Global Artisanal Ice Cream Market By Flavor (Fruits And Nuts, Chocolate, Vanilla, Others), By Type (Conventional, Lactose-free), By Distribution Channel (Hypermarket And Supermarket, Specialty Stores, Convenience Stores, Online, Others) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

- Published date: March 2025

- Report ID: 142956

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

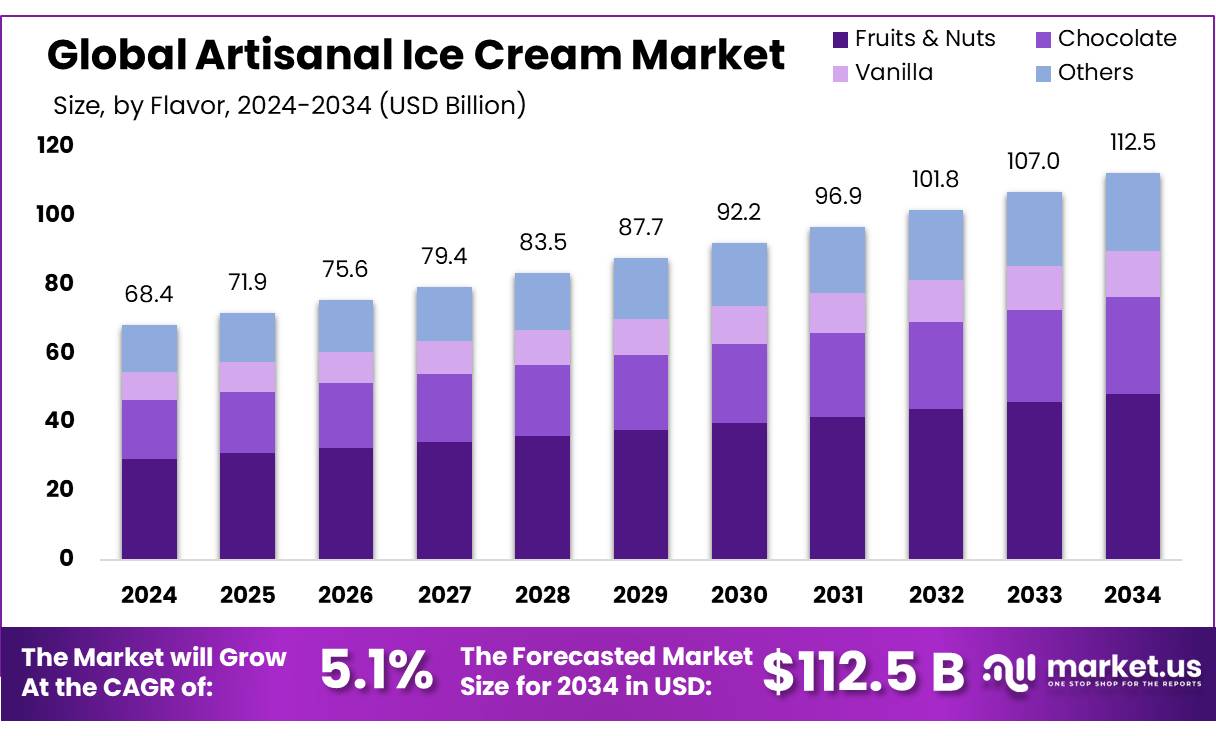

The Global Artisanal Ice Cream Market size is expected to be worth around USD 112.5 Bn by 2034, from USD 68.4 Bn in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

The artisanal ice cream market has been witnessing significant growth globally, driven by a rising consumer preference for premium, handcrafted ice creams made with natural ingredients. Artisanal ice cream, distinguished by its unique flavors and high-quality ingredients, caters to a niche yet growing segment of the ice cream industry. Unlike mass-produced varieties, artisanal ice cream focuses on authenticity and traditional methods of production, often using local and organic ingredients.

The global artisanal ice cream market is part of the broader ice cream market, which, according to a report by the International Dairy Foods Association (IDFA), reached sales of approximately $68 billion in 2022. The artisanal segment, although smaller, is growing at a faster pace compared to its commercial counterparts, with an estimated annual growth rate of around 6% over the next five years. This segment benefits significantly from the premiumization trend, where consumers are willing to pay higher prices for products perceived as superior in quality and flavor.

Governments and industry bodies have recognized the potential of artisanal products in promoting local agriculture and tourism. For instance, the European Union has initiatives that support small dairy farms and local businesses that contribute to the artisanal food sector, providing them with funding opportunities and exposure to international markets. In the United States, the Small Business Administration offers resources and loans to small-scale manufacturers, including artisanal ice cream producers, encouraging domestic entrepreneurship.

Key Takeaways

- Artisanal Ice Cream Market size is expected to be worth around USD 112.5 Bn by 2034, from USD 68.4 Bn in 2024, growing at a CAGR of 5.1%.

- Fruits & Nuts flavor segment held a dominant position in the artisanal ice cream market, capturing a significant 43.30% market share.

- Conventional artisanal ice cream continued to dominate the market, holding a substantial 76.30% share.

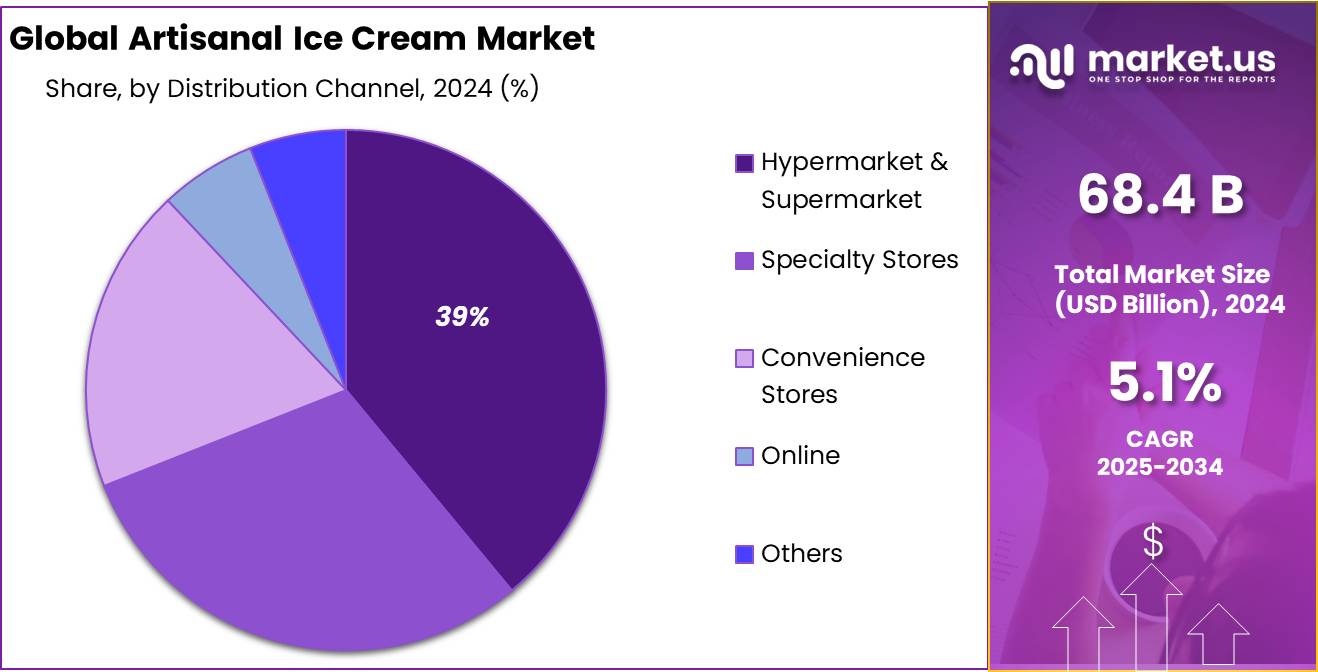

- Hypermarkets and supermarkets held a dominant market position in the distribution of artisanal ice cream, capturing more than a 39.20% share.

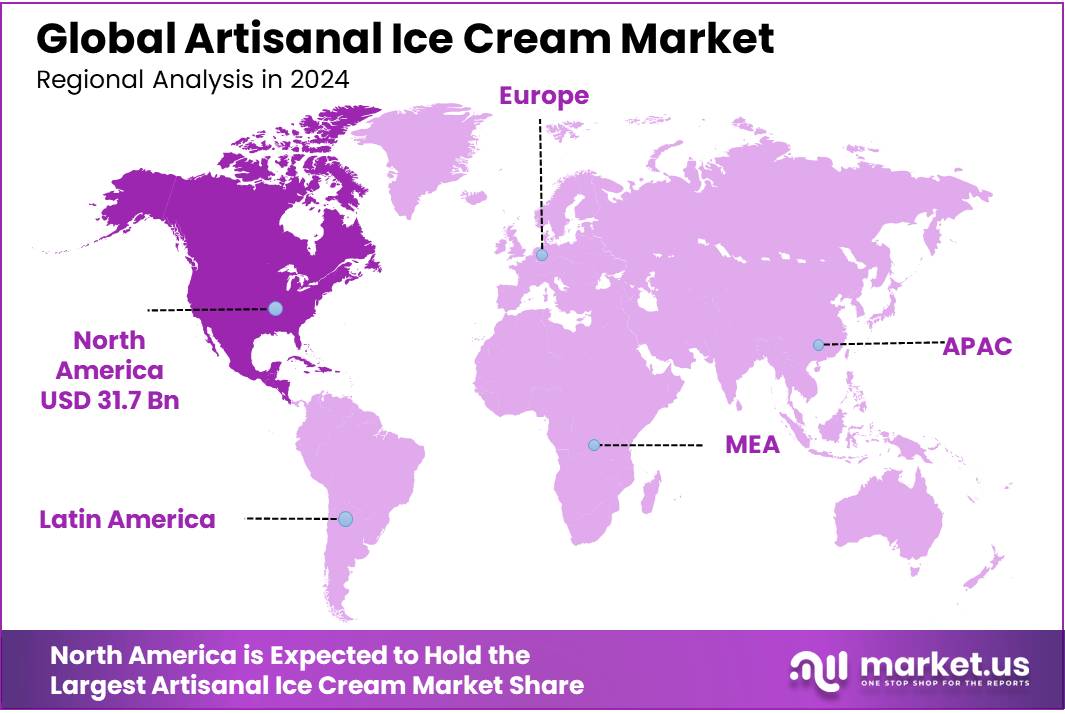

- North America’s dominance in the market, where it holds a substantial 46.40% share, valued at USD 31.7 billion.

By Flavor

Fruits & Nuts Flavor Leads with 43.30% Share in Artisanal Ice Cream Market

In 2024, the Fruits & Nuts flavor segment held a dominant position in the artisanal ice cream market, capturing a significant 43.30% market share. This substantial portion reflects a growing consumer preference for natural ingredients and unique, wholesome flavor combinations. Artisanal ice cream makers have increasingly focused on leveraging the appeal of mixed fruits and assorted nuts, which not only offer a rich taste but also align with the rising health consciousness among consumers.

This trend is particularly strong in regions where there is easy access to a wide variety of fresh fruits and nuts, facilitating the production of these flavors. As these ingredients are typically sourced locally, they support the sustainability and local economy, adding further appeal to the product. The popularity of Fruits & Nuts flavors is expected to remain robust, driven by ongoing innovations in flavor pairings and the continuous demand for premium, natural ice cream products.

By Type

Conventional Artisanal Ice Cream Dominates with 76.30% Market Share

In 2024, Conventional artisanal ice cream continued to dominate the market, holding a substantial 76.30% share. This dominance is largely attributed to the enduring popularity of traditional ice cream flavors and formulations among consumers. Conventional artisanal ice cream, known for its rich, creamy texture and classic flavor profiles, appeals to a broad audience, maintaining a strong market presence.

The segment benefits from established production techniques and widespread consumer acceptance, which have helped sustain its significant market share. As consumers often gravitate towards familiar tastes, especially in treats like ice cream, conventional artisanal products remain a preferred choice, ensuring steady demand within the market.

By Distribution Channel

Hypermarkets & Supermarkets Lead with 39.20% in Artisanal Ice Cream Distribution

In 2024, hypermarkets and supermarkets held a dominant market position in the distribution of artisanal ice cream, capturing more than a 39.20% share. This channel’s significant market share is primarily due to its extensive reach and the convenience it offers to consumers seeking a wide variety of ice cream flavors and brands under one roof.

Hypermarkets and supermarkets are typically located in accessible areas, making it easier for consumers to incorporate ice cream purchases into their regular shopping routines. The vast space of these outlets also allows for better product display and promotion, attracting customers through visually appealing arrangements and frequent promotional deals. As these stores continue to prioritize customer experience and variety, their dominance in distributing artisanal ice cream is expected to persist.

Key Market Segments

By Flavor

- Fruits & Nuts

- Chocolate

- Vanilla

- Others

By Type

- Conventional

- Lactose-free

By Distribution Channel

- Hypermarket & Supermarket

- Specialty Stores

- Convenience Stores

- Online

- Others

Drivers

Rising Health Awareness Fuels Demand for Premium Artisanal Ice Cream

One major driving factor for the growth of the artisanal ice cream market is the increasing consumer awareness about health and wellness. Over recent years, a significant shift has been observed in consumer preferences towards food products that not only satisfy taste but also offer health benefits. This trend is particularly evident in the ice cream sector, where there is a growing demand for products made with natural ingredients and less processed options.

According to a report by the Food and Agriculture Organization (FAO), there is a global movement towards organic and minimally processed foods, which has directly influenced the ice cream industry. Consumers are now more inclined to choose artisanal ice cream, which is often perceived as a healthier alternative to conventional ice cream due to its use of high-quality, natural ingredients, and lower content of artificial additives.

The popularity of artisanal ice cream is also supported by various government health initiatives that promote better food choices. For example, the U.S. Department of Agriculture (USDA) and the Department of Health and Human Services (HHS) have guidelines that recommend limiting intake of added sugars and processed foods, which aligns with the core attributes of artisanal ice cream. These guidelines encourage manufacturers to create healthier eating options, indirectly boosting the market for artisanal products.

Moreover, consumer interest in unique and exotic flavors, combined with their willingness to pay a premium for products that align with their health and ethical values, continues to drive the market forward. The demand for artisanal ice cream is not just a passing trend but a sustained movement towards a more conscious way of consuming desserts, which promises continued growth in this sector.

Restraints

High Production Costs Challenge Artisanal Ice Cream Market Growth

A significant restraining factor in the artisanal ice cream market is the high cost of production associated with these premium products. Artisanal ice cream is typically made from natural, high-quality ingredients, which are more expensive than the synthetic additives used in conventional ice creams. Additionally, the production process for artisanal ice cream often involves more labor-intensive techniques, further driving up costs.

According to insights from the National Ice Cream Retailers Association (NICRA), the cost of natural ingredients like real vanilla and fresh fruits has been steadily rising. For instance, the price of vanilla has seen substantial fluctuations, impacting producers who depend on these ingredients to create authentic and flavorful artisanal ice cream. Furthermore, the small-scale production typical of artisanal brands does not benefit from the economies of scale that larger manufacturers enjoy, resulting in higher per-unit costs.

Government regulations can also add to these costs. For example, stricter labeling requirements and health guidelines mean artisanal ice cream producers must invest in better processing equipment and quality control measures to comply with safety standards, all of which contribute to higher operational expenses.

Opportunity

Expansion into Emerging Markets Offers Growth Opportunities for Artisanal Ice Cream

A major growth opportunity for the artisanal ice cream market lies in its potential expansion into emerging markets. As global economies grow, so does the middle class, along with its disposable income and appetite for premium products, including artisanal ice cream. This trend is particularly noticeable in regions such as Asia-Pacific and Latin America, where increasing urbanization and Western influence have shifted consumer preferences towards more exotic and high-quality food products.

Data from the International Dairy Foods Association (IDFA) suggests that the ice cream market’s growth in these regions is outpacing that of more established markets due to the novelty factor and the burgeoning café culture that promotes the consumption of premium desserts. Additionally, these markets have witnessed a surge in health awareness, which aligns well with the positioning of artisanal ice cream as a healthier and more natural choice compared to traditional ice creams.

Furthermore, government initiatives in these regions aimed at boosting local food and beverage industries offer incentives for artisanal ice cream manufacturers to set up local production units. This not only reduces logistics costs but also tailors flavors and products to local tastes and preferences, which can significantly boost acceptance and demand.

For example, countries like India and Brazil have seen an increase in government support for small and medium enterprises (SMEs) in the food sector, facilitating easier market entry for new players. These initiatives provide a supportive environment for artisanal ice cream brands looking to expand their footprint in new and growing markets.

Trends

Plant-Based Ingredients: A Rising Trend in Artisanal Ice Cream

One of the latest trends shaping the artisanal ice cream market is the increasing use of plant-based ingredients. This trend is driven by a growing consumer interest in vegan and vegetarian diets, coupled with a rising awareness of lactose intolerance and the environmental impact of dairy production. As a result, more consumers are seeking dairy-free ice cream options that do not compromise on taste or texture.

Recent statistics from the Plant Based Foods Association (PBFA) indicate that sales of plant-based dairy alternatives, including ice cream, have seen double-digit growth in the past year. This surge is supported by innovations in food technology that have improved the quality and variety of dairy-free ice creams. Ingredients such as coconut milk, almond milk, and cashew milk are being increasingly used to create creamy, indulgent textures that closely mimic those of traditional dairy-based ice creams.

Moreover, the inclusion of plant-based ingredients aligns with government health initiatives promoting sustainable agriculture and healthier eating habits. For example, the U.S. Department of Agriculture (USDA) has funded research into plant-based food products, aiming to support the development of sustainable food options that can meet the nutritional needs of a growing population.

Artisanal ice cream manufacturers are capitalizing on this trend by introducing a range of innovative, plant-based flavors that cater to health-conscious consumers and those with dietary restrictions. This not only broadens their market appeal but also positions them as forward-thinking, environmentally conscious brands.

Regional Analysis

In the artisanal ice cream market, Europe stands out as a region deeply ingrained with a rich tradition of ice cream craftsmanship, complemented by a robust consumer demand for premium and innovative flavors. Despite North America’s dominance in the market, where it holds a substantial 46.40% share, valued at USD 31.7 billion, Europe maintains a significant presence driven by its culinary heritage and strong local brands.

Europe’s market is characterized by a high preference for artisanal products, which are perceived as higher in quality and authenticity. The regional market benefits from the presence of numerous artisanal gelato shops and boutiques, particularly in countries like Italy and France, which are renowned for their ice cream. These countries not only contribute significantly to the market size but also influence ice cream trends across the region.

Consumer trends in Europe show a growing inclination towards organic and natural ingredients, with an increasing awareness of health and sustainability issues. This has led to a rise in demand for artisanal ice creams made from locally sourced, organic ingredients without artificial flavors or preservatives. European consumers also show a strong preference for innovative flavors and combinations, pushing local manufacturers to continually innovate to cater to evolving tastes.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bi-Rite Creamery Based in San Francisco, Bi-Rite Creamery stands out in the artisanal ice cream market for its commitment to sustainability and community engagement. Known for using organic, locally sourced ingredients, Bi-Rite offers a variety of unique flavors that change seasonally. Their approach not only emphasizes quality and taste but also supports local farmers and sustainable agriculture practices, making them a favorite among eco-conscious consumers.

Blue Bell Creameries, headquartered in Texas, is a storied brand in the ice cream industry with a legacy dating back to 1907. Renowned for its rich, homemade-style ice cream, Blue Bell has cultivated a loyal customer base across the United States. Despite facing significant challenges, including a major product recall, the company has maintained its reputation for quality and tradition in its wide range of flavors.

Carmela Ice Cream is a Los Angeles-based artisanal ice cream producer known for its handcrafted, seasonal flavors that incorporate fresh, organic ingredients. Their focus on simple yet innovative flavor combinations has earned them a strong following in Southern California. Carmela’s commitment to natural processes and ingredients reflects the growing consumer preference for products that are both delicious and responsibly made.

Top Key Players

- Bi-Rite Creamery

- Blue Bell Creameries

- Carmela Ice Cream

- Graeter’s Ice Cream

- Nye’s Cream Sandwiches

- McConnell’s Fine Ice Creams

- Nestlé

- Salt & Straw

- Eatally Artisanal Ice Cream

- Unilever Ltd.

- À la Mère de Famille

Recent Developments

2024, Nestlé continues to enhance its artisanal ice cream range, focusing on quality and unique flavors that cater to evolving consumer preferences for gourmet and health-conscious options.

In 2024 Carmela Ice Cream’s dedication to creating unique ice cream flavors that incorporate fresh, organic ingredients caters to an increasingly health-conscious consumer base.

Report Scope

Report Features Description Market Value (2024) USD 68.4 Bn Forecast Revenue (2034) USD 112.5 Bn CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Flavor (Fruits And Nuts, Chocolate, Vanilla, Others), By Type (Conventional, Lactose-free), By Distribution Channel (Hypermarket And Supermarket, Specialty Stores, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bi-Rite Creamery, Blue Bell Creameries, Carmela Ice Cream, Graeter’s Ice Cream, Nye’s Cream Sandwiches, McConnell’s Fine Ice Creams, Nestlé, Salt & Straw, Eatally Artisanal Ice Cream, Unilever Ltd., À la Mère de Famille Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Artisanal Ice Cream MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Artisanal Ice Cream MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bi-Rite Creamery

- Blue Bell Creameries

- Carmela Ice Cream

- Graeter's Ice Cream

- Nye’s Cream Sandwiches

- McConnell’s Fine Ice Creams

- Nestlé

- Salt & Straw

- Eatally Artisanal Ice Cream

- Unilever Ltd.

- À la Mère de Famille