Global Ophthalmic Devices Market By Product (Vision Care Products, Surgical Devices, Diagnostics & Monitoring Devices), By Application (Cataract, Glaucoma, Vitreo Retinal Disorders, Refractor Disorders, Other Applications). By End-User (Hospital and Eye Clinics, Academic and Research Laboratory, Other End Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 36313

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

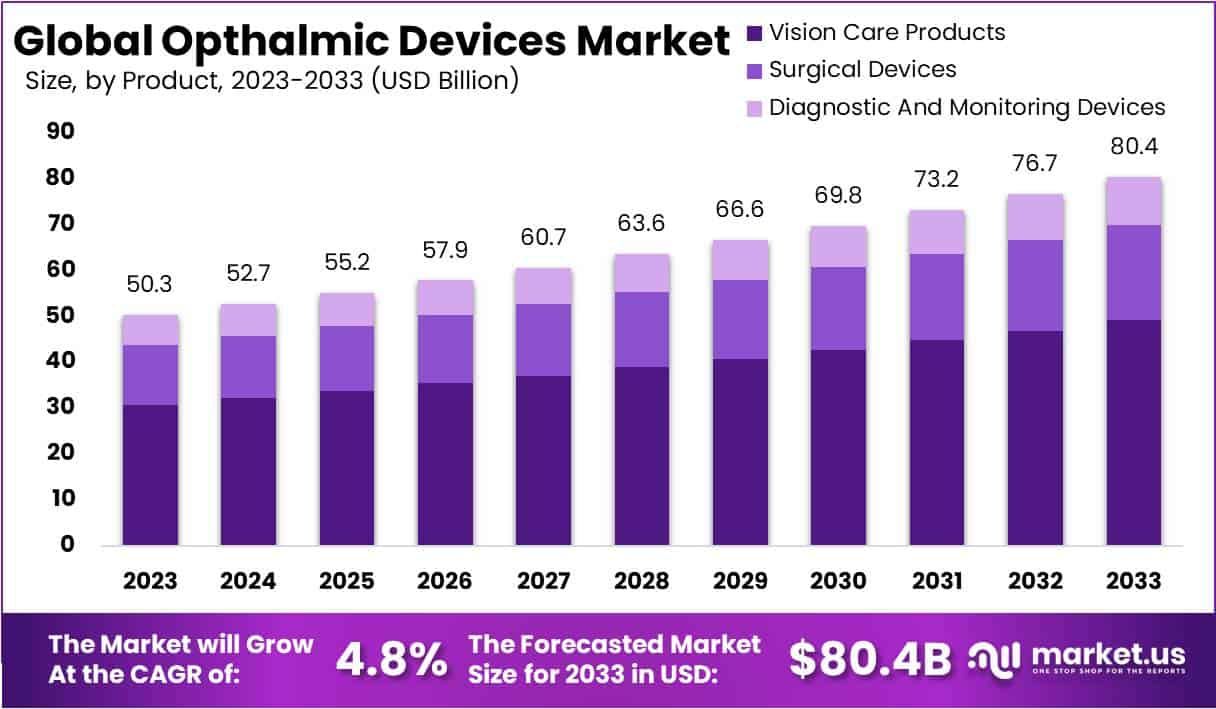

The Global Ophthalmic Devices Market size is expected to be worth around USD 80.4 Billion by 2033 from USD 50.3 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2023 to 2032.

The market growth can be driven by the increasing prevalence of optical disorders like glaucoma, diabetic retinopathy, cataract, and vitreoretinal disorders, technical advancements in ophthalmic surgery, as well as diagnostic devices required for these target applications. As they are more likely to have age-related ophthalmic problems, the aging population is driving up demand for ophthalmic devices. The base for market expansion is also expected to be expanded by improved government measures to raise awareness of visual impairment.

The COVID-19 pandemic’s lockdown measures have led to increased screen time, which has been linked to the beginning and spread of a number of eye disorders. Accurate ocular disease diagnosis and treatment have been made possible by technological advancements. A better understanding of cataracts and macular degeneration and dry eye disease is now possible because of improvements in medication, laser technology, and surgical methods.

Ophthalmic devices are likely to be used more often as a result of minimally invasive procedures including multi-wavelength diabetic retinopathy treatment, ultrasonic phacoemulsification, and femtosecond laser surgery. These procedures result in better clinical outcomes and shorter recovery periods.

Key Takeaways

- Market Growth Projection: Ophthalmic Devices Market set to reach USD 80.4 Bn by 2033, growing at 4.8% CAGR from 2023’s USD 50.3 Bn.

- Driving Factors: Aging population, government initiatives, and COVID-19 contribute to market growth, fostering demand for advanced ophthalmic solutions.

- Restraining Factors: Limited healthcare spending in emerging nations, high costs, and restricted accessibility hinder market expansion.

- Growth Opportunities: Clinics’ rise, awareness increase, and ambulatory centers drive demand, offering substantial growth opportunities.

- Trending Factors: Innovation in tools and micro-invasive glaucoma implants fuel demand for ophthalmic devices.

- Product Dominance: Vision Care Products hold a dominant market share of 61.2% in 2023, driven by eyeglasses and contact lenses demand.

- Application Dynamics: Cataract segment leads with a 48.9% market share in 2023, poised for significant expansion.

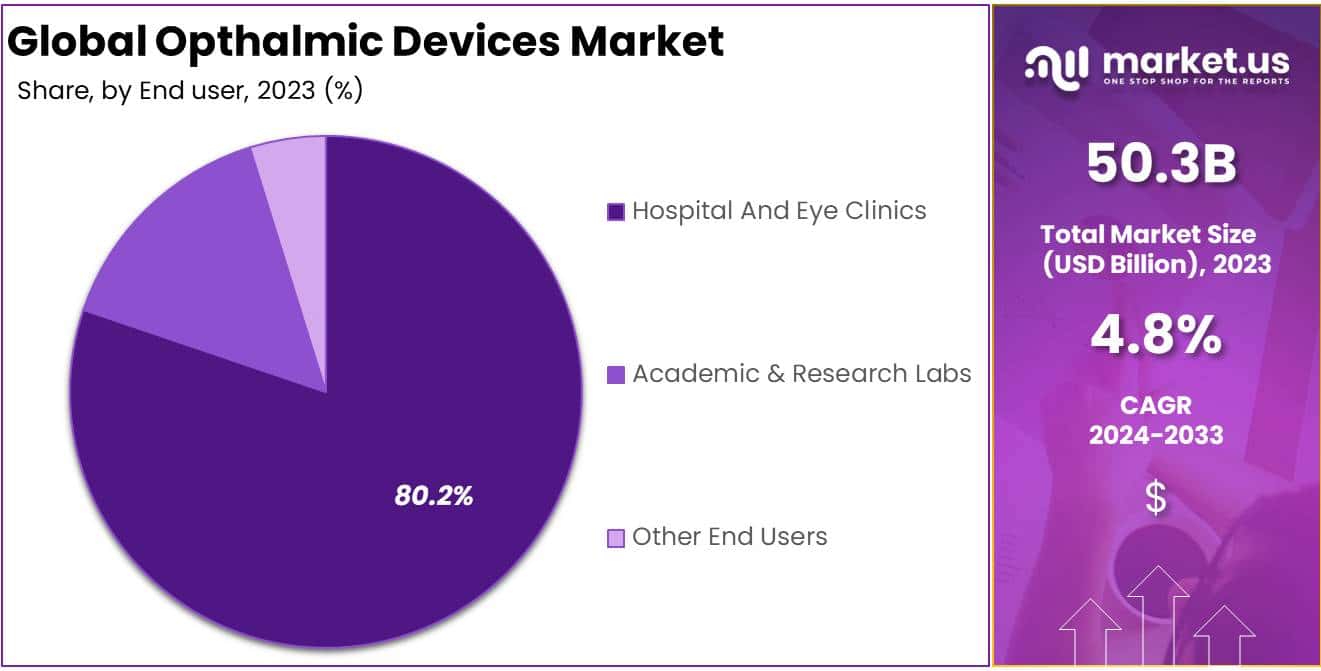

- End-User Landscape: Hospitals and Eye Clinics dominate with an 80.2% share in 2023, fueled by technology adoption and increased eye clinics.

- Key Segments: Vision Care, Surgical Devices, and Diagnostics & Monitoring are crucial product segments, addressing diverse ophthalmic needs.

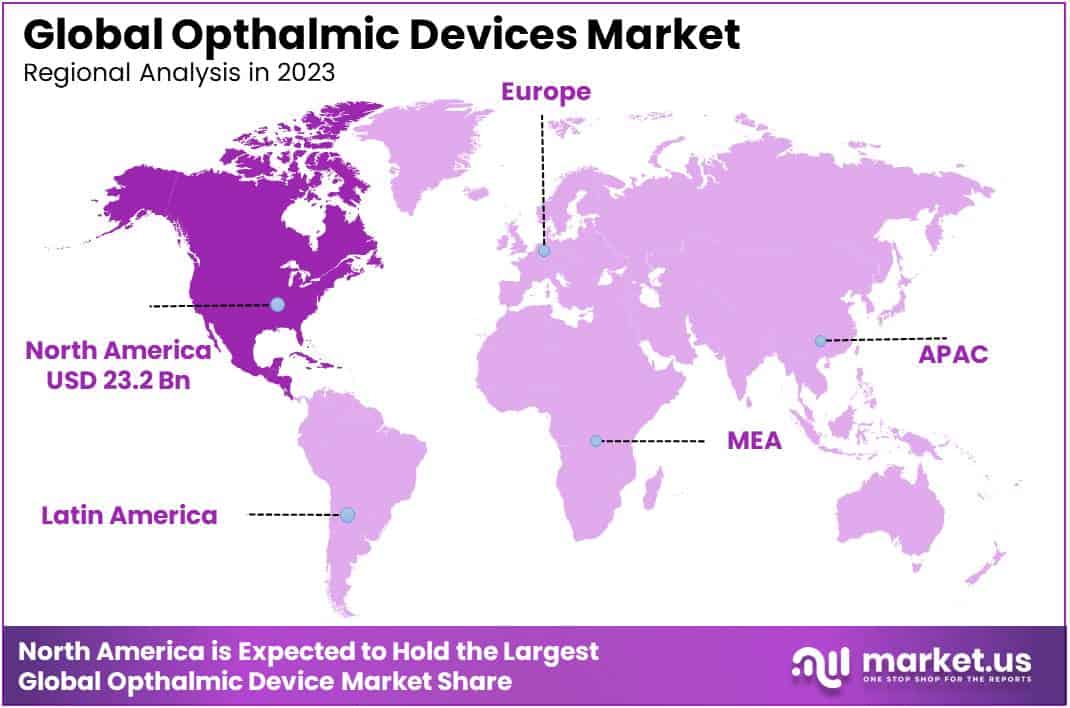

- Regional Market Dynamics: North America commands a 46.2% market share in 2023, valued at USD 23.2 Bn, while Asia-Pacific presents growth opportunities with increasing awareness and outsourcing activities.

Driving Factors

The market for ophthalmic devices has expanded as a result of the rise in the number of people suffering from diseases such as diabetic retinopathy, myopia, macular degeneration, cataract, and other types of ocular disorders. The market has grown significantly as a result of regional and national initiatives.

The greater number of precise diagnoses generated by these ophthalmic devices contributes to rising market demand for these goods. The demand for such items has grown as a result of people’s growing knowledge of the importance of eye health. The market for ophthalmic equipment has expanded significantly in part due to cosmetic and aesthetic concerns as well.

Restraining Factors

There are fewer patients receiving treatment in emerging nations due to a number of problems, such as reduced per capita healthcare spending, restricted product accessibility, and a lack of knowledge regarding ocular illnesses. The increased cost of routine checks discourages those who cannot afford them from getting them.

The market decline for ophthalmic devices is also a result of limited product accessibility. The number of people choosing such services is declining, in part because fewer people are aware of healthcare facilities. Also, many people cannot afford the treatment because of how expensive the tools are. The global ophthalmic devices market is shrinking as a result of these high-cost restrictions.

Growth Opportunities

The Ophthalmic devices industry has profited greatly from the increase in ophthalmology clinics and routine medical checkups. Also, as individuals become more aware of the advantages of having these tests done, there are fewer people who have these conditions, which results in a greater demand for ophthalmic devices, which in turn supports the substantial growth of this market.

Other factors influencing the market’s expansion include the rise in ambulatory surgery centers, super-specialty hospitals, and other facilities that aid in boosting the utilization of these ophthalmic devices. All of these elements work together to create a significant opportunity for the device industry throughout the projection.

Trending Factors

Innovative tools, consumables, contact lenses, and other products have increased the demand for these tools among both patients and healthcare providers. One of the technologies with the quickest pace of growth for the treatment of mild to moderate glaucoma is the new micro-invasive glaucoma surgical implants.

These ground-breaking implants are very effective and are probably going to close the glaucoma treatment gap. Market participants are concentrating on releasing cutting-edge micro-invasive glaucoma surgical implants that will fuel the expansion of the global ophthalmic devices market throughout the forecasted period.

Product Analysis

In 2023, the Vision Care Products segment held a dominant market position, capturing more than a 61.2% share.

The surgical, diagnostics & monitoring, and vision care product segments make up the global market for ophthalmic devices. As it includes eyeglasses, contact lenses, and other items used for vision correction or improvement. The global market is dominated by the segment of vision care. In the upcoming years, the category is projected to maintain its leading position in the market for ophthalmic devices on a global scale.

This is because of the reality that a sizable population uses vision care devices like eyeglasses and contact lenses to correct or improve their vision. Also, due to a number of variables, including an increase in the frequency of eye illnesses, greater public awareness of eye health, and technical developments in the field of vision care, the demand for goods for vision care is projected to rise in the future years.

Application Analysis

In 2023, the Cataract segment held a dominant market position, capturing more than a 48.9% share.

Throughout the forecast period, this segment is anticipated to experience considerable expansion. This is explained by the widespread use of ophthalmic tools in cataract surgeries. This is due to the widespread use of ophthalmic devices in cataract operations.

Over the projected period, it is anticipated that the refractor disorders category will increase at the fastest rate. Ophthalmic instruments like phoropters and retinoscopes are highly favored for treating such illnesses and correcting refractive errors. Major market participants are focusing on introducing innovative ophthalmic diagnosis and treatment equipment in order to suit the needs of the expanding patient population.

End-User Analysis

In 2023, the Hospitals And Eye Clinics segment held a dominant market position, capturing more than an 80.2% share.

This can be attributable to the growing use of ophthalmic technology in hospitals and the low-cost, high-quality care offered in clinics. The need for new installations is projected to increase in the coming years as a result of the rising mergers and acquisitions between ophthalmic clinics and hospitals.

Also, many eye clinics are now establishing independent diagnostic divisions, which is encouraging the use of ophthalmic gadgets. Throughout the forecast period, the market is anticipated to rise as a result of the rising number of eye clinics that provide affordable treatment. During the projected period, there is expected to be significant growth in the market for academic and research laboratories. Ophthalmic care is supported by funding for academic and research labs.

Key Market Segments

Based on Product

- Vision Care Products

- Surgical Devices

- Diagnostics & Monitoring Devices

Based on Application

- Cataract

- Glaucoma

- Vitreo Retinal Disorders

- Refractor Disorders

- Other Applications

Based on End-User

- Hospital and Eye Clinics

- Academic and Research Laboratory

- Other End Users

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 46.2% share and holds USD 23.2 Billion market value for the year. Due to the prevalence of diabetic retinopathy, vision loss, and blindness in the region, North America dominates the market for ophthalmology devices.

High-impact contributing drivers for the sector are the rapidly aging population and the increased prevalence of chronic eye disorders brought on by poor lifestyles and high levels of stress, such as diabetic retinopathy.

The demand for ophthalmic devices in this region is also anticipated to increase as a result of the adoption of new reimbursement models for ophthalmologic therapy and a strict regulatory environment designed to ensure patient safety. During the projection period, Asia-Pacific is expected to have significant growth.

The expansion might be attributable to the rising outsourcing activities for ophthalmology devices by significant market participants, like Alcon, Inc. Furthermore, one of the main growth-stimulating factors for developing nations like China and India is the rising awareness of modern corrective eyesight procedures.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Esillor and Alcon make up more than 30% of the top players in the global ophthalmic device market in terms of market revenue. Due to the relatively fragmented nature of the ophthalmic equipment market, these two companies enjoy a significant competitive advantage in terms of size and market share.

A wide variety of ocular instruments, including surgical and corrective tools as well as therapeutic and diagnostic tools, are offered by Esillor and Alcon. Together with their product lines, these companies also offer services like training and education. Both organizations have put a lot of effort into developing their technology in order to keep themselves at the forefront of innovation.

Market Key Players

- Alcon Vision LLC

- Essilor International S.A

- Johnson & Johnson Vision Care

- Carl Zeiss Meditec AG

- Bausch & Lomb Incorporated

- Essilor International S.A

- Ziemer Ophthalmic System Ltd

- Nidek Co. Ltd

- TOPCON Corporation

- Haag-Streit Group

- Hoya Corporation

- OPHTEC BV

- ClearLab

- Other key Players.

Recent Developments

- In December 2023, Nidek Co. Ltd joined the wave of advancements with the launch of the RS-600 Maestro 2 excimer laser system. Boasting advanced technology, this system is designed to facilitate faster and more precise refractive surgery procedures. This move positions Nidek competitively in the laser vision correction market.

- In October 2023, Johnson & Johnson Vision Care made a significant move by acquiring TearScience, a company dedicated to developing treatments for dry eyes. The acquisition, valued at $487 million, marks a strategic expansion for J&J Vision into the burgeoning market segment of dry eye solutions.

- In July 2023, ZEISS Meditec AG bolstered its position in the cataract surgery market through the acquisition of Verilux. Specializing in surgical visualization solutions for ophthalmology, Verilux’s expertise aligns seamlessly with ZEISS’s goals in this field.

- In June 2023, EssilorLuxottica, the parent company of Essilor International S.A, unveiled their latest innovation. The Transitions Signature GEN 8 lenses represent Essilor’s most light-responsive photochromic lenses to date, offering improved comfort and visual clarity for patients.

Report Scope

Report Features Description Market Value (2023) USD 50.3 Bn Forecast Revenue (2033) USD 80.2 Bn CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Vision Care Products, Surgical Devices, Diagnostics & Monitoring Devices), By Application (Cataract, Glaucoma, Vitreo Retinal Disorders, Refractor Disorders, Other Applications). By End-User (Hospital and Eye Clinics, Academic and Research Laboratory, Other End Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Johnson & Johnson Vision Care, Alcon Vision LLC, Carl Zeiss Meditec AG, Bausch & Lomb Incorporated, Essilor International S.A, Ziemer Ophthalmic System Ltd, Nidek Co. Ltd, TOPCON Corporation, Haag-Streit Group, Hoya Corporation, OPHTEC BV, ClearLab, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alcon Vision LLC

- Essilor International S.A

- Johnson & Johnson Vision Care

- Carl Zeiss Meditec AG

- Bausch & Lomb Incorporated

- Essilor International S.A

- Ziemer Ophthalmic System Ltd

- Nidek Co. Ltd

- TOPCON Corporation

- Haag-Streit Group

- Hoya Corporation

- OPHTEC BV

- ClearLab

- Other key Players.