Global Electrical Steel Market By Type (Non-grain Oriented, Grain Oriented), By Application (Transformer, Motors, Inductors, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140671

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

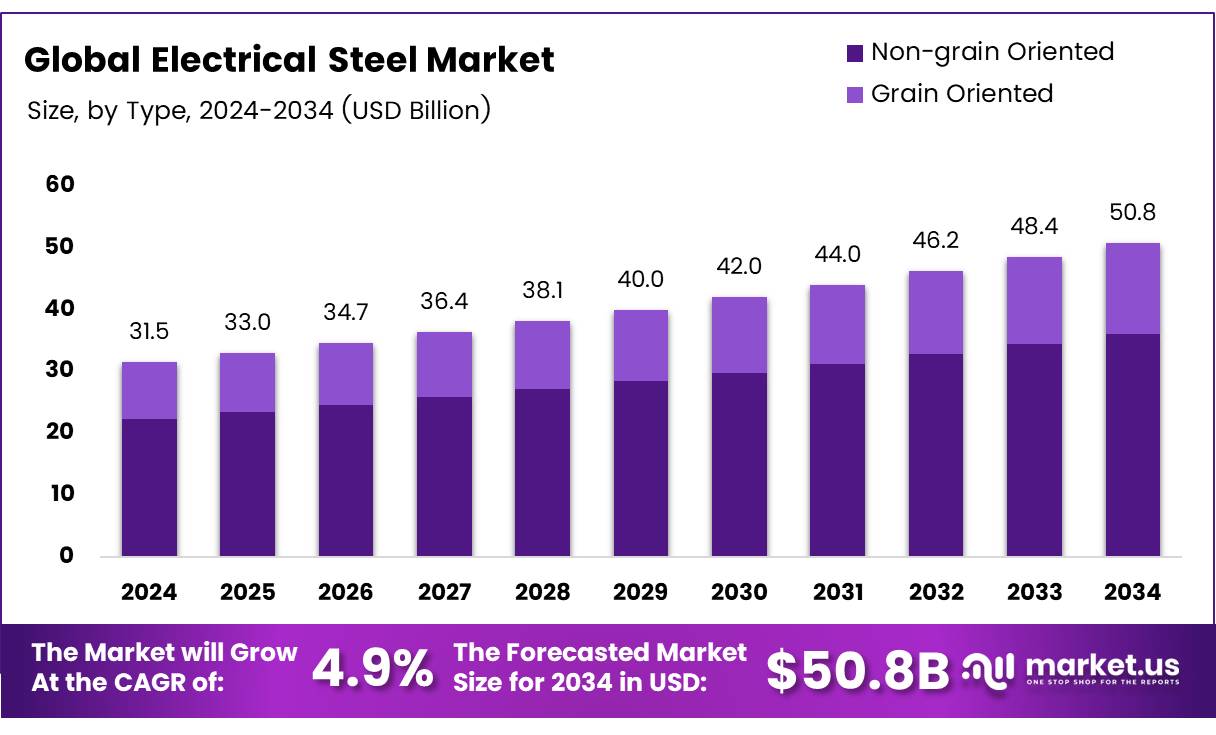

The Global Electrical Steel Market size is expected to be worth around USD 50.8 Billion by 2034, from USD 31.5 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

Electrical steel, a specialized steel used in the production of electric motors, transformers, and generators, is integral to the energy and electronics sectors. This material, often referred to as silicon steel or lamination steel, enhances electrical efficiency by reducing energy losses in magnetic devices.

The global electrical steel market has been witnessing steady growth due to increasing demand for energy-efficient technologies, particularly in the automotive and renewable energy sectors. Electrical steel is a critical component in electric vehicle motors, wind turbine generators, and transformer cores, making its demand highly correlated with global energy transitions and electrification trends.

The market is dominated by key players from China, Japan, and the United States, with China’s production showing a strong growth trajectory. According to the Chinese Society for Metals (CSM), China’s electrical steel production reached 16.1 million tonnes in 2024, representing a 5.4% year-on-year increase.

The global demand for electrical steel is expected to further rise due to innovations in electric vehicles and renewable energy systems. The growth of the electrical steel market is primarily driven by the rising adoption of electric vehicles (EVs) and renewable energy sources, both of which require high-efficiency electrical components.

Government investments in clean energy infrastructure and decarbonization goals are opening up substantial opportunities for the electrical steel sector. For example, the push towards net-zero emissions has led to increased demand for transformers, motors, and generators, which are heavily reliant on electrical steel. The regulatory landscape also plays a crucial role in the market’s growth.

Governments worldwide are implementing stricter energy efficiency standards and incentivizing the production and use of high-quality electrical steel to support the energy transition.

In the United States, for instance, approximately 71% of raw steel production in 2024 is expected to come from electric arc furnaces, according to the U.S. Geological Survey (USGS), indicating a shift towards more sustainable steel production methods.

The market is also benefiting from the expansion of industrial and manufacturing activities in emerging economies, particularly in Asia, where demand for energy-efficient technologies is on the rise. While growth prospects are promising, the electrical steel market faces challenges, particularly in terms of production capacity and supply chain bottlenecks.

A notable concern is the increasing lead times in transformer production. According to Fastmarkets, average lead times for transformers across various electric industry segments have surged by 443%, highlighting the pressure on manufacturers to meet rising demand.

Additionally, fluctuations in raw material prices and geopolitical factors may impact market stability, making it essential for market participants to remain agile and adapt to changing conditions.

Key Takeaways

- The global Electrical Steel Market is projected to reach USD 50.8 billion by 2034, growing at a CAGR of 4.9%.

- Non-grain Oriented (NGO) electrical steel accounted for 71.3% of the market share in 2024.

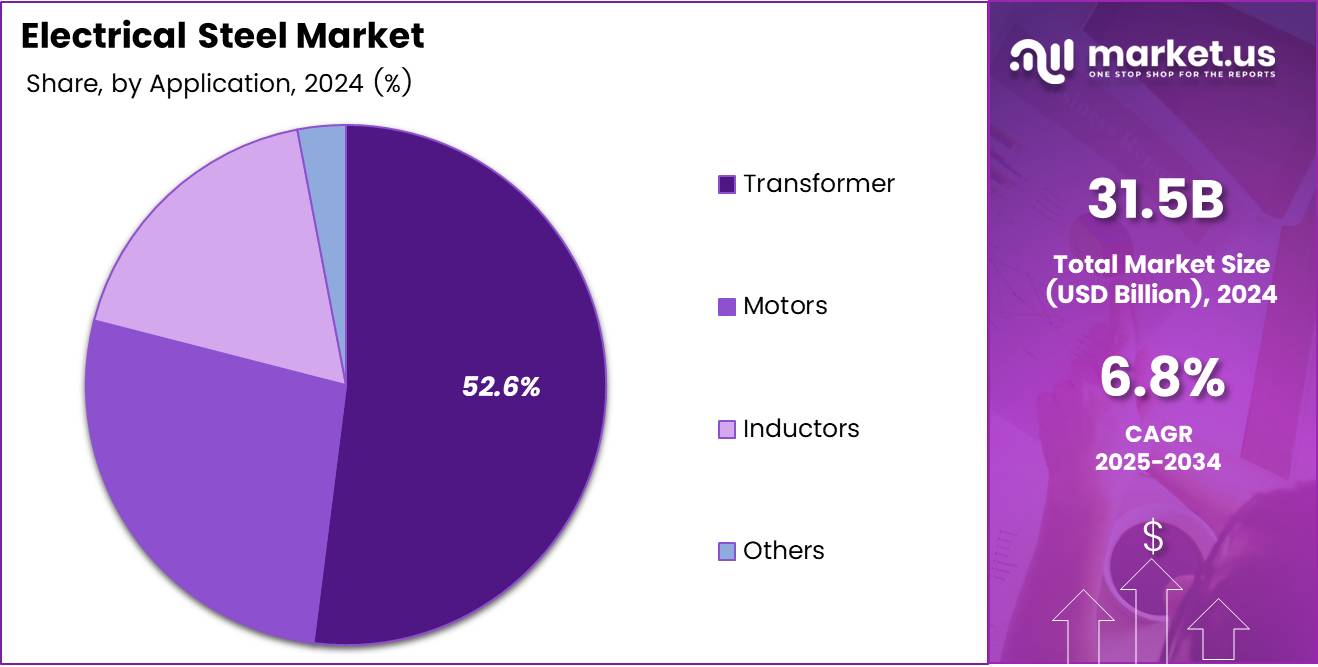

- The Transformer segment dominated the market with a 52.6% share in 2024, driven by investments in power infrastructure.

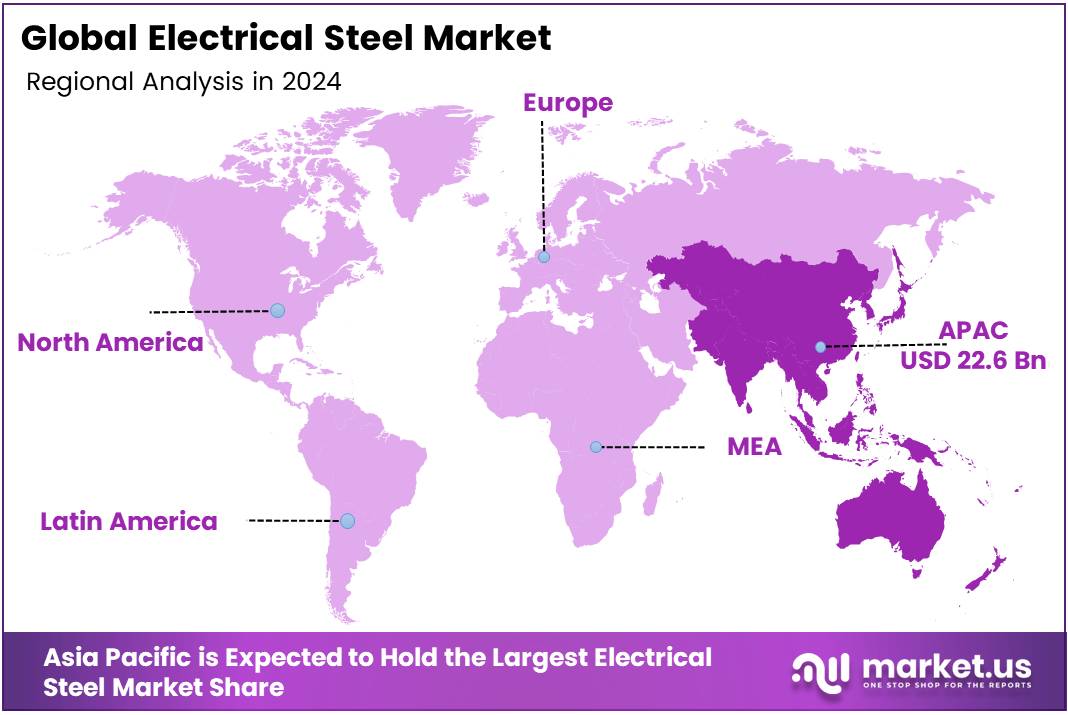

- Asia Pacific holds the largest share of the market at 72.3%, valued at approximately USD 22.6 billion.

Type Analysis

Non-Grain Oriented Electrical Steel Dominates with 71.3% Market Share in 2024, Driven by Versatility and Cost-Effectiveness

In 2024, Non-grain Oriented (NGO) electrical steel held a commanding 71.3% share in the By Type Analysis segment of the global Electrical Steel market, reflecting its broad usage across a variety of applications.

NGO steel is particularly favored in industries that require versatile magnetic properties, such as electric motors, transformers, and household appliances. Its ability to maintain high performance across a range of operating conditions makes it the material of choice for manufacturers seeking cost-effective solutions.

Grain Oriented (GO) steel, though accounting for a smaller market share, remains a critical component in applications where high efficiency and minimal energy loss are paramount. GO steel’s exceptional magnetic properties make it ideal for large-scale power transformers and high-performance motors, where precise control of magnetic flux is essential.

Despite the technological advantages of Grain Oriented steel, the broader range of applications and more cost-effective production of Non-grain Oriented steel enable it to retain a dominant position in the market, with widespread adoption across industrial and consumer sectors. As a result, Non-grain Oriented steel is expected to continue leading the market throughout 2024 and beyond.

Application Analysis

Transformer Application Leads with 52.6% Market Share in 2024, Fueled by Rising Demand for Power Infrastructure

In 2024, the Transformer segment captured a dominant 52.6% share in the By Application Analysis segment of the global Electrical Steel market, driven by increasing investments in power infrastructure and the growing need for efficient energy transmission.

Transformers, particularly those used in power grids, rely heavily on electrical steel to minimize energy losses and ensure high performance. The demand for reliable and durable transformers continues to rise with global energy consumption and the expansion of renewable energy sources, further solidifying this segment’s leading position.

The Motors segment, while holding a significant share, trails behind Transformers in market size. Motors benefit from electrical steel’s magnetic properties, especially in applications like electric vehicles, industrial machinery, and household appliances. The growing adoption of electric vehicles (EVs) and automation is expected to fuel continued growth in this segment.

Inductors and Other applications represent a smaller share but are still crucial, with electrical steel being integral to components like chokes and magnetic coils in electronics and telecommunications.

Despite the strong presence of motors and inductors in industrial applications, Transformers remain the key growth driver in the electrical steel market, contributing significantly to the overall market share in 2024 and beyond.

Key Market Segments

By Type

- Non-grain Oriented

- Grain Oriented

By Application

- Transformer

- Motors

- Inductors

- Others

Drivers

Growing Demand for Electric Vehicles (EVs) Boosts Electrical Steel Usage

The rising adoption of electric vehicles (EVs) is significantly driving the demand for electrical steel, especially in components like motors and transformers. EVs require high-efficiency electric motors that rely on the magnetic properties of electrical steel to function optimally. As more consumers and manufacturers shift towards EVs, the need for advanced electrical steel in motor and transformer production continues to increase.

In addition, the transition to electric vehicles contributes to the broader electrification of transportation, which further emphasizes the importance of high-quality electrical steel. As governments push for cleaner, more sustainable transport solutions and EV production ramps up, the electrical steel market stands to benefit from these trends.

This growth is not only limited to vehicle production but extends to charging stations and energy storage systems, all of which require electrical steel for their operational efficiency. This trend aligns with the broader movement towards electrification and clean energy, positioning electrical steel as a crucial material in shaping the future of sustainable transportation and energy solutions.

Restraints

Volatile Raw Material Prices Pose Challenges for Electrical Steel Production

The electrical steel market faces significant challenges due to the volatile prices of essential raw materials like iron ore and coal. Fluctuations in the costs of these raw materials directly affect the production cost of electrical steel, leading to unpredictable pricing for manufacturers and potential supply chain disruptions.

These price swings can make it difficult for producers to maintain consistent pricing for their products, which can in turn impact the overall stability of the market.

In addition, the high cost of raw materials can limit the production capacity of electrical steel manufacturers, especially for smaller players who may lack the resources to absorb such fluctuations. Another major restraint is the technological complexity involved in producing high-performance electrical steel.

The manufacturing process requires advanced machinery, precision, and specialized knowledge to ensure the steel meets the necessary magnetic properties and performance standards. This makes it difficult for many companies to enter the market or scale their operations, especially without the right technical expertise and financial investment.

As a result, the combination of raw material price volatility and the sophisticated manufacturing process limits the ability of some manufacturers to remain competitive, potentially hindering the market’s overall growth. These challenges emphasize the need for more stability in the supply chain and innovation to reduce production costs while maintaining quality.

Growth Factors

Expansion in Emerging Economies Fuels Market Growth for Electrical Steel

Rapid industrialization and urbanization in emerging economies, especially in Asia-Pacific and Latin America, present significant growth opportunities for the electrical steel market. As these regions continue to grow, the demand for electricity and modern infrastructure increases, driving the need for electrical steel in power generation, transmission, and distribution.

The expansion of urban centers requires more efficient power grids, and electrical steel plays a crucial role in enhancing the performance of transformers and other grid components. Furthermore, rising investments in renewable energy and electric vehicle (EV) infrastructure in these developing regions further boost the demand for high-performance electrical steel, positioning manufacturers to tap into new, expanding markets.

As these economies continue to build and modernize their energy infrastructure, electrical steel will remain a key material for meeting the growing need for reliable, sustainable energy solutions.

Emerging Trends

Growing Focus on Sustainability and Green Manufacturing in Electrical Steel Production

The electrical steel market is undergoing significant shifts, driven by sustainability and environmental concerns. Steel producers are increasingly adopting green manufacturing practices, such as recycling scrap metal and reducing carbon emissions in production processes. This shift is not only in response to global environmental goals but also due to regulatory pressures and growing consumer demand for eco-friendly products.

Along with this, the trend of miniaturizing electrical components, particularly transformers and motors, is creating a higher demand for thinner electrical steel grades. This is especially true in consumer electronics, where compactness and efficiency are key.

Furthermore, the development of high-strength electrical steels is gaining momentum. These new, durable materials are designed to perform better in high-load applications, making them ideal for industries such as renewable energy and electric vehicles.

Lastly, artificial intelligence is playing a pivotal role in revolutionizing manufacturing processes. By incorporating AI into production lines, companies are able to enhance quality control, improve efficiency, and reduce operational costs. As a result, electrical steel manufacturers are not just meeting industry needs but also aligning with global efforts toward sustainability, innovation, and more efficient production methods.

Regional Analysis

Asia Pacific leads the Electrical Steel Market with 72.3% share valued at USD 22.6 billion

The global Electrical Steel Market is segmented into key regions: Asia Pacific, North America, Europe, Middle East & Africa, and Latin America. Among these, Asia Pacific dominates the market, holding a substantial market share of 72.3%, valued at approximately USD 22.6 billion.

This dominance is attributed to the region’s rapid industrial growth, high demand for electrical steel in the automotive and energy sectors, and the increasing production of electric vehicles (EVs). China, Japan, and India are the leading contributors, with China being the largest consumer and producer of electrical steel, driven by its massive manufacturing base and government-led initiatives to boost renewable energy infrastructure.

Regional Mentions:

North America exhibits steady demand for electrical steel, with the market largely influenced by the increasing adoption of electric vehicles and the growing need for energy-efficient transformers and motors. The region benefits from the presence of major automotive manufacturers and appliance producers, contributing to its market growth.

Europe is another significant market for electrical steel, driven by the automotive industry, where electrical steel plays a critical role in electric motor production. The European Union’s focus on reducing carbon emissions and expanding renewable energy capacity supports the demand for electrical steel, particularly in countries like Germany, France, and the UK.

Middle East & Africa and Latin America represent smaller shares in the market but are experiencing gradual growth. In these regions, investment in energy infrastructure and the rising adoption of electric vehicles are fostering market development, with key players in countries like Brazil and South Africa.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global electrical steel market is poised for continued growth in 2024, driven by advancements in energy efficiency, growing demand for electric vehicles (EVs), and the expansion of renewable energy systems. Several key players are leading the way in this highly competitive landscape, each contributing through technological innovation, geographical expansion, and strategic partnerships.

Benxi Steel Group Co., Ltd. and Shougang Group have established strong positions within China’s burgeoning electrical steel industry, benefiting from government support and significant investments in production capacity. Both companies are well-positioned to meet the country’s growing demand for high-quality electrical steel, particularly for power generation and transmission applications.

Voestalpine Group and Nucor Corporation are expected to further consolidate their leadership by focusing on high-value products, particularly silicon steel, which is critical for the efficiency of transformers and electric motors. Nucor, with its focus on advanced steelmaking processes and sustainability, is likely to expand its influence in the North American market.

European companies, such as thyssenkrupp Steel and Aperam S.A., are leveraging innovations in coating technologies to deliver superior performance in electrical steel products, enhancing the efficiency of electric motors and renewable energy systems. Meanwhile, ArcelorMittal S.A. and POSCO are investing heavily in green steel technologies, positioning themselves as leaders in the market for sustainable electrical steel production.

Tata Steel, NIPPON STEEL CORPORATION, and Baosteel Group Corporation will remain dominant in the Asian markets, emphasizing their advanced production facilities and capabilities in meeting global demand. These players are also investing in capacity expansions and R&D to capitalize on rising demand from the EV sector.

Top Key Players in the Market

- Benxi Steel Group Co., Ltd

- CSC Steel Sdn. Bhd.

- Voestalpine Group

- Yieh Corporation

- Tata Steel

- Nucor Corporation

- NLMK

- ArcelorMittal S.A.

- Arnold Magnetic Technologies

- Shougang Group

- thyssenkrupp Steel

- Baosteel Group Corporation

- POSCO

- NIPPON STEEL CORPORATION

- Aperam S.A.

Recent Developments

- In January 2025, SAIL and John Cockerill will invest Rs 6,000 crore to set up an electrical steel plant in India, boosting the country’s position in the global market.

- In February 2025, Governor Ivey announced that ArcelorMittal will invest $1.2 billion in an Alabama mill to produce electrical steel, supporting renewable energy and electric vehicle growth.

- In February 2024, JSW Steel and JFE Steel formed a ₹5,500 crore JV to produce electrical steel in India, enhancing production for green technologies.

Report Scope

Report Features Description Market Value (2024) USD 31.5 Billion Forecast Revenue (2034) USD 50.8 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Non-grain Oriented, Grain Oriented), By Application (Transformer, Motors, Inductors, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Benxi Steel Group Co., Ltd, CSC Steel Sdn. Bhd., Voestalpine Group, Yieh Corporation, Tata Steel, Nucor Corporation, NLMK, ArcelorMittal S.A., Arnold Magnetic Technologies, Shougang Group, thyssenkrupp Steel, Baosteel Group Corporation, POSCO, NIPPON STEEL CORPORATION, Aperam S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Benxi Steel Group Co., Ltd

- CSC Steel Sdn. Bhd.

- Voestalpine Group

- Yieh Corporation

- Tata Steel

- Nucor Corporation

- NLMK

- ArcelorMittal S.A.

- Arnold Magnetic Technologies

- Shougang Group

- thyssenkrupp Steel

- Baosteel Group Corporation

- POSCO

- NIPPON STEEL CORPORATION

- Aperam S.A.