Global Plasma Powder Market Size, Share, In-Depth Research Analysis By Source (Bovine, Porcine, Others), By Form (Dry, Wet), By Application (Animal Feed, Food, Pharmaceutical, Others), By Sales Channel (Online, Offline) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135136

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

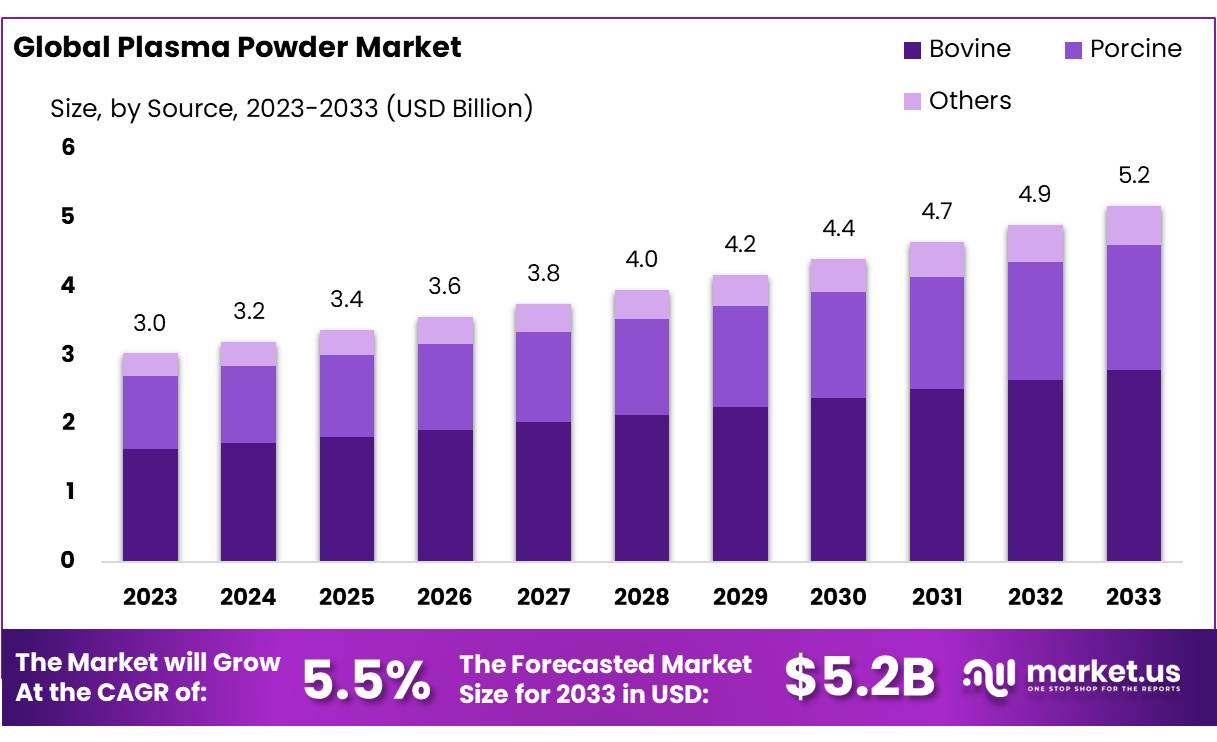

The Global Plasma Powder Market size is expected to be worth around USD 5.2 Bn by 2033, from USD 3.03 Bn in 2023, growing at a CAGR of 5.5% during the forecast period from 2024 to 2033.

Plasma powder is also seeing investments from both private companies and government-backed initiatives to improve its production processes. Companies like Archer Daniels Midland (ADM) and Ardent Mills are expanding their portfolios to include plasma powder-based products, responding to the growing demand from livestock farmers who require more efficient and nutritionally balanced animal feed.

These market dynamics, along with continuous innovations in plasma powder production, are contributing to its rising demand across various regions. Exporting countries including the United States, Canada, and Brazil. The European Union (EU) remains one of the largest markets, accounting for 32% of the global plasma powder market share, largely due to its strong livestock and aquaculture industries.

In fact, according to the Food and Agriculture Organization (FAO), the global production of meat is expected to increase by 14% by 2030, which will drive up the need for high-quality, efficient feed additives like plasma powder.

Governments around the world, including the Food and Drug Administration (FDA) in the U.S. and the European Food Safety Authority (EFSA), have strict regulations regarding the use of animal by-products like plasma powder. In particular, plasma powder is subject to rigorous safety standards to ensure it is free from pathogens and contaminants before it can be used in animal feed.

Recent orders totaling CAD 2.6 million for advanced plasma systems highlight ongoing investments in research and development across Asia, Latin America, and Europe.

According to the Food and Agriculture Organization (FAO), meat consumption in the Asia Pacific has increased by approximately 5% per year, while dairy consumption has risen by 3.5-4% per year. This growing demand for livestock products is driving the need for plasma powder as a feed additive

The increasing demand for high-protein and nutrient-rich feed ingredients is one of the key drivers of the plasma powder market. As global meat production continues to rise, particularly in regions like Asia Pacific, Latin America, and North America, the demand for plasma powder in animal feed is expected to increase significantly.

Key Takeaways

- Plasma Powder Market size is expected to be worth around USD 5.2 Bn by 2033, from USD 3.03 Bn in 2023, growing at a CAGR of 5.5%.

- Bovine held a dominant market position, capturing more than a 54.2% share.

- Dry held a dominant market position, capturing more than a 58.1% share of the Plasma Powder Market.

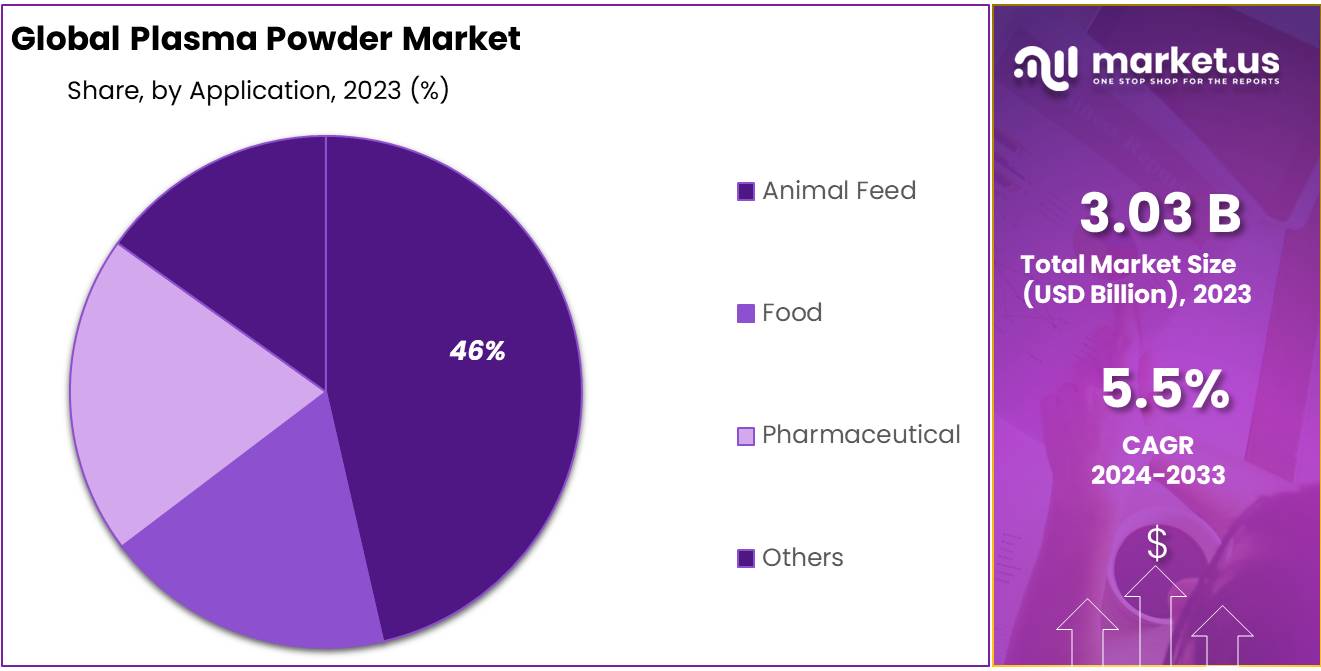

- Animal Feed held a dominant market position, capturing more than a 46.5% share.

- Offline held a dominant market position, capturing more than a 73.1% share.

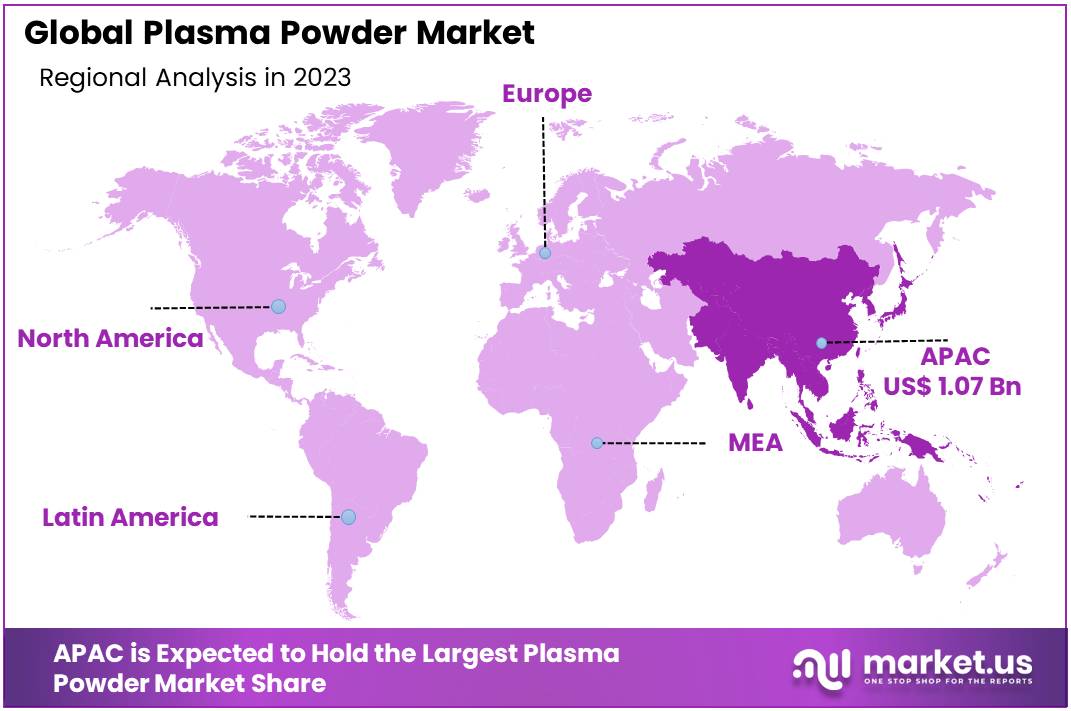

- Asia Pacific (APAC) emerges as the dominant region, holding a 35.6% market share with revenues reaching USD 1.07 billion.

By Source

In 2023, Bovine held a dominant market position, capturing more than a 54.2% share of the Plasma Powder Market. This dominance is primarily due to the high availability and cost-effectiveness of bovine plasma, which makes it a preferred source in various industries, including pharmaceuticals and animal feed.

The rising demand for protein-rich plasma powders in these sectors has contributed to the growth of bovine-based plasma powder. Additionally, its consistent supply and proven effectiveness in health supplements further support its market lead.

The porcine segment is also a significant player in the plasma powder market, holding a notable share. Porcine plasma is widely used in vaccines, biotechnology, and as a feed ingredient for livestock due to its high immunoglobulin content.

This segment’s growth is driven by increasing applications in animal health products and the expanding demand for disease-free plasma in pharmaceutical industries. However, the segment faces challenges related to supply chain fluctuations and regulatory hurdles, which may affect its market share in the coming years.

By Form

In 2023, Dry held a dominant market position, capturing more than a 58.1% share of the Plasma Powder Market. This segment is preferred due to its ease of storage, longer shelf life, and cost-effectiveness. Dry plasma powder is commonly used in pharmaceutical applications, animal feed, and research because it is lightweight and can be easily transported.

Its versatility and stability in different environmental conditions contribute to its widespread adoption across various industries. As demand for dry plasma powder continues to rise, especially in the animal health and nutrition sectors, this segment is expected to maintain its leading position.

The Wet segment, while smaller in comparison, is also essential in specific applications such as in certain medical treatments and biotechnology processes. Wet plasma powder retains more of its natural properties and is often preferred in high-quality products where these attributes are crucial.

It is particularly used in laboratories and for specialized pharmaceutical formulations. However, the Wet segment faces challenges in terms of shorter shelf life and higher storage costs, which limit its market share. Despite these challenges, it is expected to grow steadily as demand for high-performance plasma products increases in the healthcare and research sectors.

By Application

In 2023, Animal Feed held a dominant market position, capturing more than a 46.5% share. This segment benefits greatly from plasma powder’s high protein content, which supports animal growth and health. As global demand for meat and dairy products continues to rise, so too does the need for effective animal feed additives, bolstering this segment’s growth.

The Food application of plasma powder also shows promising expansion. Plasma powder is utilized in food products for its functional properties, such as emulsification and water retention, enhancing texture and nutritional value. With increasing consumer awareness of ingredient quality and a growing preference for protein-rich foods, this segment is poised for further growth.

In the Pharmaceutical sector, plasma powder is valued for its therapeutic properties, including wound healing and immune system support. This application is driven by ongoing research and clinical trials exploring new medical uses for plasma derivatives, indicating potential for significant market expansion.

By Sales Channel

In 2023, Offline held a dominant market position, capturing more than a 73.1% share. This channel, encompassing brick-and-mortar stores and direct sales from manufacturers, remains popular due to the tangible benefits it offers buyers, such as immediate product verification and personalized service. Its strong presence is supported by the trust and reliability perceived in face-to-face interactions, crucial for purchasing decisions in sectors like pharmaceuticals and food.

Online sales channels, although smaller in comparison, are rapidly gaining traction. This growth is fueled by the convenience of shopping from home and the expanding reach of e-commerce platforms. Consumers and businesses alike are increasingly turning to online markets for plasma powder due to competitive pricing and broader product availability. As digital literacy improves and logistic networks expand, the online segment is expected to capture an increasing share of the market.

Key Market Segments

By Source

- Bovine

- Porcine

- Others

By Form

- Dry

- Wet

By Application

- Animal Feed

- Food

- Pharmaceutical

- Others

By Sales Channel

- Online

- Offline

Drivers

Growing Demand for High-Quality Animal Feed

One of the primary driving factors for the plasma powder market is the increasing demand for high-quality, nutrient-rich animal feed. Plasma powder, due to its superior protein profile, is a key ingredient in improving feed efficiency, animal growth, and immunity, particularly in swine, poultry, and aquaculture sectors.

According to the U.S. Department of Agriculture (USDA), the global animal feed market was valued at approximately USD 480 billion in 2023 and is expected to grow at a 5.5% CAGR through 2025. This growth is largely driven by the rising demand for animal-based food products worldwide, particularly in emerging markets such as Asia Pacific and Latin America, where the livestock industry is expanding rapidly.

As livestock production increases, especially in regions like China, India, and Brazil, the need for protein-rich additives like plasma powder has surged. The Food and Agriculture Organization (FAO) projects that global meat production will increase by 14% by 2030, further boosting the demand for high-quality feed ingredients.

In 2023, the plasma protein segment, which includes plasma powder, accounted for about 70% of the total market share in animal feed, with a USD 450 million value in exports. Plasma powder plays a critical role in enhancing feed formulations by supporting faster growth rates, improved immune responses, and overall animal health.

Regulatory Support for Animal Feed Quality

Government regulations and initiatives aimed at improving livestock productivity and food safety are another major factor propelling the growth of the plasma powder market. Governments in key agricultural regions, such as the U.S., European Union (EU), and Brazil, have increasingly recognized the importance of protein-enriched animal feed for boosting livestock productivity.

For instance, the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have introduced stringent standards for animal feed ingredients to ensure safety and efficiency. These standards have paved the way for the inclusion of plasma powder, as it is known for its high digestibility and bioavailability.

Moreover, initiatives like the U.S. Department of Agriculture’s (USDA) efforts to enhance feed quality through innovations in animal nutrition also contribute to the growing acceptance and demand for plasma powder.

The regulatory push for higher-quality feed products ensures that plasma powder remains a safe and effective option in animal nutrition. In 2023, the EU accounted for about 32% of global plasma powder exports, reflecting the region’s robust regulatory framework supporting the use of blood-based products in animal feed.

Restraints

Regulatory Challenges and Consumer Perception

A significant restraining factor for the growth of the plasma powder market is the regulatory hurdles and consumer perception issues surrounding its use, particularly in animal feed and food products. Plasma powder, being derived from animal blood, faces strict regulatory oversight in many regions due to concerns over animal health, food safety, and the risk of diseases.

The European Union (EU), for instance, has stringent regulations on the use of animal by-products, which include plasma powder. According to the European Food Safety Authority (EFSA), plasma powder used in animal feed must meet rigorous safety standards to ensure it is free from diseases like Bovine Spongiform Encephalopathy (BSE) and Foot and Mouth Disease (FMD). Any contamination risks can lead to significant trade restrictions, limiting the market’s growth potential in certain regions.

In 2023, the FDA (Food and Drug Administration) in the U.S. also reinforced regulations regarding the use of animal-derived products in feed, requiring manufacturers to conduct thorough testing and ensure that plasma powder is free from contaminants.

These regulations can increase production costs, making plasma powder more expensive than other protein sources. As a result, plasma powder’s adoption in animal feed may be limited to higher-value products where feed quality is a priority, such as in high-performance livestock or pets, and is less likely to be used in mass-market feed solutions.

According to a report by the U.S. Department of Agriculture (USDA), plant-based and vegan diets have grown by 27% in the U.S. between 2018 and 2023, and this shift in consumer preference is influencing feed production, with some consumers seeking plant-based alternatives over animal-derived feed additives. This growing demand for plant-based products, combined with the regulatory scrutiny surrounding animal-derived ingredients, could hinder the broader adoption of plasma powder in global markets.

Opportunity

Expansion of Aquaculture Industry

One of the major growth opportunities for plasma powder lies in the rapidly expanding aquaculture industry. The global demand for seafood is increasing as populations grow and consumer preferences shift towards more sustainable protein sources.

According to the Food and Agriculture Organization (FAO), global fish production reached 178 million tons in 2023, with aquaculture accounting for nearly 50% of this total. The FAO projects that by 2030, global fish production will rise by 14%, driven largely by the growing demand for fish in Asia, particularly in countries like China and India.

Plasma powder is an essential ingredient in improving the nutritional profile of fish feed, providing high-quality protein that enhances growth, immune function, and overall health in aquatic species. The increasing adoption of high-protein feeds in aquaculture is driving demand for plasma powder.

In 2023, the aquaculture sector accounted for 17% of the total global plasma powder market, valued at USD 200 million, and this share is expected to increase by 6-7% annually in the coming years.

Governments in key aquaculture regions, including Asia Pacific and Latin America, are also supporting the growth of the industry through various initiatives aimed at boosting food security and sustainable farming practices. For example, the Government of India has set up schemes to enhance domestic fish production, targeting an annual growth rate of 10% in the aquaculture sector.

Trends

Increasing Demand for Clean Label and Sustainable Feed Ingredients

One of the latest trends in the plasma powder market is the growing demand for clean label and sustainable feed ingredients. As consumers become more conscious of the environmental and health implications of food production, there is a marked shift towards transparency in the ingredients used in animal feed. Clean label products, which are free from artificial additives and preservatives, have gained significant popularity in the last few years.

According to the U.S. Department of Agriculture (USDA), the global demand for clean-label feed additives has been increasing at a rate of 8.5% annually, with a projected market value of USD 4.7 billion by 2025. This shift is pushing the animal feed industry towards more natural and sustainable sources, with plasma powder emerging as a key ingredient due to its high protein content and clean-label appeal.

Governments and industry stakeholders are also contributing to this trend. For example, the European Commission has emphasized sustainability in the agricultural sector, promoting the use of natural, traceable ingredients in animal feed.

In 2023, the EU set a target to reduce the environmental impact of animal farming by 25% by 2030, with a focus on reducing feed waste and improving the sustainability of feed ingredients. This regulatory environment is creating a favorable market for plasma powder, which is both a natural and highly efficient protein source for animal nutrition. As a result, the use of plasma powder in animal feed is expected to increase, with market share in the clean-label segment estimated to grow by 12% annually.

Regional Analysis

Asia Pacific (APAC) emerges as the dominant region, holding a 35.6% market share with revenues reaching USD 1.07 billion. This region’s substantial market share can be attributed to rapid industrial growth, particularly in China, India, and Japan, where there is significant demand from the food and pharmaceutical sectors. The expanding agricultural activities and increasing focus on animal health also contribute to the robust demand for plasma powder in APAC.

North America follows, characterized by advanced technological integration and a strong presence of key industry players. The region benefits from a well-established industrial base and heightened regulatory support for product innovations, particularly in the United States and Canada. High awareness regarding animal nutrition and health, combined with advanced farming practices, further propels the demand for plasma powder in this region.

Europe maintains a steady growth trajectory in the plasma powder market due to stringent animal welfare regulations and a growing emphasis on sustainable agricultural practices. The region’s focus on quality and safety in animal feed additives enhances its market prospects. Germany, France, and the UK are pivotal markets, driven by technological advancements and substantial R&D activities.

Latin America and the Middle East & Africa (MEA) are witnessing gradual growth. In Latin America, countries like Brazil and Argentina are slowly increasing their market share due to developments in the agricultural and food sectors. Meanwhile, the MEA region is exploring plasma powder applications in new markets, supported by economic diversification efforts beyond oil and gas, particularly in countries like Saudi Arabia and UAE.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Plasma Powder Market is highly competitive, with several key players dominating the industry. Darling Ingredients Inc., through its subsidiary Sonac, is a leading player, with a significant market share in both the production of plasma powder and its use in animal feed.

Sonac is known for its focus on high-quality protein sources for animal nutrition, and in 2023, the company reported a revenue of USD 3.2 billion from its ingredients segment, which includes plasma powder. The company’s global reach and strategic investments in sustainability have helped maintain its position as a market leader.

Acontex GmbH, ACTIPRO, and Merck KGaA also play a crucial role in the market, contributing to the development of high-quality plasma powders for both animal feed and potential applications in human nutrition. ACTIPRO is known for its innovative processes in producing plasma protein, while Acontex GmbH focuses on the use of animal-derived proteins in the feed industry.

In 2023, Merck KGaA expanded its portfolio with a line of plasma protein products, aimed at improving animal health and feed efficiency. APC Company Inc. is another key player, focusing on the production of specialty proteins for use in aquaculture and livestock feeds.

Regional players like Lican Alimentos S.A. and SARIA Group contribute significantly to the Latin American and European markets, respectively. Shenzhen Tier and Veos N.V. also have a strong presence in Asia Pacific and Europe, catering to the growing demand for sustainable feed additives in the region.

Top Key Players

- Acontex GmbH

- ACTIPRO

- Actipro

- APC Company Inc.

- Darling ingredients

- Darling Ingredients Inc. (Sonac)

- Lican Alimentos S.A.

- Lican Food.

- Merck KGaA

- Rocky Mountain Biologicals LLC

- SARIA Group

- Shenzhen Tier

- Veos N.V.

Recent Developments

In 2024, Acontex GmbH, plans to increase its plasma powder output by 12% by 2024, aiming for USD 200 million in revenue from the plasma powder segment.

In 2024, ACTIPRO plans to increase its revenue from plasma powder to approximately USD 140 million, driven by the growing adoption of premium feed ingredients across emerging markets.

Report Scope

Report Features Description Market Value (2023) USD 3.0 Bn Forecast Revenue (2033) USD 5.2 Bn CAGR (2024-2033) 5.5% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Bovine, Porcine, Others), By Form (Dry, Wet), By Application (Animal Feed, Food, Pharmaceutical, Others), By Sales Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Acontex GmbH, ACTIPRO, Actipro, APC Company Inc., Darling ingredients, Darling Ingredients Inc. (Sonac), Lican Alimentos S.A., Lican Food., Merck KGaA, Rocky Mountain Biologicals LLC, SARIA Group, Shenzhen Tier, Veos N.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Acontex GmbH

- ACTIPRO

- Actipro

- APC Company Inc.

- Darling ingredients

- Darling Ingredients Inc. (Sonac)

- Lican Alimentos S.A.

- Lican Food.

- Merck KGaA

- Rocky Mountain Biologicals LLC

- SARIA Group

- Shenzhen Tier

- Veos N.V.