Global Ready To Drink Protein Market Size, Share, And Business Benefits By Product Type (Animal-Based Proteins (Milk, Whey, Others), Plant Source (Pea Protein, Soy Protein, Quinoa Protein, Rice Protei, Hemp Protein, Others)), By Packaging Type (Bottles, Cans, Cartons, Pouches, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144813

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

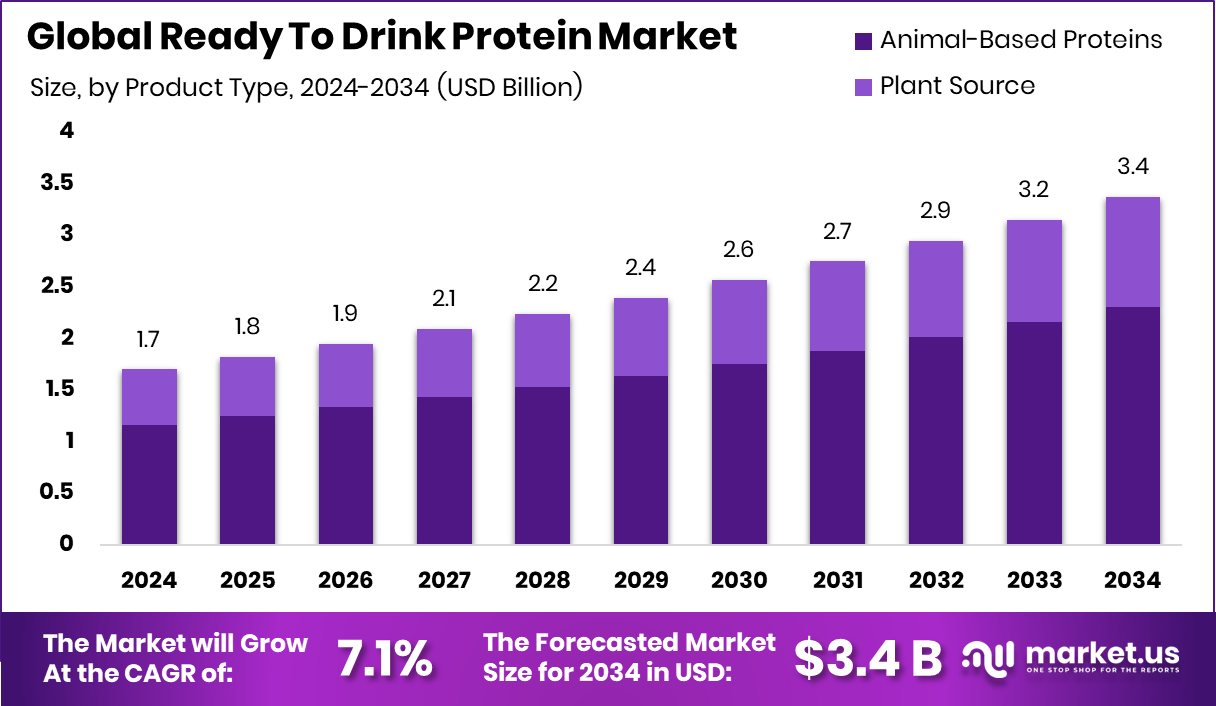

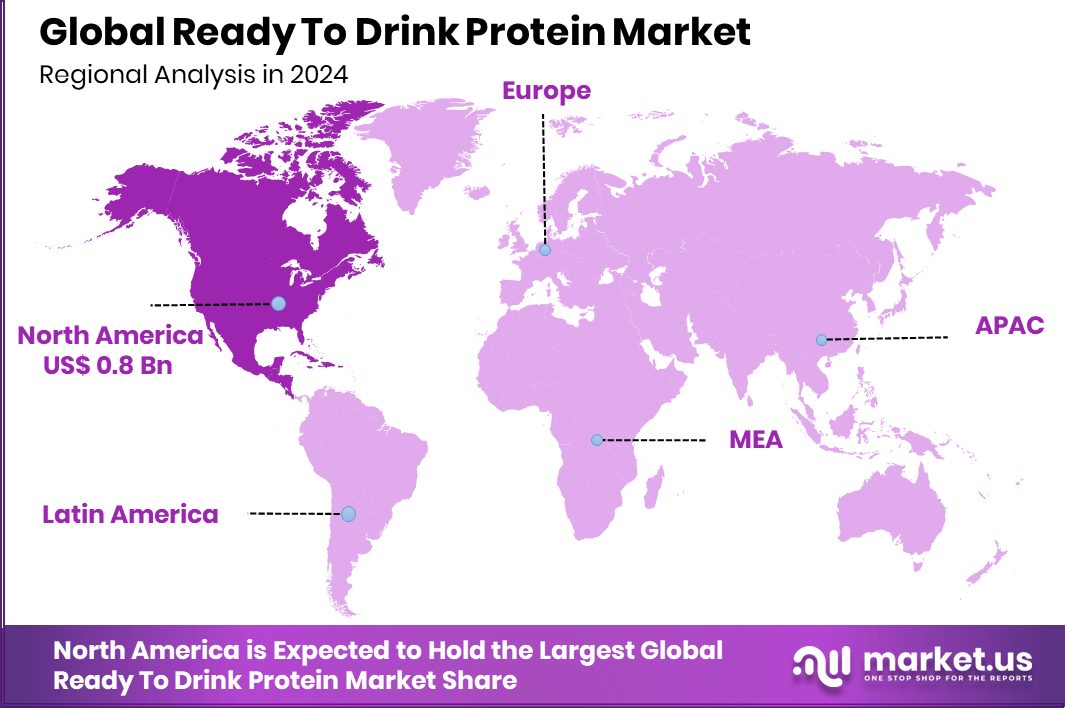

The Global Ready To Drink Protein Market is expected to be worth around USD 3.4 billion by 2034, up from USD 1.7 billion in 2024, and grow at a CAGR of 7.1% from 2025 to 2034. The RTD Protein Market in North America holds a significant USD 0.8 Bn value.

Ready To Drink (RTD) Protein beverages are pre-formulated drinks intended to provide a quick and convenient source of protein. These beverages are popular among consumers looking to supplement their protein intake without the need for preparation. RTD protein drinks are often used by individuals who engage in fitness or athletic activities, as well as by those who seek to maintain a balanced diet when they might not have time for a full meal.

The Ready To Drink Protein Market comprises the commercial production and distribution of pre-packaged protein beverages. This market caters to a diverse range of consumers, including athletes, fitness enthusiasts, busy professionals, and individuals focused on weight management or dietary supplements. Nobell Foods raised USD 150 million for plant-based dairy alternatives.

The growth of the RTD protein market is significantly driven by the increasing awareness of health and fitness across global populations. As more individuals participate in health and wellness activities, the demand for convenient nutritional products like RTD protein beverages rises. Additionally, the growing trend towards plant-based and lactose-free alternatives expands the market to include a broader range of consumers seeking dietary specific options.

Demand for RTD protein drinks is propelled by the busy lifestyles of modern consumers who require quick nutritional solutions. The ease of use and availability of these drinks in various flavors and formulations make them an appealing option for instant energy and meal replacement.

Moreover, as societal focus on protein-rich diets continues to strengthen, more consumers are turning to RTD proteins as a reliable source of essential nutrients. Kynda secured €3 million for fungal-based protein production through fermentation processes.

Key Takeaways

- The Global Ready To Drink Protein Market is expected to be worth around USD 3.4 billion by 2034, up from USD 1.7 billion in 2024, and grow at a CAGR of 7.1% from 2025 to 2034.

- Animal-based proteins dominate with 68.40% of the Ready To Drink Protein Market.

- Bottled RTD proteins lead packaging types, making up 58.30% of the market.

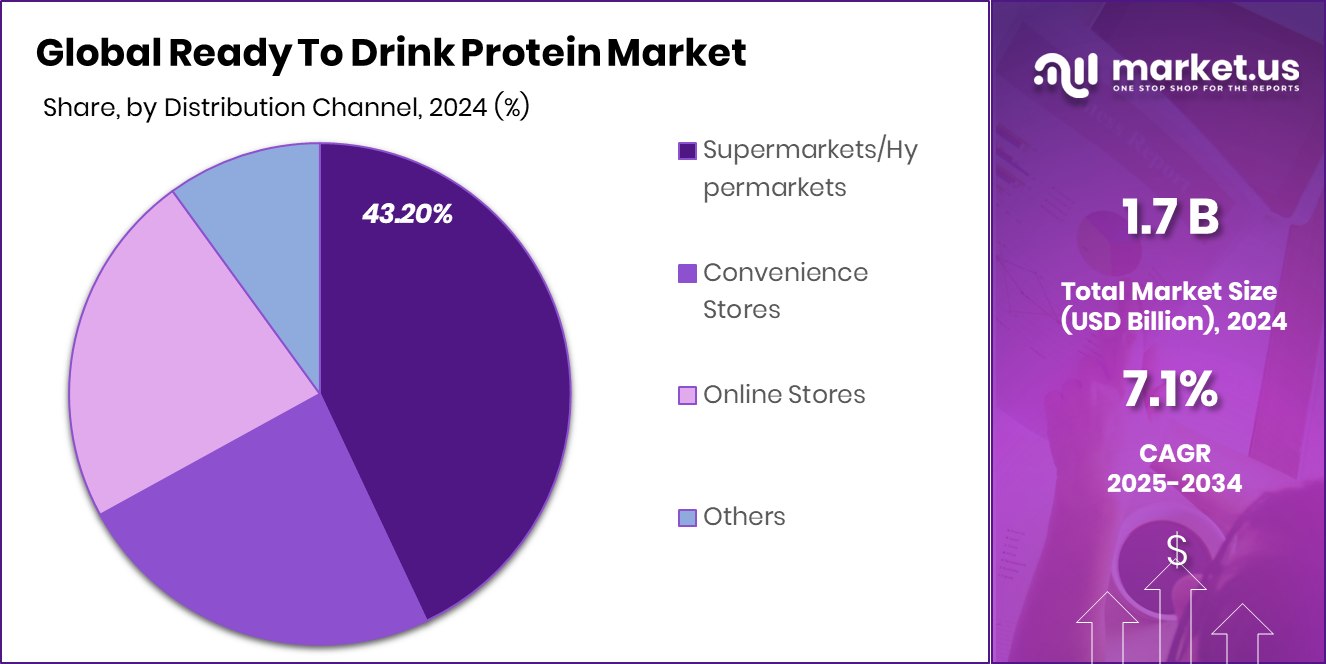

- Supermarkets and hypermarkets distribute 43.20% of RTD proteins, dominating the channel.

- With 48.10% market share, North America leads in the USD 0.8 Bn RTD sector.

By Product Type Analysis

Animal-based proteins dominate the Ready To Drink Protein Market with a 68.40% share.

In 2024, Animal-Based Proteins held a dominant market position in the by-product type segment of the Ready To Drink Protein Market, capturing a substantial 68.40% share. This segment’s strong performance is largely attributed to the widespread consumer perception of animal-based proteins as a high-quality, comprehensive source of essential amino acids, which are crucial for muscle repair and growth.

Traditionally favored by athletes and fitness enthusiasts, animal-based protein drinks have benefited from established dietary preferences and the longstanding endorsement by the fitness community.

Moreover, the segment’s dominance is supported by extensive availability and variety in product offerings that cater to taste and nutritional preferences. Products ranging from whey to collagen-based formulations have appealed to a broad audience, maintaining the segment’s majority hold on the market.

Despite the rising popularity of plant-based alternatives, the robust sales figures of animal-based RTD protein products underline their entrenched position in consumer habits and the nutritional landscape. This segment’s continued growth is poised to be driven by innovations in flavor and enhanced nutritional profiles, meeting the evolving demands of health-conscious consumers.

By Packaging Type Analysis

Bottles hold a 58.30% share in the RTD Protein Market packaging types.

In 2024, Bottles held a dominant market position in the By Packaging Type segment of the Ready To Drink Protein Market, securing a substantial 58.30% share. This preference for bottled packaging is driven by several factors, including consumer convenience, product safety, and ease of transportation.

Bottles, particularly those made from robust materials like plastic and glass, offer durable and secure packaging solutions that preserve the integrity and freshness of the protein drinks within. This packaging type has proven especially popular among consumers who value the practicality of a grab-and-go format that fits seamlessly into busy lifestyles.

The strong market share of bottles is also bolstered by their widespread availability and the extensive distribution channels that support them, ranging from large retail chains to online platforms. Additionally, the visual appeal of bottles allows for effective branding and marketing, which are crucial in attracting and retaining customers in a competitive market.

As health and fitness trends continue to rise, the demand for bottled RTD protein products is expected to maintain its growth trajectory, driven by both the convenience they offer and their effectiveness in meeting the nutritional needs of a diverse consumer base.

By Distribution Channel Analysis

Supermarkets and hypermarkets distribute 43.20% of RTD proteins, leading this channel.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Ready To Drink Protein Market, with a 43.20% share. This significant market share underscores the pivotal role that supermarkets and hypermarkets play in consumer access to RTD protein products.

These venues are highly favored by consumers for their convenience, the ability to physically evaluate products before purchase, and the immediate availability of a wide assortment of goods under one roof.

The dominance of supermarkets/hypermarkets in this segment is facilitated by their extensive network and strategic locations, which make them accessible to a broad demographic. These shopping venues cater to the needs of a diverse clientele by offering a variety of RTD protein products, including new and emerging brands, alongside established household names. Its ability to offer competitive pricing and frequent promotional deals further enhances its appeal to price-sensitive consumers.

As these retail giants continue to expand their health and wellness sections in response to growing consumer health consciousness, supermarkets/hypermarkets are likely to retain their prominence in the distribution of RTD protein beverages. Their strategic importance is amplified by the trust and shopping convenience they offer, making them crucial players in the ongoing growth and distribution dynamics of the RTD protein market.

Key Market Segments

By Product Type

- Animal-Based Proteins

- Milk

- Whey

- Others

- Plant Source

- Pea Protein

- Soy Protein

- Quinoa Protein

- Rice Protei

- Hemp Protein

- Others

By Packaging Type

- Bottles

- Cans

- Cartons

- Pouches

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Stores

- Others

Driving Factors

Convenience Meets Nutrition: The Top Driver

The paramount driving factor for the Drink Protein Market is the blend of convenience and nutrition that these products offer. In today’s fast-paced world, consumers are constantly seeking quick, healthful solutions that fit seamlessly into their busy lifestyles. RTD protein drinks answer this need by providing a nutritious, protein-packed beverage that can be consumed on the go without any preparation required.

This convenience is particularly appealing to those who juggle multiple responsibilities but still prioritize maintaining a healthy diet. As health consciousness rises and more people recognize the importance of protein in their diet, the demand for these accessible, nutritious options continues to grow, significantly propelling the market forward.

Restraining Factors

High Cost Restrains Wider Adoption in Market

A significant restraining factor for the Ready To Drink Protein Market is the relatively high cost of these products compared to other snack or meal options. The premium pricing is often due to the high-quality ingredients used, such as whey protein or plant-based proteins, and the technology involved in preserving these nutrients within a ready-to-consume format.

For many consumers, especially those in budget-conscious demographics, the price can be a deterrent, limiting the potential market reach. While the convenience and nutritional benefits are appealing, the cost factor remains a critical hurdle, as it restricts the accessibility of RTD protein drinks to a broader audience, potentially slowing down the market’s growth rate.

Growth Opportunity

Expanding Plant-Based Options Spurs Market Growth

A significant growth opportunity within the ready-to-drink protein Market lies in expanding the range of plant-based protein options. As consumer preferences shift towards vegetarian and vegan lifestyles, largely driven by health, ethical, and environmental concerns, the demand for plant-based products has seen a noticeable increase.

Offering a variety of plant-based RTD protein drinks can cater to this growing segment, not only appealing to vegans and vegetarians but also to those looking to reduce their meat consumption without compromising on protein intake.

Capitalizing on this trend by developing tasty, nutritionally rich, and diverse plant-based protein beverages could significantly broaden market reach and appeal, driving growth in new consumer segments.

Latest Trends

Functional Ingredients Trending in RTD Protein Beverages

One of the latest trends in the ready-to-drink protein Market is the incorporation of functional ingredients into protein beverages. Consumers are increasingly seeking products that not only help with protein intake but also offer additional health benefits, such as immune support, enhanced digestion, and improved energy levels. Ingredients like probiotics, vitamins, antioxidants, and natural extracts are being added to RTD protein drinks to meet this demand.

This trend reflects a growing consumer preference for holistic health products that support a wide range of bodily functions. By tapping into this trend, manufacturers can differentiate their products in a crowded market and attract health-conscious consumers looking for more than just protein from their beverages.

Regional Analysis

North America dominates with a 48.10% share, valuing USD 0.8 Bn in the RTD Protein Market.

The Ready To Drink Protein Market is segmented into key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each exhibiting unique growth dynamics.

North America is the dominating region with an impressive 48.10% market share, reflecting a market value of USD 0.8 billion. This dominance is driven by a robust fitness culture and high consumer awareness regarding dietary supplements.

Europe follows, with a developed market fostered by health-conscious consumers and well-established retail channels that enhance the accessibility and visibility of RTD protein products. Meanwhile, the Asia Pacific region is experiencing rapid growth due to increasing urbanization, rising disposable incomes, and the expanding influence of Western dietary habits, making it a key area for future market expansion.

The Middle East & Africa and Latin America regions, though smaller in comparison, are poised for growth. Increasing health awareness and improving retail infrastructure are likely to boost the consumption of RTD protein beverages in these regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global ready-to-drink protein market will see significant contributions from key players such as Ascent Protein, Danone S.A., and Glanbia plc, each bringing unique strengths to the industry.

Ascent Protein, known for its commitment to natural and organic ingredients, has carved out a niche in the market by appealing to health-conscious consumers who prioritize clean eating. Their transparency in sourcing and processing, combined with a focus on high-quality whey and plant-based proteins, positions them favorably among fitness enthusiasts and environmentally aware individuals. This focus on purity and quality enables Ascent Protein to command a premium market position.

Danone S.A., with its expansive distribution networks and strong brand recognition, plays a pivotal role in driving accessibility and consumer awareness in the RTD protein sector. As a global food and beverage giant, Danone leverages its extensive R&D capabilities to innovate and expand its product offerings, often leading the market in introducing new flavors and specialized products catered to diverse consumer needs, including dairy and non-dairy alternatives.

Glanbia plc, a powerhouse in performance nutrition, uses its expertise to penetrate various market segments, from casual fitness enthusiasts to professional athletes. Their strategic marketing and comprehensive product portfolio, which includes popular brands like Optimum Nutrition, ensure they remain at the forefront of the industry. Glanbia’s strong focus on research and development further bolsters their market position by continuously improving product efficacy and consumer appeal.

Top Key Players in the Market

- Abbott Laboratories

- Amway Corporation

- Ascent Protein

- Danone S.A.

- Glanbia plc

- ICONIC Protein

- Kellogg Company

- Koia

- Labrada Nutrition

- Nestlé S.A.

- Orgain, Inc.

- PepsiCo, Inc.

- Post Holdings Inc.

- Premier Nutrition Corporation

- Pure Protein

- The Coca-Cola Company

- The Simply Good Foods Company

Recent Developments

- In December 2024, Abbott announced the initiation of first-in-world leadless pacing procedures in the left bundle branch area of the heart, marking a significant step in cardiac care technologies.

- In 2024, Nestlé S.A. launched 40 new products, focusing on innovation and sustainability across various categories like seasonal treats, coffee, and pet care, reflecting a comprehensive market-driven approach similar to automotive industry standards

Report Scope

Report Features Description Market Value (2024) USD 1.7 Billion Forecast Revenue (2034) USD 3.4 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Animal-Based Proteins (Milk, Whey, Others), Plant Source (Pea Protein, Soy Protein, Quinoa Protein, Rice Protei, Hemp Protein, Others)), By Packaging Type (Bottles, Cans, Cartons, Pouches, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Abbott Laboratories, Amway Corporation, Ascent Protein, Danone S.A., Glanbia plc, ICONIC Protein, Kellogg Company, Koia, Labrada Nutrition, Nestlé S.A., Orgain, Inc., PepsiCo, Inc., Post Holdings Inc., Premier Nutrition Corporation, Pure Protein, The Coca-Cola Company, The Simply Good Foods Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ready To Drink Protein MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Ready To Drink Protein MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Amway Corporation

- Ascent Protein

- Danone S.A.

- Glanbia plc

- ICONIC Protein

- Kellogg Company

- Koia

- Labrada Nutrition

- Nestlé S.A.

- Orgain, Inc.

- PepsiCo, Inc.

- Post Holdings Inc.

- Premier Nutrition Corporation

- Pure Protein

- The Coca-Cola Company

- The Simply Good Foods Company