Global Premium Bottled Water Market Size, Share, And Business Benefits By Product ((Still Water (Flavored, Unflavored), Sparkling Water (Flavored, Unflavored)), Functional Water, Mineral Water), By Packaging (Plastic, Glass, Aluminium Cans), By Distribution Channel (On Trade (Hotels, Restaurants, Bars and Pubs, Others), Off Trade (Supermarkets and Hypermarkets, Specialty Stores, Online, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142434

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

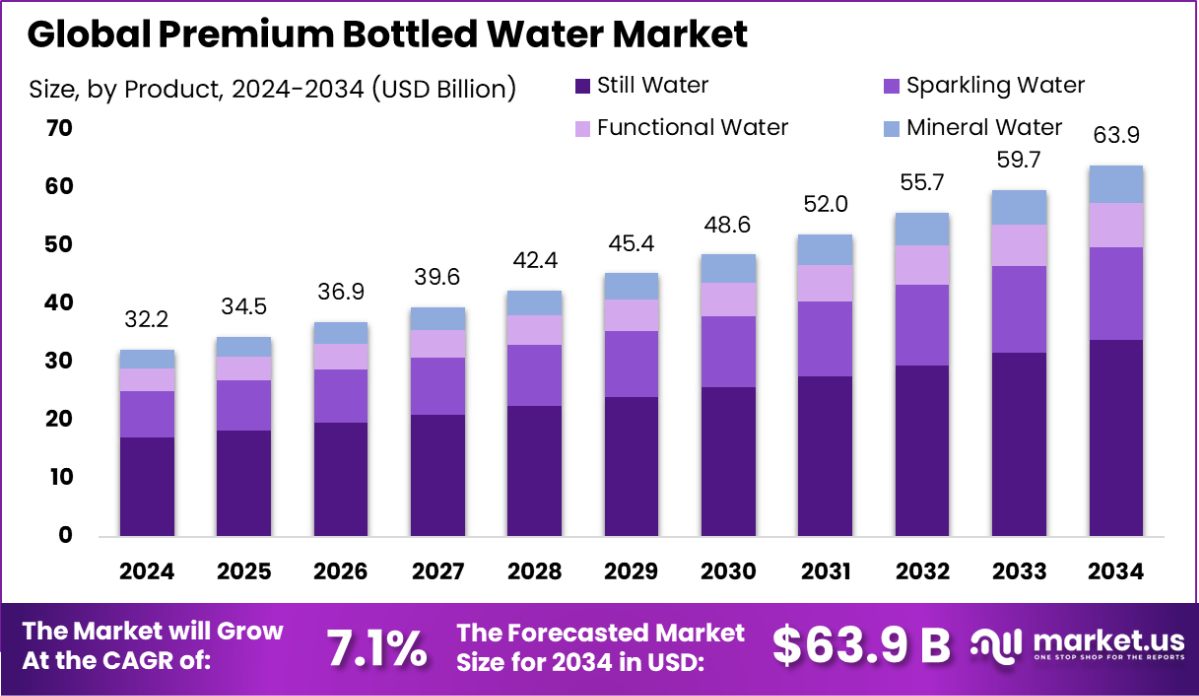

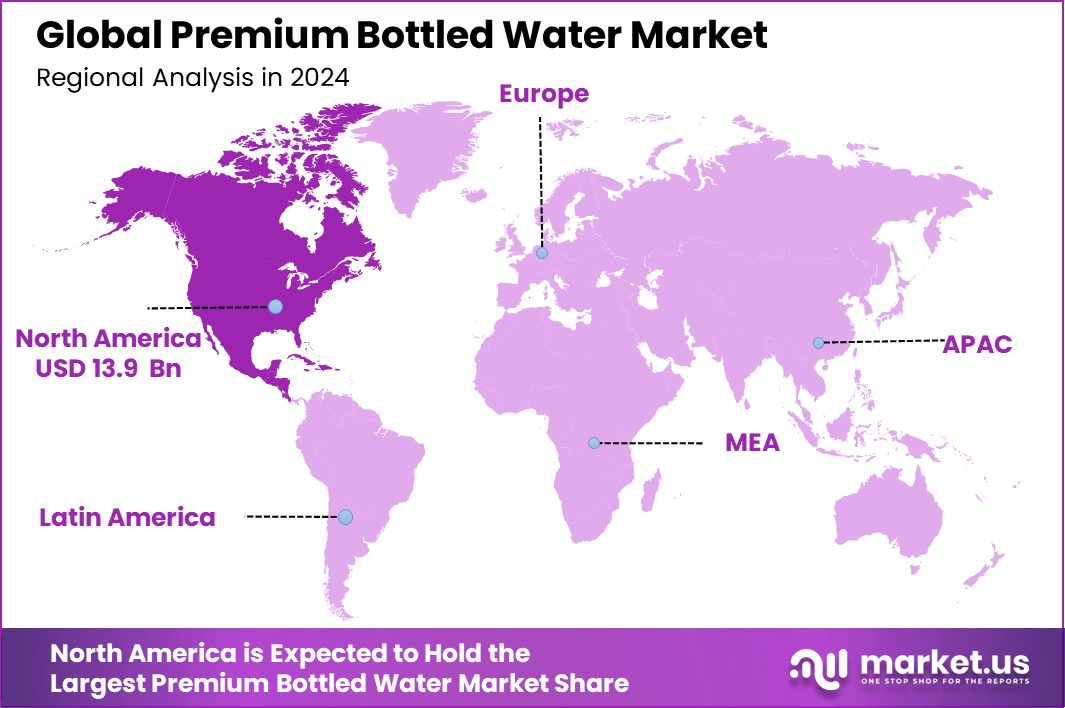

Global Premium Bottled Water Market is expected to be worth around USD 63.9 billion by 2034, up from USD 32.2 billion in 2024, and grow at a CAGR of 7.1% from 2025 to 2034. The Premium Bottled Water Market in North America is valued at USD 13.9 billion, representing a 43.30% market share.

Premium bottled water refers to high-quality water often sourced from pristine environments, treated with advanced purification processes, and packaged in sophisticated, eco-friendly containers. This type of water typically targets a luxury market, emphasizing purity, taste, and often, added health benefits. Premium brands may also focus on sustainability and ethical sourcing practices, distinguishing themselves from standard bottled water offerings.

The Premium Bottled Water Market is a dynamic segment within the broader bottled water industry, driven by consumer demand for products perceived as healthier and more sustainable than tap water. This market has seen substantial growth as health-conscious consumers increasingly prefer premium bottled water for its mineral content, lack of contamination, and sometimes for its alkaline properties, which are believed to offer health benefits.

Growth factors for this market include heightened health awareness among consumers and a rising disposable income, enabling more individuals to choose premium products. The perceived health benefits of consuming mineral-rich and uncontaminated water contribute significantly to the demand. Additionally, marketing strategies emphasizing water purity and luxury packaging enhance the appeal, expanding the consumer base.

Demand in the premium bottled water market is fueled by increasing concerns about tap water safety and the presence of contaminants. With significant public investments such as the $11.7 billion allocated to the Drinking Water State Revolving Fund and $15 billion for Lead Service Line Replacement, consumers are more aware of water quality issues, pushing them towards safer, premium options.

Opportunities in the premium bottled water market are extensive, especially with over $50 billion directed toward water infrastructure improvements under the Bipartisan Infrastructure Law. This funding, alongside the $2 billion in grant funding for drinking water infrastructure, underscores growing government support for clean water initiatives. This, in turn, heightens public awareness and concern, further boosting demand for trusted, high-quality bottled water products.

Finally, the allocation of $5 billion for WIIN Grants to address emerging contaminants underlines a proactive approach to tackling water safety concerns, providing a fertile ground for premium bottled water brands to innovate and expand, offering products that assure safety, taste, and quality.

Key Takeaways

- Global Premium Bottled Water Market is expected to be worth around USD 63.9 billion by 2034, up from USD 32.2 billion in 2024, and grow at a CAGR of 7.1% from 2025 to 2034.

- Still water holds a dominant share of 53.40% in the premium bottled water market.

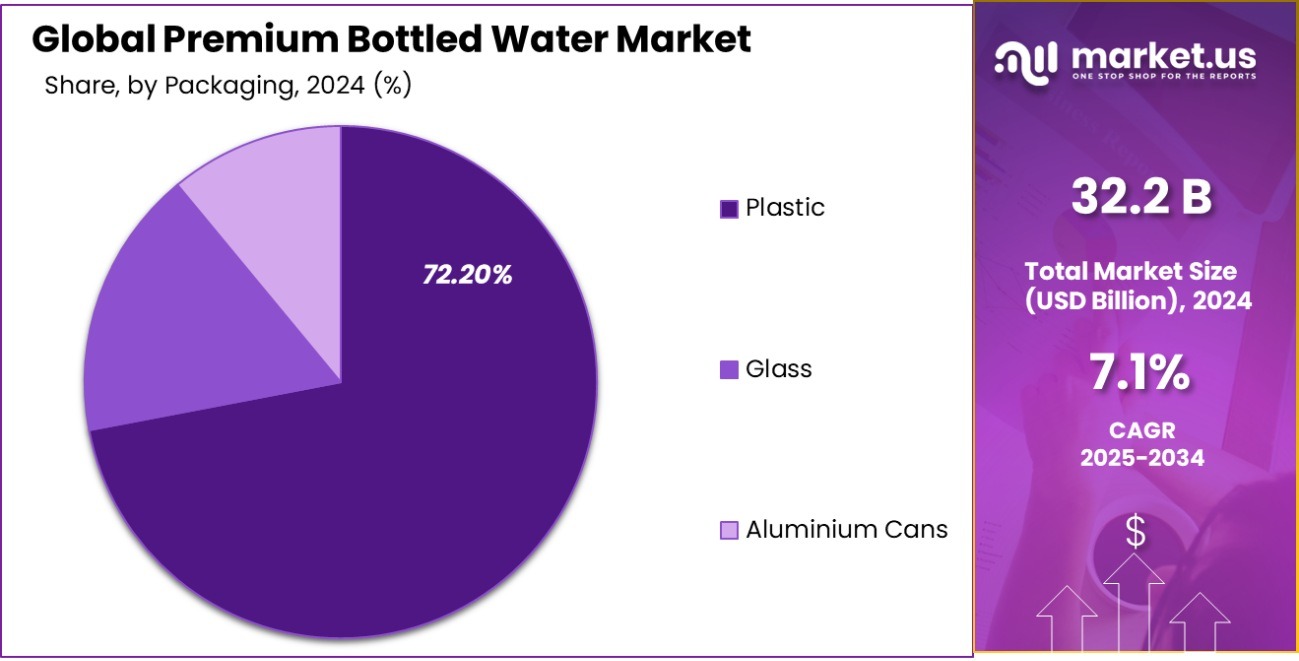

- Plastic bottles are the most preferred packaging, accounting for 72.20% of the market.

- Off-trade sales lead the distribution channels with a significant 74.40% market share.

- With a market share of 43.30%, North America leads in Premium Bottled Water sales, totaling USD 13.9 billion.

By Product Analysis

Still water dominates, holding 53.40% of the premium bottled water market.

In 2024, Still Water held a dominant market position in the by-product segment of the Premium Bottled Water Market, capturing a significant 53.40% share. This dominance can be attributed to the consumer preference for unaltered, pure water with minimal processing, which still water represents. As health-conscious consumers increasingly seek products with clear health benefits and minimal additives, still water’s appeal has grown, supported by its positioning as a natural and pure hydration solution.

The segment’s strength is further bolstered by a broad consumer base that values the simplicity and purity of still water, often associated with premium sourcing from pristine environments. This perception aligns well with the premium bottled water market’s focus on quality and exclusivity. Marketing efforts that emphasize the origin and purity of the water sources continue to play a crucial role in maintaining the segment’s market share.

As the market progresses, the still water segment is expected to retain a significant portion of the market, supported by ongoing trends in health and wellness and consumer preferences shifting toward products with transparent ingredient lists and provenance. This segment’s sustained popularity underscores its foundational role in the premium bottled water industry.

By Packaging Analysis

Plastic is the most used packaging, claiming 72.20% of the market.

In 2024, Plastic held a dominant market position in the By Packaging segment of the Premium Bottled Water Market, commanding a substantial 72.20% share. This prominent market share is largely due to the cost-effectiveness, lightweight nature, and versatility of plastic packaging, which makes it highly appealing to both manufacturers and consumers in the premium bottled water sector. Plastic bottles are favored for their convenience and durability, which are essential for transportation and retail handling.

Despite growing environmental concerns, the widespread use of plastic in this segment continues to be driven by its practical benefits. Advances in recyclable and biodegradable plastic technologies have begun to align more closely with the market’s shift toward sustainability, helping to mitigate some of the negative perceptions associated with plastic packaging in the premium sector.

However, as consumer awareness of environmental issues grows, the market may see a gradual shift towards more sustainable alternatives. For now, plastic remains the leader in the packaging segment of premium bottled water due to its unmatched combination of functionality, cost efficiency, and consumer acceptance. Manufacturers in this space continue to innovate recyclable and eco-friendly packaging solutions to maintain their market share while addressing environmental concerns.

By Distribution Channel Analysis

Off trade channels lead with 74.40% in premium bottled water sales.

In 2024, Off Trade held a dominant market position in the By Distribution Channel segment of the Premium Bottled Water Market, securing a commanding 74.40% share. This dominance is largely attributed to the robust network of retail outlets, including supermarkets, hypermarkets, and convenience stores that offer consumers easy access to a variety of premium bottled water brands. These channels are crucial for the distribution of premium bottled water as they provide visibility and accessibility to consumers who seek convenience in their purchasing habits.

The substantial share held by the Off Trade channel reflects consumer preferences for buying premium products during their regular shopping routines, where they can physically evaluate packaging and authenticity, factors that are particularly important in the premium segment. Moreover, the ability of these retail outlets to offer promotional activities and discounts also significantly contributes to their dominance in the market.

As consumer lifestyles continue to evolve with a focus on premium and health-oriented products, the off-trade channel is expected to maintain its pivotal role in the distribution of premium bottled water. Retailers are likely to continue capitalizing on this trend by enhancing their premium bottled water offerings, thus reinforcing the strong market position of the Off Trade channel.

Key Market Segments

By Product

- Still Water

- Flavored

- Unflavored

- Sparkling Water

- Flavored

- Unflavored

- Functional Water

- Mineral Water

By Packaging

- Plastic

- Glass

- Aluminium Cans

By Distribution Channel

- On Trade

- Hotels

- Restaurants, Bars, and Pubs

- Others

- Off Trade

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

Driving Factors

Increased Awareness of Health and Wellness

One of the top driving factors in the Premium Bottled Water Market is the heightened awareness of health and wellness among consumers globally. As individuals become more conscious of their health, there is a growing preference for premium bottled water, which is perceived to be purer and of higher quality compared to tap or regular bottled water.

This shift is influenced by rising concerns about water contamination and the health risks associated with pollutants in ordinary drinking water. Additionally, the trend toward healthy lifestyles has led consumers to seek out products that offer added health benefits, such as mineral-enriched or alkaline waters, which are often found within the premium segment.

Restraining Factors

Environmental Concerns Over Plastic Waste Generation

A significant restraining factor for the Premium Bottled Water Market is the growing environmental concern related to the generation of plastic waste. As premium bottled waters are often packaged in single-use plastic bottles, this contributes substantially to global plastic waste, which poses serious environmental threats, including pollution and harm to wildlife.

This concern is particularly pronounced among environmentally conscious consumers who are increasingly opting for sustainable alternatives. The backlash against plastic waste has prompted both consumers and regulatory bodies to push for more eco-friendly packaging solutions.

This shift in consumer behavior and the tightening of environmental regulations are challenging the market’s growth, as companies must now innovate with sustainable packaging solutions that meet both consumer preferences and regulatory standards without compromising the product’s premium positioning.

Growth Opportunity

Expansion into New Markets with Health Trends

A key growth opportunity for the Premium Bottled Water Market lies in the expansion into new geographical markets that are currently experiencing a surge in health and wellness trends. As global awareness of health benefits associated with premium water increases—such as mineral enhancement, alkalinity, and purity—there is significant potential to tap into emerging markets where middle-class populations are expanding.

These consumers are increasingly able to afford luxury items and are eager to adopt lifestyle choices that reflect improved health and status. By entering these markets, premium bottled water brands can capitalize on the growing demand for health-oriented products. Establishing a presence in these areas can drive significant growth, especially if companies also focus on tailoring their marketing strategies to local preferences and health-related trends.

Latest Trends

Sustainable Packaging Innovations in Premium Bottled Water

A leading trend in the Premium Bottled Water Market is the shift towards sustainable packaging innovations. As environmental concerns continue to influence consumer decisions, premium bottled water companies are increasingly adopting eco-friendly packaging solutions to appeal to this conscientious demographic.

This includes the use of biodegradable materials, recyclable plastics, and innovative designs that reduce the amount of plastic used per bottle. Additionally, some brands are exploring refillable bottle systems and bulk water dispensing solutions to minimize single-use plastic consumption.

This trend not only responds to consumer demand for sustainability but also helps brands differentiate themselves in a competitive market. Embracing these green initiatives is becoming a crucial factor for maintaining brand loyalty and market share in the premium bottled water industry.

Regional Analysis

North America dominates the Premium Bottled Water Market, holding a 43.30% share valued at USD 13.9 billion.

In the Premium Bottled Water Market, regional dynamics vary significantly, with North America dominating the sector, holding a substantial 43.30% market share valued at USD 13.9 billion. This dominance is primarily driven by high consumer awareness regarding health and wellness, coupled with a strong preference for premium consumer goods. The U.S. leads within this region due to its high per capita income and well-established retail infrastructure that supports the distribution of premium products.

Europe follows closely, characterized by mature markets such as Germany, France, and the UK, where there is a growing trend toward organic and naturally sourced products, including water. These countries exhibit a high demand for premium bottled water due to increasing concerns about water quality and the environmental impact of plastics, driving the push for innovative and sustainable packaging solutions.

The Asia Pacific region is rapidly emerging as a significant market, fueled by increasing disposable incomes and a burgeoning middle class, particularly in China and India. The region’s growing fascination with Western lifestyles, coupled with rising health consciousness, is propelling the demand for premium bottled water.

Meanwhile, the Middle East & Africa, and Latin America regions, though smaller in comparison, are experiencing growth due to urbanization and the increasing availability of premium products in these markets. However, these regions still represent a smaller fraction of the global market, emphasizing the current concentration of premium bottled water sales in more developed economies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Premium Bottled Water market saw significant contributions from key industry players such as Nestlé, Danone S.A., The Coca-Cola Company, PepsiCo, and Gerolsteiner Brunnen GmbH & Co. KG, each playing a pivotal role in shaping market dynamics.

Nestlé, renowned for its diverse portfolio of water brands, continues to lead with innovation and sustainability at the forefront. The company has leveraged its global reach to enforce stringent quality standards and explore eco-friendly packaging solutions, maintaining a strong market presence.

Danone S.A., with its focus on health-oriented products, has capitalized on the growing consumer demand for functional waters. Its range of enriched bottled waters, tailored to health-conscious consumers, has strengthened its brand in various international markets, enhancing its global footprint.

The Coca-Cola Company, traditionally known for its soft drinks, has successfully penetrated the premium bottled water segment through strategic acquisitions and marketing of premium brands like Smartwater. Its emphasis on sleek packaging and marketing campaigns that resonate with a lifestyle of wellness has helped capture a considerable market share.

PepsiCo has similarly expanded its portfolio with premium water brands such as LIFEWTR, promoting not only hydration but also supporting the arts through creatively designed bottles, which has appealed to younger demographics seeking both hydration and design.

Gerolsteiner Brunnen GmbH & Co. KG, a key player in the European market, offers distinctively mineral-rich waters sourced from Germany. Its commitment to maintaining the natural purity and mineral content has solidified its reputation as a top choice for premium natural mineral water.

Top Key Players in the Market

- Nestlé

- Danone S.A.

- The Coca-Cola Company

- PepsiCo

- Gerolsteiner Brunnen GmbH & Co. KG

- FIJI Water

- Ozarka

- Beverly Hills Drink Company

- Lofoten Arctic Water AS

- Evian (Danone)

- Voss (Reignwood Group)

- Highland Spring (Highland Spring Group)

- Icelandic Glacial (Icelandic Water Holdings)

- Ty Nant (Ty Nant Spring Water Ltd.)

- Iskilde (Iskilde ApS)

Recent Developments

- In January 2025, Nestlé announced plans to spin off its bottled water business, aiming to concentrate on high-growth segments and enhance operational efficiency. The company also set a goal to achieve cost savings of at least $4.3 billion by 2027, which will be reinvested in marketing and growth initiatives.

- In July 2023, Fiji Water launched new glass bottles specifically designed for the hotel, restaurant, and catering (HoReCa) sector as part of its efforts to reduce plastic consumption.

Report Scope

Report Features Description Market Value (2024) USD 63.9 Billion Forecast Revenue (2034) USD 32.2 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product ((Still Water (Flavored, Unflavored), Sparkling Water (Flavored, Unflavored)), Functional Water, Mineral Water), By Packaging (Plastic, Glass, Aluminium Cans), By Distribution Channel (On Trade (Hotels, Restaurants, Bars and Pubs, Others), Off Trade (Supermarkets and Hypermarkets, Specialty Stores, Online, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nestlé, Danone S.A., The Coca-Cola Company, PepsiCo, Gerolsteiner Brunnen GmbH & Co. KG, FIJI Water, Ozarka, Beverly Hills Drink Company, Lofoten Arctic Water AS, Evian (Danone), Voss (Reignwood Group), Highland Spring (Highland Spring Group), Icelandic Glacial (Icelandic Water Holdings), Ty Nant (Ty Nant Spring Water Ltd.), Iskilde (Iskilde ApS) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Premium Bottled Water MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Premium Bottled Water MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nestlé

- Danone S.A.

- The Coca-Cola Company

- PepsiCo

- Gerolsteiner Brunnen GmbH & Co. KG

- FIJI Water

- Ozarka

- Beverly Hills Drink Company

- Lofoten Arctic Water AS

- Evian (Danone)

- Voss (Reignwood Group)

- Highland Spring (Highland Spring Group)

- Icelandic Glacial (Icelandic Water Holdings)

- Ty Nant (Ty Nant Spring Water Ltd.)

- Iskilde (Iskilde ApS)