Global Ophthalmic Drugs Market By Product Type (Prescription Drugs, OTC Drugs), By Drug Class (Anti-glaucoma Drugs, Dry Eye Drugs, Anti-allergy/Inflammatory, Retinal Drugs, Anti-infective Drugs, Other Drug classes), By Dosage Form (Gels, Eye Solutions & Suspensions, Capsules and Tablets, Eye Drops, Ointments), By Route of Administration (Topical, Local Ocular, Systematic), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Other Distribution Channels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 102423

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Driving Factors

- Restraining Factors

- Product Type Analysis

- Drug Class Analysis

- Dosage Form Analysis

- Route of Administration Analysis

- Distribution Channel Analysis

- Market Segments

- Opportunity

- Trends

- Regional Analysis

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

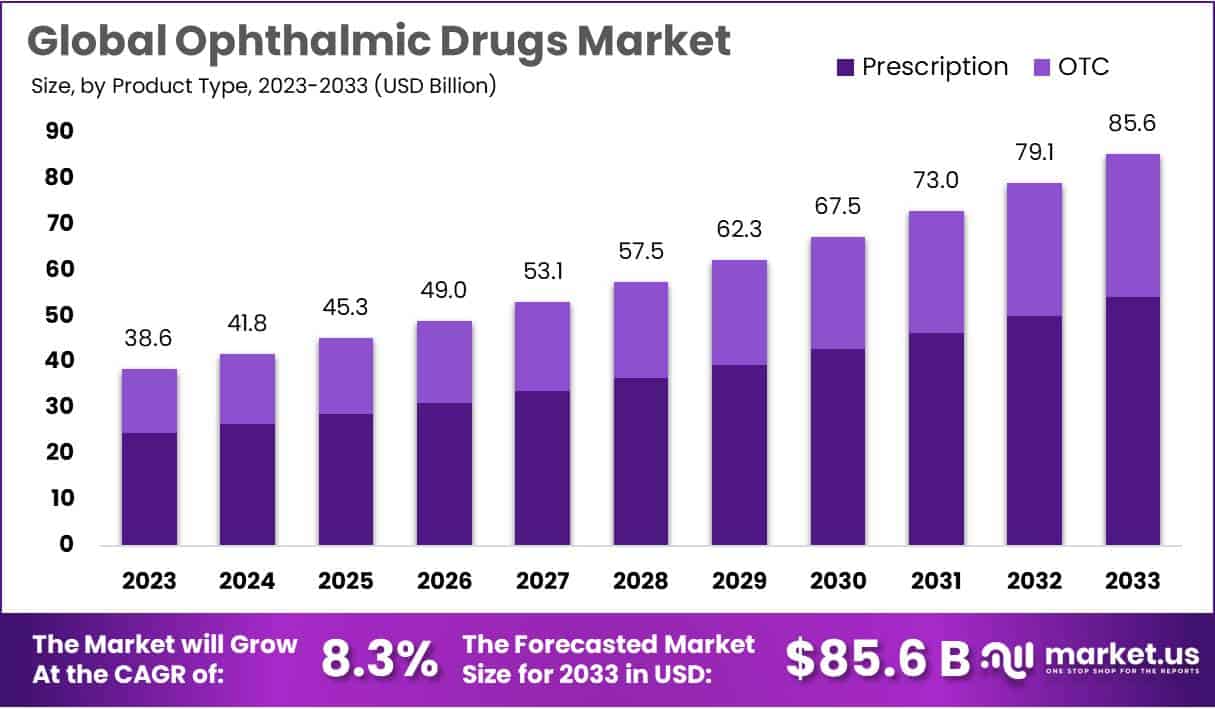

The Global Ophthalmic Drugs Market size is expected to be worth around USD 85.6 Billion by 2033, from USD 38.6 Billion in 2023, growing at a CAGR of 8.3% during the forecast period from 2024 to 2033.

The complicated sensory organ that is responsible for vision or sight is the eye. Loss of vision can be caused by disease or injury to the ocular system. A range of ocular formulations (topical, parenteral, and oral) are available for both diagnostic and therapeutic purposes.

Glaucoma, chronic dry eye, diabetic retinopathy, macular degeneration, etc., are all conditions that are significantly managed by ophthalmic medications. The study of eye diseases and disorders, often known as ophthalmology, has been chronicled from the dawn of time. The eye’s significance and attraction have propelled substantial scientific breakthroughs for ages.

Cycloplegics, mydriatics, and miotics are examples of ophthalmic medicines that either directly or indirectly activate or inhibit the autonomic nervous system’s connection to the intraocular muscles. The rising geriatric population and increased prevalence of eye-related ailments such as glaucoma, dry eye disease, and other eye-related disorders are primary factors boosting the market growth over the forecast period.

Also, rising research & development initiatives to develop novel ophthalmic drugs and medications and the implementation of strategic initiatives by the major players are expected to stimulate market growth during the projection period. Growing public knowledge of the accessibility of preventive medications will further fuel market expansion during the projected time period.

Key Takeaways

- Market Projection: Ophthalmic drugs market set to reach USD 85.6 Billion by 2033, growing at a CAGR of 8.3% from 2024 to 2033.

- Product Type Dominance: Prescription Drugs hold a substantial 63.5% market share in 2023, driven by increased prevalence of AMD and diabetic retinopathy.

- Drug Class Dominance: Anti-glaucoma Drugs claim 31.9% market share in 2023, dominated by rising glaucoma cases globally.

- Dosage Form Dominance: Eye Drops Drugs command 41.8% market share in 2023, fueled by OTC availability, patient compliance, and new product launches.

- Route of Administration Dominance: Topical administration holds a dominant market position at 57% in 2023, favored for self-administration, non-intrusiveness, and patient compliance.

- Distribution Channel Dominance: Hospital Pharmacies dominate with a 60.4% market share in 2023, driven by high chronic eye disease prevalence; online pharmacies show fastest growth.

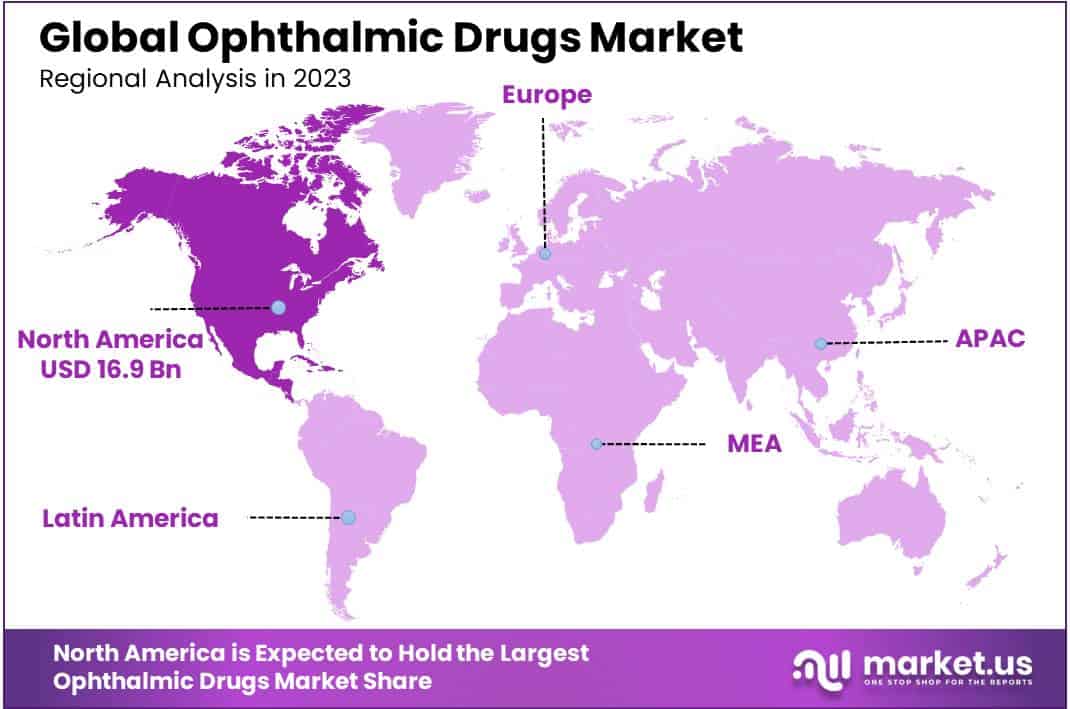

- Regional Analysis: North America holds 44% market share in 2023, driven by rising prevalence of eye diseases, technological improvements, and growing elderly population.

Driving Factors

Rising geriatric population

Over the recent decades, the geriatric population has significantly increased across many countries around the globe. The World Health Organization (WHO) predicts that in 2020, there will be more adults aged 60 and older than children under the age of five. The percentage of people over 60 in the world will increase from 12% to 22% between 2015 and 2050. One in six individuals on the planet will be 60 or older by 2030. Thus, by the year 2030, the number of people over 60 will be 1.4 billion, up from 1 billion in 2020.

The number of individuals in the world who are 60 or older will double (to 2.1 billion) by 2050. The number of people above 80 years of age is projected to rise by three folds, reaching 426 million between the time period 2020 and 2050. By 2050, 60% of the global population above the age of 60 will reside in low- and middle-income nations. Eurostat estimates that in 2022, 21.1% of the EU’s population will be above 65 years of age.

On January 1, 2022, the EU’s population’s median age, which is rising, was 44.4 years old, making up 50% of the population. As the elderly population is more likely to suffer from different eye diseases, it is likely to fuel the demand for ophthalmic drugs during the forecast period.

Increasing prevalence of eye disorders

Globally, the incidences of eye diseases are increasing at a high rate. According to WHO estimates, the number of individuals worldwide suffering from a distance or near vision impairment is about 2.2 billion. About 50% of the respective cases, or at least 1 billion, have vision damage that is still unaddressed or might have been avoided completely.

A total of 1 billion people are affected by moderate to severe blindness or distance vision impairment as a result of age-related macular degeneration (8 million), glaucoma (7.7 million), untreated refractive error (88.4 million), cataracts (94 million), vision impairment brought on by untreated presbyopia (826 million), and other conditions. Regionally, countries with lower and middle income are estimated to have a four times higher prevalence of distant vision impairment than countries with high income.

According to the CDC, i.e., Centers for Disease Control and Prevention, AMD, or age-related macular degeneration, affects more than 1.8 million Americans over 40 years of age. According to predictions, AMD will impact roughly 3 million people by 2020. Thus, the increasing prevalence of eye disorders is expected to drive market growth during the estimated time period.

Launch of awareness campaigns regarding eye disorders

Several governments as well as private organizations, are launching various campaigns, programs, and initiatives to spread awareness among the general population regarding various eye diseases. For example, in honor of “World Glaucoma Week,” the Entod Eye Health Foundation launched the glaucoma awareness campaign #GetTestedForGlaucoma from March 12 to March 2023 in various regions of India.

With a focus on the younger generation and those over 40, the campaign intends to reach one crore individuals across the nation. The campaign aims to increase awareness about glaucoma while encouraging people to regularly have their eyes checked to assess their risk factors and become familiar with the available treatment choices. In order to spread knowledge about glaucoma and stop its growth, Entod Pharmaceuticals is partnering with the Entod Eye Health Foundation. Spreading awareness regarding various eye diseases is anticipated to propel the growth of the market during the projection period.

Restraining Factors

Side-effects associated with ophthalmic drugs

Drugs used for the eye have the potential for side effects or adverse effects (AEs), much like drugs used systemically to treat any ailment or disease. Burning, redness, stinging, or a feeling of a foreign body are the most frequent side effects of topically applied ocular drops during or immediately after application. Intravitreal medication injections’ most frequent negative effects include intraocular inflammation and elevated intraocular pressure.

Ocular medications may have systemic side effects because they eventually enter the bloodstream after being injected into the eye or administered topically. This is particularly true for infants and children because weight-adjusted doses are frequently not accessible. Thus, side effects associated with ophthalmic drugs may limit the market growth during the projected time period.

Lack of health insurance in developing nations

Even though the majority of individuals in affluent or developed nations have health insurance, coverage is significantly less common in the developing world. However, citizens in wealthy and underdeveloped nations mostly benefit from insurance protection against the financial risk posed by a major or chronic disease. In many developing nations around the world, expanding health insurance is a top goal for their local and federal governments.

According to the Brookings Institute, more than 2 billion people reside in developing nations with ineffective health systems, unequal access, insufficient funding, and subpar services. Therefore, in developing nations, due to a lack of comprehensive insurance coverage, many people are not able to afford quality ophthalmic drugs or medications. Therefore, a lack of healthcare insurance coverage in developing nations may affect the market growth during the estimated time period.

Product Type Analysis

In 2023, Prescription Drugs segment held a dominant market position, capturing more than a 63.5% share. The increased prevalence of conditions like AMD and diabetic retinopathy is a key factor driving the growth of the segment.

Improved efficacy and enhanced safety are two additional beneficial aspects that are likely to increase the demand for ophthalmic prescription drugs. Certain prescription medicines have moisturizing and lubricating ingredients that momentarily increase tear production. Prescription medications are chosen over OTC ones because they are thought to be more effective at treating ocular conditions.

On the other hand, the OTC drugs segment is expected to witness steady growth during the estimated time period. The segment’s growth can be attributed to factors such as a rise in e-pharmacies, easy access to OTC drugs, and the increasing launch of several OTC medications like eye drops and ointments.

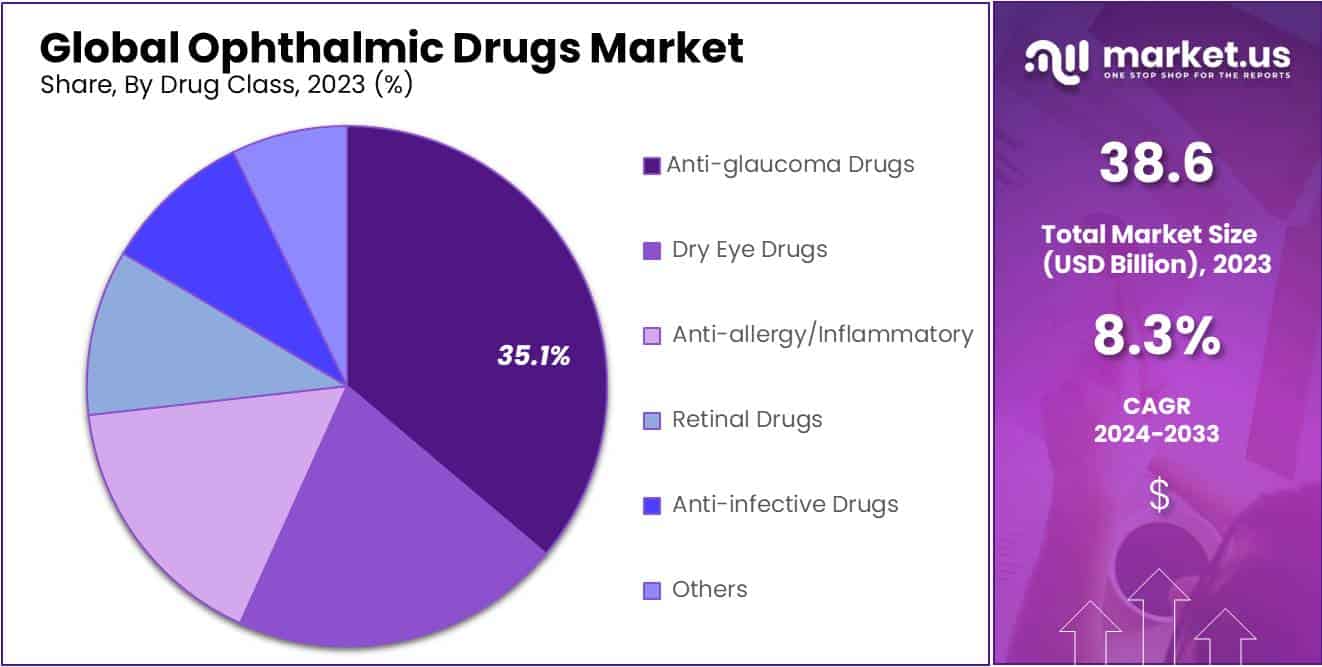

Drug Class Analysis

In 2023, Anti-glaucoma Drugs Drugs segment held a dominant market position, capturing more than a 31.9% share. Glaucoma prevalence is rising quickly, which is anticipated to raise demand for anti-glaucoma medications globally and lead to high growth in the segment.

For instance, it has been noted that the most common form of glaucoma, open-angle glaucoma, affects 2.7 million persons in the United States who are 40 years of age or older, according to the BrightFocus Foundation’s June 2021 study. Additionally, according to the same source, glaucoma affected more than 80 million people worldwide in 2020, which is anticipated to increase to more than 111 million by 2040. As a result, the demand for anti-glaucoma medications is anticipated to rise, thus supporting market expansion.

The dry eye drugs segment is expected to witness significant growth over the projection period. The increasing demand for efficient therapies, the rising incidence of dry eye illness, the existence of a profitable pipeline, and expanding public awareness of the problem are some of the key factors driving the segment’s growth.

Dosage Form Analysis

In 2023, Eye Drops Drugs segment held a dominant market position, capturing more than a 41.8% share. The expanding OTC availability of eye drops, patient compliance issues, and the prevalence of eye illnesses are key factors driving the growth of the segment. In addition, it is predicted that the launch of new products with altered formulations would contribute to the growth of the segment. For instance, in January 2022, Alcon launched their new preservative-free Systane eye drop.

Moreover, the gels segment is anticipated to experience high growth over the projected time period. Ophthalmic gels are put on the eyelids or the outer corner of the eye. For the treatment of cataracts, chronic inflammation, and uveitis, gels are available as viscous solutions. The rise in demand for aqueous gel formulations made with hydrophilic and stimuli-responsive polymers is a key factor driving the growth of the segment. Gels make it possible to incorporate pharmacological substances to produce the desired therapeutic impact and bioactivity at certain ocular locations.

Route of Administration Analysis

In 2023, Topical segment held a dominant market position, capturing more than a 57% share. To treat retinal illnesses such as neovascular age-related macular degeneration, diabetic retinopathy, retinal vein occlusion, and glaucomatous optic neuropathy, topical ophthalmic instillation is an intriguing method.

It has a number of benefits, including the ability to allow self-administration, and is non-intrusive. The rising demand for topical products as a result of convenient doses, patient compliance issues, and numerous strategic initiatives done by market players account for the segment’s growth.

Also, the local ocular route of administration is anticipated to witness high growth during the projection period. The blood-retinal barrier can be directly crossed with the help of the intraocular route, allowing for the achievement of the maximum possible peak drug concentration and high absorption. The posteriorly located tissues of the eye, like the cone-containing fovea or macula, consists of the highest intraocular bioavailability.

Distribution Channel Analysis

In 2023, Hospital Pharmacies segment held a dominant market position, capturing more than a 60.4% share. The growth of the segment can be attributed to key factors such as rising demand for ophthalmic drugs in hospital settings due to the high prevalence of chronic eye diseases, along with increasing healthcare spending in developing nations which has led to the availability of multiple therapeutic options.

Moreover, the online pharmacies segment is expected to grow at the fastest rate during the projection period. Increasing internet penetration in e-prescriptions in hospitals and clinics is a key factor contributing to the segment’s growth.

Market Segments

Product Type

- Prescription Drugs

- OTC Drugs

Drug Class

- Anti-glaucoma Drugs

- Dry Eye Drugs

- Anti-allergy/Inflammatory

- Retinal Drugs

- Anti-infective Drugs

- Other Drug classes

Dosage Form

- Gels

- Eye Solutions & Suspensions

- Capsules and Tablets

- Eye Drops

- Ointments

Route of Administration

- Topical

- Local Ocular

- Systematic

Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Other Distribution Channels

Opportunity

Research and development initiatives

More businesses globally are concentrating on investing in R&D operations for the creation of innovative and effective treatments. Alcon, a major provider of eye care, significantly increased their R&D spending from USD 673 in 2020 to USD 842 in 2021. The company provides a variety of products, including those for contact lenses, cataracts, and glaucoma. Furthermore, a strong application pool of new drugs intended for approval will likely aid market growth during the upcoming time period.

For instance, the phase III research for Nicox, a novel eye therapeutics company, is anticipated to be finished by 2029 for the novel NO donating PG analog NCX 470. Thus, such key research initiatives by several organizations across the world are anticipated to fuel the demand for ophthalmic drugs and open many opportunities for the market in the coming years.

Trends

Development of drugs with novel drug delivery

In recent years, there has been a lot of reported work on ocular medication administration. The goal is to increase the amount of time that medications administered topically stay in the cornea and conjunctiva.

Pharmaceutical companies are creating innovative methods such as nanoparticles, liposomes, contact lenses, ocular inserts, in situ activated gel creation, non-corneal routes of ocular drug diffusion, and polymeric solutions and gels based on nanoparticles. For the nearly inaccessible eye disorders or syndromes, the revolutionary improved delivery technologies offer a more protected and efficient means of therapy.

Recent advancements in the field of sustained release and regulated loading for ocular medication delivery have been made. It is now possible to improve the therapeutic efficacy of the ophthalmic route thanks to contemporary techniques.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 44% share and holds USD 16.9 Billion market value for the year. The rising prevalence of eye diseases, ophthalmology technology improvements, and the growing elderly population are some factors influencing the market’s growth. Additional factors that contribute to the market’s expansion in North America include R&D efforts, the presence of major market players, new product launches, and approvals for ophthalmic devices and medications.

Moreover, the Asia-Pacific region is likely to witness high growth during the estimated time period. The region’s demand for ophthalmic medications is anticipated to be driven by key factors such as an increase in ocular disease instances and rising consumer awareness of therapeutic efficacy. Local businesses are taking part in strategic projects to create and sell novel treatment alternatives for patients, which is fostering market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global Ophthalmic Drugs market is highly competitive and comprises several large as well as small market players. The market is growing significantly due to the rising demand for quality ophthalmic drugs to treat various ocular diseases. Additionally, key R&D initiatives, new strategic agreements, mergers and acquisitions, and the launch of new products by key market players are likely to impact market growth in the upcoming years positively.

Top Key Players

- Pfizer Inc.

- Hoffmann-La Roche Ltd

- Bayer AG

- Bausch Health Companies Inc.

- Merck & Co., Inc.

- Novartis AG

- Santen Pharmaceutical Co. Ltd.

- Sun Pharmaceutical Industries Ltd.

- Regeneron Pharmaceuticals Inc.

- Coherus Biosciences, Inc.

- Alcon

- Other Key Players

Recent Developments

- Pfizer Inc.(March 2024): Pfizer Inc. acquired Biotech Vision, a company specializing in advanced ophthalmic treatments, to expand its portfolio and strengthen its market position in the ophthalmic drugs sector.

- Hoffmann-La Roche Ltd (April 2024): Hoffmann-La Roche Ltd launched VisioCure, a novel eye drop for treating chronic dry eye syndrome, incorporating a unique bioactive ingredient that enhances tear production and ocular surface health.

- Bayer AG (May 2024): Bayer AG acquired Ophthotech Corp., a leader in age-related macular degeneration treatments, aiming to bolster its innovative offerings in the ophthalmic drug market.

- Bausch Health Companies Inc. (February 2024): Bausch Health Companies Inc. introduced LuminaX, a cutting-edge treatment for glaucoma, featuring an extended-release formula that improves patient compliance and outcomes.

- Merck & Co., Inc. (January 2024): Merck & Co., Inc. merged with OphthalBio, enhancing its research capabilities and expanding its ophthalmic drugs pipeline, focusing on innovative treatments for retinal diseases.

- Novartis AG (March 2024): Novartis AG launched OptiClear, an advanced solution for post-surgical eye care, designed to reduce inflammation and promote rapid healing after ocular procedures.

Report Scope

Report Features Description Market Value (2023) USD 38.6 Billion Forecast Revenue (2033) USD 85.6 Billion CAGR (2024-2033) 8.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type- Prescription Drugs, OTC Drugs, By Drug Class- Anti-glaucoma Drugs, Dry Eye Drugs, Anti-allergy/Inflammatory, Retinal Drugs, Anti-infective Drugs, and Other Drug Classes, By Dosage Form- Gels, Eye Solutions & Suspensions, Capsules and Tablets, Eye Drops, Ointments, By Route of Administration- Topical, Local Ocular, Systematic, By Distribution Channel- Hospital Pharmacies, Online Pharmacies, and Other Distribution Channels Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pfizer Inc., F. Hoffmann-La Roche Ltd, Bayer AG, Bausch Health Companies Inc., Merck & Co., Inc., Novartis AG, Santen Pharmaceutical Co. Ltd., Sun Pharmaceutical Industries Ltd., Regeneron Pharmaceuticals Inc., Coherus Biosciences, Inc., Alcon, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Pfizer Inc.

- Hoffmann-La Roche Ltd

- Bayer AG

- Bausch Health Companies Inc.

- Merck & Co., Inc.

- Novartis AG

- Santen Pharmaceutical Co. Ltd.

- Sun Pharmaceutical Industries Ltd.

- Regeneron Pharmaceuticals Inc.

- Coherus Biosciences, Inc.

- Alcon

- Other Key Players