Global Enzymes Market By Type (Industrial Enzymes and Specialty Enzymes), By Source (Plants, Animals and Microorganism), By Product Type (Carbohydrases, Proteases, Lipases, Polymerases And Nucleases And Others), By Formulation (Powder And Liquid), By Application (Industrial Enzymes (Food And Beverages, Cleaning Product, Biofuel, Animal Feed and Others) and Specialty Enzymes (Pharmaceutical, Research And Biotechnology, Diagnostic and Biocatalysts)), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034.

- Published date: March 2025

- Report ID: 142859

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

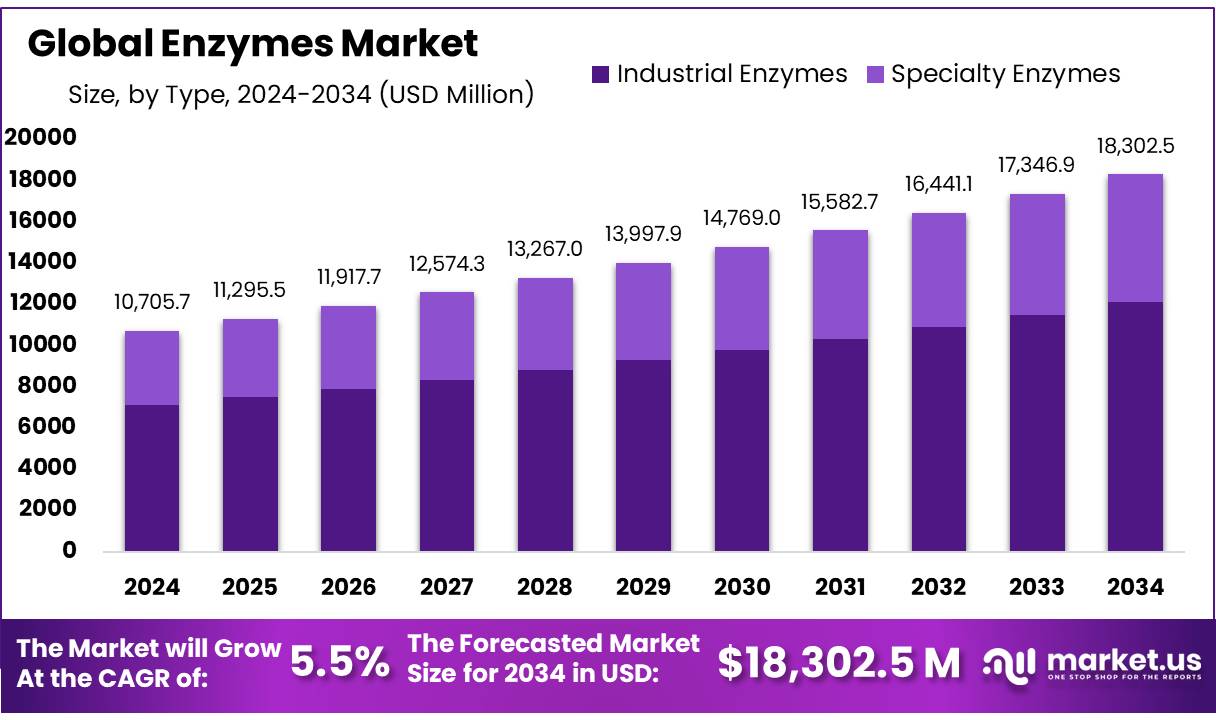

The Global Enzymes Market size is expected to be worth around USD 18,302.5 Million by 2034, from USD 10,705.7 Million in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

The global enzymes market is experiencing significant growth, driven by their expanding applications across various industries. Enzymes, acting as biocatalysts, alter reaction rates and enhance the efficiency of biological processes. Their use spans a wide range of sectors, including food and beverages, animal feed, textiles, detergents, pharmaceuticals, research, manufacturing, leather processing, and agriculture. The integration of enzymes into manufacturing processes has resulted in notable cost savings, reduced energy consumption, and improved substrate activity, contributing to the expansion of the enzymes industry.

Additionally, the food and beverage industry is witnessing increased demand for enzymes due to their ability to break down complex molecules into simpler forms — for instance, converting starch into glucose — which enhances processes such as baking and brewing.

A key driver of the global enzymes market is the rising investment in research and biotechnology. The growing demand for medicinal drugs, coupled with strong funding initiatives and extensive research activities, is expected to further propel the market. In the pharmaceutical sector, enzymes play a critical role in synthesizing intermediates for active pharmaceutical ingredients (APIs), thereby supporting the development of effective medications.

In January 2025, the U.S. Secretary of Commerce announced that the Department’s Economic Development Administration (EDA) selected the Birmingham Biotechnology Hub, led by Southern Research Institute, to receive a Tech Hubs grant of approximately USD 44 million. The grant will support the implementation of five projects designed to establish Alabama as a global leader in drug, vaccine, and diagnostics development. These projects will utilize artificial intelligence (AI)-driven biotechnology to enhance diversity in clinical genomic data and clinical trial representation, fostering innovation in the region’s biotechnology sector.

Key Takeaways

- The global enzymes market is expected to grow significantly with a CAGR of 5.5% to reach USD 18,302.5 Million by 2034

- By type, in 2024 the global market was dominated by industrial enzymes with a significant market share of 66.3%

- Among the source, microorganisms held majority of revenue share in 2024 at 78.3%

- Based on product type, the market was led by carbohydrases with a substantial market share of 49.1% in 2024

- Powdered form enzymes led the global market in the 2024 with an extensive revenue share of 64.2%

- In 2024, the global industrial enzymes market was dominated by food & beverages industry with a significant market share of 40.6%

Driving Factors

Rise of innovative technology in the global enzymes market

Enzyme engineering has undergone significant advancements in recent years, driven by innovations in molecular biology, protein engineering, and bioprocess optimization. These developments have enabled the design and modification of enzymes with tailored properties to meet the specific demands of various industrial applications.

Rational design, a key approach in enzyme engineering, involves the deliberate manipulation of enzyme structure and function based on a comprehensive understanding of enzyme-substrate interactions and catalytic mechanisms. Recent progress in computational modeling, protein structure prediction, and molecular dynamics simulations has further refined rational design techniques. This has allowed researchers to engineer enzymes with enhanced catalytic activity, improved substrate specificity, and greater stability.

In addition, protein engineering employs a range of strategies to modify enzyme properties and optimize their performance for specialized applications. Recent innovations in protein engineering techniques — such as site-directed mutagenesis, domain swapping, and semi-rational design — have enabled the precise alteration of enzyme structures. Through targeted mutations, surface modifications, and the engineering of enzyme active sites, researchers have enhanced substrate specificity, catalytic efficiency, and thermal stability. These strategies have been crucial in developing novel biocatalysts for complex reactions, improving enzyme solubility and expression levels, and adapting enzymes to function with non-natural substrates or under harsh industrial conditions.

Restraining Factors

Stringent regulatory requirements and safety considerations

Stringent regulatory requirements and safety considerations present a significant challenge to the growth of the global enzymes market. Enzyme-based products used across industrial processes must comply with rigorous regulatory standards and undergo extensive safety assessments to ensure their efficacy, quality, and safety for both workers and end consumers. Regulatory frameworks differ across regions and industries, complicating the approval process and limiting market access for enzyme manufacturers.

Moreover, concerns related to allergenicity, toxicity, and potential environmental impacts of enzyme usage necessitate thorough risk evaluations and the implementation of effective mitigation strategies. For instance, under Regulation (EC) No 1332/2008, all food enzymes within the European Union must undergo a safety evaluation by the European Food Safety Authority (EFSA) and receive approval from the European Commission for inclusion in the Union list of food enzymes. A food enzyme is only added to the EU list if it poses no health risk to consumers, fulfills a demonstrated technological need, and does not mislead consumers.

Growth Opportunities

Rapid growth in the global biofuel industry

The rapid expansion of the global biofuel industry presents a significant growth opportunity for the global enzymes market. As the world shifts towards sustainable energy alternatives, biofuels have emerged as a viable substitute for conventional fossil fuels, offering a more environmentally friendly energy source. The production of biofuels relies heavily on enzyme-driven processes, where enzymes facilitate the conversion of complex biomass into simpler compounds, playing a crucial role in bioethanol, biodiesel, and other renewable fuel production.

Biofuel enzymes, such as amylases, cellulases, and lipases, catalyze the breakdown of complex carbohydrates and lipids into fermentable sugars and fatty acid esters. This enzymatic action not only enhances process efficiency but also reduces greenhouse gas (GHG) emissions. For instance, corn ethanol has been shown to cut transportation-related GHG emissions by approximately 21% compared to gasoline. Furthermore, advancements in enzymatic and yeast technologies have enabled producers to extract greater value from raw materials, such as maximizing the yield of co-products from each bushel of corn. This increased resource efficiency minimizes waste and reduces the overall environmental footprint of biofuel production.

According to estimates published by the International Energy Agency (IEA), global biofuel demand is projected to grow by 38 billion liters between 2023 and 2028, marking a nearly 30% increase compared to the previous five-year period. By 2028, total biofuel demand is expected to reach 200 billion liters, with renewable diesel and ethanol accounting for approximately two-thirds of this growth, while biodiesel and biojet fuel contribute to the remaining share.

Latest Trends

Directed evolution techniques

Directed evolution is an advanced strategy for enzyme optimization that replicates natural selection within laboratory settings. It involves generating genetic diversity through methods like random mutagenesis or DNA shuffling, followed by screening or selecting enzyme variants with desired traits. Recent innovations in high-throughput screening, microfluidic platforms, and automated lab systems have accelerated this process, enabling the rapid identification of enhanced enzyme variants. These techniques have proven effective in improving enzyme performance across various industries, including the synthesis of fine chemicals, pharmaceuticals, and biofuels, driving innovation and efficiency in biocatalytic processes.

Advancements in computer-assisted biocatalysis optimization

Researchers from BASF, the Austrian Research Centre of Industrial Biotechnology (acib), and the University of Graz have developed a novel computer-assisted model to enhance enzyme efficiency in chemical production. This model predicts optimal reaction conditions—such as temperature and solvent concentration—thereby reducing the need for extensive laboratory experiments. By enabling faster scaling from lab to industrial manufacturing, this innovation not only lowers costs but also minimizes resource consumption, contributing to more sustainable biocatalytic processes.

By Type Analysis

The demand for industrial enzymes is expected to grow significantly in the coming years. In 2024, the industrial enzymes segment accounted for approximately 66.3% of the global market share revenue. Industrial enzymes, which catalyze chemical reactions, play a crucial role in facilitating various industrial processes and the production of a wide range of products. These enzymes are extensively utilized across multiple sectors, including food & beverages, cleaning products, biofuel, and animal feed, among others.

Notably, the food processing industry dominates more than 40.6% of the industrial enzymes market, driven by the rising global population, increasing purchasing power, and growing consumer awareness regarding health and nutrition. The demand for higher food quality, safer processing methods, and enhanced nutritional value further accelerates this segment’s growth.

Moreover, the commercial use of industrial enzymes, coupled with the development of new applications, has led to significant resource savings, such as reduced raw material and water consumption, while improving energy efficiency. This not only benefits industrial operations but also contributes to environmental sustainability. As emerging applications continue to unfold, the industry remains focused on innovation, introducing advanced enzyme solutions to meet evolving market demands.

By Source Analysis

By source, the global enzymes market is segmented into plants, animals, and microorganisms. In 2024, the microorganisms segment dominated the market, accounting for approximately 78.3% of the total revenue share. Microbial enzyme production has gained significant traction due to its low energy requirements, cost-effectiveness, and eco-friendly nature, making it ideal for various industrial processes. Microbial sources are particularly advantageous as they rapidly form large colonies, are easy to store, and facilitate simpler downstream processing.

The widespread use of microbial enzymes stems from their desirable characteristics, including rapid multiplication, ease of manipulation, and high availability. These enzymes exhibit superior stability, catalytic activity, and ease of production compared to plant and animal enzymes, further boosting their industrial appeal. Microbial enzymes are primarily produced through fermentation processes, with key expression systems involving bacteria such as Escherichia coli, Bacillus, and lactic acid bacteria, as well as filamentous fungi like Aspergillus and yeasts such as Pichia pastoris.

Microbial enzymes play a crucial role across diverse industries, including agriculture, food, chemicals, medicine, and energy. Additionally, advancements in DNA recombinant technology and protein engineering have enabled the manipulation of microbial strains, effectively meeting the rising demand for enzymes and fostering innovation in enzyme-based applications.

By Product Type Analysis

Based on product type, the global enzymes market is segmented into carbohydrases, proteases, lipases, polymerases & nucleases, and others. Among these, the carbohydrases segment emerged as the most lucrative in 2024, capturing a substantial market share of 49.1%. This segment is further categorized into amylases, cellulases, and others. Amylases play a crucial role in breaking down starch into simpler sugars, making them essential for the food industry in the production of sweeteners, syrups, and maltodextrins. Meanwhile, cellulases degrade cellulose—the primary component of plant cell walls—into glucose, with significant applications in the textile industry, particularly in bio-polishing and fabric desizing processes.

Carbohydrases, as a group of enzymes, are extensively used across various industrial sectors, especially in food processing. These enzymes are predominantly derived from microbial sources such as bacteria, yeasts, and fungi, ensuring maximum consistency and efficiency. Broadly, carbohydrases encompass diverse enzymes involved in the hydrolysis and synthesis of carbohydrates, including amylases and invertases used in starch and sucrose syrup production, and β-glucosidase, which enhances flavor profiles in fruit juices and wine.

By formulation Analysis

Based on formulation, market can be segregated as powder and liquid. In 2024, powder based segment dominated the global market with a substantial market share of 64.2%, driven by their stability, extended shelf life, and ease of handling during storage and transportation. Powdered enzymes offer superior thermal stability, making them suitable for applications requiring high-temperature processing, such as in the baking, textile, and detergent industries.

Their ability to maintain enzymatic activity over prolonged periods ensures consistent performance in various industrial processes. Additionally, powder enzymes enable flexible formulation options, allowing manufacturers to customize enzyme blends according to specific application needs. The cost-effectiveness and reduced risk of microbial contamination associated with powder enzymes further enhance their adoption across diverse sector.

By application analysis

The food and beverages industry dominated the global industrial enzymes market, accounting for a significant 40.6% market share in 2024. As one of the primary sectors catering to the growing global population, the food and beverage industry relies heavily on industrial enzymes to streamline production processes across various segments, including dairy products, beverages, and meat, poultry, and seafood. Enzymes such as lipases and proteases are increasingly utilized due to their role in reducing greenhouse gas emissions and minimizing raw material waste.

The use of industrial enzymes offers high-performing, flexible solutions that ensure cost-effective production while maintaining consistent product quality. With continuous innovation in the food industry, enzymes have found expanding applications, particularly in fat modification and sweetener technology. This trend is further supported by advancements in enzyme technology, which enhance the functional properties of food products.

For instance, in November 2024, International Flavors & Fragrances Inc. (IFF) launched TEXSTAR, an advanced enzymatic texturizing solution designed to improve the viscosity of both dairy and plant-based fresh fermented products without the need for added stabilizers.

Enzymes Market Key Segmentation

Based on Type

- Industrial Enzymes

- Specialty Enzymes

Based on Source

- Plants

- Animals

- Microorganisms

Based on product type

- Carbohydrases

- Amylases

- Cellulases

- Others

- Proteases

- Lipases

- Polymerases & Nucleases

- Others

Based on Formulation

- Powder

- Liquid

Based on Application

- Industrial Enzymes

- Food & Beverages

- Dairy & Dairy Products

- Bakery & Confectionery

- Meat Processing

- Nutraceuticals

- Beverages

- Others

- Cleaning Product

- Biofuel

- Animal Feed

- Others

- Food & Beverages

- Specialty Enzymes

- Pharmaceutical

- Research & Biotechnology

- Diagnostic

- Biocatalysts

Regional Analysis

North America dominated the global enzymes market in 2024, accounting for a 35.6% market share, driven by strong demand across key industries such as food and beverages, biofuels, and pharmaceuticals. The increasing preference for natural ingredients has led to a greater reliance on food enzymes in manufacturing, particularly as health-conscious consumers seek clean-label products. Enzymes play a crucial role in food processing, with applications varying across industry segments.

For instance, the dairy sector increasingly utilizes lactase to address lactose intolerance, while the baking industry benefits from enzymes that enhance dough leavening and texture, including those tailored for gluten-free formulations.

Understanding industry-specific needs has become essential for enzyme manufacturers, allowing for the development of targeted enzyme solutions. By segmenting the market based on customer profiles, enzyme producers can address distinct requirements, such as enzymes that enhance milk digestion for dairy manufacturers or those that improve the structural integrity of baked goods.

The United States remains a key hub for food and beverage processing, with 42,708 processing establishments recorded in 2022, according to the U.S. Department of Commerce. California leads with 6,569 food and beverage manufacturing facilities, followed by Texas (2,898) and New York (2,748), further driving the demand for enzyme-based processing solutions.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- India

- Japan

- South Korea

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Key Players Analysis

Key players in the global enzymes market include Novozymes A/S, DSM, DuPont, Associated British Foods Plc, BASF SE, Kerry Group, Soufflet Biotechnologies, and others. These companies are actively focused on product innovation, consistently introducing new biocatalysts and formats to address evolving enzyme handling and labeling processes. To strengthen their market presence, strategic partnerships and acquisitions have become common approaches, enabling companies to expand their reach into new markets and demographics.

For instance, in March 2023, BASF and Cargill expanded their partnership by adding South Korea—the first Asian nation—to their existing feed enzymes development and distribution agreement. This collaboration aims to deliver innovative enzyme-based solutions, providing added value for animal feed customers. Furthermore, in January 2023, the two companies extended their cooperation to include the United States, reinforcing their commitment to advancing feed enzyme technologies. Such strategic moves highlight the competitive landscape of the global enzymes market, where leading players continuously seek to enhance their product portfolios and strengthen their global footprint through collaborative innovations and targeted market expansion initiatives.

Market Key Players

- Novozymes A/S

- DSM

- Dupont

- Associated British Foods Plc

- BASF SE

- Kerry Group

- Soufflet Biotechnologies

- Ajinomoto Co., Inc.

- Amano Enzyme Inc.

- NAGASE Group

- Advanced Enzyme Technologies Limited

- Lesaffre

- Adisseo

- Novus International, Inc.

- Other Key Players

Recent Developments

- In February 2025, Novonesis announced an agreement with dsm-firmenich to dissolve the Feed Enzyme Alliance and undertake full control of its sales and distribution activities. As part of the agreement, Novonesis will pay a total cash consideration of EUR 1.5 billion. This strategic move is expected to strengthen Novonesis’ position in the feed enzyme market by enabling the company to directly manage its commercial operations, enhance customer relationships, and accelerate the development of innovative enzyme solutions.

- In August 2024, Lallemand Inc. announced the completion of an equity investment in Livzym Biotechnologies (“Livzym”) as part of a strategic collaboration in the industrial enzymes sector. This partnership reflects Lallemand’s commitment to expanding its presence in the enzyme industry by leveraging Livzym’s expertise and innovative capabilities.

Report Scope

Report Features Description Market Value (2024) USD 10,705.7 Mn Forecast Revenue (2034) USD 18,302.5 Mn CAGR (2025-2034) 5.5 % Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Geopolitical Impact Analysis, Competitive Landscape, Recent Developments Segments Covered By Type (Industrial Enzymes and Specialty Enzymes), By Source (Plants, Animals and Microorganism), By Product Type (Carbohydrases, Proteases, Lipases, Polymerases & Nucleases And Others), By Formulation (Powder And Liquid), By Application (Industrial Enzymes (Food & Beverages, Cleaning Product, Biofuel, Animal Feed and Others) and Specialty Enzymes (Pharmaceutical, Research & Biotechnology, Diagnostic and Biocatalysts)) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape Novozymes A/S, DSM, Dupont, Associated British Foods Plc, BASF SE, Kerry Group, Soufflet Biotechnologie, Ajinomoto Co., Inc., Amano Enzyme Inc., NAGASE Group, Advanced Enzyme Technologies Limited, Lesaffre, Adisseo, Novus International, Inc. and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Novozymes A/S

- DSM

- Dupont

- Associated British Foods Plc

- BASF SE

- Kerry Group

- Soufflet Biotechnologies

- Ajinomoto Co., Inc.

- Amano Enzyme Inc.

- NAGASE Group

- Advanced Enzyme Technologies Limited

- Lesaffre

- Adisseo

- Novus International, Inc.

- Other Key Players