Mobile Hospitals Market By Type (Accident & Emergency Care Facility, General Surgery Facility, Diagnostics & Imaging Facility, Specialized Surgery Facilty, Dental & Ophthalmic Facility and Others) By Function (Observation, Therapy /Treatment, Consultation, Intensive Care and Others) By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec 2023

- Report ID: 74676

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

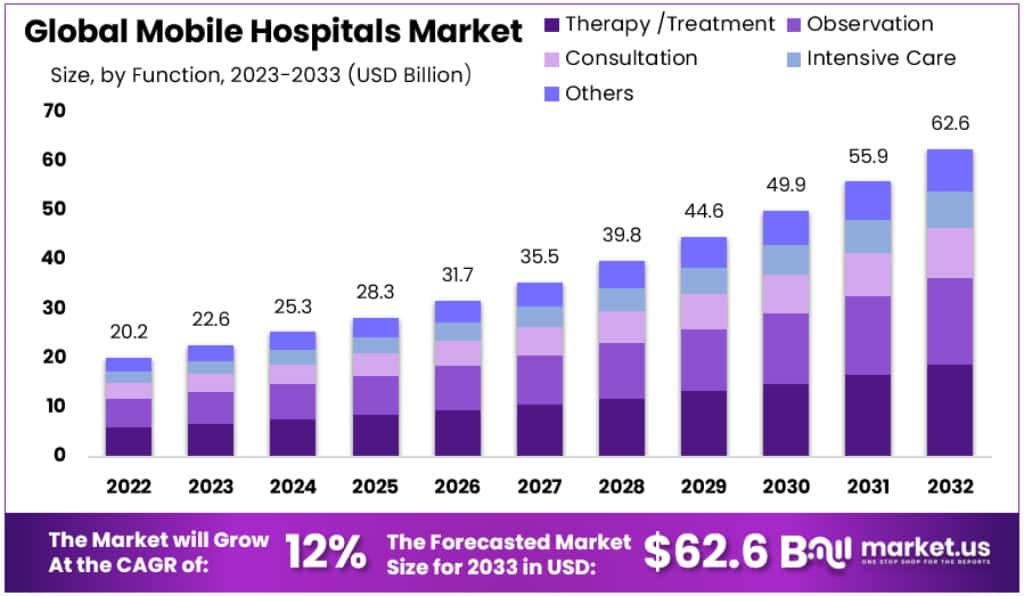

The Global Mobile Hospitals Market size is expected to be worth around USD 62.6 Billion by 2033, from USD 22.6 Billion in 2023, growing at a CAGR of 12% during the forecast period from 2023 to 2033.

Mobile hospitals are medical centers or small hospitals with the necessary equipment and facilities that can be moved from one location to another. Mobile hospitals can offer medical assistance to individuals in need in crucial situations such as warfare activities, natural disasters, and civil unrest.

Mobile hospitals look after patients who require immediate treatment on-site before being admitted to brick-and-mortar hospitals. Intensive care and advanced life support, essential pharmaceutical support, resuscitation and stabilization, life & limb-saving surgical interventions, treatment & observation of infectious diseases, common medical conditions, general & local anesthesia, and basic dental services are among the services provided by mobile hospitals.

Mobile hospitals are efficient and flexible to meet the same needs as conventional hospitals. These hospitals are configured with a changing entrance room and a sterilization room.

Key Takeaways

- The Global Mobile Hospitals Market is expected to reach approximately USD 62.6 Billion by 2033, up from USD 22.6 Billion in 2023.

- This market is projected to experience a Compound Annual Growth Rate (CAGR) of 12% from 2023 to 2033.

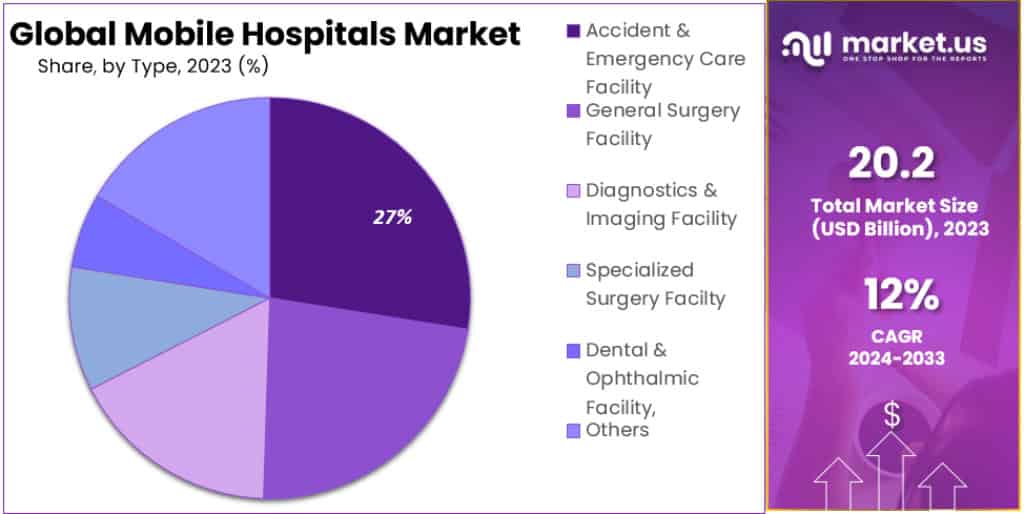

- In 2023, the Accident & Emergency Care Facility segment held the largest market share at over 27.5%.

- Therapy/Treatment services dominated the market in 2023, accounting for more than 29.8% of the share.

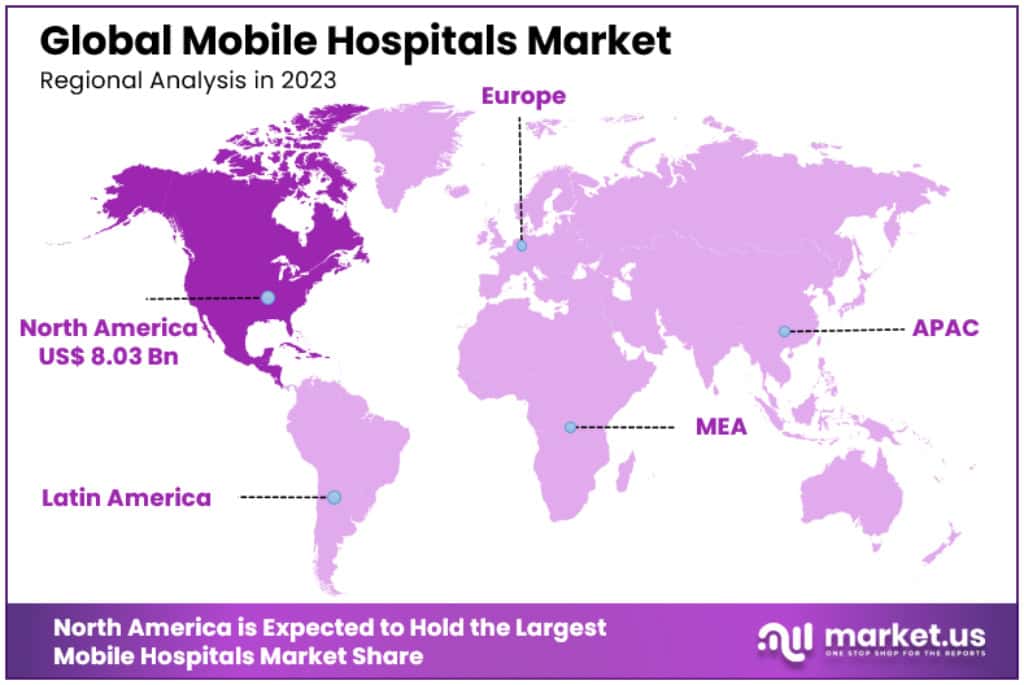

- North America is expected to command a dominant 39.8% share of the market in 2023, with a value of USD 8.3 Billion.

- The Asia Pacific region is emerging as a key player, with significant growth potential driven by countries like India and China.

Type Analysis

In 2023, the Accident & Emergency Care Facility segment held a dominant market position in the mobile hospitals market, capturing more than a 27.5% share. This segment’s prominence is largely due to the increasing demand for immediate and accessible healthcare services in remote and disaster-prone areas. The facilities are equipped to provide rapid response to accidents and emergencies, showcasing their critical role in healthcare delivery, especially in regions with limited access to permanent hospital structures.

The General Surgery Facility segment also plays a significant role in the mobile hospitals market. These units are designed to offer essential surgical services in areas where such facilities are scarce or non-existent. Their importance is underscored in situations where permanent hospital facilities are overburdened or unreachable, providing a vital service in surgical care.

Diagnostics & Imaging Facility is another key segment, offering advanced diagnostic services in a mobile setting. This segment addresses the growing need for accessible diagnostic services, including X-rays, ultrasound, and other imaging technologies, crucial for timely and accurate diagnosis of medical conditions.

Specialized Surgery Facility represents a niche but important segment, providing specialized surgical treatments such as orthopedic, cardiac, or neurological surgeries in a mobile setup. This segment caters to specific medical needs that are not commonly available in all regions, highlighting its importance in specialized healthcare delivery.

The Dental and Ophthalmic Facility segment, though smaller, addresses the essential need for dental and eye care services in remote areas. These facilities are particularly important in areas where such specialized care is not readily available, underscoring their role in comprehensive healthcare provision.

Other segments in the mobile hospitals market include various specialized units designed to meet specific healthcare needs. These may encompass units for maternity care, mental health services, or chronic disease management, among others, indicating the market’s adaptability and response to diverse healthcare requirements.

Function Analysis

In 2023, the Therapy/Treatment segment held a dominant market position in the mobile hospitals market, capturing more than a 29.8% share. This segment’s strong performance is driven by the increasing need for immediate medical interventions in various settings, including disaster zones and remote areas. Mobile hospitals specializing in therapy and treatment provide essential services such as wound care, medication administration, and post-surgical care, catering to urgent health needs on the move.

Observation functions in mobile hospitals are also crucial, representing a significant portion of the market. These units are instrumental in monitoring patients with acute or chronic conditions, ensuring continuous care in environments where traditional hospital facilities are unavailable or inaccessible. Their role in patient monitoring and early detection of complications is pivotal in managing health outcomes effectively.

Consultation services in mobile hospitals offer vital healthcare access, especially in underserved areas. This segment includes general medical advice, disease management guidance, and health education, playing a key role in preventive care and early diagnosis. The mobility of these units extends the reach of healthcare professionals, bridging gaps in primary care services.

The Intensive Care segment, though smaller, is critical for providing high-level care in emergency situations. These mobile units are equipped with advanced medical technologies and staffed by specialized personnel to handle critical cases, such as severe injuries or life-threatening conditions, offering a lifeline in scenarios where traditional ICU facilities are too distant.

Other functions in the mobile hospitals market encompass a range of specialized services tailored to meet specific healthcare needs. This can include mental health services, maternity care, and pediatric care, among others. These specialized units reflect the market’s versatility and commitment to addressing a broad spectrum of healthcare demands in varying environments.

Key Market Segments

Based on Type

- Accident & Emergency Care Facility

- General Surgery Facility

- Diagnostics & Imaging Facility

- Specialized Surgery Facility

- Dental & Ophthalmic Facility

- Others

Based on Function

- Observation

- Therapy /Treatment

- Consultation

- Intensive Care

- Others

Drivers

- Emergency Response Teams and Disaster Incidents: The need for quick and effective medical responses in disaster zones and remote areas is a primary driver. According to a study, the increasing rate of accidents and natural disasters has significantly boosted the demand for mobile hospitals. Governments worldwide are ramping up funding for mobile healthcare, further fueling market growth.

- COVID-19 Pandemic Impact: During the COVID-19 crisis, mobile hospitals proved crucial in providing healthcare to isolated and displaced individuals. As reported in a 2020 article, “Mobile health clinic model in the COVID-19 pandemic: Lessons Learned and Opportunities for Policy Changes and Innovation”, these units played a vital role in healthcare delivery during the pandemic.

- Technological Advancements: The market is propelled by advancements in medical technology and telehealth. The integration of telemedicine services, remote diagnostics, and real-time patient monitoring has expanded the capabilities of mobile hospitals.

- Aging Population: With the global aging population, there’s an increased demand for healthcare services. The World Population Prospects 2022 report projects a significant rise in the population aged 65 years or above, driving the need for mobile healthcare services.

Restraints

- Limited Awareness and Accessibility: Many people remain hesitant to use mobile healthcare units due to limited awareness of their efficiency. This hesitancy hinders market growth.

- Continuity of Care Challenges: Mobile hospitals face challenges in maintaining continuity of care. Their integration into the broader healthcare system is still evolving, impacting their effectiveness in long-term patient care.

- Skilled Workforce Shortage: A global shortage of qualified specialists and operators restricts the expansion of the mobile hospitals market.

Opportunities

- Emerging Markets in Asia Pacific: Countries like India and China present significant growth potential due to their large patient populations and increasing prevalence of infectious diseases. Government initiatives for chronic illness treatment in rural areas are expected to boost market expansion.

- Geriatric Care: The increasing geriatric population, especially in regions like Eastern and South-Eastern Asia and Sub-Saharan Africa, presents vast opportunities for mobile clinics, as this demographic significantly influences the demand for healthcare services.

- Rising Demand in Remote Areas: With increasing healthcare needs in remote regions and ongoing renovations of existing hospitals, mobile hospitals are becoming more crucial. As per the United Nations Office for the Coordination of Humanitarian Affairs (OCHA), mobile clinics played a vital role in 2021, serving over 73,000 people, with beneficiaries of medical services exceeding 91,000. This trend indicates a growing market opportunity.

Challenges

- Infrastructure and Operational Limitations: Mobile hospitals, while versatile, face challenges in terms of infrastructure and operational capabilities. Scaling these units to provide comprehensive care can be complex and resource-intensive.

- Integration into Healthcare Systems: Fully integrating mobile hospitals into existing healthcare systems remains a challenge, impacting their overall effectiveness and ability to provide continuous care.

Trends

- Rise in Chronic Diseases: The increasing incidence of chronic diseases globally, including diabetes and COPD, is influencing the demand for mobile healthcare services.

- Government Initiatives: Governments are actively supporting mobile healthcare initiatives. For example, in March 2022, China’s donation of mobile clinics to Sierra Leone demonstrated this trend.

- Increased Healthcare Expenditure: The overall increase in healthcare spending globally is also contributing to the growth of the mobile hospital market.

Regional Analysis

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The global mobile hospitals market is a dynamic and diverse landscape dominated by established players like Alvo Medical, Aspen Medical, CGS Premier, and Saba Palaye. These companies offer comprehensive healthcare solutions, deploying mobile hospitals and clinics for diverse applications, from emergency situations to remote locations. Alongside them, Vanguard Healthcare Solutions and Vetter GmbH cater to the North American and European markets respectively, while U-PROJECT brings its innovative modular units to the table.

Additionally, regional players like EMS Healthcare Ltd. and La Clinica Health Centers ensure underserved communities have access to healthcare, while Coastal Community Health Services and Lamboo Mobile Medical focus on rural and coastal regions. Other smaller players contribute to the market’s dynamism, offering specialized solutions and catering to specific regional demands. This competitive landscape fosters innovation and ensures the constant evolution of mobile hospitals, ultimately providing crucial healthcare services to communities worldwide.

Market Key Players

- Alvo Medical

- Aspen Medical

- CGS Premier

- Saba Palaye

- Vanguard Healthcare Solutions

- Vetter GmbH

- U-PROJECT

- EMS Healthcare Ltd.

- La Clinica Health Centers

- Coastal Community Health Services

- Lamboo Mobile Medical

- Other Key Players

Recent Developments

- November 2023: WHO and Siemens Healthineers Collaboration: The World Health Organization (WHO) joined forces with Siemens Healthineers, a prominent medical technology company, to set up mobile hospitals in 10 countries with developing economies by 2025. The goal of this initiative is to bring crucial healthcare services to communities that currently lack adequate medical facilities.

- November 2023: Inmarsat and eHealth Africa’s Telemedicine Platform: Inmarsat, known for its global satellite communications, partnered with eHealth Africa to introduce a new telemedicine platform tailored for mobile hospitals. This innovative platform will allow doctors to diagnose and treat patients remotely, greatly improving medical care in remote locations where traditional healthcare is hard to access.

- November 2023: Royal Philips Expands Mobile Imaging Portfolio: Royal Philips, a leader in healthcare technology, announced its plans to enhance its range of mobile X-ray and ultrasound devices. These portable imaging tools are designed specifically for use in mobile hospitals, allowing for immediate diagnosis and treatment right at the patient’s location.

Report Scope

Report Features Description Market Value (2023) USD 22.6 Billion Forecast Revenue (2033) USD 62.6 Billion CAGR (2023-2032) 12% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Accident & Emergency Care Facility, General Surgery Facility, Diagnostics & Imaging Facility, Specialized Surgery Facilty, Dental & Ophthalmic Facility and Others) By Function (Observation, Therapy /Treatment, Consultation, Intensive Care and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Alvo Medical, Aspen Medical, CGS Premier, Saba Palaye, Vanguard Healthcare Solutions, Vetter GmbH, U-PROJECT, EMS Healthcare Ltd., La Clinica Health Centers, Coastal Community Health Services, Lamboo Mobile Medical and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alvo Medical

- Aspen Medical

- CGS Premier

- Saba Palaye

- Vanguard Healthcare Solutions

- Vetter GmbH

- U-PROJECT

- EMS Healthcare Ltd.

- La Clinica Health Centers

- Coastal Community Health Services

- Lamboo Mobile Medical

- Other Key Players