Asia Pacific and Middle East and Africa Frozen Pizza Market By Crust Type (Thin Crust, Thick Crust, Stuffed and Others), By Type (Non-Veg and Veg), By Toppings (Meat, Vegetables, Cheese and Others), By Size (Regular, Medium and Large), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142877

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Latest Trends

- By Crust Type Analysis

- By Type Analysis

- By Toppings Analysis

- By Size Analysis

- By Distribution Channel Analysis

- Key Segmentation

- Geopolitical Impact Analysis

- Regional Analysis

- Market Share & Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

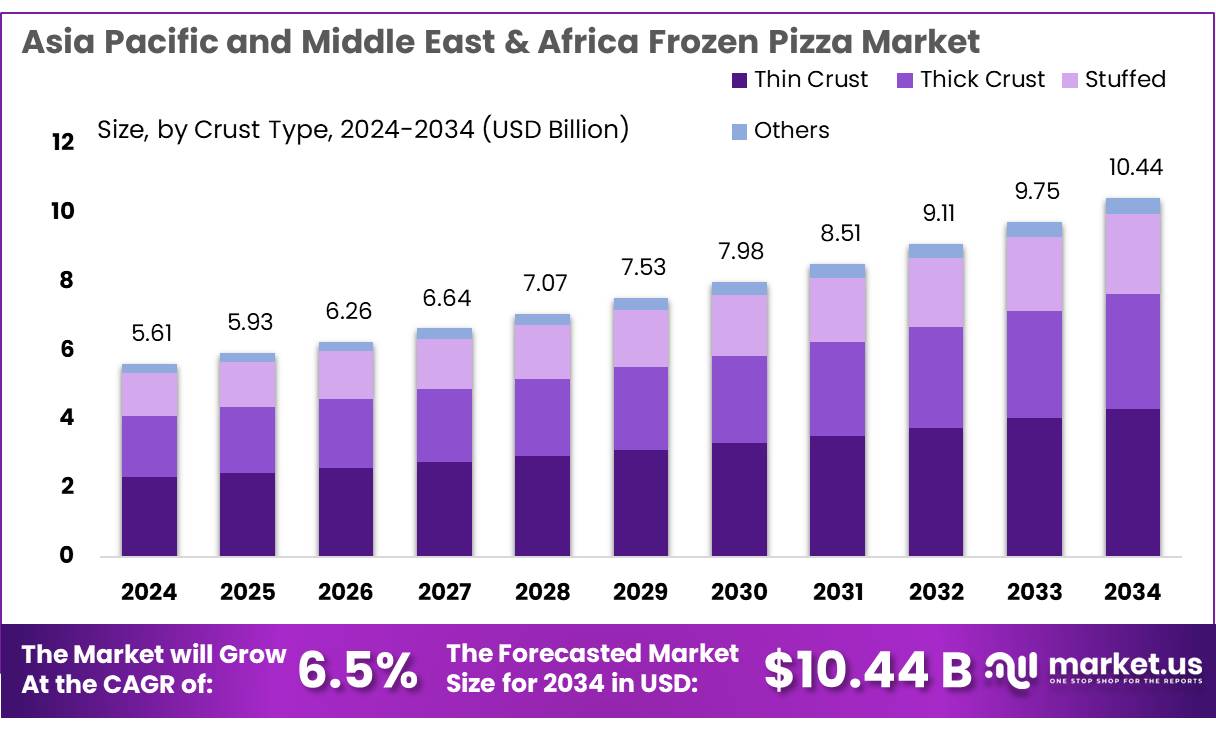

The Asia Pacific and Middle East & Africa frozen pizza market was valued at USD 5.61 billion in 2024 and is anticipated to reach USD 10.44 billion by 2034, registering CAGR of 6.5% from 2025 to 2034.

The pizza industry has long been a popular choice for consumers seeking quick and convenient meal options. In recent years, the demand for frozen pizza has seen a marked increase, driven by several factors including shifting consumer preferences, advancements in frozen food technology, and the convenience and accessibility of frozen pizza varieties.

A primary driver of the rising demand for frozen pizza is the change in consumer preferences. As hectic lifestyles and busy schedules become increasingly common, convenience has emerged as a top priority for many consumers. Frozen pizza offers a fast and easy solution for busy families and individuals who seek a substantial meal without the need for extensive preparation. Additionally, frozen pizza brands have broadened their product offerings to include a diverse range of toppings, crust styles, and dietary options, catering to a wide array of tastes and preferences.

Another significant factor contributing to the growth of the frozen pizza market is the advancements in frozen food technology. Earlier, frozen pizza was often perceived as lower in quality compared to its freshly made counterpart. However, improvements in freezing and packaging techniques have enabled frozen pizza to better retain its flavor, texture, and nutritional value. These advancements have aided to dispel the negative perceptions associated with frozen food, leading to greater acceptance and adoption of frozen pizza as a convenient and delicious meal choice.

Key Takeaways

- In 2024, the Asia Pacific and Middle East & Africa Frozen Pizza market was valued at US$ 5.61 Billion.

- By crust type, the thin crust frozen pizzas held a major market share of 41.3% in 2024.

- In 2024, non-veg frozen pizza dominated the market with 60.8% market share.

- By toppings, the meat segment dominated the Asia Pacific and Middle East & Africa market with 56.8% market share in 2024.

- By size, in 2024, regular frozen pizza held a significant revenue share of 47.4%.

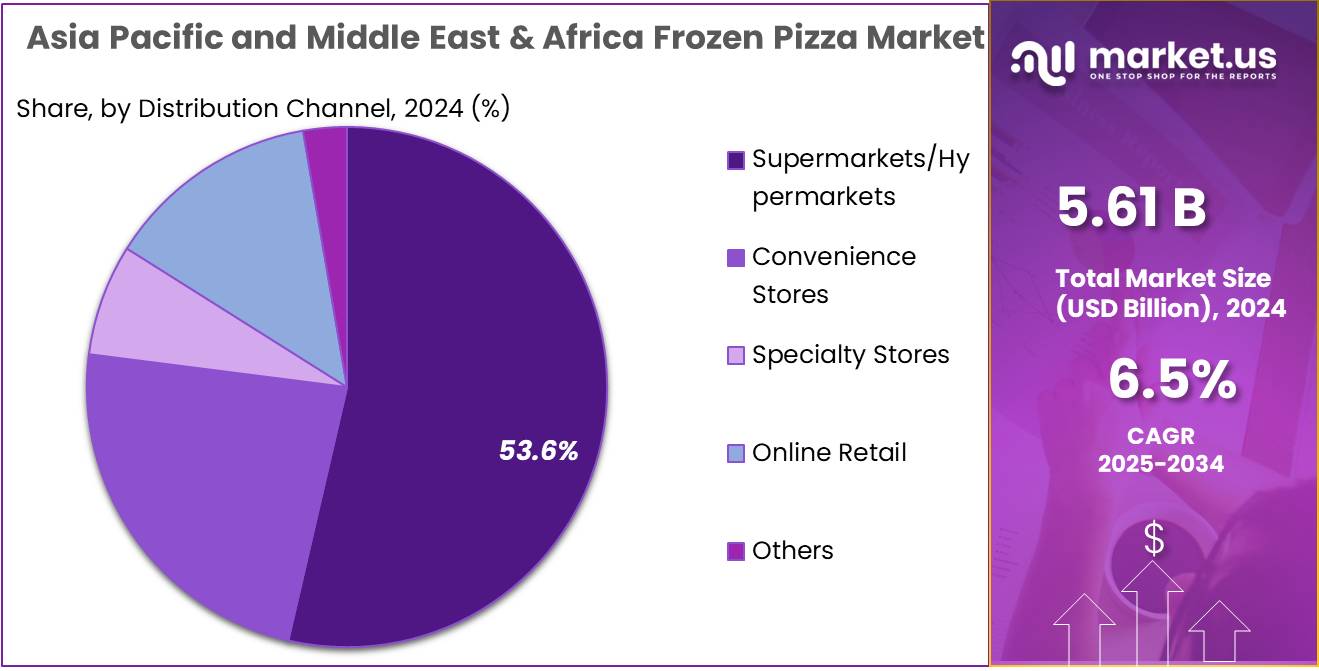

- By 2034, supermarkets/hypermarkets distribution channel is expected to hold 55.1% of market share in the Asia Pacific and Middle East & Africa regions.

Driving Factors

Rising Demand for Convenience and Time-saving Meal Options

The rising demand for convenience and time-saving meal options is a significant driver for the growth of the APAC & MEA (Asia-Pacific and Middle East & Africa) frozen pizza market. This trend is largely influenced by changing lifestyle dynamics, urbanization, and the increasing pace of life, which collectively push consumers towards more convenient meal solutions.

As urbanization intensifies across APAC and MEA, more people are living in cities where lifestyle pace tends to be faster. Urban dwellers often face longer working hours and commutes, which reduces the time available for traditional meal preparation. The convenience of frozen pizzas, which can be quickly prepared with minimal effort, makes them an attractive option for these consumers. Frozen pizza offers a practical solution by delivering a ready-to-eat meal that saves time and energy, aligning perfectly with the busy urban lifestyle.

The growth of modern retail infrastructure like supermarkets and hypermarkets across APAC and MEA has made frozen pizzas more accessible to the average consumer. These retail channels are equipped with the necessary refrigeration facilities to store frozen products, ensuring that frozen pizzas retain their quality and appeal. The availability of a wider range of frozen pizza brands and products in these outlets also helps cater to varied consumer tastes and preferences. The combined impact of these factors—urbanization, shifting family dynamics, western influence, improved retail infrastructure, higher disposable incomes, an increase in single-person households, and better freezing technology—creates a conducive environment for the growth of the frozen pizza market in APAC and MEA.

Restraining Factors

Intense Competition from Fresh Pizza Hinder the Market Growth

The preference for fresh pizza over frozen pizza is a notable restraint in the APAC & MEA frozen pizza market, driven by the perception of superior quality and taste. Fresh pizza is often associated with the use of fresh, locally sourced ingredients, premium cheeses, and a wider variety of toppings. Additionally, the dough is typically prepared as a fresh, delivering a fresher, more authentic flavor compared to frozen pizza, which is pre-cooked, frozen, and reheated by consumers—resulting in a potential compromise in taste and texture. This perceived superiority in quality encourages consumers to opt for fresh pizza over frozen alternatives, thus restraining the market growth for frozen pizzas in the region.

Additionally, health-conscious consumers frequently view fresh pizza as a healthier alternative, as frozen pizzas may contain preservatives and additives to extend their shelf life. Growing awareness about healthy eating and the increasing preference for minimally processed foods further steer consumers towards fresh options. In APAC and MEA regions where dietary trends are shifting towards health and wellness, this perception significantly hinders the adoption of frozen pizzas.

Growth Opportunities

Evolving Snacking Culture Expected to Open New Growth Opportunity for the Frozen Pizza market

The evolving snacking culture in the APAC and MEA regions presents a substantial opportunity for the frozen pizza market, as it influences consumer perceptions and consumption patterns of pizza products. As snacking continues to evolve, it opens up multiple growth avenues in the frozen pizza market. These include the development of new and innovative snack-sized pizza flavors, leveraging health-conscious trends to create nutritious snack options, and expanding marketing efforts to target on-the-go consumers. Traditionally, pizza has been viewed as a full meal, often served for lunch or dinner.

However, with the rise of snacking culture, the lines between meals have blurred, as consumers increasingly integrate snacks into their daily routines. This lifestyle shift, driven by busy schedules, on-the-go habits, and a preference for smaller, more frequent meals, creates a considerable opportunity for frozen pizza manufacturers to diversify their offerings and cater to this rising demand for convenient, satisfying snack options.

To capitalize on this trend, frozen pizza brands in the APAC and MEA regions have begun to introduce mini and bite-sized pizza varieties. These smaller portions are well-suited for quick, in-between-meal snacks, positioning frozen pizza as a versatile choice for consumers. Mini-pizzas, available in a variety of flavors and crust options, provide consumers the ability to enjoy a quick pizza fix without the commitment of a full-sized meal. The convenience of these smaller portions has resonated strongly with consumers, especially those seeking a delicious and indulgent snack option.

- For instance, in 2023 McCain Foods has expanded its product portfolio with the launch of two exciting new offerings: McCain Popcorn Fries and McCain Cheesy Pizza Fingers.

Latest Trends

Emergence of Plant-Based Pizzas: The rising consumer demand for plant-based products is reshaping the frozen pizza category in APAC and MEA regions, marking a significant trend in the market. The mainstreaming of plant-based pizzas is taking various forms, with brands adapting to meet the evolving preferences of health-conscious and environmentally aware consumers.

- For instance, DiGiorno’s Meatless Supreme replaces traditional meat toppings with plant-based alternatives while retaining dairy cheese, highlighting a hybrid approach.

- On the other hand, American Flatbread’s Meatless Evolution line offers both vegan and vegetarian options, catering to a wider range of dietary preferences.

Dietary Accommodations and Specialized Offerings: The growing prevalence of dietary restrictions and evolving consumer preferences have prompted frozen pizza brands to diversify their product offerings, leading to a notable trend in dietary accommodations and specialized options. This shift is driven by an increasing awareness of health, wellness, and specific dietary needs such as gluten intolerance, lactose sensitivity, and veganism. As a result, frozen pizza brands are expanding their portfolios to include a wide range of gluten-free, dairy-free, and vegan pizzas, enabling them to cater to a broader and more diverse customer base.

One of the key innovations in this space is the introduction of alternative crusts made from ingredients such as cauliflower, sweet potatoes, and chickpeas. These alternatives not only offer a gluten-free option but also cater to consumers seeking low-carb or nutrient-dense choices. The rise of such health-conscious offerings aligns with the growing demand for clean-label, minimally processed foods, reflecting consumers’ desire for nutritious options without compromising on flavor or convenience.

By Crust Type Analysis

The thin crust segment held the largest market share in 2024 due to their crispy texture and lighter profile compared to thicker varieties

Based on crust type, the market for frozen pizza is segmented into thin crust, thick crust, stuffed and others. Among these, the thin crust segment was the most lucrative in the Asia Pacific and Middle East & Africa frozen pizza market, with a market share of 41.3% in 2024. Thin crust pizzas are renowned by their remarkably thin and crispy base, making them a preferred option among consumers favoring a lighter and more refined pizza experience.

The thin and delicate crust is achieved by rolling the dough to minimal thickness, which results in a crisp texture upon baking. The dough composition often includes high-protein flour, water, yeast, and a small amount of olive oil, creating a flavorful yet light crust that enhances the pizza’s overall appeal. This style of crust provides a delightful balance, where the crisp base complements the vibrant flavors of the toppings without overwhelming them.

By Type Analysis

The non-veg frozen pizza held a significant market share owing to its widespread appeal among consumers preferring protein-rich and indulgent meal options.

By type, the Asia Pacific and Middle East & Africa frozen pizza can be further categorized into non-veg and veg. The non-veg frozen pizza dominated the market with a significant share of 60.8% in 2024. The non-vegetarian frozen pizza segment caters to consumers seeking protein-rich toppings, including meats such as pepperoni, chicken, bacon, sausage, and seafood. These pizzas are a popular choice for individuals favoring bold flavors and a hearty meal experience.

The segment benefits from innovations in meat processing and freezing technologies, ensuring the freshness and quality of the protein toppings. Additionally, non-veg frozen pizzas often feature gourmet combinations with premium ingredients like prosciutto, smoked salmon, or specialty sausages, appealing to more sophisticated palates. The growing popularity of high-protein diets and indulgence-driven consumption patterns further propels demand in this segment.

By Toppings Analysis

Meat toppings dominated the frozen pizza market in both Asia Pacific and Middle East & Africa, appealing to consumers seeking protein-rich and indulgent options

Meat-topped frozen pizzas hold a 56.8% share in the market, catering to consumers preferering a rich and hearty flavor profile. Key choices include pepperoni, chicken, and spiced beef, with regional preferences such as lamb in the Middle East and barbecue chicken in Asia. Meat-topped frozen pizzas are particularly popular among younger demographics and families due to their savory and substantial flavors.

The segment benefits from ongoing innovation, including plant-based meat alternatives, which cater to the growing flexitarian audience. Manufacturers are leveraging bold seasoning and locally inspired flavors to differentiate their offerings. As urbanization and Western dining trends continue to spread, meat toppings are expected to sustain their strong position in the market.

By Size Analysis

The demand for regular-sized frozen pizza is expected to grow significantly in the forecast period, driven by the ongoing demand for affordable, convenient, and customizable meal options.

Regular-sized frozen pizzas remain the most common and popular option in the market catering 47.4% market share in 2024. These pizzas typically serve one to two people, making them ideal for individuals or smaller households. Regular-sized pizzas offer convenience and affordability, making them a popular choice for everyday meals. With a wide variety of crusts, toppings, and flavors available, regular-sized pizzas cater to a broad range of consumer preferences. This segment is expected to continue dominating the market, driven by the ongoing demand for affordable, convenient, and customizable meal options.

By Distribution Channel Analysis

Supermarkets and hypermarkets continue to be the dominant distribution channel for frozen pizzas, offering consumers a broad selection of products in one convenient location.

By distribution channel, the Asia Pacific and Middle East & Africa frozen pizza market was dominated by supermarkets/hypermarkets segment with 53.6% market share in 2024. This channel benefits from the growing trend of one-stop shopping, where consumers can purchase frozen pizzas alongside other grocery items. In regions like Asia Pacific and the Middle East, large retail chains are expanding their frozen food sections to meet the increasing demand for convenience foods. Supermarkets and hypermarkets also provide consumers with the opportunity to compare different brands and products, further boosting their appeal. The continued growth of these retail formats is expected to support the frozen pizza market’s expansion.

For instance, in February 2025, Lulu Retail announced the its newest store in Al Satwa, Dubai. This hypermarket will offer world-class shopping experience to the local community and its adjoining areas.

Key Segmentation

Based on Crust Type

- Thin Crust

- Thick Crust

- Stuffed

- Others

Based on Type

- Non-Veg

- Veg

Based on Toppings

- Meat

- Vegetables

- Cheese

- Others

Based on Size

- Regular

- Medium

- Large

Based on Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Geopolitical Impact Analysis

The frozen pizza market in Asia Pacific (APAC) and Middle East & Africa (MEA) is shaped significantly by geopolitical factors, impacting trade, supply chains, and consumer trends. In APAC, trade policies and tariffs play a crucial role, especially as many countries rely on imports for key ingredients like premium meats and specialty cheeses. Disruptions caused by geopolitical tensions, such as U.S.-China trade conflicts, can escalate production costs and affect product availability.

However, regional trade agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) are fostering smoother trade, benefiting frozen pizza manufacturers. Rapid urbanization and government-backed infrastructure projects in countries like India and Indonesia are improving cold storage and logistics, expanding market reach.

In the Middle East and Africa (MEA) region, several nations encounter challenges due to their reliance on imported raw materials for frozen pizza production. Geopolitical instability, particularly in conflict-affected areas such as Syria and Libya, disrupts logistics networks and diminishes consumer purchasing power. Additionally, the Israel-Hamas conflict has exacerbated supply chain issues in Israel, leading to a shortage of frozen pizza. This shortage stems from a lack of available workers and complications with ammonia tanks used in the rapid freezing process.

These tanks, essential for ensuring product freshness, pose significant safety risks to workers, further hampering production and distribution capabilities. However, stable economies like the UAE and Saudi Arabia are seeing growth in Western food consumption, supported by economic diversification initiatives like Saudi Vision 2030. The cultural and religious context also influences the market, with halal-certified products being essential for penetration in Muslim-majority regions.

Regional Analysis

In 2024, Asia Pacific held a significant position in the Asia Pacific and Middle East & Africa Frozen Pizza market, with in around 79.4%. The frozen pizza market in the Asia Pacific region is witnessing robust growth, driven by urbanization, changing lifestyles, and increasing disposable incomes. As more people in countries like China, India, Japan, and Australia adopt busy, on-the-go lifestyles, the demand for convenient and quick meal solutions has surged. The younger demographic, in particular, is gravitating towards Western food habits, making frozen pizza a popular choice.

Additionally, the expansion of retail networks and the rise of e-commerce platforms have made frozen pizzas more accessible to a broader audience. Manufacturers in the region are also introducing localized flavors to cater to regional tastes, which further boosts market acceptance. The Asia Pacific frozen pizza market is poised for significant growth as more consumers embrace the convenience and variety offered by frozen pizzas.

In the Middle East and Africa, the frozen pizza market is gradually gaining traction, influenced by the region’s expanding urban population and the increasing penetration of Western food culture. Countries such as the UAE, Saudi Arabia, and South Africa are leading the charge due to their higher disposable incomes and the prevalence of expatriate populations who bring their food preferences with them. The market in these regions is characterized by a preference for premium and gourmet pizza options, as well as halal-certified products, which cater to the dietary requirements of the local population.

Moreover, the growth of modern retail chains and supermarkets is enhancing the distribution and availability of frozen pizzas. While the market is still in its nascent stage compared to other regions, the increasing awareness of convenience foods and the entry of international pizza brands are expected to drive substantial growth in the coming years.

Key Regions and Countries Covered in this Report:

- APAC

- China

- India

- Japan

- South Korea

- ASEAN

- Rest of APAC

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Key players in the Asia Pacific and Middle East & Africa Frozen Pizzas market include Nestlé S.A., General Mills, Inc., Conagra Brands, McCain Foods Limited, Dr. August Oetker AG, and Others. The frozen pizza market in Asia Pacific (APAC) and Middle East & Africa (MEA) is characterized by intense competition among global and regional players, driven by diverse consumer preferences and evolving lifestyles. In the regions, international brands such as Nestlé’s DiGiorno and Dr. Oetker dominate, leveraging their extensive distribution networks and product innovation to cater to urban populations.

However, regional players like Milky Mist Dairy , Sunbulah Group and Amul are gaining traction by offering locally inspired flavors and affordable pricing. The rise of private-label products from major retail chains, including Lulu Hypermarket and Carrefour, has intensified price competition across both regions. Furthermore, increasing e-commerce penetration is enabling smaller brands to enter the market, fostering a more fragmented competitive landscape.

Market Key Players

- Nestlé S.A

- General Mills, Inc.

- August Oetker AG

- Conagra Brands

- Gujarat Cooperative Milk Marketing Federation Limited (GCMMF)

- Milky Mist Dairy

- Amy’s Kitchen, Inc

- McCain Foods Limited

- Sunbulah Group

- Bellisio Foods, Inc

- The Simply Good Foods Company

- California Pizza Kitchen

- Daiya Foods Inc.

- Freiberger Lebensmittel GmbH

- Other Key Players

Recent Developments

- In May 2023, CJ CheilJedang a South Korean food company announced that its U.S.-based subsidiary, Schwan’s Company, has successfully completed the expansion of its pizza manufacturing facility in Salina, Kansas. The project, which added an impressive 40,000 square meters to the existing plant, has increased the facility’s total area to nearly 90,000 square meters. This expansion establishes the Salina Factory as the world’s largest frozen pizza manufacturing site.

- In May 2023, Nestlé’s DiGiorno frozen pizza brand has introduced two new varieties to its lineup: Loaded Ultra-Thin and Detroit Style.

Report Scope

Report Features Description Market Value (2024) USD 5.61 Bn Forecast Revenue (2034) USD 10.44 Bn CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Geopolitical Impact Analysis, Competitive Landscape, Recent Developments Segments Covered By Crust Type (Thin Crust, Thick Crust, Stuffed and Others), By Type (Non-Veg and Veg), By Toppings (Meat, Vegetables, Cheese and Others), By Size (Regular, Medium and Large), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail and Others) Regional Analysis APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape Nestlé S.A, General Mills, Inc., Dr. August Oetker AG, Conagra Brands, Gujarat Cooperative Milk Marketing Federation Limited (GCMMF), Milky Mist Dairy, Amy’s Kitchen, Inc, McCain Foods Limited, Sunbulah Group, Bellisio Foods, Inc, The Simply Good Foods Company, California Pizza Kitchen, Daiya Foods Inc., Freiberger Lebensmittel GmbH and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Asia Pacific and Middle East And Africa Frozen Pizza MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Asia Pacific and Middle East And Africa Frozen Pizza MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nestlé S.A

- General Mills, Inc.

- August Oetker AG

- Conagra Brands

- Gujarat Cooperative Milk Marketing Federation Limited (GCMMF)

- Milky Mist Dairy

- Amy's Kitchen, Inc

- McCain Foods Limited

- Sunbulah Group

- Bellisio Foods, Inc

- The Simply Good Foods Company

- California Pizza Kitchen

- Daiya Foods Inc.

- Freiberger Lebensmittel GmbH

- Other Key Players