Global Soft Drink Concentrate Market By Type (Carbonated, Non-Carbonated), By Flavor (Orange, Black Current, Peach, Jeera Masala, Strawberry, Apple, Blueberry, By Packaging, Bottles, Cans, Others), By Form (Liquid, Powder), By Distribution Channels (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, Others) , Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145138

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

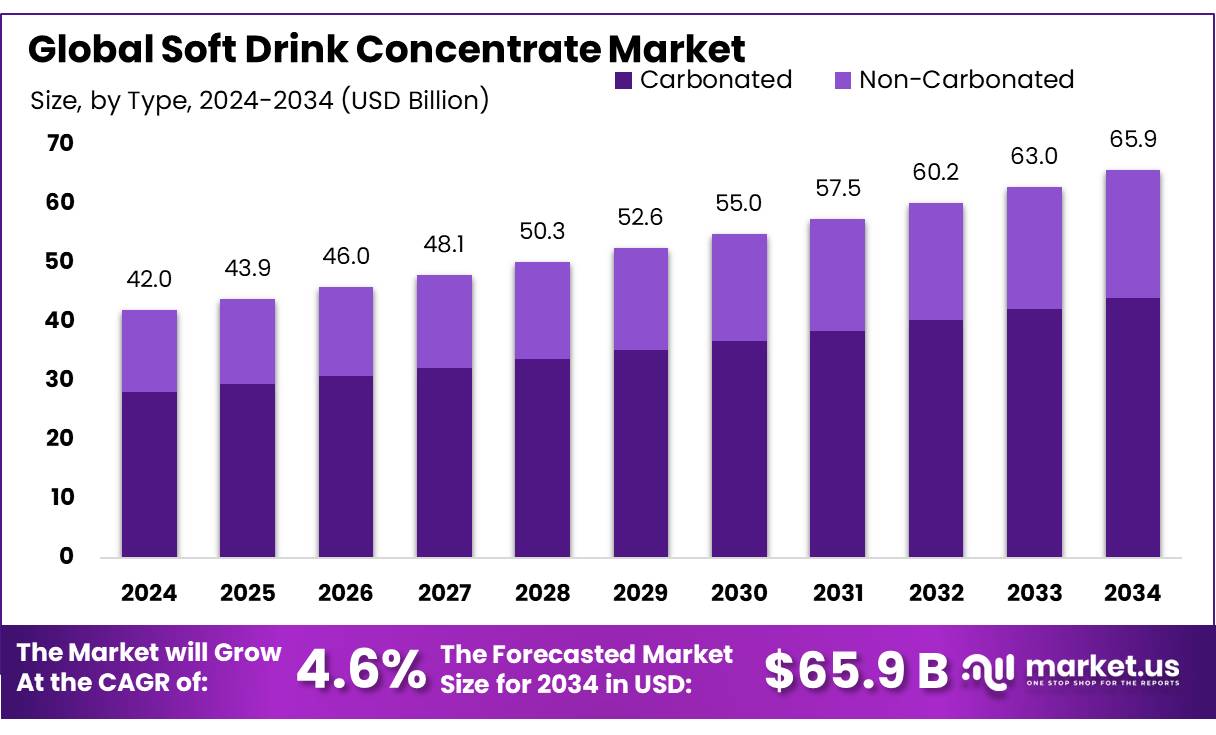

The Global Soft Drink Concentrate Market size is expected to be worth around USD 65.9 Billion by 2034, from USD 42.0 Billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

The soft drink concentrate industry plays a vital role in the global non-alcoholic beverage sector, forming the base for producing carbonated and non-carbonated soft drinks. These concentrates—available in liquid, powder, or syrup forms—offer cost-efficiency in production, transportation, and storage, making them integral to large-scale beverage manufacturing. The sector is marked by increasing demand for flavor innovation, sugar reduction, and value-added health benefits.

According to the Food and Agriculture Organization (FAO), global beverage consumption, including carbonated drinks, surpassed 235 billion liters in 2023, with concentrates accounting for a significant portion of the input material used in production.

In 2022, the U.S. Department of Agriculture (USDA) reported that per capita soft drink consumption in the U.S. was approximately 37.6 gallons, reflecting the consistent demand across age groups. Moreover, increased investment in the food and beverage sector—pegged at ₹6,000 crore (approx. $720 million) under India’s Production Linked Incentive (PLI) scheme for food processing—continues to stimulate innovation and manufacturing capabilities.

One of the core growth drivers is the global shift toward healthier beverage alternatives. The World Health Organization (WHO) has consistently advocated for sugar reduction in beverages to combat obesity and diabetes. In response, many producers are focusing on low-calorie soft drink concentrates using natural sweeteners like stevia and monk fruit.

The European Union, under its Farm to Fork strategy, has also pushed for reformulation and cleaner labeling, indirectly driving soft drink concentrate producers to align with public health objectives. In 2023, the European Commission reported that over 35% of new beverage formulations included sugar-free or reduced-sugar claims.

Technological advancements in flavor encapsulation and shelf-life enhancement have further propelled market expansion. The U.S. Food and Drug Administration (FDA) approved more than 60 new beverage additives and processing aids in the last five years, enabling diversified concentrate offerings. Additionally, government-led initiatives such as China’s “Healthy China 2030” plan—targeting a 20% reduction in sugar-sweetened beverage intake by 2030—are encouraging domestic concentrate reformulations and R&D investments.

Key Takeaways

- Soft Drink Concentrate Market size is expected to be worth around USD 65.9 Billion by 2034, from USD 42.0 Billion in 2024, growing at a CAGR of 4.6%.

- Carbonated segment of the soft drink concentrate market commanded an impressive presence, securing more than a 67.80% share of the market.

- Orange flavor segment in the soft drink concentrate market firmly established its leadership, capturing more than a 24.50% share.

- Bottles as a packaging option for soft drink concentrates secured a dominant market position, capturing more than a 56.40% share.

- Liquid form of soft drink concentrates maintained a dominant market position, capturing more than an 83.40% share.

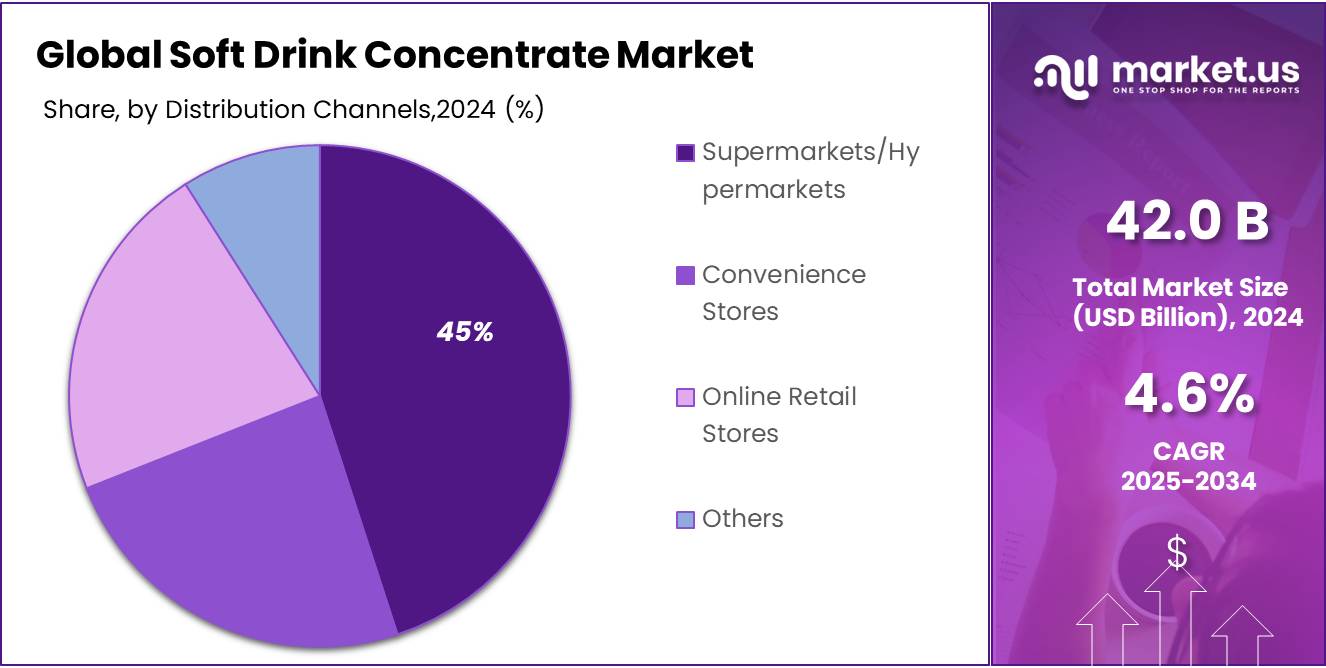

- Supermarkets/hypermarkets emerged as the leading distribution channel for soft drink concentrates, commanding over a 45.60% market share.

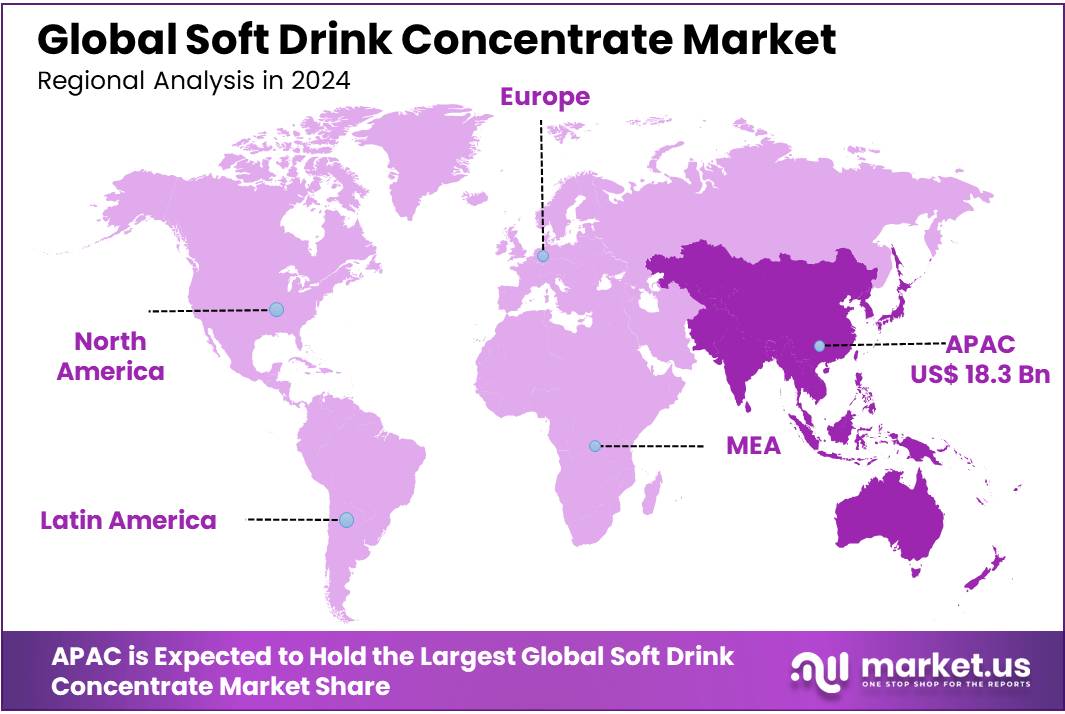

- Asia Pacific region asserted its dominance in the global soft drink concentrate market, capturing a substantial 43.60% share, equivalent to a market size of approximately $18.3 billion.

By Type

Carbonated Soft Drink Concentrates Surge Ahead with Over Two-Thirds Market Share

In 2024, the carbonated segment of the soft drink concentrate market commanded an impressive presence, securing more than a 67.80% share of the market. This substantial market control underscores the enduring preference for carbonated beverages among consumers, driven by their appealing effervescence and widespread availability.

Carbonated concentrates, essential for crafting popular sodas and sparkling beverages, continue to captivate both the young and old, maintaining their status as a staple in casual dining, fast food, and home consumption. The dominance of carbonated concentrates not only highlights their role in traditional beverage preferences but also indicates their adaptability in new, innovative drink mixes that cater to evolving consumer tastes.

By Flavor

Orange Flavor Leads with a Robust 24.5% Market Share Due to Consumer Preferences

In 2024, the orange flavor segment in the soft drink concentrate market firmly established its leadership, capturing more than a 24.50% share. This dominant position reflects the classic appeal of orange flavor, which continues to resonate with a broad base of consumers. Known for its refreshing taste and often associated with health benefits due to its vitamin C content, orange-flavored concentrates are a favored choice in households and dining establishments alike. Their versatility in various beverage applications—from standalone drinks to mixed concoctions—further solidifies their status as a top choice in the soft drink concentrate market.

By Packaging

Bottles Take the Lead in Packaging with a Strong 56.4% Market Share

In 2024, bottles as a packaging option for soft drink concentrates secured a dominant market position, capturing more than a 56.40% share. This prevalent use of bottles highlights their integral role in the storage and distribution of concentrated beverages. Bottles, preferred for their durability and convenience, facilitate ease of transport and extend shelf life, making them a popular choice among manufacturers and consumers alike. Their recyclability and reusability also contribute to their popularity, aligning with growing consumer demand for sustainable packaging solutions in the beverage industry.

By Form

Liquid Form Dominates Soft Drink Concentrates with a Commanding 83.4% Market Share

In 2024, the liquid form of soft drink concentrates maintained a dominant market position, capturing more than an 83.40% share. This overwhelming preference for liquid concentrates stems from their ease of use and consistency in quality. Ideal for quick preparation, liquid concentrates simplify the mixing process, allowing for perfect replication of taste across countless servings. Their efficiency and convenience make them a staple in both commercial settings and household kitchens, underpinning their vast market share and continued consumer preference in the soft drink concentrate industry.

By Distribution Channels

Supermarkets/Hypermarkets Lead Distribution with a 45.6% Share in Soft Drink Concentrates

In 2024, supermarkets/hypermarkets emerged as the leading distribution channel for soft drink concentrates, commanding over a 45.60% market share. This prominent position is attributed to the extensive reach and convenience these outlets offer. Supermarkets and hypermarkets provide consumers with the ability to physically assess product options, benefit from competitive pricing, and enjoy one-stop shopping for all their beverage needs. Their strategic location and the variety of choices available make them a preferred destination for purchasing soft drink concentrates, significantly influencing buying decisions and consumer accessibility.

Key Market Segments

By Type

- Carbonated

- Non-Carbonated

By Flavor

- Orange

- Black Current

- Peach

- Jeera Masala

- Strawberry

- Apple

- Blueberry

By Packaging

- Bottles

- Cans

- Others

By Form

- Liquid

- Powder

By Distribution Channels

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail Stores

- Others

Drivers

Increasing Demand for Convenience and Flavor Variety Drives Soft Drink Concentrate Market Growth

One of the major driving factors for the growth of the soft drink concentrate market is the increasing consumer demand for convenience and a variety of flavors in their beverages. As lifestyles become busier, the appeal of quick and easy meal solutions is rising. Soft drink concentrates offer a convenient solution for both households and food service providers by simplifying beverage preparation, saving time without sacrificing taste.

According to the Food and Agriculture Organization (FAO), global per capita consumption of soft drinks has seen a steady increase, reflecting a growing preference for convenient and ready-to-consume food and beverages among consumers worldwide. This trend is particularly pronounced in urban areas, where fast-paced living and higher disposable incomes drive the demand for ready-to-mix products.

Moreover, consumers are not just looking for convenience but also variety in their dietary choices, including beverages. The availability of a wide range of flavors in soft drink concentrates, from classic options like cola and orange to exotic flavors such as tamarind and lychee, caters to this desire for diversity. The introduction of new flavors is continuously revitalizing the market, attracting more consumers seeking novel and personalized drink options.

Furthermore, government initiatives aimed at promoting food and beverage industries have supported market growth. For instance, several governments have launched campaigns to boost local food and beverage sectors by reducing regulatory hurdles and providing incentives for new businesses. These efforts make it easier for manufacturers to innovate and expand their product lines, thereby fueling the market for soft drink concentrates.

Restraints

Rising Health Concerns Over Sugar Intake Slows Soft Drink Concentrate Market

One of the major factors restraining the growth of the soft drink concentrate market is the rising awareness about health risks linked to high sugar consumption. As more people begin to focus on wellness and nutrition, sugary beverages are increasingly falling out of favor—especially among health-conscious consumers and parents choosing drinks for their children.

According to the World Health Organization (WHO), high sugar intake is directly linked to obesity, type 2 diabetes, and tooth decay. WHO recommends that both adults and children reduce their daily intake of free sugars to less than 10% of their total energy intake, and ideally below 5% for additional health benefits. This shift in public perception and growing concern around sugar-heavy diets has significantly influenced consumer choices, especially in developed markets like Europe and North America.

Governments have responded to these health concerns by implementing sugar taxes on soft drinks in several countries. For example, the United Kingdom introduced a Soft Drinks Industry Levy (SDIL) in 2018, which charges manufacturers a tax based on the amount of sugar in their beverages. Since its implementation, there’s been a noticeable reformulation of products to reduce sugar levels and avoid taxation, which has affected traditional concentrate recipes. The UK government reported that the sales-weighted average sugar content of drinks subject to the SDIL fell by 43.7% between 2015 and 2020.

Opportunity

Growing Demand for Low-Sugar and Natural Concentrates Creates New Market Opportunities

One of the biggest growth opportunities in the soft drink concentrate market lies in the rising demand for low-sugar and natural ingredient options. As global health awareness rises, more consumers are moving away from sugary drinks and seeking healthier alternatives—yet they still want flavorful beverages. This shift has opened the door for new, innovative concentrate products made with natural sweeteners, fruit extracts, and reduced-calorie formulations.

According to the World Health Organization (WHO), noncommunicable diseases like diabetes and cardiovascular issues are among the leading causes of death globally, often linked to poor dietary habits. WHO strongly encourages food manufacturers to cut sugar levels and increase transparency in ingredient labeling. This global push is steering both consumer demand and company innovation in the direction of better-for-you beverages.

In response, many soft drink concentrate producers are now introducing products sweetened with stevia, monk fruit, or erythritol—ingredients known for being plant-based and lower in calories. These formulations are finding strong demand, especially in urban centers and among younger consumers who are mindful of their health and lifestyle choices.

Government support also plays a key role in this trend. For example, the U.S. Food and Drug Administration (FDA) has updated its nutrition labeling guidelines to help consumers identify added sugars more easily. This regulation has nudged beverage manufacturers to reformulate and promote low-sugar options more aggressively.

Trends

Embracing Health-Conscious Trends: The Rise of Functional and Gut-Healthy Soft Drink Concentrates

In recent years, a significant shift has been observed in consumer preferences within the beverage industry. An increasing number of individuals are gravitating towards functional beverages that not only quench thirst but also offer health benefits. This trend is particularly evident in the growing popularity of gut-health-focused drinks, such as prebiotic sodas. Brands like Olipop and Poppi have led this movement, promoting beverages infused with prebiotic fibers aimed at supporting digestive health. Their combined U.S. retail sales reached approximately $817 million in the 52 weeks ending January 25, 2025, underscoring the burgeoning consumer interest in health-centric soft drinks.

Recognizing this shift, major industry players are making strategic moves to align with consumer demand. For instance, Coca-Cola introduced “Simply Pop,” a prebiotic soda designed to support digestive health, featuring 25% to 30% real juice, six grams of prebiotic fiber, vitamin C, and zinc. This product aims to cater to health-conscious consumers seeking functional benefits in their beverages.

Similarly, PepsiCo’s acquisition of Poppi for $2 billion highlights the company’s commitment to expanding its portfolio with health-focused offerings. Poppi’s success, driven by its low-sugar, prebiotic-infused sodas, reflects a broader industry trend where traditional beverage giants are investing in brands that resonate with the wellness-oriented preferences of modern consumers.

This evolution in consumer behavior presents a substantial growth opportunity for the soft drink concentrate market. By developing concentrates that incorporate functional ingredients like prebiotics, probiotics, vitamins, and minerals, manufacturers can meet the rising demand for beverages that contribute to overall well-being. Furthermore, such innovations align with global health initiatives advocating for reduced sugar consumption and enhanced nutritional profiles in food and beverages.

Regional Analysis

In 2024, the Asia Pacific region asserted its dominance in the global soft drink concentrate market, capturing a substantial 43.60% share, equivalent to a market size of approximately $18.3 billion. This commanding position is largely attributed to the region’s vast and growing population, particularly in countries like China and India, where increasing urbanization and rising disposable incomes have led to heightened consumption of soft drink concentrates. China, for instance, remains the largest consumer within the region, accounting for approximately 47% of total soft drink consumption, translating to around 113 billion liters.

The region’s market is further bolstered by the expanding middle class and a youthful demographic that exhibits a strong preference for flavored beverages. Additionally, the proliferation of retail channels, including supermarkets and convenience stores, has enhanced product accessibility, fueling market growth. However, the market also faces challenges, such as increasing health consciousness among consumers leading to a demand for low-sugar and natural ingredient-based concentrates. Despite these hurdles, the Asia Pacific soft drink concentrate market is poised for continued expansion, driven by product innovations and the untapped potential in emerging economies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arizona Beverage Company is a prominent player in the soft drink concentrate market, known for its bold branding and wide flavor variety. The company offers a range of concentrates tailored for iced teas, fruit punches, and energy drinks. With a strong presence in North America and growing international appeal, Arizona leverages creative packaging and affordable pricing to stay competitive. Its focus on natural ingredients and low-sugar offerings aligns well with evolving consumer health trends.

Britvic PLC is a leading soft drink manufacturer based in the UK, with a strong footprint in Europe and global markets. The company produces a variety of concentrates under well-known brands like Robinsons and Teisseire. Britvic is recognized for its innovation in low-calorie and sugar-free beverage formulations. Sustainability is also a key focus, with initiatives aimed at reducing plastic use and improving energy efficiency in production. The company benefits from strong retail partnerships and a well-established distribution network.

Dohler GmbH, headquartered in Germany, is a global leader in natural ingredients and beverage concentrates. The company serves both industrial and consumer markets, offering tailor-made soft drink concentrate solutions. Dohler stands out for its focus on clean-label ingredients, natural colors, and plant-based formulations. With operations in over 130 countries, the company invests heavily in R&D and technology to support innovation. It also collaborates with beverage startups and multinational brands to drive customized product development.

Top Key Players in the Market

- Arizona Beverage Company

- Britvic PLC

- Dohler GmbH

- Kraft Foods

- Monster Beverage Corporation

- Nestlé S.A.

- PepsiCo Inc.

- Red Bull GmbH

- The Coca-Cola Company

Recent Developments

In 2024, AriZona Beverage Company maintained its strong presence in the soft drink concentrate market, achieving an estimated annual revenue of $3 billion. Known for its diverse range of iced teas and juice cocktails, AriZona has expanded its product lineup to include beverage concentrates, catering to both commercial businesses and consumers seeking convenient drink-making solutions.

In 2024, Britvic PLC, a leading UK-based soft drink manufacturer, reported a revenue increase of 9.5%, reaching £1.899 billion. This growth was driven by both price adjustments and higher sales volumes.

Report Scope

Report Features Description Market Value (2024) USD 42.0 Billion Forecast Revenue (2034) USD 65.9 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Carbonated, Non-Carbonated), By Flavor (Orange, Black Current, Peach, Jeera Masala, Strawberry, Apple, Blueberry, By Packaging, Bottles, Cans, Others), By Form (Liquid, Powder), By Distribution Channels (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arizona Beverage Company, Britvic PLC, Dohler GmbH, Kraft Foods, Monster Beverage Corporation, Nestlé S.A., PepsiCo Inc., Red Bull GmbH, The Coca-Cola Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Soft Drink Concentrate MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Soft Drink Concentrate MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Arizona Beverage Company

- Britvic PLC

- Dohler GmbH

- Kraft Foods

- Monster Beverage Corporation

- Nestlé S.A.

- PepsiCo Inc.

- Red Bull GmbH

- The Coca-Cola Company