Global Foldable Drones Market By Type (Four Wing, Six Wing, Eight Wing), By End-use Industry (Consumer/ Civil, Commercial, Military), By Application (Filming & Photography, Inspection & Maintenance, Mapping & Surveying, Precision Agriculture, Surveillance & Monitoring, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 113976

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

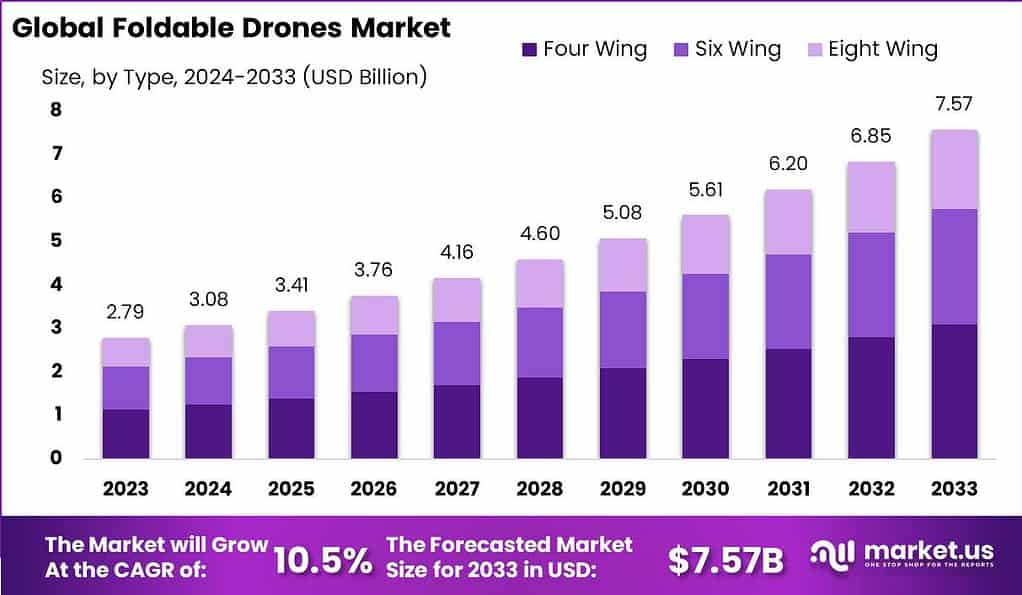

The Global Foldable Drones Market size is expected to be worth around USD 7.57 Billion by 2033, from USD 2.79 Billion in 2023, growing at a CAGR of 10.5% during the forecast period from 2024 to 2033.

Foldable drones are designed with portability and convenience in mind, characterized by their retractable arms and propellers which allow them to be compacted into smaller sizes for easy transportation. These drones are equipped with a range of features including high-definition cameras, GPS navigation, and autonomous flight modes, making them suitable for both recreational and professional applications.

The foldable drones market is experiencing significant growth, driven by increasing demand in sectors such as photography, videography, agriculture, and surveillance. This growth can be attributed to the compactness, versatility, and advanced technological features these drones offer, appealing to a broad spectrum of users from hobbyists to professionals. Market expansion is further facilitated by continuous advancements in battery life, camera quality, and autonomous flying capabilities, making these drones more accessible and user-friendly.

Analyst Viewpoint

From an analyst perspective, the foldable drones market is poised for substantial growth, propelled by several driving factors. The increasing demand for compact and efficient aerial devices across various applications, from commercial photography and videography to emergency response and agricultural surveillance, significantly contributes to market expansion. The evolution of foldable drones, characterized by their enhanced portability without compromising on performance capabilities, addresses the consumer need for easy-to-transport drones that deliver professional-grade imagery and robust flight performance.

Opportunities within the foldable drones market are vast, with technological advancements opening new avenues for application and innovation. The integration of artificial intelligence for improved flight control and autonomous operations, coupled with advancements in battery technology for longer flight times, presents significant potential for market differentiation and value addition.

Additionally, the expanding use of drones in emerging sectors such as urban planning, environmental monitoring, and delivery services further broadens the market’s horizon. As regulatory frameworks around drone usage continue to evolve, making the airspace more accessible, the foldable drones market is expected to witness increased adoption rates, driving further innovation and competition in the sector.

Key Takeaways

- The foldable drones market is anticipated to expand from USD 3.08 Billion in 2024 to USD 7.57 Billion by 2033. The market is expected to grow at a CAGR of 10.5% through 2033.

- In 2023, the four-wing segment held a dominant market position in the foldable drones market, capturing more than a 41% share.

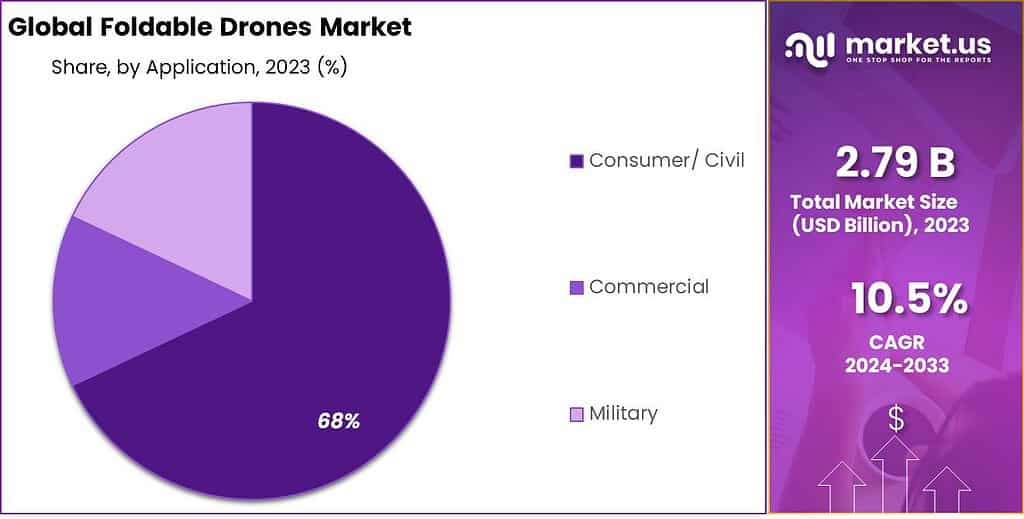

- In 2023, the Consumer/Civil segment emerged as the frontrunner in the foldable drones market, securing a dominant market position with a share of over 68%.

- In 2023, the Filming & Photography segment took the lead in the foldable drones market, commanding a dominant market position with a share of over 24.5%.

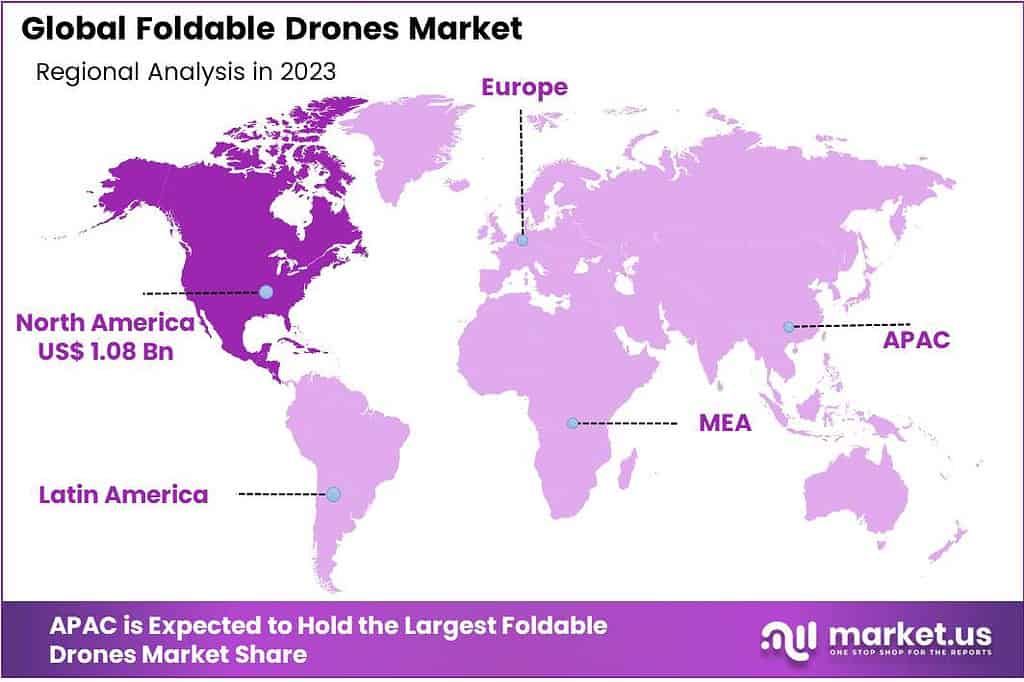

- In 2023, North America emerged as the dominant region in the foldable drones market, capturing a share of over 39%.

Type Analysis

In 2023, the four-wing segment held a dominant market position in the foldable drones market, capturing more than a 41% share. This segment refers to foldable drones that feature a quadcopter configuration, with four propellers arranged in a cross formation. The popularity of four-wing foldable drones can be attributed to several factors that have contributed to their market dominance.

One of the key reasons behind the prominence of the four-wing segment is the stability and maneuverability offered by quadcopter designs. The four-wing configuration provides balanced lift and control, allowing for precise flight movements and steady hovering. This stability is particularly important for capturing high-quality aerial imagery, as it helps in reducing vibrations and ensuring smooth footage. Moreover, quadcopters are known for their agility, making them suitable for various applications, including photography, videography, and recreational flying.

Furthermore, four-wing foldable drones are favored by both beginners and experienced users due to their ease of use and intuitive controls. The quadcopter design simplifies the flight dynamics, making it easier for users to master the basics of drone piloting. This accessibility has contributed to the widespread adoption of four-wing foldable drones among hobbyists, photographers, and content creators.

In addition, four-wing foldable drones often come equipped with advanced features and technologies. These drones typically offer a wide range of functionalities, such as GPS positioning, altitude hold, and intelligent flight modes. These features enhance the user experience, allowing for automated flight paths, precise positioning, and creative shooting modes. The availability of such advanced features has attracted professionals and enthusiasts who require more sophisticated capabilities for their aerial photography or videography projects.

End-use Industry Analysis

In 2023, the Consumer/Civil segment emerged as the frontrunner in the foldable drones market, securing a dominant market position with a share of over 68%. This segment primarily comprises individuals and hobbyists who utilize foldable drones for recreational purposes, aerial photography, and videography. The growing popularity of social media platforms and the increasing demand for captivating visual content have significantly contributed to the rise of consumer-driven applications. Furthermore, advancements in drone technology, such as improved stability, longer flight times, and higher-resolution cameras, have made foldable drones more accessible and appealing to a wider range of consumers.

The consumer/civil segment has witnessed substantial growth due to several factors. Firstly, the affordability and availability of entry-level foldable drones have attracted a large number of enthusiasts, driving the market’s expansion. Additionally, the ease of use and compactness of foldable drones make them highly portable and convenient for recreational activities such as hiking, camping, and outdoor events. Moreover, the integration of intelligent features, including obstacle avoidance systems, automated flight modes, and real-time video transmission, has enhanced the user experience and further fueled the demand for foldable drones in the consumer market.

Furthermore, the adoption of foldable drones for civilian applications beyond entertainment has also played a significant role in the segment’s dominance. Industries such as agriculture, construction, and inspection services have increasingly utilized foldable drones for tasks such as crop monitoring, site surveys, and infrastructure inspections. The ability of foldable drones to access hard-to-reach locations and capture high-resolution imagery has proven to be a valuable asset in these sectors, leading to increased efficiency and cost savings.

Application Analysis

In 2023, the Filming & Photography segment took the lead in the foldable drones market, commanding a dominant market position with a share of over 24.5%. This segment primarily caters to the needs of photographers, videographers, and content creators who rely on foldable drones to capture stunning aerial imagery and videos for various purposes. The rapid growth of social media platforms, the increasing demand for visually appealing content, and the rise of online video sharing platforms have been significant drivers for the dominance of the Filming & Photography segment.

There are several key factors contributing to the success of the Filming & Photography segment. Firstly, foldable drones equipped with high-resolution cameras and stable gimbal systems offer filmmakers and photographers the ability to capture breathtaking aerial shots that were once only possible with expensive and cumbersome equipment. The flexibility and agility of foldable drones allow professionals and enthusiasts to explore creative angles, perspectives, and compositions, resulting in visually compelling content.

Moreover, the portability and compactness of foldable drones make them an ideal choice for on-the-go filmmakers and photographers. These drones can be easily transported to remote locations or crowded areas, allowing content creators to capture unique footage that was previously challenging or impossible to obtain.

Furthermore, the integration of advanced features such as intelligent flight modes, object tracking, and automated camera settings adjustment has significantly enhanced the filming and photography experience with foldable drones. These features not only assist in capturing smooth and cinematic shots but also enable users to focus on their creative vision rather than technical aspects.

Key Market Segments

By Type

- Four Wing

- Six Wing

- Eight Wing

By End-use Industry

- Consumer/ Civil

- Commercial

- Military

By Application

- Filming & Photography

- Inspection & Maintenance

- Mapping & Surveying

- Precision Agriculture

- Surveillance & Monitoring

- Others

Driver

Rising Demand for Aerial Photography and Videography

The foldable drones market is being driven by the rising demand for aerial photography and videography. With the increasing popularity of social media platforms, there is a growing need for captivating visual content. Aerial photography and videography offer a unique perspective that was previously only accessible through expensive equipment or manned aircraft. Foldable drones equipped with high-resolution cameras and stable gimbal systems provide an affordable and convenient alternative for capturing stunning aerial shots.

The demand for aerial photography and videography spans across various industries, including real estate, tourism, filmmaking, and advertising. Real estate agents can showcase properties from a bird’s-eye view, providing potential buyers with a comprehensive understanding of the property’s features and surroundings. Similarly, filmmakers can achieve breathtaking cinematic shots that add depth and visual interest to their productions. Furthermore, the tourism industry can utilize aerial photography to promote destinations and attractions, enticing travelers with captivating imagery.

As the demand for aerial photography and videography continues to grow, the foldable drones market is expected to witness significant expansion. Advancements in drone technology, such as improved camera quality, longer flight times, and intelligent flight modes, will further enhance the capabilities of foldable drones for aerial imaging applications.

Restraint

Regulatory Challenges and Privacy Concerns

Despite the promising growth prospects, the foldable drones market faces regulatory challenges and privacy concerns. Governments and aviation authorities have introduced regulations to ensure the safe and responsible use of drones. These regulations encompass restrictions on flight altitudes, mandatory registration of drones, and the need for pilot certifications in some cases.

Additionally, privacy concerns have emerged as a significant restraint for the foldable drones market. With the ability to capture high-resolution imagery from the air, there are concerns about the misuse of drones for surveillance or invasion of privacy. This has led to debates and discussions regarding the need for stricter regulations to protect individuals’ privacy rights.

To overcome these restraints, stakeholders in the foldable drones market must work closely with regulatory bodies to establish clear guidelines and frameworks for the operation of drones. Education and awareness campaigns can also play a crucial role in promoting responsible drone usage and addressing privacy concerns. By addressing these challenges, the foldable drones market can continue to thrive while ensuring safety and privacy for all stakeholders.

Opportunity

Advancements in Battery Technology

Advancements in battery technology present a significant opportunity for the foldable drones market. One of the major limitations of drones has been their limited flight time due to the capacity and weight of the batteries. However, with ongoing advancements in battery technology, the flight time of foldable drones has significantly improved.

Lithium-polymer (LiPo) batteries have become the industry standard for foldable drones, offering high energy density and lightweight properties. These batteries provide longer flight times, allowing users to capture more footage or cover larger areas in a single flight. Furthermore, rapid charging capabilities reduce downtime between flights, increasing operational efficiency.

The development of solid-state batteries and other emerging battery technologies holds immense potential for the foldable drones market. Solid-state batteries offer higher energy density, increased safety, and faster charging times compared to conventional lithium-ion batteries. These advancements will further extend flight times and enhance the overall performance of foldable drones.

As battery technology continues to evolve, foldable drones will become more capable and versatile. Industries such as agriculture, infrastructure inspection, and emergency services can benefit from longer flight times, enabling more comprehensive coverage and efficient operations. The advancement of battery technology is expected to drive the adoption of foldable drones in various sectors and open up new opportunities for application expansion.

Challenge

Ensuring Reliable Connectivity

Ensuring reliable connectivity poses a challenge for the foldable drones market. Foldable drones rely on wireless communication systems to transmit real-time data and video feeds to the controller or ground station. However, maintaining a stable and uninterrupted connection between the drone and the controller can be challenging, especially in areas with signal interference or long distances.

Reliable connectivity is crucial for safe and efficient drone operations. It enables real-time monitoring of flight parameters, live video feeds, and control inputs, which are essential for piloting and capturing accurate data. In sectors such as inspection and surveillance, where immediate and accurate information is critical, any loss of connectivity can hinder the effectiveness of foldable drones.

To address this challenge, advancements in communication technologies such as 5G networks and satellite communication systems can significantly improve connectivity for foldable drones. These technologies offer increased bandwidth, reduced latency, and broader coverage, ensuring a stable and reliable connection even in remote or congested areas.

Regional Analysis

In 2023, North America emerged as the dominant region in the foldable drones market, capturing a share of over 39%. North America is home to a significant number of key players in the foldable drones industry, including manufacturers, technology developers, and service providers. The presence of established companies and a robust ecosystem for drone research and development has propelled the growth of the market in the region.

The demand for Foldable Drones in North America reached US$ 1.08 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future. Additionally, North America boasts a highly developed infrastructure, including advanced communication networks and regulatory frameworks that support the safe and efficient operation of foldable drones.

The region has witnessed a growing demand for foldable drones across various sectors, including filmmaking, agriculture, infrastructure inspection, and public safety. Innovations in drone technology, such as improved camera systems, longer flight times, and enhanced autonomous features, have further fueled the adoption of foldable drones in North America.

Furthermore, favorable government initiatives and regulations have facilitated the integration of drones into various industries. The Federal Aviation Administration (FAA) in the United States, for example, has established clear guidelines and certification processes for commercial drone operations, providing a supportive environment for businesses to leverage the benefits of foldable drones.

Looking ahead, North America is expected to continue its dominance in the foldable drones market. The region’s strong technological capabilities, supportive regulatory environment, and increasing adoption of drones across industries are likely to drive market growth. Additionally, the expanding applications of foldable drones, such as in delivery services and emergency response, present new opportunities for market expansion in North America.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The foldable drones market features a competitive landscape with several prominent players leading the industry. These key players have played a pivotal role in shaping the market dynamics and driving innovation in drone technology. Some of the noteworthy key players in the foldable drones market include established companies and emerging contenders. They are characterized by their commitment to research and development, strategic collaborations, and a strong global presence.

Top Market Leaders

- DJI

- RIEGL LMS

- Intellisystem Technologies

- Parrot

- Heliceo

- EMOTION

- Diodon

- ALPSdrone

- ONYXSTAR

- Autel Robotics

- Skydio

- PowerVision

- Hubsan

- Other key players

Recent Developments

1. DJI:

- January 2023: Launched the Mavic 3 Classic, a foldable consumer drone offering high-resolution photography and video capabilities in a compact form factor.

- September 2023: Partnered with Intel to explore the integration of Intel processors into future foldable drone models, aiming to enhance performance and AI capabilities.

2. RIEGL LMS:

- April 2023: Unveiled the RiCOPTER VUX-1LR, a long-range foldable LiDAR drone designed for surveying and mapping applications, offering extended flight times and high-precision data acquisition.

- October 2023: Announced a collaboration with Microsoft to develop cloud-based processing solutions for foldable drone LiDAR data, improving efficiency and accessibility for data analysis.

3. Intellisystem Technologies:

- February 2023: Released the Atom Pro, a compact foldable drone designed for industrial inspections and infrastructure monitoring, featuring ruggedized construction and autonomous flight capabilities.

- November 2023: Secured a contract with a major energy company to provide a fleet of foldable drones for pipeline inspection, showcasing the increasing adoption of these solutions in critical infrastructure monitoring.

4. Skydio:

- May 2023: Launched the Skydio 2+, an AI-powered foldable drone featuring enhanced object tracking and autonomous flight modes, aimed at expanding its presence in the consumer and professional drone market.

- August 2023: Announced a partnership with Verizon to offer cellular connectivity for the Skydio 2+, enabling beyond-visual-line-of-sight (BVLOS) operations in specific regulatory environments.

Report Scope

Report Features Description Market Value (2023) US$ 2.79 Bn Forecast Revenue (2033) US$ 7.57 Bn CAGR (2024-2033) 10.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Four Wing, Six Wing, Eight Wing), By End-use Industry (Consumer/ Civil, Commercial, Military), By Application (Filming & Photography, Inspection & Maintenance, Mapping & Surveying, Precision Agriculture, Surveillance & Monitoring, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape DJI, RIEGL LMS, Intellisystem Technologies, Parrot, Heliceo, EMOTION, Diodon, ALPSdrone, ONYXSTAR, Autel Robotics, Skydio, PowerVision, Hubsan, Other key players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are foldable drones?Foldable drones are unmanned aerial vehicles designed with collapsible or foldable components, making them more portable and convenient for transportation.

How big is Foldable Drones Market?The Global Foldable Drones Market size is expected to be worth around USD 7.57 Billion by 2033, from USD 2.79 Billion in 2023, growing at a CAGR of 10.5% during the forecast period from 2024 to 2033.

Which drone type holds the highest market share?In 2023, the Consumer/Civil segment emerged as the frontrunner in the foldable drones market, securing a dominant market position with a share of over 68%.

Which regional foldable drone market accounts for a leading market share?In 2023, North America emerged as the dominant region in the foldable drones market, capturing a share of over 39%.

What are the primary applications of foldable drones?Foldable drones are versatile and find applications in various fields, including photography, videography, surveillance, recreational flying, and even in professional sectors like agriculture and inspection services.

-

-

- DJI

- RIEGL LMS

- Intellisystem Technologies

- Parrot

- Heliceo

- EMOTION

- Diodon

- ALPSdrone

- ONYXSTAR

- Autel Robotics

- Skydio

- PowerVision

- Hubsan

- Other key players