Global Frozen Seafood Market Size, Share Analysis Report By Source (Sea Area, Brackish Water Area, Fresh Water Area, Others), By Product Type (Fish, Shellfish, Others), By Form (Raw Frozen Seafood, Pre-Cooked Seafood, Ready-To-Eat Seafood), By Freezing Technique (Contact Freezing, Blast Freezing, Brine Freezing, Cryogenic Freezing, Others), By Distribution Channel (Direct Sales/B2B, Indirect Sales/B2C, Supermarkets/Hypermarkets, Specialty Stores, Online Retail, Others), By End-use (Food Service, Retail) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145930

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

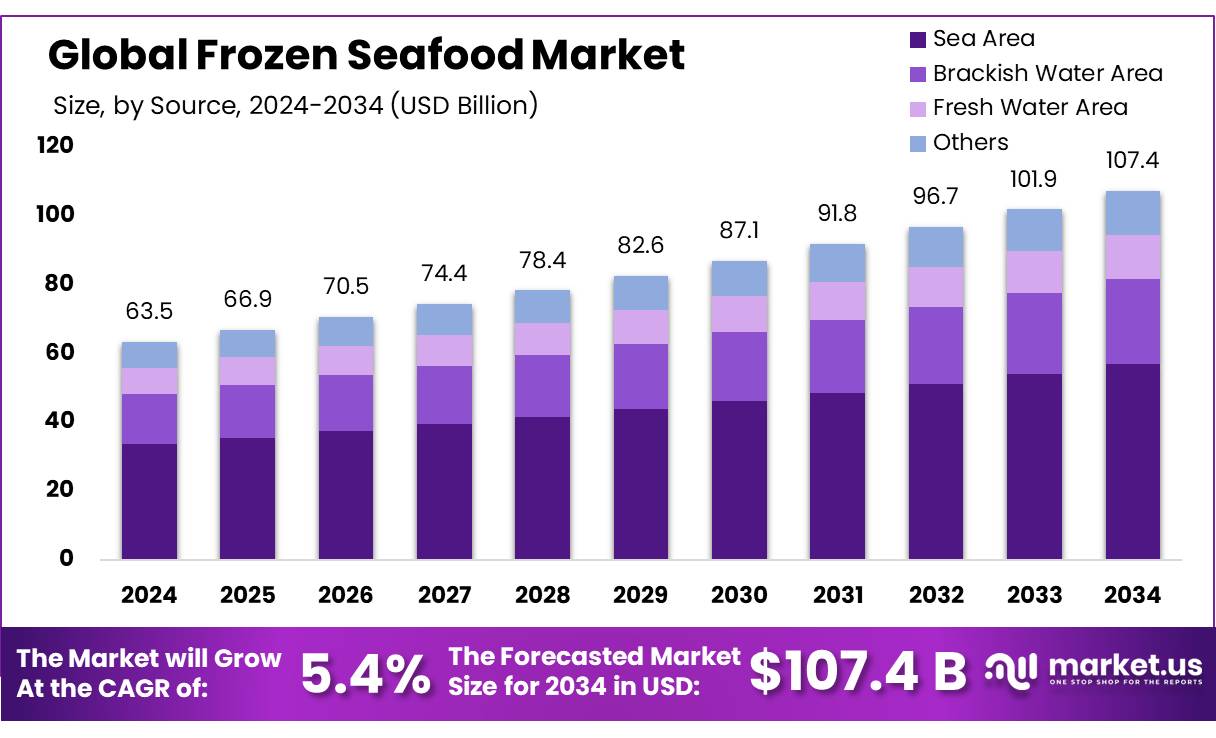

The Global Frozen Seafood Market size is expected to be worth around USD 107.4 Bn by 2034, from USD 63.5 Bn in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

The frozen seafood market has emerged as a pivotal segment within the global food sector, driven by evolving consumer preferences, advancements in preservation technologies, and a growing emphasis on food safety and convenience. This industry encompasses a wide range of products, including frozen fish, shrimp, mollusks, and other marine delicacies, catering to both domestic consumption and international trade.

The industry is bolstered by a rising awareness of the health benefits associated with seafood, which is rich in omega-3 fatty acids, proteins, and essential nutrients. According to the Food and Agriculture Organization (FAO), the global fish production peaked at about 179 million tonnes in 2018, with aquaculture contributing an impressive 46% to this figure, indicating robust sector growth. The expansion of aquaculture is instrumental in sustaining the supply chain for the frozen seafood industry.

Several factors are propelling the growth of the frozen seafood industry. Urbanization and changing lifestyles have increased the demand for ready-to-cook and ready-to-eat seafood products. Technological advancements in freezing and cold chain logistics have enhanced product shelf life and quality, facilitating wider distribution. Moreover, the rising awareness of the health benefits associated with seafood consumption has contributed to its growing popularity.

Government initiatives For example, the U.S. Department of Agriculture (USDA) offers the Seafood Trade Relief Program, aimed at compensating fishermen affected by tariff impositions with a budget allocation of $530 million, showcasing significant governmental support which could help stabilize the industry’s growth trajectory.

Key Takeaways

- Frozen Seafood Market size is expected to be worth around USD 107.4 Bn by 2034, from USD 63.5 Bn in 2024, growing at a CAGR of 5.4%.

- Sea Area segment of the Frozen Seafood Market held a commanding position, accounting for over 53.30% of the market share.

- Fish category within the Frozen Seafood Market established a robust market presence, securing more than a 63.40% share.

- Raw Frozen Seafood carved out a significant niche in the Frozen Seafood Market, securing over a 58.40% share.

- Blast Freezing emerged as a leading freezing technique in the Frozen Seafood Market, securing a substantial 38.40% share.

- Direct Sales/B2B channel prominently led the distribution of the Frozen Seafood Market, holding a dominant 64.40% share.

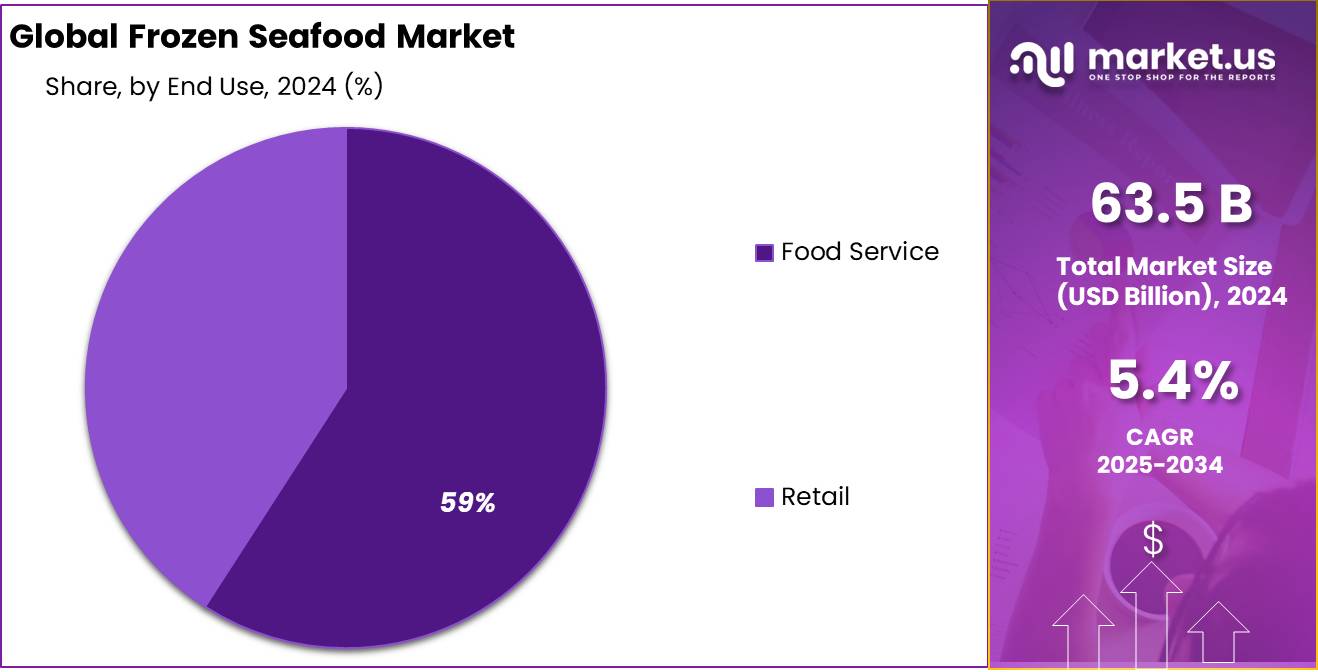

- Food Services sector secured a dominant position in the Frozen Seafood Market, capturing more than a 59.30% share.

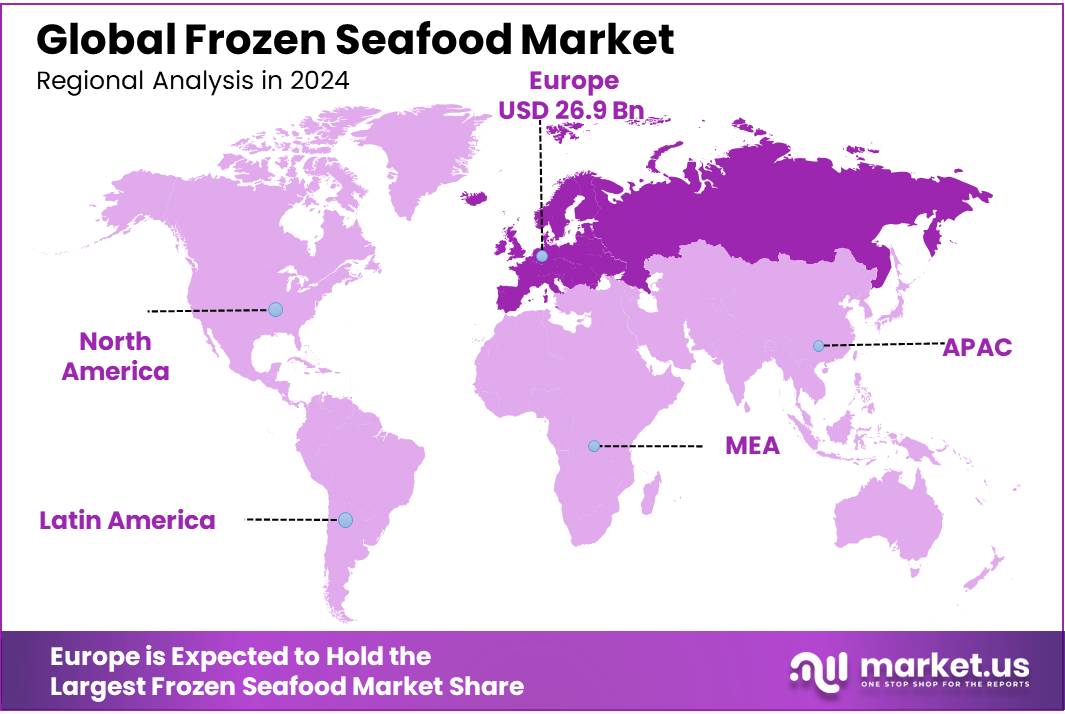

- Europe maintained a strong foothold in the global Frozen Seafood Market, capturing a notable 42.50% share, valued at approximately USD 26.9 billion.

Analysts’ Viewpoint

From an investment perspective, the frozen seafood market presents a promising arena with substantial growth prospects. This growth trajectory is underpinned by factors such as increased demand from food establishments and heightened consumer awareness of the nutritional benefits of seafood, which supports a shift towards ready-to-eat and convenience food options

Regulatory frameworks play a critical role in shaping the market, especially concerning food safety standards and sustainable fishing practices. Companies are increasingly adopting responsible sourcing and traceability technologies to ensure compliance with these regulations, which not only helps in maintaining biodiversity but also enhances consumer trust in product quality.

Investing in the frozen seafood market comes with its risks, such as potential fluctuations in raw material supply due to environmental changes and regulatory adjustments. However, the steady increase in demand and technological advancements in food preservation are likely to mitigate these risks, presenting a robust opportunity for growth in both domestic and international markets.

By Source

Sea Area Dominates with 53.30% Due to Its Abundant Supply and Variety

In 2024, the Sea Area segment of the Frozen Seafood Market held a commanding position, accounting for over 53.30% of the market share. This significant dominance is primarily attributed to the extensive and varied offerings sourced directly from the oceans. These areas are rich in biodiversity, providing a wide array of seafood options that cater to global tastes and preferences.

Consumers’ growing preference for naturally sourced, wild-caught seafood, which is often perceived as being more sustainable and flavorful, plays a crucial role in this segment’s strong performance. The abundance of seafood available in these regions ensures a steady supply, meeting the rising demand in international markets and supporting the segment’s leading status in the industry.

By Product Type

Fish Leads with 63.40% Share Due to High Consumer Preference

In 2024, the Fish category within the Frozen Seafood Market established a robust market presence, securing more than a 63.40% share. This dominant position is largely driven by the universal appeal and high consumer demand for fish products. Fish is not only a staple in many diets worldwide due to its nutritional benefits, including high omega-3 fatty acids and protein content, but it is also versatile in culinary applications.

The ease of preparation and the broad variety of species available, from salmon to cod, ensure that fish remains a preferred choice among consumers seeking convenience without compromising on health. This segment’s strength is further bolstered by innovations in freezing technology that maintain the quality and taste of fish, making it a reliable and appealing option in the frozen seafood sector.

By Form

Raw Frozen Seafood Captures 58.40% Market Share for its Freshness and Convenience

In 2024, Raw Frozen Seafood carved out a significant niche in the Frozen Seafood Market, securing over a 58.40% share. This segment’s dominance is primarily due to consumer appreciation for the freshness that raw frozen seafood offers, closely mirroring the quality of fresh catch while providing extended shelf life and convenience.

The ability to preserve seafood in its raw state without adding preservatives appeals to health-conscious consumers who are keen on obtaining maximum nutritional value. Additionally, the versatility of raw frozen seafood, which can be used in various culinary dishes, from exotic sushi to traditional fish stews, enhances its popularity among diverse consumer bases, further supporting its leading position in the market.

By Freezing Technique

Blast Freezing Commands 38.40% Share for Preserving Seafood Quality

In 2024, Blast Freezing emerged as a leading freezing technique in the Frozen Seafood Market, securing a substantial 38.40% share. This prominence is largely due to the method’s efficiency in quickly reducing the temperature of seafood products, which is crucial for preserving their texture, flavor, and nutritional integrity.

Blast freezing’s capability to inhibit bacterial growth and prevent spoilage extends the shelf life of seafood significantly, making it a favored choice for seafood processors and distributors. The technique’s adoption is further driven by the growing consumer demand for high-quality, well-preserved frozen seafood products that are as close to their natural state as possible. This makes blast freezing an indispensable part of the supply chain in the frozen seafood industry.

By Distribution Channel

Direct Sales/B2B Leads with 64.40% for Streamlined Distribution

In 2024, the Direct Sales/B2B channel prominently led the distribution of the Frozen Seafood Market, holding a dominant 64.40% share. This channel’s significant market position stems from its ability to streamline the supply chain by directly connecting seafood processors with retailers and food service providers.

This direct connection not only ensures a more controlled distribution process but also reduces the time from catch to market, crucial for maintaining the freshness and quality of seafood. The efficiency of Direct Sales/B2B in handling large volume transactions with minimal intermediaries appeals to businesses looking to optimize their operations and reduce costs, thus reinforcing its substantial share in the market.

By End-use

Food Services Secure 59.30% Share in Frozen Seafood Market

In 2024, the Food Services sector secured a dominant position in the Frozen Seafood Market, capturing more than a 59.30% share. This substantial market share reflects the integral role that frozen seafood plays in the food service industry, from quick service restaurants to upscale dining. The sector values frozen seafood for its convenience, consistent quality, and year-round availability, which are crucial for menu planning and meeting consumer expectations in a dynamic food market.

Moreover, the ability to store and use seafood as needed helps reduce waste and manage costs effectively, making frozen seafood a preferred choice among chefs and restaurant operators. This end-use segment’s dominance is a testament to the ongoing demand for versatile and easy-to-prepare seafood options in culinary establishments across the globe.

Key Market Segments

By Source

- Sea Area

- Brackish Water Area

- Fresh Water Area

- Others

By Product Type

- Fish

- Cod

- Salmon

- Tuna

- Haddock

- Mackerel

- Sardines

- Others

- Shellfish

- Shrimp

- Crab

- Lobster

- Mussels

- Others

- Others

By Form

- Raw Frozen Seafood

- Pre-Cooked Seafood

- Ready-To-Eat Seafood

By Freezing Technique

- Contact Freezing

- Blast Freezing

- Brine Freezing

- Cryogenic Freezing

- Others

By Distribution Channel

- Direct Sales/B2B

- Indirect Sales/B2C

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Others

By End-use

- Food Service

- Retail

Drivers

Health Benefits Drive Demand for Frozen Seafood

One of the major driving factors for the Frozen Seafood Market is the increasing consumer awareness of the health benefits associated with seafood consumption. Seafood, particularly fish, is rich in omega-3 fatty acids, proteins, vitamins, and minerals that support cardiovascular health, improve joint mobility, and enhance brain function.

Government health organizations globally advocate for the inclusion of seafood in regular diets to combat nutritional deficiencies and promote health. For instance, the American Heart Association recommends eating two servings of fish per week, which translates to approximately 8 ounces of seafood, to reduce the risk of heart disease.

The demand for frozen seafood is further bolstered by the convenience it offers. Frozen seafood products are ready to cook, often pre-cleaned, and pre-portioned, which significantly cuts down preparation time for consumers. This convenience is highly valued in fast-paced lifestyles, particularly in urban areas where time is a premium.

Moreover, government initiatives to support sustainable fishing and seafood traceability have also played a crucial role in shaping consumer preferences towards frozen seafood. For example, the European Union’s Common Fisheries Policy (CFP) includes measures to ensure that fishing and aquaculture activities are environmentally, economically, and socially sustainable. These regulations not only help protect marine ecosystems but also ensure a steady supply of seafood, boosting the confidence of consumers in frozen seafood products.

Additionally, the development of improved freezing technology that maintains the nutritional quality and taste of seafood has helped in expanding the market. Advanced freezing techniques such as blast freezing and cryogenic freezing ensure that the seafood retains its freshness, texture, and taste, almost equivalent to its fresh counterparts.

Restraints

Concerns Over Seafood Fraud and Mislabeling Hinder Market Growth

One significant restraining factor impacting the Frozen Seafood Market is the prevalent concern over seafood fraud and mislabeling. These practices not only mislead consumers but also pose risks to health, especially when endangered species or those with high mercury content are unknowingly consumed. Reports from the Food and Agriculture Organization (FAO) indicate that approximately 30% of all fishery products are subject to some form of misrepresentation globally. This widespread issue can diminish consumer trust and deter them from purchasing frozen seafood products, affecting overall market growth.

Governments and international bodies have been actively working to combat seafood fraud. For instance, the U.S. National Oceanic and Atmospheric Administration (NOAA) operates the Seafood Import Monitoring Program (SIMP), which requires traceability for certain seafood products to prevent illegal, unreported, and unregulated (IUU) fishing and seafood fraud. This initiative aims to ensure that all seafood sold in the U.S. is fully traceable from the point of capture to the point of sale, thus safeguarding consumer interests and the integrity of the seafood supply chain.

Despite these efforts, the challenges of enforcing these regulations across global markets remain daunting. The complexity of seafood supply chains, involving multiple stages of processing and distribution across different countries, makes it difficult to maintain complete oversight and ensure compliance at every step. This complexity can lead to gaps in traceability and opportunities for fraudulent activities to persist.

Addressing these issues requires ongoing commitment from both industry stakeholders and regulatory bodies to develop more robust systems for monitoring, verification, and enforcement. Advancements in technology, such as blockchain and DNA testing for species verification, are promising tools that could enhance transparency and traceability in the seafood industry.

Opportunity

Expansion into Emerging Markets Presents Major Growth Opportunity

A significant growth opportunity for the Frozen Seafood Market lies in expanding into emerging markets, particularly in Asia and Africa. These regions have shown rapid economic growth, increased urbanization, and a rising middle class, all of which contribute to a growing appetite for diverse and high-quality food products, including seafood.

According to the United Nations Food and Agriculture Organization (FAO), Asia accounts for nearly 70% of global fish consumption. As disposable incomes rise in countries like China, India, and Indonesia, there is an increasing demand for convenient, ready-to-cook seafood products that align with busier lifestyles and health-conscious behaviors. This demographic shift presents a substantial opportunity for frozen seafood producers to tap into new consumer segments eager for products that offer both convenience and nutritional benefits.

Furthermore, government initiatives across these regions support the development of cold chain infrastructure to reduce food spoilage and improve food distribution networks. For instance, the Indian government has launched schemes like the Pradhan Mantri Kisan Sampada Yojana (PMKSY), which aims to modernize processing facilities and improve cold storage capacities. Such initiatives are crucial for the frozen seafood industry, as they directly enhance the market’s logistical capabilities and product accessibility to remote areas.

Moreover, as consumer awareness about sustainable eating practices increases, there is a growing preference for seafood as a protein alternative to meat. This trend is supported by numerous health organizations that advocate for seafood’s role in reducing cardiovascular risks and improving overall health. Capitalizing on this shift in dietary habits can open new avenues for growth in these burgeoning markets.

Trends

Eco-Friendly Packaging Innovations Shape Frozen Seafood Market Trends

A notable trend within the Frozen Seafood Market is the increasing adoption of eco-friendly packaging solutions, driven by growing environmental concerns and consumer demand for sustainable practices. This shift is particularly significant as the industry seeks to reduce its carbon footprint and enhance the appeal of its products to environmentally conscious consumers.

Traditional plastic packaging, widely used in the seafood industry, has come under scrutiny due to its long decomposition period and harmful impact on marine life. In response, major players in the frozen seafood sector are turning to biodegradable and recyclable packaging options. These innovations not only help in minimizing environmental damage but also align with global regulatory pressures to reduce plastic waste.

Governments worldwide are implementing stricter regulations on packaging materials. For example, the European Union’s directive on single-use plastics aims to significantly reduce the use of plastic items and packaging by 2030. These regulations encourage the seafood industry to innovate in packaging solutions that are both functional and sustainable.

Moreover, advancements in packaging technology have led to the development of materials that extend the shelf life of frozen products while maintaining their quality and freshness. For instance, the use of smart packaging that includes indicators for temperature and freshness can help consumers ensure the product’s integrity from purchase to consumption.

This trend towards sustainable packaging is not just a response to regulatory requirements but also a business strategy that caters to the growing segment of consumers who prefer products that are packaged responsibly. Companies that proactively adopt these practices are likely to see enhanced brand loyalty and a competitive edge in the market.

Regional Analysis

In 2024, Europe maintained a strong foothold in the global Frozen Seafood Market, capturing a notable 42.50% share, valued at approximately USD 26.9 billion. This significant market presence is underpinned by a combination of advanced freezing technologies, high consumer demand for seafood, and stringent food safety regulations that ensure product quality and safety across the supply chain.

Europe’s leadership in the frozen seafood sector is driven largely by its sophisticated logistics and cold storage facilities, which are integral to maintaining the integrity of frozen products from catch to consumer. The region benefits from a well-established infrastructure that supports efficient distribution and storage, reducing the risk of spoilage and extending the reach of seafood products to various markets across the continent.

Moreover, the cultural importance of seafood in European diets contributes to the steady demand within the region. Countries such as Spain, Italy, and Portugal, with their long coastlines and traditional seafood cuisines, are significant consumers of frozen seafood products. The convenience and year-round availability of frozen seafood make it a popular choice for both households and the vibrant food service sector in these countries.

Environmental sustainability remains a key focus for the European market. The European Union’s Common Fisheries Policy (CFP) not only regulates fishing quotas to prevent overfishing but also promotes sustainable practices across the seafood value chain. This policy has encouraged innovations in eco-friendly packaging and responsible sourcing, aligning with consumer preferences for sustainability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

High Liner Foods Inc., headquartered in Canada, is a prominent player in the global frozen seafood industry. The company specializes in processing and marketing a wide range of seafood products, including fish fillets, shellfish, and breaded seafood varieties. Known for its commitment to sustainability and quality, High Liner Foods leverages advanced processing techniques to ensure freshness and taste. They actively pursue initiatives to ensure responsible sourcing and environmental stewardship in their operations.

Maruha Nichiro Corporation, based in Japan, stands as one of the largest seafood companies worldwide. It offers a diverse array of products, from frozen seafood to pet foods and health supplements. Maruha Nichiro is renowned for its extensive supply chain and innovation in seafood preservation and packaging technology. The company’s dedication to quality and sustainability makes it a trusted name in providing seafood products to consumers globally.

Mowi ASA, formerly known as Marine Harvest, is headquartered in Norway and is one of the world’s leading seafood companies, specializing particularly in Atlantic salmon. The company controls all aspects of production, from feed to farming to finished products, ensuring high standards of quality and sustainability. Mowi is committed to innovation in aquaculture practices and actively contributes to the growth of the global seafood market with its eco-friendly and efficient farming techniques.

Top Key Players in the Market

- High Liner Foods Inc.

- Maruha Nichiro Corporation

- Mowi ASA

- Nissui Corporation

- Thai Union Group PCL

- Trident Seafood Corporation

- Dongwon Industries

- Bumble Bee Foods, LLC

- Cooke Aquaculture

- Nueva Pescanova

- Premium Seafood Company Inc.

- Nomad Foods

- Gadre Premium Seafood

- Apex Frozen Foods Ltd.

- Other Key Players

Recent Developments

High Liner Foods Inc. continues to make significant strides in the frozen seafood market as of 2024. This Canadian-based company has carved out a reputable niche by providing a variety of high-quality seafood products, ranging from deliciously prepared fish fillets to savory breaded and battered seafood.

In 2024, Maruha Nichiro has excelled in merging traditional seafood practices with modern technology, which has been pivotal in maintaining freshness and extending shelf life of their products. Their commitment to sustainability is evident in their stringent adherence to international fishing regulations and their proactive approach to reducing environmental impact.

Report Scope

Report Features Description Market Value (2024) USD 63.5 Bn Forecast Revenue (2034) USD 107.4 Bn CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Sea Area, Brackish Water Area, Fresh Water Area, Others), By Product Type (Fish, Shellfish, Others), By Form (Raw Frozen Seafood, Pre-Cooked Seafood, Ready-To-Eat Seafood), By Freezing Technique (Contact Freezing, Blast Freezing, Brine Freezing, Cryogenic Freezing, Others), By Distribution Channel (Direct Sales/B2B, Indirect Sales/B2C, Supermarkets/Hypermarkets, Specialty Stores, Online Retail, Others), By End-use (Food Service, Retail) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape High Liner Foods Inc., Maruha Nichiro Corporation, Mowi ASA, Nissui Corporation, Thai Union Group PCL, Trident Seafood Corporation, Dongwon Industries, Bumble Bee Foods, LLC, Cooke Aquaculture, Nueva Pescanova, Premium Seafood Company Inc., Nomad Foods, Gadre Premium Seafood, Apex Frozen Foods Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- High Liner Foods Inc.

- Maruha Nichiro Corporation

- Mowi ASA

- Nissui Corporation

- Thai Union Group PCL

- Trident Seafood Corporation

- Dongwon Industries

- Bumble Bee Foods, LLC

- Cooke Aquaculture

- Nueva Pescanova

- Premium Seafood Company Inc.

- Nomad Foods

- Gadre Premium Seafood

- Apex Frozen Foods Ltd.

- Other Key Players