Global Food Emulsifiers Market Size, Share, Statistics Analysis Report By Source (Plant-based, Animal-based, Synthetic), By Type (Mono-, di-glycerides and Derivatives, Lecithin, Stearoyl Lactylates, Sorbitan Esters, Polyglycerol Ester, Others), By Application (Bakery and Confectionery, Convenience Foods, Dairy and Frozen Products, Meat, Poultry, and Seafood, Spreads and Margarines, Others) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144933

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

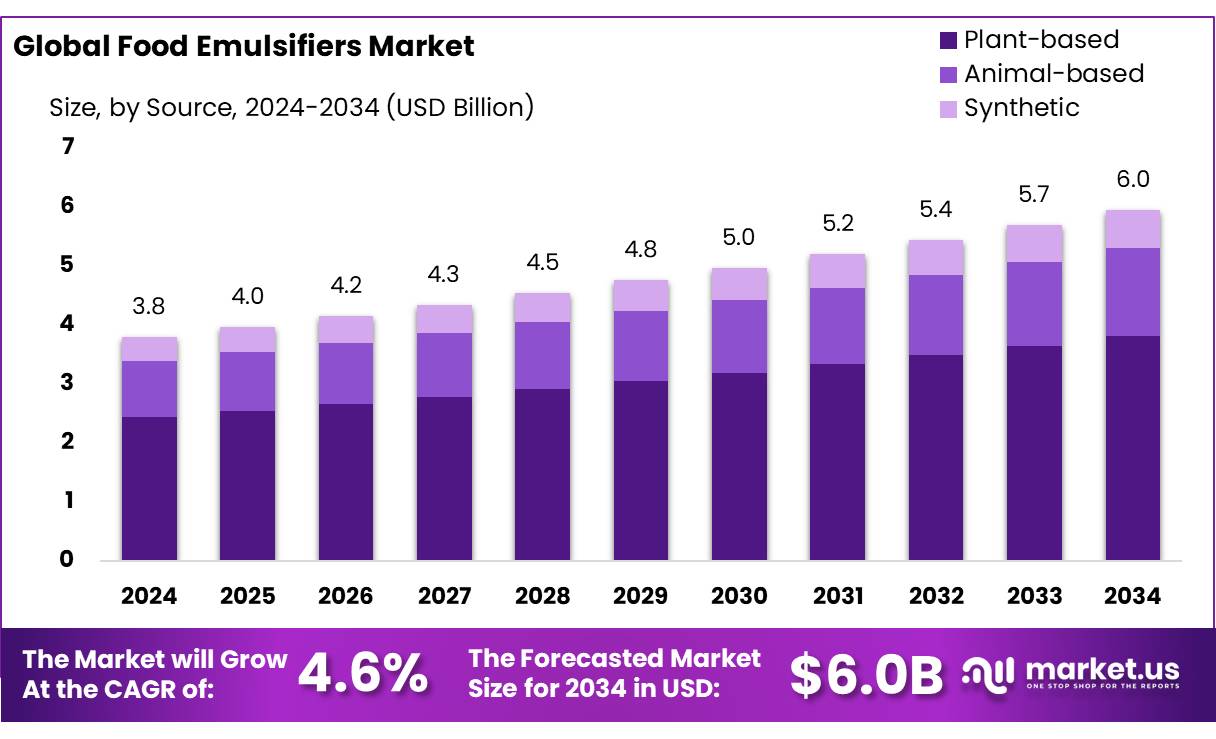

The Global Food Emulsifiers Market size is expected to be worth around USD 6.0 Billion by 2034, from USD 3.8 Billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

Food emulsifiers are specialized chemical substances used extensively in the food and beverage industry to stabilize emulsions, preventing the separation of ingredients such as oil and water. These substances play a critical role in enhancing the texture, consistency, and shelf-life of various products including bakery goods, dairy products, confectioneries, and processed meats. The global market for food emulsifiers is witnessing substantial growth, driven by evolving consumer preferences and innovations in food technology.

The food emulsifiers industry is characterized by its dynamic nature, with companies continuously innovating to meet the stringent quality standards and changing preferences of consumers. Key players such as Dow, DuPont, Cargill, and Kerry Group are at the forefront, contributing significantly to advancements in the sector.

According to recent data from the U.S. Department of Agriculture, the food processing industry accounts for approximately 16% of the total U.S. manufacturing shipments, with emulsifiers playing a vital role in this segment.

Several factors drive the food emulsifiers market, including the increasing demand for processed foods and the rising popularity of convenience food products. The health and wellness trend is particularly impactful, as consumers seek products with better nutritional profiles and cleaner labels. This shift has prompted manufacturers to reformulate products using natural emulsifiers, such as lecithin, derived from sources like soybeans and sunflower. The industry also benefits from regulatory support, such as the FDA’s guidelines on safe food additives, which help maintain high standards of food safety and quality.

Governments worldwide are actively supporting the food emulsifiers industry through various initiatives aimed at boosting food manufacturing sectors. In the European Union, regulations such as Regulation (EC) No 1333/2008 govern the use of food additives, including emulsifiers, setting the stage for market expansion and innovation. Financial allocations from government bodies, such as the €100 million fund from the European Investment Bank for food and beverage SMEs in 2020, underscore the commitment to fostering industry growth.

Key Takeaways

- Food Emulsifiers Market size is expected to be worth around USD 6.0 Billion by 2034, from USD 3.8 Billion in 2024, growing at a CAGR of 4.6%.

- Plant-based segment held a commanding position in the food emulsifiers market, boasting a share of over 64.20%.

- Mono-, di-glycerides, and their derivatives held a robust market position within the food emulsifiers sector, capturing more than 43.20% of the market share.

- Bakery and confectionery segment emerged as a powerhouse in the food emulsifiers market, securing more than a 37.40% share.

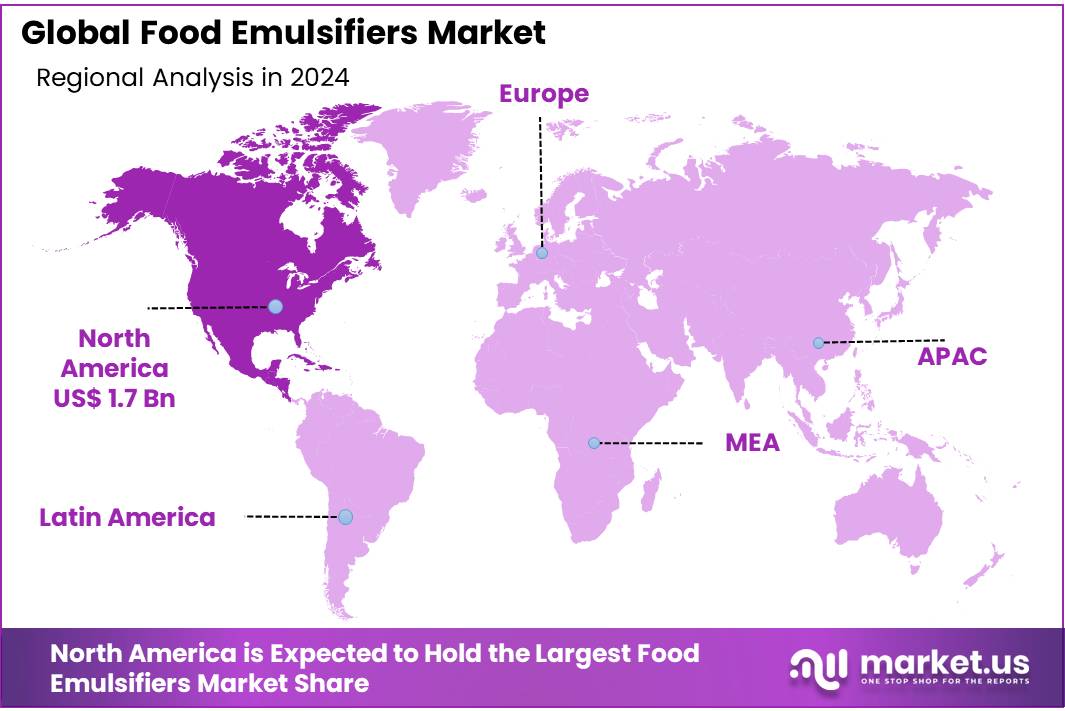

- North America stands out as a dominating region, capturing a significant market share of 46.20%, which equates to approximately $1.7 billion.

By Source

Plant-Based Emulsifiers Take the Lead with a 64.20% Market Share

In 2024, the plant-based segment held a commanding position in the food emulsifiers market, boasting a share of over 64.20%. This dominant market share underscores the growing consumer preference for natural ingredients within the food industry. The shift towards plant-based emulsifiers is driven by increasing awareness about health and wellness, as well as the demand for clean label products.

These emulsifiers are derived from natural sources such as plants, making them highly appealing to health-conscious consumers looking for food products free from synthetic additives. As the market continues to evolve, the reliance on plant-based emulsifiers is expected to grow, supported by advancements in food technology and rising consumer expectations for sustainability and natural composition in food products.

By Type

Mono-, Di-Glycerides & Derivatives Lead with 43.20% Share Due to Their Functional Versatility

In 2024, mono-, di-glycerides, and their derivatives held a robust market position within the food emulsifiers sector, capturing more than 43.20% of the market share. This significant share reflects their essential role in food processing. These emulsifiers are favored for their effectiveness in improving the texture, stability, and shelf life of various food products, ranging from baked goods to dairy items. Their ability to act as interface agents between conflicting components like oil and water makes them indispensable in creating smooth and consistent food products. The widespread use and functional versatility of these emulsifiers ensure their continued dominance in the market, catering to both industrial and consumer demands for high-quality food products.

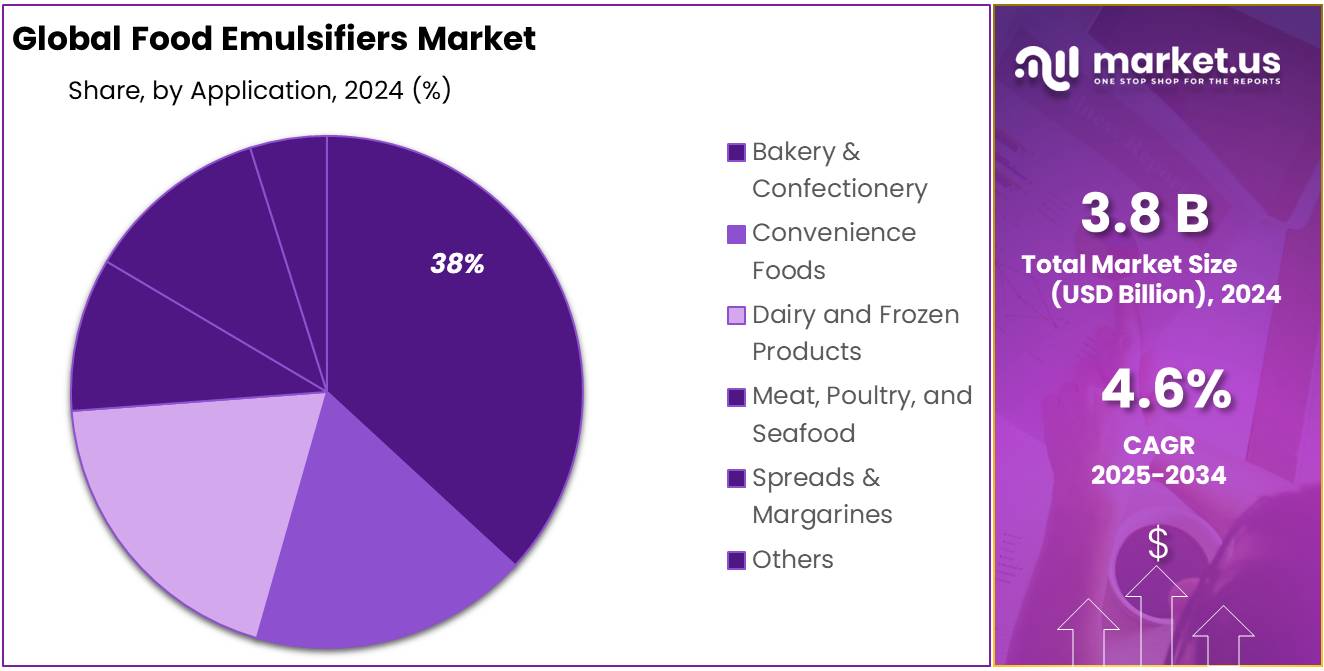

By Application

Bakery & Confectionery Sector Stands Out with 37.40% Share, Bolstering Market Growth

In 2024, the bakery and confectionery segment emerged as a powerhouse in the food emulsifiers market, securing more than a 37.40% share. This segment’s dominance is fueled by the critical role emulsifiers play in the production of baked goods and sweets. These ingredients are pivotal in achieving the desired texture, volume, and freshness in bakery products, while also enhancing the mouthfeel and stability of confections. The reliance on emulsifiers in this sector is driven by continuous innovations in bakery and confectionery goods, coupled with growing consumer expectations for quality and longevity in these products. The enduring popularity of bakery items and sweets ensures a steady demand for emulsifiers, making this application a central pillar in the overall market landscape.

Key Market Segments

By Source

- Plant-based

- Animal-based

- Synthetic

By Type

- Mono-, di-glycerides & Derivatives

- Lecithin

- Stearoyl Lactylates

- Sorbitan Esters

- Polyglycerol Ester

- Others

By Application

- Bakery & Confectionery

- Convenience Foods

- Dairy and Frozen Products

- Meat, Poultry, and Seafood

- Spreads & Margarines

- Others

Drivers

Rising Demand for Processed Foods Drives Growth in Food Emulsifiers Market

One of the major driving factors for the growth of the food emulsifiers market is the increasing global demand for processed and convenience foods. As lifestyles become busier, consumers are seeking quicker, more convenient eating options that do not compromise on taste or quality. Food emulsifiers play a crucial role in meeting these expectations by improving the texture, stability, and shelf life of processed foods.

According to data from the Food and Agriculture Organization (FAO), the global processed food market is expected to grow steadily, driven by urbanization and the rising incomes of middle-class consumers worldwide. Emulsifiers are essential in products ranging from bread and cakes to ready meals, which require consistency and an appealing texture to satisfy consumer preferences.

Furthermore, government initiatives aimed at food safety and quality are encouraging the use of approved emulsifiers. These initiatives support the use of ingredients that help achieve compliance with food safety regulations, enhancing the trust and confidence of consumers in processed food products. For example, the European Food Safety Authority (EFSA) regularly updates its list of approved food additives, including emulsifiers, ensuring they meet strict safety standards.

The impact of such trends is significant, suggesting a sustained increase in the use of food emulsifiers. Industry leaders in the food manufacturing sector, such as Nestlé and Unilever, have reported an increased utilization of emulsifiers to maintain the quality and extend the shelf life of their products, thereby catering to the global demand for high-quality processed foods.

Restraints

Health Concerns Over Synthetic Emulsifiers Impact Market Growth

A significant restraining factor for the food emulsifiers market is the growing health concerns associated with synthetic emulsifiers. As consumer awareness increases, more people are scrutinizing the ingredients in their food, particularly those with potential health risks. Synthetic emulsifiers, often used in processed foods to improve texture and extend shelf life, are facing scrutiny due to studies suggesting they might affect gut microbiota and potentially lead to inflammation or chronic diseases.

Organizations like the World Health Organization (WHO) and the Centers for Disease Control and Prevention (CDC) have published guidelines and research linking poor diet and artificial additives to various health issues, which has led to a cautious approach towards synthetic emulsifiers among health-conscious consumers. Although not banning these additives, these bodies recommend moderation and careful consideration of all food ingredients for a healthy lifestyle, which indirectly affects consumer choices and, consequently, the demand for synthetic emulsifiers.

In response to these concerns, some governments and regulatory agencies have tightened regulations surrounding food additives, pushing manufacturers to seek natural alternatives or reduce the use of synthetic emulsifiers altogether. For instance, the European Union regulates food additives under Regulation (EC) No 1333/2008, which dictates strict conditions for the use of emulsifiers, including detailed safety assessments and approved usage levels.

These factors combined are compelling food manufacturers to innovate and explore safer, more natural emulsifying alternatives that align with consumer preferences for ‘cleaner’ labels. This shift poses a challenge to the growth of the synthetic segment of the food emulsifiers market, as producers must balance the technical benefits of emulsifiers with consumer health perceptions and regulatory compliance.

Opportunity

Clean Label Trends Offer New Growth Avenues for Food Emulsifiers

One of the most promising growth opportunities in the food emulsifiers market is the rising demand for clean label products. This trend reflects a broader consumer movement towards food products that are perceived as natural, organic, and free from artificial ingredients. As consumers become more health-conscious and wary of processed foods, the demand for clean label products has seen a significant surge.

Industry leaders and organizations, including the Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA), have recognized this shift towards healthier eating habits. They encourage food producers to use ingredients that can be easily recognized and understood by consumers, promoting transparency in food labeling. This push aligns with consumer demand for products containing ingredients they perceive as wholesome.

The clean label trend presents a significant opportunity for food emulsifier manufacturers to innovate and develop new products that meet these criteria. Natural emulsifiers, such as lecithin, derived from sources like soy or eggs, and mono- and diglycerides sourced from vegetable fats, are particularly well-positioned to capitalize on this trend. These emulsifiers can help food producers maintain the quality and stability of their products while meeting consumer demands for natural ingredients.

According to a report by a leading global food policy organization, the clean label ingredients market is projected to grow annually by 6.75% over the next five years, indicating robust market potential for natural emulsifiers. By leveraging this trend, manufacturers can not only enhance their product offerings but also strengthen their market position by aligning with consumer values centered on health and sustainability.

Trends

Plant-Based Emulsifiers Gain Momentum in Market Trends

A significant and emerging trend in the food emulsifiers market is the shift towards plant-based sources. This trend is fueled by the increasing consumer preference for vegan and vegetarian diets, along with a rising awareness of environmental and ethical concerns associated with animal-derived ingredients. Plant-based emulsifiers such as lecithin, derived from sunflower and soy, are gaining popularity due to their natural origin and sustainability credentials.

Leading food organizations, including the United Nations Food and Agriculture Organization (FAO), have highlighted the growth in plant-based diets as a global movement. The FAO notes that the demand for plant-based products is not just a temporary trend but a significant shift in consumer eating patterns that is expected to persist long-term. This shift is influencing food manufacturers to reconsider their ingredient lists and opt for plant-based emulsifiers that align with consumer values.

Moreover, government health bodies and environmental groups are supporting this trend through educational campaigns and initiatives that promote plant-based eating for health and environmental benefits. Such endorsements are encouraging manufacturers to develop new formulations that replace traditional synthetic or animal-derived emulsifiers with plant-based alternatives.

The global market for plant-based foods is projected to grow exponentially, suggesting a broad and expanding market for related ingredients like emulsifiers. Food producers who innovate in this area can tap into a growing segment of health-conscious and environmentally aware consumers, opening up new avenues for growth and differentiation in the competitive food industry landscape.

Regional Analysis

In the global food emulsifiers market, North America stands out as a dominating region, capturing a significant market share of 46.20%, which equates to approximately $1.7 billion. This leadership is largely driven by the United States, which is a hub for food production and innovation. The region’s dominance is supported by several factors, including advanced food processing technologies and a robust food and beverage industry that continually demands innovative solutions to enhance food quality and shelf life.

The demand for food emulsifiers in North America is also propelled by the growing consumer awareness of the health aspects of food ingredients, leading to an increased demand for clean-label products and natural emulsifiers. Consumers in this region are more inclined towards products that are free from synthetic additives, which has spurred the development and adoption of plant-based and natural emulsifiers by manufacturers.

Furthermore, regulatory support from bodies such as the U.S. Food and Drug Administration (FDA) and Health Canada play a crucial role in the market. These agencies ensure that food emulsifiers meet stringent safety standards, thereby boosting consumer confidence and facilitating the use of these ingredients across a wide range of food applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill stands as a titan in the food emulsifiers market, leveraging its extensive global presence and innovation capabilities. The company specializes in a diverse range of emulsifiers that cater to various food applications, emphasizing sustainability and health. Cargill’s commitment to producing high-quality, safe, and sustainable food ingredients aligns with the increasing consumer demand for clean-label products, positioning it as a leader in natural and plant-based emulsifiers.

Riken Vitamin excels in the development of specialized food emulsifiers that enhance texture and stability in food products. Based in Japan, the company has carved a niche by focusing on technologically advanced solutions and customized products that meet specific customer needs. Riken’s dedication to quality and innovation in emulsifier formulations makes it a preferred partner for food manufacturers looking to improve product performance.

Palsgaard A/S is renowned for its expertise in the creation of sustainable and highly effective emulsifiers. As a pioneer in the field, Palsgaard places a strong emphasis on environmental responsibility, producing its emulsifiers using 100% renewable energy. Their products are integral in producing smoother, creamier, and more stable food products, fulfilling the requirements of an increasingly eco-conscious consumer base.

Top Key Players

- Cargill, Incorporated

- Riken Vitamin Co., Ltd.

- Palsgaard A/S

- Archer Daniels Midland Company

- BASF SE

- Corbion

- Kerry Group

- Ingredion Incorporated

- International Flavors & Fragrances Inc

- Tate & Lyle

- Fine Organics

- Stepan Company

- Barentz

- Puratos

- Other Key Players

Recent Developments

Cargill’s strategy includes enhancing the functionality and performance of emulsifiers under various processing conditions, which is crucial for food manufacturers aiming to improve product quality and extend shelf life.

In 2024 Riken Vitamin Co., Ltd., the company continued to leverage its expertise in molecular distillation technology, a method they pioneered back in 1959, to produce high-quality monoglycerides, a type of food emulsifier.

Report Scope

Report Features Description Market Value (2024) USD 3.8 Bn Forecast Revenue (2034) USD 6.0 Bn CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plant-based, Animal-based, Synthetic), By Type (Mono-, di-glycerides and Derivatives, Lecithin, Stearoyl Lactylates, Sorbitan Esters, Polyglycerol Ester, Others), By Application (Bakery and Confectionery, Convenience Foods, Dairy and Frozen Products, Meat, Poultry, and Seafood, Spreads and Margarines, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill, Incorporated, Riken Vitamin Co., Ltd., Palsgaard A/S, Archer Daniels Midland Company, BASF SE, Corbion, Kerry Group, Ingredion Incorporated, International Flavors & Fragrances Inc, Tate & Lyle, Fine Organics, Stepan Company, Barentz, Puratos, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill, Incorporated

- Riken Vitamin Co., Ltd.

- Palsgaard A/S

- Archer Daniels Midland Company

- BASF SE

- Corbion

- Kerry Group

- Ingredion Incorporated

- International Flavors & Fragrances Inc

- Tate & Lyle

- Fine Organics

- Stepan Company

- Barentz

- Puratos

- Other Key Players