Global Bottled Water Market By Technology (Membrane Filtration, Distillation, Deionization, Chlorination, Ozonation, Others), By Product Type (Still Bottled Water, Sparkling Bottled Water, Functional Bottled Water), By Nature (Plain, Flavored), By Packaging Type (PET Bottles, Glass Bottles, Cans), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, HoReCa, Online Retail, Other Distribution Channels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146335

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

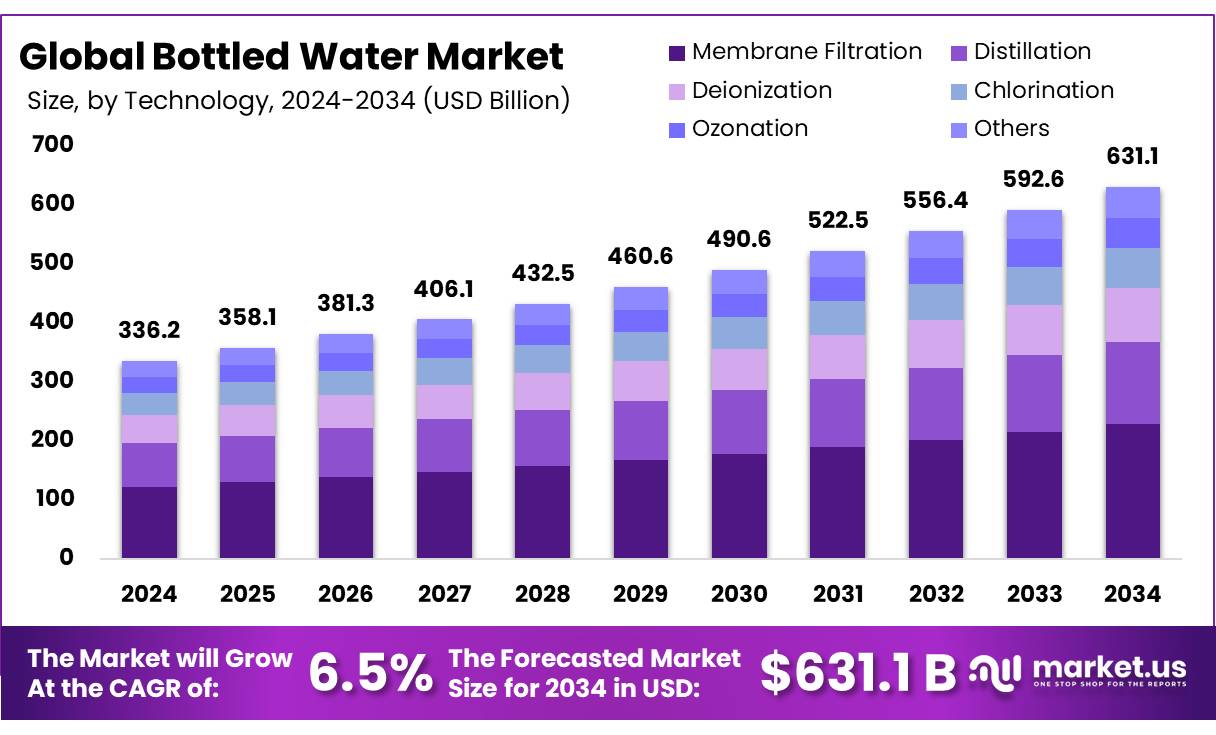

The Global Bottled Water Market size is expected to be worth around USD 631 Bn by 2034, from USD 336.2 Bn in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

Bottled water is potable water sealed in a sanitary container and sold for human consumption, meeting all federal and provincial regulations. It may contain added minerals, flavorings, or vitamins, and can be still or carbonated. Its primary purpose is to provide a safe alternative to tap water, especially in areas where the local water supply may be contaminated. The bottled water market has experienced steady growth globally, driven by increasing health awareness, consumer demand for convenience, and concerns over water safety.

- According to the National Institutes of Health, over half of the 700 million people globally without access to safe water live in sub-Saharan Africa, including Ethiopia, underscoring the growing importance of bottled water.

- According to the Dubai Chamber of Commerce, the consumption of bottled drinking water in the UAE is projected to reach 1.153 billion liters by 2025, with an annual growth rate of 1.4% by volume from 2020 to 2025, signaling a steady demand for bottled water.

The demand for bottled water continues to rise, especially in North America and Asia-Pacific regions. Key market trends include the popularity of health-conscious beverages, with consumers opting for calorie-free hydration options like mineral or flavored waters. Additionally, sustainability is a growing concern, with an increasing focus on eco-friendly packaging, such as bottles made from recycled materials. The overall market is expected to continue expanding, fueled by the demand for premium, healthy, and convenient hydration solutions.

Key Takeaways

- The global bottled water market was valued at USD 336.2 billion in 2024.

- The global bottled water market is projected to grow at a CAGR of 6.5% and is estimated to reach USD 631 billion by 2034.

- Among technology, membrane filtration accounted for the largest market share of 36.3%. Due to its efficiency in removing contaminants while preserving essential minerals, ensuring high-quality water.

- Among product types, still bottled Water accounted for the majority of the market share at 66.3%. Due to its widespread consumer preference for non-carbonated, simple hydration options.

- By NATURE, PLAIN ACCOunted for the largest market share of 86.3%. Due to its simplicity, widespread consumer preference for unflavored hydration, and its versatility in meeting diverse consumer needs.

- By Packaging type, pet bottles accounted for the largest market share of 77.3%. Due to their lightweight, cost-effectiveness, and recyclability, they are the preferred choice for both manufacturers and consumers.

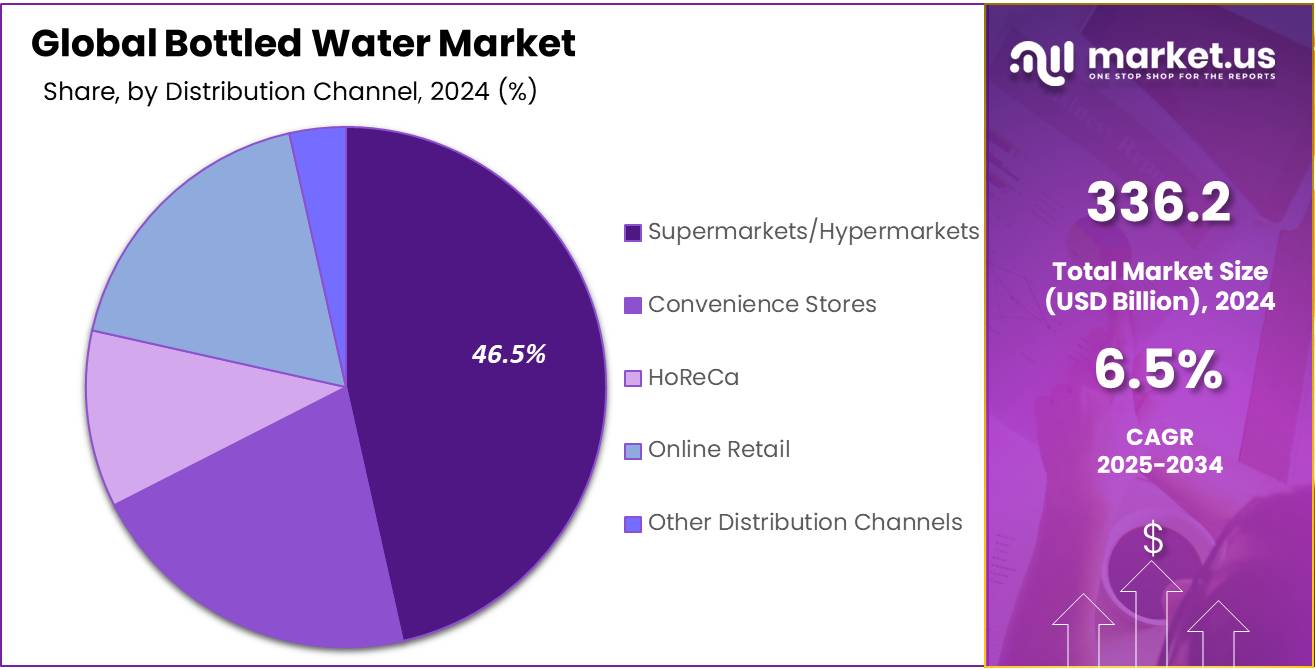

- By distribution channel, supermarkets/hypermarkets accounted for the largest market share of 46.5%. Due to their wide reach, convenience, and the ability to offer a variety of bottled water brands in one location.

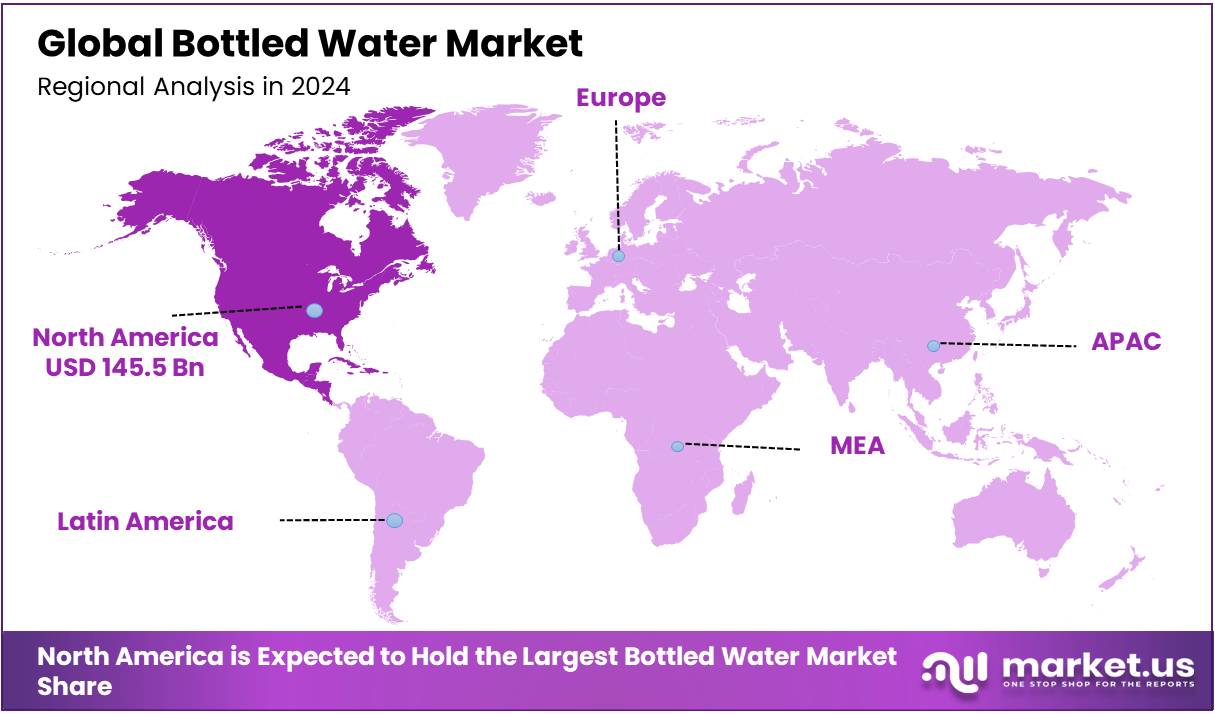

- North America is estimated as the largest market for Bottled Water with a share of 43.3% of the market share.

Technology Analysis

Membrane Filtration Dominates the Bottled Water Market in 2024

The bottled water market is segmented based on technology into membrane filtration, distillation, deionization, chlorination, ozonation, and others. In 2024, the membrane filtration segment held a significant revenue share of 36.3%. Due to its efficiency in removing contaminants while preserving essential minerals, membrane filtration has become the preferred technology for producing high-quality bottled water. Its ability to effectively filter bacteria, viruses, and chemicals, while maintaining a natural taste, has driven its popularity. As consumers prioritize health and safety, the demand for membrane-filtered water has significantly boosted its market share, making it the leading technology in the bottled water sector.

Product Type Analysis

Still Bottled Water Leads the Market with a Significant Share

Based on product type, the market is further divided into still bottled water, sparkling bottled water, and functional bottled water. The predominance of still bottled Water, commanding a substantial 66.3% market share in 2024. Due to its simplicity, versatility, and widespread consumer preference for hydration without added carbonation or flavors, still bottled water continues to dominate the market. It is considered a healthy and natural alternative to sugary beverages, making it a go-to choice for health-conscious individuals. Additionally, the convenience of still water, combined with its universal appeal across various demographics, has contributed to its large market share in 2024.

Nature Analysis

Plain Bottled Water Dominated The Market

Based on nature, the market is further divided into Plain and Flavored. The predominance of the Plain commanded a substantial 86.30 % market share in 2024. Due to its purity and simplicity, plain bottled water continues to be the preferred choice for consumers seeking hydration without any added ingredients or flavors. The growing awareness of health and wellness, coupled with the increasing demand for natural and calorie-free beverages, has driven the dominance of plain water. Additionally, plain water remains the most versatile option, appealing to a broad consumer base and maintaining a strong market presence.

Packaging Type Analysis

PET Bottles Remain the Preferred Packaging for Bottled Water

Based on Product Type, the market is further divided into PET Bottles, Glass Bottles, and Cans. The predominance of the Packaging commanding a substantial 77.30 % market share in 2024, Due to its cost-effectiveness, convenience, and widespread availability, PET (Polyethylene Terephthalate) bottles dominate the bottled water market. PET bottles are lightweight, durable, and offer excellent protection for the water, making them ideal for both storage and transportation. The material’s ability to be molded into various shapes and sizes, along with its recyclability, further contributes to its widespread use. Additionally, PET’s affordability compared to glass or cans, along with consumer preference for portable, on-the-go hydration, ensures its substantial market share.

Distribution Channel Analysis

Supermarkets/Hypermarkets Command the Largest Distribution Share in the Bottled Water Market in 2024

Based on Distribution Channel, the market is further divided into Supermarkets/Hypermarkets, Convenience Stores, HoReCa, Online Retail,and Other Distribution Channels. The predominance of the Supermarkets/Hypermarkets commanding a substantial 46.50 % market share in 2024. Due to their wide accessibility, large-scale operations, and ability to offer a variety of bottled water brands in one location, Supermarkets/Hypermarkets dominate the bottled water market.

These retail outlets attract a broad consumer base, offering convenience for customers who can purchase bottled water along with their regular grocery needs. Additionally, the significant foot traffic in these stores, combined with promotional offers and bulk purchasing options, contributes to their leading market share. Theirstrategic locations and the availability of both premium and budget-friendly bottled water options further solidify their dominance in the market.

Key Market Segments

By Technology

- Membrane Filtration

- Distillation

- Deionization

- Chlorination

- Ozonation

- Others

By Product Type

- Still Bottled Water

- Sparkling Bottled Water

- Functional Bottled Water

By Nature

- Plain

- Flavored

By Packaging Type

- PET Bottles

- Glass Bottles

- Cans

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- HoReCa

- Online Retail

- Other Distribution Channels

Drivers

Increasing Prevalence Of Water Contamination In Municipal Tap Water Systems.

The increasing prevalence of water contamination in municipal tap water systems is significantly driving the growth of the global bottled water market. As concerns about the safety and quality of tap water rise, particularly in regions with aging infrastructure or contamination issues, consumers are increasingly turning to bottled water as a safer alternative. In both developed and developing countries, issues such as bacterial contamination, high levels of nitrates, and poor water quality have led to widespread mistrust of municipal tap water, pushing consumers to seek bottled water for reassurance about the purity and safety of their drinking water.

- According to the report published by UNESCO on behalf of UN-Water at the UN 2023 Water Conference in New York states that globally 2 billion people (26%) lack access to safe drinking water, and 3.6 billion (46%) lack safely managed sanitation, increasing the demand for bottled water as a safer alternative.

- In developing countries, over 80% of the disease burden is linked to poor drinking water quality, primarily due to contamination from unsanitary conditions, driving the demand for safer bottled water.

- With 2.4 billion people lacking access to basic sanitation and 1.8 billion deaths annually from diarrheal diseases (mainly among children under five), bottled water consumption grows as a means to avoid waterborne illnesses.

Furthermore, the growing shift towards bottled water is fueled by factors such as health concerns, convenience, and targeted marketing efforts. In emerging markets, where access to clean water is limited, consumers often perceive bottled water as a more reliable and hygienic option compared to tap water. In industrialized nations, factors such as fears of contaminants in tap water and aging infrastructure further contribute to this trend. The rising consumer demand for bottled water is a direct response to the increasing prevalence of water contamination, highlighting the need for safer and more accessible drinking water solutions worldwide.

- About 31% of Canadians and 38% of Americans use bottled water as their primary drinking water source, reflecting concerns over tap water safety.

- Bottled water is the main drinking water source for around 60% of Italians and Koreans, indicating a preference for perceived safety and quality.

- In the Dominican Republic, 60% of households rely on bottled water as their primary water source, driven by concerns over local water quality.

Restraints

Strict Government Bans And Penalties on Plastic Bottles

Strict government bans and penalties on plastic bottles are increasingly restraining the growth of the global bottled drinking water market. Strict government bans and penalties on plastic bottles are increasingly restraining the growth of the global bottled drinking water market. Many countries, particularly in Europe, Asia, and Africa, have implemented stringent regulations to reduce plastic waste, including bans on single-use plastics like bottles. According to Corporate Accountability International, millions of plastic bottles pollute landfills, rivers, and oceans, taking 400 to 1000 years to degrade. These measures are forcing bottled water producers to adapt by adopting more sustainable packaging or facing penalties, which limits the market’s growth.

- China phased out non-degradable plastic bags by 2022 and continue banning plastic items until 2025; India enforced a nationwide ban on single-use plastics starting in 2019; Japan introduced plastic bag charges in 2020 and passed the Plastic Resource Recycling Promotion Law in 2022; South Korea banned disposable plastic bags in 2019 and restricted imports of certain plastic products in 2020.

Additionally, rising consumer awareness of plastic pollution and environmental concerns has led to a shift towards eco-friendly alternatives, further impacting bottled water demand. As governments enforce these bans and promote recycling, companies in the bottled water industry must navigate these changes by investing in biodegradable or reusable packaging solutions to stay compliant and maintain market share.

- For instance, Kenya imposes heavy fines and prison sentences for violations of its strict plastic bag ban, while the European Union requires a 90% plastic bottle recycling target by 2029, with penalties for non-compliance.

Opportunity

Introduction of biodegradable and edible water packaging

The rise of biodegradable and edible water packaging offers a significant opportunity for growth in the global bottled water market, driven by increasing consumer awareness of environmental issues and plastic pollution. As demand for sustainable alternatives to conventional plastic packaging grows, biodegradable biopolymers and edible packaging solutions, made from renewable sources, help reduce plastic waste and align with global sustainability trends. These eco-friendly options meet the rising consumer preference for environmentally conscious products while addressing pressing environmental concerns.

- According to the U.S. Environmental Protection Agency (EPA), packaging and containers accounted for 28.1% and 82.2 million tons of municipal solid waste in 2018, driving the increasing demand for sustainable solutions like biobased packaging in the bottled water industry to reduce environmental impact and support market growth.

Furthermore, biobased Bioplastics, which offer similar properties to traditional plastics like strength and flexibility, are becoming a preferred choice for bottled water packaging. As the market for sustainable packaging expands, bottled water producers are adopting biodegradable and edible materials to stand out in a competitive landscape. This shift is further supported by government regulations and consumer demand for greener products, creating a favorable environment for the growth of the bottled water market. Innovative solutions like edible and plantable packaging also offer unique opportunities for product differentiation and market expansion.

- According to a survey conducted by the Dubai Chamber of Commerce, 42.4% of consumers indicated a strong preference for purchasing 100% biodegradable bottles, while approximately 70% expressed a willingness to pay a premium of at least AED 1 for these eco-friendly alternatives, highlighting a growing market demand for sustainable packaging solutions in the bottled water sector.

Trends

Rising demand of functional and mineral enhanced water

The global bottled water market is experiencing a surge in demand for functional and mineral-enhanced water. Consumers are increasingly seeking water products that offer additional health benefits, such as infused vitamins, minerals, and specialized additives. Functional waters, which may include oxygen-enriched, flavored, or vitamin-infused varieties, are gaining traction for their perceived wellness benefits, while mineral waters, sourced from natural springs with high levels of trace minerals, are being valued for their health-enhancing properties.

- Mineral water, sourced from underground reserves, contains at least 250 parts per million (ppm) of total dissolved solids.

This trend is being driven by a growing consumer focus on health, convenience, and sustainable hydration options. As wellness continues to be a major consumer priority, the functional and mineral water segments are rapidly expanding, with more manufacturers entering the market to meet the rising demand for products that provide added value beyond basic hydration. This shift is positioning functional and mineral-enhanced waters as key drivers of growth in the global bottled water market.

- European bottled waters provide a significant source of essential minerals, with some brands offering between 20% and 58%. This highlights the growing consumer preference for functional beverages that not only hydrate but also contribute to meeting daily nutritional needs.

Geopolitical Impact Analysis

Geopolitical Water Conflicts And Climate Change-Driven Water Scarcity Are Likely To Drive Increased Demand For Bottled Water In Affected Regions, Fueling Market Growth.

Geopolitical conflicts over shared water resources, such as the Brahmaputra River, the Grand Ethiopian Renaissance Dam (GERD) on the Nile, and the Ilisu Dam on the Tigris River, have significant implications for the bottled water market. As these conflicts intensify, especially in regions heavily dependent on shared water sources, bottled water demand could rise in areas where local water supplies are impacted. Consumers may increasingly turn to bottled water as a secure alternative to unreliable or polluted water sources.

Moreover, geopolitical tensions and climate change-induced water scarcity could drive demand for bottled water in areas experiencing droughts or reduced access to fresh water. This increased reliance on bottled water could contribute to market growth, particularly in regions directly affected by these water disputes, as consumers seek more stable and safe hydration options.

Regional Analysis

In 2024, North America dominated the global bottled water market, accounting for 43.30% of the total market share, Driven by several key factors. The increasing consumer preference for healthier beverages, especially bottled water over sugary drinks, is one of the primary drivers. Consumers are becoming more health-conscious and are turning to bottled water as a convenient, on-the-go hydration option. Additionally, the growing popularity of functional waters, such as vitamin-infused, mineral-enriched, and alkaline waters, is further propelling market growth. As individuals seek to meet their health and wellness goals, premium bottled water options are gaining traction.

Sustainability is a major factor influencing the market, with both governments and the bottled water industry implementing regulations to reduce plastic waste. In response, bottled water companies are adopting eco-friendly packaging solutions, such as recyclable and biodegradable materials. This shift aligns with the growing demand for sustainable products and supports the continued expansion of the market.

- North America, particularly the U.S., has implemented various state-level initiatives to combat plastic pollution, with states like California and New York leading the charge on bans for plastic bags and straws. As of May 2024, 12 states have banned single-use plastic bags, and Canada has committed to a federal ban. These actions contribute to the growing demand for sustainable alternatives in sectors like bottled water.

The U.S., in particular, is a dominant player in the North American bottled water market, with expectations of steady growth. The combination of health trends, the growing preference for bottled water, and the shift toward environmentally friendly packaging is expected to keep North America at the forefront of the global bottled water industry.

- In 2009, the U.S. ranked 10th in per capita bottled water consumption, while leading the world in total bottled water consumption, followed by Mexico and China, with Mexico having the highest per capita consumption.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the bottled water market emphasize innovation, sustainability, and regional expansion to enhance their competitive edge.

Key players in the bottled water market include Nestlé, Coca-Cola, PepsiCo, Danone, and Fiji Water. These companies are leveraging a variety of strategies to maintain dominance, including expanding product portfolios with flavored and functional water, investing in eco-friendly packaging, and enhancing sustainability efforts.

Additionally, many are focusing on regional expansion, particularly in emerging markets, and developing innovative technologies such as membrane filtration to improve water quality. Partnerships with retailers and online platforms are also a key strategy to ensure wide product availability and reach a broader consumer base.

Major Players in the Industry

- Nestle S.A.

- The Coca-Cola Company

- PepsiCo Inc.

- Danone

- Suntory Beverage & Food Ltd.

- Tata Consumer Products

- CG Roxane

- Keurig Dr Pepper Inc.

- Talking Rain Beverage Company

- Harvest Hill Beverage Company

- Spindrift Beverage Co.

- Nongfu Spring

- Voss of Norway

- Crystal Springs

- FIJI Water Company LLC

- Gerolsteiner Brunnen GmbH & Co. KG

- VOSS WATER

- National Beverage Corp.

- Other Key Players

Recent Development

- In August 2024 – Flow Beverage Corp. has launched Flow Sparkling Mineral Spring Water in Canada (October 2024) and will expand to the U.S. shortly after. The product is available in 300ml aluminum bottles, offering organic flavors like Blackberry + Hibiscus and Lemon + Ginger, all with zero sugar and zero calories. The bottles are made from 70% recycled aluminum, supporting Flow’s commitment to sustainability and carbon neutrality.

- In September 2024-Waterloo Sparkling Water has launched a new Pomegranate Açaí flavor and brought back the fan-favorite Spiced Apple flavor for a limited time this fall. Both beverages are calorie-free, sugar-free, and made with non-GMO natural flavors, offering a refreshing and authentic taste perfect for autumn.

- In February 2024- Gatorade is expanding into new categories, including unflavoured water and energy drink mixes, to stay competitive as rivals like Prime Energy and Coca-Cola’s Bodyarmor challenge its market share. Despite increased competition, Gatorade continues to grow across various hydration sectors.

- In September 2023-Gatorade is entering the bottled water category with the launch of Gatorade Water, an electrolyte-infused, alkaline water aimed at supporting all-day hydration for active individuals. Set to hit shelves in Q1 2024, it will be available in various formats and packaged in 100% recycled plastic.

Report Scope

Report Features Description Market Value (2024) USD 336.2 Bn Forecast Revenue (2034) USD 631 Bn CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Membrane Filtration, Distillation, Deionization, Chlorination, Ozonation, Others), By Product Type (Still Bottled Water, Sparkling Bottled Water, Functional Bottled Water), By Nature (Plain, Flavored), By Packaging Type (PET Bottles, Glass Bottles, Cans), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, HoReCa, Online Retail, Other Distribution Channels), Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Nestle S.A., the Coca-Cola Company, PepsiCo Inc. Danone, Suntory Beverage & Food Ltd., Tata Consumer Products, CG Roxane, Keurig Dr Pepper Inc., Talking Rain Beverage Company, Harvest Hill Beverage Company, Spindrift Beverage Co., Nongfu Spring, Voss of Norway, Crystal Springs, FIJI Water Company LLC, Gerolsteiner Brunnen GmbH & Co. KG, VOSS WATER, National Beverage Corp., Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nestle S.A.

- The Coca-Cola Company

- PepsiCo Inc.

- Danone

- Suntory Beverage & Food Ltd.

- Tata Consumer Products

- CG Roxane

- Keurig Dr Pepper Inc.

- Talking Rain Beverage Company

- Harvest Hill Beverage Company

- Spindrift Beverage Co.

- Nongfu Spring

- Voss of Norway

- Crystal Springs

- FIJI Water Company LLC

- Gerolsteiner Brunnen GmbH & Co. KG

- VOSS WATER

- National Beverage Corp.

- Other Key Players