Global Fish Protein Isolate Market Size, Share, Segments Analysis By Type (Isolates, Concentrates, Hydrolysates), By Form (Powder, Liquid, Others), By Product Type (Soy Protein, Wheat Protein, Pea Protein, Others), By Nature (Organic, Conventional), By Application (Food, Beverages, Animal Feed, Cosmetic and Personal Care, Pharmaceuticals, Others), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast: 2024-2033

- Published date: Dec 2024

- Report ID: 135170

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

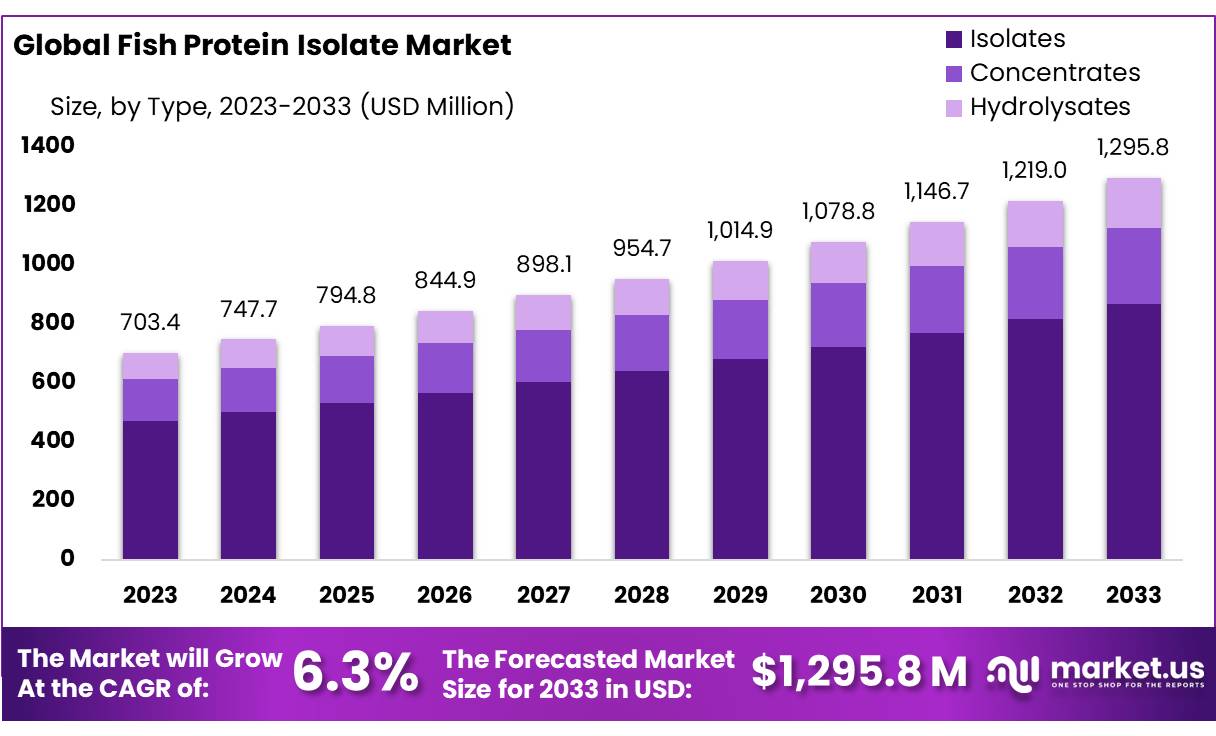

The Global Fish Protein Isolate Market size is expected to be worth around USD 1295.8 Mn by 2033, from USD 703.4 Mn in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2033.

Fish Protein Isolate (FPI) is a highly concentrated form of protein derived from fish, typically obtained through a process of filtration and isolation that removes fats, carbohydrates, and other non-protein components. It is considered a high-quality protein source, as it contains all the essential amino acids required for human nutrition.

Fish protein isolate is used in a variety of food products, including protein bars, nutritional supplements, and sports nutrition products. It is also increasingly used in animal feed, pet food, and aquaculture.

Fish Protein Isolate is made from fish such as tilapia, cod, or haddock, and it is processed to yield a protein content of over 90%, making it significantly higher in protein than whole fish or fish meal. This process ensures that the protein is easily digestible and highly bioavailable, meaning the body can efficiently absorb and use it.

The market for fish protein isolate is expanding, particularly in the health and wellness sector, where demand for alternative protein sources is growing. According to the Food and Agriculture Organization (FAO), global fish production reached 179 million tonnes in 2023, with fish protein isolate seeing increased adoption in both food and feed markets.

Government Regulations and Initiatives: Governments globally are supporting the use of fish protein isolates as part of efforts to promote sustainable food sources. In 2022, the European Union launched a EUR 45 million initiative under its Green Deal to invest in sustainable aquaculture practices, including the production of fish-based proteins.

Additionally, the U.S. Food and Drug Administration (FDA) has developed standards to ensure the safety and quality of fish protein products used in food and animal feed, encouraging more companies to enter the market.

According to the Food and Agriculture Organization (FAO), global protein consumption is expected to increase by 25% by 2030, and fish protein is emerging as a sustainable solution. Additionally, FPI is widely used in pet food, where demand for premium, protein-enriched diets continues to rise, accounting for approximately 22% of the market share in 2023.

The international trade in fish protein isolate is expanding, particularly between Asia-Pacific and North America. The Asia-Pacific region remains the largest exporter of fish protein isolates, with China and Thailand contributing to over 45% of global exports. Meanwhile, the U.S. is the largest importer, accounting for 30% of global imports in 2023, valued at USD 800 million.

Investments and Innovation the fish protein isolate market is also seeing increased investments from both government and private sectors. In 2023, Cargill and Skretting, a subsidiary of Nutreco, formed a joint venture to develop new fish protein products aimed at the pet food and animal feed industries.

This partnership, worth an initial USD 50 million, focuses on improving the sustainability and nutritional value of fish protein isolate. Furthermore, DSM (Dutch multinational) announced a USD 70 million investment in its new fish protein production facility in the Netherlands to cater to the growing demand for sustainable protein alternatives in Europe.

Mergers and Acquisitions in the market is also witnessing mergers and acquisitions. For example, in 2023, Omega Protein Corporation, one of the largest producers of fish-based products, acquired Arista Industries, a leading supplier of fish protein isolate, for USD 120 million.

Key Takeaways

- Fish Protein Isolate Market size is expected to be worth around USD 1295.8 Mn by 2033, from USD 703.4 Mn in 2023, growing at a CAGR of 6.3%.

- Isolates held a dominant market position, capturing more than a 67.1% share of the fish protein isolate market.

- Powder held a dominant market position, capturing more than a 76.3% share of the fish protein isolate market.

- Soy Protein held a dominant market position, capturing more than a 46.2% share of the fish protein isolate market.

- Conventional held a dominant market position, capturing more than a 73.1% share.

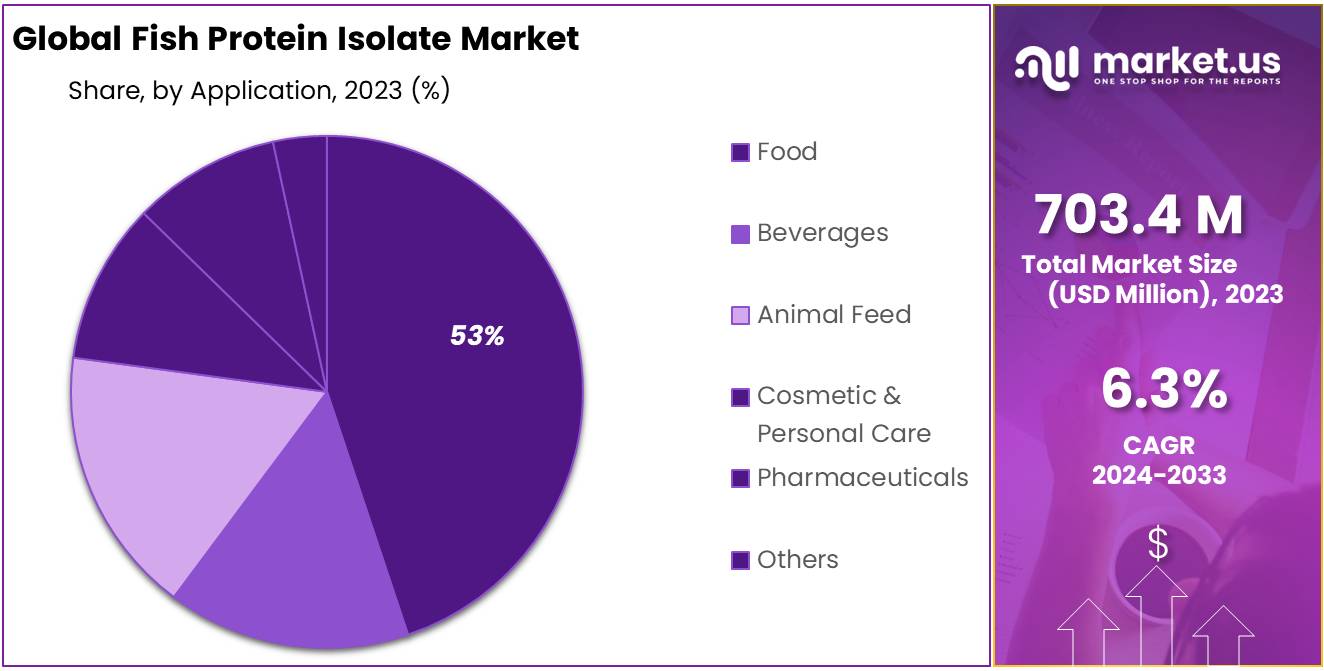

- Food held a dominant market position, capturing more than a 53.2% share of the fish protein isolate market.

- Hypermarkets/Supermarkets held a dominant market position, capturing more than a 39.1% share.

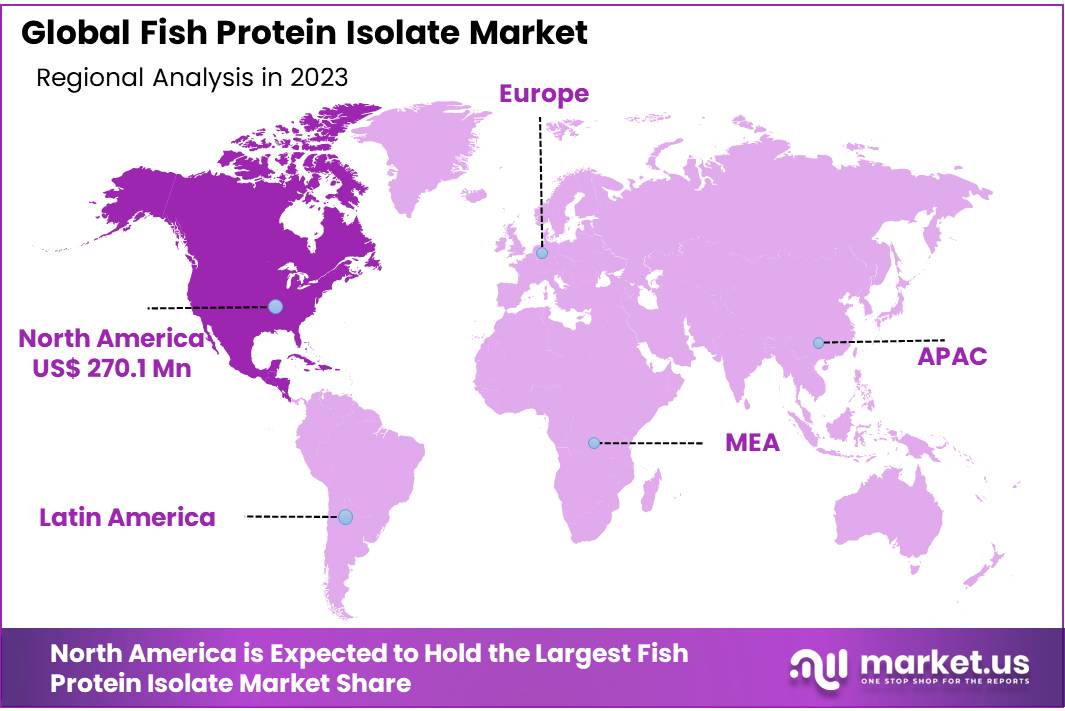

- North America, the market is particularly robust, holding a dominant share of 38.6% with a value of USD 270.1 million.

By Type

In 2023, Isolates held a dominant market position, capturing more than a 67.1% share of the fish protein isolate market. Fish protein isolates are the most refined form of fish protein, containing over 90% protein content.

This high protein concentration makes them highly desirable in various industries, particularly in food products like protein bars, meal replacements, and nutritional supplements. They are also widely used in pet food and animal feed due to their excellent nutritional profile and digestibility.

The popularity of isolates is driven by their versatility and the increasing demand for high-quality protein in functional foods. As consumers seek healthier, protein-enriched diets, fish protein isolates are preferred for their ability to provide a clean, pure protein source without excess fats or carbohydrates. The high protein content in isolates also makes them ideal for sports nutrition and weight management products.

Concentrates and Hydrolysates are gaining traction, but they hold smaller shares in the market. Concentrates typically contain around 70-85% protein and are used in a wider range of applications where slightly lower protein content is acceptable.

Hydrolysates, which are pre-digested proteins, are increasingly used in specialized products like infant nutrition, where easier protein absorption is crucial. However, these segments are still developing and are expected to grow as demand for functional, easily digestible protein sources rises.

By Form

In 2023, Powder held a dominant market position, capturing more than a 76.3% share of the fish protein isolate market. Powdered fish protein isolate is the most popular form due to its ease of use, long shelf life, and versatility in various applications.

It is widely used in the production of protein bars, meal replacements, sports nutrition supplements, and baked goods. The powder form is easy to mix into beverages, smoothies, and other food products, making it a preferred choice for both consumers and manufacturers.

The Powder form’s dominance is driven by its cost-effectiveness and convenience for large-scale production. It can be stored and transported efficiently, with minimal risk of spoilage. The high protein content in powdered form also ensures it meets the growing consumer demand for protein-enriched food products.

Liquid fish protein isolate is gaining popularity, particularly in specialized applications such as protein drinks and functional beverages. However, it holds a smaller share of the market compared to powder. The Liquid form is easier to digest and is increasingly used in products targeted at athletes and individuals seeking quick protein absorption. Despite this, the liquid segment’s higher production costs and shorter shelf life limit its broader adoption.

By Product Type

By Nature

By Application

In 2023, Food held a dominant market position, capturing more than a 53.2% share of the fish protein isolate market. The food industry remains the largest consumer of fish protein isolate due to the growing demand for high-protein, nutrient-dense ingredients. Fish protein isolate is widely used in protein bars, meal replacements, sports nutrition products, and plant-based alternatives to meat.

The high protein content, along with its complete amino acid profile, makes it an ideal ingredient in functional foods aimed at health-conscious consumers. The rising trend for high-protein diets and the increasing popularity of plant-based nutrition further boost its demand in this sector.

Beverages also represent a significant segment, though smaller in comparison to food. Fish protein isolate is increasingly being used in protein-enriched beverages, including smoothies, protein shakes, and functional drinks. With the growing trend of on-the-go health supplements, beverages that offer easy protein intake are gaining popularity. The demand for protein-enriched drinks is expected to grow, pushing the fish protein isolate market in this direction.

The Animal Feed segment accounts for a considerable portion of the market, with fish protein isolate used in the production of premium pet food and animal feed. As pet owners seek higher quality, protein-rich diets for their pets, demand for fish-based protein sources has risen. This segment is expected to grow as the global pet food market expands.

Cosmetic & Personal Care and Pharmaceuticals segments are emerging but still represent a smaller share of the market. Fish protein isolate is used in cosmetic products for its moisturizing and skin-repairing properties. In pharmaceuticals, it is utilized for its potential health benefits, including promoting joint health and improving overall wellness.

By Distribution Channel

Key Market Segments

By Type

- Isolates

- Concentrates

- Hydrolysates

By Form

- Powder

- Liquid

- Others

By Product Type

- Soy Protein

- Wheat Protein

- Pea Protein

- Others

By Nature

- Organic

- Conventional

By Application

- Food

- Beverages

- Animal Feed

- Cosmetic & Personal Care

- Pharmaceuticals

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Convenience Stores

- Online Retail

- Others

Drivers

Growing Demand for High-Quality Protein in Functional Foods

The increasing consumer demand for high-protein, functional foods is a key driver for the growth of the fish protein isolate market. According to the International Food Information Council (IFIC), 45% of U.S. consumers report that they are actively trying to consume more protein in their daily diets. This shift is largely driven by a growing awareness of the benefits of protein for muscle health, weight management, and overall well-being.

This trend is supported by governments encouraging healthier eating habits. For example, the U.S. Department of Agriculture (USDA) has highlighted the importance of protein in balanced diets, which has spurred the demand for higher-quality protein sources like fish. The increase in health-conscious consumers and their preference for protein-rich diets is expected to continue pushing the demand for fish protein isolate as a premium ingredient in food products.

Growth in Pet Food Industry

The expanding pet food industry is another significant driver for the fish protein isolate market. According to a report from the American Pet Products Association (APPA), the U.S. pet food market alone was valued at $42 billion in 2023 and continues to grow year-over-year.

As pet owners increasingly seek higher-quality, protein-rich food for their pets, fish protein isolate is becoming an essential ingredient in premium pet food formulations. Fish protein isolate offers an excellent amino acid profile and digestibility, making it an ideal choice for pet food manufacturers looking to meet the nutritional needs of pets, particularly for dogs and cats with food sensitivities.

The demand for fish protein in pet food is particularly strong in regions like North America and Europe, where consumers are more likely to invest in high-quality, specialty pet foods. Furthermore, pet food brands are capitalizing on the trend for clean-label, sustainable products, and fish protein isolate fits into these categories due to its natural composition and sourcing from sustainable fisheries.

Increased Focus on Sustainability and Eco-Friendly Sourcing

Sustainability concerns are playing an increasingly important role in the growth of the fish protein isolate market. Consumers and companies are becoming more conscious of the environmental impact of their food choices, and there is growing interest in sustainably sourced ingredients.

Fish protein isolate, when sourced responsibly, offers a more sustainable alternative to animal-based proteins like beef or chicken. According to a study by the United Nations Food and Agriculture Organization (FAO), the carbon footprint of fish protein production is significantly lower compared to other animal proteins, making it a more eco-friendly option for food manufacturers.

Restraints

High Production Costs and Limited Supply

One of the key restraining factors for the growth of the fish protein isolate market is the high production costs and limited availability of fish protein. According to the Food and Agriculture Organization (FAO), the global supply of fish is under significant pressure due to overfishing and environmental concerns, leading to rising costs in sourcing raw materials.

Fish protein isolate production requires specialized processes like hydrolysis and filtration to separate the protein from other components, which increases operational expenses. For example, it has been reported that fish protein isolates produced using sustainable practices can cost up to 20-30% more than traditional animal proteins.

Moreover, while the demand for fish protein isolate is increasing, the supply of suitable fish is constrained by the limits of ocean fishing and aquaculture. Sustainable sourcing is crucial, but it involves stringent regulations and higher operational costs.

The FAO’s The State of World Fisheries and Aquaculture (SOFIA) report noted that nearly 33% of global fish stocks were overfished in 2020, which not only impacts the supply of fish but also makes sustainable sourcing more difficult and costly. Consequently, manufacturers face challenges in securing a consistent, affordable supply of fish for protein production, which drives up the overall market price.

Regulatory and Sustainability Challenges

The fish protein isolate market faces increasing scrutiny due to regulatory challenges around sustainable sourcing and environmental impact. Many countries, particularly in the European Union and North America, have stringent environmental and sustainability regulations for sourcing fish and seafood.

The European Commission’s Common Fisheries Policy aims to ensure sustainable fishing practices and prevent overfishing by setting quotas on fish catches. However, these regulations, while crucial for protecting marine ecosystems, also lead to reduced catch limits and limited availability of raw materials, making fish protein isolates more expensive to produce.

Furthermore, the push for sustainability in food production has led to rising demand for certified sustainable ingredients, such as those with the Marine Stewardship Council (MSC) certification. While these certifications help to ensure that fish protein isolates are responsibly sourced, they can add to the production costs and reduce the overall volume of supply.

As reported by the MSC, only 14% of the world’s wild-caught seafood is certified as sustainable. This limitation on sustainable sourcing increases costs and limits market growth, particularly as governments and consumers demand more sustainable options.

Consumer Awareness and Perception Issues

Although fish protein isolate offers several nutritional benefits, consumer awareness and perception of the product remain a challenge. A survey by the International Food Information Council (IFIC) revealed that only 20-25% of consumers are familiar with fish protein isolate as a dietary ingredient.

Many consumers still associate fish proteins with potential allergens or the “fishy” taste and odor, which can deter them from adopting such products. The lack of widespread consumer education about the health benefits and versatility of fish protein isolate could limit its adoption in mainstream food products.

Opportunity

Rising Demand for Plant-Based Protein Alternatives

One of the major growth opportunities for the fish protein isolate market is the rising demand for plant-based protein alternatives. As more consumers turn to plant-based diets, many are seeking high-quality proteins that are not derived from animals. Fish protein isolate, while not strictly plant-based, is gaining attention as a sustainable and high-quality alternative to traditional animal proteins.

According to the International Food Information Council (IFIC), about 23% of U.S. consumers are actively reducing or eliminating animal products from their diets, creating significant opportunities for plant-based and alternative protein sources. Fish protein isolate, with its amino acid profile similar to that of meat, provides a viable protein option for those who still seek animal-based proteins but wish to avoid meat from land animals.

Pet Food Industry Growth

The pet food industry presents a rapidly expanding growth opportunity for the fish protein isolate market. The American Pet Products Association (APPA) reported that the U.S. pet food market alone reached a value of $42 billion in 2023, with projections for continued growth.

As pet owners become more conscious about the nutritional quality of pet food, the demand for protein-rich, sustainable ingredients such as fish protein isolate is rising. Pet food manufacturers are increasingly looking for premium ingredients that support health and well-being in pets, particularly in terms of improving joint health, digestion, and skin condition.

Sustainable Sourcing and Innovation in Aquaculture

Sustainability and innovation in the aquaculture industry present another growth opportunity for the fish protein isolate market. As global fish stocks face pressure from overfishing, the focus has shifted towards sustainable aquaculture practices. According to the Food and Agricultural Organization, the total volume of fish produced from aquaculture reached 82 million tons in 2022, accounting for about 50% of the global fish supply. As aquaculture continues to expand, the potential for sourcing fish protein isolate from responsibly farmed fish is significant.

Trends

Increasing Demand for Sustainable Protein Sources

One of the latest trends in the fish protein isolate market is the growing demand for sustainable protein sources. As global concerns over environmental degradation and food security intensify, consumers and manufacturers are turning to protein sources that are both nutritionally beneficial and environmentally responsible.

According to the Food and Agriculture Organization (FAO), fisheries and aquaculture provide about 17% of animal protein to over 3 billion people worldwide. However, the industry faces growing pressure to adopt sustainable practices as overfishing and habitat destruction threaten marine ecosystems. As a result, fish protein isolate, which can be sourced from sustainably managed fisheries and aquaculture farms, is becoming increasingly attractive to consumers seeking to reduce their ecological footprint.

Sustainable sourcing of fish, particularly from MSC-certified fisheries, is gaining traction. In 2022, the Marine Stewardship Council (MSC) certified over 450 fisheries, ensuring that fish used for protein production meet environmental sustainability standards.

Furthermore, government initiatives such as the European Green Deal, which aims to achieve a carbon-neutral economy by 2050, are encouraging the adoption of sustainable practices across the food sector, further supporting the growth of fish protein isolate.

Growth in the Functional Foods and Beverages Sector

Another significant trend for fish protein isolate is its growing application in functional foods and beverages. Functional foods, which offer health benefits beyond basic nutrition, are gaining popularity globally, with the functional foods market projected to reach $275 billion by 2025 (as reported by the International Food Information Council (IFIC)).

Fish protein isolate, with its superior bioavailability and amino acid profile, is being increasingly used in protein-enriched foods and beverages, such as protein shakes, bars, and meal replacements. The ability to provide essential nutrients while offering a clean-label ingredient makes fish protein isolate an ideal choice for the growing demand for fortified, functional food products.

The popularity of plant-based diets and the rise of health-conscious consumers are also driving this trend. As per the IFIC, 27% of consumers are actively increasing their protein intake through non-meat sources, which presents a significant opportunity for fish protein isolate, especially for those seeking alternatives to soy or pea protein.

In response, food manufacturers are exploring innovative ways to incorporate fish protein isolate into ready-to-eat meals, smoothies, and other nutritionally enhanced products. The growing demand for functional foods is expected to contribute to the market’s expansion, with the fish protein isolate sector likely to benefit from its use in innovative, health-focused applications.

Increasing Use in Pet Food Formulations

The pet food industry is another major growth driver for fish protein isolate, with an increasing number of pet food manufacturers incorporating high-quality, hypoallergenic protein sources into their formulations. In 2023, the global pet food market was valued at approximately $118 billion, with the demand for premium pet food growing steadily.

As pet owners become more concerned about the health and nutrition of their pets, the preference for protein-rich, sustainable, and natural ingredients like fish protein isolate is rising. This trend is especially evident in the growing popularity of grain-free and high-protein diets for pets, which are designed to meet specific health needs, such as improving digestion, supporting healthy skin, and managing allergies.

Fish protein isolate is highly digestible, hypoallergenic, and rich in essential amino acids, making it a perfect choice for pet foods, particularly for dogs and cats with food sensitivities.

According to the American Pet Products Association (APPA), the pet food segment of the market is expected to grow at a CAGR of 5.4% from 2023 to 2027, driven by trends towards natural and organic ingredients.

Regional Analysis

The global market for fish protein isolate is segmented into several key regions, each demonstrating unique growth dynamics and market potential. In North America, the market is particularly robust, holding a dominant share of 38.6% with a value of USD 270.1 million. This region benefits from advanced food processing technologies and a rising consumer preference for dietary supplements, which drives demand for high-quality fish protein isolate.

Moving to Europe, the market is driven by increasing awareness regarding sustainable fishing practices and the nutritional benefits of fish protein. European consumers, particularly in Nordic countries, show a high inclination towards fish-based products, supporting the growth of the fish protein isolate market in this region. Furthermore, stringent EU regulations on food safety ensure high product standards, fostering trust and encouraging consumption.

In Asia Pacific, the market is expanding rapidly due to growing population and rising health consciousness among consumers. Countries like Japan and China are leading this growth, where fish protein is traditionally integrated into daily diets. The increasing urbanization and disposable income in these countries also contribute to the expanding market base for fish protein isolates.

The Middle East & Africa region shows promising growth, driven by a growing fitness and wellness industry. Urbanization and changing lifestyles have led to an increased demand for dietary supplements, including fish protein isolates, particularly in affluent parts of the Middle East.

Latin America, though smaller in market size compared to other regions, is witnessing growth due to increasing local aquaculture activities and a gradual shift towards more protein-rich diets among the population.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Fish Protein Isolate Market is highly competitive, with several key players dominating the landscape. Among these, Scanbio Marine Group stands out as a prominent player, known for its sustainable fish processing techniques and production of high-quality marine proteins. The company has a strong presence in the European market and is recognized for its commitment to environmentally friendly practices, aligning with growing consumer demand for sustainable protein sources.

Bio-marine Ingredients Ireland Ltd. is another major player in the market, specializing in the production of marine-based ingredients, including fish protein isolate, which is used in various industries such as food, nutraceuticals, and animal feed. The company has a solid market position in Europe and North America, where demand for fish protein isolate is rapidly increasing.

In addition, Diana Aqua, a subsidiary of Symrise AG, has expanded its footprint in the fish protein isolate market through significant investments in innovation and sustainable sourcing. They cater to the food and beverage sectors with high-quality, nutrient-dense fish protein ingredients.

Hofseth BioCare ASA and Copalis Sea Solutions are also key players known for their focus on sustainable aquaculture and fish-derived protein solutions. Hofseth BioCare, for instance, is expanding its operations in North America and Europe, focusing on high-value fish protein products derived from sustainable fisheries.

Other noteworthy players such as Omega Protein Corporation, Titan Biotech Limited, and TripleNine Group A/S are also making strides in the market, with investments in expanding their product portfolios and global reach.

Omega Protein Corporation, based in the U.S., is particularly dominant in the North American market, capitalizing on the increasing demand for high-quality fish protein isolates in both human and animal nutrition.

Top Key Players in the Market

- Scanbio Marine Group

- Bio-marine Ingredients Ireland Ltd.

- Diana Aqua (Symrise AG)

- Hofseth BioCare ASA

- Copalis Sea Solutions

- Colpex International

- Janatha Fish Meal & Oil Products

- Siam Industries International

- Bio-Oregon Protein

- Nutrifish

- Omega Protein Corporation

- Titan Biotech Limited

- Aroma NZ

- Alaska Protein Recovery

- TripleNine Group A/S

Recent Developments

In 2023, Scanbio’s revenues were reported to exceed USD 150 million, with a consistent annual growth rate of 7-10% due to its strong market presence in Europe and North America.

In 2023, Bio-marine Ingredients reported a revenue growth of approximately 6-8%, with the global market for their products reaching an estimated value of USD 80 million.

Report Scope

Report Features Description Market Value (2023) USD 703.4 Mn Forecast Revenue (2033) USD 1295.8 Mn CAGR (2024-2033) 6.3% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Isolates, Concentrates, Hydrolysates), By Form (Powder, Liquid, Others), By Product Type (Soy Protein, Wheat Protein, Pea Protein, Others), By Nature (Organic, Conventional), By Application (Food, Beverages, Animal Feed, Cosmetic and Personal Care, Pharmaceuticals, Others), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Scanbio Marine Group, Bio-marine Ingredients Ireland Ltd., Diana Aqua (Symrise AG), Hofseth BioCare ASA, Copalis Sea Solutions, Colpex International, Janatha Fish Meal & Oil Products, Siam Industries International, Bio-Oregon Protein, Nutrifish, Omega Protein Corporation, Titan Biotech Limited, Aroma NZ, Alaska Protein Recovery, TripleNine Group A/S Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fish Protein Isolate MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Fish Protein Isolate MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Scanbio Marine Group

- Bio-marine Ingredients Ireland Ltd.

- Diana Aqua (Symrise AG)

- Hofseth BioCare ASA

- Copalis Sea Solutions

- Colpex International

- Janatha Fish Meal & Oil Products

- Siam Industries International

- Bio-Oregon Protein

- Nutrifish

- Omega Protein Corporation

- Titan Biotech Limited

- Aroma NZ

- Alaska Protein Recovery

- TripleNine Group A/S