Global Glucose Biosensors Market By Type (Electrochemical Biosensor, Optical Biosensor, and Other Types), By End-Use (Homecare, Hospitals, and Diagnostic centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 20907

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

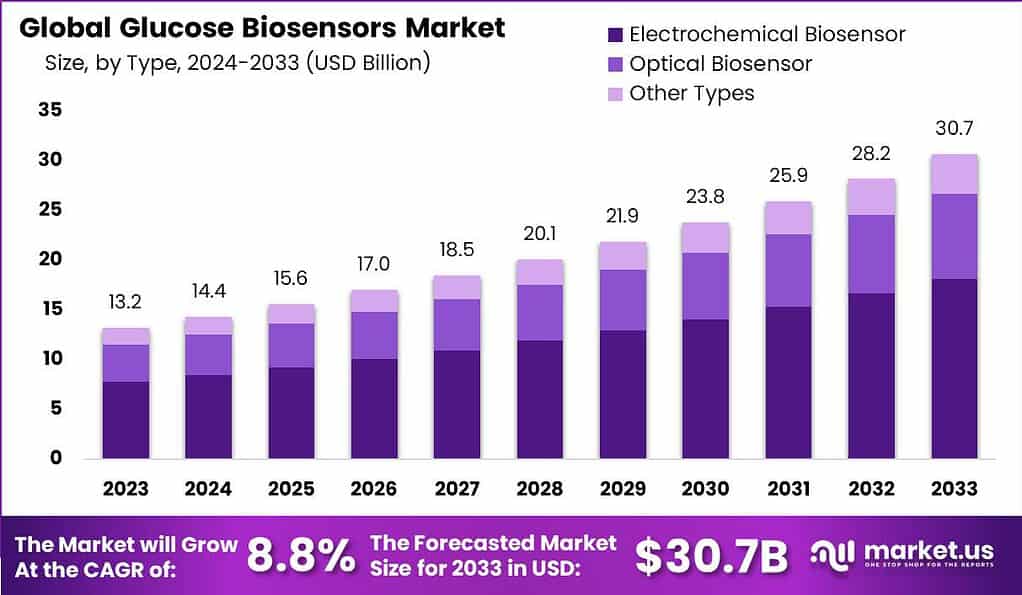

The Global Glucose Biosensors Market size is expected to be worth around USD 30.7 Billion by 2033, from USD 13.2 Billion in 2023, growing at a CAGR of 8.8% during the forecast period from 2024 to 2033.

The Glucose Biosensors Market encompasses a dynamic and rapidly evolving segment within the medical device industry, aimed at providing innovative solutions for real-time glucose monitoring. These biosensors are critical for managing diabetes, offering patients and healthcare providers with precise, instantaneous data to make informed decisions regarding insulin administration and dietary adjustments.

Glucose biosensors leverage enzymatic or non-enzymatic detection methods to measure glucose levels in the body, primarily through interstitial fluid or blood samples. The market is driven by advancements in technology, increasing prevalence of diabetes worldwide, and a growing demand for non-invasive monitoring solutions.

For instance, According to Elsevier Ltd. in July 2023, projections indicate that by 2050, over ~1.31 billion people worldwide may be affected by diabetes, making it a leading cause of death and health issues globally. This widespread impact presents a significant opportunity for healthcare and pharmaceutical sectors to address the escalating need for effective diabetes management solutions.

In the competitive landscape of the glucose biosensors market, 2022 was a year marked by significant achievements and strategic positioning by leading companies. Dexcom, with its innovative G6 and newly launched G7 continuous glucose monitoring (CGM) systems, secured a dominant 38% market share, generating an impressive $2.5 billion in revenue.

This performance underscores the company’s commitment to technological advancement and market leadership. Close on its heels, Abbott captured a 35% market share with its FreeStyle Libre system, a testament to its stronghold in the market and reporting over $3.5 billion in diabetes care sales.

The 2023 estimates suggest a notable shift in market dynamics. Dexcom’s market share is projected to adjust to 24.8%, with revenues expected to climb to $3.02 billion, reflecting a broadening of the competitive field and possibly the impact of new entrants or enhanced product offerings by rivals.

Abbott is anticipated to hold a 23.1% share, with a staggering revenue increase, indicative of its diversified portfolio and effective market penetration strategies. Medtronic and Senseonics, with 12.1% and 3.1% market shares respectively, underscore the diverse ecosystem of players in the CGM segment, highlighting varied approaches to innovation and market engagement.

Key Takeaways

- Market Size Projection: The global glucose biosensors market is estimated to reach a substantial value of USD 30.7 billion by 2033, indicating robust growth prospects with a CAGR of 8.8% throughout the forecast period.

- Market Dynamics: Advancements in technology, coupled with the increasing prevalence of diabetes worldwide, are key drivers propelling the growth of the glucose biosensors market. These biosensors play a critical role in real-time glucose monitoring, aiding patients and healthcare providers in making informed decisions regarding insulin administration and dietary adjustments.

- Market Leaders: Dexcom and Abbott emerged as frontrunners in the glucose biosensors market in 2022. Dexcom secured a dominant 38% market share with its innovative G6 and G7 continuous glucose monitoring (CGM) systems, while Abbott captured a 35% market share with its FreeStyle Libre system.

- Market Dynamics Shift: Market dynamics shifted in 2023, with Dexcom’s market share projected to adjust to 24.8%, and Abbott anticipated to hold a 23.1% share. This reflects a broader competitive field and possibly the impact of new entrants or enhanced product offerings by rivals.

- Type Analysis: Electrochemical biosensors dominated the market in 2023, capturing over 59.2% share. This segment’s robust performance is attributed to its accuracy, affordability, and user-friendly nature, making it indispensable for continuous glucose monitoring (CGM) systems.

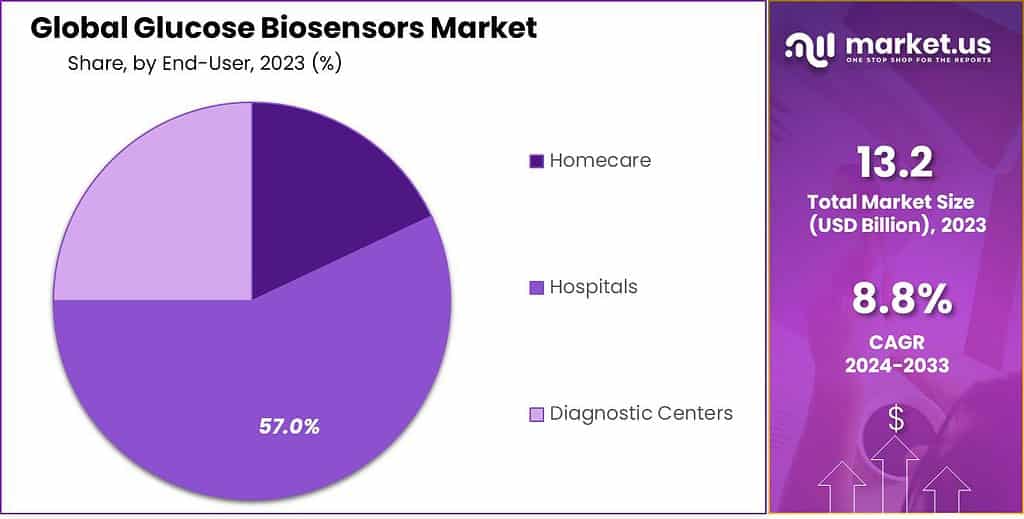

- End-Use Analysis: Hospitals held a dominant market position in 2023, capturing over 57.0% share. This can be largely attributed to the critical role hospitals play in diabetes diagnosis and management, necessitating accurate and reliable glucose biosensors.

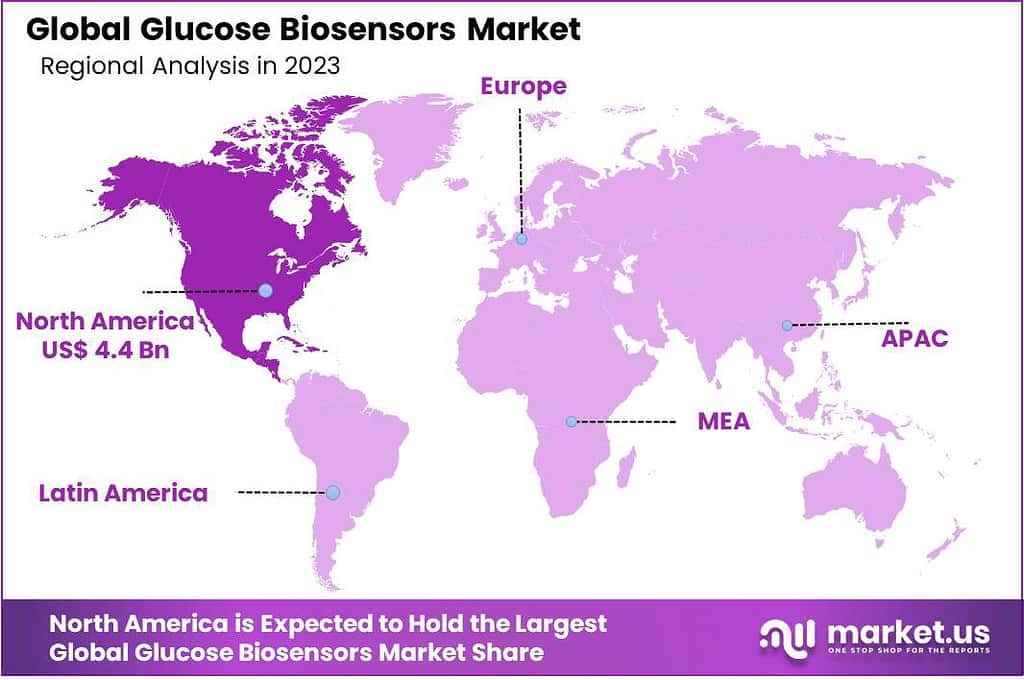

- Regional Analysis: North America led the glucose biosensors market in 2023, with a dominant share of over 33.4%. Factors contributing to this strong market presence include advanced healthcare infrastructure, a high prevalence of diabetes, and favorable reimbursement policies.

Type Analysis

In 2023, the Electrochemical Biosensor segment held a dominant market position, capturing more than a 59.2% share. This impressive market share can be attributed to the segment’s robust performance driven by its accuracy, affordability, and user-friendly nature.

Electrochemical biosensors, utilized extensively in glucose monitoring, have become indispensable for patients managing diabetes, offering them real-time insights into their glucose levels. This technology’s leading edge lies in its direct electrical output, making it easier to integrate with digital devices and apps, thus enhancing patient monitoring and data management.

The appeal of electrochemical biosensors extends beyond their technical advantages. These devices have benefited from significant investments in research and development, leading to continuous improvements in sensitivity, specificity, and miniaturization. As a result, they offer a compelling combination of reliability and convenience for continuous glucose monitoring (CGM) systems.

The market’s inclination towards non-invasive and minimally invasive diabetes management solutions has further fueled the demand for electrochemical biosensors. Their ability to provide accurate readings with minimal discomfort positions them as a preferred choice for patients and healthcare providers alike.

Moreover, the cost-effectiveness of electrochemical biosensors has played a crucial role in their market dominance. Compared to other biosensor types, they offer a more affordable solution for continuous monitoring, making them accessible to a broader segment of the population.

This affordability, coupled with the global rise in diabetes prevalence, underscores the segment’s substantial market share and forecasts its continued growth. With advancements in technology and a focus on patient-centered care, the electrochemical biosensor segment is poised to maintain its leadership in the glucose biosensors market.

End-Use Analysis

In 2023, the Hospitals segment held a dominant market position, capturing more than a 57.0% share. This substantial market share can be largely attributed to the critical role hospitals play in the diagnosis and management of diabetes. Hospitals are at the forefront of providing comprehensive care, from initial diagnosis to advanced treatment options for diabetes.

This setting necessitates the availability and utilization of accurate and reliable glucose biosensors, making them indispensable tools within these institutions. The reliance on these devices in hospitals is driven by the need for precise glucose monitoring to inform treatment decisions, manage emergency cases of hyperglycemia or hypoglycemia, and monitor patients post-operatively or in intensive care units.

The leadership of the Hospitals segment is further reinforced by the growing adoption of technologically advanced glucose monitoring systems within these settings. Hospitals are increasingly investing in the latest biosensor technologies to improve patient outcomes, reduce the risk of complications, and streamline diabetes management protocols.

This adoption is supported by the healthcare sector’s broader push towards digitalization and smart healthcare solutions, integrating continuous glucose monitoring (CGM) systems with hospital information systems for real-time data access and better patient management. Additionally, the increase in hospital admissions due to diabetes and its complications underscores the segment’s significant share.

With diabetes reaching epidemic proportions globally, the demand for in-hospital glucose monitoring solutions has surged, driving the growth of the Hospitals segment. The ability to offer timely and effective glucose management within the hospital setting is crucial, not only for the immediate well-being of patients but also for their long-term health outcomes, further solidifying the segment’s leading position in the glucose biosensors market.

Key Market Segments

By Type

- Electrochemical biosensor

- Optical biosensor

- Other Types

By End-use

- Homecare

- Hospitals

- Diagnostic centers

Driver

Technological Advancements in Glucose Monitoring

The global glucose biosensors market is experiencing significant growth, primarily driven by technological advancements in glucose monitoring devices. Innovations such as non-invasive biosensors, continuous glucose monitoring (CGM) systems, and integration with digital health platforms have enhanced the accuracy, convenience, and efficiency of diabetes management.

These advancements address the critical need for real-time monitoring of glucose levels, enabling patients to make informed decisions about their diet, exercise, and insulin intake. For instance, the introduction of devices that can seamlessly sync with smartphones and wearable technology has enabled users to monitor their glucose levels more discreetly and efficiently, fostering a more proactive approach to diabetes management.

Additionally, the development of smart biosensors that can seamlessly connect to smartphones and wearable devices has improved patient compliance and engagement. The ability to track glucose levels continuously and receive instant feedback has revolutionized diabetes care, making it easier for patients to manage their condition effectively.

Restraint

High Cost and Affordability Issues

Despite the advancements and benefits of glucose biosensors, high costs associated with CGM systems and advanced biosensor technologies remain a significant restraint. The initial purchase price, along with ongoing expenses for sensor replacements and maintenance, can be prohibitive for many patients, especially those in low- and middle-income countries. This affordability issue limits the widespread adoption of advanced glucose monitoring systems, confining their use to a segment of the population that can bear the cost.

Moreover, the lack of comprehensive insurance coverage for these technologies in several regions further exacerbates the issue, making it challenging for a broad base of patients to access these life-saving devices. The high cost and affordability issues thus represent a major barrier to the global penetration and adoption of glucose biosensors, hindering the market’s growth potential.

Opportunity

Rising Prevalence of Diabetes Globally

The escalating prevalence of diabetes worldwide presents a significant opportunity for the expansion of the glucose biosensors market. According to the International Diabetes Federation, the number of people with diabetes is expected to rise to 642 million by 2040. This alarming increase in diabetes cases globally is driving the demand for efficient and accurate glucose monitoring solutions.

Glucose biosensors play a crucial role in managing diabetes, offering patients the ability to monitor their glucose levels in real-time and adjust their lifestyle and medication accordingly. The growing diabetes epidemic, coupled with increasing awareness about the importance of regular glucose monitoring, is expected to boost the demand for glucose biosensors. This trend offers manufacturers an opportunity to innovate and expand their product offerings to cater to the growing needs of the diabetes population.

Challenge

Regulatory and Reimbursement Hurdles

One of the significant challenges facing the global glucose biosensors market is navigating the complex regulatory landscape and securing reimbursement approvals. The process of obtaining regulatory clearance for new biosensor technologies can be lengthy and costly, involving rigorous testing and validation to meet safety and efficacy standards set by regulatory bodies such as the FDA and EMA.

Furthermore, securing reimbursement from insurance companies and health systems is another critical hurdle. Reimbursement policies vary widely across different countries, and the lack of uniformity can complicate market entry and expansion.

Manufacturers must demonstrate not only the clinical benefits but also the cost-effectiveness of their devices to gain reimbursement approval. These regulatory and reimbursement challenges can delay the introduction of innovative glucose monitoring solutions to the market, limiting patient access to the latest technologies.

Growth Factors

- Rising Prevalence of Diabetes: The increasing number of diabetes patients globally is a primary driver of the glucose biosensors market. This trend is fueled by unhealthy lifestyles, such as poor diet and physical inactivity, which increase the demand for effective glucose monitoring solutions.

- Technological Advancements: Continuous innovations in biosensor technology enhance the accuracy, sensitivity, and user-friendliness of glucose monitoring devices. Developments in electrochemical and optical biosensors are particularly notable for their improved performance and reliability.

- Government Support and Awareness Campaigns: Supportive government policies and initiatives aimed at diabetes management, along with increased awareness campaigns, especially in rural areas, contribute significantly to the growth of the glucose biosensors market.

- Integration with Smart Devices: The ability to integrate glucose biosensors with smart devices and wearables enhances their functionality and convenience, making them more appealing to users. This integration supports continuous and real-time glucose monitoring, which is crucial for effective diabetes management.

- Demand for Non-Invasive Monitoring Techniques: There is a growing consumer preference for non-invasive glucose monitoring technologies. These devices eliminate the need for finger pricks, making glucose monitoring less painful and more convenient, thus driving user adoption and market growth.

Emerging Trends

- Wearable and Implantable Biosensors: The development of wearable and implantable glucose biosensors is rapidly progressing. These devices promise continuous monitoring without the need for active user intervention, representing a significant advancement in patient care and diabetes management

- Eco-Friendly Designs: There is an increasing focus on developing eco-friendly biosensor designs that reduce environmental impact while maintaining device efficacy and safety.

- Enhanced Data Integration and Sharing: Advances in data integration capabilities allow for better tracking and management of diabetes. Modern glucose biosensors can share data with healthcare providers in real-time, improving the quality of care and enabling more personalized treatment plans.

- Expansion of Home Healthcare Applications: As home healthcare becomes more prevalent, glucose biosensors are increasingly designed for easy use in non-clinical settings. This trend is driven by the need for devices that support remote monitoring and management of chronic conditions like diabetes.

- Non-Invasive and Minimally Invasive Technologies: Innovations continue in developing non-invasive and minimally invasive glucose monitoring technologies, which are highly desirable for reducing the discomfort associated with traditional blood glucose testing methods.

Regional Analysis

In 2023, North America held a dominant market position in the Glucose Biosensors market, capturing more than a 33.4% share. The demand for Glucose Biosensors in North America was valued at US$ 4.4 billion in 2023 and is anticipated to grow significantly in the forecast period.

The region’s strong market presence can be attributed to several factors. Firstly, North America boasts advanced healthcare infrastructure and a high prevalence of diabetes, driving the demand for glucose biosensors. Additionally, the region has witnessed significant investments in research and development activities, fostering technological advancements in biosensors for glucose monitoring.

Moreover, favorable reimbursement policies and extensive awareness campaigns related to diabetes management have further propelled the adoption of glucose biosensors in North America. Following North America, Europe emerged as a prominent market for glucose biosensors, accounting for a substantial market share. The region’s well-established healthcare systems, increasing diabetic population, and growing focus on personalized healthcare have contributed to the market’s growth.

Europe also benefits from significant government initiatives aimed at improving diabetes prevention and management, supporting the uptake of glucose biosensors. With the introduction of innovative products and ongoing research in the region, Europe is expected to maintain a strong position in the glucose biosensors market.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Leading companies are enhancing their product portfolios through advancements in their offerings, leveraging strategic collaborations, and pursuing acquisitions and regulatory approvals. These efforts aim to broaden their customer reach and secure a more significant portion of the market share.

These companies are at the forefront of technological advancements, offering sophisticated solutions to meet the growing demands for accurate and convenient glucose monitoring. Their efforts are crucial in driving the market forward, enhancing patient outcomes, and facilitating diabetes management on a global scale.

Abbott stands out as a leader in the glucose monitoring market, primarily through its revolutionary FreeStyle Libre system, a continuous glucose monitoring (CGM) device that has significantly impacted the way diabetes is managed. The company’s focus on innovation and patient-centered solutions has solidified its position in the market.

Top Market Leaders

- Abbott Laboratories

- Medtronic plc

- Ascenia Diabetes Care

- DexCom, Inc.

- LifeScan, Inc.

- B. Braun Melsungen AG

- AgaMatrix, Inc.

- Trividia Health, Inc.

- ARKRAY, Inc.

- ACON Laboratories, Inc.

- Sinocare Inc.

- Other Key Players

Recent Developments

- In October 2023, DexCom entered into a strategic partnership with a leading telehealth provider to integrate its CGM data into broader telehealth services, aiming to enhance remote diabetes management.

- In July 2023, LifeScan announced the launch of OneTouch Verio Reflect, a new glucose monitoring system that features Blood Sugar Mentor technology, offering personalized guidance, insights, and encouragement based on blood glucose results

- In June 2023, Abbott expanded its portfolio with the launch of the FreeStyle Libre 3, the latest iteration of its continuous glucose monitoring (CGM) system, which offers real-time glucose readings with enhanced accuracy and connectivity feature.

- In March 2023, Medtronic launched the Guardian Connect CGM system in new international markets, expanding its global footprint and making advanced glucose monitoring technology more accessible.

Report Scope

Report Features Description Market Value (2023) US$ 13.2 Bn Forecast Revenue (2033) US$ 30.7 Bn CAGR (2024-2033) 8.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Electrochemical Biosensor, Optical Biosensor, and Other Types), By End-Use (Homecare, Hospitals, and Diagnostic centers) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Abbott Laboratories, Medtronic plc, Ascenia Diabetes Care, DexCom Inc., LifeScan Inc. , B. Braun Melsungen AG, AgaMatrix Inc., Trividia Health Inc., ARKRAY, Inc., ACON Laboratories Inc., Sinocare Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Glucose Biosensors?Glucose biosensors are devices designed to measure glucose levels in the body. They are commonly used by individuals with diabetes to monitor their blood sugar levels.

How big is the glucose biosensors market?The Global Glucose Biosensors Market size is expected to be worth around USD 30.7 Billion by 2033, from USD 13.2 Billion in 2023, growing at a CAGR of 8.8% during the forecast period from 2024 to 2033.

Who are the key players in glucose biosensor market?Some of the key players in the glucose biosensors market include Abbott Laboratories, Medtronic plc, Ascenia Diabetes Care, DexCom Inc., LifeScan Inc. , B. Braun Melsungen AG, AgaMatrix Inc., Trividia Health Inc., ARKRAY, Inc., ACON Laboratories Inc., Sinocare Inc., Other Key Players

Which region will contribute notably towards the global glucose biosensor market value?In 2023, North America held a dominant market position in the Glucose Biosensors market, capturing more than a 33.4% share.

What are the factors driving the glucose biosensor market?The factors driving the glucose biosensors market include the increasing prevalence of diabetes, rising awareness about the importance of glucose monitoring, technological advancements in biosensor technology, and the growing demand for continuous glucose monitoring (CGM) systems.

-

-

- Abbott Laboratories

- Medtronic plc

- Ascenia Diabetes Care

- DexCom, Inc.

- LifeScan, Inc.

- B. Braun Melsungen AG

- AgaMatrix, Inc.

- Trividia Health, Inc.

- ARKRAY, Inc.

- ACON Laboratories, Inc.

- Sinocare Inc.

- Other Key Players