Masterbatch Market Report By Type (White, Black, Color, Additive, Filler, Others), By Polymer Polypropylene (PP) (Polyethylene (PE), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Biodegradable Plastics, Others), By End-Use Packaging, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 20354

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

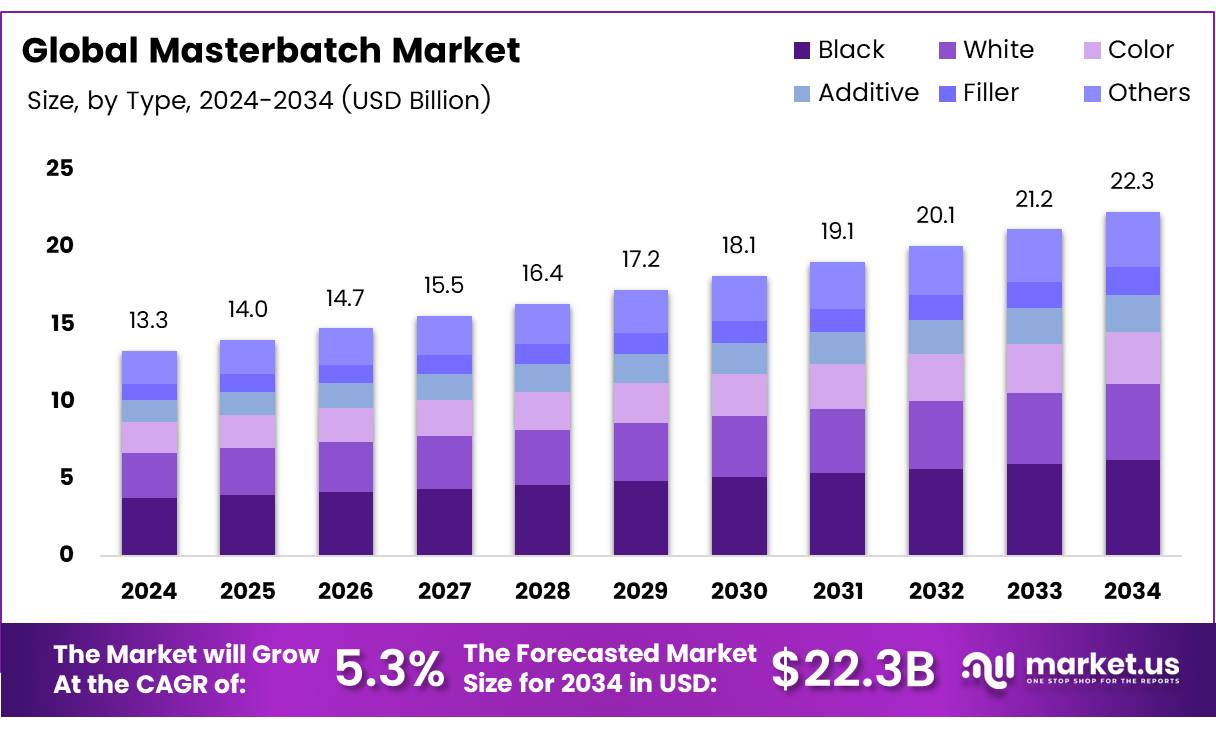

The Global Masterbatch Market size is expected to be worth around USD 22.3 Billion by 2034, from USD 13.3 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

The Masterbatch Market comprises specialized, concentrated mixtures designed to impart colors, properties, or functionalities to plastics during the manufacturing process.

Utilized across a wide range of industries, including automotive, consumer goods, packaging, and construction, masterbatches enable precise coloration and enhancement of plastic products without compromising their inherent properties. This market caters to manufacturers seeking efficiency and consistency in product quality, offering solutions in color masterbatches, additive masterbatches, and filler masterbatches.

Within the evolving landscape of the Masterbatch Market, a significant shift towards sustainability and efficiency is evident. Masterbatches, essential for imparting desired colors, properties, and functionalities to plastics, typically contain additives ranging from 15% to 80%, with the most prevalent concentrations falling between 40% to 65%. This variance in additive percentage underscores the adaptability of masterbatches to diverse industrial requirements, offering manufacturers tailored solutions to meet specific product specifications.

The industry is witnessing a pivotal transition from conventional petroleum-based materials to sustainable alternatives. These eco-friendly masterbatches, characterized by their biodegradability and bio-based composition, are gaining traction, driven by mounting environmental concerns and regulatory pressures.

The European Union’s ambitious targets to reduce plastic packaging volumes by up to 20% by 2040 further accentuate the demand for sustainable masterbatches. This regulatory landscape presents a compelling opportunity for innovation and market growth, aligning with global sustainability goals.

The Asia-Pacific region, led by market giants such as China and India, plays a crucial role in driving the Masterbatch Market. China’s substantial market share and the region’s rapid industrial growth highlight its strategic importance.

This dynamic role of sustainability initiatives, regulatory frameworks, and regional market forces underscores a broader trend towards eco-friendly and efficient manufacturing solutions.

Key Takeaways

- The Global Masterbatch Market is projected to grow from USD 13.3 Billion in 2024 to USD 22.3 Billion by 2034, at a CAGR of 5.3%.

- Black Masterbatch dominates with a 28.4% market share, utilized widely in sectors like automotive and electronics.

- Polypropylene is the most used polymer in the Masterbatch Market, accounting for 27.6% of the market due to its versatile properties.

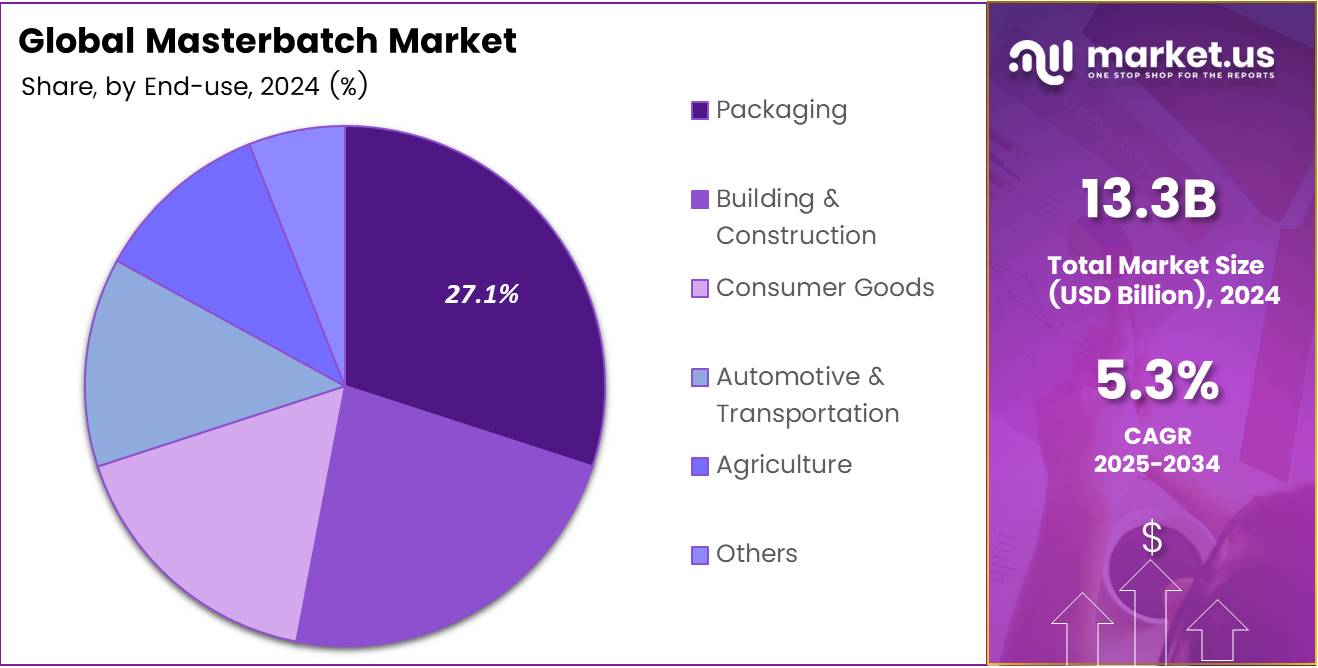

- Packaging is the largest end-use sector in the Masterbatch Market, holding a 27.1% share, essential for its role in enhancing product presentation and durability.

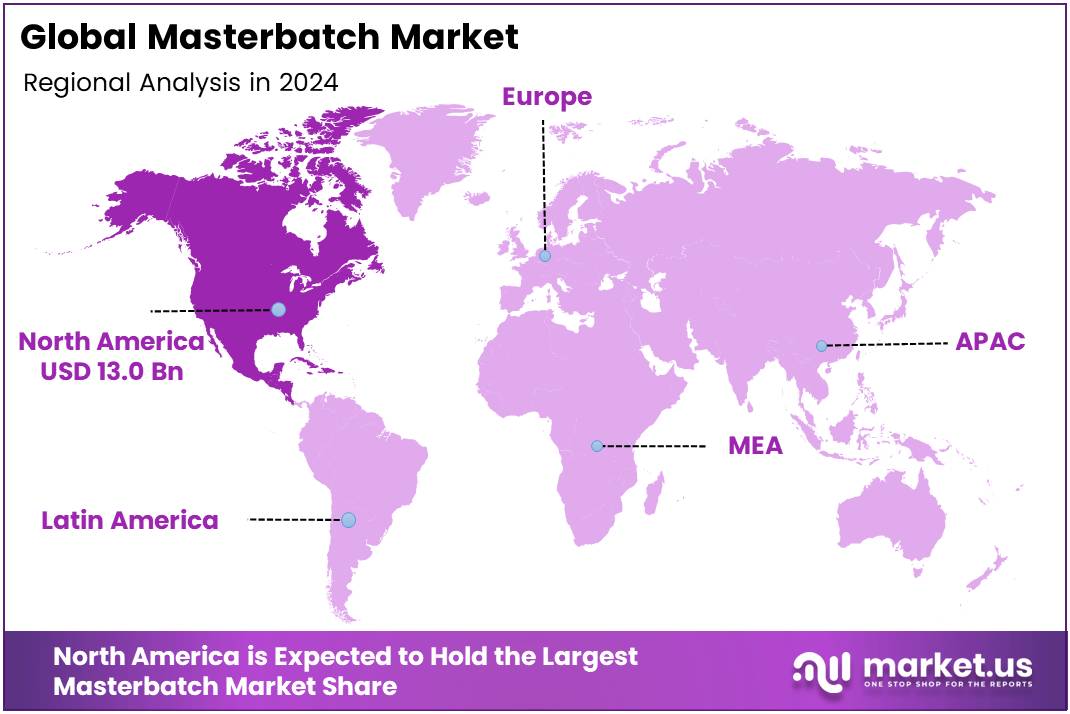

- Asia Pacific leads the Masterbatch Market with a 45.2% share, driven by strong manufacturing outputs from China and India.

Driving Factors

Increasing Demand from the Packaging Industry Drives Market Growth

The packaging industry’s expansion significantly contributes to the growth of the Masterbatch Market. As the largest application segment for masterbatches, packaging benefits from the rising global demand for packaged foods, beverages, and consumer goods.

With the packaging industry projected to surpass USD 1 trillion by 2025, the need for masterbatches, which provide color and functional properties to packaging materials, is set to increase. This growth is fueled by consumer preferences for convenience, product safety, and aesthetic appeal, positioning masterbatches as essential components in meeting these market demands. The synergy between packaging innovations and masterbatch development underscores a dynamic market, driven by evolving consumer behaviors and packaging technologies.

Environmental Regulations Propel Eco-friendly Masterbatch Development

Stringent environmental regulations are catalyzing the development of eco-friendly masterbatches, marking a significant trend in the industry. Europe’s REACH regulations, which restrict the use of hazardous chemicals, fuel the regulatory environment’s impact.

Innovations like Cabot Corporation’s REPLASBLAK™, launched in November 2023, featuring circular black masterbatches with up to 100% attributed recycled content, highlight the industry’s response to these regulations. Such developments not only align with global sustainability goals but also open new market opportunities for masterbatches that reduce environmental impact, reflecting a shift towards greener, more responsible manufacturing practices.

Growth of the Automotive Industry Fuels Masterbatch Demand

The automotive industry’s steady growth, particularly in the Asia Pacific region, is a driving force behind the increased demand for masterbatches. With approximately 85 million motor vehicles produced worldwide in 2022, the use of masterbatches to color and enhance the properties of plastics in automotive parts is on the rise.

This sector’s expansion supports the masterbatch market’s growth by necessitating advanced materials that meet the automotive industry’s stringent standards for durability, performance, and aesthetics. The interplay between automotive manufacturing advancements and masterbatch innovation highlights the crucial role of specialized materials in supporting the automotive sector’s evolving needs.

Restraining Factors

Volatility in Raw Material Prices Restrains Market Growth

The Masterbatch Market faces significant challenges due to the volatility in raw material prices, particularly for essential components like polymer resins and carrier materials. These price fluctuations are primarily driven by supply-demand imbalances, often exacerbated by geopolitical tensions, trade policies, and supply chain disruptions.

For instance, PE (Polyethylene) prices witnessed a near 60% increase in 2021, underscoring the vulnerability of the market to external shocks. Such unpredictability creates a challenging environment for masterbatch producers, impacting their cost structures and pricing strategies, ultimately restraining market growth by increasing operational uncertainty and making long-term planning more difficult for manufacturers.

Competition from Substitutes Limits Market Expansion

The presence of substitutes, such as liquid colorants and additives, poses a considerable threat to the Masterbatch Market, potentially limiting its expansion. These alternatives offer several advantages, including ease of use and more uniform color distribution, which can be particularly appealing in applications like packaging.

With liquid colorants accounting for 26% of the global colorants market share, their growing adoption highlights a significant shift in consumer preference that could impact the demand for traditional masterbatch products. This competition not only challenges the market share of masterbatches but also forces producers to innovate and differentiate their offerings to maintain relevance and competitiveness in the evolving market landscape.

Type Analysis

Black Masterbatch Dominates with 28.4% Market Share, Driving Growth in Versatile Applications

The Black Masterbatch segment, holding a significant 28.4% share, is renowned for its versatility and utility in numerous applications, from automotive components and consumer electronics to packaging and agricultural films. The preference for black masterbatch is primarily attributed to its excellent UV stabilization properties, electrical conductivity, and thermal stability, making it indispensable in applications requiring prolonged outdoor exposure and durability. Furthermore, black masterbatch offers superior color consistency and dispersion, enhancing the aesthetic and functional qualities of plastics.

While the Black Masterbatch leads, other segments like White, Color, Additive, Filler, and Others significantly contribute to the market’s diversity and growth. The White Masterbatch is essential for applications demanding high brightness and opacity, such as in medical and food packaging. Color Masterbatches cater to the need for aesthetically appealing and brand-specific colors in consumer goods and packaging.

Additive Masterbatches enhance plastics’ properties, including antimicrobial, anti-static, and flame-retardant characteristics, tailored to specific industry requirements. Filler Masterbatches, on the other hand, are used to improve the physical properties of plastic products and reduce production costs by incorporating fillers like calcium carbonate or talc.

Polymer Analysis

Polypropylene (PP) Leads Masterbatch Market with 27.6% Share, Dominating Packaging, Automotive, and Consumer Goods Sectors

Polypropylene (PP), holding a 27.6% share, emerges as the leading polymer in the Masterbatch Market. This dominance is largely due to PP’s versatile properties, including its resistance to chemicals, flexibility, and durability, making it a preferred choice across various applications.

PP’s widespread use in packaging, automotive components, consumer goods, and textiles underlines its significance. The demand for PP masterbatches is driven by the need for coloration and performance enhancement in these applications, ensuring products meet the aesthetic and functional requirements of end-users.

Other polymers, such as Polyethylene (PE), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), and Biodegradable Plastics, each play crucial roles in the market. PE masterbatches are essential for the packaging and agricultural sectors due to their toughness and clarity.

PVC masterbatches find applications in construction for piping and cable insulation, while PET masterbatches are pivotal in the beverage packaging industry for their clarity and strength. Biodegradable Plastics are gaining traction due to growing environmental concerns, with masterbatches tailored to enhance their performance and appearance.

End-Use Analysis

Packaging Leads End-Use Segment with 27.1% Share, Driving Growth in Durable and Functional Masterbatch Solutions

In the By End-Use category, Packaging stands out with a 27.1% market share, highlighting its critical role in the Masterbatch Market. The packaging industry’s reliance on masterbatches stems from the need for durable, visually appealing, and functional packaging solutions that can withstand the rigors of supply chains while enhancing brand value. Masterbatches enable precise color matching, UV protection, and barrier properties, essential for packaging applications in food, beverage, healthcare, and consumer goods.

Other end-use segments, including Building & Construction, Consumer Goods, Automotive & Transportation, and Agriculture, contribute to the market’s diversity. Building & Construction utilizes masterbatches for products like pipes, fittings, and sheets, requiring specific properties such as UV resistance and flame retardancy.

Automotive & Transportation demands masterbatches for interior and exterior components, seeking enhancements in aesthetics and performance. Consumer Goods and Agriculture use masterbatches to achieve desired product features and functionality, from household items to agricultural films.

Key Market Segments

By Type

- Black

- White

- Color

- Additive

- Filler

- Others

By Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- Others

By End-Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

Growth Opportunities

Light-weighting Offers Growth Opportunity in the Masterbatch Market

The trend towards light-weighting in various industries, particularly automotive, presents a significant growth opportunity for the Masterbatch Market. Plastic producers are increasingly seeking masterbatches that enable the production of lighter end products, catering to the demand for portability and fuel efficiency.

Automakers’ target to reduce vehicle weight by 10% by 2025 underscores the urgency and potential for developing masterbatches that can contribute to lighter, yet durable, plastic components. This drive towards light-weighting not only aligns with the automotive industry’s goals but also reflects broader market trends towards sustainability and efficiency.

Specialty Additives Offer Growth Opportunity in Diverse Industries

The expansion of masterbatch portfolios to include specialty additives presents a lucrative growth opportunity, particularly in sectors such as healthcare, construction, and automotive. These industries demand masterbatches with specialized additives like antimicrobial agents, oxygen scavengers, and flame retardants to meet specific product requirements and regulatory standards.

For instance, the need for plastics in medical devices to feature antimicrobial and antistatic properties highlights the critical role of specialty additives in enhancing the functionality and safety of products. The development and incorporation of these specialty additives into masterbatches cater to a growing market demand for high-performance, customized plastic solutions, driving growth and innovation within the Masterbatch Market.

Trending Factors

Smart Color and Effects Are Trending Factors in the Masterbatch Market

The integration of advanced technologies like thermochromics, photochromic pigments, metallic effects, and glow-in-the-dark features into masterbatches is a significant trend shaping the Masterbatch Market. These innovations allow plastics to offer interactivity, enhanced aesthetics, and visual appeal, meeting consumer demands for more dynamic and engaging products.

The ability of these smart colors and effects to transform the appearance of plastics based on changes in environment or light conditions opens up new possibilities in product design and differentiation, making them increasingly popular across sectors such as packaging, toys, consumer electronics, and fashion. This trend towards adding value and functionality through color and effects is driving market expansion and innovation.

Improved Processing Offers Growth Opportunity through Efficiency

Masterbatch manufacturers are focusing on developing solutions that enable faster filling, reduced cycle times, and lower processing temperatures for plastic processors. This emphasis on improved processing efficiency addresses a critical need within the plastics manufacturing industry for solutions that can enhance productivity and reduce energy consumption.

By offering masterbatches that contribute to more efficient manufacturing processes, manufacturers can significantly reduce costs and environmental impact, making these innovations highly attractive to plastic processors. The trend towards improved processing efficiency is gaining momentum as companies seek ways to stay competitive in a market that demands both high-quality products and sustainable practices, marking a clear path for growth and development in the Masterbatch Market.

Regional Analysis

Asia Pacific Dominates with 45.2% of the Masterbatch Market

The Asia Pacific region’s commanding 45.2% market share valued USD 5.9 Billion in the Masterbatch Market is primarily driven by its robust manufacturing sector, particularly in China and India. The region’s extensive plastic production and consumption, fueled by its large population and rapid industrialization, significantly contribute to this dominance. Additionally, the increasing demand for consumer goods, packaging, and automotive components that utilize masterbatches for coloration and functional properties underpins the region’s leading position.

Asia Pacific benefits from cost-effective manufacturing processes and a supportive regulatory environment that encourages the use of innovative and sustainable materials. The region’s focus on enhancing product aesthetics and functionality, along with a growing emphasis on environmental sustainability, shapes its market dynamics, making it a hub for both traditional and advanced masterbatch solutions.

The Asia Pacific region is poised to maintain its dominance in the Masterbatch Market, driven by ongoing economic growth, urbanization, and technological advancements. The increasing adoption of eco-friendly and smart masterbatches, coupled with the expansion of end-use industries, suggests a positive outlook for the market’s future in this region.

North America’s Masterbatch Market is characterized by high demand for specialty and sustainable masterbatches, with the region’s advanced manufacturing sector and stringent environmental regulations fostering innovation.

Europe’s market is significantly influenced by regulatory compliance and a strong focus on sustainability, leading to increased demand for eco-friendly masterbatches and innovations in material science.

The Middle East & Africa region shows potential for growth driven by infrastructure development, economic diversification, and an increasing focus on manufacturing and industrialization.

Latin America’s market benefits from its emerging manufacturing sector and growing demand for consumer goods and packaging, presenting opportunities for masterbatch applications across diverse industries.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the Masterbatch Market, companies such as Avient Corporation, Clariant AG, and LyondellBasell stand out as key players, each wielding significant influence and strategic positioning. These organizations are renowned for their extensive portfolios that encompass a wide range of color, additive, and filler masterbatches, catering to diverse industry needs from packaging and automotive to consumer goods and construction.

Avient Corporation and Clariant AG, in particular, are recognized for their commitment to sustainability and innovation, offering eco-friendly masterbatch solutions that align with global environmental standards and market demands. Their strategic focus on developing advanced materials that enhance the performance, appearance, and recyclability of plastics has positioned them as leaders in the market.

LyondellBasell distinguishes itself with a strong global presence and a focus on technological advancements in polymer and masterbatch solutions, ensuring high-quality and efficient products for its customers. Similarly, companies like Tosaf Group and Ampacet Corporation contribute to the market’s growth with their specialized offerings and global reach, addressing the evolving needs of the plastic industry.

Market Key Players

- Avient Corporation

- Cabot Corporation

- Plastika Kritis S.A.

- Penn Color, Inc.

- Tosaf Group

- Ampacet Corporation

- Plastiblends India Ltd.

- Hubron International

- LyondellBasell

- A. Schulman, Inc.

- Clariant AG

- PolyOne Corporation

Recent Developments

- On Oct 2023, Ampacet has introduced ProVital+ Permstat, a non-migratory antistatic masterbatch that provides immediate and permanent antistatic properties to polyolefin films used in pharmaceutical processes.

- On July 2023, Delta Tecnic, a producer of masterbatches for the cable and PVC industry, has developed a solution to simplify the coloring of thermoplastic polyurethane (TPU) cables. This innovation allows manufacturers to use a single color masterbatch for all TPU cables, reducing the number of references and standardizing the final color of the cables.

- On June 2023, Colourmaster NIP has achieved ISO 14001 accreditation, which recognizes their commitment to continuous environmental improvements, such as waste reduction, energy efficiency, and reducing their carbon footprint

Report Scope

Report Features Description Market Value (2024) USD 13.3 Billion Forecast Revenue (2034) USD 22.3 Billion CAGR (2025-2034) 5.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (White, Black, Color, Additive, Filler, Others), By Polymer Polypropylene (PP) (Polyethylene (PE), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Biodegradable Plastics, Others), By End-Use Packaging (Building & Construction, Consumer Goods, Automotive & Transportation, Agriculture, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Avient Corporation, Cabot Corporation, Plastika Kritis S.A., Penn Color, Inc., Tosaf Group, Ampacet Corporation, Plastiblends India Ltd., Hubron International, LyondellBasell, A. Schulman, Inc., Clariant AG, PolyOne Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected worth of the Global Masterbatch Market?The Global Masterbatch Market is expected to be worth around USD 21.3 Billion by 2033, showing growth from USD 12.7 Billion in 2023, at a CAGR of 5.30% during the forecast period from 2024 to 2033.

What are some driving factors contributing to the growth of the Masterbatch Market?Driving factors contributing to the growth of the Masterbatch Market include increasing demand from the packaging industry, regulatory push towards eco-friendly solutions, and growth in the automotive industry's demand for advanced materials.

What are the dominant segments in the Masterbatch Market?By Type, Black holds a significant market share of 28.4%, while by Polymer, Polypropylene (PP) leads with 27.6%, and by End-Use, Packaging dominates with 27.1%.

Which region dominates the Masterbatch Market, and why?Asia Pacific dominates the market with 45.2% share, driven by its extensive use of masterbatches in various industries, rapid industrialization, and manufacturing activities, particularly in countries like China and India.

-

-

- Avient Corporation

- Cabot Corporation

- Plastika Kritis S.A.

- Penn Color, Inc.

- Tosaf Group

- Ampacet Corporation

- Plastiblends India Ltd.

- Hubron International

- LyondellBasell

- A. Schulman, Inc.

- Clariant AG

- PolyOne Corporation