Global Luxury Food Market Size, Share, And Growth Analysis Report By Type (Vegetarian Food, Poultry, Pork, Meat, Seafood, Others), By End-User (High-End Restaurants, Small Food Chains), By Distribution Channel (Supermarkets and Hypermarkets, Online Retailers, Specialty Stores, Others) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

- Published date: April 2025

- Report ID: 146708

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

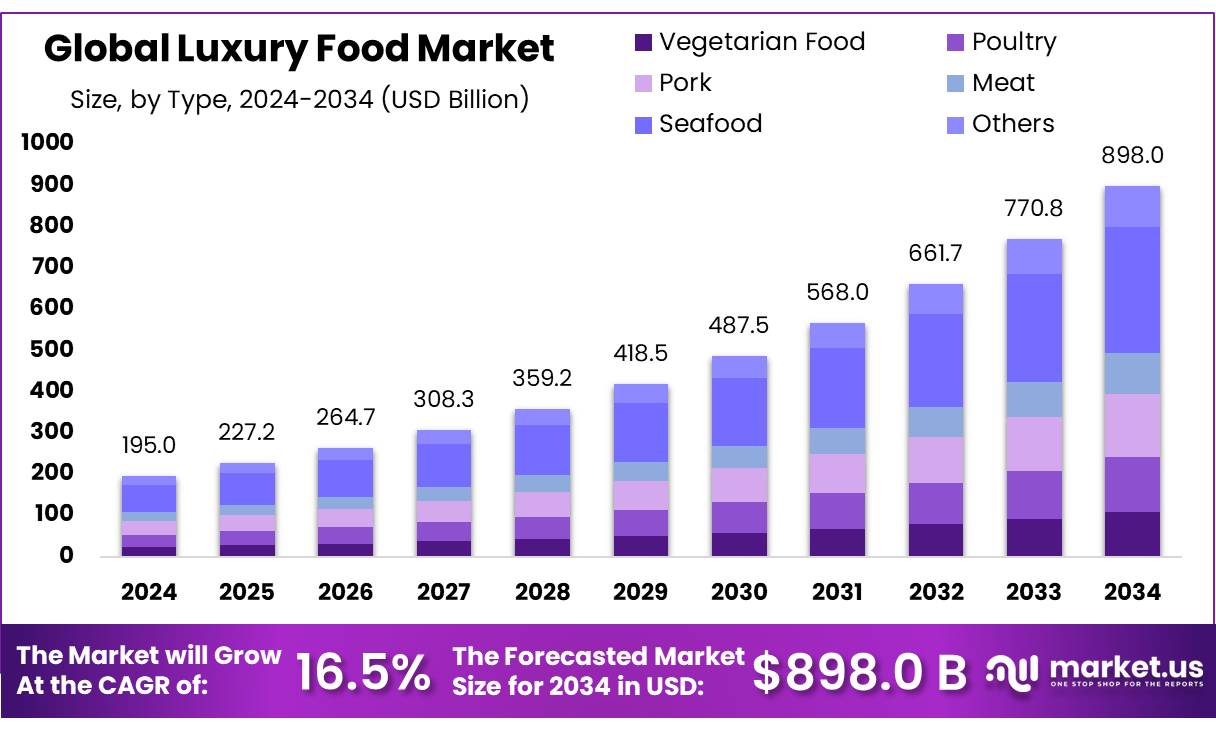

The Global Luxury Food Market size is expected to be worth around USD 898.0 Bn by 2034, from USD 195.0 Bn in 2024, growing at a CAGR of 16.5% during the forecast period from 2025 to 2034.

The global luxury food industry is evolving rapidly, driven by rising disposable incomes, changing consumer preferences, and a growing appetite for premium culinary experiences. Luxury foods include gourmet products such as truffles, caviar, premium cheeses, aged wines, fine chocolates, organic meats, and specialty seafood, among others.

These products are often associated with exclusivity, craftsmanship, and exceptional quality. According to the Food and Agriculture Organization (FAO), the global consumption of specialty food products has increased by 22% between 2018 and 2023, largely driven by urbanization and expanding middle-class populations in emerging economies. Consumers are now willing to pay a premium for authenticity, origin-specific items, and ethical sourcing.

The primary driving factors behind this industry include rising health consciousness, increased awareness of food provenance, and the growing influence of social media on food culture. The US Department of Agriculture (USDA) reports that demand for organic and specialty food products in the US grew by 10.5% year-over-year in 2023, signaling a shift toward quality over quantity.

Additionally, tourism and experiential dining are fueling growth, with luxury hotels and Michelin-star restaurants sourcing high-end ingredients to enhance brand positioning and consumer appeal. The World Tourism Organization (UNWTO) highlighted that culinary tourism contributed approximately USD 1.4 trillion to global travel expenditures in 2023, with luxury food experiences forming a key segment.

Government initiatives are also supporting sectoral growth. For instance, the Indian Ministry of Food Processing Industries (MoFPI) launched the “One District One Product” scheme to boost specialty food production, covering over 137 food products across different regions in 2024. In France, the government supports artisanal producers under the “Label Rouge” and “IGP” certifications, aimed at preserving traditional food craftsmanship. These policies are not only enhancing domestic production but also strengthening the export competitiveness of luxury food items.

Key Takeaways

- Luxury Food Market size is expected to be worth around USD 898.0 Bn by 2034, from USD 195.0 Bn in 2024, growing at a CAGR of 16.5%.

- Seafood held a dominant market position, capturing more than a 34.5% share in the global luxury food market.

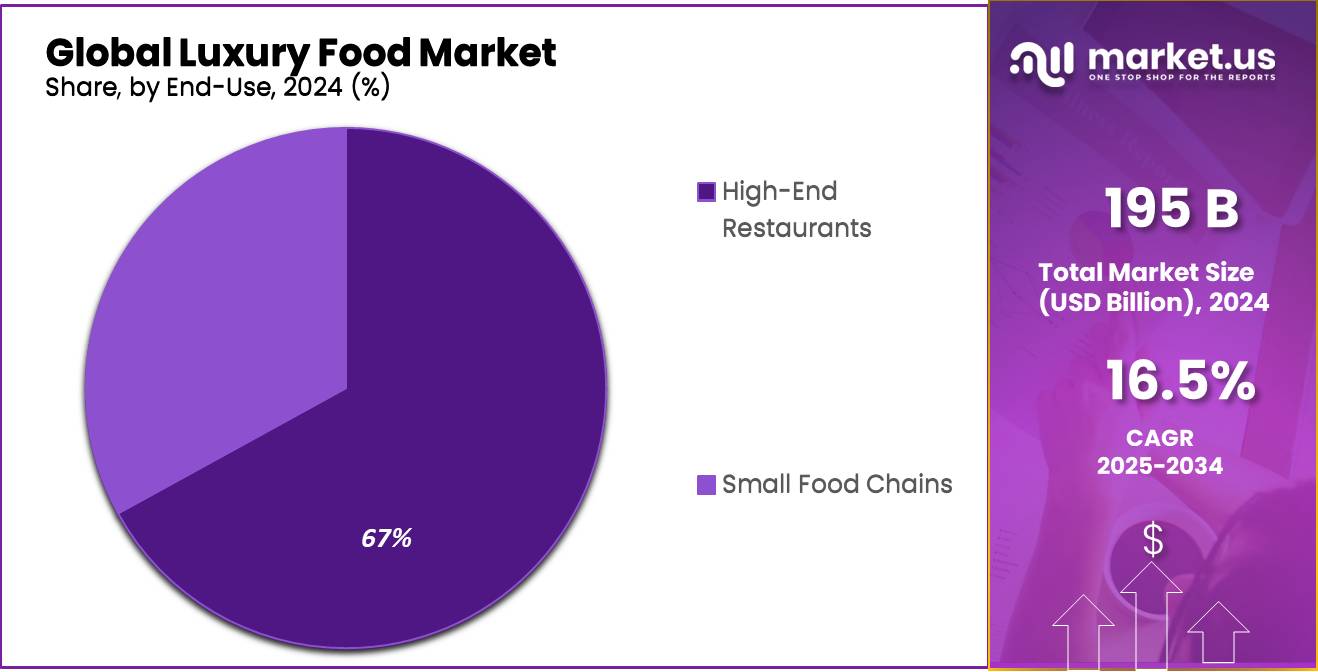

- High-End Restaurants held a dominant market position, capturing more than a 67.3% share in the luxury food market.

- Hypermarkets & Supermarkets held a dominant market position, capturing more than a 46.6% share in the global luxury food market.

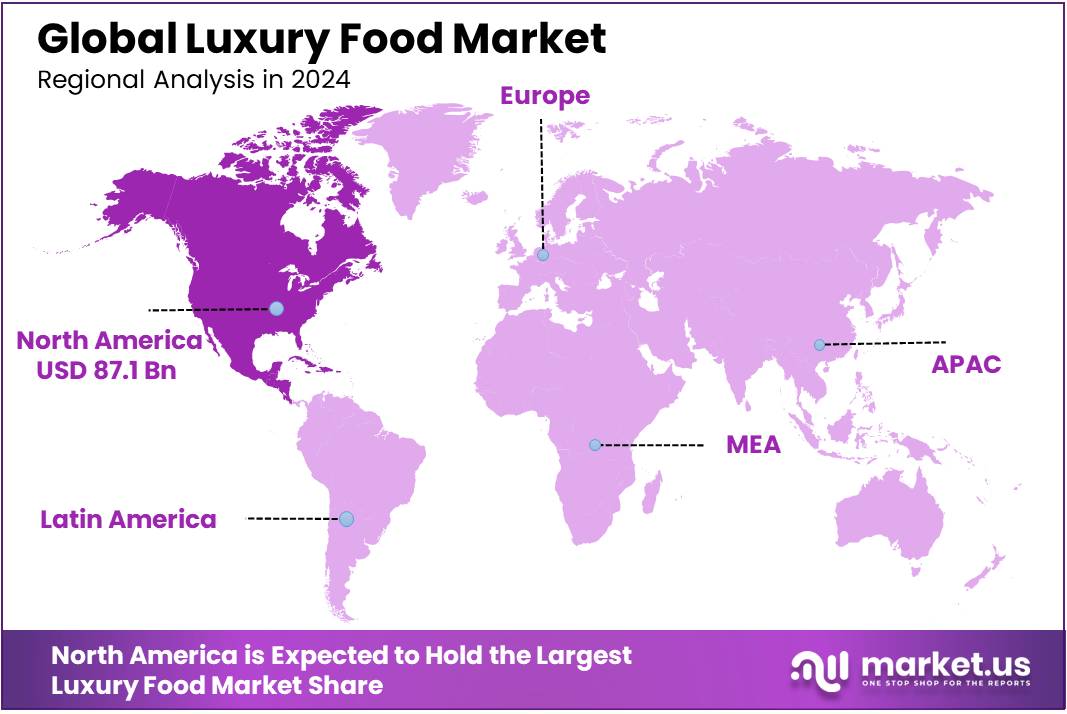

- North America emerged as the leading region in the global luxury food market, capturing a substantial 44.7% share and reaching a market value of USD 87.1 billion.

Analyst Viewpoint

From an investment perspective, the luxury food market is navigating through an interesting phase as we approach 2025. Despite some signs of “luxury fatigue” where growth in organic sales may not accelerate significantly, there are still substantial opportunities, especially in Asian markets and emerging regions like Southeast Asia and India. In 2025, it’s anticipated that China will continue as a dominant force, contributing significantly to global luxury consumption

Technology is playing an increasingly vital role in reshaping the luxury market. Consumers, particularly younger generations such as Millennials and Gen Z, are driving a shift towards luxury experiences rather than just luxury goods. This includes personalized and unique experiences, from luxury tourism to exclusive dining. Technological advancements like AI and augmented reality are being leveraged to enhance customer experiences in both digital and physical retail spaces, suggesting a trend towards a more integrated and personalized luxury consumer journey.

The regulatory environment also continues to evolve, with significant implications for luxury goods companies, particularly around issues of sustainability and digital security. As the luxury market grows, keeping abreast of these regulatory changes will be crucial for maintaining competitive advantage and ensuring compliance.

By Type

Seafood leads Luxury Food Market with 34.5% share in 2024, driven by premium demand

In 2024, Seafood held a dominant market position, capturing more than a 34.5% share in the global luxury food market. This strong lead was largely driven by rising consumer interest in high-quality, nutrient-rich, and exotic seafood items such as caviar, lobster, and king crab. Seafood’s association with health benefits, exclusivity, and gourmet experiences has positioned it as a preferred choice among affluent consumers across regions.

Countries like Japan, France, and the U.S. saw increased consumption of premium seafood in fine dining and hotel chains. Additionally, the rise of sustainable aquaculture and traceable sourcing practices made luxury seafood more appealing to conscious buyers in 2024. With global luxury food trends tilting toward freshness, rarity, and culinary experience, seafood continues to attract demand both in home consumption and high-end hospitality.

By End-User

High-End Restaurants dominate with 67.3% share in 2024 as luxury dining trends soar

In 2024, High-End Restaurants held a dominant market position, capturing more than a 67.3% share in the luxury food market. This stronghold was fueled by rising global demand for gourmet experiences and chef-curated tasting menus that highlight premium ingredients. Diners, especially in urban and tourist-heavy regions, increasingly sought out exclusive culinary experiences, contributing to higher spending at upscale establishments.

Michelin-starred restaurants, luxury hotel dining, and fine-dining chains saw significant growth, particularly in cities like Paris, Dubai, Tokyo, and New York. Events, corporate hospitality, and affluent travelers also played a key role in this trend during 2024. These restaurants prioritized quality sourcing, authenticity, and presentation, which aligned well with the expectations of high-end consumers. As a result, high-end dining venues continued to dominate the end-user segment of luxury food, reinforcing their influence on the industry’s premium product choices.

By Distribution Channel

Hypermarkets & Supermarkets lead with 46.6% share in 2024, thanks to wide premium food access

In 2024, Hypermarkets & Supermarkets held a dominant market position, capturing more than a 46.6% share in the global luxury food market. Their broad reach, strong supply chains, and focus on curated premium food sections played a big role in this lead. Shoppers increasingly turned to these retail giants for accessible yet high-quality luxury items like imported cheeses, fine meats, and gourmet packaged goods. Many stores improved their in-store experiences with tasting counters, wine pairings, and freshly prepared upscale meals to attract affluent buyers.

Urban locations saw strong footfall, especially in major markets across Europe and North America, where demand for convenience blended with luxury. Supermarkets also benefited from partnerships with high-end brands and seasonal promotions in 2024. This made them a top choice for consumers wanting premium food without the exclusivity or formality of luxury boutiques.

Key Market Segments

By Type

- Vegetarian Food

- Poultry

- Pork

- Meat

- Seafood

- Others

By End-User

- High-End Restaurants

- Small Food Chains

By Distribution Channel

- Supermarkets and Hypermarkets

- Online Retailers

- Specialty Stores

- Others

Drivers

Rising Disposable Incomes and Changing Lifestyle Preferences Fuel Premium Food Demand

One of the major driving factors for the luxury food market is the steady rise in global disposable incomes, especially among the middle and upper-middle classes. As people earn more, their preferences shift toward better quality, healthier, and more indulgent food experiences.

According to the OECD, global household disposable income per capita rose by 2.6% year-on-year in Q4 2023, after a 2.3% increase in the previous quarter. This growth in income has translated directly into increased spending on premium food items such as artisanal chocolates, gourmet cheeses, truffle-infused products, and organic seafood.

Consumers in countries like the U.S., China, and India have begun prioritizing luxury food not only for special occasions but also as a regular part of their diet, especially in urban areas. For instance, the USDA reported that U.S. consumer expenditures on food at home hit USD 1.05 trillion in 2023, with a growing share allocated to premium categories such as organic, locally sourced, and imported goods.

In response, governments have also started supporting high-quality food production and international food trade. The European Union’s Farm to Fork Strategy, launched under the Green Deal, aims to increase the sustainability and transparency of premium food chains, supporting organic and high-quality producers with subsidies and marketing support. This initiative has helped improve access and confidence in European luxury food products across global markets.

Restraints

High Prices and Inflation Limit Access to Luxury Foods

One of the biggest challenges facing the luxury food market is the high cost of premium products, which makes them less accessible to many consumers. In 2023, U.S. consumers spent an average of $7,672 per person on food, with a significant portion directed towards dining out. This increase in spending was largely driven by a 12% rise in food-away-from-home expenses, reaching $4,485 per capita, up from $4,004 in 2022.

While overall food spending rose, the share of disposable personal income allocated to food remained at 11.2% in 2023, unchanged from the previous year. However, there was a notable shift in spending patterns: the share spent on food at home decreased from 5.6% to 5.3%, while the share spent on food away from home increased from 5.6% to 5.9%.

These trends indicate that while consumers are spending more on food, the rising costs, especially for dining out, are impacting their overall food budgets. For many, the high prices of luxury food items make them occasional indulgences rather than regular purchases. This limits the market’s growth potential, as only a segment of consumers can afford these premium products regularly.

Opportunity

Food Tourism and Experiential Dining Drive Growth in Luxury Food Market

A significant opportunity for the luxury food market lies in the rising trend of food tourism and the growing consumer desire for unique culinary experiences. As more individuals seek not just meals but memorable dining adventures, the demand for high-quality, exclusive food offerings has surged.

This growth is largely attributed to the increasing number of consumers who prioritize experiences over material possessions. Travelers are now more inclined to explore destinations through their culinary landscapes, seeking out local delicacies, gourmet restaurants, and authentic food experiences. This shift in consumer behavior has led to a boom in food tourism, where the journey is as much about tasting as it is about sightseeing.

Governments and tourism boards worldwide have recognized this trend and are actively promoting their unique culinary offerings to attract tourists. For instance, various countries have launched initiatives to highlight regional cuisines, support local food festivals, and encourage the development of food trails. These efforts not only boost tourism but also provide a platform for luxury food producers to showcase their products to a global audience.

Trends

Sustainable Luxury Foods Gain Momentum Amid Growing Consumer Awareness

A notable trend shaping the luxury food market is the increasing consumer demand for sustainably sourced and environmentally friendly products. As awareness of environmental issues rises, consumers are seeking luxury food items that align with their values of sustainability and ethical sourcing.

Consumers are now more inclined to purchase luxury food products that are organic, locally sourced, and have a lower environmental impact. This shift is evident in the rising popularity of plant-based gourmet foods, sustainably harvested seafood, and ethically produced meats. Retailers and producers are responding by offering products that meet these criteria, thereby attracting a broader customer base that values both luxury and sustainability.

Government initiatives and regulations are also playing a role in promoting sustainable practices within the food industry. Policies encouraging sustainable agriculture, reducing food waste, and promoting ethical sourcing are influencing how luxury food products are produced and marketed. These measures not only support environmental goals but also cater to the growing consumer demand for responsible consumption.

Regional Analysis

North America Leads Luxury Food Market with 44.7% Share, Valued at $87.1 Billion in 2024

In 2024, North America emerged as the leading region in the global luxury food market, capturing a substantial 44.7% share and reaching a market value of USD 87.1 billion. This dominance is driven by a combination of high disposable incomes, a strong culture of premium dining, and a growing appetite for gourmet experiences among consumers.

The United States stands at the forefront of this trend, with consumers increasingly seeking high-quality, unique, and artisanal food products. Boutique grocery stores like Pop Up Grocer in New York and Erewhon in Los Angeles have transformed grocery shopping into a luxury experience, offering exclusive products that cater to health-conscious and trend-aware shoppers. These establishments have become cultural staples, attracting a diverse clientele and setting new standards for luxury food retail.

Canada and Mexico also contribute significantly to the region’s market share. Canada’s emphasis on sustainable and organic food options aligns with the luxury market’s focus on quality and ethical sourcing. In Mexico, there is a growing demand for upscale foods, with over 45% of consumers expressing intentions to purchase luxury cuisine in the coming years.

The region’s robust infrastructure, including a well-established network of high-end restaurants, specialty stores, and gourmet food suppliers, supports the distribution and accessibility of luxury food products. Additionally, the increasing popularity of food tourism and culinary experiences further fuels the market’s growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Caviar House & Prunier is a luxury seafood brand headquartered in Switzerland, specializing in high-end caviar and smoked salmon. The company owns and operates one of the last fully integrated caviar production sites in Europe. In 2024, it recorded strong sales in travel retail and premium hospitality channels. Its Prunier-branded caviar, sourced sustainably, remains a flagship product. With a presence in top international airports and gourmet outlets, it remains a leading name in global luxury seafood.

D’Artagnan is a U.S.-based gourmet food company offering premium meats, foie gras, truffles, and mushrooms. Known for its strong relationships with small farms, the company focuses on humane and sustainable farming. In 2024, D’Artagnan strengthened its e-commerce presence and expanded its specialty retail partnerships across North America. The brand is favored by top chefs and luxury restaurants. Its transparency in sourcing and commitment to quality continue to resonate with health-conscious and gourmet-focused consumers.

Fauchon is a historic French gourmet food company offering luxury items like foie gras, fine teas, and pastries. Founded in 1886, it remains a symbol of Parisian elegance and gastronomy. In 2024, Fauchon launched limited-edition product lines targeting Middle Eastern and Asian luxury markets. Its boutique stores, mainly located in high-end shopping districts and airports, cater to both local elites and international travelers. The brand’s legacy and innovation drive its global appeal in premium food retail.

Top Key Players in the Market

- Alain Ducasse Chocolat

- Caviar House & Prunier

- D’Artagnan

- Dom Pérignon

- Fauchon

- Fortnum & Mason

- Godiva

- Harrods Food Halls

- Kaviari

- La Maison du Chocolat

- Ladurée

- Murray’s Cheese

- Petrossian

- Pierre Hermé

- Valrhona

- Venchi

- Vosges Haut-Chocolat

Recent Developments

In 2024, Le Chocolat Alain Ducasse expanded its global footprint by opening new boutiques in Tokyo and Munich, catering to a growing international clientele . With a workforce of approximately 125 employees, the company continues to blend tradition with innovation, offering a range of products that appeal to discerning consumers worldwide .

In 2024, Fauchon introduced “Millennium Water” at its Kyoto hotel, utilizing local mineral water to enrich its culinary offerings and promote sustainability.

Report Scope

Report Features Description Market Value (2024) USD 195.0 Bn Forecast Revenue (2034) USD 898.0 Bn CAGR (2025-2034) 16.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Vegetarian Food, Poultry, Pork, Meat, Seafood, Others), By End-User (High-End Restaurants, Small Food Chains), By Distribution Channel (Supermarkets and Hypermarkets, Online Retailers, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alain Ducasse Chocolat, Caviar House & Prunier, D’Artagnan, Dom Pérignon, Fauchon, Fortnum & Mason, Godiva, Harrods Food Halls, Kaviari, La Maison du Chocolat, Ladurée, Murray’s Cheese, Petrossian, Pierre Hermé, Valrhona, Venchi, Vosges Haut-Chocolat Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alain Ducasse Chocolat

- Caviar House & Prunier

- D’Artagnan

- Dom Pérignon

- Fauchon

- Fortnum & Mason

- Godiva

- Harrods Food Halls

- Kaviari

- La Maison du Chocolat

- Ladurée

- Murray’s Cheese

- Petrossian

- Pierre Hermé

- Valrhona

- Venchi

- Vosges Haut-Chocolat