Global Food Grade Iron Powder Market Size, Share, And Business Benefits By Type (Elemental Iron, Iron Compounds), By End-use (Food and Beverages, Animal Feed, Agriculture, Others), By Distribution Channel (Direct Sales, Retail Sales, Online Sales, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 140706

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

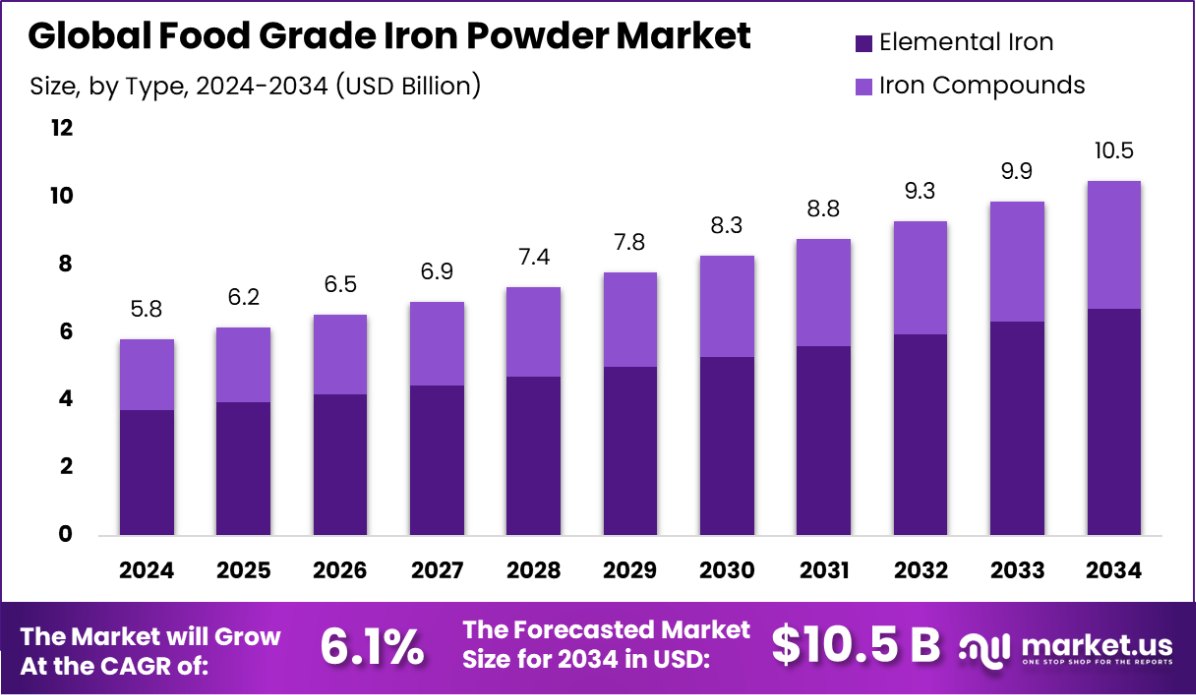

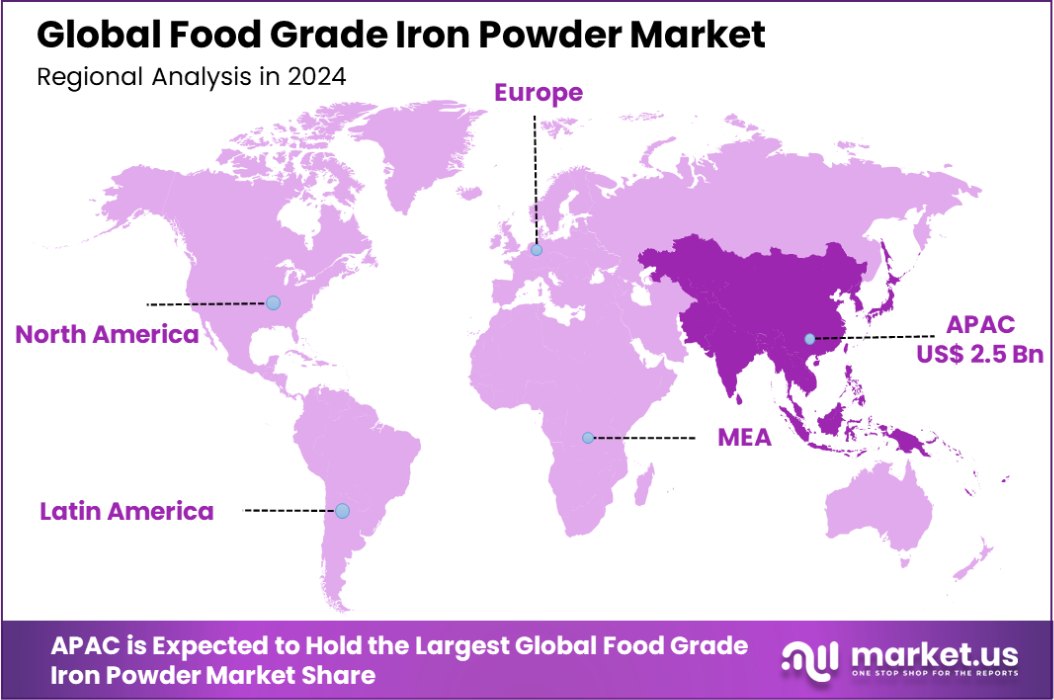

Global Food Grade Iron Powder Market is expected to be worth around USD 10.5 Billion by 2034, up from USD 5.8 Billion in 2024, and grow at a CAGR of 6.1% from 2025 to 2034. Asia-Pacific leads the Food Grade Iron Powder Market with a 43.2% share, valued at USD 2.5 billion.

Food grade iron powder is a finely processed form of iron used as a dietary supplement to prevent or treat iron deficiency. It is produced under strict quality controls to ensure that it is safe for human consumption. Iron powder is typically added to food products or used in the production of fortified beverages, nutritional supplements, and even functional foods.

Food-grade iron powder is highly bioavailable, meaning the body can easily absorb and use it, making it an important ingredient in addressing iron-deficiency anemia, especially in populations with inadequate dietary intake of iron.

The food grade iron powder market is growing due to increasing awareness of the importance of iron in maintaining overall health and wellness. The market is driven by demand from the food and beverage industry, nutritional supplement manufacturers, and the healthcare sector. Factors such as rising global cases of iron deficiency and anemia, particularly in developing nations, are propelling market growth. Additionally, the increasing trend of functional foods and fortified products further supports the market’s expansion.

The growth of the food grade iron powder market is significantly influenced by the increasing prevalence of iron deficiency globally. With rising awareness about the benefits of iron supplementation, particularly in women, children, and elderly populations, there is a growing demand for iron-enriched food products and supplements. Furthermore, the adoption of iron powder in the fortification of various food items, such as cereals and beverages, continues to expand.

Demand for food grade iron powder is mainly driven by the growing awareness of iron deficiency anemia and the rising consumption of fortified foods and supplements. The prevalence of iron deficiency anemia in underdeveloped and developing regions is boosting demand for affordable and accessible iron supplementation, fueling market growth. In developed countries, increasing health consciousness and a trend toward preventive healthcare are also contributing to demand.

The food grade iron powder market presents numerous growth opportunities, particularly in emerging markets where iron deficiency remains a significant health issue. There is a strong opportunity for companies to expand their product portfolios by introducing innovative iron-enriched foods, dietary supplements, and functional beverages.

Key Takeaways

- Global Food Grade Iron Powder Market is expected to be worth around USD 10.5 Billion by 2034, up from USD 5.8 Billion in 2024, and grow at a CAGR of 6.1% from 2025 to 2034.

- The Food Grade Iron Powder Market is valued at 64.6% by elemental iron content.

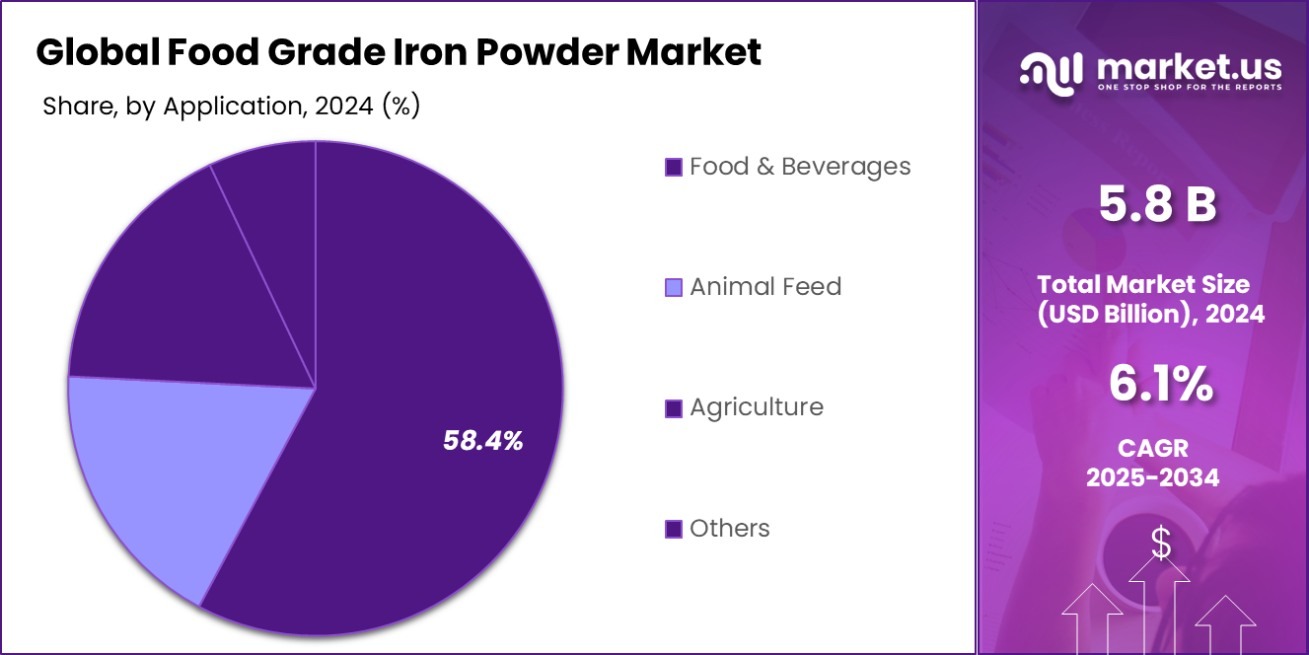

- Food and Beverages dominate the market, accounting for 58.4% of value.

- Direct sales represent 53.5% of the Food Grade Iron Powder market.

- Asia-Pacific leads the Food Grade Iron Powder Market with a 43.2% share, valued at USD 2.5 billion.

By Type Analysis

Elemental iron dominates the food grade iron powder market, comprising 64.6% of total sales.

In 2024, Elemental held a dominant market position in the By Type segment of the Food Grade Iron Powder Market, with a 64.6% share. This significant market share reflects Elemental’s strong foothold in the food-grade iron powder industry, driven by its consistent product quality and broad application base. The company’s robust supply chain, advanced production processes, and established reputation in the market have positioned it as a leader in this segment.

Elemental’s food-grade iron powders are widely used in the fortification of food products, primarily in the production of iron-fortified cereals, beverages, and nutritional supplements. The demand for iron supplementation has been consistently high, owing to the rising global awareness of iron deficiency and its related health implications, particularly in developing economies. Elemental’s extensive product portfolio, which includes various iron powder grades tailored for different food applications, further strengthens its competitive advantage in the market.

Additionally, the company’s commitment to research and development has led to the continuous improvement of its food-grade iron powder formulations, enhancing their bioavailability and stability. Elemental’s strategic partnerships with key players in the food processing and supplement industries have further bolstered its market leadership in the food-grade iron powder segment.

By End-Use Analysis

The food and beverages segment accounts for 58.4% of the food grade iron powder market.

In 2024, Food and Beverages held a dominant market position in the By End-Use segment of the Food Grade Iron Powder Market, with a 58.4% share. This substantial market share reflects the growing demand for iron-fortified food products, particularly in regions with high iron deficiency rates. The food and beverage industry’s significant contribution to the market is driven by the increasing need for nutritional supplements, particularly iron fortification in products such as cereals, energy bars, and beverages.

The rise in consumer awareness regarding iron deficiency anemia, coupled with the expanding health-conscious population, has fueled the demand for iron-enriched food products. Food and beverage manufacturers are increasingly incorporating food-grade iron powder to improve the nutritional profile of their offerings and meet consumer needs for better health outcomes. Iron fortification is particularly important in developing regions, where iron deficiency is more prevalent.

Moreover, the food and beverage industry benefits from ongoing innovations in iron powder formulations, ensuring higher bioavailability and stability in various food applications. As a result, companies are better positioned to meet the stringent regulatory standards for food additives, driving growth in the sector. The continuous development of new food-grade iron powder products further cements Food and Beverages’ dominance in the market, positioning it as a key end-use segment in 2024.

By Distribution Channel Analysis

Direct sales channels make up 53.5% of food-grade iron powder market transactions.

In 2024, Direct Sales held a dominant market position in the By Distribution Channel segment of the Food Grade Iron Powder Market, with a 53.5% share. This strong market presence is attributed to the direct-to-consumer model, which allows companies to establish a closer relationship with their customers while ensuring better control over pricing, delivery, and customer support.

Direct sales have become an increasingly popular distribution channel for food-grade iron powder due to its efficiency in reaching end-users, including food manufacturers and supplement producers.

The ability to provide tailored solutions, bulk order capabilities, and personalized services makes direct sales an appealing option for both large and small-scale clients in the food and beverage sector. Additionally, this channel helps reduce the reliance on intermediaries, which can often lead to higher prices and logistical complexities. As a result, direct sales offer cost advantages and quicker turnaround times for customers.

Moreover, direct sales channels enable manufacturers to offer specialized product offerings, such as custom iron powder blends, to meet the specific needs of different food and beverage applications. This flexibility and customization have made direct sales the preferred choice for many players in the food-grade iron powder market.

Key Market Segments

By Type

- Elemental Iron

- Iron Compounds

By End-use

- Food and Beverages

- Animal Feed

- Agriculture

- Others

By Distribution Channel

- Direct Sales

- Retail Sales

- Online Sales

- Others

Driving Factors

Growing Demand for Iron-Fortified Foods

One of the key driving factors in the Food Grade Iron Powder Market is the growing demand for iron-fortified foods. Iron deficiency is a common nutritional problem globally, particularly in developing countries, which has led to an increase in consumer awareness about the importance of iron in the diet. This awareness, coupled with the rise in anemia-related health issues, has driven food manufacturers to incorporate iron powder into their products, such as cereals, energy bars, and beverages, to meet the nutritional needs of consumers.

The demand for fortified foods is expected to continue growing, fueled by the increasing focus on health and wellness among consumers. As a result, food-grade iron powder is becoming an essential ingredient in the food and beverage industry, further boosting its market growth. Additionally, regulatory support for food fortification programs in many countries has created a favorable environment for manufacturers, providing a solid foundation for the market to expand in the coming years.

Restraining Factors

High Production Costs for Food Grade Iron Powder

A significant restraining factor in the Food Grade Iron Powder Market is the high production costs associated with manufacturing iron powders. The production process requires advanced technology, stringent quality control measures, and high-quality raw materials, all of which contribute to the overall cost of production. As a result, food-grade iron powder can be more expensive compared to other food additives or fortification methods.

These higher costs are particularly challenging for small-scale food manufacturers or those operating in price-sensitive markets. While the benefits of iron fortification are clear, the cost barriers can limit the widespread adoption of food-grade iron powder, especially in regions with lower economic standards. This can lead to price fluctuations, limiting market growth and affecting the affordability of fortified products for end consumers.

Growth Opportunity

Rising Popularity of Plant-Based and Vegan Foods

A key growth opportunity in the Food Grade Iron Powder Market lies in the rising popularity of plant-based and vegan foods. As more consumers shift towards plant-based diets, there is a growing need for iron fortification in plant-based products, which often lack sufficient natural iron. Iron is essential for those following vegan and vegetarian diets, as plant-based iron sources are not as easily absorbed by the body as those from animal products.

This shift in consumer dietary preferences presents a significant opportunity for food-grade iron powder manufacturers to cater to a growing segment of the market. By offering specialized iron powders tailored for vegan food products, manufacturers can tap into this expanding market, meeting consumer demand for fortified, plant-based options. This trend is expected to drive further market growth and innovation in the coming years.

Latest Trends

Innovation in Bioavailable Iron Powder Formulations

One of the latest trends in the Food Grade Iron Powder Market is the innovation in bioavailable iron powder formulations. Manufacturers are increasingly focusing on enhancing the bioavailability of iron in food products. Bioavailability refers to how easily the body can absorb and utilize iron, which is a critical factor in the effectiveness of iron fortification. Traditional iron powders often have lower absorption rates, leading to limited health benefits for consumers.

To address this, companies are developing new forms of iron powders, such as microencapsulated or chelated iron, which improve absorption and minimize side effects like gastrointestinal discomfort. These innovations are making iron fortification more effective, driving demand in the food and beverage sector. As consumer awareness about nutrient absorption grows, the adoption of these advanced formulations is expected to increase, creating a competitive edge for manufacturers.

Regional Analysis

Asia-Pacific leads the Food Grade Iron Powder Market with a 43.2% share, valued at USD 2.5 billion.

In 2024, Asia-Pacific dominated the Food Grade Iron Powder Market, accounting for 43.2% of the global market share, valued at USD 2.5 billion. The region’s strong growth can be attributed to the increasing prevalence of iron deficiency and anemia, particularly in countries like India and China, where large populations are affected by nutritional deficiencies.

Additionally, rising awareness about the importance of iron fortification in food products and government-supported initiatives for fortifying staples are further driving demand in this region.

North America holds a significant share of the market due to high consumer awareness of health and wellness, along with strong demand for iron-fortified dietary supplements and food products. The U.S. continues to be the leading market player in the region, supported by well-established food manufacturing industries and a growing trend in functional foods.

Europe follows with steady market growth, driven by stringent food fortification regulations and the increasing adoption of iron-fortified foods in response to rising anemia cases. The European market also benefits from a growing preference for clean-label and natural products.

Latin America and the Middle East & Africa, while smaller in market share, are witnessing gradual growth due to increasing health-consciousness and a rising demand for fortified food products in emerging markets, offering long-term growth potential.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Food Grade Iron Powder Market is characterized by a highly competitive landscape, with several key players shaping the industry’s growth. Companies such as Agrium Inc., Akzo Nobel N.V., and BASF SE are at the forefront of innovation, capitalizing on their strong expertise in chemical manufacturing and food-grade products. Their ability to produce high-quality iron powders with superior bioavailability has given them a competitive edge in the market, catering to the growing demand for iron fortification in food products.

BASF SE, for instance, is leveraging its advanced research and development capabilities to create specialized iron formulations that address the nutritional needs of consumers, particularly in emerging markets with high anemia rates. Similarly, Bayer AG and Syngenta International AG are focusing on expanding their product portfolios to meet the evolving requirements of food manufacturers, particularly with natural and clean-label iron powders.

Companies like Rio Tinto Metal Powders and Yara International Ltd. bring valuable resources and expertise in large-scale production, supporting the broader adoption of food-grade iron powders. Their global reach allows them to tap into both mature and emerging markets, positioning them as key players in the market.

Smaller but notable players like Reade, Salvi Chemical Industries Ltd., and Spectrum Chemical Mfg. Corp. offers niche products and specialized iron powders, further diversifying the market and creating opportunities for customized solutions in food fortification.

Top Key Players in the Market

- Agrium Inc.

- Akzo Nobel N.V.

- American Elements

- Ashland Global Holdings Inc.

- BASF SE

- Bayer AG

- Belmont Metals

- Belmont Metals Inc.

- Cathay Industries Australasia Pty Ltd.

- Chengdu Huarui Industrial

- Compass Minerals International Inc.

- DuPont Inc.

- G K Min Met Alloys

- Gangotri Inorganic

- INDUSTRIAL METAL POWDERS

- Industrial Metal Powders (I) Pvt. Ltd.

- Iron Powder Manufacturers and Distributors

- Jiangxi Yuean Superfine Metal

- Micnelf USA Inc.

- Precheza AS

- Reade

- Rio Tinto Metal Powders

- Salvi Chemical Industries Ltd.

- Spectrum Chemical Mfg. Corp.

- Stanford Advanced Materials

- Syngenta International AG

- Widerangemetals

- Yara International Ltd.

Recent Developments

- In 2024, Nutrien continues to innovate in the food sector with its expansion into micronutrient fortification. They may launch new food-grade iron powder products designed to meet global nutritional needs.

- In 2024, Ashland may announce a partnership or acquisition of a specialized producer of food-grade iron powder, expanding their portfolio in nutritional and food fortification products.

Report Scope

Report Features Description Market Value (2024) USD 5.8 Billion Forecast Revenue (2034) USD 10.5 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Elemental Iron, Iron Compounds), By End-use (Food and Beverages, Animal Feed, Agriculture, Others), By Distribution Channel (Direct Sales, Retail Sales, Online Sales, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agrium Inc., Akzo Nobel N.V., American Elements, Ashland Global Holdings Inc., BASF SE, Bayer AG, Belmont Metals, Belmont Metals Inc., Cathay Industries Australasia Pty Ltd., Chengdu Huarui Industrial, Compass Minerals International Inc., DuPont Inc., G K Min Met Alloys, Gangotri Inorganic, INDUSTRIAL METAL POWDERS, Industrial Metal Powders (I) Pvt. Ltd., Iron Powder Manufacturers and Distributors, Jiangxi Yuean Superfine Metal, Micnelf USA Inc., Precheza AS, Reade, Rio Tinto Metal Powders, Salvi Chemical Industries Ltd., Spectrum Chemical Mfg. Corp., Stanford Advanced Materials, Syngenta International AG, Widerangemetals, Yara International Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Food Grade Iron Powder MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Global Food Grade Iron Powder MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Agrium Inc.

- Akzo Nobel N.V.

- American Elements

- Ashland Global Holdings Inc.

- BASF SE

- Bayer AG

- Belmont Metals

- Belmont Metals Inc.

- Cathay Industries Australasia Pty Ltd.

- Chengdu Huarui Industrial

- Compass Minerals International Inc.

- DuPont Inc.

- G K Min Met Alloys

- Gangotri Inorganic

- INDUSTRIAL METAL POWDERS

- Industrial Metal Powders (I) Pvt. Ltd.

- Iron Powder Manufacturers and Distributors

- Jiangxi Yuean Superfine Metal

- Micnelf USA Inc.

- Precheza AS

- Reade

- Rio Tinto Metal Powders

- Salvi Chemical Industries Ltd.

- Spectrum Chemical Mfg. Corp.

- Stanford Advanced Materials

- Syngenta International AG

- Widerangemetals

- Yara International Ltd.