Global Industrial Food Cutting Machines Market Size, Share, Growth Analysis By Type (Slicers, Dicers, Choppers, Graters, Others), By Technology (Manual, Semi-Automatic, Fully Automatic), By Application (Vegetables, Fruits, Meat, Seafood, Bakery & Confectionery, Dairy, Others), By End User (Food Processing Companies, Food Service Providers, Commercial Kitchens), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145907

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

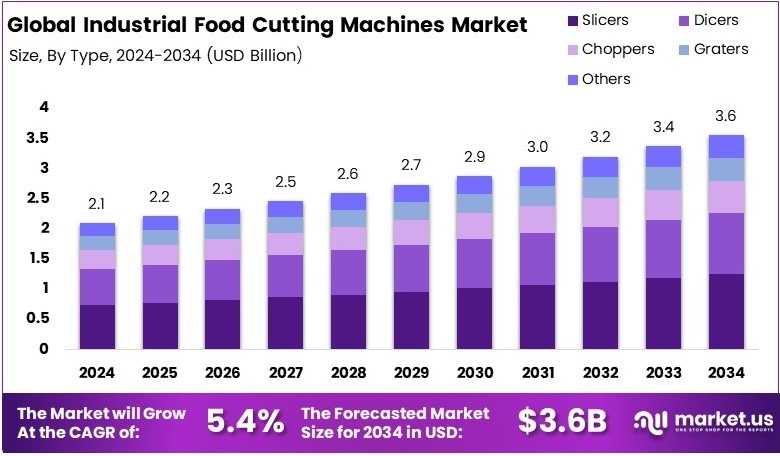

The Global Industrial Food Cutting Machines Market size is expected to be worth around USD 3.6 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

Industrial Food Cutting Machines are automated tools used to slice, dice, or chop food in large volumes. These machines help food processors maintain speed, quality, and hygiene. They are used in factories, commercial kitchens, and meat or vegetable processing units for uniform and efficient food preparation.

The Industrial Food Cutting Machines Market tracks the global industry making and selling food cutting equipment. It includes machine types, customer segments, and technological innovation. Market growth is driven by rising food automation, plant-based product processing, and the need for precision in large-scale food manufacturing.

Industrial food cutting machines are now widely used in food factories. They help save time, improve hygiene, and ensure consistent quality. Many food producers are choosing these machines to reduce labor costs and increase production speed, especially with rising global food demand.

Moreover, growth is fueled by rising demand for ready-to-eat foods, especially in cities. For instance, food companies in China, the U.S., and Germany are using cutting machines to increase speed and hygiene. These machines also help reduce manual labor and improve safety standards on the factory floor.

In developing countries like India and Vietnam, food processing is scaling up. Cutting machines are becoming essential to meet local and export demands. For this reason, manufacturers and distributors are focusing on smaller models that fit both large and medium-sized operations.

In contrast, markets in Europe and Japan are reaching saturation. Most large-scale food firms already use automated systems. Even so, there’s a rising demand for machine upgrades and maintenance. This opens a steady flow of work for service providers and spare part suppliers.

The market is competitive. Major players include FAM, Urschel, and GEA Group. However, smaller firms offering smart features like blade sensors and programmable cutting styles are gaining popularity. In this context, innovation, after-sale service, and pricing have become key to gaining customer loyalty.

On a wider scale, industrial cutting machines improve food supply chains. They support higher output with consistent size and shape. This helps companies ship food faster, reduce waste, and meet international quality standards. It also helps large brands cut costs and increase output volume.

Key Takeaways

- The Industrial Food Cutting Machines Market was valued at USD 2.1 Billion in 2024, and is expected to reach USD 3.6 Billion by 2034, with a CAGR of 5.4%.

- In 2024, Slicers led the type segment with 31.4%, owing to their widespread use in meat and bakery processing.

- In 2024, Fully Automatic machines accounted for 56.2%, driven by demand for efficiency and labor reduction in food processing.

- In 2024, Vegetables dominated the application segment with 42.3%, supported by rising demand for pre-cut and packaged produce.

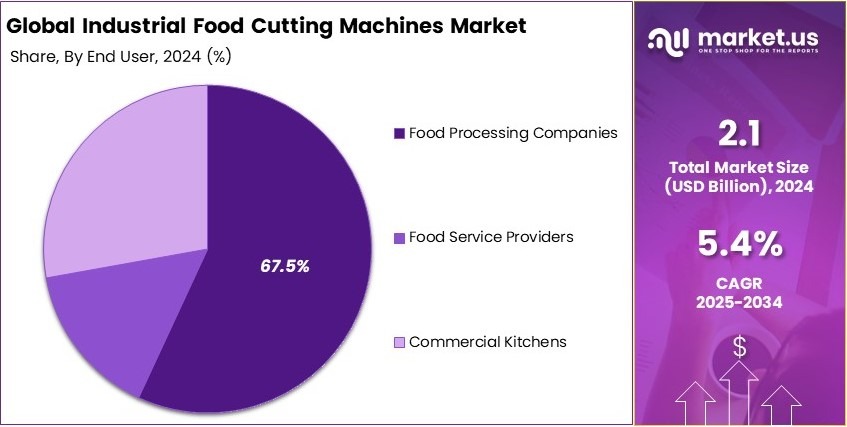

- In 2024, Food Processing Companies held a 67.5% share due to their large-scale equipment procurement needs.

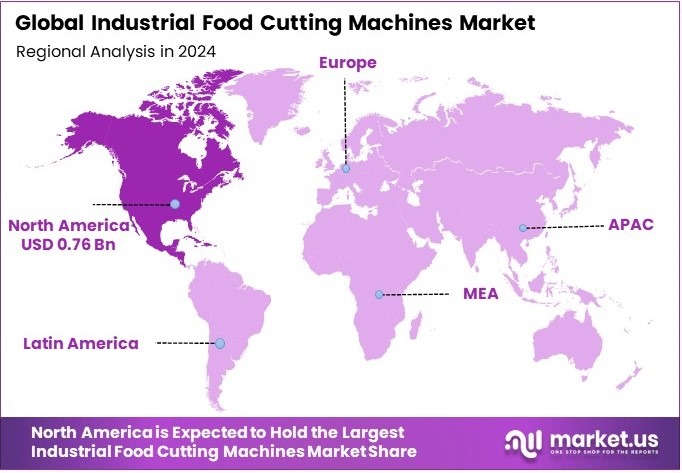

- In 2024, North America led with 36.3% share, totaling USD 0.76 Billion, due to advanced food manufacturing technologies.

Type Analysis

Slicers dominate with 31.4% due to their precision and efficiency in cutting.

In the industrial food cutting machines market, types of equipment include slicers, dicers, choppers, graters, and others. Household Slicers have emerged as the dominant sub-segment, holding a 31.4% market share.

This prominence is due to their essential role in food processing, providing precise and uniform cuts, which are crucial for maintaining quality and consistency in food products. The efficiency and speed of slicers also help in increasing the production throughput for food processing companies, making them a preferred choice.

Dicers and choppers also contribute significantly to the market. Dicers are favored in applications requiring uniform size pieces such as in canned products or quick-service restaurants. Choppers are versatile and are primarily used for preliminary food processing tasks.

Graters, while less prominent, are indispensable in dairy and bakery products for tasks such as cheese and coconut shredding. The other equipment includes specialized machines tailored for specific cutting needs that do not fit into the standard categories but are essential for certain niche applications.

Technology Analysis

Fully Automatic machines dominate with 56.2% due to their high productivity and minimal human intervention.

The technology segment of the industrial food cutting machines market can be categorized into manual, semi-automatic, and fully automatic. Fully Automatic machines lead this segment with a market share of 56.2%.

Their dominance is attributed to their ability to deliver high productivity with minimal human intervention, which significantly reduces labor costs and enhances the consistency of the output. These machines are equipped with advanced features like programmable settings, which allow for precise control over the cutting process, thereby increasing efficiency and reducing waste.

Manual machines, while less common, are used in smaller operations where control and artisanal quality are prioritized. Semi-automatic machines serve as a middle ground, offering some automation but at a lower cost than fully automatic systems. They are suitable for medium-scale operations that balance cost with efficiency.

Application Analysis

Vegetables dominate with 42.3% due to their widespread use in food processing.

Segmenting the market by application, the industrial food cutting machines are used for vegetables, fruits, meat, seafood, bakery & confectionery, dairy, and others. Vegetables account for the largest share at 42.3%, underlining their widespread use in food processing.

The demand for vegetable cutting machines is driven by the growing consumer preference for ready-to-cook and processed foods, which require pre-cut vegetables. These machines help in achieving the high-volume output needed to meet the demands of quick-service restaurants and packaged food producers.

Fruits and meat are also significant segments, with specific cutting requirements that influence the design and functionality of the machines used. Seafood and bakery & confectionery follow closely, each with specialized cutting needs that cater to particular textures and consistencies. Dairy and other applications, though smaller, require precision cutting for products like cheese blocks and various confectionery items.

End User Analysis

Food Processing Companies dominate with 67.5% due to their large-scale operations and high demand for cutting solutions.

End users of industrial food cutting machines include food processing companies, food service providers, and commercial kitchens. Food processing companies are the dominant segment, with a 67.5% market share.

Their leadership is based on the scale of operations and the extensive use of cutting machines to meet the high-volume production demands. These companies prioritize automation, precision, and efficiency to maintain product quality and production speed.

Food service providers and commercial kitchens also utilize these machines, albeit to a lesser extent. Food service providers focus on consistency and speed to cater to the hospitality sector, while commercial kitchens in hotels and large restaurants use these machines for daily food preparation needs, prioritizing versatility and ease of use.

Key Market Segments

By Type

- Slicers

- Dicers

- Choppers

- Graters

- Others

By Technology

- Manual

- Semi-Automatic

- Fully Automatic

By Application

- Vegetables

- Fruits

- Meat

- Seafood

- Bakery & Confectionery

- Dairy

- Others

By End User

- Food Processing Companies

- Food Service Providers

- Commercial Kitchens

Driving Factors

Food Automation and Precision Cutting Drives Market Growth

The demand for automation in food processing is a major force pushing growth in the industrial food cutting machines market. In commercial kitchens and large-scale production facilities, the need to cut, slice, or dice ingredients quickly and accurately is growing rapidly. Automated machines save time, reduce labor costs, and improve overall efficiency.

In parallel, the rise in ready-to-eat and packaged food products is fueling machine adoption. These products require consistent size, shape, and presentation—qualities that precision cutters can provide. Uniformity also plays a key role in maintaining quality control and cooking performance.

Additionally, the global expansion of cold chains and meat processing centers is creating new avenues for machine installations. These facilities depend on reliable, high-speed equipment to meet strict standards and timelines.

For example, meat processors in North America and Asia are investing in modern cutters to boost output while maintaining hygiene and consistency. To sum up, the shift toward efficiency, standardization, and large-scale food production is directly boosting the market for industrial food cutting machines.

Restraining Factors

High Costs and Skill Gaps Restraints Market Growth

While demand is growing, several roadblocks are slowing adoption—especially among smaller players. High capital investment is a major challenge for small and mid-sized food processors. These machines are costly to purchase and maintain, often requiring large upfront spending.

Another hurdle is the complexity of maintaining hygiene. Food cutting machines must be cleaned thoroughly to meet food safety standards. However, disassembling and cleaning them can be time-consuming and technically demanding.

In many low-income or rural regions, there’s also a shortage of trained personnel to operate and maintain this equipment safely. This increases the risk of breakdowns or safety incidents.

Finally, performance inconsistency is a concern. Machines may not handle different food textures—like soft fruits versus frozen meat—with the same level of efficiency. This leads to product waste or delays. Together, these challenges make it harder for the market to grow evenly across all regions and business sizes.

Growth Opportunities

Smart Design and New Markets Provide Opportunities

New product innovations are opening up strong growth potential for machine manufacturers. Compact, modular machines are being developed for small and mid-sized food makers who previously couldn’t afford large-scale equipment. These space-saving models offer flexibility and lower operating costs.

Another major development is the launch of multi-blade and programmable machines. These units can handle a wider range of food types—from vegetables to processed meats—making them more useful in mixed-product facilities.

Plant-based and vegan food producers are also fueling demand. These companies need cutters that can process delicate, plant-derived ingredients with precision. As more consumers switch to plant-based diets, the demand for these specialized machines will likely increase.

Furthermore, adding IoT features allows manufacturers to monitor machine performance in real time. This means issues can be identified early, reducing downtime through predictive maintenance. These combined opportunities are shaping the next wave of smart, adaptable, and industry-specific cutting solutions.

Emerging Trends

Clean Tech and Industry 4.0 Are Latest Trending Factor

Recent trends show that hygiene, efficiency, and advanced technology are at the forefront of the market. More food processors now prefer stainless-steel machines with built-in cleaning systems. These models not only improve food safety but also reduce labor needed for maintenance.

Energy efficiency is another trend driving innovation. New machines are being designed to use less power and operate more quietly, which improves the work environment and reduces utility costs.

At the same time, cutting-edge technologies like ultrasonic and waterjet cutting are gaining traction. These methods offer high-precision slicing with minimal product damage—especially important for delicate items like fruits or cheese.

Finally, there’s growing demand for machines that align with Industry 4.0 systems. This means machines that can “talk” to other production tools, share data, and operate with minimal human input. Factories looking to automate entire food production lines are quickly adopting these smart-compatible machines. These trends clearly show that the market is moving toward smarter, cleaner, and more efficient operations.

Regional Analysis

North America Dominates with 36.3% Market Share

North America leads the Industrial Food Cutting Machines Market with a 36.3% share and valuation of USD 0.76 Bn. The region’s dominance is largely due to its developed food processing industry, high standards for food safety, and rapid adoption of automated technologies in food manufacturing.

Key factors contributing to North America’s market leadership include the presence of major food producers and processors who continuously invest in automation to enhance efficiency and product quality. The region also benefits from a strong technological infrastructure, which supports the implementation of advanced food cutting solutions.

The future influence of North America on the global market is expected to grow as the region continues to lead innovations in food technology and sustainability. Increasing consumer demand for processed and pre-packaged foods is likely to drive further investment in cutting-edge food cutting machinery, consolidating the region’s market position.

Regional Mentions:

- Europe: Europe remains a significant player in the market, driven by its stringent food safety regulations and high demand for precision food processing equipment. The region’s focus on sustainability and energy-efficient machines also plays a critical role.

- Asia Pacific: The Asia Pacific region is seeing rapid growth due to expanding food markets and increasing investments in food processing technology, especially in China and India. This region benefits from rising urbanization and changing dietary preferences.

- Middle East & Africa: Middle East & Africa are slowly expanding their market share, with investments in food processing and packaging technology to meet the growing demand for food products in the region.

- Latin America: Latin America is gradually increasing its market presence by modernizing its food processing capabilities to boost efficiency and meet the rising demand for processed foods among its growing middle class.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Industrial Food Cutting Machines sector, the top companies focus on precision, efficiency, and safety in food processing. Marel is a leader in this field, renowned for its cutting-edge technology and extensive service network that ensures clients receive comprehensive support.

GEA Group Aktiengesellschaft ranks next, offering a wide range of food processing machinery that emphasizes sustainability and energy efficiency. GEA’s machines are tailored to meet the high-capacity needs of global food manufacturers.

Bühler Group follows with its focus on innovation in food safety and processing efficiency. Bühler’s cutting machines are designed for precision and minimal waste, making them a favorite in sectors requiring high-quality output.

FAM nv rounds out the top four, specializing in cutting solutions that adapt to various food textures and sizes. FAM nv is known for its customizability and the robustness of its equipment, suitable for a range of food products from soft fruits to hard cheeses.

These companies set the standard in the industrial food cutting machines market through technological leadership, global reach, and commitment to meeting the evolving demands of food production.

Major Companies in the Market

- Marel

- GEA Group Aktiengesellschaft

- Bühler Group

- FAM nv

- TREIF Maschinenbau GmbH

- Urschel Laboratories, Inc.

- Weber Maschinenbau GmbH

- Holac Maschinenbau GmbH

- Jaymech Food Machines

- KRONEN GmbH

- Sormac B.V.

- Cabinplant A/S

- Brunner-Anliker AG

Recent Developments

- JBT Corporation: On April 2024, JBT Corporation announced the execution of a definitive transaction agreement to acquire Marel hf., aiming to combine their strengths in food processing solutions. This strategic move is expected to enhance their global footprint and technological capabilities in the food processing equipment sector.

- Snack & BakeTec 2025: On April 2025, Snack & BakeTec 2025, held at the Bombay Exhibition Centre in Mumbai, showcased cutting-edge innovations in food manufacturing, with a special focus on snacks, bakery products, confectionery, and beverages. The event featured over 250 exhibitors from India and abroad, presenting live demonstrations of state-of-the-art machinery, automation solutions, and novel ingredients revolutionizing the food processing industry.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Billion Forecast Revenue (2034) USD 3.6 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Slicers, Dicers, Choppers, Graters, Others), By Technology (Manual, Semi-Automatic, Fully Automatic), By Application (Vegetables, Fruits, Meat, Seafood, Bakery & Confectionery, Dairy, Others), By End User (Food Processing Companies, Food Service Providers, Commercial Kitchens) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Marel, GEA Group Aktiengesellschaft, Bühler Group, FAM nv, TREIF Maschinenbau GmbH, Urschel Laboratories, Inc., Weber Maschinenbau GmbH, Holac Maschinenbau GmbH, Jaymech Food Machines, KRONEN GmbH, Sormac B.V., Cabinplant A/S, Brunner-Anliker AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Industrial Food Cutting Machines MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Global Industrial Food Cutting Machines MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Marel

- GEA Group Aktiengesellschaft

- Bühler Group

- FAM nv

- TREIF Maschinenbau GmbH

- Urschel Laboratories, Inc.

- Weber Maschinenbau GmbH

- Holac Maschinenbau GmbH

- Jaymech Food Machines

- KRONEN GmbH

- Sormac B.V.

- Cabinplant A/S

- Brunner-Anliker AG