Aerial Work Platforms Market By Product (Boom Lifts, Scissor Lifts, Vertical Lifts, Others), By Propulsion (ICE, Electric, Air), By Lifting Height (Less than 20 ft, 21-50 ft, More than 51 ft), By Application (Construction, Utilities, Logistics & Transportation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 20801

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

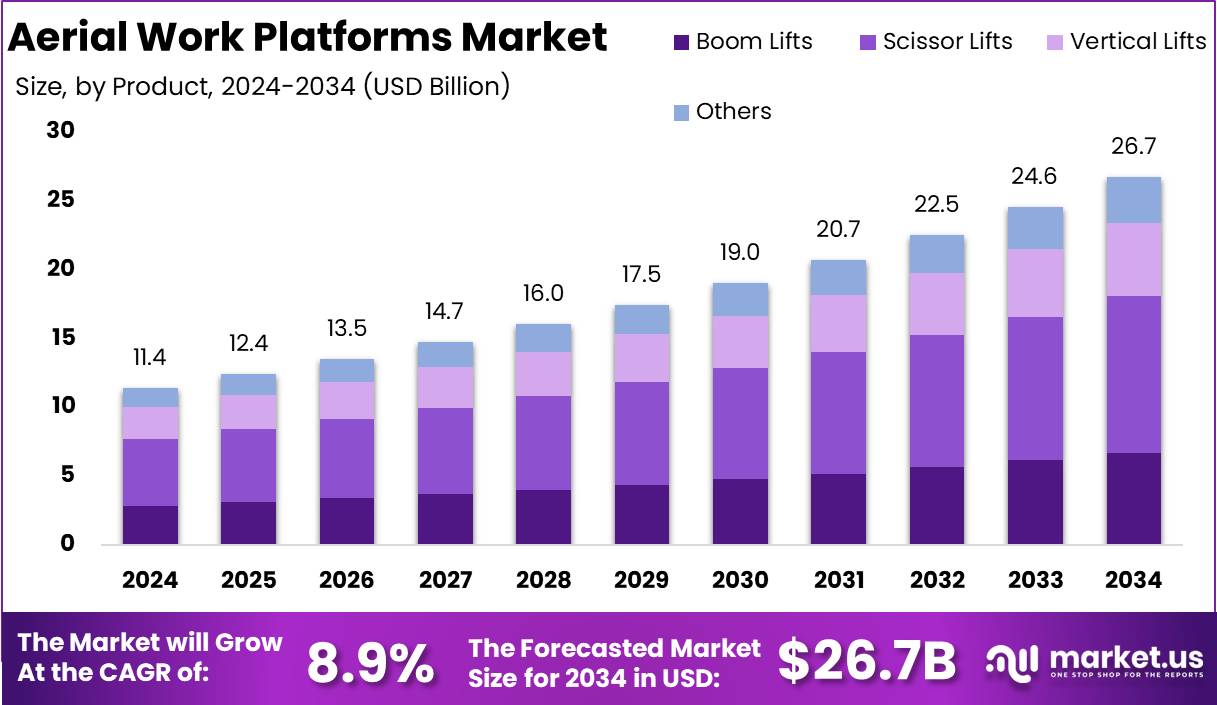

The Global Aerial Work Platforms Market size is expected to be worth around USD 26.7 Billion by 2034 from USD 11.4 Billion in 2024, growing at a CAGR of 8.9% during the forecast period from 2025 to 2034.

Aerial Work Platforms (AWPs) are specialized mechanical devices designed to provide temporary access to elevated work areas that are difficult to reach. These platforms, commonly referred to as aerial lifts or mobile elevating work platforms (MEWPs), are used across industries such as construction, manufacturing, maintenance, and warehousing.

AWPs enhance worker safety, efficiency, and flexibility, reducing the need for conventional scaffolding or ladders. They come in various types, including scissor lifts, boom lifts, vertical mast lifts, and spider lifts, each catering to specific operational requirements.

The Aerial Work Platforms market encompasses the production, distribution, and deployment of lifting equipment designed for working at heights across diverse industries. This market is driven by advancements in automation, stringent workplace safety regulations, and increasing infrastructure projects globally.

The industry is characterized by a growing preference for rental services over direct equipment purchases, enabling cost-efficient access to high-quality platforms. Key players in the market include equipment manufacturers, rental service providers, and technology integrators working to enhance performance, safety, and operational efficiency.

Several factors contribute to the growth of the Aerial Work Platforms market. The increasing emphasis on workplace safety and stringent regulatory requirements drive the adoption of AWPs across construction, logistics, and industrial sectors. Rapid urbanization and infrastructure development projects worldwide further accelerate demand.

Technological advancements, including electric and hybrid AWPs with enhanced energy efficiency and lower emissions, are reshaping the market landscape. Additionally, the rising penetration of telematics and IoT in equipment management enhances operational monitoring, improving fleet utilization and preventive maintenance.

The demand for Aerial Work Platforms is primarily influenced by the expansion of the construction and infrastructure sectors, along with the growing need for efficient material handling solutions. The shift toward automated and electrified lifting solutions is also fueling demand, particularly in developed economies where sustainability goals are a priority.

The market presents significant opportunities for growth, particularly in emerging economies experiencing rapid industrialization and infrastructure development. The transition toward electric and hybrid AWPs aligns with global sustainability initiatives, creating a lucrative space for innovation.

According to United Rentals, the Aerial Work Platforms Market is experiencing robust expansion, driven by increasing construction and infrastructure development. The market’s growth trajectory is reinforced by strategic acquisitions, such as United Rentals’ definitive agreement to acquire H&E Rentals for $92 per share in cash, translating to a total enterprise value of approximately $4.8 billion, including $1.4 billion in net debt.

This consolidation reflects the industry’s push for scale and operational efficiency. With rising demand for high-reach equipment across industrial and commercial sectors, the market is poised for sustained growth, underpinned by strong capital investments and fleet modernization trends.

Key Takeaways

- The global aerial work platforms market is projected to expand from USD 11.4 billion in 2024 to USD 26.7 billion by 2034, growing at a CAGR of 8.9% during the forecast period (2025-2034).

- Scissor Lifts hold the largest share in the market, accounting for 46.2% of the total market share in 2024.

- Internal Combustion Engine (ICE) Aerial Work Platforms dominate the propulsion segment with a 61.2% market share.

- Aerial work platforms with a lifting height of more than 51 ft lead the market, capturing 45.1% of the share

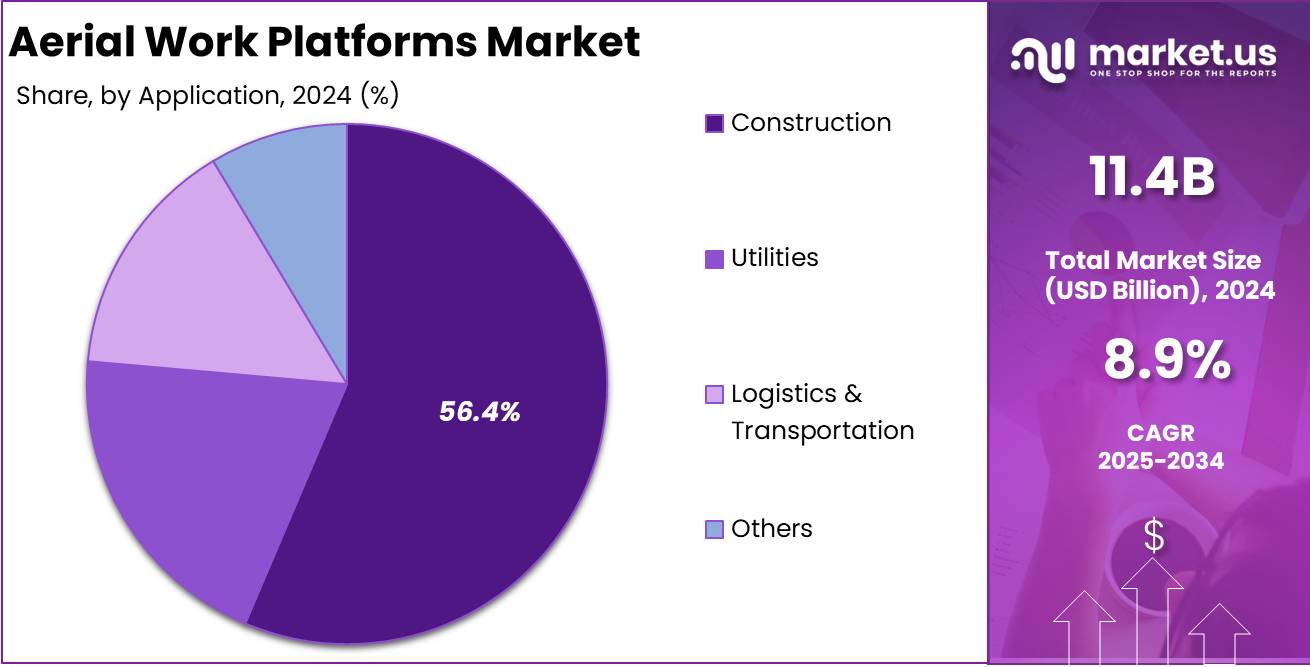

- The construction sector is the largest end-user, holding 56.4% of the total market share in 2024.

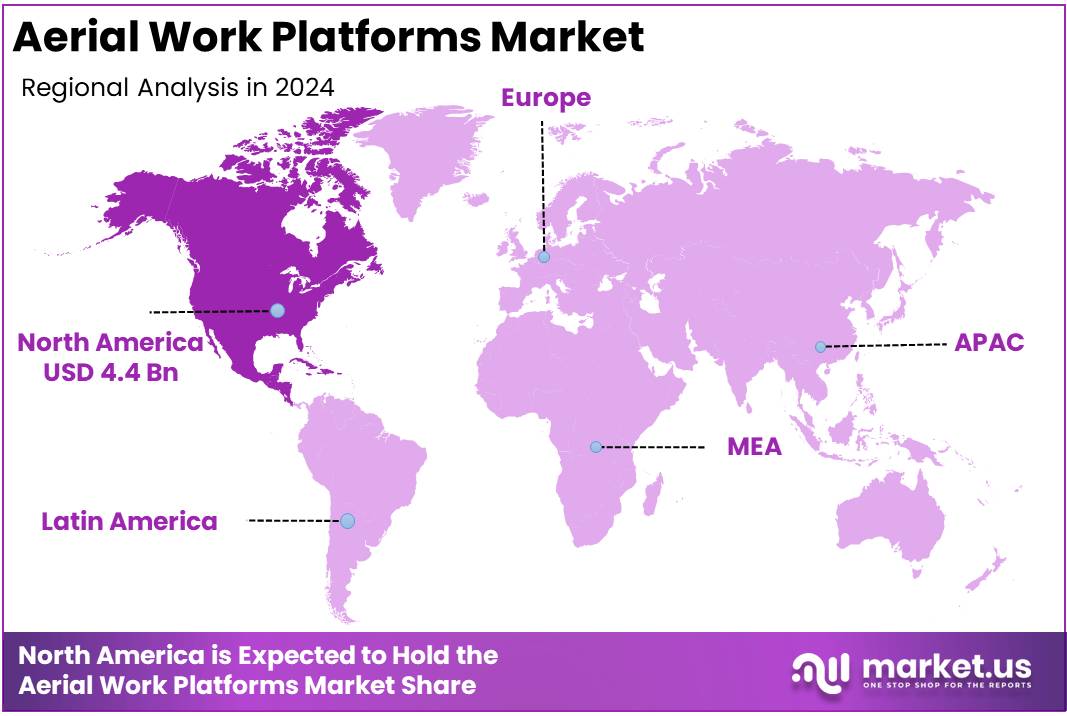

- North America is projected to dominate the global aerial work platforms market, holding 39.2% of the total market share, with a regional market value of USD 4.4 billion in 2024.

By Product Analysis

Scissor Lifts Dominate the Aerial Work Platforms Market with a 46.2% Share

In 2024, Scissor Lifts held a dominant market position in the Aerial Work Platforms market, capturing more than 46.2% of the total market share. The widespread adoption of scissor lifts can be attributed to their versatility, stability, and cost-effectiveness in applications such as construction, maintenance, and warehousing. The demand for electric scissor lifts has also surged due to stringent emission regulations and the shift towards sustainable equipment.

Boom Lifts held a significant position in the Aerial Work Platforms market in 2024, driven by their increasing adoption across construction, telecommunication, and utility sectors. Their ability to reach higher elevations and provide extended horizontal outreach makes them essential for tasks requiring enhanced mobility and flexibility. The rising demand for hybrid and electric boom lifts, fueled by sustainability initiatives and emission regulations, continues to support market expansion.

Vertical Lifts played a crucial role in compact and indoor applications such as facility management, retail, and logistics. Their small footprint, ease of use, and cost-effectiveness make them a preferred choice for low-height maintenance and warehouse operations. The increasing focus on operational efficiency and the growing demand for lightweight aerial work platforms are key factors supporting the expansion of vertical lifts.

The Others segment, encompassing truck-mounted platforms, push-around lifts, and specialty aerial work platforms, demonstrated steady market growth in 2024. These platforms are widely utilized in specialized applications such as firefighting, bridge inspection, and industrial maintenance. The adoption of advanced technologies and infrastructure development projects are expected to further propel the demand for these solutions in the coming years.

By Propulsion Analysis

ICE Dominates Aerial Work Platforms Market by Propulsion with a 61.2% Share

In 2024, Internal Combustion Engine (ICE) Aerial Work Platforms held a dominant market position in the propulsion segment, capturing more than 61.2% of the total market share. The widespread adoption of ICE-powered platforms can be attributed to their higher load capacity, extended operational range, and suitability for outdoor applications.

Industries such as construction, infrastructure maintenance, and shipbuilding continue to rely on these platforms due to their ability to operate in rugged environments and support heavy-duty lifting requirements.

Electric Aerial Work Platforms are experiencing steady growth, driven by increasing environmental regulations and the demand for low-emission solutions. The shift towards electrification in industrial and commercial applications has fueled the adoption of battery-powered platforms, particularly in indoor and urban settings where noise reduction and zero emissions are critical factors. Enhanced battery technologies and improved charging infrastructure are further accelerating the transition towards electric alternatives.

Air-powered Aerial Work Platforms primarily serve specialized applications that require lightweight, high-mobility solutions. These platforms are preferred in sectors where compressed air is readily available, such as certain manufacturing and industrial maintenance operations.

Although their adoption remains limited compared to ICE and electric variants, advancements in pneumatic technology and growing sustainability concerns may support moderate growth in this segment.

By Lifting Height Analysis

More than 51 ft Leads Aerial Work Platforms Market by Lifting Height with a 45.1% Share

In 2024, Aerial Work Platforms with a lifting height of more than 51 ft held a dominant market position, capturing more than 45.1% of the total market share. The demand for high-reach platforms is driven by large-scale construction projects, infrastructure maintenance, and industrial applications requiring extended height capabilities. Their ability to provide safe access to elevated workspaces in sectors such as telecommunications, oil & gas, and utilities further supports their widespread adoption.

Aerial Work Platforms with a 21-50 ft lifting height are widely used for medium-height applications across various industries. These platforms are preferred for both indoor and outdoor operations in warehousing, facility management, and maintenance activities due to their versatility and balance between reach and maneuverability. Their strong presence in industries requiring frequent yet moderate elevation tasks has contributed to steady market demand.

The less than 20 ft segment serves industries that require compact and easily maneuverable solutions. These platforms are primarily used for low-height maintenance, retail stocking, and indoor applications where space constraints limit the use of larger machines. The growing adoption of compact electric scissor lifts and push-around lifts in commercial settings continues to drive demand in this segment.

By Application Analysis

Construction Leads Aerial Work Platforms Market by Application with a 56.4% Share

In 2024, Construction held a dominant market position in the Aerial Work Platforms market by application, capturing more than 56.4% of the total share. The increasing demand for high-reach equipment in infrastructure projects, commercial building developments, and residential construction has driven the adoption of these platforms. Their ability to enhance worker safety, efficiency, and accessibility in high-altitude tasks continues to fuel growth in this segment.

The Utilities sector plays a crucial role in the adoption of Aerial Work Platforms, driven by the rising need for aerial access in power distribution, telecommunications, and maintenance operations. These platforms are essential for providing safe and efficient access to overhead power lines, wind turbines, and other utility infrastructure, ensuring operational efficiency and worker safety in high-altitude tasks.

The Logistics & Transportation sector is witnessing steady growth in the use of Aerial Work Platforms, particularly in warehousing, cargo handling, and fleet maintenance. The increasing need for efficient material handling and infrastructure maintenance in large logistics hubs and transportation facilities has driven demand. Their ability to streamline operations while enhancing safety has made them a preferred choice in this industry.

The Others category, including industries such as manufacturing, aviation, and facility management, continues to contribute to the demand for Aerial Work Platforms. These platforms are widely used for equipment installation, routine maintenance, and specialized tasks requiring elevated access. While representing a smaller portion of the market, advancements in automation and safety features are expected to drive further adoption across various industrial applications.

Key Market Segments

By Product

- Boom Lifts

- Scissor Lifts

- Vertical Lifts

- Others

By Propulsion

- ICE

- Electric

- Air

By Lifting Height

- Less than 20 ft

- 21-50 ft

- More than 51 ft

By Application

- Construction

- Utilities

- Logistics & Transportation

- Others

Driver

Urbanization and Infrastructure Development

The rapid pace of urbanization and the consequent surge in infrastructure development have significantly propelled the demand for aerial work platforms (AWPs). As urban areas expand, there is an escalating need for residential, commercial, and public infrastructure projects. AWPs have become indispensable in these endeavors, offering safe and efficient access to elevated work sites, thereby enhancing productivity and ensuring worker safety.

The versatility of AWPs allows their application across various tasks, from building maintenance to electrical installations, making them essential tools in modern construction practices. Consequently, the ongoing urban development initiatives continue to drive the demand for AWPs across regions.

In addition to urbanization, substantial investments in infrastructure projects further amplify the need for AWPs. Governments and private entities worldwide are allocating significant resources to develop and upgrade infrastructure, including transportation networks, energy facilities, and public utilities.

These projects often involve complex construction activities at considerable heights, necessitating the use of AWPs to ensure operational efficiency and adherence to safety standards. As infrastructure development remains a priority in many regions, the reliance on AWPs is expected to persist, thereby contributing to the sustained growth of the AWP market

Restraint

High Initial Investment Costs Limiting

Despite their numerous advantages, the high initial investment required for acquiring aerial work platforms (AWPs) poses a significant barrier to their widespread adoption. Small and medium-sized enterprises (SMEs), in particular, may struggle to allocate substantial capital toward purchasing these specialized machines, especially when operating within tight budget constraints.

This financial hurdle can impede access to advanced equipment, limiting opportunities for companies to enhance operational efficiency and safety. While rental services offer a viable alternative, some organizations may still prefer ownership for long-term projects, creating a dilemma. Consequently, the substantial upfront costs associated with AWPs present a challenge to their broader utilization, particularly in developing markets where financial limitations are more pronounced.

Moreover, the total cost of ownership extends beyond the initial purchase price, encompassing expenses related to maintenance, training, and compliance with safety regulations. These additional costs can further deter businesses from investing in AWPs, especially if the anticipated return on investment is uncertain.

As a result, companies may resort to alternative methods, such as scaffolding or ladders, despite the potential compromises in safety and efficiency. Addressing this restraint requires innovative financing solutions, such as leasing options or government subsidies, to make AWPs more accessible to a broader range of businesses.

Opportunity

Integration of Advanced Technologies

The integration of advanced technologies, such as telematics, the Internet of Things (IoT), and automation, presents a significant opportunity for the aerial work platforms (AWP) market. Telematics systems enable real-time monitoring of equipment performance, allowing operators to track usage patterns, maintenance schedules, and location data. This technology enhances fleet management efficiency, reduces downtime, and improves overall operational effectiveness.

Additionally, the incorporation of IoT solutions facilitates predictive maintenance, enabling businesses to identify potential issues before they lead to equipment failure. As the industry continues to embrace technological advancements, the demand for smart and connected AWPs is expected to grow, driving innovation and enhancing the user experience.

Furthermore, automation features, such as self-leveling and obstacle detection, enhance safety and ease of operation, making AWPs more user-friendly and reducing the likelihood of accidents. These technological advancements not only improve the functionality of AWPs but also contribute to cost savings by minimizing downtime and extending equipment lifespan. As businesses increasingly recognize the benefits of integrating advanced technologies into their operations, the adoption of technologically enhanced AWPs is poised to accelerate, offering a substantial growth opportunity for the market.

Trends

Shift Towards Eco-Friendly Aerial Work Platforms

A prominent trend in the aerial work platforms (AWP) market is the increasing adoption of electric and hybrid models over traditional diesel-powered machines. Electric AWPs offer several advantages, including lower emissions, reduced noise levels, and lower operating costs. As businesses increasingly prioritize sustainability and environmental responsibility, the demand for electric AWPs is rising.

This trend is particularly prominent in urban areas, where regulations around emissions are becoming stricter. Manufacturers are responding to this shift by developing more efficient electric platforms that meet the needs of various industries, ensuring a steady increase in their market share.

Moreover, the shift towards eco-friendly AWPs aligns with global efforts to reduce carbon footprints and promote sustainable practices. Companies adopting electric or hybrid AWPs can enhance their corporate social responsibility profiles and comply with environmental regulations.

Additionally, the lower operating costs associated with electric AWPs, due to reduced fuel consumption and maintenance requirements, present an economic incentive for businesses. As technological advancements continue to improve the performance and affordability of electric and hybrid AWPs, this trend is expected to gain further momentum, contributing to the overall growth of the AWP market.

Regional Analysis

North America Leads the Aerial Work Platforms Market with the Largest Market Share of 39.2%

The North America aerial work platforms (AWP) market is projected to dominate the global landscape, accounting for 39.2% of the total market share in 2024. The region is valued at USD 4.4 billion, driven by strong demand from the construction, infrastructure, and maintenance sectors. Increasing investments in commercial and residential construction, coupled with stringent worker safety regulations, have significantly contributed to the market’s expansion.

The growing adoption of advanced and electric-powered aerial lifts, particularly in the United States and Canada, further supports market growth. Additionally, the presence of well-established rental businesses and a high replacement rate of aging machinery continue to fuel the demand for AWPs across various industries.

Europe represents a significant portion of the global aerial work platforms market, benefiting from ongoing infrastructure modernization projects and the increasing emphasis on workplace safety. The demand for AWPs in countries such as Germany, the United Kingdom, and France is fueled by the rise in urbanization and government investments in smart city initiatives. Additionally, the shift towards sustainable and electric-powered lifts is further driving market penetration.

Asia Pacific is emerging as a rapidly growing market, supported by the increasing infrastructure development activities in China, India, and Southeast Asia. The demand for AWPs is driven by large-scale construction projects, rising industrialization, and government initiatives to improve worker safety standards. The market is witnessing significant growth due to expanding real estate and urban development projects. Additionally, the region is experiencing a rising trend in equipment rental services, further propelling market demand.

The Middle East & Africa aerial work platforms market is growing due to increasing investments in commercial and industrial infrastructure, particularly in the UAE, Saudi Arabia, and South Africa. The expansion of the construction and oil & gas industries in the region is creating demand for AWPs, especially scissor lifts and boom lifts, which are widely used for high-altitude operations. Government-backed infrastructure projects and upcoming smart city developments are also supporting market growth.

Latin America is witnessing a steady increase in demand for aerial work platforms, primarily in Brazil, Mexico, and Argentina. The region’s growth is driven by urban expansion, increased investments in commercial and industrial projects, and rising awareness regarding worker safety regulations. The rental model for AWPs is gaining popularity in the region, making the equipment more accessible to businesses.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Global Aerial Work Platforms (AWP) Market in 2024 is characterized by increasing demand for safer and more efficient lifting solutions across construction, maintenance, and industrial applications. Leading industry players continue to drive innovation, product diversification, and geographical expansion to strengthen their market positions.

Linamar Corporation has reinforced its market presence through strategic acquisitions and advancements in hybrid and electric AWPs. JLG Industries, Inc., a dominant player, maintains its leadership with a focus on high-capacity and energy-efficient solutions, supported by its global service network. MEC Aerial Work Platforms is gaining traction with innovations in safety features and compact, low-weight designs.

Terex Corporation, through its Genie brand, remains a significant contributor, leveraging its strong global distribution channels and investment in electrification. Tadano Ltd. is capitalizing on its expertise in cranes to enhance its AWP offerings, particularly in high-reach applications.

Haulotte Group is driving sustainability with an expanded electric and hybrid AWP portfolio, while Mtandt Limited is strengthening its foothold in Asia through rental solutions and safety-focused equipment. V-Tech continues to innovate in niche market segments, particularly in low-level access platforms. Aichi Corporation, backed by Toyota Industries, is advancing automation and IoT integration in its AWP lineup.

Altec Inc. and Bronto Skylift are expanding their product range to cater to utility and firefighting sectors. Diversified Technologies and Palfinger AG are investing in ergonomic and high-performance lifting solutions. J.C. Bamford Excavators Limited (JCB) and Manitou Group remain strong competitors with a focus on durability and expanding telehandler-based AWPs for rough terrain applications.

Top Key Players in the Market

- Linamar Corporation

- JLG Industries, Inc.

- MEC Aerial Work Platforms

- Terex Corporation

- Tadano Ltd.

- Haulotte Group

- Mtandt Limited

- V-tech

- Aichi Corporation

- Altec Inc.

- Bronto Skylift

- Diversified Technologies

- Palfinger AG

- J.C. Bamford Excavators Limited

- Manitou Group

Recent Developments

- In March 13, 2025, Bell Textron Inc., a subsidiary of Textron Inc. (NYSE: TXT), revealed at VAI Verticon 2025 that it achieved a record number of aircraft orders in Latin America for FY2024. This marks the highest annual sales of Bell 429 helicopters in the region, highlighting the increasing demand for Bell’s advanced rotorcraft solutions.

- In March 2025, United Rentals, Inc. (NYSE: URI) and H&E Equipment Services, Inc. (NASDAQ: HEES) have entered into a definitive agreement for United Rentals to acquire H&E for $92 per share in cash. The transaction, valued at approximately $4.8 billion, includes H&E’s net debt of $1.4 billion, strengthening United Rentals’ market presence.

- In January 2, 2025 – Tadano Ltd. successfully completed the acquisition of Manitex International, making Manitex a fully owned subsidiary. As a result, Manitex shares are no longer traded on Nasdaq. Tadano initially invested in Manitex in 2018 and expanded its ownership in September 2024 by acquiring the remaining shares.

- In May 8, 2024 – Oshkosh Corporation (NYSE: OSK) announced a definitive agreement to acquire AUSACORP S.L. (AUSA), a global manufacturer of off-road equipment. The acquisition will integrate AUSA into Oshkosh’s Access segment, expanding its portfolio in construction, material handling, and specialty vehicle solutions.

Report Scope

Report Features Description Market Value (2024) USD 11.4 Billion Forecast Revenue (2034) USD 26.7 Billion CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Boom Lifts, Scissor Lifts, Vertical Lifts, Others), By Propulsion (ICE, Electric, Air), By Lifting Height (Less than 20 ft, 21-50 ft, More than 51 ft), By Application (Construction, Utilities, Logistics & Transportation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Linamar Corporation, JLG Industries, Inc., MEC Aerial Work Platforms, Terex Corporation, Tadano Ltd., Haulotte Group, Mtandt Limited, V-tech, Aichi Corporation, Altec Inc., Bronto Skylift, Diversified Technologies, Palfinger AG, J.C. Bamford Excavators Limited, Manitou Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aerial Work Platforms MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Aerial Work Platforms MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Linamar Corporation

- JLG Industries, Inc.

- MEC Aerial Work Platforms

- Terex Corporation

- Tadano Ltd.

- Haulotte Group

- Mtandt Limited

- V-tech

- Aichi Corporation

- Altec Inc.

- Bronto Skylift

- Diversified Technologies

- Palfinger AG

- J.C. Bamford Excavators Limited

- Manitou Group