Plant based Protein Supplements Market Size, Share, And Business Benefits By Raw Material (Soy, Spirulina, Pumpkin Seed, Wheat, Hemp, Rice, Pea, Others), By Nature (Conventional, Organic), By Product (Protein Powder, Protein Bars, Ready-to-Drink, Others), By Application (Sports Nutrition, Functional Food, Others), By Distribution Channel (Supermarkets and Hypermarkets, Online Stores, DTC, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 136605

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits of Plant based Protein Supplements

- By Raw Material Analysis

- By Nature Analysis

- By Product Analysis

- By Application Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

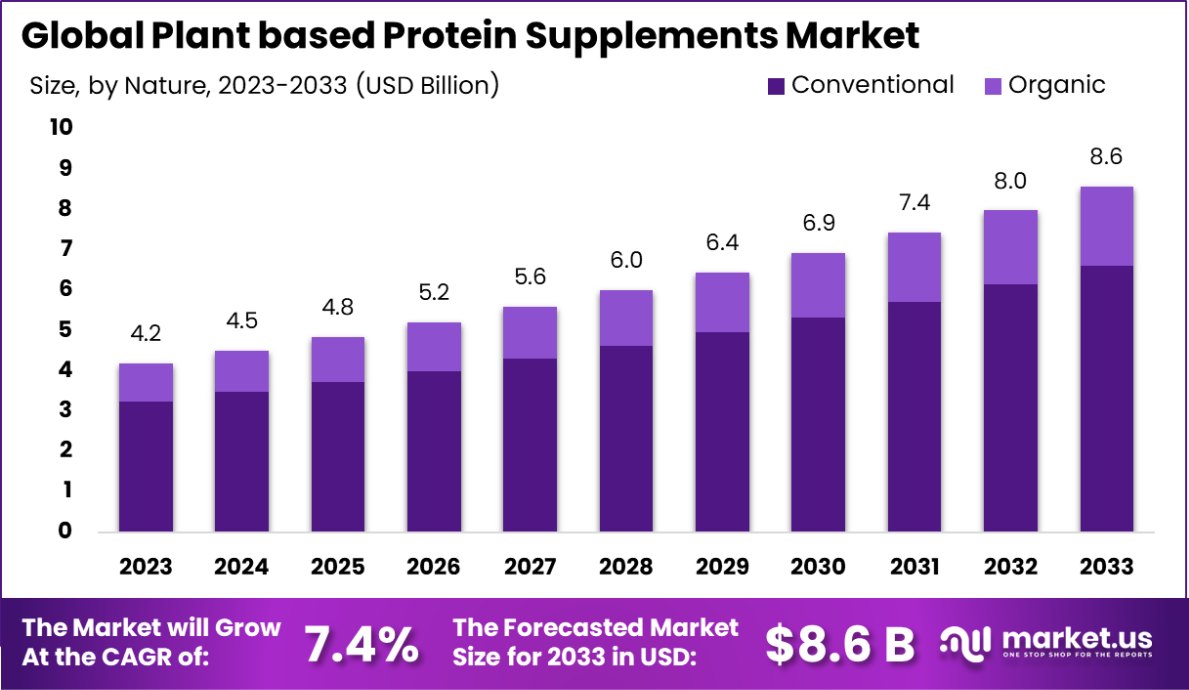

The Global Plant based Protein Supplements Market is expected to be worth around USD 8.6 Billion by 2033, up from USD 4.2 Billion in 2023, and grow at a CAGR of 7.4% from 2024 to 2033.

The plant-based protein supplements market is witnessing robust growth, driven by rising consumer awareness of health, sustainability, and ethical considerations. With dietary preferences increasingly shifting towards plant-based nutrition, fueled by the expanding vegan and flexitarian populations, the demand for alternative protein sources is surging.

Government initiatives promoting sustainable food production and plant-based dietary guidelines further bolster market growth. For example, the Food and Agriculture Organization (FAO) highlights the environmental benefits of plant-based diets, noting reduced land use, water consumption, and carbon emissions compared to meat-based alternatives. These factors align with consumer preferences for eco-friendly and sustainable products.

Plant-based protein supplements find wide application in fitness, wellness, and dietary contexts, offering benefits such as muscle recovery, weight management, and improved metabolic health. Manufacturers are innovating formulation by incorporating diverse protein sources, including soy, pea, rice, hemp, and pumpkin seeds, to cater to varied dietary needs.

Advances in extraction and processing technologies have enhanced the functional properties of these proteins, addressing historical challenges related to texture, taste, and bioavailability. The FAO also emphasizes the diversity of plant-based protein sources, ranging from legumes to nuts, seeds, cereals, and tubers.

The rising prevalence of lifestyle-related diseases such as obesity, diabetes, and cardiovascular disorders drives consumers toward healthier dietary choices, amplifying the demand for plant-based protein supplements.

Moreover, environmental concerns tied to traditional animal-based protein production, such as greenhouse gas emissions, water usage, and land degradation, push consumers to adopt sustainable alternatives. Studies indicate that plant-based meat alternatives are more environmentally favorable, requiring fewer resources and generating lower emissions.

Market trends highlight growing consumer demand for organic, non-GMO, and allergen-free products, along with adopting biodegradable and recyclable packaging solutions to meet environmentally conscious expectations. Functional blends of plant proteins with probiotics, fibers, and adaptogens are also gaining traction, offering holistic health benefits.

According to the U.S. Department of Agriculture (USDA), the plant-based food market is growing rapidly, with industry players reporting annual growth rates above 20%. Soy protein dominates the sector, accounting for over 60% of global product innovations in plant-based foods and beverages.

The plant-based protein supplements market is poised for substantial growth, driven by a combination of consumer health consciousness, environmental sustainability, and evolving dietary preferences. The increasing adoption of vegan and flexitarian lifestyles has significantly fueled the demand for these supplements, with soy, pea, and hemp proteins leading the charge.

The market’s expansion is further supported by significant governmental backing, as evidenced by the Biden-Harris administration’s commitments exceeding $8 billion towards nutrition and health initiatives, which include enhancing plant-based food options.

From a financial perspective, the protein supplement industry in the US generated revenues of approximately $2,069.3 million in 2021, with expectations to reach around $10.80 billion by 2030. The segment specifically for plant-based protein supplements is forecasted to grow at a compound annual growth rate (CAGR) of 8.7%.

Additionally, ready-to-drink formats are witnessing a similar growth trajectory with a CAGR of 8.5%. This is indicative of the market’s rapid adaptation to consumer demand for convenience and quality.

The strategic focus on research and development is underscored by the USDA’s National Institute of Food and Agriculture, which announced about $300 million in funding for 2024. This includes significant investments in plant-based protein research, reflecting a robust commitment to advancing the sector.

Key Takeaways

- The Global Plant based Protein Supplements Market is expected to be worth around USD 8.6 Billion by 2033, up from USD 4.2 Billion in 2023, and grow at a CAGR of 7.4% from 2024 to 2033.

- Soy dominates the raw material segment with 41.2% in the plant-based protein supplements market.

- Conventional products constitute 77.7% of the nature category in the plant-based protein supplements market.

- Protein powder leads product offerings, accounting for 56.5% of the plant-based protein supplements market.

- Sports nutrition is the top application, representing 67.3% of the plant-based protein supplement market.

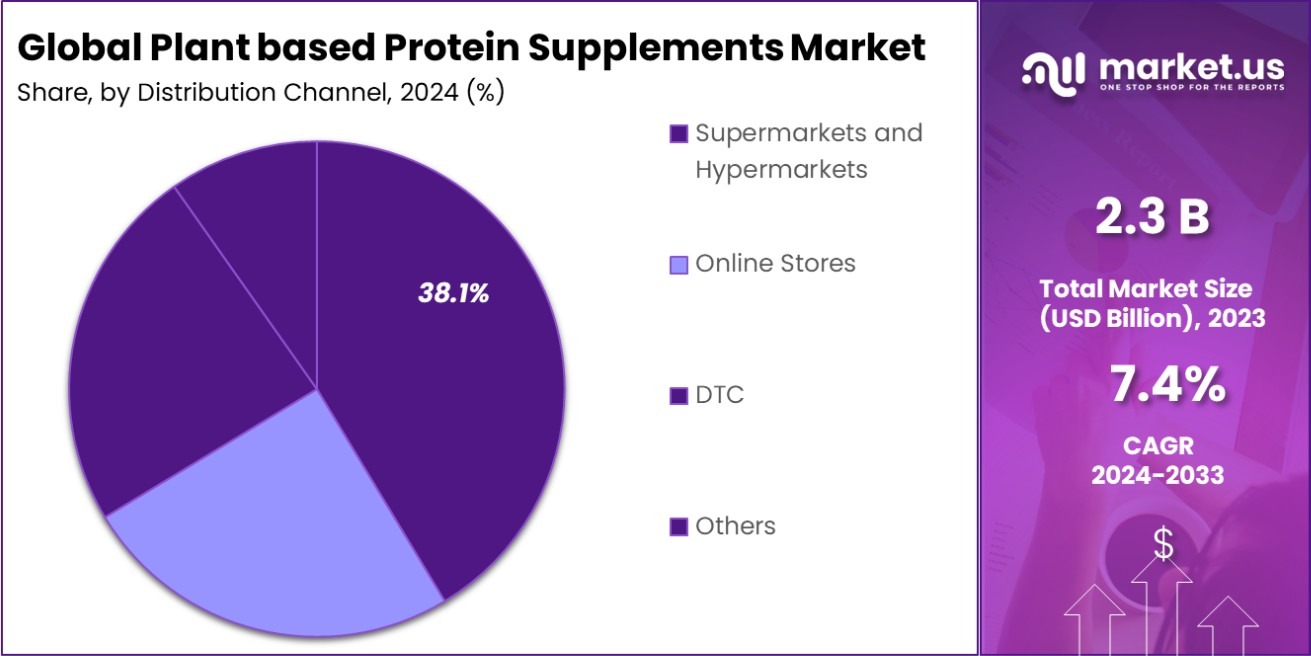

- Supermarkets and hypermarkets are key distribution channels, comprising 38.1% of the plant-based protein market.

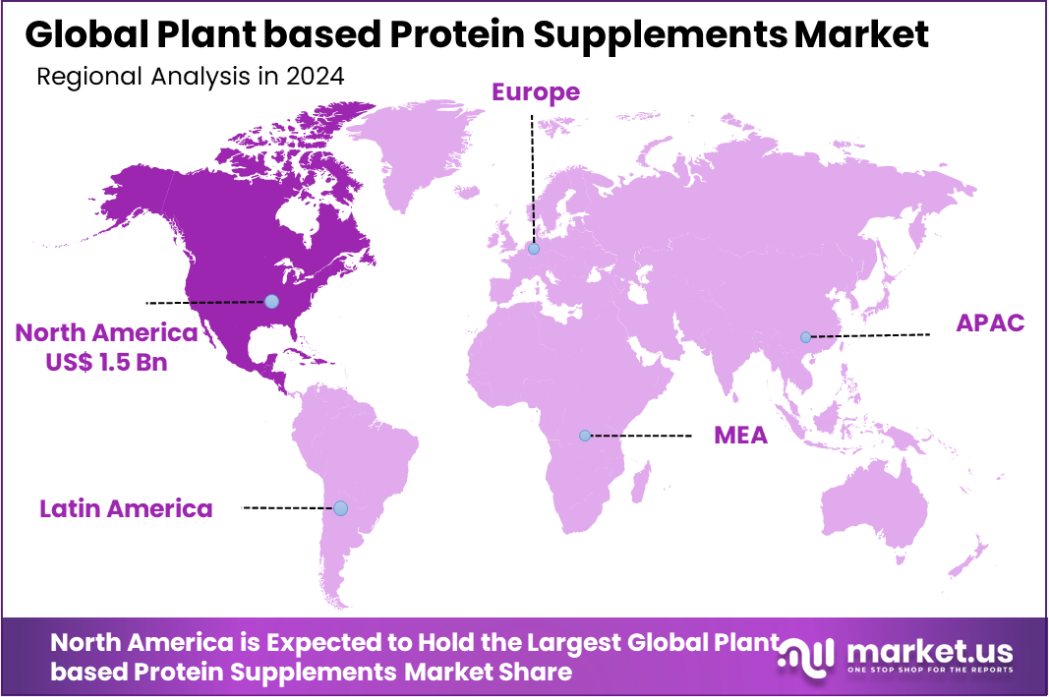

- In North America, the Plant-Based Protein Supplements Market is valued at USD 1.5 billion, representing 36.2%.

Business Benefits of Plant based Protein Supplements

The business benefits of incorporating plant-based protein supplements are numerous and align well with current consumer and economic trends. Plant-based diets are recognized for their potential health benefits, such as lowering the risk of chronic diseases including heart disease, diabetes, and certain cancers. This positive health perception drives consumer demand, providing a strong market for businesses involved in the production and sale of plant-based protein supplements.

From an economic standpoint, the expanding interest in flexitarian diets, which emphasize plant-based foods while not completely excluding meat, creates a growing consumer base for plant-based proteins. This trend is particularly strong among younger demographics who are increasingly health-conscious and environmentally aware. Businesses can tap into this demographic by offering plant-based alternatives that cater to their dietary preferences and sustainability values.

Moreover, the plant-based protein market is supported by governmental and educational initiatives that explore the economic benefits and job creation potential associated with alternative proteins. Such support can lead to further development and acceptance of plant-based proteins, enhancing market opportunities for businesses in this sector.

Overall, entering or expanding in the plant-based protein supplements market can provide businesses with access to a growing, health-focused consumer base, supported by favorable public health data and governmental initiatives that encourage the adoption of plant-based diets.

By Raw Material Analysis

Soy-based products dominate the plant-based protein supplements market, representing 41.2% of raw materials used.

In 2023, Soy held a dominant market position in the By Raw Material segment of the Plant-Based Protein Supplements Market, with a 41.2% share. Soy’s prominence in the market is attributed to its high protein content, widespread availability, and versatility in various dietary applications.

Following closely, Pea protein captured a significant portion, marked by a 26.8% market share, favored for its hypoallergenic properties and strong amino acid profile. Rice protein accounted for 15.1% of the market, appreciated for its easy digestibility and suitability for sensitive individuals.

Hemp protein, with a market share of 7.4%, is gaining traction due to its rich omega fatty acid content and comprehensive protein composition. Spirulina, although smaller in market share at 4.8%, is noted for its superfood status, providing not only protein but also a host of vitamins and antioxidants.

Pumpkin Seed and Wheat proteins hold smaller segments of 3.2% and 1.5% respectively. Pumpkin seed protein is recognized for its nutrient density and health benefits, while wheat protein, often sidelined due to gluten concerns, remains a niche but steady segment due to its cost-effectiveness and texture-enhancing properties in formulations.

By Nature Analysis

Conventional sources account for 77.7% of the nature segment in the plant-based protein supplements industry.

In 2023, Conventional held a dominant market position in the By Nature segment of the Plant-Based Protein Supplements Market, with a 77.7% share. This substantial market dominance is primarily due to the affordability and extensive product availability of conventional plant-based proteins compared to their organic counterparts.

Conventional plant-based proteins benefit from more robust supply chains and higher production efficiencies, which keep costs lower and accessibility high, catering to a broader consumer base.

On the other hand, Organic plant-based proteins accounted for 22.3% of the market. Despite its smaller share, the organic segment is witnessing significant growth, driven by increasing consumer awareness of health, environmental sustainability, and clean labeling. Consumers opting for organic protein supplements are often willing to pay a premium for products perceived as safer, purer, and more ethical.

The growth trajectory of organic protein supplements suggests a strengthening consumer preference towards organic labeling and practices that could reshape market dynamics in the coming years, potentially closing the gap with conventional protein supplements as consumer values evolve.

By Product Analysis

Protein powder is the most popular product form, comprising 56.5% of the plant-based protein market.

In 2023, Protein Powder held a dominant market position in the By Product segment of the Plant-Based Protein Supplements Market, with a 56.5% share. This segment’s leadership is largely due to the versatility and popularity of protein powders among consumers.

They are highly favored for their ease of integration into diverse diets and routines, ability to deliver high protein content per serving, and customization in terms of flavors and formulations.

Protein Bars accounted for 26.2% of the market share. These convenient, on-the-go options cater to busy lifestyles, providing a quick protein fix in a compact and often tasty format. The growth in this segment reflects an increasing consumer preference for nutritious snack alternatives that support active and health-conscious living.

The Ready-to-Drink (RTD) products held 17.3% of the market. The RTD segment is growing due to its convenience and the emerging trend of clean and clear labeling that appeals to health-aware consumers.

These products are ideal for those seeking immediate post-workout recovery or a quick protein source without the need for preparation, attracting a significant customer base looking for instant nutritional solutions.

By Application Analysis

Sports nutrition is the leading application for plant-based protein supplements, capturing 67.3% of the market.

In 2023, Sports Nutrition held a dominant market position in the By Application segment of the Plant-Based Protein Supplements Market, with a 67.3% share. This significant market share underscores the deep penetration and widespread acceptance of plant-based proteins within the athletic and fitness communities.

Sports Nutrition’s dominance is driven by the growing consumer awareness of the benefits of plant-based diets in enhancing performance, recovery, and overall health. Products in this category are specifically formulated to meet the nutritional demands of athletes and active individuals, focusing on muscle repair, energy yield, and endurance enhancement.

Conversely, the Functional Food segment, which includes foods enhanced with additional proteins to offer health benefits beyond basic nutrition, accounted for 32.7% of the market. This segment is expanding as more consumers seek everyday foods with added health benefits, such as weight management, improved metabolic health, and increased satiety.

Functional foods often come in the form of fortified plant-based yogurts, beverages, and snacks that are not only nutritious but also align with consumer preferences for natural and minimally processed options.

By Distribution Channel Analysis

Supermarkets and hypermarkets are the primary distribution channels, holding a 38.1% share of the market.

In 2023, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Plant-Based Protein Supplements Market, with a 38.1% share. This channel’s leadership is attributed to its broad accessibility and the ability to offer a diverse range of products under one roof, catering to the immediate purchasing preferences of the general public.

The convenience of comparing multiple brands and types of plant-based protein supplements in person and the benefit of no waiting time for product delivery contribute significantly to their market dominance.

Online Stores accounted for 34.5% of the market. The growth of this channel is driven by the increasing trend of digital shopping, competitive pricing, wider selection, and consumer convenience, especially among tech-savvy and time-constrained consumers. As e-commerce platforms continue to enhance their customer service and delivery speed, this segment is expected to grow further.

Direct-to-Consumer (DTC) channels captured a 27.4% share. The appeal of DTC lies in its ability to offer customized products, exclusive deals, and a direct relationship with consumers. Brands utilizing this model can engage more deeply with their customer base through personalized marketing, fostering loyalty, and offering a tailored shopping experience.

Key Market Segments

By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

By Nature

- Conventional

- Organic

By Product

- Protein Powder

- Protein Bars

- Ready-to-Drink

- Others

By Application

- Sports Nutrition

- Functional Food

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Online Stores

- DTC

- Others

Driving Factors

Rising Awareness of Health and Wellness Benefits

Consumers are increasingly drawn to plant-based protein supplements due to their numerous health benefits, including better digestion, reduced risk of heart disease, and lower cholesterol levels. As awareness of these advantages grows, more individuals are making the switch from animal-based proteins to plant-based options.

This shift is further supported by a growing number of health professionals advocating for plant-based diets as part of a healthy lifestyle, influencing consumer preferences and driving market growth.

Expanding Vegan and Vegetarian Populations

The global rise in veganism and vegetarianism is a significant driver for the plant-based protein supplement market. People adopting these lifestyles often seek reliable protein sources to substitute meat and dairy products.

Plant-based proteins, being an ideal alternative, have seen increased demand in these demographic groups. This trend is supported by social media and celebrity endorsements, which continue to promote plant-based diets as a sustainable and ethical choice, further boosting market expansion.

Innovation in Product Taste and Texture

The plant-based protein supplement market is experiencing rapid growth due to continuous improvements in product taste and texture. Manufacturers are investing in research and development to overcome past issues related to the earthy taste and gritty texture of plant-based proteins.

Today’s products offer a variety of flavors and smoother consistencies that appeal to a broader audience. This enhancement in sensory attributes makes plant-based proteins more appealing to both existing and new consumers, significantly driving market adoption.

Restraining Factors

High Cost of Plant-Based Protein Products

The premium pricing of plant-based protein supplements compared to their animal-based counterparts is a major barrier to market growth. These products often involve higher costs due to more expensive sourcing of raw materials and advanced processing technologies.

The price differential can deter budget-conscious consumers from switching to plant-based options, particularly in price-sensitive markets. This economic factor limits the potential consumer base to those who can afford or are willing to invest in higher-priced health products.

Limited Consumer Acceptance and Perception Issues

Despite growing popularity, plant-based protein supplements still face skepticism from certain consumer segments. Common concerns include doubts about the protein quality and the nutritional equivalence to animal-based proteins.

Additionally, some consumers are hesitant to try plant-based proteins due to unfamiliar tastes and textures, which can differ significantly from traditional protein sources. These perception issues slow down the adoption rate among new users who are not accustomed to plant-based diets.

Allergenic Concerns with Plant Ingredients

Plant-based proteins, such as soy and wheat proteins, are common allergens that can restrict their use among consumers with specific dietary restrictions or allergies. This presents a significant restraint in the market, as potential customers must either avoid these products or seek alternatives that may not meet their protein needs or preferences as well.

Addressing allergenic concerns while maintaining product efficacy and appeal remains a challenge for manufacturers, impacting the overall market growth potential.

Growth Opportunity

Expansion into Emerging Markets with Health Trends

Emerging markets present significant growth opportunities for the plant-based protein supplement industry. As health and wellness trends gain traction globally, particularly in developing regions, the demand for healthier dietary options is rising.

Companies can capitalize on this by introducing plant-based proteins to these new markets, where awareness is growing and disposable incomes are increasing. Tailoring products to meet local tastes and dietary preferences can further enhance market penetration and consumer acceptance in these regions.

Development of Hypoallergenic Plant-Based Proteins

Developing hypoallergenic plant-based protein supplements could tap into a niche yet substantial market segment. By creating proteins free from common allergens like soy, nuts, and gluten, manufacturers can cater to consumers who face dietary restrictions due to allergies but still seek plant-based nutritional options.

This approach not only widens the consumer base but also positions a brand as inclusive and sensitive to consumer health needs, enhancing brand loyalty and market share.

Technological Advancements in Product Processing

Investing in new technologies to improve the texture, taste, and nutritional value of plant-based protein supplements is a lucrative growth opportunity. As technology evolves, the ability to produce more palatable and nutritionally enhanced products can attract a broader audience.

This includes using fermentation techniques or extraction methods that preserve protein integrity while improving flavor. Such innovations can differentiate products in a competitive market, appealing to both existing consumers and those new to plant-based proteins.

Latest Trends

Increasing Use of Mixed Plant-Based Protein Blends

A notable trend in the plant-based protein supplements market is the increasing use of mixed protein blends. Manufacturers are combining different plant sources, like pea, rice, and hemp, to create a complete amino acid profile that rivals that of animal proteins.

This approach not only enhances the nutritional value of the supplements but also improves their taste and texture. By leveraging the unique properties of multiple plant proteins, brands can cater to health-conscious consumers seeking the best nutritional outcomes from their supplements.

Rise of Clean Label and Organic Protein Supplements

Consumers are increasingly demanding clean-label products, which include organic plant-based protein supplements. These products are marketed with an emphasis on natural, non-GMO, and minimally processed ingredients, aligning with the broader consumer shift towards health and transparency.

Organic plant-based proteins are particularly appealing because they assure consumers of pesticide-free ingredients and environmentally friendly farming practices, tapping into the growing market segment that prioritizes ecological and health impacts in their purchasing decisions.

Collaboration with Fitness Professionals and Influencers

Collaborations between plant-based protein supplement brands and fitness professionals or influencers are becoming increasingly popular. These partnerships help brands leverage the credibility and reach of these individuals to promote their products.

Fitness experts and influencers often have loyal followers who trust their recommendations, making this strategy an effective way to expand market visibility and credibility. Such collaborations also often involve product endorsements or co-branded products, which can significantly boost sales and consumer interest in plant-based options.

Regional Analysis

In 2023, North America held 36.2% of the Plant-Based Protein Supplements Market, valued at USD 1.5 billion.

The Plant-Based Protein Supplements Market showcases distinct dynamics across various regions. North America emerges as the dominant region, holding 36.2% of the market with revenues reaching USD 1.5 billion. This substantial market share is driven by a high consumer awareness of health and wellness, coupled with a robust presence of leading market players innovating in product offerings.

Europe follows closely, characterized by strong demand from health-conscious consumers and supported by stringent regulations favoring plant-based products. The increasing vegan and vegetarian populations further propel the market growth in this region.

Asia Pacific presents a rapid growth trajectory, spurred by changing dietary habits and rising income levels. The growing fitness trend and expanding middle class in countries like China and India are key contributors to the rising demand for plant-based protein supplements.

Meanwhile, the Middle East & Africa, and Latin America are smaller but growing markets, where increasing health awareness and urbanization are gradually fostering the adoption of plant-based diets. These regions offer significant growth opportunities due to their untapped market potential and increasing health consciousness among the population.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Plant-Based Protein Supplements Market saw significant contributions from a diverse array of key players, each bringing unique strengths and strategies to the industry.

Abbott Laboratories is noted for its well-established distribution networks and trusted brand reputation, which help it maintain a strong market presence. Their research-driven approach allows them to offer innovative, scientifically backed products that appeal to health-conscious consumers.

AMCO Proteins stands out for its specialized focus on high-quality protein manufacturing, catering particularly to niche markets that require specific protein formulations. This specialization helps them carve out a distinct place in the market.

General Nutrition Centers, Inc. (GNC) continues to be a leader in the retail segment, with a vast global footprint that facilitates direct consumer access to a broad range of supplements, including plant-based options. GNC’s strong focus on consumer education and loyalty programs significantly enhances its market share.

Glanbia plc has leveraged its expertise in nutrition and dairy to expand into plant-based proteins, successfully integrating these offerings into its global brand portfolio. Their strategic acquisitions and focus on innovation have driven their growth in this sector.

Hormel Foods Corporation has diversified its traditional food products to include plant-based proteins, tapping into the mainstream market with appealing, ready-to-consume options that resonate with a broader consumer base.

MusclePharm Corporation and NOW Foods both emphasize purity and performance in their product lines, targeting athletes and fitness enthusiasts who demand high efficacy from their nutritional supplements. MusclePharm’s endorsement deals and NOW’s commitment to non-GMO and organic products have solidified their standings in the market.

VEGA and Nutiva Inc., as early entrants into the plant-based nutrition space, continue to enjoy strong brand loyalty. Their focus on organic and environmentally sustainable practices appeals particularly to environmentally conscious consumers.

Overall, these key players, with their varied approaches—from focusing on niche markets to expanding existing product lines into plant-based formulas—illustrate the dynamic nature of the Plant-Based Protein Supplements Market.

Their ability to innovate and adapt to consumer preferences will likely dictate their success in the coming years, as the market continues to evolve towards more sustainable and health-focused dietary choices.

Top Key Players in the Market

- Abbott Laboratories

- AMCO Proteins

- General Nutrition Centers, Inc.

- Glanbia plc

- Hormel Foods Corporation

- IOVATE Health Sciences International, Inc.

- MusclePharm Corporation

- NOW Foods

- Quest Nutrition

- Reliance Private Label Supplements

- The Bountiful Company

- Transparent Labs

- True Nutrition, Nutiva Inc.

- VEGA

- Vital Amine, Inc.

- WOODBOLT DISTRIBUTION LLC

Recent Developments

- In 2023, Abbott Laboratories enhanced its position in the plant-based protein supplements market with the Ensure Plant-Based Protein shake, catering to vegan and vegetarian dietary needs. This initiative aligns with their broader strategy to offer scientifically-backed nutritional products across diverse consumer needs.

- In 2023, AMCO Proteins emphasized its plant-based protein segment, particularly its Pea Protein Isolate from Canadian yellow peas, offered in 80% and 85% protein content levels. Designed for high functionality, this all-natural, non-GMO, and vegan protein supports various applications, aligning with consumer demands for sustainable and health-conscious dietary options.

Report Scope

Report Features Description Market Value (2023) USD 4.2 Billion Forecast Revenue (2033) USD 8.6 Billion CAGR (2024-2033) 7.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material (Soy, Spirulina, Pumpkin Seed, Wheat, Hemp, Rice, Pea, Others), By Nature (Conventional, Organic), By Product (Protein Powder, Protein Bars, Ready-to-Drink, Others), By Application (Sports Nutrition, Functional Food, Others), By Distribution Channel (Supermarkets and Hypermarkets, Online Stores, DTC, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, AMCO Proteins, General Nutrition Centers, Inc., Glanbia plc, Hormel Foods Corporation, IOVATE Health Sciences International, Inc., MusclePharm Corporation, NOW Foods, Quest Nutrition, Reliance Private Label Supplements, The Bountiful Company, Transparent Labs, True Nutrition, Nutiva Inc., VEGA, Vital Amine, Inc., WOODBOLT DISTRIBUTION LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plant based Protein Supplements MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Plant based Protein Supplements MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- AMCO Proteins

- General Nutrition Centers, Inc.

- Glanbia plc

- Hormel Foods Corporation

- IOVATE Health Sciences International, Inc.

- MusclePharm Corporation

- NOW Foods

- Quest Nutrition

- Reliance Private Label Supplements

- The Bountiful Company

- Transparent Labs

- True Nutrition, Nutiva Inc.

- VEGA

- Vital Amine, Inc.

- WOODBOLT DISTRIBUTION LLC