Global Plastic Bottles and Containers Market Size, Share, And Business Benefits By Material (Polyethylene Terephthalate (PET), Polypropylene (PP), Low-density Polyethylene (LDPE), High-density Polyethylene (HDPE), Others), By Plastic Processing (Extraction Blow Molding, Injection Blow Molding, Others), By End-use (Food and Beverages, Cosmetics, Pharmaceuticals, Household Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147520

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

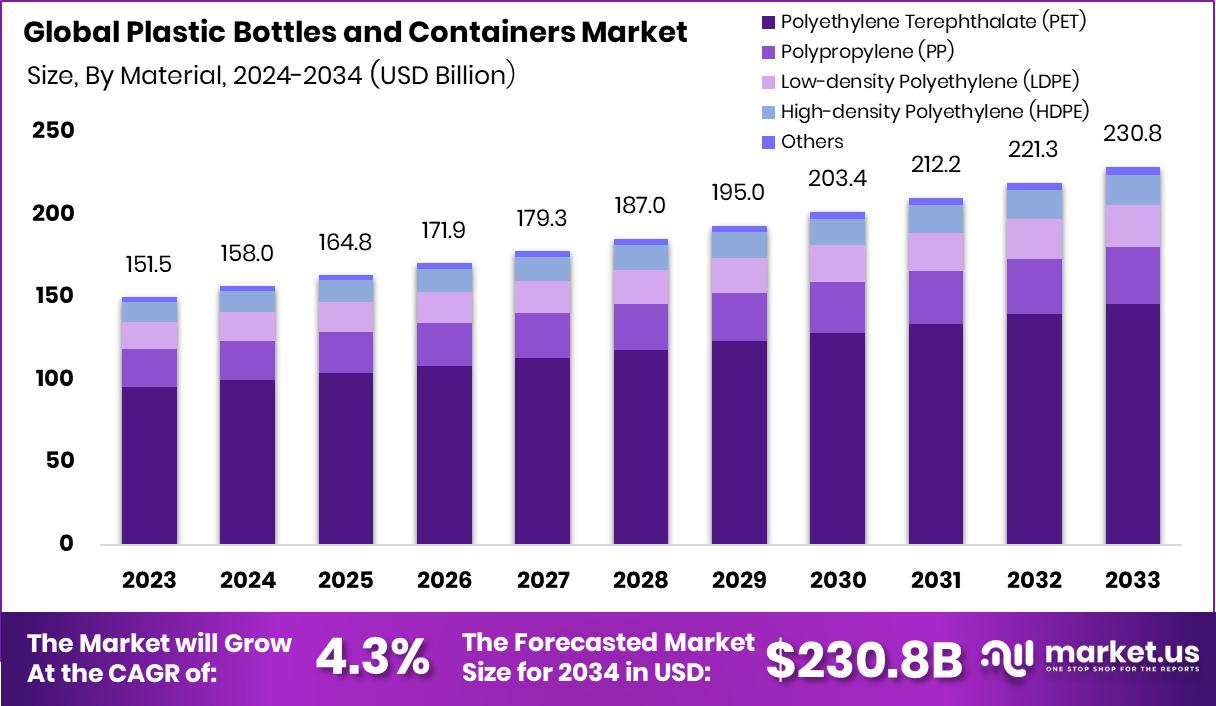

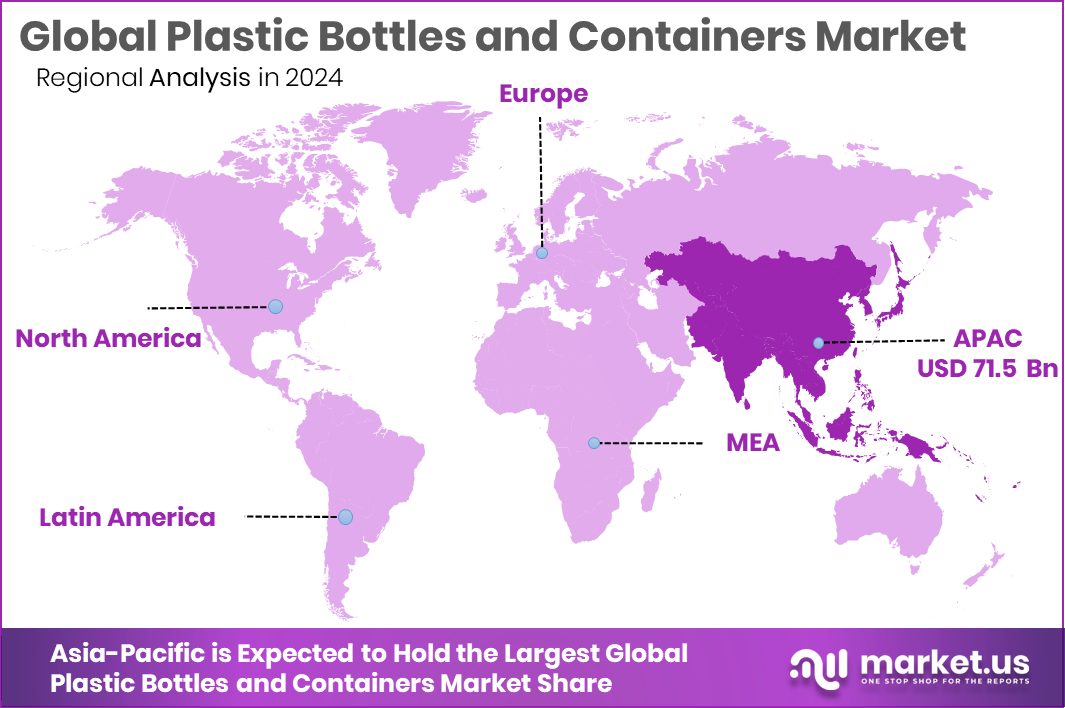

Global Plastic Bottles and Containers Market is expected to be worth around USD 230.8 billion by 2034, up from USD 151.5 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034. With 47.2% market share, Asia-Pacific remained the top plastic packaging consumer region.

Plastic bottles and containers are molded packaging products typically made from polyethylene terephthalate (PET), high-density polyethylene (HDPE), or polypropylene (PP). These are commonly used to store liquids, powders, and semi-solids in industries like food and beverages, pharmaceuticals, personal care, and household cleaning. Their lightweight, durability, and low cost make them a preferred choice for both manufacturers and consumers.

The plastic bottles and containers market includes the production, consumption, and innovation around these packaging forms. It is driven by urbanization, changing lifestyles, and the convenience they offer in storing, transporting, and dispensing products. This market spans across sectors—from storing soft drinks and cooking oil to shampoos and disinfectants. Braskem grants US$ 6,000 to develop new recycling process technology to extract pure polypropylene from PCR

One major growth factor is the booming food and beverage industry, especially in emerging economies. Increasing demand for ready-to-drink beverages and packaged foods has accelerated the use of plastic packaging. The shift towards on-the-go consumption and bulk buying further boosts this trend. The UK government, via the Engineering and Physical Sciences Research Council (EPSRC), allocated £8 million (across eight projects) for research into plastics pollution, including polypropylene.

Looking at future opportunities, bioplastics and smart packaging technologies offer strong potential. Brands are exploring biodegradable containers, embedded sensors, and innovative closure systems to enhance safety, shelf life, and sustainability—all opening new doors for the market’s evolution. According industry report, 4.2M in Grants were awarded to Improve Polypropylene Curbside Recycling for nearly 15 million Americans.

Key Takeaways

- Global Plastic Bottles and Containers Market is expected to be worth around USD 230.8 billion by 2034, up from USD 151.5 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034.

- In 2024, PET captured 63.2% market share due to its lightweight and recyclable properties.

- Extraction blow molding secured a 56.9% share due to efficient mass production of uniform plastic containers.

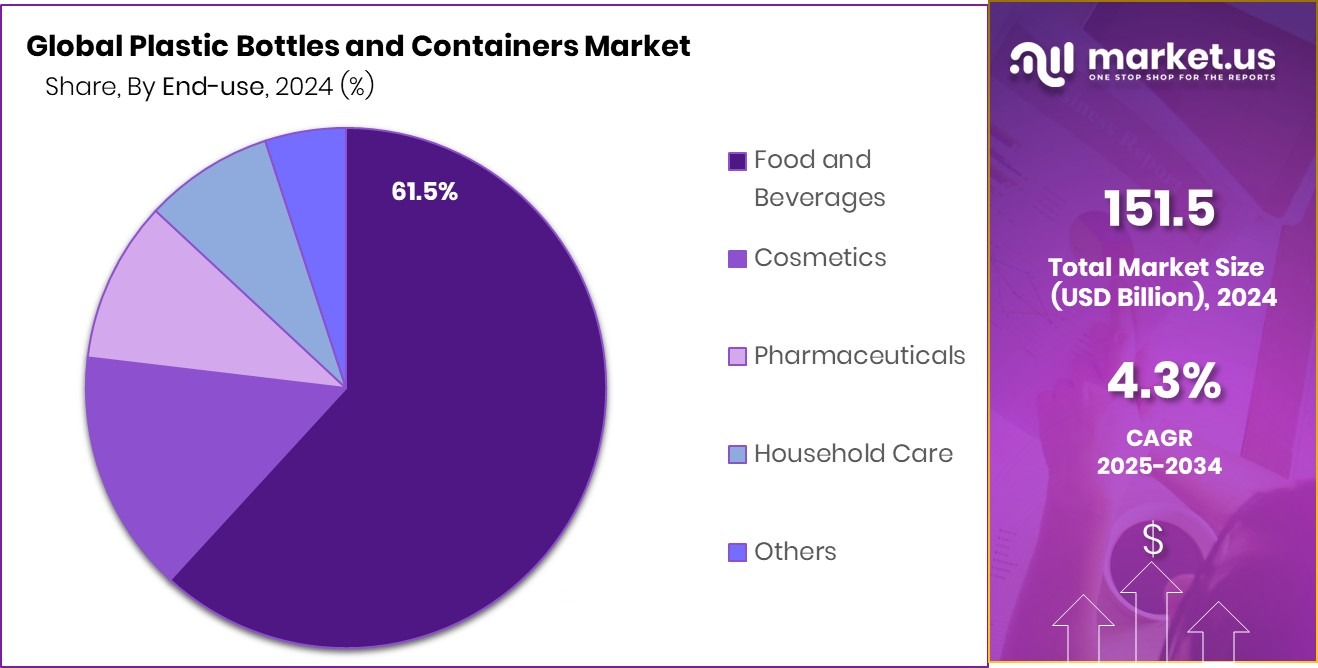

- The food and beverages industry led with a 61.5% share, relying heavily on plastic container packaging solutions.

- Asia-Pacific dominated demand for plastic containers, valued at USD 71.5 billion globally.

By Material Analysis

PET holds a strong 63.2% share in material usage preference globally.

In 2024, Polyethylene Terephthalate (PET) held a dominant market position in By Material segment of Plastic Bottles and Containers Market, with a 63.2% share. This dominance reflects the material’s widespread acceptance across industries due to its lightweight, durability, and excellent barrier properties. PET has emerged as the preferred choice for packaging in various end-use sectors, especially where transparency and strength are critical, such as in food and beverage packaging.

Its recyclability and cost-effectiveness have further supported its broad adoption amid growing environmental consciousness and regulatory scrutiny. The 63.2% share highlights how PET continues to outperform other plastic materials in terms of commercial usage and market value. In 2024, its extensive application in producing bottles for water, carbonated drinks, and edible oil significantly contributed to this share.

Additionally, PET’s compatibility with blow molding processes, which are widely used in bottle manufacturing, has reinforced its dominance in the segment. The material’s ability to withstand pressure, maintain form, and offer superior product visibility gives it a commercial edge in retail settings.

By Plastic Processing Analysis

Extraction blow molding leads the processing segment with a 56.9% market share.

In 2024, Extraction Blow Molding held a dominant market position in the By Plastic Processing segment of the Plastic Bottles and Containers Market, with a 56.9% share. This processing method maintained its lead due to its efficiency in mass-producing hollow plastic containers with uniform wall thickness and consistent quality.

The 56.9% share underlines its extensive application across industries that demand high-volume production, particularly in the packaging of beverages, personal care, and household products. Extraction blow molding is favored for its compatibility with a range of plastic materials, including PET, which is the dominant material type in this market.

Its ability to form complex shapes, reduce material wastage, and produce containers at relatively lower costs makes it an ideal choice for manufacturers focused on both quality and economy. In 2024, the rising demand for lightweight and durable plastic packaging further boosted the use of this method.

The technology’s adaptability in creating bottles with integrated handles and customized designs helped cater to diverse packaging needs, reinforcing its position in the segment. Moreover, the process supports automation, which enhances production speed and consistency, critical for large-scale packaging operations.

By End-use Analysis

The food and beverage sector drives demand with a 61.5% usage share globally.

In 2024, Food and Beverages held a dominant market position in By End-use segment of Plastic Bottles and Containers Market, with a 61.5% share. This strong share reflects the sector’s consistent and high-volume demand for reliable, lightweight, and cost-effective packaging solutions. Plastic bottles and containers are widely used across food and beverage applications due to their convenience, portability, and excellent product protection.

The 61.5% market share highlights the significant consumption driven by bottled water, soft drinks, juices, dairy, sauces, and edible oils. The dominance of this segment is also closely tied to consumer lifestyle shifts, with rising preferences for on-the-go and single-serve packaging.

In 2024, food safety, shelf-life extension, and brand visibility continued to be top priorities, where plastic packaging offers clear advantages such as sealing efficiency, transparency, and custom shapes.

Additionally, the compatibility of PET material—also a dominant material in this market—with food and beverage packaging further supported this end-use segment’s leadership. As the global population grows and urbanization continues, demand for packaged food and drinks remains on an upward trajectory, reinforcing the segment’s stronghold.

Key Market Segments

By Material

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Low-density Polyethylene (LDPE)

- High-density Polyethylene (HDPE)

- Others

By Plastic Processing

- Extraction Blow Molding

- Injection Blow Molding

- Others

By End-use

- Food and Beverages

- Cosmetics

- Pharmaceuticals

- Household Care

- Others

Driving Factors

Rising Packaged Food Demand Boosts Plastic Bottles Use

One major driving factor for the plastic bottles and containers market is the rising demand for packaged food and beverages. As more people prefer ready-to-eat meals, bottled drinks, and convenience-based products, the need for lightweight and safe packaging grows rapidly.

Plastic containers are preferred because they are affordable, durable, and easy to carry. In developing regions, urbanization and increasing income levels have further increased packaged food consumption.

Also, modern retail formats like supermarkets and online grocery stores are boosting sales of packaged items, which rely heavily on plastic bottles. This trend is expected to continue as consumers demand longer shelf life, better product safety, and easy handling, making plastic packaging a top choice for manufacturers and consumers alike.

Restraining Factors

Environmental Concerns and Plastic Waste Limit Market Growth

A major restraining factor for the plastic bottles and containers market is the growing environmental concern related to plastic waste. Governments, environmental groups, and consumers are increasingly worried about pollution caused by single-use plastics.

These bottles often end up in oceans and landfills, harming ecosystems and wildlife. As a result, stricter rules on plastic usage, bans on certain products, and taxes on plastic packaging are being introduced in many countries.

Consumers are also shifting toward eco-friendly alternatives like glass, metal, or biodegradable packaging. These changes are pushing manufacturers to rethink their materials and packaging strategies. While plastic offers many advantages, its environmental impact is becoming a serious challenge that may slow market growth in the future.

Growth Opportunity

Emerging Markets Drive Plastic Packaging Growth

A significant growth opportunity for the plastic bottles and containers market lies in the expanding demand from emerging economies. Countries like India, China, and Brazil are experiencing rapid urbanization and rising disposable incomes, leading to increased consumption of packaged goods.

This shift fuels the need for efficient and affordable packaging solutions, with plastic bottles and containers being a preferred choice due to their lightweight, durability, and cost-effectiveness. The growing middle-class population in these regions is also contributing to higher demand for bottled beverages, personal care products, and household items, all of which commonly utilize plastic packaging.

Moreover, the expansion of modern retail formats and e-commerce platforms in these markets further amplifies the demand for convenient packaging solutions. As manufacturers and brands seek to tap into these burgeoning markets, the plastic bottles and containers industry stands to benefit significantly from the evolving consumer preferences and market dynamics in emerging economies.

Latest Trends

Sustainable Packaging Innovations Transforming the Plastic Bottles Market

A significant trend shaping the plastic bottles and containers market is the shift towards sustainable packaging solutions. Manufacturers are increasingly adopting recyclable and biodegradable materials, such as bio-based polymers and recycled plastics, to address environmental concerns.

This transition is driven by consumer demand for eco-friendly products and stringent regulatory frameworks aimed at reducing plastic waste. Innovations in material science, including the development of lightweight and durable alternatives, are enabling companies to produce packaging that meets both sustainability goals and functional requirements.

Additionally, advancements in recycling technologies are enhancing the feasibility of closed-loop systems, promoting the reuse of materials and minimizing environmental impact. These sustainable packaging initiatives are not only mitigating ecological issues but also offering economic benefits by reducing material costs and aligning with consumer preferences, thereby influencing purchasing decisions and fostering brand loyalty.

Regional Analysis

In 2024, Asia-Pacific led with a 47.2% share, worth USD 71.5 billion.

In 2024, Asia-Pacific held the dominant position in the Plastic Bottles and Containers Market, accounting for 47.2% of the global share, with a market value of USD 71.5 billion. The region’s leadership is driven by strong demand from fast-growing economies such as China, India, and Southeast Asian countries, where rapid urbanization, population growth, and expanding food and beverage industries are boosting plastic packaging consumption.

The increasing preference for convenience and ready-to-drink products has further reinforced this dominance. In contrast, North America and Europe are mature markets, with stable demand supported by established retail infrastructure and ongoing innovation in recyclable packaging formats. These regions continue to invest in sustainable materials but show slower volume growth compared to Asia-Pacific.

Meanwhile, the Middle East & Africa and Latin America represent emerging opportunities, fueled by improving industrial development and growing consumer markets. However, their market shares remain comparatively smaller due to limited manufacturing capacities and slower adoption of advanced packaging technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Graham Packaging remained a pivotal player in the plastic bottles and containers space with its continued focus on sustainable packaging innovations. The company’s long-standing experience in custom blow-molded plastic containers enabled it to serve a diverse set of industries, including food, beverages, personal care, and household products. Graham’s efforts toward integrating post-consumer recycled (PCR) content in their packaging gained strong traction this year, aligning with global sustainability goals and customer preferences for eco-conscious solutions.

Huhtamaki, known for its food and drink packaging expertise, strengthened its presence in rigid plastic containers through a balance of innovation and geographic expansion. The company placed particular emphasis on recyclable and bio-based plastics, especially for food-grade applications. In 2024, Huhtamaki’s strategic investments in Asia and Europe helped enhance capacity and meet regional packaging demands more efficiently.

JSK Plastics showed notable performance in 2024 as a growing regional supplier specializing in PET and HDPE bottles for the FMCG sector. Their flexible production capabilities and ability to offer cost-effective custom designs gave them an edge in the mid-size manufacturer category. JSK’s consistent supply to regional beverage and personal care brands strengthened its market visibility, particularly in price-sensitive markets where speed and agility matter.

Top Key Players in the Market

- Air Sea Containers

- Alpla

- Amcor

- Berry Global

- Cambrian Packaging

- Cospak

- Gerresheimer

- Graham Packaging

- Huhtamaki

- JSK Plastics

- Jyoti Chemicals

- Kee Pet Containers

- KHS

- MJS Packaging

- Plastoworld

- Silgan Plastics

- Tekni-Plex

Recent Developments

- In April 2025, Huhtamaki acquired Zellwin Farms Company, a Florida-based molded fiber packaging firm, for USD 18 million. This acquisition expands Huhtamaki’s capacity in producing sustainable molded fiber products like egg cartons, aligning with the industry’s shift toward renewable packaging solutions.

- In May 2024, ALPLA partnered with Re-Purpose, a South African company specializing in reverse logistics of post-consumer plastic waste. This collaboration aims to strengthen the feedstock value chain for ALPLA’s first PET recycling facility in Africa, located in Ballito, KwaZulu-Natal. The plant, expected to produce over 35,000 tonnes of recycled PET annually from early 2025, will benefit from Re-Purpose’s collection programs and material recovery facilities.

Report Scope

Report Features Description Market Value (2024) USD 151.5 Billion Forecast Revenue (2034) USD 230.8 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Polyethylene Terephthalate (PET), Polypropylene (PP), Low-density Polyethylene (LDPE), High-density Polyethylene (HDPE), Others), By Plastic Processing (Extraction Blow Molding, Injection Blow Molding, Others), By End-use (Food and Beverages, Cosmetics, Pharmaceuticals, Household Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Air Sea Containers, Alpla, Amcor, Berry Global, Cambrian Packaging, Cospak, Gerresheimer, Graham Packaging, Huhtamaki, JSK Plastics, Jyoti Chemicals, Kee Pet Containers, KHS, MJS Packaging, Plastoworld, Silgan Plastics, Tekni-Plex Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plastic Bottles and Containers MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Plastic Bottles and Containers MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Air Sea Containers

- Alpla

- Amcor

- Berry Global

- Cambrian Packaging

- Cospak

- Gerresheimer

- Graham Packaging

- Huhtamaki

- JSK Plastics

- Jyoti Chemicals

- Kee Pet Containers

- KHS

- MJS Packaging

- Plastoworld

- Silgan Plastics

- Tekni-Plex