Global Plant-based Pet Food Market By Product Type (Dry Food, Wet Food, Treats and Snacks, Others), By Ingredient Type (Soy-Based, Pea Protein-Based, Lentil-Based, Grain-Based, Potato and Sweet Potato-Based, Others), By Application (General Health and Nutrition, Digestive Health, Weight Management, Allergy and Sensitivity Support, Skin and Coat Health, Others), By Pet Type ( Cat, Birds, Others), By End-User (Households, Animal Shelters and Rescues, Veterinary Clinics and Pet Care Centers, Others), By Sales Channel (Store-based Retailing, Online Retailers) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

- Published date: March 2025

- Report ID: 142828

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

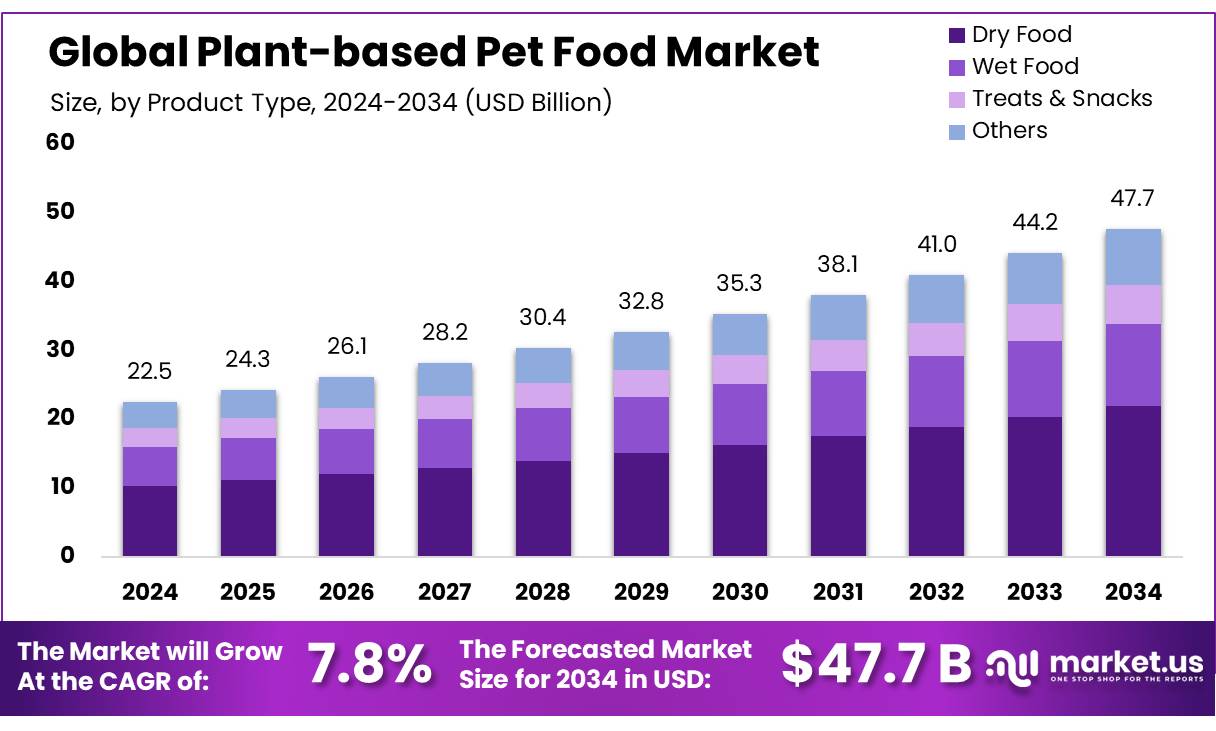

The Global Plant-based Pet Food Market size is expected to be worth around USD 47.7 Billion by 2034, from USD 22.5 Billion in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034.

Plant-based pet foods, which are vegan and free from animal-derived ingredients, are gaining popularity due to growing trends in plant-based human diets and rising demand for vegan pet products. The trend towards pet humanization, where pet owners prefer to offer their pets human-like flavors and high-quality food, is driving market growth. Pet owners are increasingly opting for premium, plant-based products to improve their pets’ health and wellbeing, which in turn is opening up new opportunities in the market.

However, challenges such as limited availability of key ingredients and strict government regulations affecting international trade pose restraints to the growth of the plant-based pet food industry. Despite these hurdles, the industry continues to expand as pet owners are willing to spend more on healthier and sustainable food options for their pets.

According to reports from organizations like the Plant Based Foods Association and the Pet Food Manufacturers’ Association, the global plant-based pet food market has been growing at a compound annual growth rate (CAGR) of around 8.6% over the last five years. This growth is supported by an increasing variety of plant-based pet food products available across various retail channels, which has enhanced consumer accessibility and choice.

Moreover, governments around the world are beginning to promote sustainable pet food options through various initiatives. In Europe, for example, there are government-backed campaigns that highlight the environmental benefits of plant-based diets, which now include pet foods. Additionally, regulatory bodies are intensifying their scrutiny of pet food safety and nutritional standards, leading to more rigorous formulation requirements for plant-based pet foods to ensure they meet these nutritional adequacy standards.

Key Takeaways

- Plant-based Pet Food Market size is expected to be worth around USD 47.7 Billion by 2034, from USD 22.5 Billion in 2024, growing at a CAGR of 7.8%.

- Dry food segment of the plant-based pet food market held a significant lead, securing over 46.30% of the market share.

- Soy-based ingredients in the plant-based pet food market captured a commanding 38.20% share.

- General Health & Nutrition application within the plant-based pet food market held a substantial lead, securing more than 54.20% of the market share.

- Dogs held a dominant market position in the plant-based pet food market, capturing more than 67.30% of the market share.

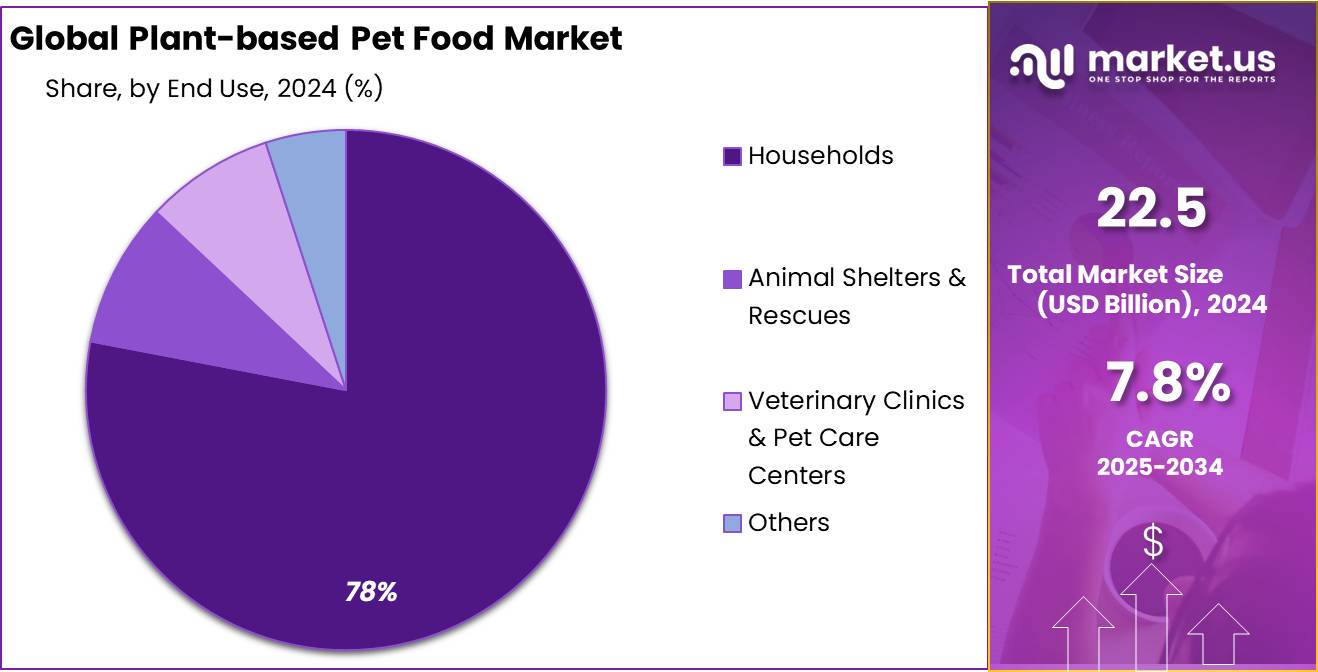

- Households held a dominant market position in the plant-based pet food market, securing an impressive 78.30% share.

- Store-based Retailing held a dominant position in the plant-based pet food market, capturing more than a 78.30% share.

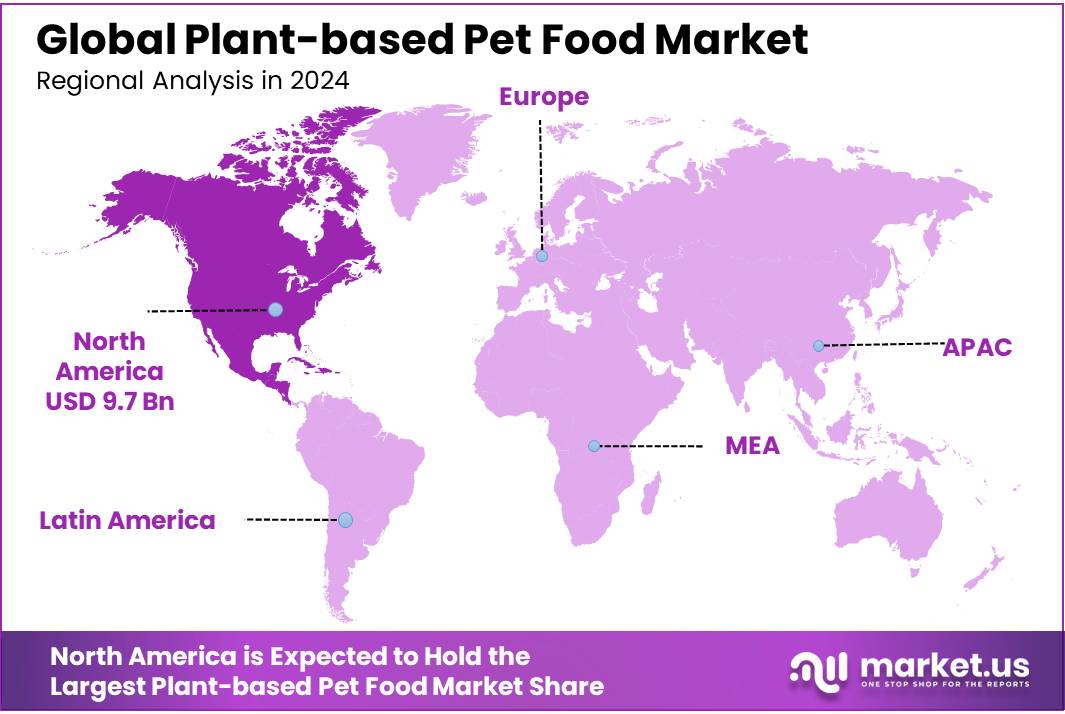

- North America, however, dominates the global plant-based pet food market, holding a substantial 43.20% market share and generating revenues close to USD 9.7 billion.

By Product Type

Plant-Based Pet Food Market Dominance in Dry Food Segment

In 2024, the dry food segment of the plant-based pet food market held a significant lead, securing over 46.30% of the market share. This dominance can be attributed to the increasing consumer preference for sustainable and ethical feeding options for pets. Dry plant-based pet foods have been favored by pet owners due to their convenience, longer shelf life, and nutritional completeness. Moreover, these products have seen a surge in demand as they align with the growing trend of veganism and concerns about animal welfare among pet owners.

Additionally, innovations in flavor and nutritional content have made these foods more appealing to pets, further boosting their popularity. As the market continues to evolve, dry plant-based pet food is expected to maintain its leading position, driven by ongoing product development and an expanding base of health-conscious pet owners.

By Ingredient Type

Soy-Based Ingredients Lead with a 38.20% Market Share in Plant-Based Pet Food

In 2024, soy-based ingredients in the plant-based pet food market captured a commanding 38.20% share, underscoring their dominance. This significant market share is largely due to soy’s well-established reputation as a reliable and nutritious plant protein source. Soy-based pet foods have gained popularity among pet owners looking for nutritious, allergy-friendly alternatives to traditional pet foods.

The ingredient’s high protein content, essential amino acids, and digestibility make it particularly attractive for pet food formulations aimed at supporting the health and well-being of pets. Additionally, the affordability and wide availability of soy compared to other plant-based protein sources have further cemented its position as a leading choice in the market. As consumer awareness and preference for sustainable pet nutrition options grow, soy-based products are poised to continue their market dominance.

By Application

General Health & Nutrition Takes the Lead with a 54.20% Share in Plant-Based Pet Food Market

In 2024, the General Health & Nutrition application within the plant-based pet food market held a substantial lead, securing more than 54.20% of the market share. This segment’s dominance is driven by the increasing number of pet owners seeking healthier diet options for their pets that promote long-term wellbeing and prevent common health issues. Plant-based formulas, particularly those designed for general health and nutrition, have become popular due to their ability to offer balanced nutrients with lower risks of causing dietary intolerances and allergies that are sometimes associated with meat-based diets.

The shift towards these diets reflects a broader trend of pet owners prioritizing the health and ethical implications of their pet’s diet, making plant-based options a go-to choice for those focused on nurturing their pets in a more natural and wholesome way. This trend is anticipated to persist as more pet owners become aware of the benefits of plant-based nutrition in fostering pet health.

By Pet Type

Dogs Lead in Plant-Based Pet Food Market with a 67.30% Share

In 2024, dogs held a dominant market position in the plant-based pet food market, capturing more than 67.30% of the market share. This predominance is primarily due to the increasing number of dog owners adopting plant-based diets for their pets, motivated by health concerns and ethical considerations regarding animal welfare and environmental sustainability. Dog owners are increasingly aware of the potential health benefits of plant-based diets, such as reduced risks of obesity, diabetes, and heart disease, which are common in canines.

Moreover, the availability of a wide range of plant-based food products formulated specifically for dogs has facilitated this shift. As more companies invest in research and development to improve the taste and nutritional content of plant-based dog foods, this segment is expected to maintain its lead in the market, reflecting a growing trend towards healthier and more sustainable feeding practices for pets.

By End-User

Households Dominate Plant-Based Pet Food Market with a 78.30% Share

In 2024, households held a dominant market position in the plant-based pet food market, securing an impressive 78.30% share. This significant market share is driven by a growing number of pet owners who are choosing plant-based options to align with their own dietary choices and ethical values. Household consumers are increasingly conscious of the health implications and environmental impact of their purchasing decisions, including their pet food selections.

This trend is reinforced by the availability of a wide variety of plant-based pet food products that are not only nutritious but also cater to the taste preferences of pets. As awareness of the benefits of plant-based diets for pets continues to spread, household consumption is expected to maintain its leading position, driven by a strong consumer shift towards more sustainable and health-conscious living.

By Sales Channel

Store-based Retailing Leads Plant-based Pet Food Market with 78.30% Share in 2024

In 2024, Store-based Retailing held a dominant position in the plant-based pet food market, capturing more than a 78.30% share. The segment has consistently shown growth, driven by consumers’ preference for the convenience of physical stores where they can directly assess the quality and variety of products. Stores such as supermarkets, hypermarkets, and pet-specialty stores have become the go-to places for purchasing plant-based pet food, benefiting from established trust and familiarity. The growing trend of pet humanization, where pet owners are increasingly opting for plant-based diets for their pets, has led to an increase in sales at brick-and-mortar retail outlets.

The dominance of store-based retailing is expected to continue, though at a slower growth rate. This will likely be due to the continuing reliance on physical stores for product discovery and the sensory experience that online shopping cannot fully replicate. Despite the rise of e-commerce platforms, store-based retailing remains the leading channel for plant-based pet food sales, with consumer confidence in the quality and availability of these products in physical locations.

Key Market Segments

By Product Type

- Dry Food

- Wet Food

- Treats & Snacks

- Others

By Ingredient Type

- Soy-Based

- Pea Protein-Based

- Lentil-Based

- Grain-Based

- Potato & Sweet Potato-Based

- Others

By Application

- General Health & Nutrition

- Digestive Health

- Weight Management

- Allergy & Sensitivity Support

- Skin & Coat Health

- Others

By Pet Type

- Cat

- Kitten

- Senior

- Dog

- Puppy

- Adult

- Senior

- Birds

- Others

By End-User

- Households

- Animal Shelters & Rescues

- Veterinary Clinics & Pet Care Centers

- Others

By Sales Channel

- Store-based Retailing

- Hypermarkets/Supermarkets

- Convenience Stores

- Pet Stores

- Independent Grocery Retailers

- Drugstores

- Others

- Online Retailers

Drivers

Increasing Pet Health Awareness and Dietary Shifts Drive Plant-Based Pet Food Market Growth

One of the primary driving factors for the growth of the plant-based pet food market is the increasing awareness among pet owners about pet health and nutrition. As reported by the American Pet Products Association (APPA), spending on pet food reached $42 billion in 2022, with a notable shift toward healthier, premium options that include plant-based varieties.

Pet owners are more informed and concerned about the ingredients in their pets’ diets and are seeking foods that promote longevity and reduce the incidence of common health issues like allergies, obesity, and digestive problems. This shift is largely influenced by the broader human trend towards plant-based diets, which is mirrored in pet food choices. According to a survey conducted by the Pet Food Manufacturers’ Association (PFMA), approximately 10% of pet owners in the UK are considering or have already switched their pets to a plant-based diet, citing health benefits and ethical reasons.

Government initiatives and endorsements from veterinary professionals also play a crucial role in this trend. For instance, the U.S. Food and Drug Administration (FDA) has been actively involved in regulating and providing guidelines for manufacturing pet food to ensure safety and nutritional adequacy, which includes guidelines for plant-based pet foods.

Moreover, the environmental impact of traditional pet food production, which often involves high meat consumption, has led to a reconsideration of plant-based alternatives. The global push towards sustainability and reducing carbon footprints has further fueled this trend, as plant-based diets are generally associated with lower environmental impact compared to conventional meat-based diets.

These factors combined are propelling the plant-based pet food market forward, as more consumers opt for products that promise not only to meet the nutritional needs of their pets but also align with their values and concerns for health and the environment. As this market continues to evolve, it is expected that more pet owners will embrace plant-based options, supported by ongoing research and product innovation in the industry.

Restraints

Nutritional Concerns and Skepticism Impact Plant-Based Pet Food Adoption

One significant restraining factor affecting the growth of the plant-based pet food market is the ongoing concern and skepticism regarding the nutritional adequacy of plant-based diets for pets. Despite the rising popularity of plant-based foods among humans, translating this trend to pet diets has encountered resistance, primarily due to doubts about whether these diets meet all the nutritional requirements of carnivorous pets like cats and omnivorous pets like dogs.

Nutritional adequacy is a paramount concern, especially highlighted by organizations such as the Association of American Feed Control Officials (AAFCO), which sets guidelines for proper nutritional standards in pet foods.

According to AAFCO, all pet foods must provide a complete and balanced diet for the animal’s life stage, something that skeptics argue may not be guaranteed with plant-based options, particularly concerning essential nutrients like proteins, amino acids (such as taurine), and vitamins that are naturally abundant in animal-based ingredients.

Veterinary professionals often express concerns regarding plant-based diets potentially leading to nutritional deficiencies if not properly formulated. For example, a lack of research and verified case studies showing long-term health benefits or consequences of plant-based diets for different breeds and sizes of pets adds to consumer hesitancy. The British Veterinary Association (BVA) cautions pet owners to consult with a vet before switching to a plant-based diet for their pets to ensure all dietary needs are met without compromising animal health.

Moreover, the higher cost of premium, plant-based pet foods compared to traditional pet foods can also deter budget-conscious consumers. The processing and formulation required to ensure that plant-based foods meet nutritional standards often result in a higher price point.

Opportunity

Expansion into Emerging Markets Presents Growth Opportunities for Plant-Based Pet Food

A significant growth opportunity for the plant-based pet food market lies in its expansion into emerging markets. As global awareness about environmental issues and animal welfare increases, so does the interest in plant-based diets, not only for humans but for pets as well. This trend is particularly notable in rapidly developing regions such as Asia Pacific, Latin America, and parts of Eastern Europe, where pet ownership rates are on the rise.

According to the Global Pet Expo and American Pet Products Association (APPA), the international pet market saw an increase in spending, indicating a broadening base of pet owners who are becoming more attuned to the health and dietary needs of their pets. This burgeoning market is ripe for the introduction of plant-based pet food products that cater to new consumer preferences for sustainability and health-conscious diets.

Government initiatives across these regions are also starting to focus on sustainable agricultural and manufacturing practices, which includes the promotion of plant-based products to reduce carbon footprints and environmental impact. For instance, several governments are implementing policies that encourage the production and consumption of sustainable products, which aligns with the production of plant-based pet foods.

Furthermore, the increase in urbanization and humanization of pets in these markets has led to a greater consumer willingness to invest in premium pet food products. This shift is supported by data from the Pet Food Manufacturers’ Association (PFMA), which notes an increase in the demand for high-quality and specialized pet foods. Plant-based pet food manufacturers can leverage this trend by offering products that meet the nutritional standards and ethical expectations of this new and growing customer base.

Trends

Customization and Specialized Diets: The Latest Trend in Plant-Based Pet Food

One of the latest trends in the plant-based pet food market is the rise of customized and specialized diet options catering to specific health needs and lifestyle choices of pets. This trend is gaining traction as pet owners increasingly seek personalized nutrition plans that not only align with their ethical and environmental values but also address specific health conditions like allergies, obesity, and digestive issues.

The demand for specialized plant-based pet food products is supported by data from the American Pet Products Association (APPA), which shows a growing segment of consumers willing to spend more on high-quality, tailored pet food products. These consumers are driven by a deeper understanding of how diet affects their pets’ health and well-being, paralleling trends seen in human nutrition.

Recognizing this shift, manufacturers are introducing a range of tailored plant-based options that include hypoallergenic recipes, weight management formulas, and age-specific diets that cater to the unique needs of puppies, adult dogs, and seniors. The customization extends to offering subscriptions and personalized meal plans that are delivered directly to the consumer, adding convenience and catering to the modern pet owner’s busy lifestyle.

Government initiatives are also reinforcing this trend. For example, regulatory bodies like the U.S. Food and Drug Administration (FDA) are closely monitoring and regulating pet food labeling to ensure that products marketed as “complete and balanced” meet stringent nutritional standards. This ensures that plant-based pet foods provide all necessary nutrients, further boosting consumer confidence in these products.

Regional Analysis

North America, however, dominates the global plant-based pet food market, holding a substantial 43.20% market share and generating revenues close to $9.7 billion. This dominance is primarily driven by the high level of pet ownership and the increasing awareness of pet health and nutrition among American and Canadian pet owners. The region’s market is characterized by a wide availability of products and a strong presence of major industry players who are continuously innovating and expanding their plant-based product lines.

In contrast, Europe’s market growth is bolstered by aggressive sustainability targets set by the EU and active participation from non-governmental organizations promoting animal welfare and environmentally friendly products. The increasing vegan population in countries such as the UK, Germany, and Sweden also significantly contributes to the regional demand for plant-based pet foods. European consumers show a high preference for products that align with their personal values, which is mirrored in their pet food choices, driving the growth of the plant-based pet food sector in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Amì Pet Food is a pioneer in the plant-based pet food industry, offering a variety of products that cater to dogs and cats. Based in Italy, Amì focuses on creating nutritionally complete and balanced vegan pet foods, emphasizing eco-friendly and cruelty-free ingredients. Their products are distributed globally, appealing to pet owners who seek sustainable and ethical alternatives for their pets’ diets.

Dr. Goodpet in the United States focuses on natural pet care, offering a range of dietary supplements and plant-based food options aimed at improving pet health holistically. Their products are designed to support various health issues in pets, such as digestive problems and allergies, emphasizing clean, natural ingredients without artificial additives.

Benevo: UK-based Benevo stands out in the plant-based pet food market with its innovative approach to pet nutrition. They provide a range of vegan pet food products devoid of meat, dairy, and eggs. Benevo prides itself on producing foods with sustainably sourced ingredients, meeting the nutritional needs of pets through scientifically formulated recipes that do not compromise on taste or health benefits.

Top Key Players in the Market

- Amì Pet Food

- Benevo

- Dr. Goodpet

- Mars, Inc.

- My Aistra

- Nature’s Recipe

- Nestlé Purina PetCare

- Oatly

- Wild Earth

- Wysong

- Yarrah Organic Pet Food

- Kerry Group plc

- CRB

- PetKonnect

- ADM

Recent Developments

Benevo’s strategic approach includes expanding its product offerings and enhancing its online presence to connect with a broader customer base. This strategy is aligned with current market trends where there is a growing demand for plant-based, nutritionally complete pet foods that support pet health without compromising ethical standards.

Dr. Goodpet has carved out a niche in the plant-based pet food market by focusing on natural and organic dietary solutions for pets. As a recognized player, Dr. Goodpet emphasizes products that are free from artificial additives and are primarily aimed at improving the overall health and wellness of pets.

Report Scope

Report Features Description Market Value (2024) USD 22.5 Bn Forecast Revenue (2034) USD 47.7 Bn CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Dry Food, Wet Food, Treats and Snacks, Others), By Ingredient Type (Soy-Based, Pea Protein-Based, Lentil-Based, Grain-Based, Potato and Sweet Potato-Based, Others), By Application (General Health and Nutrition, Digestive Health, Weight Management, Allergy and Sensitivity Support, Skin and Coat Health, Others), By Pet Type ( Cat, Birds, Others), By End-User (Households, Animal Shelters and Rescues, Veterinary Clinics and Pet Care Centers, Others), By Sales Channel (Store-based Retailing, Online Retailers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amì Pet Food, Benevo, Dr. Goodpet, Mars, Inc., My Aistra, Nature’s Recipe, Nestlé Purina PetCare, Oatly, Wild Earth, Wysong, Yarrah Organic Pet Food, Kerry Group plc, CRB, PetKonnect, ADM Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plant-based Pet Food MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Plant-based Pet Food MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amì Pet Food

- Benevo

- Dr. Goodpet

- Mars, Inc.

- My Aistra

- Nature's Recipe

- Nestlé Purina PetCare

- Oatly

- Wild Earth

- Wysong

- Yarrah Organic Pet Food

- Kerry Group plc

- CRB

- PetKonnect

- ADM