Global Hydrogen Aircraft Market Size, Share, Growth Analysis Report By Type (UAV (Unmanned Aerial Vehicles), Passenger Aircraft, Others), By Range (Short Range (up to 1,500 nmi), Medium Range (1,501 to 4,000 nmi), Long Range (over 4,000 nmi)), By Technology (Fuel Cell Technology, Hydrogen Combustion Engines), By Capacity (1-12 Passengers, 13-50 Passengers, 51-200 Passengers, 201+ Passengers), By Application (Commercial Aviation, Military Aviation, General & Business Aviation), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 73087

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

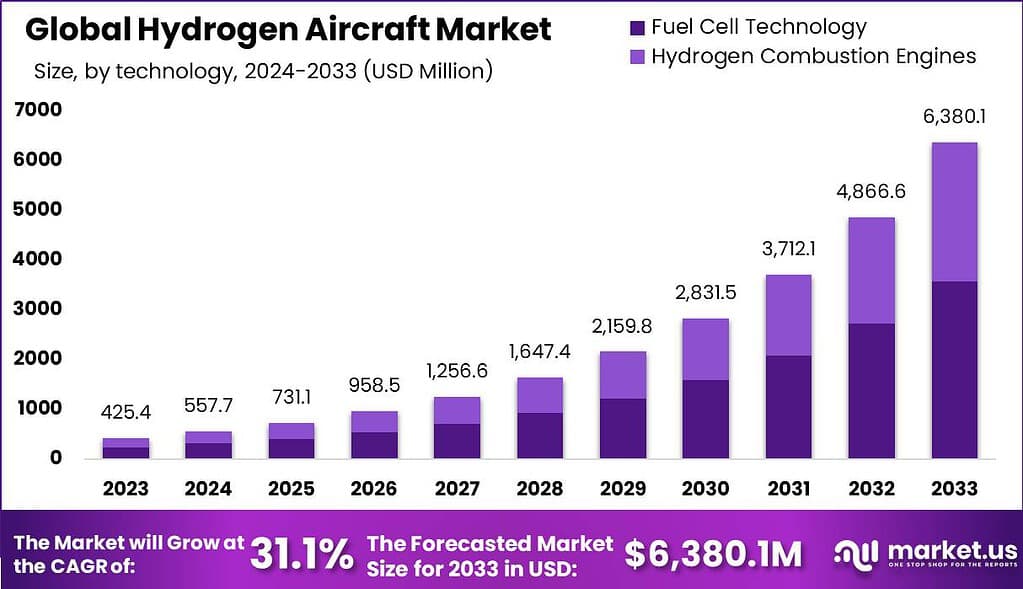

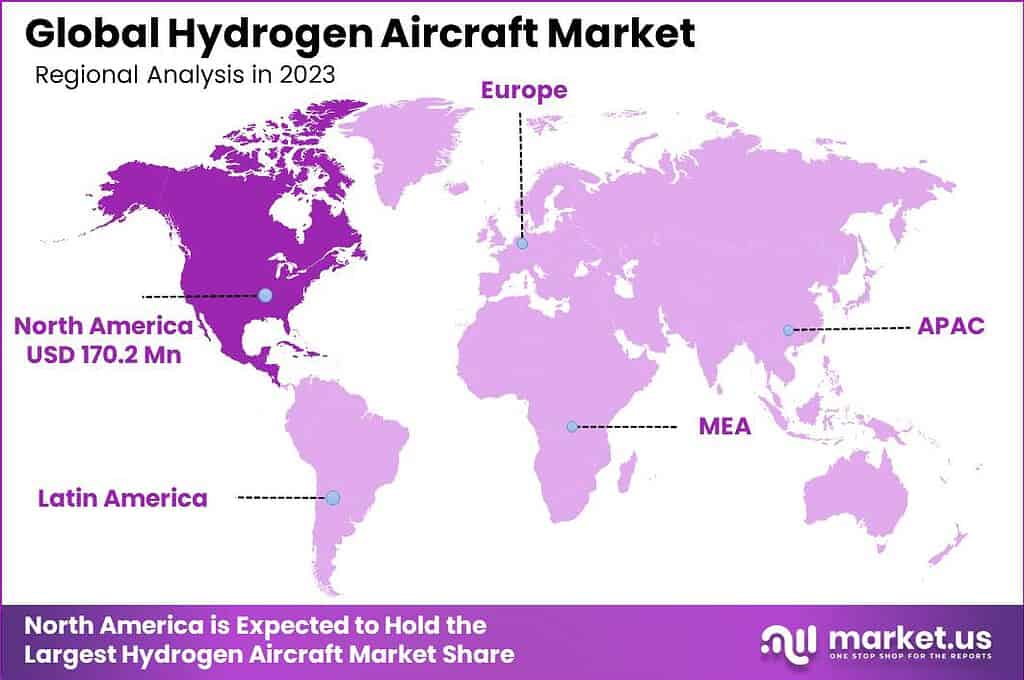

The Global Hydrogen Aircraft Market size is expected to be worth around USD 6,380.1 Million By 2033, from USD 425.4 Million in 2023, growing at a CAGR of 31.1% during the forecast period from 2024 to 2033. In 2023, North America captured over 40% of the hydrogen aircraft market, generating a revenue of USD 170.2 million, maintaining a dominant position in the sector.

Hydrogen aircraft represent a pioneering sector within aviation that utilizes hydrogen as a primary fuel source either through combustion in a gas turbine or via fuel cells to produce electrical power for propulsion. This innovative approach aims to dramatically reduce aircraft emissions, supporting the aviation industry’s goals towards sustainability and decreased dependence on fossil fuels.

The growth of the hydrogen aircraft market is driven by several factors such as the global push for reduced carbon emissions, as hydrogen aircraft offer the potential for zero-emission flights, particularly important in the context of international agreements on climate change. Technological advancements in hydrogen fuel storage and fuel cell efficiency also propel the market forward by making hydrogen a more practical and feasible option for aviation.

Additionally, government incentives and regulatory support for green energy technologies encourage research and investment in hydrogen-powered aircraft. These factors collectively contribute to the accelerating interest and investment in the hydrogen aircraft industry, aligning with broader environmental and sustainability objectives.

For instance, Japan is heavily investing in hydrogen fuel cell technology for aviation, marking a bold step toward sustainable aviation solutions. In April 2024, the Japanese government allocated ¥17.3 billion (approximately $110 million) to two groundbreaking research projects. These initiatives aim to develop the world’s largest hydrogen fuel cell propulsion system, demonstrating the country’s commitment to clean energy.

One of these projects focuses on building a 4MW fuel cell propulsion system, expected to be the largest globally. The prototype is slated for completion and demonstration within the next five years, showcasing Japan’s ambition to lead in green aviation innovation.

There’s a strong demand for hydrogen aircraft as the aviation industry seeks sustainable solutions to address climate change concerns. Airlines and aerospace manufacturers are increasingly investing in hydrogen technologies to meet future regulatory mandates and to appeal to environmentally conscious consumers.

Hydrogen aircraft are growing in popularity among stakeholders in the aviation sector. This trend is supported by advancements in fuel cell technologies and the integration of renewable energy sources, which are making hydrogen a more viable and attractive option. As public and corporate awareness of environmental issues continues to rise, the push towards adopting hydrogen aircraft technologies gains further momentum.

The market is ripe with opportunities for innovation in design, fuel storage, and infrastructure development. The integration of hydrogen propulsion systems in aircraft offers a considerable opportunity for aerospace engineers and designers to redefine aircraft architecture. Additionally, the need for specialized hydrogen refueling infrastructure at airports presents significant opportunities for investments in green infrastructure.

Key Takeaways

- The Global Hydrogen Aircraft Market is expected to grow significantly, reaching an estimated value of USD 6,380.1 million by 2033, up from USD 425.4 million in 2023. This represents a CAGR of 31.1% during the forecast period from 2024 to 2033.

- In 2023, the Passenger Aircraft segment dominated the hydrogen aircraft market, accounting for more than 60.3% of the total market share.

- The Medium Range (1,501 to 4,000 nmi) segment also held a significant position in the market in 2023, capturing over 44% of the market share.

- Fuel Cell Technology led the hydrogen aircraft market in 2023, holding more than 56% of the market share, reflecting its central role in hydrogen-powered aviation.

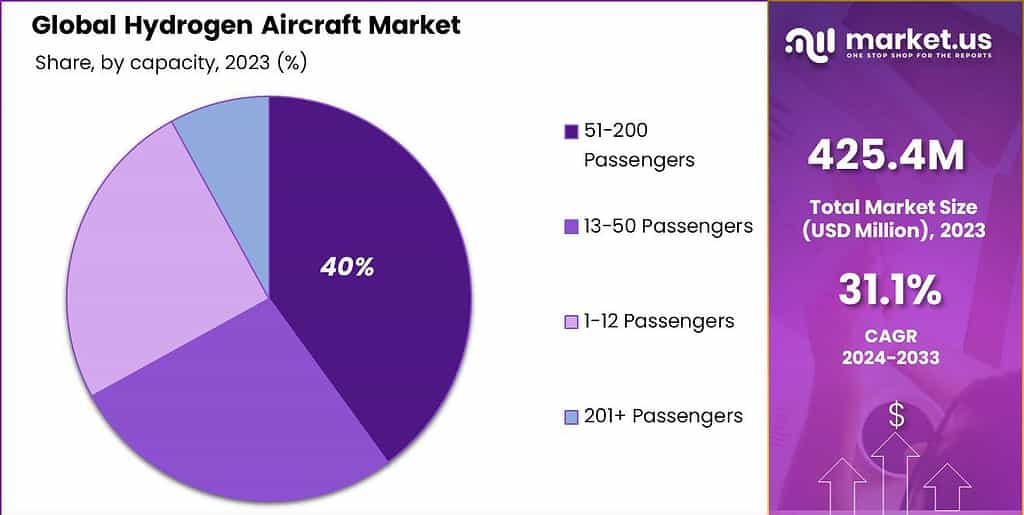

- The 51-200 Passengers segment was another dominant player in the market, capturing over 40% of the total share in 2023.

- Commercial Aviation had a leading position in the hydrogen aircraft market in 2023, securing more than 51% of the market share, driven by its large-scale potential for adopting hydrogen technologies.

- In 2023, North America held a dominant share in the hydrogen aircraft sector, accounting for over 40% of the market, with a revenue of USD 170.2 million.

Type Analysis

In 2023, the Passenger Aircraft segment held a dominant market position within the hydrogen aircraft market, capturing more than a 60.3% share. This substantial market share can primarily be attributed to the increasing investments from commercial airlines and aerospace manufacturers in developing hydrogen-powered passenger planes.

Moreover, the Passenger Aircraft segment benefits from significant governmental and private funding aimed at pioneering zero-emission aviation solutions. Countries across Europe and initiatives in the United States have launched various programs to support the integration of hydrogen fuel technology into commercial aviation.

The public and regulatory pressure for cleaner transportation modes has heightened the focus on passenger aircraft as a viable alternative to traditional jet fuel planes. The visibility and impact of passenger aircraft on environmental sustainability are considerable, making this segment a critical focus for achieving greener aviation.

Range Analysis

In 2023, the Medium Range (1,501 to 4,000 nmi) segment held a dominant position in the hydrogen aircraft market, capturing more than a 44% share. This segment’s leadership is primarily due to its alignment with the current operational ranges of most commercial and cargo flights, which frequently cover continental distances.

The medium range segment meets the operational requirements of major airlines without the need for extensive new infrastructure, making it an attractive, practical option for many companies looking to transition to hydrogen power.

The appeal of this segment also stems from its versatility in application across both passenger and cargo transport. It serves as a sweet spot, providing sufficient range for significant routes without the complexities and higher technological demands associated with long-range travel.

Also, the infrastructure required to support medium-range hydrogen aircraft is currently more developed compared to the long-range alternatives, which still face significant technical and economic hurdles. The in-development hydrogen refueling stations are more suited to support flights within this range, reducing initial barriers to entry for airlines.

Technology Analysis

In 2023, the Fuel Cell Technology segment held a dominant market position in the hydrogen aircraft market, capturing more than a 56% share. This substantial market share can be attributed primarily to the segment’s advancements in energy efficiency and lower environmental impact compared to traditional aviation fuels.

The leadership of the Fuel Cell Technology segment is further reinforced by the ongoing global initiatives aimed at reducing carbon footprints in the aviation sector. Air travel is a significant contributor to carbon emissions, and the adoption of hydrogen fuel cell technology offers a promising path to mitigate these effects.

Moreover, significant investments in research and development by leading aerospace corporations and government bodies worldwide have spurred technological innovations within this segment. These developments have enhanced the viability and reliability of fuel cell technologies, fostering broader acceptance and integration into mainstream aircraft designs.

Capacity Analysis

In 2023, the 51-200 Passengers segment held a dominant market position in the hydrogen aircraft market, capturing more than a 40% share. This segment’s prominence is largely due to its alignment with the current demands of commercial aviation, where medium-sized aircraft are preferred for their balance between range and capacity.

The 51-200 Passengers segment benefits significantly from the increasing focus on reducing carbon emissions in the aviation sector. Hydrogen technology in this passenger range offers a sustainable solution without compromising the operational efficiency essential for commercial carriers.

The development of more efficient and compact hydrogen storage solutions has enabled medium-sized aircraft to integrate these systems without losing valuable passenger or cargo space. This capacity segment’s adaptability to incorporate hydrogen technology, coupled with its critical role in global air travel, positions it at the forefront of the transition towards greener aviation solutions.

Application Analysis

In 2023, the Commercial Aviation segment held a dominant market position in the Hydrogen Aircraft Market, capturing more than a 51% share. This leadership can be attributed primarily to the escalating demands for eco-friendly and sustainable air travel solutions among large airlines.

As global awareness and regulatory pressures regarding environmental impact intensify, commercial airlines are increasingly investing in hydrogen-fueled aircraft to reduce carbon emissions and comply with international green aviation standards.

Another contributing factor is the significant financial and technological investments by leading aerospace corporations and governments aiming to innovate and expand hydrogen fuel infrastructure. These investments are driving advancements in hydrogen aircraft technology, making it more accessible and feasible for commercial use. The support from public policies and subsidies for research and development in sustainable aviation technologies further bolsters this segment’s growth.

Key Market Segments

By Type

- UAV (Unmanned Aerial Vehicles)

- Passenger Aircraft

- Others

By Range

- Short Range (up to 1,500 nmi)

- Medium Range (1,501 to 4,000 nmi)

- Long Range (over 4,000 nmi)

By Technology

- Fuel Cell Technology

- Hydrogen Combustion Engines

By Capacity

- 1-12 Passengers

- 13-50 Passengers

- 51-200 Passengers

- 201+ Passengers

By Application

- Commercial Aviation

- Military Aviation

- General & Business Aviation

Driver

Environmental Sustainability Focus

Hydrogen aircraft are propelled by a strong focus on environmental sustainability. As the world grapples with climate change, there is an increased urgency to reduce carbon emissions. Conventional jet fuel-powered aircraft contribute significantly to greenhouse gas emissions, accounting for around 2-3% of global CO2 emissions.

Hydrogen-powered aircraft offer a greener alternative, as hydrogen fuel cells emit only water vapor during operation. This makes hydrogen one of the most promising options for reducing aviation’s carbon footprint. The shift towards green energy is being driven by stricter regulations on emissions and government mandates aimed at achieving carbon neutrality by mid-century. Many countries are incentivizing cleaner technologies and implementing policy frameworks to drive green aviation adoption.

Restraint

Infrastructure Limitations

One of the main restraints is the lack of existing infrastructure for hydrogen production, storage, and refueling. Unlike conventional aviation fuel, hydrogen requires specialized infrastructure that currently exists only in limited capacities worldwide. Developing new hydrogen production facilities, storage systems, and airport refueling stations is a complex, time-consuming, and costly endeavor.

Furthermore, hydrogen is challenging to transport and store. It must be kept at extremely low temperatures when in liquid form or stored under high pressure in gas form. This makes handling and distribution cumbersome and increases costs. Even airports with hydrogen refueling capabilities might find it difficult to accommodate large-scale usage without comprehensive upgrades to their systems.

Opportunity

Government Support and Incentives

Government support and incentives present a golden opportunity for the growth of hydrogen aircraft. With nations worldwide setting ambitious targets for net-zero emissions, governments are actively promoting cleaner aviation technologies.

Various financial incentives, such as grants, subsidies, and tax benefits, are being offered to aerospace companies and airlines developing hydrogen-powered solutions. These initiatives reduce the upfront costs associated with hydrogen technology research and development, encouraging industry participation.

Governments are also investing in large-scale hydrogen production projects and renewable energy sources, such as green hydrogen produced through water electrolysis using renewable energy. These projects help reduce the cost of hydrogen production, which has historically been a barrier to adoption.

Challenge

High Costs and Technological Complexity

A key challenge facing the hydrogen aircraft industry is the high cost and technological complexity associated with the transition. Hydrogen-powered planes require new designs, materials, and systems to handle the unique characteristics of hydrogen fuel. This demands extensive research and testing, significantly increasing the costs of production and development compared to conventional aircraft.

Moreover, hydrogen fuel cell technology is still maturing, and there are numerous engineering hurdles to overcome. Hydrogen is less energy-dense than jet fuel, meaning it takes up more volume for the same energy content. This limits its applicability to larger aircraft unless breakthroughs in energy density or onboard storage solutions are realized.

Emerging Trends

Hydrogen aircraft technology is swiftly evolving, marked by several emerging trends that reshape the aviation industry. One notable trend is the shift towards regional and short-haul flights using hydrogen-powered aircraft. These segments are considered ideal for early adoption due to the current range limitations of hydrogen fuel cell technology, which suits shorter routes without the need for extensive new infrastructure.

Another trend is the increasing collaboration between aviation companies and energy firms. These partnerships are crucial for developing the necessary hydrogen infrastructure, including production, storage, and refueling stations at airports.

Additionally, technological advancements in fuel cell efficiency and hydrogen storage are making hydrogen aircraft more feasible. Innovations in lightweight composite materials for tanks and improved fuel cell designs are helping increase the range and efficiency of hydrogen planes.

Business Benefits

- Environmental Sustainability: Hydrogen-powered aircraft produce zero carbon emissions during flight, aligning with global efforts to combat climate change and meeting increasing regulatory demands for greener operations.

- Market Differentiation: Adopting hydrogen technology positions airlines as industry leaders in sustainability, appealing to environmentally conscious consumers and enhancing brand reputation.

- Operational Cost Savings: While initial investments are substantial, hydrogen fuel can potentially reduce long-term operational costs due to its abundance and the possibility of local production, decreasing reliance on volatile fossil fuel markets.

- Regulatory Compliance: Proactive adoption of hydrogen technology prepares airlines for future environmental regulations, potentially avoiding penalties and benefiting from incentives aimed at reducing carbon footprints.

- Innovation Leadership: Investing in hydrogen propulsion technologies fosters innovation, opening new business opportunities and partnerships in the evolving aerospace sector.

Regional Analysis

In 2023, North America held a dominant market position in the hydrogen aircraft sector, capturing more than a 40% share with a revenue of USD 170.2 million. This leadership stems primarily from the advanced technological infrastructure and substantial investments in research and development related to hydrogen fuel technologies in the region.

The presence of major aerospace corporations such as Boeing and numerous innovative startups focusing on sustainable aviation fuels has propelled North America to the forefront of the hydrogen aircraft market. Also, the region benefits from strong governmental support through incentives and regulations aimed at reducing aviation emissions.

Policies promoting clean energy technologies have led to increased funding and subsidies for projects related to hydrogen-powered aircraft. This supportive regulatory environment encourages further development and adoption of these technologies within the commercial aviation sector.

The collaboration between industry leaders and academic institutions in North America also plays a crucial role in driving the market. These partnerships foster innovation and speed up the commercialization of hydrogen aircraft technologies.

Moreover, the increasing public and corporate awareness regarding the environmental impacts of aviation fuels has boosted the demand for sustainable alternatives in the region. The push towards achieving carbon neutrality in air travel continues to drive investment and interest in hydrogen-powered solutions, ensuring ongoing growth and development in North America’s hydrogen aircraft market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The hydrogen aircraft sector, although still in its early stages, is rapidly gaining attention as several key players are pushing the boundaries of this technology, each focusing on different aspects such as aircraft design, hydrogen fuel production, and infrastructure development.

Airbus SE is a leading player in the hydrogen aircraft market, spearheading several initiatives to integrate hydrogen technology into commercial aviation.The company’s strategic partnerships across the globe for developing hydrogen refueling infrastructure further enhance its standing in the market.

Boeing, another titan in the aerospace industry, is actively pursuing hydrogen aircraft technology as part of its broader strategy to achieve greater fuel efficiency and reduce environmental impact. Boeing’s investment in research and development of hydrogen propulsion systems demonstrates its commitment to sustainable aviation solutions.

H2FLY, although smaller compared to giants like Airbus and Boeing, is making notable strides in the hydrogen aircraft market, particularly in the development of hydrogen fuel cell technology for aviation. Based in Germany, H2FLY has successfully tested several prototypes that highlight the practicality and efficiency of hydrogen as an aviation fuel.

Top Key Players in the Market

- Airbus SE

- Boeing

- H2FLY

- GKN Aerospace

- AeroVironment Inc.

- AeroDelft

- Pipistrel

- Thales Group

- Universal Hydrogen Co.

- Urban Aeronautics

- Other Key Players

Recent Developments

- In September 2023, the HY4, operated by DLR spinoff H2Fly, achieved a historic milestone by completing the world’s first piloted electric flight powered by liquid hydrogen. The flight lasted over three hours, demonstrating the viability of hydrogen as a clean, sustainable fuel source for aviation.

- In late 2023, Airbus’ ZEROe teams made significant progress by powering on the iron pod, a hydrogen-propulsion system designed for the company’s future electric concept aircraft. This milestone, along with the activation of the hydrogen fuel cell system, marks a critical step toward Airbus’ goal of developing a hydrogen-powered aircraft by 2035.

- In May 2024, AirBaltic took a significant step toward the future of hydrogen aviation by signing a Memorandum of Understanding with Fokker Next Gen. The collaboration aims to accelerate the development and integration of hydrogen-powered aircraft, with the goal of bringing them into service by 2035.

- In June 2024, Joby Aviation successfully completed a 523-mile flight with its hydrogen-electric technology demonstrator aircraft, emitting only water as its byproduct.

- In October 2024, JetZero unveiled plans for a blended-wing aircraft design, inspired by stealth bombers, aiming to reduce fuel consumption and emissions by 50%. The company plans to start flights with a full-scale demonstrator in 2027.

Report Scope

Report Features Description Market Value (2023) USD 425.4 Mn Forecast Revenue (2033) USD 6,380.1 Mn CAGR (2024-2033) 31.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (UAV (Unmanned Aerial Vehicles), Passenger Aircraft, Others), By Range (Short Range (up to 1,500 nmi), Medium Range (1,501 to 4,000 nmi), Long Range (over 4,000 nmi)), By Technology (Fuel Cell Technology, Hydrogen Combustion Engines), By Capacity (1-12 Passengers, 13-50 Passengers, 51-200 Passengers, 201+ Passengers), By Application (Commercial Aviation, Military Aviation, General & Business Aviation) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Airbus SE, Boeing, H2FLY, GKN Aerospace, AeroVironment Inc., AeroDelft, Pipistrel, Thales Group, Universal Hydrogen Co., Urban Aeronautics, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Airbus SE

- Boeing

- H2FLY

- GKN Aerospace

- AeroVironment Inc.

- AeroDelft

- Pipistrel

- Thales Group

- Universal Hydrogen Co.

- Urban Aeronautics

- Other Key Players