transition to cleaner energy.

Key drivers of this market include the higher fuel efficiency and lower operational costs of NGVs compared to traditional gasoline and diesel vehicles. According to the International Energy Agency, natural gas vehicles emit up to 20% less CO2 than gasoline-powered vehicles, offering a compelling case for broader adoption amid increasing environmental concerns.

Key Takeaways

- Natural Gas Refueling Stations Market size is expected to be worth around USD 4.1 Bn by 2034, from USD 2.1 Bn in 2024, growing at a CAGR of 6.8%.

- CNG (Compressed Natural Gas) filling stations held a dominant market position, capturing more than a 76.4% share.

- Maintenance services for natural gas refueling stations held a dominant market position, capturing more than a 52.3% share.

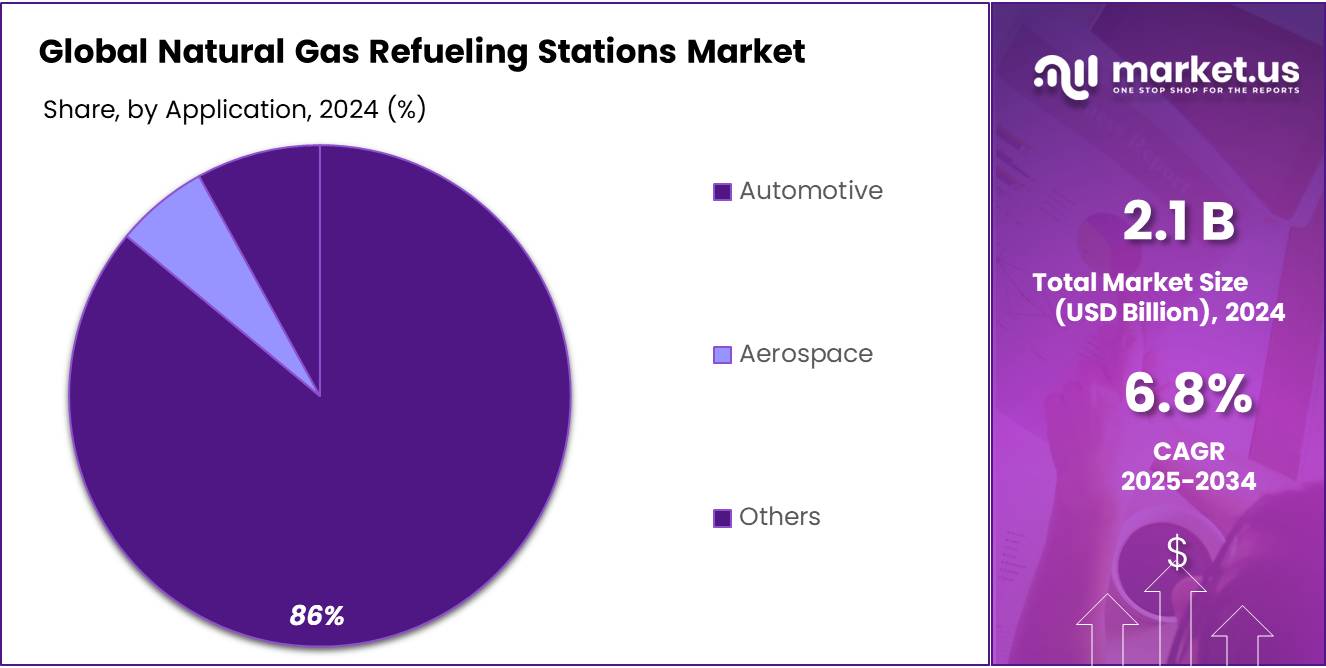

- Automotive sector held a dominant market position, capturing more than an 86.4% share.

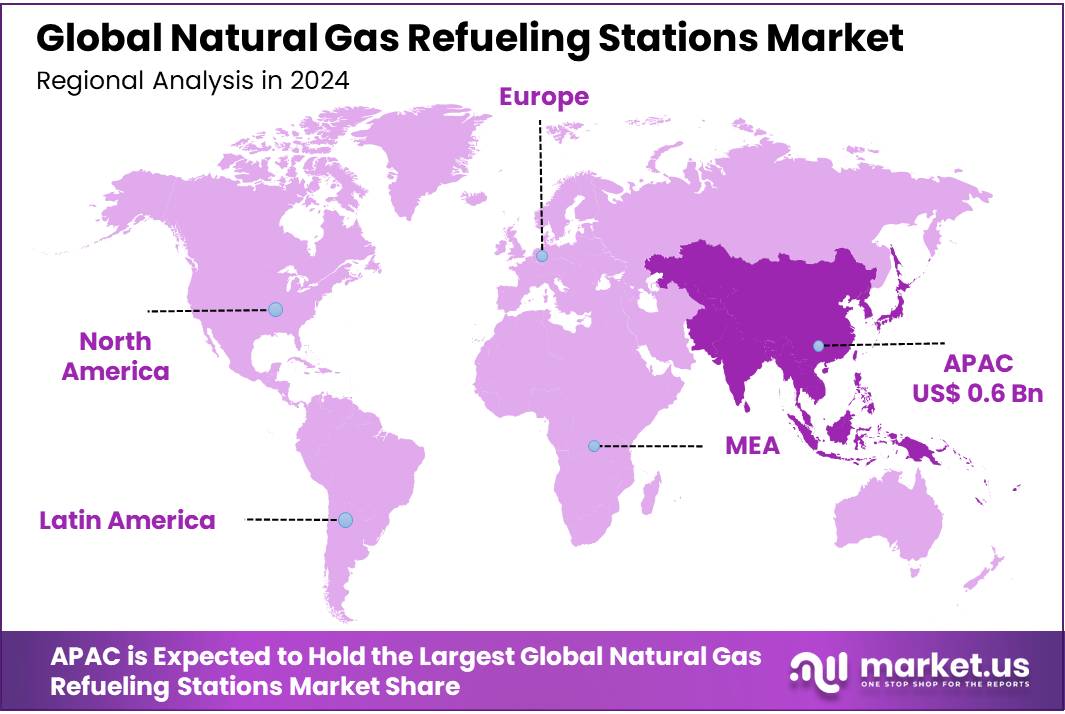

- Asia-Pacific (APAC) region leads with a dominating share of 32.7%, translating to a market size of approximately USD 0.6 billion.

By Type

In 2024, CNG (Compressed Natural Gas) filling stations held a dominant market position, capturing more than a 76.4% share of the natural gas refueling stations market. This prominent position reflects the increasing adoption of CNG as a cleaner alternative to traditional fossil fuels. CNG stations have been particularly popular due to their lower fuel costs and reduced emissions compared to gasoline or diesel stations.

The widespread installation of CNG stations has been driven by the push for more environmentally friendly transportation solutions. Governments and private sector initiatives have supported the infrastructure expansion necessary to accommodate CNG vehicles, which has further fueled the growth of this segment. Moreover, the availability of technology for compressing natural gas at filling stations has improved, making these installations more cost-effective and efficient.

By Application

In 2024, maintenance services for natural gas refueling stations held a dominant market position, capturing more than a 52.3% share. This significant market share underscores the crucial role of maintenance in ensuring the efficiency and safety of natural gas refueling infrastructure. As the network of these stations expands, consistent and reliable service becomes paramount to meet the operational demands and compliance standards set by regulatory bodies.

The dominance of maintenance services can be attributed to the complex nature of natural gas refueling technology, which requires regular checks and upkeep to prevent leaks, ensure proper pressure levels, and manage the sophisticated compressors and dispensers used in CNG stations. Moreover, as these stations become more integrated with advanced technologies for payment systems and fuel management, the scope of maintenance has broadened, encompassing software updates and cybersecurity measures alongside traditional mechanical upkeep.

By End User

In 2024, independent service providers in the natural gas refueling stations market for the automotive sector held a dominant market position, capturing more than an 86.4% share. This significant market share is indicative of the pivotal role these providers play in the expansion and accessibility of natural gas refueling infrastructure. Independent service providers have been instrumental in deploying and operating natural gas refueling stations across various locations, thereby facilitating the broader adoption of natural gas vehicles (NGVs).

The predominance of independent service providers is attributed to their flexibility and responsiveness to the needs of the automotive industry, which is increasingly turning towards cleaner and more cost-effective fuel alternatives like compressed natural gas (CNG) and liquefied natural gas (LNG). These providers are often quicker to set up new stations and adapt to market demands compared to their larger, often more bureaucratic counterparts.

Key Market Segments

By Type

- CNG Filling Stations

- LNG Filling Stations

By Application

- Vehicle

- Ship

- Others

By End User

- Automotive

- Aerospace

- Others

Drivers

Government Incentives Propel Growth in Natural Gas Refueling Infrastructure

One major driving factor for the expansion of natural gas refueling stations is the comprehensive support from government initiatives aimed at promoting cleaner alternative fuels. These incentives are designed to reduce carbon emissions and dependency on oil imports, aligning with broader environmental goals.

For instance, in the United States, the federal government offers various tax incentives, including the Alternative Fuel Tax Credit, which provides a $0.50 per gallon tax credit to natural gas used as a motor fuel. Additionally, several states have their own incentive programs that further enhance the economic viability of natural gas vehicles (NGVs) and the infrastructure required to support them. California, a leader in environmental regulation, extends grants and funding opportunities through its California Energy Commission (CEC), which supports the development of natural gas refueling infrastructure as part of the state’s Low Carbon Transportation initiative.

Similarly, in Europe, the European Union’s Alternative Fuels Infrastructure Directive mandates that member states develop national policy frameworks for the market development of alternative fuels and implement measures to ensure that adequate refueling points, accessible to the public, are available by 2025. This directive has been a significant catalyst for investment in natural gas refueling infrastructure across Europe.

These government-backed financial incentives and regulatory frameworks are crucial in driving the growth of the natural gas refueling stations market. They not only make projects more economically attractive but also ensure a consistent increase in the adoption of NGVs by reducing the total cost of ownership compared to conventional fossil fuels.

Restraints

High Installation Costs as a Barrier to Natural Gas Refueling Station Deployment

A significant restraining factor for the expansion of natural gas refueling stations is the high installation and operational costs associated with setting up and maintaining these facilities. Establishing a natural gas refueling station involves substantial upfront investment primarily due to the sophisticated technology required to compress and store natural gas at high pressures. This financial barrier can deter many potential operators from entering the market.

For example, constructing a single compressed natural gas (CNG) station can cost between $1 million to $2 million, depending on the station’s capacity and location. Additionally, ongoing maintenance costs for high-pressure equipment and safety measures further add to operational expenses, making it a less attractive investment compared to more traditional fuel stations. These costs are particularly prohibitive for small or independent operators without the financial backing of larger corporations or government subsidies.

Government incentives can help mitigate some of these costs, but they may not always cover a significant portion of the initial investment required. For instance, while the U.S. federal government and various states offer tax credits and grants for alternative fuel projects, the funding is often competitive and limited in scope, covering only a fraction of the total costs.

Moreover, the economic feasibility of investing in natural gas refueling infrastructure heavily relies on the steady growth in demand for natural gas vehicles (NGVs). If NGV adoption does not increase as anticipated, station operators may not recover their investments, discouraging further expansion of the network.

Opportunity

Emerging Markets Offer Expansive Growth Opportunities for Natural Gas Refueling Stations

The expansion into emerging markets presents a significant growth opportunity for the natural gas refueling stations industry. These markets, particularly in Asia and Eastern Europe, are experiencing rapid industrialization and urbanization, leading to increased demand for energy solutions that are both cost-effective and environmentally sustainable. The adoption of natural gas vehicles (NGVs) is being driven by the dual pressures of rising oil prices and growing environmental awareness, which in turn fuels the need for more natural gas refueling infrastructure.

Countries like India and China are spearheading this growth. For instance, the Indian government’s commitment to reduce its carbon footprint has led to supportive policies, including subsidies and incentives for NGVs and related infrastructure. The “City Gas Distribution” (CGD) project aimed at expanding the natural gas network to cover approximately 70% of the country’s population by 2030, creates a direct pathway for growth in the refueling station market.

Similarly, in China, the push towards reducing severe air pollution has resulted in aggressive government strategies favoring natural gas. Plans to convert large numbers of public transport and commercial vehicles to natural gas are already underway, with substantial state funding backing the construction of new CNG and LNG stations across the nation.

These emerging markets are characterized by lower initial competition and potentially high rates of adoption for NGVs, due to the pressing need for more affordable and clean energy solutions. Companies looking to capitalize on these opportunities will benefit from early investments in local partnerships and compliance with regional regulatory frameworks to facilitate smoother market entries.

Trends

Integration of Renewable Biogas in Natural Gas Refueling Stations

A significant trend in the natural gas refueling stations market is the integration of renewable biogas, which is gaining traction due to its potential to reduce the environmental impact of natural gas vehicles (NGVs). This trend is being driven by increasing global commitments to reduce greenhouse gas emissions and the ongoing search for more sustainable fuel options.

Biogas, primarily composed of methane derived from agricultural waste, landfill sites, and wastewater treatments, is being upgraded to biomethane standards and fed into the natural gas grid or used directly at refueling stations. The use of renewable biogas not only leverages existing natural gas infrastructure but also offers a carbon-neutral or even carbon-negative alternative by offsetting the use of conventional natural gas derived from fossil sources.

In Europe, countries like Sweden, Germany, and the UK are leading the way in this transition. For instance, in Sweden, a substantial portion of the fuel supplied at public CNG stations is biomethane, thanks to favorable policies and strong governmental support. The European Union is also promoting the use of renewable gases through various directives and funding mechanisms aimed at achieving the EU’s ambitious 2030 climate targets.

Moreover, advancements in biogas upgrading technologies and decreasing processing costs are making biomethane a more competitive and attractive option for energy providers and consumers alike. This adoption is further facilitated by increasing government initiatives that provide financial incentives for biogas projects, including feed-in tariffs and tax benefits, reinforcing the growth and expansion of renewable fuel resources within the NGV sector.

Regional Analysis

Statistically, North America is a major player in the global market, although it is not the largest. The Asia-Pacific (APAC) region leads with a dominating share of 32.7%, translating to a market size of approximately USD 0.6 billion. In comparison, North America, while substantial, does not reach these levels but maintains a robust growth trajectory supported by both public and private sector initiatives.

The growth in North America is largely facilitated by the availability of natural gas and the increasing conversion of public and private vehicle fleets to natural gas, which has spurred the development of new refueling infrastructure. The U.S. Department of Energy supports these developments through various grants and programs aimed at enhancing the energy infrastructure, which solidifies the region’s role in the global market.

Additionally, the market in North America is expected to continue expanding, thanks to technological advancements in refueling equipment and the rising demand for environmentally friendly transportation solutions. These factors ensure that North America remains a key market, driving forward the adoption of natural gas vehicles and supporting the establishment of a comprehensive network of refueling stations. This is crucial not only for reducing greenhouse gas emissions but also for setting a benchmark in the transition towards sustainable energy solutions globally.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Atlas Copco AB is a renowned provider in the compressed air and gas equipment industry, including technology for natural gas refueling stations. Their solutions are pivotal in enabling efficient compression and refueling technologies, making them a key player in the infrastructure that supports the proliferation of natural gas vehicles (NGVs). Atlas Copco’s commitment to innovation and sustainability helps drive the expansion of natural gas as a clean and cost-effective alternative to traditional fuels.

Clean Energy Fuels Corp. Specializing in natural gas, Clean Energy Fuels Corp. is a leader in the development, operation, and provision of natural gas fueling stations across North America. Their extensive network supports both compressed natural gas (CNG) and liquefied natural gas (LNG), catering to a wide range of vehicles from light-duty cars to heavy-duty trucks, underlining their significant role in advancing the use of natural gas in transportation.

CNOOC As one of China’s largest oil companies, CNOOC has ventured extensively into the natural gas sector, including the operation of natural gas refueling stations. Their involvement extends beyond just fueling to also encompassing the exploration and production of natural gas, which ensures a stable supply chain to meet the growing demand for cleaner fuel options in Asia and globally.

Cryostar is a specialist in advanced technologies for high-performance equipment in both the LNG and CNG markets, including pumps and compressors for natural gas refueling stations. Their expertise lies in providing equipment that is crucial for the effective and safe dispensing of natural gas at refueling points, playing a critical role in the infrastructure needed for NGVs.

Top Key Players

- FASTECH

- OPAL Fuels Inc.

- TotalEnergies

- Clean Energy Fuels

- Megha Engineering & Infrastructures Ltd

- Énergir

- CommTank

- CGRS, Inc.

- ZeitEnergy, LLC.

- ANGI Energy Systems, Inc.

- Trillium Energy Solutions.

- Snam S.p.A.

- IGS Energy

- Sunoco LP

- Other Key Players

Recent Developments

In 2024, Clean Energy Fuels Corp. continued to reinforce its position as a leader in the natural gas refueling station market, particularly in the renewable natural gas (RNG) sector. As the largest provider of RNG in North America, Clean Energy operates over 600 fueling stations, demonstrating significant market presence and expertise in sustainable fuel solutions for transportation.

In 2024, Dover Corporation, through its subsidiary Dover Fueling Solutions (DFS), continued to enhance the natural gas refueling sector by introducing advanced technologies and expanding its product offerings.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 4.1 Bn CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (CNG Filling Stations, LNG Filling Stations), By Application (Vehicle, Ship, Others), By End User ( Automotive, Aerospace, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape FASTECH, OPAL Fuels Inc., TotalEnergies, Clean Energy Fuels, Megha Engineering & Infrastructures Ltd, Énergir, CommTank, CGRS, Inc., ZeitEnergy, LLC., ANGI Energy Systems, Inc., Trillium Energy Solutions., Snam S.p.A., IGS Energy, Sunoco LP, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Natural Gas Refueling Stations MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Natural Gas Refueling Stations MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- FASTECH

- OPAL Fuels Inc.

- TotalEnergies

- Clean Energy Fuels

- Megha Engineering & Infrastructures Ltd

- Énergir

- CommTank

- CGRS, Inc.

- ZeitEnergy, LLC.

- ANGI Energy Systems, Inc.

- Trillium Energy Solutions.

- Snam S.p.A.

- IGS Energy

- Sunoco LP

- Other Key Players